Printed on December twenty seventh, 2024 by Bob Ciura

Intergenerational wealth is created when one’s investments present not just for themselves, however for his or her kids, grandchildren, and past.

Sadly, the talents that it takes to construct and keep a rising funding portfolio are usually not transferred with an inheritance.

Time estimates that 70% of wealthy households lose their wealth by the 2nd era, and 90% by the third era.

Constructing lasting intergenerational wealth requires an investing plan that’s each efficient and comparatively straightforward to implement.

And that’s what makes purchase and maintain without end investing in top quality dividend progress shares so interesting for creating intergenerational wealth.

In terms of high quality dividend progress shares, we advocate traders take a more in-depth have a look at the Dividend Aristocrats, a gaggle of 66 shares within the S&P 500 Index, with 25+ consecutive years of dividend will increase.

You may obtain an Excel spreadsheet of all 66 Dividend Aristocrats (with metrics that matter comparable to dividend yields and price-to-earnings ratios) by clicking the hyperlink beneath:

Disclaimer: Positive Dividend is just not affiliated with S&P International in any manner. S&P International owns and maintains The Dividend Aristocrats Index. The data on this article and downloadable spreadsheet is predicated on Positive Dividend’s personal evaluate, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person traders higher perceive this ETF and the index upon which it’s based mostly. Not one of the data on this article or spreadsheet is official information from S&P International. Seek the advice of S&P International for official data.

The Dividend Aristocrats broadly have sturdy aggressive benefits, and long-term progress.

The next 10 dividend progress shares are on the Dividend Aristocrats checklist, have present yields above 2%, and Dividend Danger Scores of A or B within the Positive Evaluation Analysis Database.

This makes them best candidates for traders trying to create intergenerational wealth.

The highest 10 checklist is ranked based on dividend yield, from lowest to highest.

Desk of Contents

Dividend Inventory For Intergenerational Wealth: Abbott Laboratories (ABT)

Abbott Laboratories, based in 1888, is without doubt one of the largest medical home equipment & tools producers on the planet, comprised of 4 segments: Vitamin, Diagnostics, Established Prescription drugs and Medical Units. Abbott

Laboratories generated $40 billion in gross sales and $8.3 billion in revenue in 2023.

On October sixteenth, 2024, Abbott Laboratories reported third quarter outcomes for the interval ending September thirtieth, 2024.

For the quarter, the corporate produced $10.6 billion in gross sales (60.5% outdoors of the U.S.), which represented a 4.9% enchancment in comparison with the third quarter of 2023 and was $90 million greater than anticipated. Adjusted earnings-per share of $1.21 in comparison with $1.14 within the prior 12 months and was $0.01 forward of estimates.

U.S. gross sales grew 10.1% whereas worldwide elevated 1.7%. Forex alternate was a 2.5% headwind for the interval. Companywide natural gross sales grew 7.6%. Nonetheless, excluding Covid-19 testing merchandise, natural progress was 8.2%.

Click on right here to obtain our most up-to-date Positive Evaluation report on ABT (preview of web page 1 of three proven beneath):

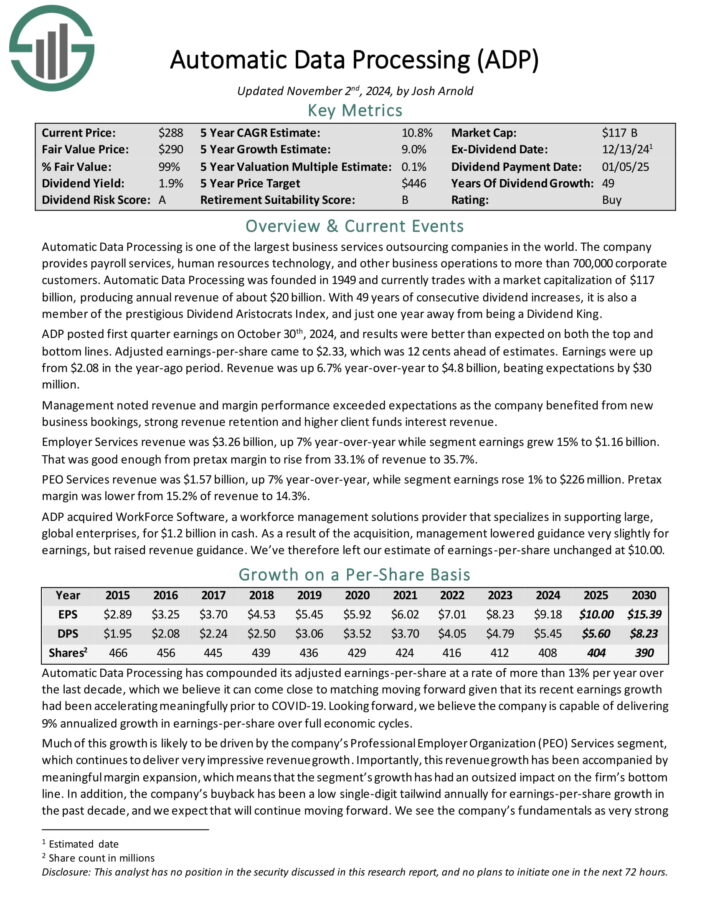

Dividend Inventory For Intergenerational Wealth: Automated Knowledge Processing (ADP)

Automated Knowledge Processing is without doubt one of the largest enterprise companies outsourcing corporations on the planet. The corporate offers payroll companies, human sources know-how, and different enterprise operations to greater than 700,000 company clients.

ADP posted first quarter earnings on October thirtieth, 2024, and outcomes have been higher than anticipated on each the highest and backside strains. Adjusted earnings-per-share got here to $2.33, which was 12 cents forward of estimates.

Earnings have been up from $2.08 within the year-ago interval. Income was up 6.7% year-over-year to $4.8 billion, beating expectations by $30 million.

Administration famous income and margin efficiency exceeded expectations as the corporate benefited from new enterprise bookings, sturdy income retention and better consumer funds curiosity income.

Employer Providers income was $3.26 billion, up 7% year-over-year whereas section earnings grew 15% to $1.16 billion. That was ok from pretax margin to rise from 33.1% of income to 35.7%.

Click on right here to obtain our most up-to-date Positive Evaluation report on ADP (preview of web page 1 of three proven beneath):

Dividend Inventory For Intergenerational Wealth: Basic Dynamics (GD)

Basic Dynamics is a US aerospace & protection firm that now operates in 4 enterprise segments: Aerospace (21% of gross sales), Fight Methods (19%), Marine Methods (26%), and Applied sciences (33%). Basic Dynamics mixed the IT and Mission Methods segments in 2020.

The corporate’s Aerospace section is concentrated on enterprise jets and companies whereas the rest of the corporate is protection. The corporate makes the well-known M1 Abrams tank, Stryker car, Virginia-class submarine, Columbia-class submarine, and Gulfstream enterprise jets.

Basic Dynamics had income of roughly $42.3B in 2023.

Basic Dynamics reported poor Q3 2024 outcomes on October twenty third, 2024, lacking estimates on greater prices and taxes. Income rose 10.4% and diluted earnings per share elevated 10.2% to $3.35 from $3.04 on a year-over-year foundation. Aerospace income rose 22% whereas Gulfstream’s book-to-bill ratio was 1.0X.

Income for Marine Methods elevated 20% to $3,599M from $3,002M on the power of the Columbia and Virginia class submarine packages.

Click on right here to obtain our most up-to-date Positive Evaluation report on GD (preview of web page 1 of three proven beneath):

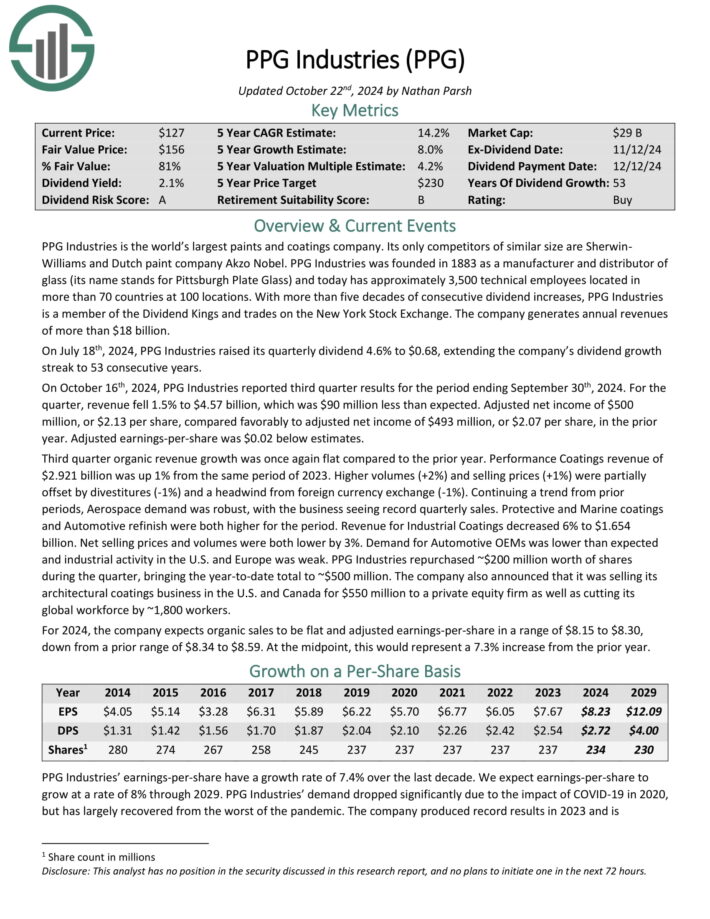

Dividend Inventory For Intergenerational Wealth: PPG Industries (PPG)

PPG Industries is the world’s largest paints and coatings firm. Its solely opponents of comparable measurement are Sherwin-Williams and Dutch paint firm Akzo Nobel.

On October sixteenth, 2024, PPG Industries reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, income fell 1.5% to $4.57 billion, which was $90 million lower than anticipated.

The corporate generates annual income of about $18.2 billion.

Supply: Investor Presentation

Adjusted internet earnings of $500 million, or $2.13 per share, in contrast favorably to adjusted internet earnings of $493 million, or $2.07 per share, within the prior 12 months. Adjusted earnings-per-share was $0.02 beneath estimates.

Third quarter natural income progress was as soon as once more flat in comparison with the prior 12 months. Efficiency Coatings income of $2.921 billion was up 1% from the identical interval of 2023.

Increased volumes (+2%) and promoting costs (+1%) have been partially offset by divestitures (-1%) and a headwind from overseas forex alternate (-1%).

Click on right here to obtain our most up-to-date Positive Evaluation report on PPG (preview of web page 1 of three proven beneath):

Dividend Inventory For Intergenerational Wealth: McCormick & Co. (MKC)

McCormick & Firm produces, markets, and distributes seasoning mixes, spices, condiments and different merchandise to clients within the meals business. McCormick was based in 1889 by Willoughby M. McCormick and controls ~20% of the worldwide seasoning and spice market.

On October 1st, 2024, McCormick introduced third quarter outcomes for the interval ending August thirty first, 2024. For the quarter, income was secure at $1.68 billion, however this beat estimates by $10 million. Adjusted earnings-per-share of $0.83 in contrast favorably to $0.65 within the prior 12 months and was $0.10 greater than anticipated.

For the quarter, quantity and blend improved 0.6%. This was offset by a 0.2% decline in value, a 0.3% lower associated to acquisitions and divestitures, and a 0.4% headwind from forex translation. The Client section was flat for the interval. Quantity and blend (+1.0) have been offset by decrease pricing (-0.8%) and forex alternate (-0.2%).

The Americas have been down 0.4% as pricing offset quantity and blend enhancements. EMEA continues to carry out effectively, with gross sales greater by 2.9% as quantity and blend added 3.5%.

Click on right here to obtain our most up-to-date Positive Evaluation report on MKC (preview of web page 1 of three proven beneath):

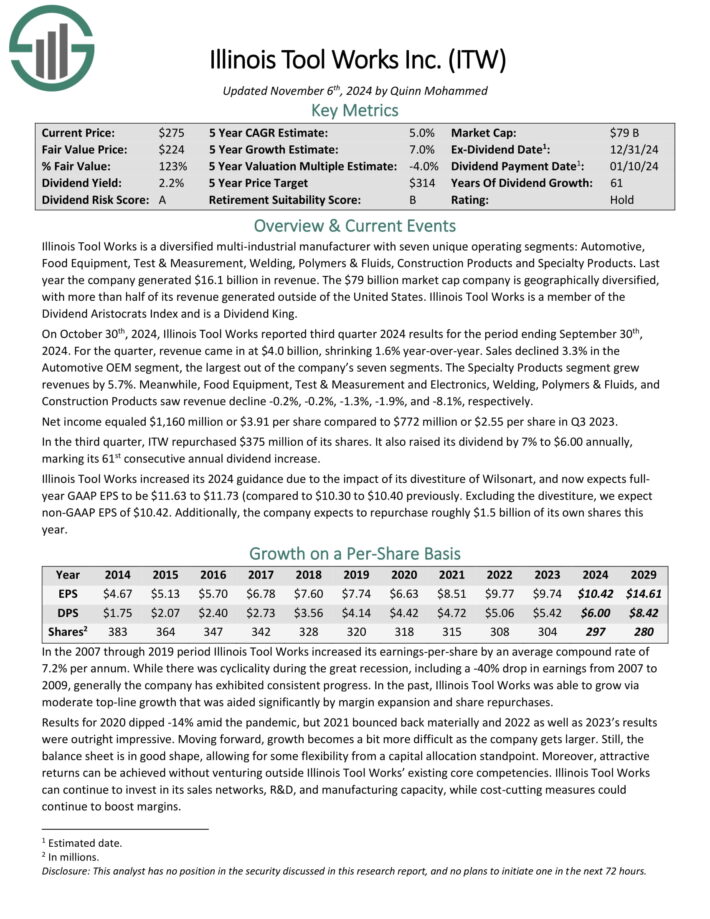

Dividend Inventory For Intergenerational Wealth: Illinois Device Works (ITW)

Illinois Device Works is a diversified multi-industrial producer with seven distinctive working segments: Automotive, Meals Gear, Check & Measurement, Welding, Polymers & Fluids, Building Merchandise and Specialty Merchandise. Final 12 months the corporate generated $16.1 billion in income.

On October thirtieth, 2024, Illinois Device Works reported third quarter 2024 outcomes for the interval ending September thirtieth, 2024. For the quarter, income got here in at $4.0 billion, shrinking 1.6% year-over-year. Gross sales declined 3.3% within the Automotive OEM section, the biggest out of the corporate’s seven segments.

The Specialty Merchandise section grew revenues by 5.7%. In the meantime, Meals Gear, Check & Measurement and Electronics, Welding, Polymers & Fluids and

Building Merchandise noticed income decline -0.2%, -0.2%, -1.3%, -1.9%, and -8.1%, respectively.

Internet earnings equaled $1,160 million or $3.91 per share in comparison with $772 million or $2.55 per share in Q3 2023. Within the third quarter, ITW repurchased $375 million of its shares. It additionally raised its dividend by 7% to $6.00 yearly, marking its 61st consecutive annual dividend improve.

Click on right here to obtain our most up-to-date Positive Evaluation report on ITW (preview of web page 1 of three proven beneath):

Dividend Inventory For Intergenerational Wealth: NextEra Vitality (NEE)

NextEra Vitality is an electrical utility with two working segments, Florida Energy & Gentle (“FPL”) and NextEra Vitality Assets (“NEER”). FPL is the biggest U.S. electrical utility by retail megawatt hour gross sales and buyer numbers.

The speed-regulated electrical utility serves about 5.9 million buyer accounts in Florida. NEER is the biggest generator of wind and photo voltaic power on the planet. NEE was based in 1925. NEE generates roughly 80% of its revenues from FPL.

NextEra Vitality reported its Q3 2024 monetary outcomes on 10/23/24. For the quarter, the corporate reported revenues of $7.6 billion (up 5.5% 12 months over 12 months), translating to adjusted earnings of $2.1 billion (up 11% 12 months over 12 months). On a per share foundation, adjusted earnings climbed 10% to $1.03.

The utility added ~3 GW of recent renewables and storage initiatives to its backlog, together with ~1.4 GW of photo voltaic and ~1.4 GW of battery storage, bringing its backlog to over 24 GW.

12 months so far, it generated working income of $19.4 billion (down 8.8% 12 months over 12 months), adjusted earnings of $6.0 billion (up 11%), and adjusted earnings per share (“EPS”) of $2.90 (up 9%).

Click on right here to obtain our most up-to-date Positive Evaluation report on NEE (preview of web page 1 of three proven beneath):

Dividend Inventory For Intergenerational Wealth: S&P International (SPGI)

S&P International is a worldwide supplier of economic companies and enterprise data and income of over $13 billion. By its numerous segments, it offers credit score rankings, benchmarks and indices, analytics, and different information to commodity market contributors, capital markets, and automotive markets.

S&P International has paid dividends constantly since 1937 and has elevated its payout for 51 consecutive years.

S&P International posted third quarter earnings on October twenty fourth, 2024, and outcomes have been fairly sturdy as soon as once more. Adjusted earnings-per-share got here to $3.89, which was 25 cents forward of estimates. Earnings have been down from $4.04 in Q2, however a lot greater than $3.21 within the year-ago interval.

Income soared 16% greater year-on-year to $3.58 billion, which additionally beat estimates by $150 million. Progress within the Rankings and Indices section led the highest line greater in Q3, though power was broad.

Click on right here to obtain our most up-to-date Positive Evaluation report on SPGI (preview of web page 1 of three proven beneath):

Dividend Inventory For Intergenerational Wealth: The Coca-Cola Firm (KO)

Coca-Cola was based in 1892. At this time, it’s the world’s largest non-alcoholic beverage firm. It owns or licenses greater than 500 non-alcoholic drinks, together with each glowing and nonetheless drinks.

Its manufacturers account for about 2 billion servings of drinks worldwide on daily basis, producing greater than $45 billion in annual income.

The glowing beverage portfolio contains the flagship Coca-Cola model, in addition to different soda manufacturers like Weight loss plan Coke, Sprite, Fanta, and extra.

The nonetheless beverage portfolio contains water, juices, and ready-to-drink teas, comparable to Dasani, Minute Maid, Vitamin Water, and Trustworthy Tea.

Supply: Investor Presentation

Coca-Cola dominates glowing tender drinks, however the firm is making an attempt to take care of and even enhance this dominant place with product extensions of present common manufacturers, together with lowered and zero-sugar variations of manufacturers like Sprite and Fanta.

Coca-Cola posted third quarter earnings on October twenty third, 2024, and outcomes have been higher than anticipated on each income and income. The corporate noticed adjusted earnings-per-share of 77 cents, which was two cents higher than estimates.

Income was off fractionally year-over-year to $11.9 billion, however did beat estimates by $290 million. Natural revenues have been up by 9%. That included 10% progress in value and blend, a 2% decline in focus gross sales, and a 1% achieve in case volumes.

Click on right here to obtain our most up-to-date Positive Evaluation report on KO (preview of web page 1 of three proven beneath):

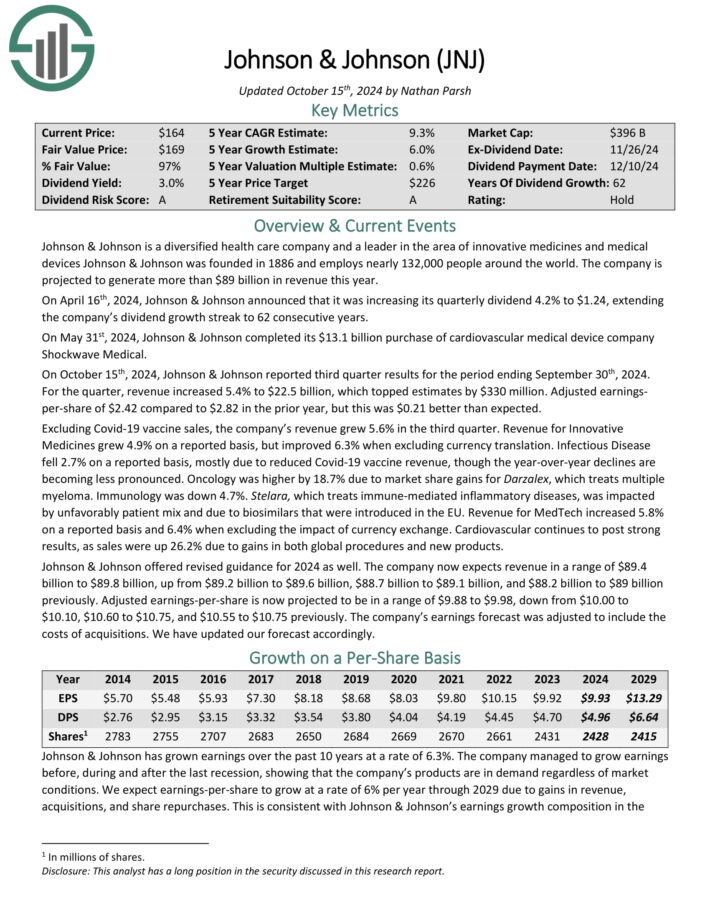

Dividend Inventory For Intergenerational Wealth: Johnson & Johnson (JNJ)

Johnson & Johnson was based in 1886 and has reworked into one of many largest corporations on the planet. Johnson & Johnson is a mega-cap inventory. The corporate generates annual gross sales above $99 billion.

Johnson & Johnson operates a diversified enterprise mannequin, permitting it to attraction to all kinds of consumers inside the healthcare sector. J&J now operates two segments, prescribed drugs and medical units, after spinning off its shopper well being franchises.

Johnson & Johnson reported third-quarter 2024 gross sales progress of 5.2%, reaching $22.5 billion, with operational progress of 6.3%.

Supply: Investor Presentation

Nonetheless, earnings per share (EPS) decreased by 34.3%, largely attributable to a one-time particular cost and bought in-process analysis and improvement (IPR&D).

Adjusted EPS fell 9.0% to $2.42, pushed by the identical IPR&D influence. The corporate made important developments, together with approvals for remedies like TREMFYA and RYBREVANT, and the submission of a brand new normal surgical procedure robotic system, OTTAVA.

Click on right here to obtain our most up-to-date Positive Evaluation report on JNJ (preview of web page 1 of three proven beneath):

Extra Studying

The next databases of dividend progress shares can also be helpful for earnings traders:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.