Este artículo también está disponible en español.

Dogecoin has had fairly an eventful few days when it comes to worth motion, buying and selling quantity, buying and selling exercise, and curiosity amongst traders. Dogecoin led the complete market in inflows, outperforming even Bitcoin prior to now week. This momentum has launched a compelling shift in Dogecoin’s technical outlook, significantly with the Bollinger Bands on the DOGE/BTC chart.

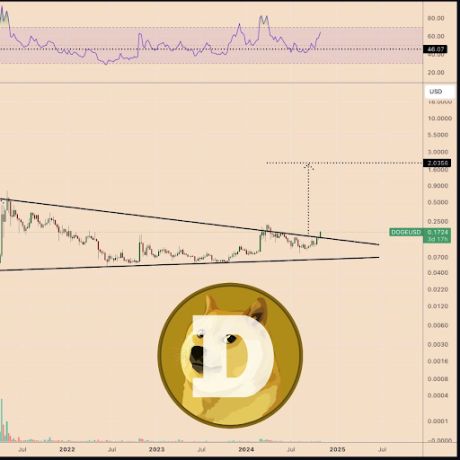

This attention-grabbing outlook was highlighted by crypto analyst Tony Severino, who identified that the Bollinger Bands have tightened to a level not seen in years. In truth, Severino notes that the bands are actually tighter than they have been earlier than Dogecoin’s rally in 2021.

Dogecoin Bollinger Bands Squeeze To Tightest Stage

Bollinger Bands are extensively used technical indicators that mark worth volatility boundaries. When the bands slim, it usually indicators low volatility. Then again, widening bands point out excessive volatility. A squeeze, the place the bands transfer nearer collectively, means that the asset is buying and selling inside a decent vary. Within the case of Dogecoin, Severino’s statement notes that the DOGE/BTC Bollinger Bands are actually nearer than they’ve ever been on the month-to-month timeframe.

Associated Studying

The final the Bollinger bands have been at such a squeeze was simply earlier than the 2021 rally, which noticed the meme coin surge exponentially throughout the meme coin craze. Going by the historical past of the Dogecoin-Bitcoin pair, if the result performs out like its earlier worth motion, Dogecoin may very well be on the cusp of a robust rally within the coming months that might even result in extra returns than the 2024 rally.

DOGE Breakout From Three-12 months Channel

As famous earlier, Dogecoin’s rally over the previous few days has been spectacular. Notably, Dogecoin went on a 72% rally to peak at $0.176, its highest level in over six months. This upward momentum allowed Dogecoin to interrupt out of a three-year-long channel sample on the value chart outlined by a downward-sloping higher trendline relationship again to the 2021 excessive. This breakout is important, because it marks Dogecoin’s transfer past a key resistance stage that had contained its development because the 2021 peak.

Associated Studying

The chance of a Dogecoin rally within the upcoming months has elevated massively attributable to this breakout, though there stays a risk of a retest. In line with a crypto analyst on social media platform X, $2 is a possible peak goal if the momentum holds. Nevertheless, it is very important notice that a number of resistance ranges lie between the present worth and this bold goal. Two examples of notable resistance ranges are the 2024 excessive of $0.22 and the all-time excessive of $0.7316.

On the time of writing, the Dogecoin worth is buying and selling at $0.1585, which suggests it has reversed by about 10% from $0.176 to retest the channel breakout.

Featured picture created with Dall.E, chart from Tradingview.com