Earlier than we get began on at present’s , let me add just a few smart phrases from an previous market observer:

- The inventory market is just not the economic system. The inventory market is the (non-public actual economic system) instances (worth per unit of the non-public actual economic system). When the inventory market goes down, generally it’s as a result of the true economic system is contracting, and generally it’s as a result of the worth individuals are prepared to pay to personal a chunk of that’s declining. Typically, it’s each. Moreover, the primary a part of that equation is basically (actual financial efficiency) instances (capital share vs labor share vs authorities share) The tariffs will have an effect on company earnings, particularly for multinationals, and within the quick time period for home corporations that single-source from a international supply. However the impact on the economic system won’t be dramatic, regardless that we’ll see a technical recession due to the massive swings within the commerce stability in Q1 and Q2 as imports surged forward of the tariffs. So the primary factor we’re seeing in equities is a a number of impact. Shares have been method overpriced, and a few of that’s unwinding. Backside line: if a bear market in equities causes you severe angst or damages your long-term monetary targets, you’re too lengthy equities. If a bear market in equities causes you severe harm to your short-term monetary targets, you’re too lengthy equities. It’s okay. A bear market doesn’t imply we’re headed for a melancholy.

- The quantity of complaining about how the Administration didn’t seek the advice of Wall Road or take into consideration how their actions would have an effect on massive fairness holders and corporations is superb and the complainers are lacking the purpose. That isn’t a bug of the coverage, and a lot of the nation doesn’t see it as a bug. It’s the primary function. As a result of in case you seek the advice of these guys all of them would have mentioned “yeah, go get China with a 2% tariff and naturally don’t contact anybody else.” These are the identical guys who freaked out when Trump slapped tariffs on China in his first time period…which have been clearly looking back method too small to matter. The consultants and Wall Road primarily need to be sure that nobody rocks the boat. However rocking the impact right here isn’t a aspect impact. It’s the major level.

I’ve a 3rd remark, nevertheless it’s inflation-related with all the remainder so I’ll reserve it for the tip. Let’s get into at present’s quantity.

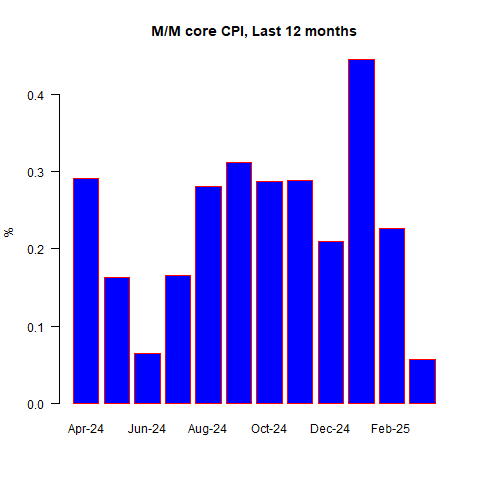

Heading into the quantity, the final consensus was that can be usually within the vary it has been, round 0.25% or so, and headline can be smooth due primarily to vitality that was weaker than the seasonal adjustment accounts for. This month’s CPI, although, is a sidelight in the identical method that the are a sidelight when one thing actually massive occurs subsequent to the final assembly: it isn’t March inflation we’re taken with however quite inflation over the following 3-6 months as tariffs go into impact and start to chunk. The inflation swaps curve is sharply inverted, and has gotten more and more so during the last yr, as quick (1y, 2y, 3y) have been rising whereas the lengthy finish of the curve has truly come down a bit.

Really, long-term inflation expectations have been fairly regular, even within the latest market volatility, which is a method that that (a) this can be a market-price occasion and never an economic system occasion and (b) there aren’t massive liquidity points on the market like we had within the GFC. 10-year inflation breakevens have been between 2.20% and a pair of.30% during the last week regardless of the record-breaking collection of enormous fairness swings. Anyway, again to CPI.

Some individuals thought we’d see slightly trace of the primary tariffs on this information. Welp, we didn’t. Headline CPI truly declined – costs fell on common (however look forward to it) – by -0.05% m/m and headline inflation is simply 2.41% during the last yr. Extra stunning was that core inflation crashed decrease, and was solely +0.06% m/m to convey the y/y all the way down to 2.81%. That was far beneath expectations.

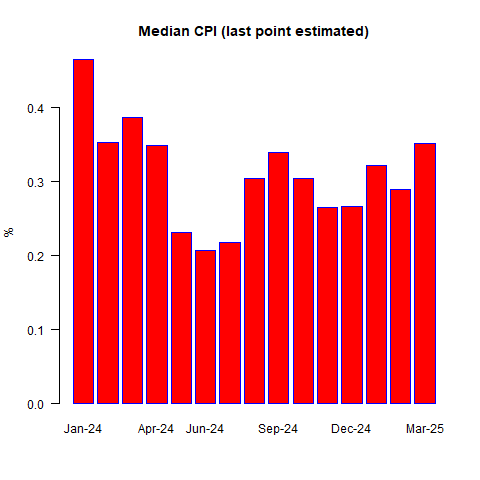

Sadly, it’s right here I’ve to inform you to carry your horses. As a result of once we estimate Median CPI, we don’t get even a whisper of the identical impact. Actually, my early estimate has m/m median inflation the highest it has been in a couple of yr. (This month, a number of regional housing subcategories are clustering across the median so my estimate of +0.35% is topic to being off by just a few foundation factors relying on how the official seasonal adjustment impacts the precise m/m will increase in these subgroups, nevertheless it won’t be far from +0.35%).

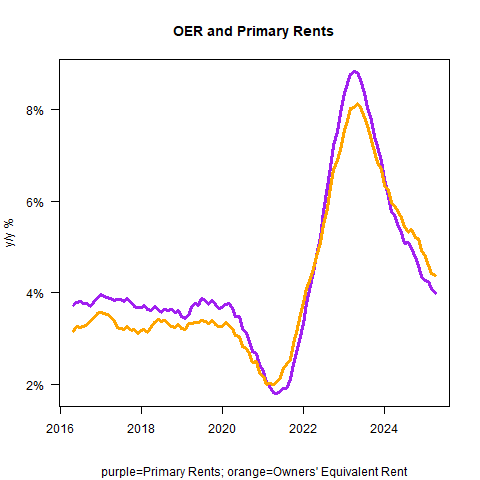

The truth that median doesn’t actually present any of the deceleration that core does tells us that that is completely different from the deceleration final Might/June/July, when rents had a short however short-term lull. In March, House owners’ Equal Lease was +0.40% m/m, and Major Rents +0.33% – each of that are quicker than final month’s +0.28%/+0.28%. The y/y numbers are nonetheless declining however at a decelerating charge. Nonetheless proper on schedule, and nonetheless zero signal of deflation in housing. Sorry!

If rents accelerated final month, how did we get an enormous dip in core however nothing in median? That tells you that we should have gotten massive strikes in low-weight classes. Which is precisely what occurred.

- Medicinal Medicine, -1.30% m/m (final month, +0.18%)

- Used Vehicles and Vans, -0.69% (final month +0.88%)

- Airfares, -5.27% m/m (final month -3.99%)

- Lodging Away from Residence, -3.54% (final month +0.18%)

- Automotive and Truck Rental, -2.66% (final month -1.25%)

These are, sadly, a lot of the ‘normal suspects’ in relation to surprises in both path. Once they all shock in the identical path, it means we get a core quantity that’s method off. And that, my associates, is why we have a look at Median CPI. Of this checklist, the Used Vehicles one is the one one which was truly a shock within the sense that folks these days take note of that subcomponent and the non-public surveys anticipated a rise. I’ve written beforehand about what I believe is going on in Medicinal Medicine, and even had a podcast episode just lately to debate it (Ep. 137: Drug Costs and the Most-Favored-Nation Clause). This isn’t going to proceed, with 100%+ tariffs on China, the place most of our Energetic Pharmaceutical Components come from. I do ponder whether the decline in airfares (greater than can be anticipated from jetfuel costs) and lodging away from residence may partly replicate a decline in tourism to the US – each the official form and the unofficial ‘tourism’ that has been reversing just lately with the assistance of INS – which suggests it gained’t quickly be reversed. Unsure on that.

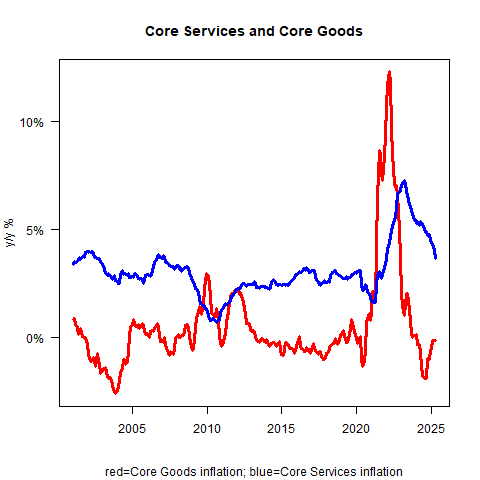

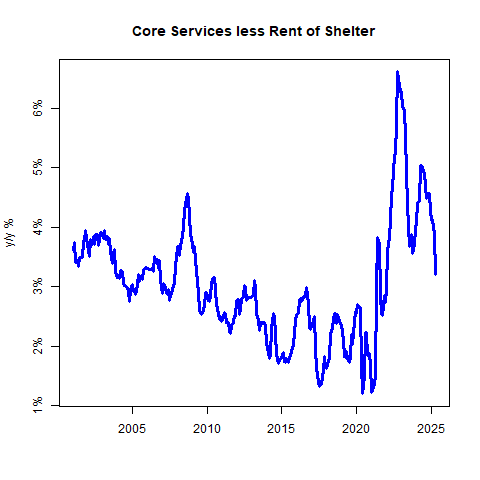

The web impact of those massive strikes in small classes is that core items has not but turned optimistic (however it would, as soon as the tariffs go into impact, though not by an enormous quantity) and core companies dropped sharply to three.7% y/y from 4.1% y/y.

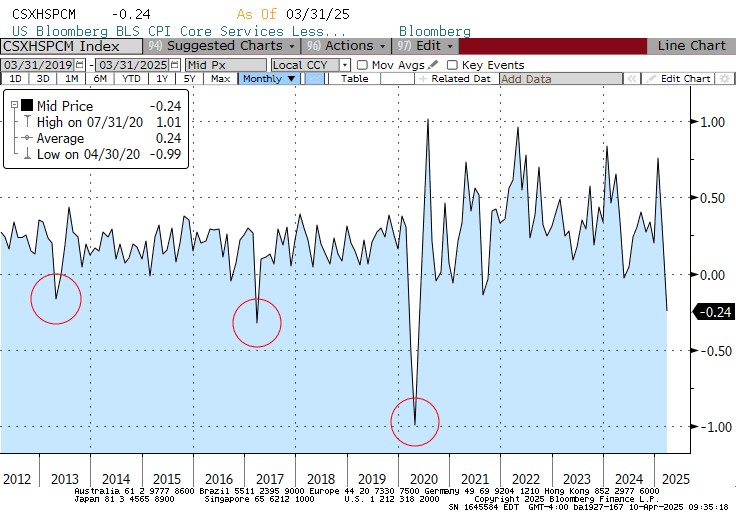

Supercore seems nice for the primary time shortly. Month/month it fell -0.24%, the sharpest decline since COVID. And the y/y dropped in direction of 3% as if although it was going to overlook the bus if it didn’t get there quickly.

Earlier than all of us get excited, I’ll level out that the three spikes on the m/m Supercore chart beneath have been all March and April numbers. I think that a part of what we’re seeing is as a result of altering placement of Easter, together with Spring Break…and in that case, these components will likely be unwound within the subsequent month or two.

That doesn’t clarify the sharp fall in automotive and truck rental costs. That could be a little bit of a head scratcher.

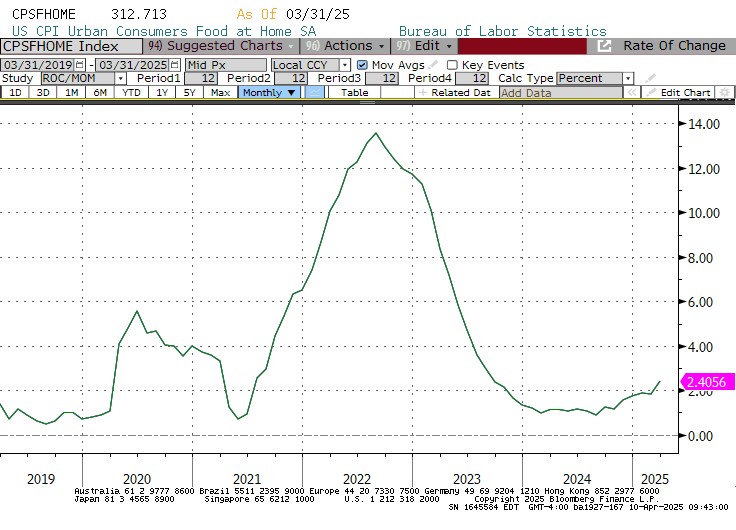

There’s a little little bit of dangerous information right here, however it’s away from core. Meals Away from Residence (which is in supercore) was behaved at +0.36% m/m vs +0.39% m/m final month, however Meals at Residence was +0.49% seasonally-adjusted in contrast with +0.01% final month. It wasn’t simply Eggs, which rose lower than 2% final month on the retail degree and are declining on the wholesale degree. Milk, Cheese, and Meats/poultry/fish all noticed significant will increase. The proletariat (of which I’m one) notices these items, so if we have been weighting the index by salience as a substitute of {dollars} spent they’d get a heavy weight. Now, there’s a cause that we take out Meals and Power…the noise usually outweighs the sign. However take administrative notice of the small however noticeable acceleration in meals costs on a y/y foundation.

General, regardless that this was the second nice Core CPI shock in a row it was additionally the second Core CPI shock that shouldn’t get you very excited. In each circumstances, the truth that Median CPI won’t echo the deceleration tells you that that is occurring within the small classes that are inclined to mean-revert. They didn’t mean-revert this month, however I think they are going to. Sadly, that can occur on the similar time that 10% broad tariffs, and enormous tariffs on Chinese language items, are kicking into impact. We’d have a whopper of a Core CPI developing right here in one of many subsequent few months.

Within the broader image, inflation is settling within the mid-to-high 3s (measured by Median CPI), however there are clouds on the fast horizon from tariffs. However as the steadiness within the longer-term inflation measures suggests, the market isn’t actually but involved that one other upswing is on the best way. Tariffs are a one-off impact, and a fairly small impact total though vital within the particular classes the place they’re leveed. Keep in mind, although, that core items, the place the tariffs primarily fall, is simply 19.4% of the general consumption basket.

The longer-term image depends upon how lengthy the uncertainty lasts. As I’ve identified earlier than, financial coverage uncertainty – which is off the charts proper now – manifests itself in downward stress on financial velocity. I count on that the uncertainty will largely be previous us in 6 months, and within the meantime the upward stress on costs from tariffs that exhibits up in core items will in all probability dominate the downward stress from coverage uncertainty (which causes shoppers to maintain extra precautionary financial savings, inflicting the speed decline). These results will in all probability put on off at roughly the identical time so that we’ll solely discover it on the micro degree.

Uncertainty additionally, clearly, lowers the worth of dangerous belongings (I’ve additionally written about this!), in a wholesome method. However I’m not a type of individuals who worries that uncertainty could have a big impact on the underlying financial exercise. Sure, CEOs might delay making massive plans for a month or two. However the uncertainty gained’t final ceaselessly, after which they’ll make their plans. CEOs who can’t make choices below a minimum of gentle uncertainty aren’t going to be CEOs very lengthy. The home economic system will likely be simply effective, particularly as we proceed to provide extra of our inner consumption wants, domestically.

And for the ? The correct reply to uncertainty from a policymaker perspective is to extend the hurdle for taking motion. The correct reply is to make no modifications to coverage. I’m not assured that the Federal Reserve will appropriately separate the ‘worth of threat’ impact from the ‘financial progress’ impact. They’re appropriate to notice that tariffs by themselves usually are not inflationary in that they’re one-off results. In the event that they imagine that, they usually suppose there’s an enormous recession coming, they’ll lower charges. That may be a mistake, particularly given the uncertainty.

Unique Submit