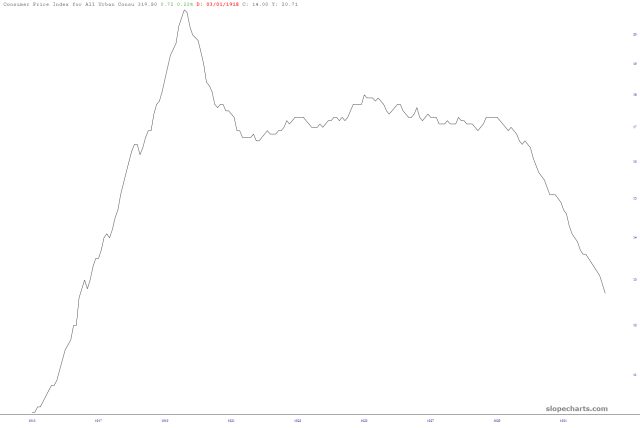

All of the inflation information is out ( yesterday, in the present day), and it’s ice chilly. The precise information (left column) is method, method beneath the anticipated (proper). In regular occasions – – and these are NOT – – the bulls can be celebrating this with +200 on the /ES. As an alternative, it’s slowly sinking in that deflation is creeping into our lives, and that’s not one thing to have a good time.

Certainly, none of us have been even alive throughout any deflationary interval till now. The final time this occurred was within the late Twenties and early Thirties, and I vaguely keep in mind that was an attention-grabbing interval of financial historical past on the planet.

Within the markets, proceed to sink, because the world is appropriately concluded that the U.S. is bankrupt, not reliable, and headed for monetary destroy, so it’s not precisely a peachy-keen credit score threat.

Likewise, of us are realizing that the is gently used rest room paper, and that the higher factor to outdated is actual cash, in any other case often known as gold.

As for “digital gold“, , is has remained surprisingly strong inasmuch because it by no means cracked the $73,500 stage. If and when it does, it’s going to exacerbate the bearish emotions which have unfold o’er the land of belongings.

Now let’s discuss Tim’s emotions which, let’s face it, is why we’re all right here.

I promised myself yesterday afternoon that I wouldn’t take a look at a single quote till this morning, and I saved that promise. It was like taking a vow of chastity and strolling all night via an orgy, averting my eyes each step of the way in which. I merely didn’t need to torture myself anymore, as a result of the previous couple of weeks have felt like at the very least a 12 months. Are you able to even consider that Trump pulled out that tariffs poster solely final Wednesday? It looks as if a lifetime in the past!

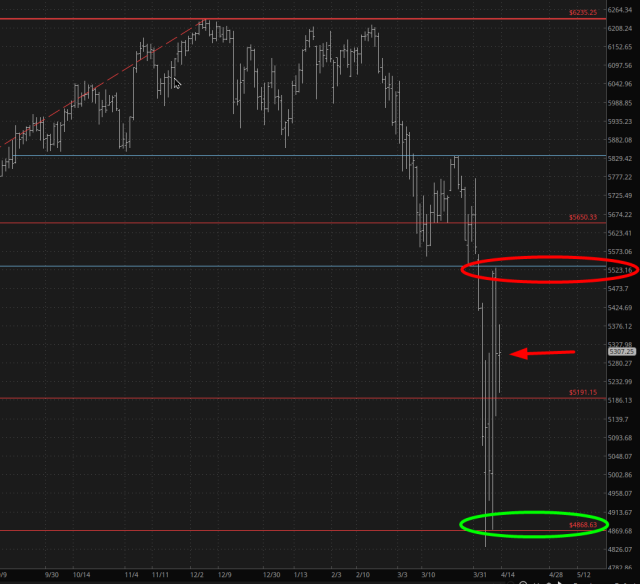

I ended my buying and selling Thursday INCREDIBLY brief, and I stay in abject terror that what occurred two days in the past (intraday) would occur in some type in a single day, and I’d need as much as horrific numbers.

As an alternative, once I ambled over to my show, the inventory futures have been up very modesty, similar to the outdated days. They’ve slipped considerably into the purple, which I respect, however issues appear eerily and freakishly calm proper now, all issues thought-about.

The factor is, we’re type of in no man’s land (arrow) proper now, smack dab in the midst of the very apparent place to purchase (inexperienced oval, the place I purchased XOP and EFA) and the very apparent place to brief (purple oval, the place I shorted every part that had the misfortune of getting a ticker image). So, I really feel fairly “in danger” proper now, significantly since, I dunno, Powell would possibly pull some stunt this weekend to save lots of his billionaire bond butt buddies.

What I can say, although, a lot longer-term phrases, is that our time is right here. That is expressed by one easy ratio chart that I’ve been speaking about for months and months, which is the divided by .

My thesis all this time has been BUY gold and SHORT equities, primarily based on this chart. For oh so lengthy, the charting was hammering out its prime, teasing us with its completion.

That completion is right here. The time is now. Quick-term wiggles apart, the world has modified endlessly.