Ethereum (ETH) has dropped 13.6% over the previous week, largely attributable to rising geopolitical tensions within the Center East, significantly between Israel and Iran. Regardless of this current value hunch, Ethereum whales seem undeterred, signalling confidence within the digital asset’s long-term restoration.

Ethereum Whales Are Not Budged Regardless of Latest Loss

Based on a current CryptoQuant Quicktake submit by technical dealer Mignolet, ETH whales are unfazed by the current value pullback within the cryptocurrency. Notably, the digital asset has tumbled from $2,869 on June 11 to the mid $2,200 vary on the time of writing.

Not like the double-top sample noticed in 2021 – when Ethereum noticed a notable enhance in transaction outflows as whales exited close to the highest – present information means that whales don’t make related strikes.

The analyst shared the next comparative chart displaying that in earlier market cycles, spikes in ETH withdrawals from wallets have been usually adopted by main value pullbacks. Nonetheless, such spikes are presently absent, suggesting low exit exercise.

In a current submit on X, crypto analyst Ted Pillows added additional assist to this view, stating that Ethereum whales are literally shopping for the dip. Based on the analyst, wallets holding 10,000 ETH or extra collectively added over $265 million price of ETH throughout the market pullback on June 21.

However, Pillows warned that if ETH fails to interrupt above the $2,350 resistance degree quickly, it might revisit the $2,100 assist. A failure to carry this degree might expose the asset to an extra decline towards $1,800.

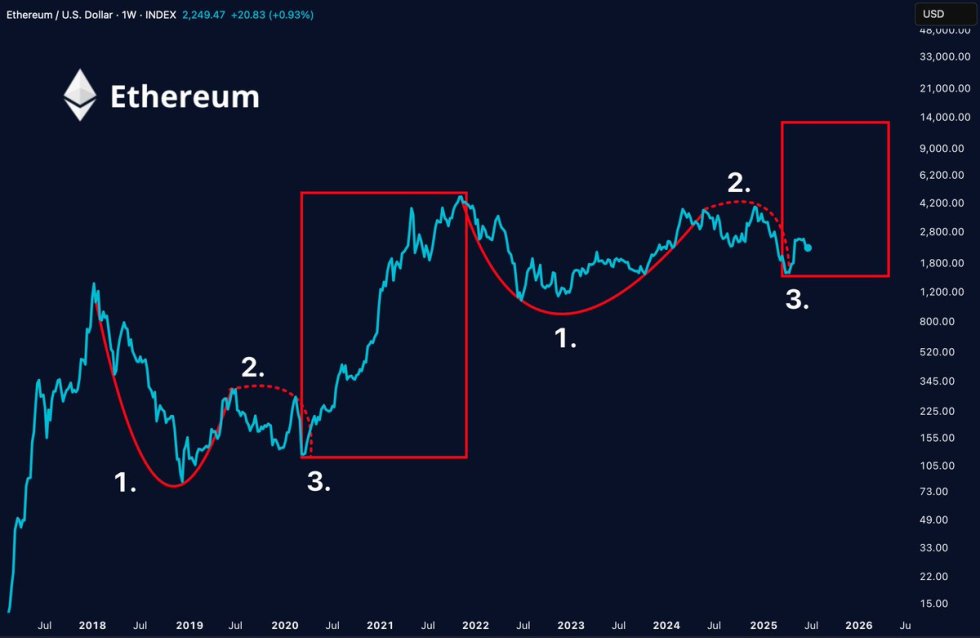

However, crypto dealer Merlijn The Dealer supplied a extra optimistic take. The analyst in contrast Ethereum’s present value conduct to the buildup part seen between 2019 and 2021, stating that “ETH to five-figures isn’t a dream,” implying a long-term bullish outlook stays intact.

Headwinds Brewing For ETH?

Though technical indicators level towards additional upside for the second-largest cryptocurrency by market cap, some market specialists opine that ETH could also be on the verge of coming into a interval of downtrend earlier than it resumes its bullish trajectory.

For instance, seasoned crypto market professional Aksel Kibar lately remarked that ETH could also be getting ready for a interval of serious downtrend motion. The analyst gave a stark warning of ETH presumably falling all the way in which all the way down to $900.

Equally, rising sell-volume for ETH threatens to additional disrupt the digital asset’s constructive value momentum. At press time, ETH trades at $2,233, up 2.4% previously 24 hours.

Featured Picture from Unsplash.com, charts from CryptoQuant, X, and TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.