With the broader crypto market’s renewed bullish situation, Ethereum is starting to reveal strong upward actions because it hovers close to the pivotal $1,900 stage. Following the current bullish efficiency, traders and merchants are selecting to carry onto their cash, as indicated by a pointy drop in ETH’s alternate reserves.

Exchanges Ethereum Reserves Drop Sharply

Ethereum’s value has picked up its tempo as soon as once more, reclaiming above $1,800 amidst favorable market situations. In the course of the optimistic interval, traders seem to have been withdrawing ETH from main exchanges, particularly Binance, the most important crypto alternate.

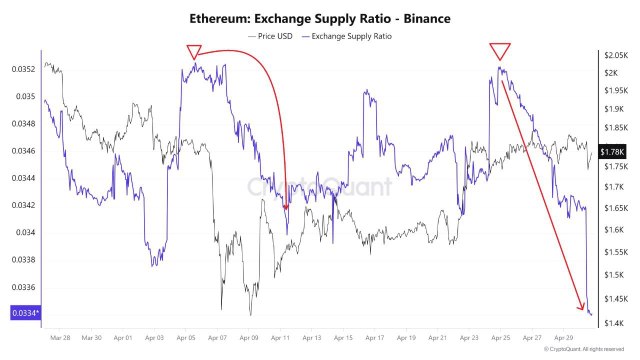

Kyle Doops, the host of the Crypto Banter present, revealed the shift in investor sentiment towards ETH after investigating the Ethereum Alternate Provide Ratio metric on the Binance alternate.

This drop in alternate reserves signifies that traders are more and more placing ETH into long-term or chilly storage, reducing the amount that’s simply accessible for buying and selling. It additionally displays traders’ robust conviction within the altcoin‘s long-term prospects because the bull market progresses.

Knowledge shared by Kyle Doops within the X publish exhibits that Ethereum is quietly tightening on exchanges, with its out there provide plummeting sharply to the bottom ranges in weeks. Over time, these provide reductions have usually come earlier than value will increase, fueled by the dynamics of rising demand and shortage.

In line with the professional, ETH leaves crypto exchanges, inflicting promoting stress to drop and tightening provide when this occurs, which ends up in value squeezes within the close to time period. As Ethereum’s alternate provide reduces, Kyle Doops claims that the Binance platform is the liquidity hub.

ETH’s Uptrend Unable to Halt Bearish Streak

For the reason that growth usually indicators potential upward surges, this suggests that Ethereum’s value may be gearing up for bullish responses, suggesting a continuation of its present uptrend. Nonetheless, regardless of the continuing upside actions, the altcoin has completed one other month in a bearish fashion.

Technical professional and investor, Venturefounder delved into the month-to-month value motion, highlighting 5 consecutive months of unhinged promoting stress and bearish efficiency. He additionally highlighted that the altcoin has flipped right into a bullish outlook as Could begins, hinting at a potential finish to the adverse streak.

The chart exhibits that April’s bearish shut marked the second-largest streak of consecutive purple months since 2018, the place ETH witnessed 7 straight purple months between Could and November. By the point the streak ended, Ethereum’s value had dropped considerably to the $91 stage.

Within the meantime, Crypto Bullet, a market professional, is assured that this mid-term correction has reached its finish, mapping out an enormous reversal candle from the August to October 2023 lows. Whereas the underside is in, the analyst anticipates an excellent bounce within the mid-term.

Crypto Bullet acknowledged that the anticipated transfer may be a rally to a brand new all-time excessive or a useless cat bounce. Nonetheless, the professional is leaning towards the useless cat bounce state of affairs based mostly on ETH’s weak spot this cycle and that the cycle is simply 7 months away from concluding.

Featured picture from Getty Pictures, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.