Key Takeaways

- The US housing finance regulator needs Fannie Mae and Freddie Mac to draft plans that deal with crypto as a part of a borrower’s belongings for mortgage overview.

- Crypto holdings could be counted instantly in mortgage underwriting if the proposals are authorized.

Share this text

The US Federal Housing Finance Company (FHFA) has directed mortgage giants Fannie Mae and Freddie Mac to develop and submit proposals that will permit crypto belongings to be included in mortgage underwriting with out a necessary USD conversion.

The directive, signed on June 25 by William Pulte, the Director of the FHFA, got here shortly after Pulte stated Monday that the housing finance regulator would discover the opportunity of together with crypto as a part of the asset analysis in mortgage {qualifications}.

Technique’s Government Chairman, Michael Saylor, provided to share the corporate’s BTC credit score mannequin, which was created to guage creditworthiness primarily based on Bitcoin belongings, which addresses mortgage length, collateral, Bitcoin worth fluctuations, and threat projections, with Pulte.

In response, Pulte stated he would overview Technique’s mannequin.

Beneath the brand new order, government-sponsored enterprises should contemplate solely crypto belongings that may be verified and held on US-regulated centralized exchanges working inside acceptable authorized frameworks.

The order additionally requires each enterprises to include threat mitigation measures, together with changes for market volatility and acceptable risk-based modifications to the portion of reserves held in crypto belongings.

Any proposed adjustments should obtain approval from every enterprise’s Board of Administrators earlier than submission to FHFA for overview. The directive takes impact instantly and requires implementation “as quickly as fairly sensible.”

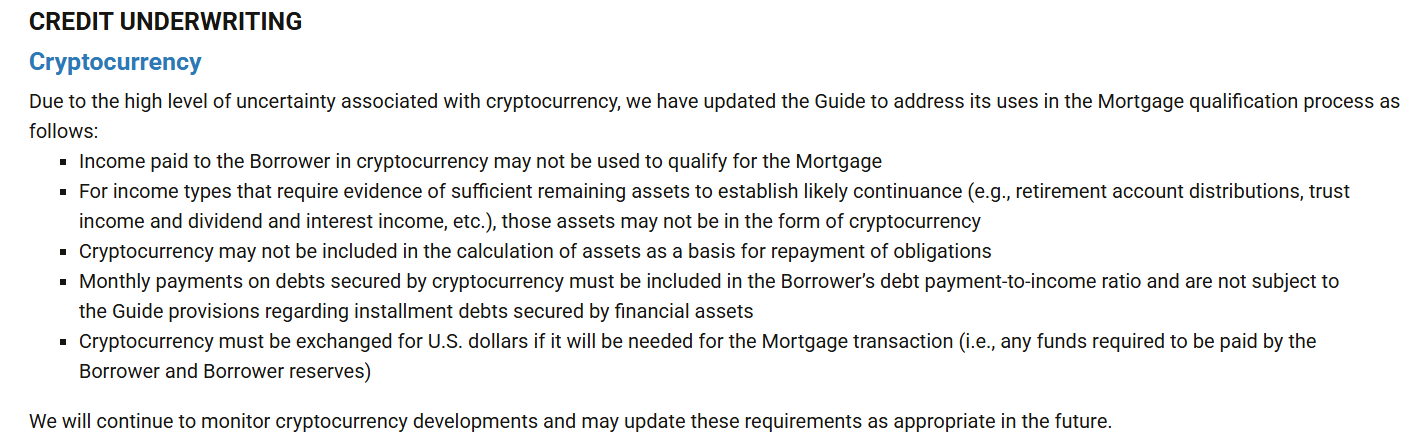

Crypto belongings are usually not accepted as mortgage reserves until transformed into US {dollars}. In 2021 steerage, Freddie Mac explicitly said that crypto will not be included within the calculation of belongings as a foundation for mortgage reimbursement and should be exchanged for US {dollars} for mortgage transactions.

Likewise, lenders are usually required to transform crypto belongings into money or money equivalents earlier than counting them as reserves, attributable to volatility and regulatory uncertainty.

If authorized, the transfer might assist combine crypto belongings extra totally into conventional mortgage finance, making borrowing extra accessible to crypto holders.

Share this text