Printed on Might thirteenth, 2025 by Bob Ciura

Lengthy-term dividend development inventory investing combines the first cause most individuals make investments – passive revenue – with the tried-and-true knowledge that underlies profitable investing.

For an organization to pay rising dividends year-after-year for many years, it should have favorable long-term financial traits and a fairly competent and trustworthy administration workforce.

Blue-chip shares are well-established, financially sturdy, and constantly worthwhile firms.

This analysis report has the next sources that can assist you put money into blue chip shares:

As well as, we now have ranked the highest 10 prime quality dividend development shares for the long term.

The ten dividend shares beneath are anticipated to develop their future earnings-per-share on the highest compound annual charge of all firms we cowl within the Positive Evaluation Analysis Database.

They don’t have excessive dividend yields, however their fast anticipated earnings development ought to permit them to boost their dividends at very excessive charges annually.

They’re ranked so as of 5-year anticipated EPS development charge, in ascending order.

Desk of Contents

The desk of contents beneath permits for straightforward navigation.

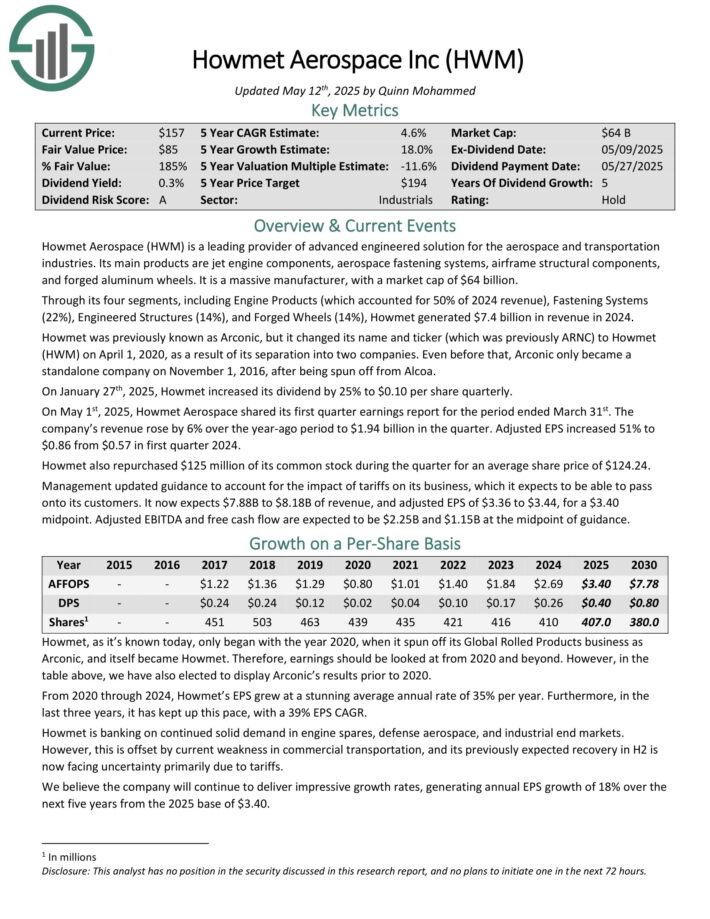

Quick Rising Dividend Inventory #10: Howmet Aerospace (HWM)

- Anticipated Annual EPS Progress: 18.0%

Howmet Aerospace (HWM) is a number one supplier of superior engineered answer for the aerospace and transportation industries. Its predominant merchandise are jet engine elements, aerospace fastening methods, air body structural elements, and solid aluminum wheels.

Via its 4 segments, together with Engine Merchandise (which accounted for 50% of 2024 income), Fastening Programs (22%), Engineered Constructions (14%), and Solid Wheels (14%), Howmet generated $7.4 billion in income in 2024.

On January twenty seventh, 2025, Howmet elevated its dividend by 25% to $0.10 per share quarterly.

On Might 1st, 2025, Howmet Aerospace shared its first quarter earnings report for the interval ended March thirty first. The corporate’s income rose by 6% over the year-ago interval to $1.94 billion within the quarter. Adjusted EPS elevated 51% to $0.86 from $0.57 in first quarter 2024.

Howmet additionally repurchased $125 million of its widespread inventory through the quarter for a mean share value of $124.24.

Click on right here to obtain our most up-to-date Positive Evaluation report on HWM (preview of web page 1 of three proven beneath):

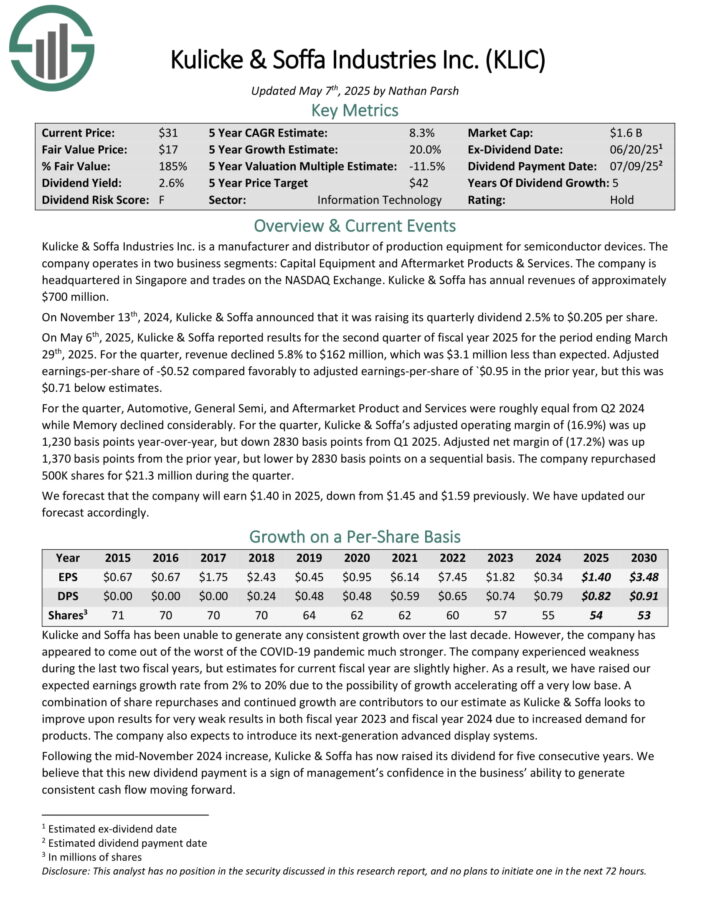

Quick Rising Dividend Inventory #9: Kulicke & Soffa Industries (KLIC)

- Anticipated Annual EPS Progress: 20.0%

Kulicke & Soffa Industries Inc. is a producer and distributor of manufacturing tools for semiconductor units. The corporate operates in two enterprise segments: Capital Gear and Aftermarket Merchandise & Providers.

It’s headquartered in Singapore and trades on the NASDAQ Change. Kulicke & Soffa has annual revenues of roughly $700 million.

On Might sixth, 2025, Kulicke & Soffa reported outcomes for the second quarter of fiscal yr 2025. For the quarter, income declined 5.8% to $162 million, which was $3.1 million lower than anticipated. Adjusted earnings-per-share of -$0.52 in contrast favorably to adjusted earnings-per-share of -$0.95 within the prior yr.

For the quarter, Automotive, Common Semi, and Aftermarket Product and Providers have been roughly equal from Q2 2024 whereas Reminiscence declined significantly. For the quarter, Kulicke & Soffa’s adjusted working margin of (16.9%) was up 1,230 foundation factors year-over-year, however down 2830 foundation factors from Q1 2025.

Click on right here to obtain our most up-to-date Positive Evaluation report on KLIC (preview of web page 1 of three proven beneath):

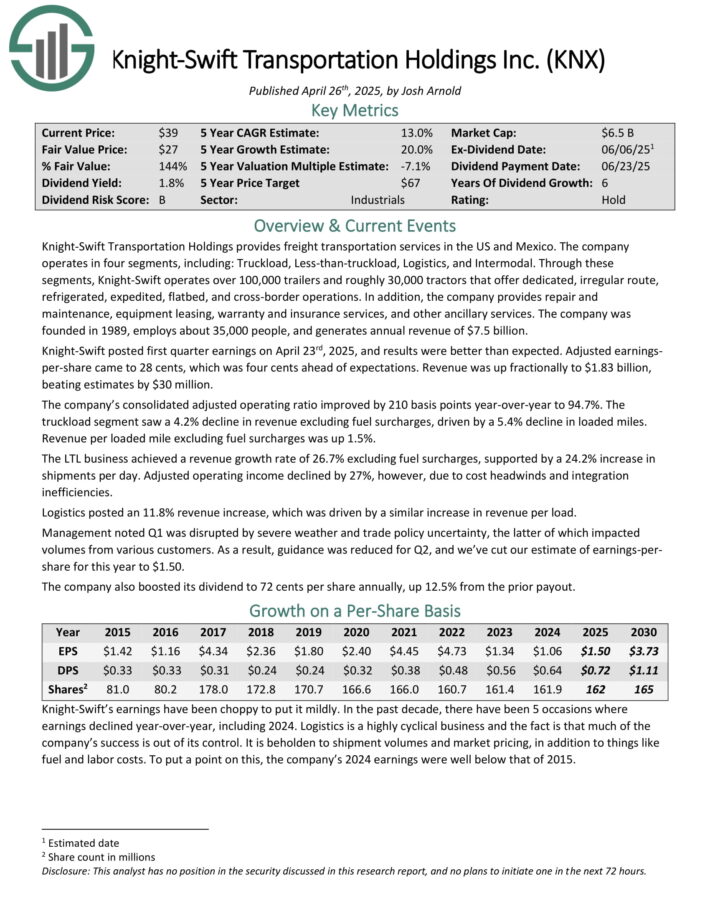

Quick Rising Dividend Inventory #8: Knight-Swift Transportation Holdings (KNX)

- Anticipated Annual EPS Progress: 20.0%

Knight-Swift Transportation Holdings offers freight transportation companies within the US and Mexico. The corporate operates in 4 segments, together with: Truckload, Much less-than-truckload, Logistics, and Intermodal.

Knight-Swift operates over 100,000 trailers and roughly 30,000 tractors that supply devoted, irregular route, refrigerated, expedited, flatbed, and cross-border operations.

As well as, the corporate offers restore and upkeep, tools leasing, guarantee and insurance coverage companies, and different ancillary companies. The corporate was based in 1989, employs about 35,000 individuals, and generates annual income of $7.5 billion.

Knight-Swift posted first quarter earnings on April twenty third, 2025, and outcomes have been higher than anticipated. Adjusted earnings-per-share got here to twenty-eight cents, which was 4 cents forward of expectations. Income was up fractionally to $1.83 billion, beating estimates by $30 million.

The corporate’s consolidated adjusted working ratio improved by 210 foundation factors year-over-year to 94.7%. The truckload section noticed a 4.2% decline in income excluding gas surcharges, pushed by a 5.4% decline in loaded miles.

Click on right here to obtain our most up-to-date Positive Evaluation report on KNX (preview of web page 1 of three proven beneath):

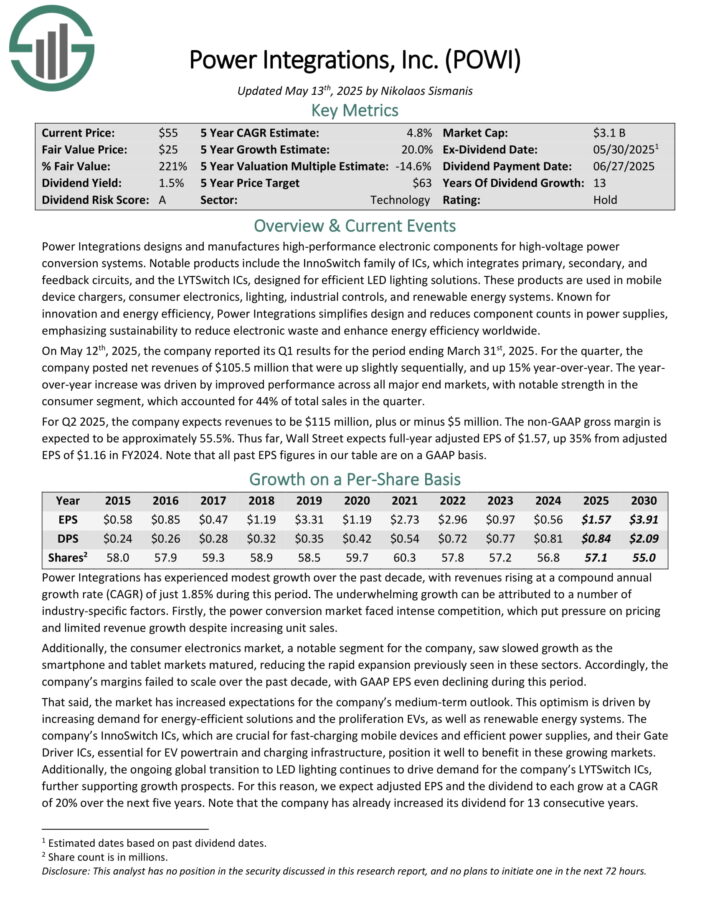

Quick Rising Dividend Inventory #7: Energy Integrations Inc. (POWI)

- Anticipated Annual EPS Progress: 20.0%

Energy Integrations designs and manufactures high-performance digital elements for high-voltage energy conversion methods.

Notable merchandise embrace the InnoSwitch household of ICs, which integrates main, secondary, and suggestions circuits, and the LYTSwitch ICs, designed for environment friendly LED lighting options.

These merchandise are utilized in cellular machine chargers, client electronics, lighting, industrial controls, and renewable power methods.

On Might twelfth, 2025, the corporate reported its Q1 outcomes for the interval ending March thirty first, 2025. For the quarter, the corporate posted internet revenues of $105.5 million that have been up barely sequentially, and up 15% year-over-year.

The year-over-year enhance was pushed by improved efficiency throughout all main finish markets, with notable energy within the client section, which accounted for 44% of complete gross sales within the quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on POWI (preview of web page 1 of three proven beneath):

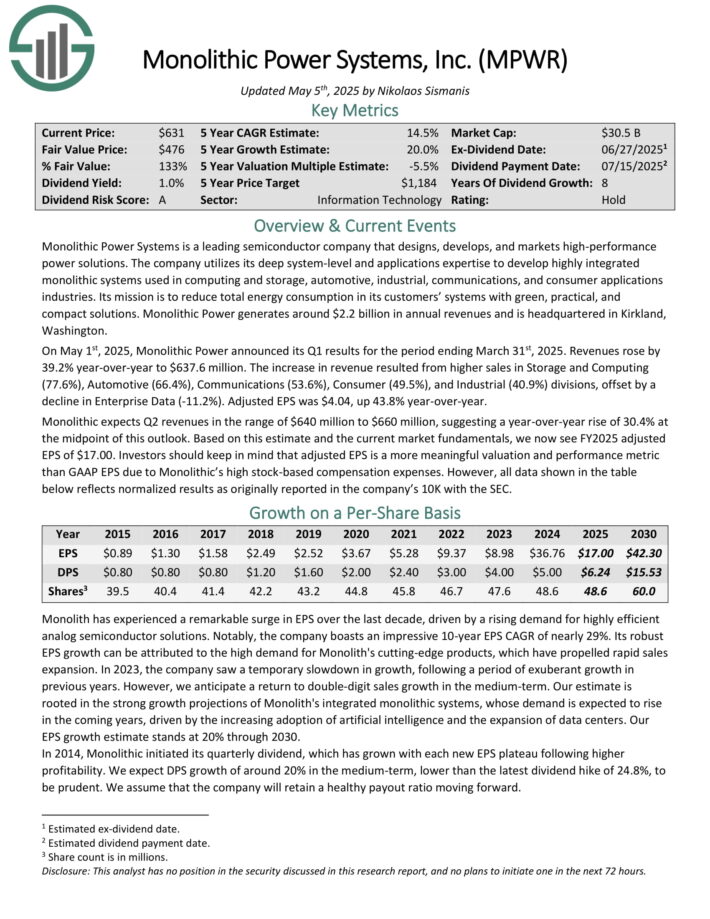

Quick Rising Dividend Inventory #6: Monolithic Energy Programs (MPWR)

- Anticipated Annual EPS Progress: 20.0%

Monolithic Energy Programs is a number one semiconductor firm that designs, develops, and markets high-performance energy options.

The corporate makes use of its deep system-level and purposes experience to develop extremely built-in monolithic methods utilized in computing and storage, automotive, industrial, communications, and client purposes industries.

Monolithic Energy generates round $2.2 billion in annual revenues and is headquartered in Kirkland, Washington.

On Might 1st, 2025, Monolithic Energy introduced its Q1 outcomes for the interval ending March thirty first, 2025. Revenues rose by 39.2% year-over-year to $637.6 million.

The rise in income resulted from larger gross sales in Storage and Computing (77.6%), Automotive (66.4%), Communications (53.6%), Client (49.5%), and Industrial (40.9%) divisions, offset by a decline in Enterprise Knowledge (-11.2%). Adjusted EPS was $4.04, up 43.8% year-over-year.

Monolithic expects Q2 revenues within the vary of $640 million to $660 million, suggesting a year-over-year rise of 30.4% on the midpoint of this outlook.

Click on right here to obtain our most up-to-date Positive Evaluation report on MPWR (preview of web page 1 of three proven beneath):

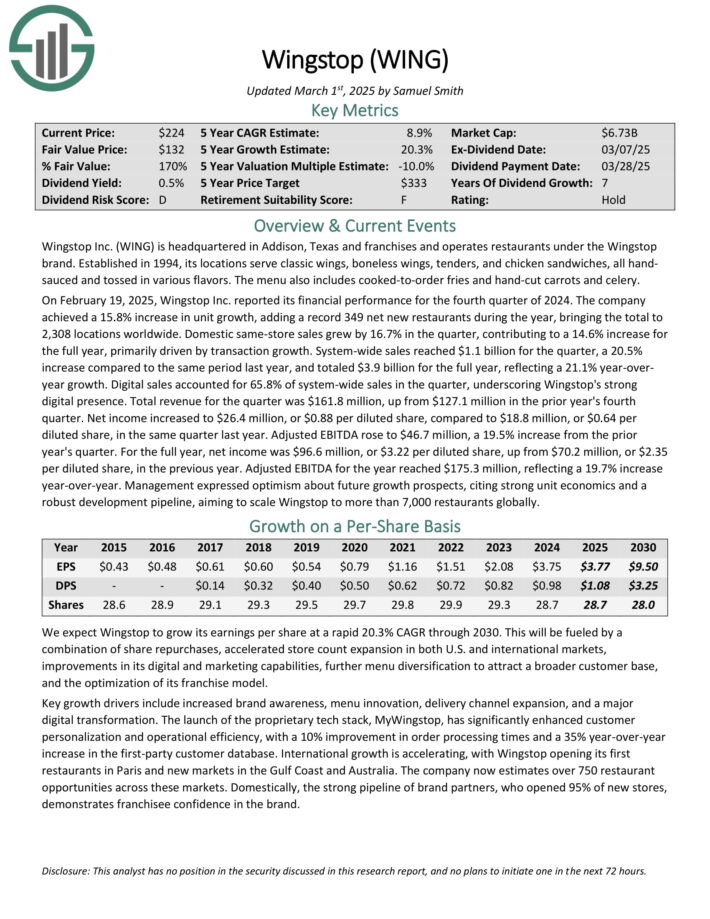

Quick Rising Dividend Inventory #5: Wingstop Inc. (WING)

- Anticipated Annual EPS Progress: 20.3%

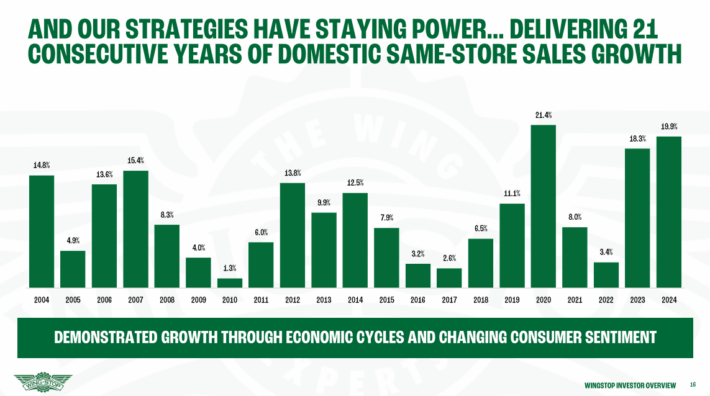

Wingstop Inc. (WING) is headquartered in Addison, Texas and franchises and operates eating places underneath the Wingstop model.

The corporate has an extended observe document of excessive development.

Supply: Investor Presentation

On February 19, 2025, Wingstop Inc. reported its monetary efficiency for the fourth quarter of 2024. The corporate achieved a 15.8% enhance in unit development, including a document 349 internet new eating places through the yr, bringing the whole to 2,308 places worldwide.

Home same-store gross sales grew by 16.7% within the quarter, contributing to a 14.6% enhance for the complete yr, primarily pushed by transaction development.

System-wide gross sales reached $1.1 billion for the quarter, a 20.5% enhance in comparison with the identical interval final yr, and totaled $3.9 billion for the complete yr, reflecting a 21.1% year-over-year development.

Complete income for the quarter was $161.8 million, up from $127.1 million within the prior yr’s fourth quarter. Internet revenue elevated to $26.4 million, or $0.88 per diluted share, in comparison with $18.8 million, or $0.64 per diluted share, in the identical quarter final yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on WING (preview of web page 1 of three proven beneath):

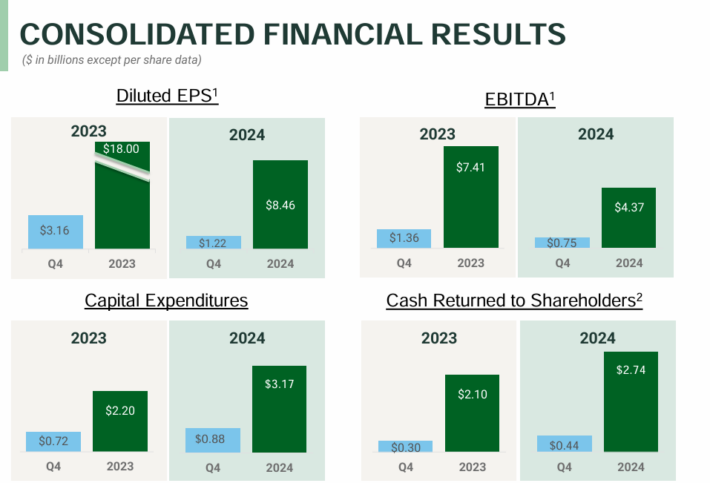

Quick Rising Dividend Inventory #4: Nucor Corp. (NUE)

- Anticipated Annual EPS Progress: 20.6%

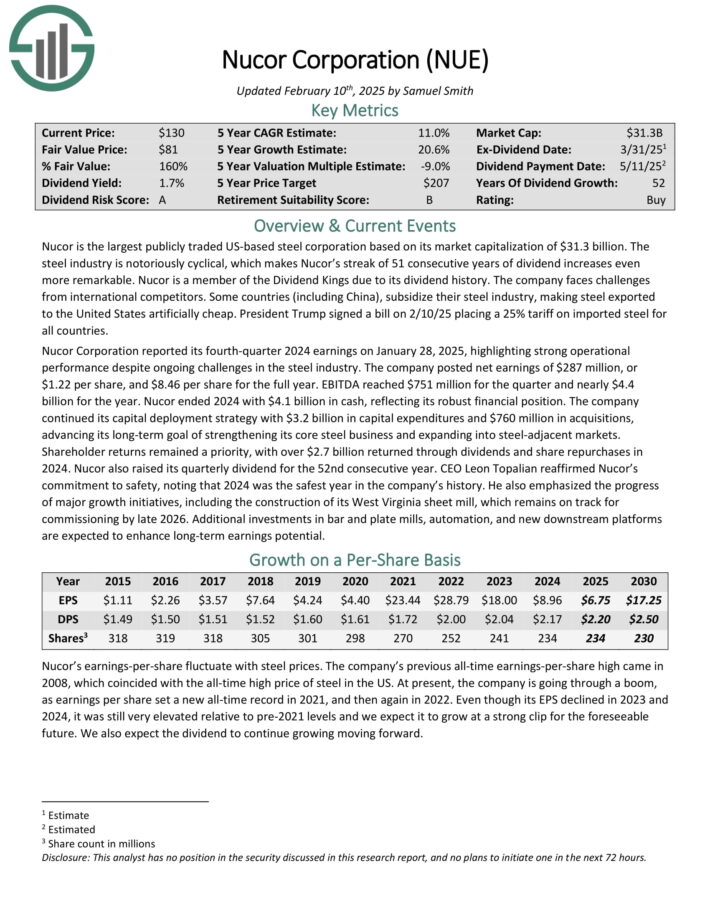

Nucor is the most important publicly traded US-based metal company primarily based on its market capitalization. The metal business is notoriously cyclical, which makes Nucor’s streak of 52 consecutive years of dividend will increase much more outstanding.

Nucor Company reported its fourth-quarter 2024 earnings on January 28, 2025, highlighting sturdy operational efficiency regardless of ongoing challenges within the metal business.

The corporate posted internet earnings of $287 million, or $1.22 per share, and $8.46 per share for the complete yr. EBITDA reached $751 million for the quarter and practically $4.4 billion for the yr.

Supply: Investor Presentation

Nucor ended 2024 with $4.1 billion in money, reflecting its sturdy monetary place.

As a commodity producer, Nucor is susceptible to fluctuations within the value of metal. Metal demand is tied to development and the general economic system.

Traders ought to pay attention to the numerous draw back threat of Nucor as it’s more likely to carry out poorly in a protracted recession.

That mentioned, Nucor has raised its base dividend for 52 straight years. This means the energy of its enterprise mannequin and administration workforce.

Click on right here to obtain our most up-to-date Positive Evaluation report on NUE (preview of web page 1 of three proven beneath):

Quick Rising Dividend Inventory #3: Thor Industries (THOR)

- Anticipated Annual EPS Progress: 25.0%

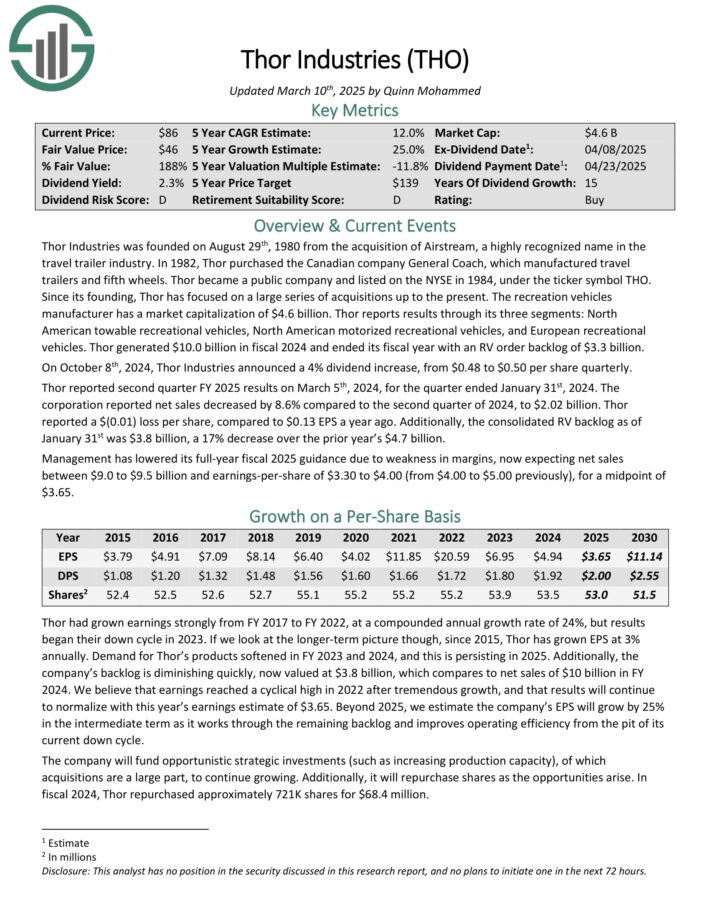

Thor Industries was based on August twenty ninth, 1980 from the acquisition of Airstream, a extremely acknowledged title within the journey trailer business.

Thor reviews outcomes by its three segments: North American towable leisure automobiles, North American motorized leisure automobiles, and European leisure automobiles.

Supply: Investor Presentation

Thor generated $10.0 billion in fiscal 2024 and ended its fiscal yr with an RV order backlog of $3.3 billion.

Thor reported second quarter FY 2025 outcomes on March fifth, 2024. The company reported internet gross sales decreased by 8.6% in comparison with the second quarter of 2024, to $2.02 billion. Thor reported a $(0.01) loss per share, in comparison with $0.13 EPS a yr in the past.

Moreover, the consolidated RV backlog as of January thirty first was $3.8 billion, a 17% lower over the prior yr’s $4.7 billion.

Click on right here to obtain our most up-to-date Positive Evaluation report on THOR (preview of web page 1 of three proven beneath):

Quick Rising Dividend Inventory #2: Microchip Expertise (MCHP)

- Anticipated Annual EPS Progress: 30.0%

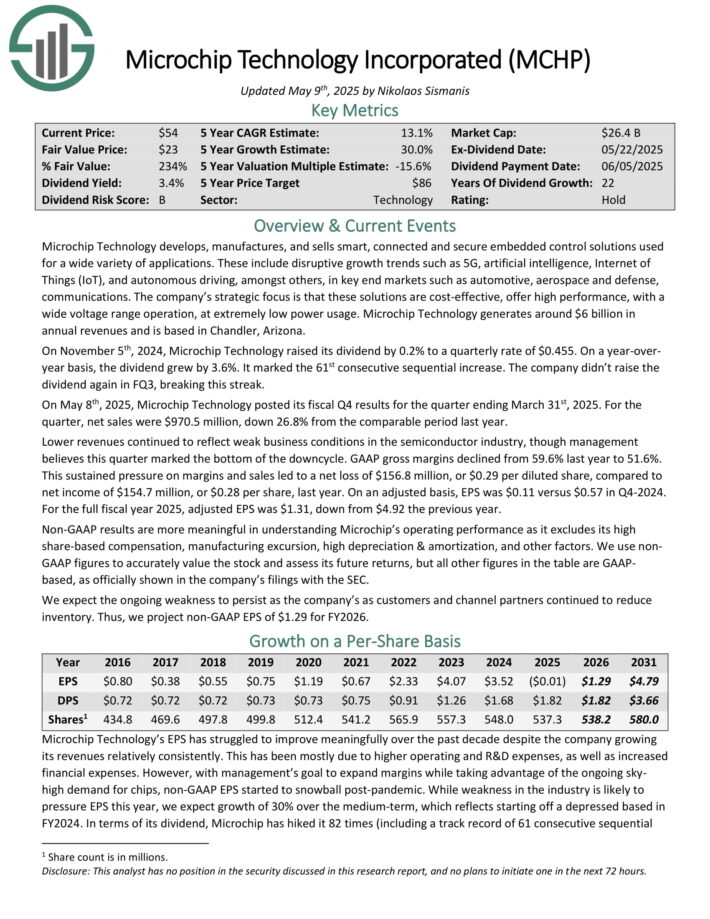

Microchip Expertise develops, manufactures, and sells good, related and safe embedded management options used for all kinds of purposes.

These embrace disruptive development tendencies resembling 5G, synthetic intelligence, Web of Issues (IoT), and autonomous driving, amongst others, in key finish markets resembling automotive, aerospace and protection, communications.

Microchip Expertise generates round $6 billion in annual revenues and relies in Chandler, Arizona.

On Might eighth, 2025, Microchip Expertise posted its fiscal This autumn outcomes for the quarter ending March thirty first, 2025. For the quarter, internet gross sales have been $970.5 million, down 26.8% from the comparable interval final yr.

Decrease revenues continued to replicate weak enterprise situations within the semiconductor business, although administration believes this quarter marked the underside of the downcycle. GAAP gross margins declined from 59.6% final yr to 51.6%.

This sustained strain on margins and gross sales led to a internet lack of $156.8 million, or $0.29 per diluted share, in comparison with internet revenue of $154.7 million, or $0.28 per share, final yr. On an adjusted foundation, EPS was $0.11 versus $0.57 in This autumn-2024.

Click on right here to obtain our most up-to-date Positive Evaluation report on MCHP (preview of web page 1 of three proven beneath):

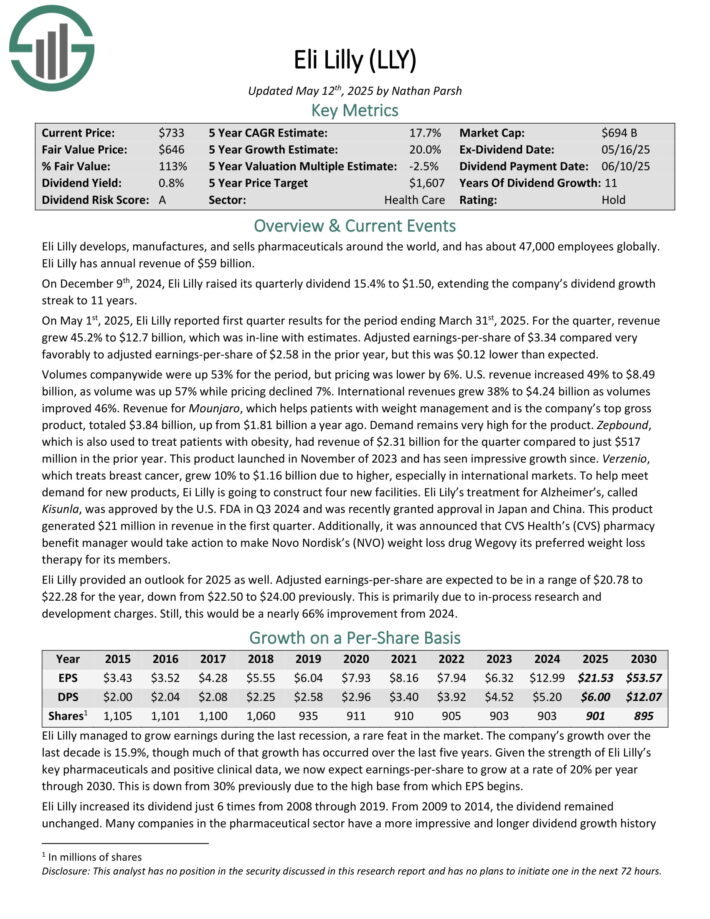

Quick Rising Dividend Inventory #1: Eli Lilly & Co. (LLY)

- Anticipated Annual EPS Progress: 30.0%

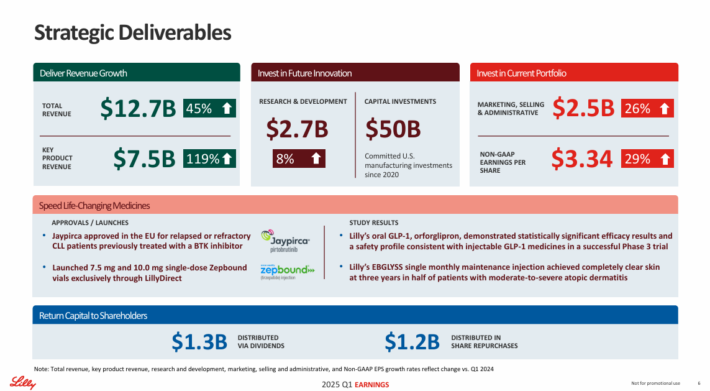

Eli Lilly develops, manufactures, and sells prescription drugs all over the world, and has about 47,000 workers globally. Eli Lilly has annual income of $59 billion.

On Might 1st, 2025, Eli Lilly reported first quarter outcomes for the interval ending March thirty first, 2025. For the quarter, income grew 45.2% to $12.7 billion, which was in-line with estimates.

Adjusted earnings-per-share of $3.34 in contrast very favorably to adjusted earnings-per-share of $2.58 within the prior yr, however this was $0.12 decrease than anticipated.

Supply: Investor Presentation

Volumes company-wide have been up 53% for the interval, however pricing was decrease by 6%. U.S. income elevated 49% to $8.49 billion, as quantity was up 57% whereas pricing declined 7%. Worldwide revenues grew 38% to $4.24 billion as volumes improved 46%.

Income for Mounjaro, which helps sufferers with weight administration and is the corporate’s high gross product, totaled $3.84 billion, up from $1.81 billion a yr in the past. Demand stays very excessive for the product.

Zepbound, which can be used to deal with sufferers with weight problems, had income of $2.31 billion for the quarter in comparison with simply $517 million within the prior yr. This product launched in November of 2023 and has seen spectacular development since.

Verzenio, which treats breast most cancers, grew 10% to $1.16 billion.

Click on right here to obtain our most up-to-date Positive Evaluation report on LLY (preview of web page 1 of three proven beneath):

Different Blue Chip Inventory Sources

The sources beneath provides you with a greater understanding of dividend development investing:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.