The concept the UK’s power market is ‘damaged’ is each true and unfaithful on the similar time. Lengthy-standing warnings that the system of marginal pricing doesn’t present a significant worth for power safety have been roundly confirmed proper. Excessive costs are the consequence.

That it doesn’t put a value on air pollution was equally evident, however ultimately acted upon by way of the introduction of a carbon market.

In any other case, it’s working just about as meant.

Within the UK’s wholesale gasoline and electrical energy markets, the very best bid that matches provide with demand units the worth for all. Gasoline-fired technology usually supplies the marginal MW of energy when demand is excessive as a result of it may be dispatched flexibly, not like wind or photo voltaic which depend upon the climate – or nuclear technology, which goals to run at a gradual fee, offering baseload reasonably than peak energy.

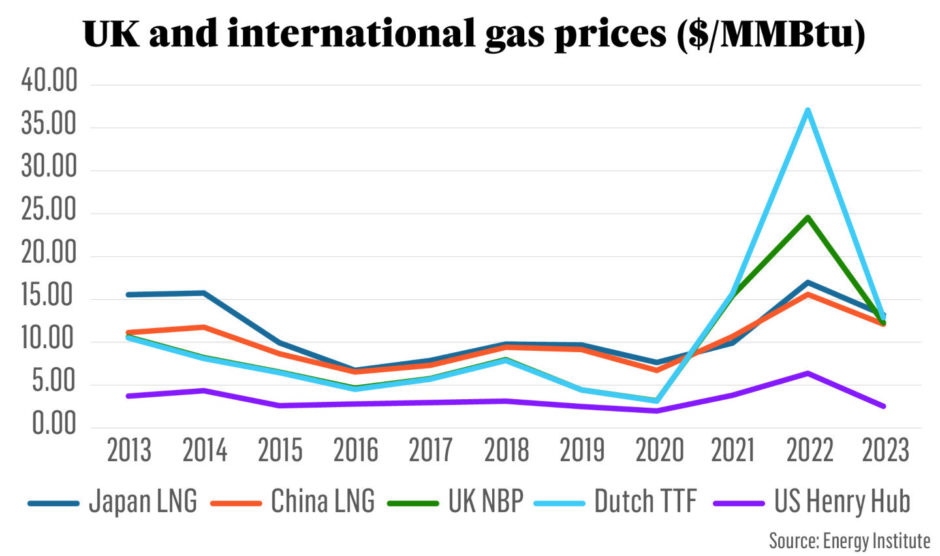

As gas-fired technology units the marginal value of electrical energy, the worth of gasoline turns into a key part of the electrical energy value. Regardless of nonetheless producing gasoline from the North Sea, the UK relies on gasoline imports, with LNG offering the marginal therm.

As within the electrical energy market, the marginal value units the worth for all. Because of this, the worldwide value of gasoline flows immediately by into UK electrical energy costs. Forces far-off that have an effect on the availability and demand of LNG impression what UK shoppers pay to run a fridge, watch the tv or activate the central heating.

The UK’s power disaster is thus a product of its dependency on the worldwide gasoline market and the forces to which it’s topic. These, in recent times, have been momentous.

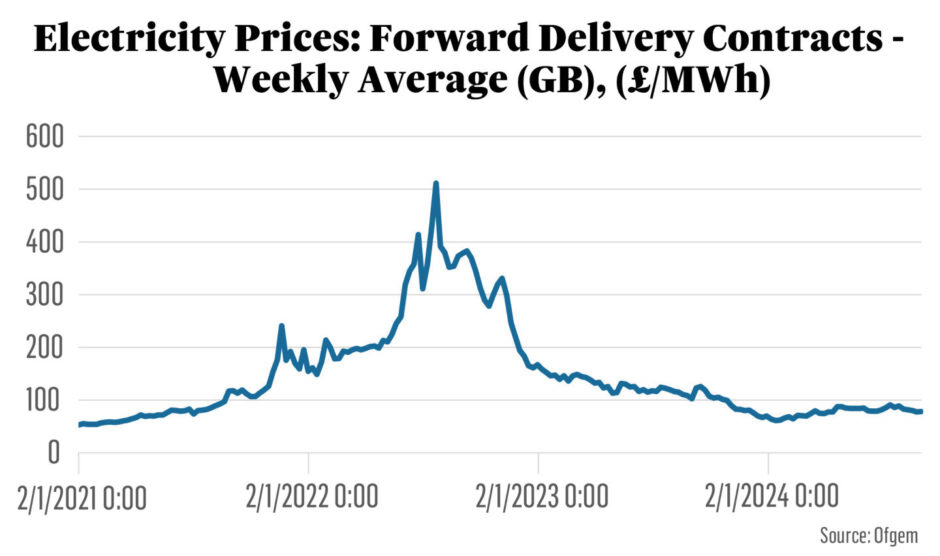

The power disaster didn’t begin with Putin’s invasion of Ukraine, nevertheless it actually consolidated it; day-ahead electrical energy costs hit data in December 2021, two months earlier than Russia invaded, however climbed to new highs thereafter as Russian gasoline pipeline exports to Europe have been curtailed.

Nearly all of Europe grew to become more and more depending on an already tight LNG market, ensuing within the huge peaks in each gasoline and energy costs seen in August and December 2022. LNG provide takes time to extend and funding ranges previous to the power disaster have been low, so there was little new capability coming onstream to deal with the sudden surge in European LNG demand. Costs have nonetheless not returned to the degrees prevalent earlier than Russia’s invasion of Ukraine.

So what wants fixing?

The price of a MWh of photo voltaic or wind energy could also be solely £30, however the client would possibly pay over £200, if that’s what the worth of gasoline and gas-fired technology dictates below a marginal pricing system. It doesn’t appear honest, however the system is there for a motive.

Excessive market costs present a sign for funding. They encourage new technology capability to be constructed. Extra capability will increase provide, often of the lowest-cost types of technology (as they promise the best profitability) and intensifies competitors, in the end decreasing costs. On this sense, the marginal pricing system will not be damaged. It’s doing exactly what was meant – offering a transparent market sign for elevated funding.

Within the gasoline market, the identical course of is happening. Excessive costs stimulate funding and elevated provide.

The issue is that constructing new technology capability takes time, as does constructing new LNG capability. Ultimately… and none too quickly for shoppers and companies – new wind and photo voltaic technology capability will scale back the period of time the UK electrical energy system relies on gas-fired technology and costs will fall.

In the meantime, LNG costs by 2026/27 are additionally anticipated to drop as new liquefaction capability comes on-line within the US, Qatar and to a lesser extent elsewhere.

The rebalancing of both or each of the electrical energy market (nationwide) or gasoline market (worldwide) will ultimately return UK power costs to extra regular ranges.

Interventions unsound

A key downside is that the marginal pricing system is reactive reasonably than anticipatory and the response takes time. It’s at its worst when confronted with sudden shocks, such because the lack of Russian pipeline gasoline to Europe. The extra sudden the shock, the extra brutal the adjustment interval. The pressures on governments to provide you with a ‘repair’ are intense.

Value caps and ensures supply a level of short-term reduction to shoppers, however retard market rebalancing by skewing the funding alerts and investor confidence. If buyers don’t obtain the returns dictated by marginal pricing, their enthusiasm to take a position is diminished.

Furthermore, some firms get caught within the center – usually retailers. They face increased costs for the electrical energy they purchase on the wholesale market, however can’t go the fee by to shoppers, whose costs are capped. The retailers go bust and competitors within the retail market is broken, often benefitting massive incumbent, vertically built-in suppliers.

On November 19, accountants Value Bailey reported that over half of the UK’s remaining home electrical energy and gasoline suppliers have been technically bancrupt and susceptible to collapse.

Is there a repair?

Marginal pricing is helpful in that it promotes the environment friendly allocation of assets, however solely within the pursuits of maximising earnings. It doesn’t encourage the upkeep of spare capability or massive gasoline shares. Simply because the marginal pricing system fails to cost air pollution, it fails to cost adequately power safety. On this sense, marginal pricing didn’t break a lot as by no means labored.

Nonetheless, there’s a repair – the power transition.

Gasoline consumption will steadily get replaced by electrical energy and electrification, with gas-for-power technology out by 2035, the goal for full UK energy sector decarbonisation. With no gas-fired technology, UK electrical energy costs won’t be topic to the vagaries of the worldwide gasoline market.

What then will set the marginal value, assuming back-up diesel turbines are additionally regulated out of the equation on emissions grounds – curtailment, demand-side administration, biomass-fired energy plant? It’s laborious to say.

The marginal pricing system was designed for competing fossil fuels. Wind and photo voltaic add a brand new aspect of variable, must-run, zero gasoline price technology. The UK energy system of the not-too-distant future will probably be dominated by must-run turbines with no or comparatively minor gasoline prices.

Any surplus technology will probably be became renewable gases, saved or, within the worst-case situation, wastefully curtailed. Assembly energy demand will stay the precedence and surplus technology implies costs trending in the direction of zero within the wholesale market as a result of the vast majority of technology may have no selection however to generate. The incidence of zero pricing within the UK wholesale electrical energy market, and throughout European markets, has been nicely documented.

The marginal value could possibly be shaped by the offtake of surplus technology for fuels and storage, each of which search low costs. This is able to be a unprecedented turnaround: from being a product of gasoline consumption, electrical energy turns into the uncooked materials for the manufacturing of fuels. To maintain gasoline prices low (consider the excessive price of hydrogen manufacturing), electrical energy would have to be low cost.

Market already altering

A market trending in the direction of zero presents challenges for all types of technology, as all must recoup their prices. Nonetheless, though they feed their technology into the wholesale market, a lot of the UK’s new technology capability has already been faraway from the marginal pricing system.

EDF’s two nuclear reactors below development will probably be remunerated by costly contracts for distinction (CfDs). Most offshore wind is topic to CfDs, at extra affordable costs, as are more and more photo voltaic and onshore wind by way of the UK’s renewable power licensing rounds.

As these applied sciences start to dominate, marginal pricing within the electrical energy wholesale market will make much less and fewer sense, and its usefulness in offering a market sign for funding will fall, if not be misplaced totally.

Furthermore, the worth paid by the federal government for the CfDs will enhance as wholesale costs development downward. Shoppers would more and more pay for electrical energy by common taxation. Costs could be closely topic to new technology capability development by way of the federal government’s provision or withholding of recent CfD contracts, a transfer, possibly inadvertent, within the course of state planning with all of the pitfalls that entails.

There is no such thing as a motive why the marginal pricing system, designed for competing fossil fuels, must be match for objective in a world with no fossil fuels. However when and the way it will likely be changed are open questions.

Beneficial for you