by Mike Maharrey

Indians have a powerful affinity for gold and silver. This has historically been expressed in demand for gold and silver jewellery, together with bars and cash. However over the past 12 months, there was great development in gold and silver exchange-traded funds (ETFs).

In easiest phrases, an ETF represents a basket of investments that trades available on the market as a single entity. As an illustration, a gold ETF is backed by a belief firm that holds metallic owned and saved by the belief. Generally, investing in an ETF doesn’t entitle you to any quantity of bodily gold or silver. (There are exceptions.) You personal a share of the ETF, not the metallic itself.

ETFs are a handy method for buyers to play the gold and silver markets, however proudly owning ETF shares will not be the identical as holding bodily gold or silver.

Inflows of gold into ETFs can considerably impression the worldwide gold market by pushing general demand increased.

2024 Gold and Silver Demand in India

Even with the value of each gold and silver at document ranges, Indian demand for each metals has been sturdy thus far in 2024.

The Indian authorities lower taxes on gold and silver imports by greater than half in July, reducing duties from 15 % to six %. The transfer initially pushed costs down by about 6 % and drove document gold imports in August. The worth drop boosted demand for each metals.

Regardless of the import obligation lower, gold and silver costs have charted sturdy positive aspects in rupee phrases. In accordance with Metals Focus, gold has surged 20 % this 12 months, touching Rs.80,000/10g within the course of. Silver costs have jumped by 17 %, briefly exceeding the psychologically necessary Rs.100,000/kg.

Indian patrons are typically value delicate, and the upper value has undoubtedly created some headwinds for retail demand, however based on Metals Focus, rising costs have “attracted recent funding amid expectations of additional value will increase.”

Demand for gold bars and cash has jumped by an estimated 38 % year-on-year to 163 tons via the primary 9 months of 2024. That’s the best degree since 2013.

In the meantime, silver funding demand is up an estimated 15 % to 1,766 tons. That’s the second-highest degree since 2015.

Indian Gold ETFs Get pleasure from Resurgence

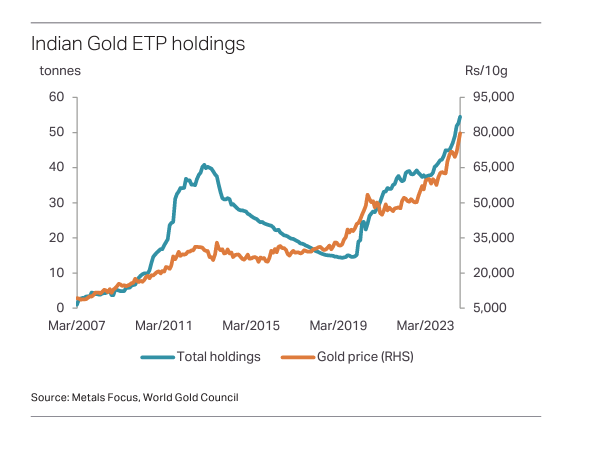

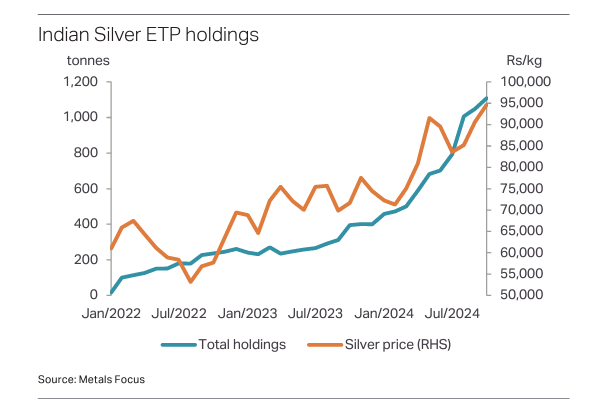

Gold and silver ETFs are a comparatively new phenomenon in India. The primary Indian gold ETF was launched in 2007, and the primary silver fund was created in January 2022.

Gold ETFs initially failed to draw significant flows. In accordance with Metals Focus, this was as a consequence of two elements.

- Lack of investor consciousness

- A desire for bodily metallic.

Indian gold ETF holdings initially peaked at 40.8 tons in 2013. Because the Nice Recession pale into the rearview, tepid curiosity in ETFs waned much more, with gold-backed fund holdings falling to simply 14 tons in 2019.

The introduction of sovereign gold bonds (SGBs) in 2015 put a drag on ETF funding. The federal government-issued securities are denominated in grams of gold, however they aren’t backed by bodily metallic. Nonetheless, they’re assured by the federal government and provide a 2.5 % yield. Additionally they have tax benefits.

In accordance with Metals Focus, SGBs attracted gold funding equal to 147 tons, with a lot of the motion coming post-pandemic.

“To place this into perspective, up till March 2020, the Reserve Financial institution of India (RBI) had issued 37 tranches of those bonds, however this attracted simply 31 tons of gold. After March 2020, 30 tranches had been issued, which introduced in 116 tons.”

The federal government didn’t situation any SGBs in February 2024, boosting ETF demand.

The optimistic sentiment towards the yellow metallic additionally boosted gold ETF funding post-COVID. Golding holdings in Indian-based funds rose from 19.4 tons in March 2020 to 54.5 tons as of October 2024. In accordance with Metals Focus, “These inflows, though restricted in tonnage phrases, had been pushed by varied elements resembling a bounce in retail buying and selling accounts, the launch of multi-asset funds, and price-driven optimism.”

The tempo of gold inflows has accelerated this 12 months. Indian ETF holdings have elevated by 12 tons, the best acquire since 2020.

Indian Silver ETFs: A Success Story

India’s love affair with gold is well-known, however Indians even have an affinity for silver. In accordance with Metals Focus, Indian buyers have collected over 17,000 tons of silver in bar and coin kind within the final 10 years.

Indians not solely view silver as a retailer of wealth, however additionally they see it as a strategic funding choice. As Metals Focus put it, the white metallic has “tactical enchantment, which is pushed by its inherent volatility. This has attracted recent buyers in India through the current bull run they place themselves for potential value positive aspects.”

Silver ETFs based mostly in India have skilled outstanding development because the first one launched simply over 2 years in the past. Silver holdings exceeded 1,000 tons in August.

Silver ETFs now equal about 40 % of annual retail silver funding. This compares to about 5 % for gold ETFs.

In accordance with Metals Focus, silver’s value efficiency coupled with an absence of competing merchandise has pushed the expansion of silver ETFs.

As Metals Focus famous, silver-backed ETFs additionally remedy a sensible drawback.

“Given the scale of silver bars, this will current a problem for retail contributors to retailer the metallic. This situation was addressed with the launch of ETPs, the place buyers can maintain silver as a safety of their buying and selling account.”

Wanting Forward

Metals Focus tasks each silver and gold ETFs in India to see inflows of metallic.

“This displays each extra funding managers recommending publicity to treasured metals and a rising consciousness amongst buyers of treasured metals ETPs. Consequently, we anticipate to see appreciable development in India’s share of world ETPs, which is presently at 1.6 % for gold and 4 % for silver.”