Key Takeaways

- Franklin filed an S-1 with the SEC to launch an ETF targeted on XRP.

- A remaining choice is predicted by October 2025 for many filings.

Share this text

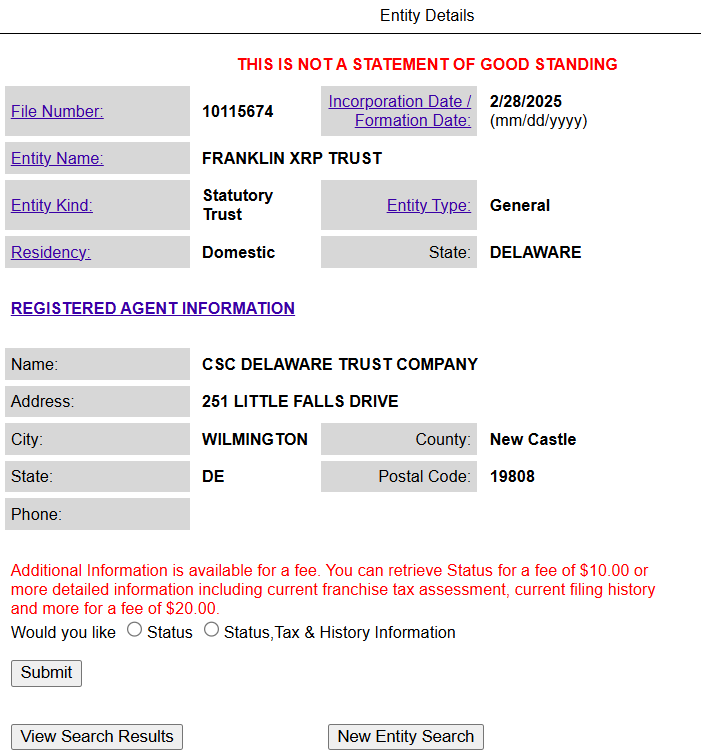

Franklin Templeton has filed an S-1 registration kind with the SEC for an XRP ETF, following the February registration of the Franklin XRP Belief in Delaware.

The brand new submitting with the SEC formally locations the entity amongst a rising variety of asset managers vying for an XRP ETF, together with Bitwise, 21Shares, Canary Capital, Grayscale, and WisdomTree.

The proposed fund, which might commerce on the CBOE BZX Alternate, goals to supply traders publicity to XRP, at the moment the fourth largest crypto asset by market cap. The ETF’s ticker image has but to be decided, in accordance with a Tuesday submitting.

Coinbase Custody would function the custodian for the fund’s XRP holdings, whereas Coinbase would act because the prime dealer. CSC Delaware Belief Firm would function trustee.

The shares can be supplied constantly at internet asset worth, with solely licensed contributors in a position to create or redeem creation models. The fund would use the CME CF XRP-Greenback Reference Fee to find out its internet asset worth.

Franklin Holdings will sponsor the fund and has agreed to pay most abnormal working bills in change for a sponsor’s charge. The belief is structured as an rising progress firm below the JOBS Act.

The submitting marks the newest try to launch a spot crypto ETF following earlier Bitcoin and Ethereum ETF approvals. The SEC might want to evaluation and approve the submitting earlier than the fund can start buying and selling.

The SEC acknowledged a number of XRP ETF filings in latest weeks, beginning with Grayscale’s XRP ETF utility on February 14, initiating a 240-day evaluation interval.

This was additionally the primary time the SEC responded to a request to launch an funding product that instantly holds XRP, the crypto asset that’s nonetheless below regulatory scrutiny because of the SEC’s ongoing authorized battle with Ripple Labs over its classification as a safety

Different filings, together with these from WisdomTree, Canary Capital, and CoinShares, have been additionally formally accepted for evaluation. These filings are actually within the public commentary part, which is a part of the SEC’s evaluation course of.

Share this text