Key Takeaways

- GameStop plans so as to add Bitcoin as a treasury reserve asset, resulting in a 15% rise in pre-market inventory costs.

- GameStop joins different firms like MicroStrategy and Tesla in holding Bitcoin amid challenges in its core enterprise.

Share this text

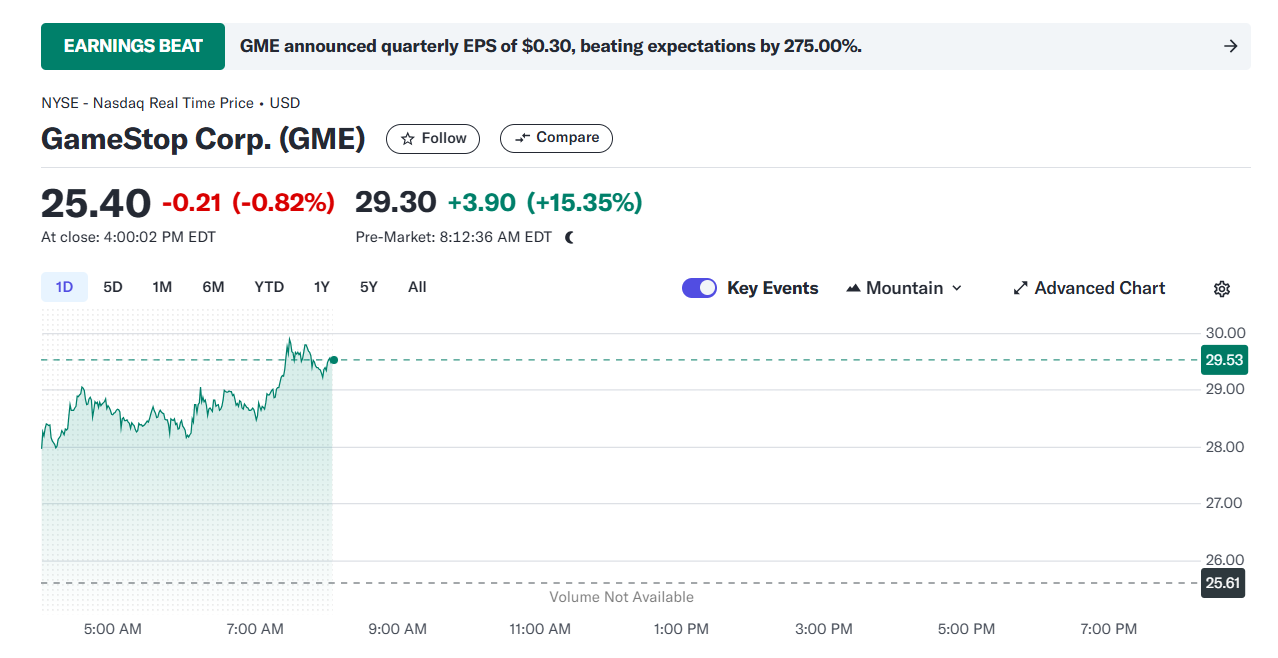

Shares of GameStop (GME) jumped over 15% in pre-market buying and selling as we speak after the online game retailer confirmed plans so as to add Bitcoin as a treasury reserve asset, in line with Yahoo Finance information.

The corporate’s inventory climbed to $29.6 in pre-market buying and selling, following Tuesday’s shut at $25.4. Regardless of a roughly 68% surge in GameStop shares during the last 12 months, the so-called meme inventory remains to be down practically 19% to date this 12 months.

GameStop, the 2021 quick squeeze icon, on Tuesday joined Technique, Tesla, and a rising checklist of public firms in stacking Bitcoin on its steadiness sheet.

The corporate’s board of administrators unanimously permitted the Bitcoin technique, which was revealed throughout its fourth quarter earnings launch.

GameStop could use current money or future debt and fairness choices to spend money on Bitcoin, although particular buy quantities stay undisclosed.

The announcement comes alongside improved quarterly efficiency, with GameStop reporting round $131 million in web revenue for the fourth quarter, up from $63 million in the identical interval final 12 months.

The retailer held about $4.6 billion in money on the finish of the third quarter of 2024, in line with its disclosure to the SEC.

The Bitcoin determination follows a February report from CNBC which revealed that GameStop was exploring investments in Bitcoin and different crypto property.

The report got here simply days after the corporate’s CEO Ryan Cohen met with Bitcoin advocate Michael Saylor, Technique’s Govt Chairman. Saylor, nevertheless, was not concerned within the firm’s inner crypto discussions.

Later that month, Matt Cole, CEO of Attempt Asset Administration, co-founded by Vivek Ramaswamy, despatched a letter to GameStop CEO Ryan Cohen, proposing the corporate use its money reserves to spend money on Bitcoin.

In his assertion, Cole claimed that GameStop may turn into “the premier Bitcoin treasury firm within the gaming business.”

GameStop beforehand explored digital property by way of an NFT market launched in July 2022, however scaled again the initiative in early 2024 citing “regulatory uncertainty.” The corporate additionally discontinued its crypto pockets service in late 2023.

The corporate has confronted challenges from elevated digital recreation downloads. This strategic pivot may assist stabilize GameStop’s declining core enterprise and presents a chance to boost its monetary place within the aggressive market.

Since Donald Trump’s election win in November 2024, a rising variety of firms have began changing their money reserves to Bitcoin. The pattern is pushed by Trump’s pro-crypto agenda and his administration’s dedication to fostering a extra favorable regulatory atmosphere for digital property.

Share this text