Up to date on November twenty fourth, 2025 by Bob Ciura

Grocery shares are in an unsure place. Business tendencies are altering as extra shoppers gravitate towards on-line buying and grocery supply, which accelerated through the coronavirus pandemic.

In the meantime, competitors amongst grocery shares is heating up. E-commerce large Amazon.com (AMZN) made an enormous entry into grocery with its ~$14 billion acquisition of Entire Meals.

Many of those grocery shares stay enticing for dividend development buyers. For instance, Walmart and Goal are each members of the Dividend Aristocrats.

The Dividend Aristocrats are a bunch of 69 shares within the S&P 500 Index with 25+ years of consecutive dividend will increase.

The necessities to be a Dividend Aristocrat are:

- Be within the S&P 500

- Have 25+ consecutive years of dividend will increase

- Meet sure minimal dimension & liquidity necessities

You possibly can obtain an Excel spreadsheet of all 66 Dividend Aristocrats (with necessary monetary metrics similar to dividend yields and payout ratios) by clicking the hyperlink under:

Disclaimer: Positive Dividend shouldn’t be affiliated with S&P World in any approach. S&P World owns and maintains The Dividend Aristocrats Index. The knowledge on this article and downloadable spreadsheet relies on Positive Dividend’s personal assessment, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person buyers higher perceive this ETF and the index upon which it’s primarily based. Not one of the info on this article or spreadsheet is official information from S&P World. Seek the advice of S&P World for official info.

In the meantime, Costco and Kroger are members of the Dividend Achievers listing, a bunch of shares with 10+ years of consecutive dividend development.

You possibly can see your complete listing of all ~400 Dividend Achievers by clicking right here.

These retailers are all making progress to raised compete with Amazon, adapt to the altering shopper calls for, and proceed producing development.

This text will talk about the highest 7 grocery shares ranked so as of anticipated complete returns.

Desk of Contents

Now we have ranked the highest 7 grocery shares in accordance with anticipated returns. The grocery shares are listed from lowest to highest five-year anticipated complete returns.

You should utilize the next hyperlinks to immediately leap to any particular inventory:

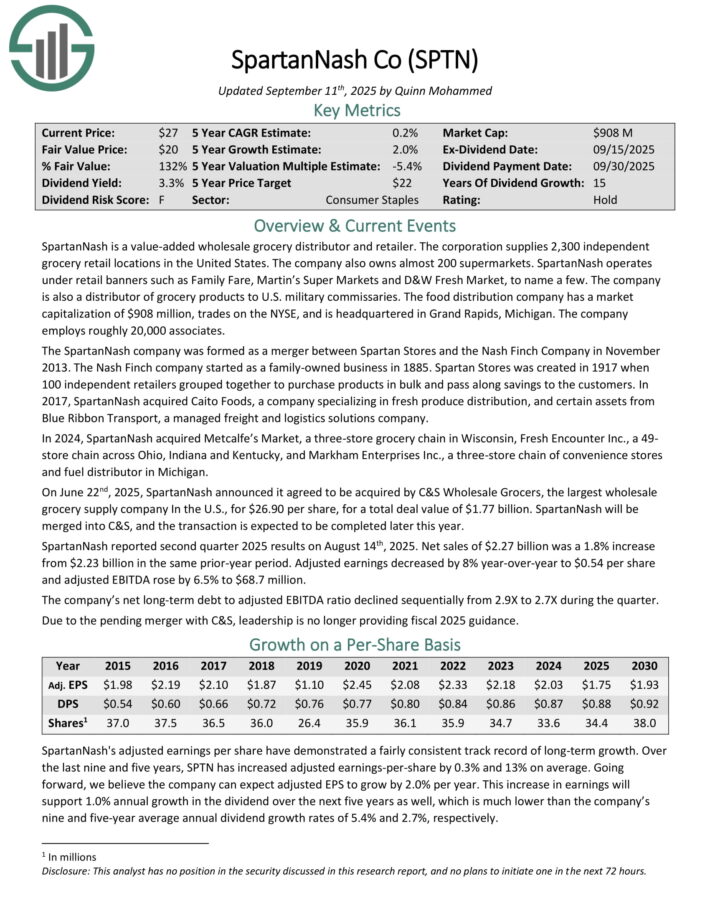

Greatest Grocery Inventory #7: SpartanNash Co. (SPTN)

- 5-year anticipated annual returns: -0.2%

SpartanNash is a value-added wholesale grocery distributor and retailer. The company provides 2,300 impartial grocery retail areas in america. The corporate additionally owns virtually 200 supermarkets.

SpartanNash operates underneath retail banners similar to Household Fare, Martin’s Tremendous Markets and D&W Contemporary Market, to call a couple of. The corporate can also be a distributor of grocery merchandise to U.S. army commissaries.

On June twenty second, 2025, SpartanNash introduced it agreed to be acquired by C&S Wholesale Grocers, the most important wholesale grocery provide firm Within the U.S., for $26.90 per share, for a complete deal worth of $1.77 billion. SpartanNash can be merged into C&S, and the transaction is anticipated to be accomplished later this 12 months.

SpartanNash reported second quarter 2025 outcomes on August 14th, 2025. Web gross sales of $2.27 billion was a 1.8% improve from $2.23 billion in the identical prior-year interval. Adjusted earnings decreased by 8% year-over-year to $0.54 per share and adjusted EBITDA rose by 6.5% to $68.7 million.

Click on right here to obtain our most up-to-date Positive Evaluation report on SpartanNash (preview of web page 1 of three proven under):

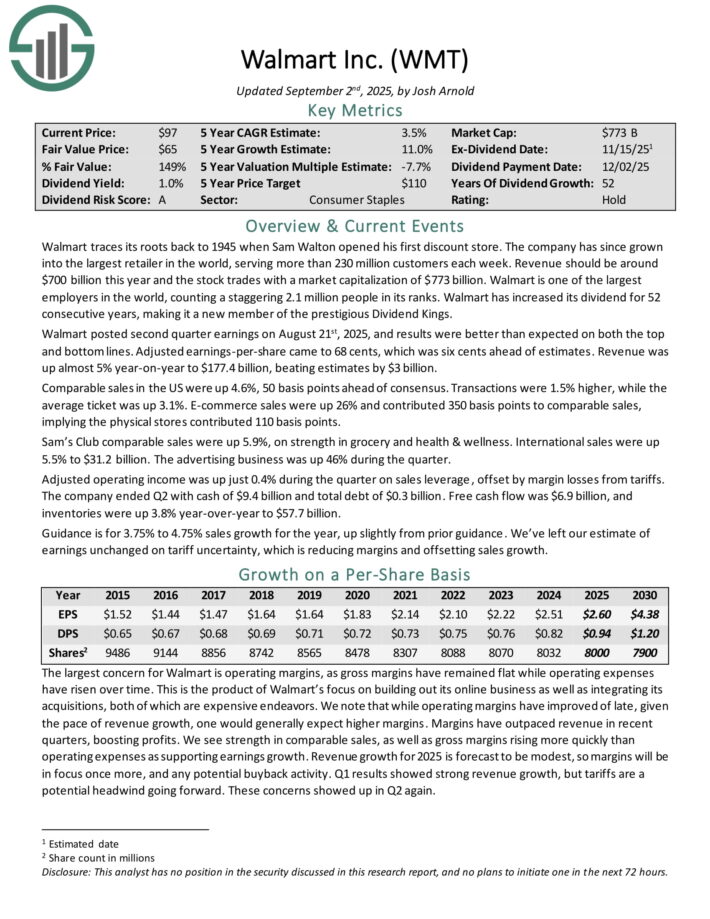

Greatest Grocery Inventory #6: Walmart Inc. (WMT)

- 5-year anticipated annual returns: 1.8%

Walmart traces its roots again to 1945 when Sam Walton opened his first low cost retailer. The corporate has since grown into the most important retailer on the planet, serving greater than 230 million clients every week. Income must be round $700 billion this 12 months.

Walmart posted second quarter earnings on August twenty first, 2025, and outcomes had been higher than anticipated on each the highest and backside strains.

Adjusted earnings-per-share got here to 68 cents, which was six cents forward of estimates. Income was up virtually 5% year-on-year to $177.4 billion, beating estimates by $3 billion.

Comparable gross sales within the US had been up 4.6%, 50 foundation factors forward of consensus. Transactions had been 1.5% greater, whereas the typical ticket was up 3.1%.

E-commerce gross sales had been up 26% and contributed 350 foundation factors to comparable gross sales, implying the bodily shops contributed 110 foundation factors.

Sam’s Membership comparable gross sales had been up 5.9%, on power in grocery and well being & wellness. Worldwide gross sales had been up 5.5% to $31.2 billion. The promoting enterprise was up 46% through the quarter.

Adjusted working revenue was up simply 0.4% through the quarter on gross sales leverage, offset by margin losses from tariffs. The corporate ended Q2 with money of $9.4 billion and complete debt of $0.3 billion.

Steering is for 3.75% to 4.75% gross sales development for the 12 months, up barely from prior steering.

Click on right here to obtain our most up-to-date Positive Evaluation report on WMT (preview of web page 1 of three proven under):

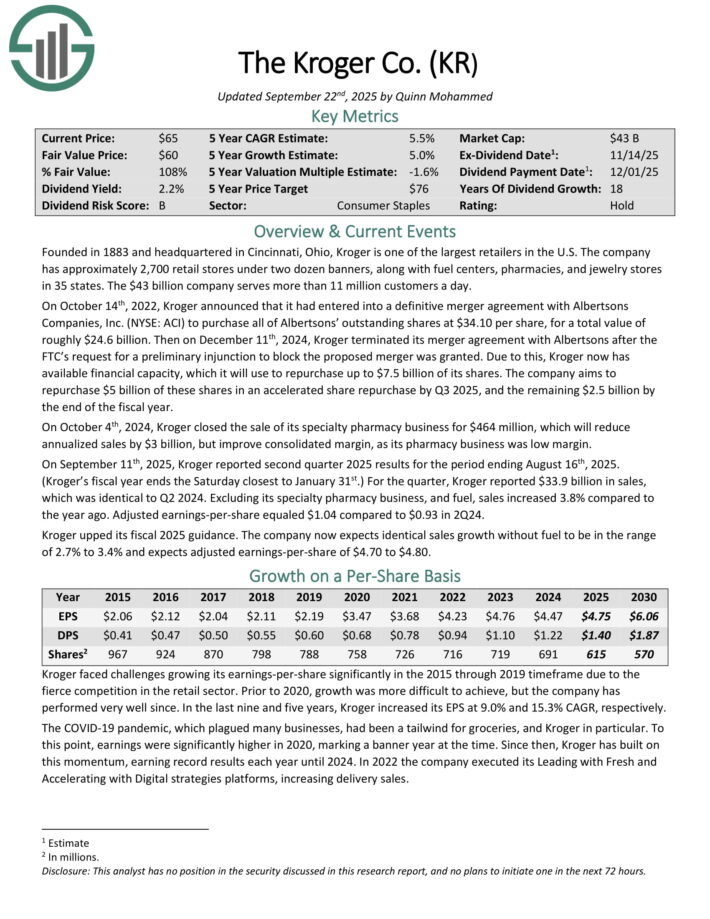

Greatest Grocery Inventory #5: Kroger Co. (KR)

- 5-year anticipated annual returns: 5.1%

Kroger is likely one of the largest retailers within the U.S. The corporate has roughly 2,700 retail shops underneath two dozen banners, together with gas facilities, pharmacies, and jewellery shops in 35 states. The corporate serves greater than 11 million clients a day.

On September eleventh, 2025, Kroger reported second quarter 2025 outcomes for the interval ending August sixteenth, 2025 (Kroger’s fiscal 12 months ends the Saturday closest to January thirty first.)

For the quarter, Kroger reported $33.9 billion in gross sales, which was an identical to Q2 2024. Excluding its specialty pharmacy enterprise, and gas, gross sales elevated 3.8% in comparison with the 12 months in the past. Adjusted earnings-per-share equaled $1.04 in comparison with $0.93 in 2Q24.

Kroger has decreased its share depend by 3.7% over the past decade. And now that the Albertson’s merger has been terminated, Kroger intends to repurchase $7.5 billion of its widespread inventory, which can meaningfully cut back its share depend and result in greater EPS .

Click on right here to obtain our most up-to-date Positive Evaluation report on Kroger (preview of web page 1 of three proven under):

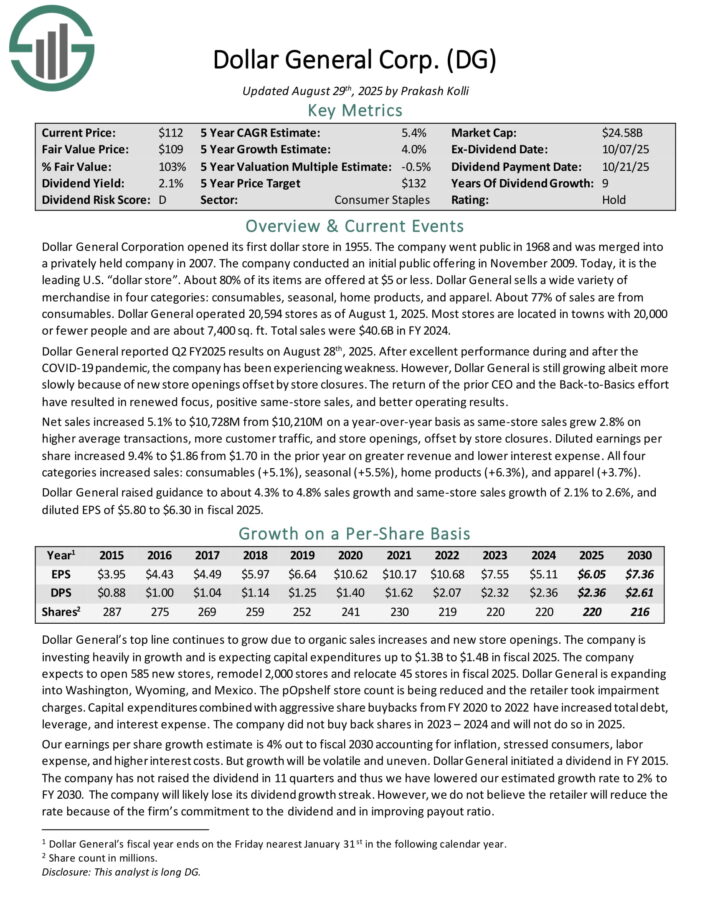

Greatest Grocery Inventory #4: Greenback Normal Corp. (DG)

- 5-year anticipated annual returns: 7.3%

Greenback Normal Company opened its first greenback retailer in 1955. At present, it’s the main U.S. “greenback retailer”. About 80% of its objects are provided at $5 or much less.

Greenback Normal sells all kinds of merchandise in 4 classes: consumables, seasonal, residence merchandise, and attire. About 77% of gross sales are from consumables. Greenback Normal operated 20,594 shops as of August 1, 2025.

Most shops are situated in cities with 20,000 or fewer folks and are about 7,400 sq. ft. Complete gross sales had been $40.6B in FY 2024.

Greenback Normal reported Q2 FY2025 outcomes on August twenty eighth, 2025. Web gross sales elevated 5.1% to $10,728M from $10,210M on a year-over-year foundation as same-store gross sales grew 2.8% on greater common transactions, extra buyer site visitors, and retailer openings, offset by retailer closures.

Diluted earnings per share elevated 9.4% to $1.86 from $1.70 within the prior 12 months on larger income and decrease curiosity expense. All 4 classes elevated gross sales: consumables (+5.1%), seasonal (+5.5%), residence merchandise (+6.3%), and attire (+3.7%).

Greenback Normal raised steering to about 4.3% to 4.8% gross sales development and same-store gross sales development of two.1% to 2.6%, and diluted EPS of $5.80 to $6.30 in fiscal 2025.

Click on right here to obtain our most up-to-date Positive Evaluation report on DG (preview of web page 1 of three proven under):

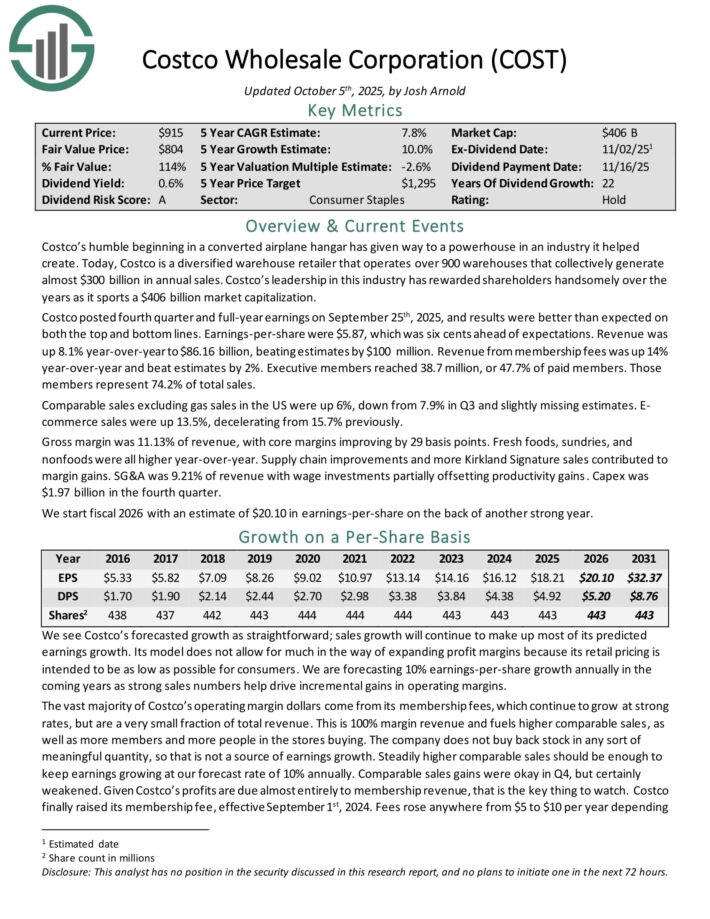

Greatest Grocery Inventory #3: Costco Wholesale (COST)

- 5-year anticipated annual returns: 8.2%

Costco is a diversified warehouse retailer that operates over 900 warehouses that collectively generate virtually $300 billion in annual gross sales.

Costco posted fourth quarter and full-year earnings on September twenty fifth, 2025, and outcomes had been higher than anticipated on each the highest and backside strains. Earnings-per-share had been $5.87, which was six cents forward of expectations.

Income was up 8.1% year-over-year to $86.16 billion, beating estimates by $100 million. Income from membership charges was up 14% year-over-year and beat estimates by 2%.

Government members reached 38.7 million, or 47.7% of paid members. These members characterize 74.2% of complete gross sales.

Comparable gross sales excluding fuel gross sales within the US had been up 6%, down from 7.9% in Q3 and barely lacking estimates. E-commerce gross sales had been up 13.5%, decelerating from 15.7% beforehand.

The overwhelming majority of Costco’s working margin {dollars} come from its membership charges, which proceed to develop at robust charges, however are a really small fraction of complete income. That is 100% margin income and fuels greater comparable gross sales, in addition to extra members and extra folks within the shops shopping for.

The corporate doesn’t purchase again inventory in any form of significant amount, so that’s not a supply of earnings development. Steadily greater comparable gross sales must be sufficient to maintain earnings rising at our forecast price of 10% yearly.

Click on right here to obtain our most up-to-date Positive Evaluation report on Costco (preview of web page 1 of three proven under):

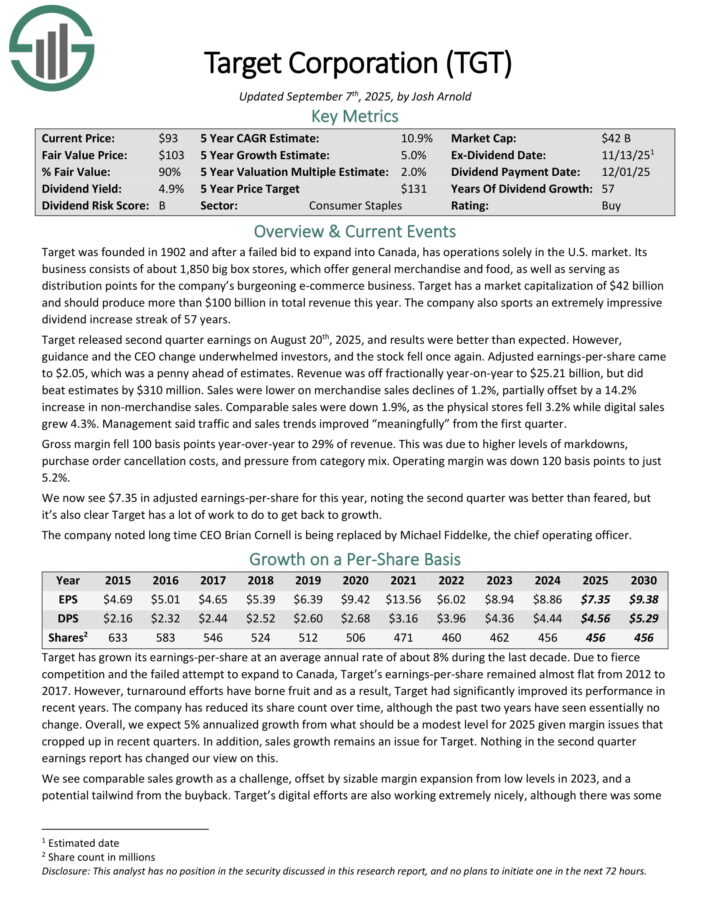

Greatest Grocery Inventory #2: Goal (TGT)

- 5-year anticipated annual returns: 12.3%

Goal was based in 1902 and now operates about 1,850 massive field shops, which supply common merchandise and meals, in addition to serving as distribution factors for the corporate’s e-commerce enterprise.

Goal launched second quarter earnings on August twentieth, 2025, and outcomes had been higher than anticipated. Nevertheless, steering and the CEO change underwhelmed buyers, and the inventory fell as soon as once more.

Adjusted earnings-per-share got here to $2.05, which was a penny forward of estimates. Income was off fractionally year-on-year to $25.21 billion, however did beat estimates by $310 million. Gross sales had been decrease on merchandise gross sales declines of 1.2%, partially offset by a 14.2% improve in non-merchandise gross sales.

Comparable gross sales had been down 1.9%, because the bodily shops fell 3.2% whereas digital gross sales grew 4.3%. Administration mentioned site visitors and gross sales tendencies improved “meaningfully” from the primary quarter.

The corporate is investing closely in its enterprise with the intention to navigate via the altering panorama within the retail sector. The payout is now 62% of earnings for this 12 months, which is elevated from historic ranges, however the dividend stays well-covered.

Click on right here to obtain our most up-to-date Positive Evaluation report on TGT (preview of web page 1 of three proven under):

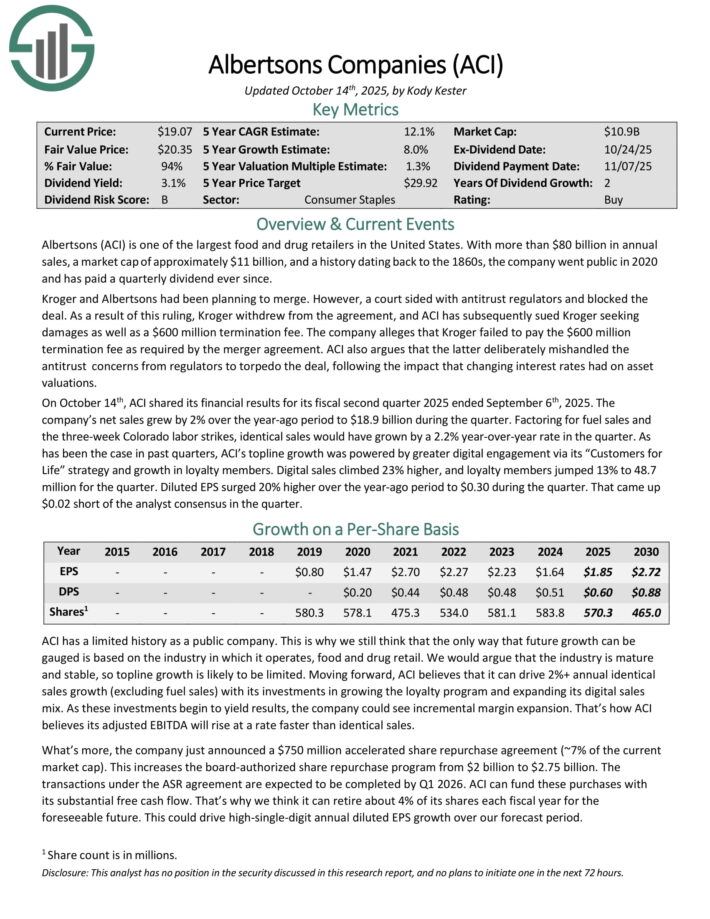

Greatest Grocery Inventory #1: Albertsons Company (ACI)

- 5-year anticipated annual returns: 13.8%

Albertsons is likely one of the largest meals and drug retailers in america. With greater than $80 billion in annual

gross sales, and a historical past courting again to the 1860s, the corporate went public in 2020 and has paid a quarterly dividend ever since.

On October 14th, ACI shared its monetary outcomes for its fiscal second quarter 2025 ended September sixth, 2025. The corporate’s web gross sales grew by 2% over the year-ago interval to $18.9 billion through the quarter.

Factoring for gas gross sales and the three-week Colorado labor strikes, an identical gross sales would have grown by a 2.2% year-over-year price within the quarter.

As has been the case in previous quarters, ACI’s topline development was powered by larger digital engagement by way of its “Prospects for Life” technique and development in loyalty members.

Digital gross sales climbed 23% greater, and loyalty members jumped 13% to 48.7 million for the quarter. Diluted EPS surged 20% greater over the year-ago interval to $0.30 through the quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on Albertsons (preview of web page 1 of three proven under):

Ultimate Ideas

The grocery trade is altering like by no means earlier than. Now that Amazon has acquired Entire Meals, the corporate will possible speed up its push into the grocery trade even additional, particularly with new applied sciences on the way in which.

That mentioned, the highest grocery shares have a long time of expertise within the retail trade. They’ve confirmed the power to navigate tough situations earlier than and adapt when needed.

Broadly talking, the grocery trade is enticing for buyers proper now. Traders seeking to purchase grocery shares ought to give attention to these with sturdy aggressive benefits and the monetary power to proceed investing in development.

Goal and Walmart have the longest histories of annual dividend will increase, whereas a number of others even have significant dividend development histories.

Further Assets

At Positive Dividend, we regularly advocate for investing in firms with a excessive chance of accelerating their dividends every 12 months.

If that technique appeals to you, it could be helpful to flick through the next databases of dividend development shares:

- The Dividend Kings Checklist is much more unique than the Dividend Aristocrats. It’s comprised of 56 shares with 50+ years of consecutive dividend will increase.

- The Excessive Yield Dividend Kings Checklist is comprised of the 20 Dividend Kings with the very best present yields.

- The Blue Chip Shares Checklist: shares that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The Excessive Dividend Shares Checklist: shares that attraction to buyers within the highest yields of 5% or extra.

- The Month-to-month Dividend Shares Checklist: shares that pay dividends each month, for 12 dividend funds per 12 months.

- The Dividend Champions Checklist: shares which have elevated their dividends for 25+ consecutive years.

Word: Not all Dividend Champions are Dividend Aristocrats as a result of Dividend Aristocrats have further necessities like being in The S&P 500.

The key home inventory market indices are one other stable useful resource for locating funding concepts. Positive Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].