- Cling Seng Tech rallies previous 20% bull market threshold, momentum sturdy.

- Tech valuations stay low cost—can the rally maintain if sentiment shifts?

- USD/CNH breaks key help, hinting at additional draw back threat.

Abstract

Whether or not pushed by DeepSeek, easing commerce tensions with the USA, low cost valuations relative to Western markets, or just optimism that the economic system has bottomed following an engineered property building downturn, sentiment in direction of Chinese language property—each shares and the yuan—has improved noticeably in latest weeks.

Hong Kong’s Cling Seng has led the cost, fueled by sturdy features in tech shares. The Tech Index trades at 17.4 instances ahead earnings regardless of being in a bull market—nicely under the five-year common of 24.5 instances—suggesting room for the rally to increase, significantly if offshore buyers unwind underweight positions in Chinese language equities.

This notice will define key ranges on and Cling Seng Tech futures, in addition to , offering a primary framework for assessing future commerce setups.

Cling Seng Futures

Supply: TradingView

are on the cusp of coming into a bull market, with features from early January’s lows now approaching 19%. The pattern stays sturdy, aligning with bullish alerts from momentum indicators like MACD and RSI (14), favouring shopping for dips and bullish breaks within the close to time period.

A gradual pickup in buying and selling volumes strengthens the bullish case, contrasting with the unsustainable surge seen final September when the federal government tried to revive mainland fairness markets. This transfer appears extra sturdy.

Futures are overbought on RSI (14), making entry, goal choice, and stop-loss placement essential. Persistence might repay for these ready for an optimum setup.

Key draw back ranges to observe are 21,728, 21,377, and the January 13 uptrend. On the topside, 22,500 might entice sellers, although seen resistance is restricted till the September 2024 double prime at 23,330. Past that, 23,870 was a key degree in 2021, seeing important value motion on each side.

Cling Seng Tech Futures

Supply: TradingView

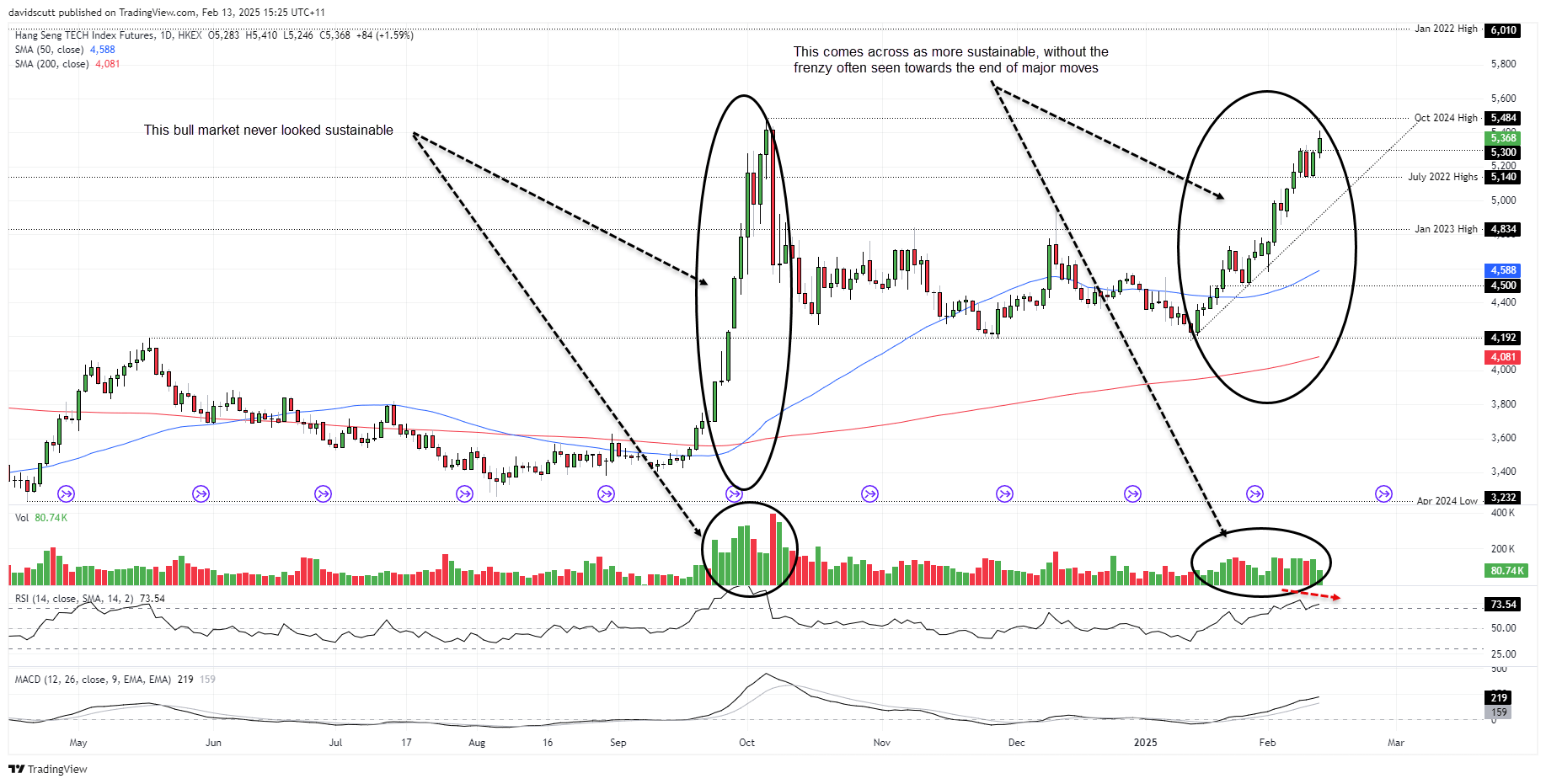

Like broader Cling Seng futures, Cling Seng Tech futures stay in a longtime uptrend however have already cleared the 20% threshold for a technical bull market.

MACD and RSI (14) proceed to pattern larger, reinforcing a bullish bias, although RSI is now in overbought territory and diverging from value—a possible sign of a near-term pullback.

Earlier this week, 5,300 capped features, however with the worth now above that degree it could flip to help. Beneath, 5,140 and the January 13 uptrend are ranges to observe. On the topside, bulls shall be eyeing the October 2024 excessive of 5,484, with a break opening the door for a possible push in direction of the January 2022 excessive of 6,010.

USD/CNH

Supply: TradingView

USD/CNH is exhibiting indicators of turning decrease, breaking beneath the intersection of horizontal and uptrend help at 7.3000. Bids emerged under 7.2800 earlier this month, making it a degree to observe for these contemplating brief setups after Thursday’s draw back break.

Beneath, 7.2400 has repeatedly drawn in consumers in latest months, with 7.2130 and seven.1400 further draw back ranges of curiosity.

Momentum indicators stay blended, favouring a impartial bias. RSI (14) has damaged its uptrend, hinting at bearish momentum, although MACD has but to verify the sign.

Unique Put up