-

Recognizing undervalued shares amid bull markets is an important talent for traders in search of sturdy returns.

-

Instruments like InvestingPro’s Honest Worth may also help discover alternatives hidden beneath market highs.

-

From industrial giants to auto leaders, data-driven insights uncover the worth others may miss.

- Prepare for enormous financial savings on InvestingPro this Black Friday! Entry premium market knowledge and supercharge your analysis at a reduction. Do not miss out – click on right here to save lots of 55%!

Towards the backdrop of a second Trump mandate within the US, the prospect of extra charge cuts, enhancing prospects in China, and a world financial system that refuses to show decrease despite all predictions in the beginning of the yr, one factor is for certain: Danger-on sentiment has seldom been greater within the inventory market.

Whereas that has to date confirmed extremely optimistic for the bulls, as world markets notched the most effective week of an already wonderful yr final week, it additionally considerably will increase the general risk-reward proposition when holding shares.

Definitely, that does not indicate that it’s best to simply take your income and run for the hills – though hoarding some money may in actual fact be a good suggestion at this level (simply take a look at what Buffett has been doing).

Nonetheless, what it does indicate is that having a greater understanding of the particular worth of the shares in your portfolio has turn out to be extra vital than ever earlier than.

As savvy traders know, allocating your investments to property that provide a higher upside and a smaller draw back potential will typically show the distinction between having an ideal and a mean yr when the tides finally flip.

Furthermore, regardless of the market being at such frothy heights, there are arguably a number of bargains on the market. In truth, chances are you’ll be stunned to study that, amid final week’s rally, the index that gained probably the most was the extremely undervalued , which jumped a large 8.6%.

However how do you see these shares? Properly, that’s the place InvestingPro’s Honest Worth software will show a game-changer.

With only one click on, you’ll be able to entry over 17 industry-standard metrics for each inventory in the marketplace, offering correct worth targets to assist information your subsequent transfer.

And now, as a part of our Black Friday sale, you’ll be able to faucet into this software at a 55% low cost.

However do not simply take our phrase for it – let’s take a look on the success tales by way of real-world examples, which we’ll talk about intimately beneath.

1. 3M Firm – Market Shunned the Inventory, Honest Worth Recognized a 47.26% Low cost

Authorized woes can sink a inventory, however 3M’s (NYSE:) story took a shocking flip when market watchers noticed an undervalued gem beneath the headlines.

In 2022 3M Firm confronted mounting authorized troubles and the economic big’s inventory plummeted. Few traders wished to the touch the St. Paul, Minnesota-based firm, which was grappling with a slew of high-profile lawsuits, together with an $850 million settlement in 2018 for contaminating water and pure sources in its hometown.

The extraordinary market pessimism and cascading liabilities dragged 3M’s inventory down 32% for the yr, inflicting frustration and panic amongst traders and damaging the corporate’s status.

As authorized liabilities loomed, 3M’s valuation dropped considerably, with the fixed circulation of lawsuits casting doubt on its future stability. But, at this low level, Honest Worth (FV)—a data-driven valuation software—noticed a compelling alternative.

FV recognized a considerable 47.26% low cost on 3M’s truthful worth, suggesting that the corporate’s fundamentals had been nonetheless intact regardless of the unfavorable sentiment weighing down the inventory.

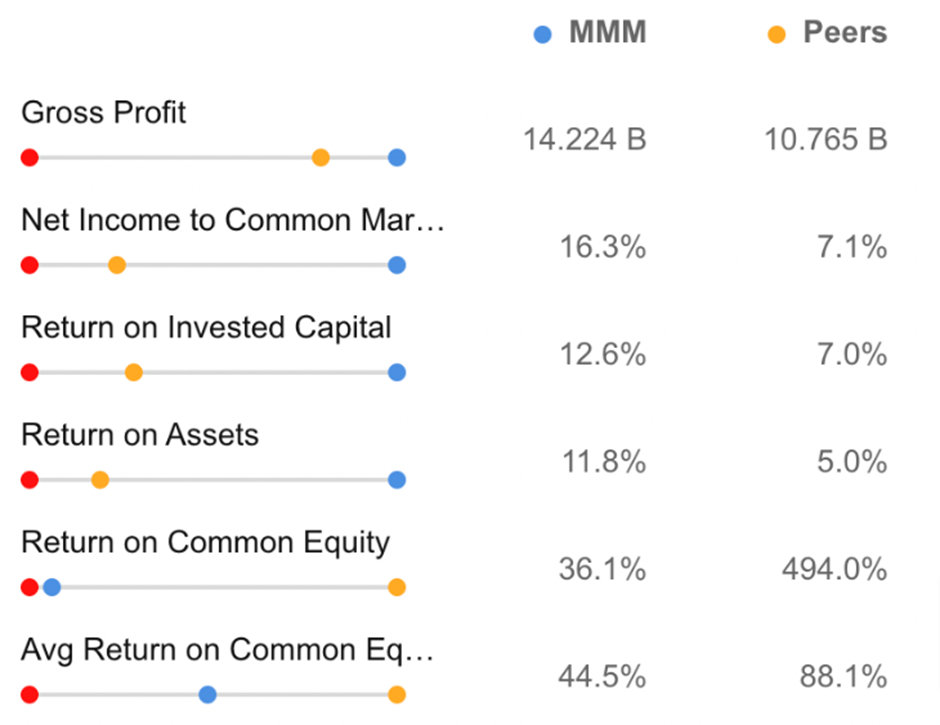

Inspecting 3M’s financials validated FV’s perception. The corporate remained an {industry} chief, displaying energy in gross revenue, internet earnings margins, return on invested capital, and return on property in comparison with friends.

Supply: InvestingPro

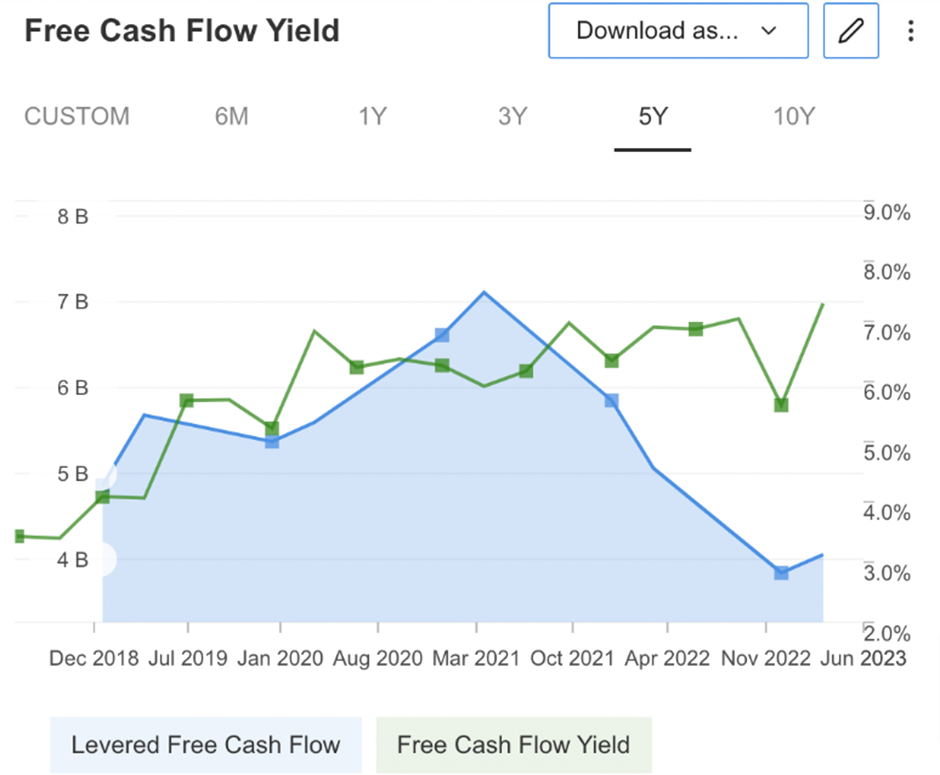

Moreover, 3M’s free money circulation yield continued to develop, whereas money circulation leverage stayed impressively low.

Supply: InvestingPro

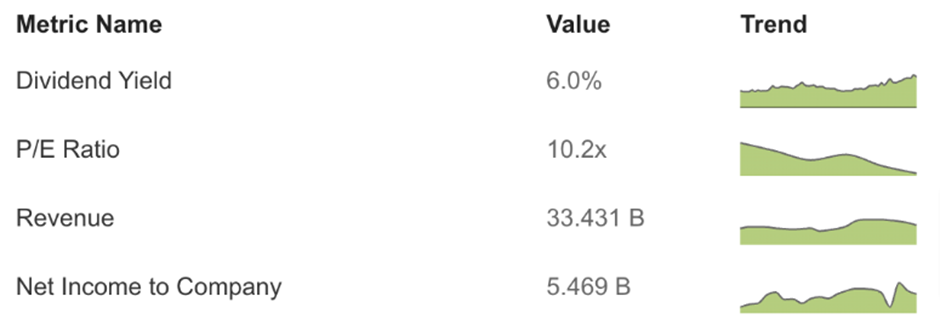

Regardless of the unfavorable headlines, 3M appeared financially strong, boasting a ten.2 P/E ratio with sturdy profitability by October 2022—simply as FV highlighted its deep-value potential.

Caption: P/E as of late 2023

Honest Worth’s name turned out to be prescient. On the shut of 2023, 3M’s inventory started a exceptional comeback, rallying to ship a formidable 52.68% return by August 2024.

The restoration proved that beneath the authorized storms, 3M’s monetary basis remained resilient, in the end rewarding those that noticed worth the place others noticed danger.

2. Common Motors – High Performing Auto Inventory That Left Rivals within the Mud

The auto {industry} is reworking quick, pushed by electrical autos, autonomous tech, and vehicle-as-a-service fashions.

Amid a difficult yr, Common Motors (NYSE:) has surged forward, posting a 51% return in 2024—outpacing rivals like Tesla (NASDAQ:), up 29%, and Ford (NYSE:), which has confronted losses alongside Stellantis (NYSE:), down 41% YTD.

How did GM pull this off? The corporate has stored sturdy margins and boosted income, fueling its inventory’s spectacular climb.

Traders who used InvestingPro’s Honest Worth software received an early benefit: the software recognized GM as a possible cut price, recognizing a forty five% low cost on November 11, 2023, simply earlier than the rally started.

Not solely was the inventory capable of fulfill the Honest Worth potential of 45% by August 7, 2024, it went past, exceeding the FV goal by 6.5%, returning 51.40% in complete.

The inventory outperformed the broader market by far, because the returned 18% in the identical interval.

Backside Line

In an period the place market rallies could make even cautious traders keen to leap in, recognizing undervalued gems turns into essential—and instruments like InvestingPro’s Honest Worth have confirmed invaluable.

3M and GM’s spectacular rebounds exemplify how good insights, powered by knowledge, can uncover alternatives that others may miss.

As market optimism grows, now may very well be the time so as to add undervalued shares to your portfolio with confidence.

With InvestingPro’s Honest Worth software, you’ll achieve entry to deep insights, serving to you make knowledgeable choices even when the market appears at its peak.

Don’t miss out on at this time’s alternatives—equip your self with InvestingPro and make the most of our Black Friday supply to remain forward.

***

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, counsel or suggestion to take a position as such it’s not supposed to incentivize the acquisition of property in any manner. I want to remind you that any sort of asset, is evaluated from a number of views and is extremely dangerous and due to this fact, any funding choice and the related danger stays with the investor.