Article up to date on November twenty ninth, 2024 by Bob Ciura

Spreadsheet knowledge up to date each day

Excessive dividend shares are shares with a dividend yield properly in extra of the market common dividend yield of ~1.3%.

The sources on this report deal with actually excessive yielding securities, usually with dividend yields multiples greater than the market common.

We now have created a spreadsheet of excessive dividend shares (and carefully associated REITs and MLPs, and so forth.) with dividend yields of 5% or extra.

You may obtain your free full record of all excessive dividend shares with 5%+ yields (together with necessary monetary metrics equivalent to dividend yield and payout ratio) by clicking on the hyperlink under:

This text gives an outline of excessive dividend shares, and features a high 10 record of excessive dividend shares that the majority revenue buyers haven’t heard of.

Desk of Contents

Excessive Dividend Shares Overview

Excessive dividend shares are instantly interesting for revenue buyers, attributable to their greater yields than the market common.

Investing in high-yield shares is a good way to generate revenue. However it’s not with out dangers.

First, inventory costs fluctuate. Buyers want to grasp their danger tolerance earlier than investing in excessive dividend shares. Share worth fluctuations implies that your funding can (and virtually definitely will) decline in worth, at the least briefly (and presumably completely) do to market volatility.

Second, companies develop and decline. Investing in a inventory offers you fractional possession within the underlying enterprise. Some companies develop over time. These companies are prone to pay greater dividends over time.

The Dividend Champions are a superb instance of this; every has paid rising dividends for 25+ consecutive years.

What’s harmful is when a enterprise declines. Dividends are paid out of an organization’s money flows. If the enterprise sees its money flows decline, or worse is shedding cash, it could scale back or get rid of its dividend.

Enterprise decline is a big danger with excessive yield investing. Enterprise declines usually coincide with and or speed up throughout recessions.

The next 10 excessive dividend shares you’ve by no means heard of have present yields above 5%, optimistic anticipated returns over the following 5 years, and market caps under $8 billion which suggests they’re small-caps or mid-caps.

Enterprise Growth Corporations (BDCs) and Grasp Restricted Partnerships (MLPs) have been excluded from the record under, as they’ve distinctive tax conditions and danger elements to contemplate.

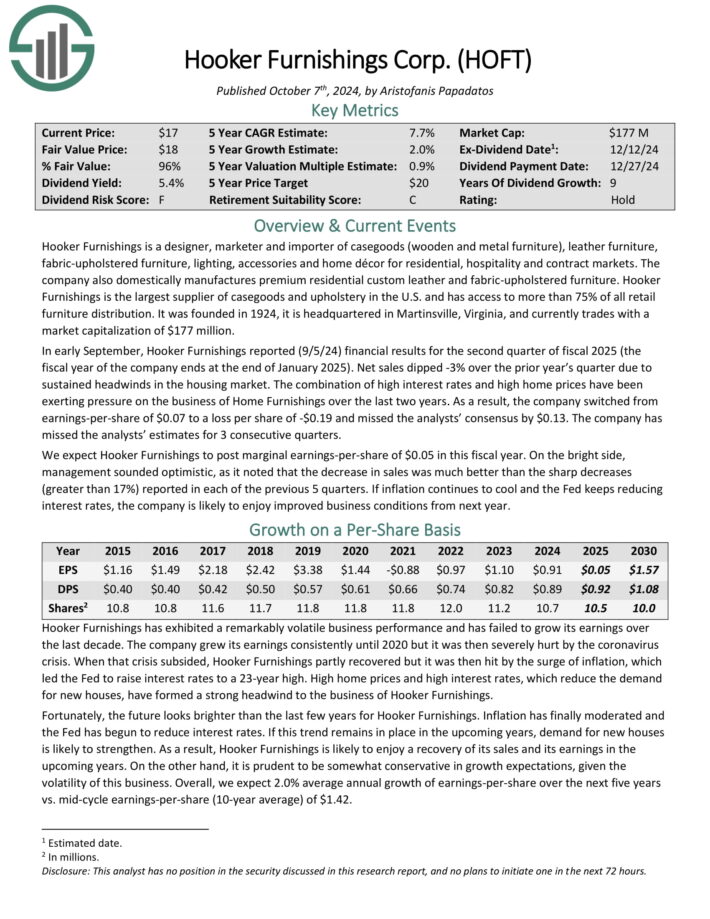

Excessive Dividend Inventory You’ve By no means Heard Of: Hooker Furnishings Company (HOFT)

Hooker Furnishings is a designer, marketer and importer of casegoods (wood and steel furnishings), leather-based furnishings, fabric-upholstered furnishings, lighting, equipment and residential décor for residential, hospitality and contract markets.

The corporate additionally domestically manufactures premium residential customized leather-based and fabric-upholstered furnishings.

Hooker Furnishings is the most important provider of casegoods and fabric within the U.S. and has entry to greater than 75% of all retail furnishings distribution.

Supply: Investor Presentation

In early September, Hooker Furnishings reported (9/5/24) monetary outcomes for the second quarter of fiscal 2025 (the fiscal 12 months of the corporate ends on the finish of January 2025). Internet gross sales dipped -3% over the prior 12 months’s quarter attributable to sustained headwinds within the housing market.

The mix of excessive rates of interest and excessive residence costs have been exerting stress on the enterprise of Dwelling Furnishings over the past two years.

Because of this, the corporate switched from earnings-per-share of $0.07 to a loss per share of -$0.19 and missed the analysts’ consensus by $0.13. The corporate has missed the analysts’ estimates for 3 consecutive quarters.

Click on right here to obtain our most up-to-date Certain Evaluation report on HOFT (preview of web page 1 of three proven under):

Excessive Dividend Inventory You’ve By no means Heard Of: First Bancorp Inc. (FNLC)

The First Bancorp, which is headquartered in Damariscotta, Maine, is the holding firm for First Nationwide Financial institution, a full service neighborhood financial institution that was based in 1864.

First Nationwide Financial institution is a regional financial institution with 18 branches alongside Maine’s coast and a pair of branches within the better Bangor space. It gives a variety of business and retail banking providers; it has complete belongings of $3.1 billion.

The First Bancorp advantages from the financial progress of Maine’s coastal counties and downtown Bangor.

Because of the surge of rates of interest to almost 23-year highs, the web curiosity margin of The First Bancorp has pronouncedly contracted in latest quarters.

In late October, The First Bancorp reported (10/23/24) monetary outcomes for the third quarter of fiscal 2024. Loans grew 3% and deposits grew 5% sequentially.

Internet curiosity margin expanded from 2.21% to 2.32%, as greater yields greater than offset excessive deposit prices amid intense competitors amongst banks.

Because of this, internet curiosity revenue grew 8% and earnings-per-share grew 24%, from $0.55 to $0.68.

Click on right here to obtain our most up-to-date Certain Evaluation report on FNLC (preview of web page 1 of three proven under):

Excessive Dividend Inventory You’ve By no means Heard Of: LCNB Corp. (LCNB)

LCNB Corp. is a Ohio-based monetary holding firm offering banking and insurance coverage providers by way of its subsidiaries, LCNB Nationwide Financial institution and Dakin Insurance coverage Company, Inc. The corporate reported $2.35 billion in complete belongings as of September thirtieth, 2024.

LCNB Nationwide Financial institution gives client and industrial banking providers, together with checking and financial savings accounts, certificates of deposit, and loans for residential mortgages, industrial actual property, and private wants.

Dakin Insurance coverage Company gives private and industrial insurance coverage merchandise and annuity providers. LCNB additionally gives belief administration, property settlement, and funding administration providers, in addition to monetary merchandise like mutual funds, annuities, and life insurance coverage.

On October twenty first, 2024, LCNB Corp. launched its third-quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, the corporate reported a internet revenue of $4.5 million, or $0.31 per diluted share, in comparison with $4.1 million, or $0.37 per diluted share, in the identical quarter final 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on LCNB (preview of web page 1 of three proven under):

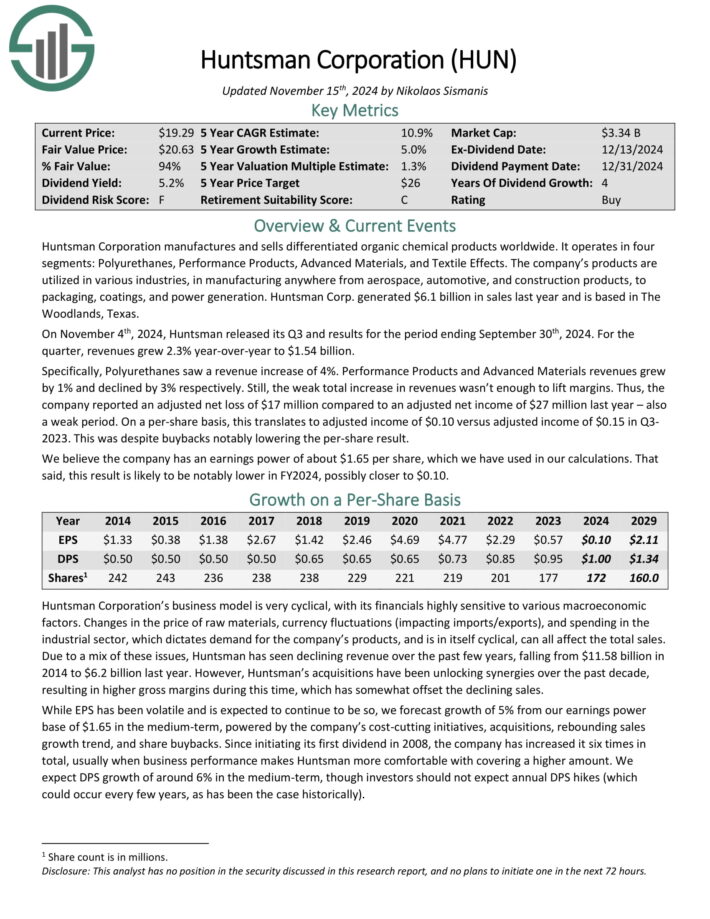

Excessive Dividend Inventory You’ve By no means Heard Of: Huntsman Corp. (HUN)

Huntsman Company manufactures and sells differentiated natural chemical merchandise worldwide. It operates in 4 segments: Polyurethanes, Efficiency Merchandise, Superior Supplies, and Textile Results.

The corporate’s merchandise are utilized in numerous industries, in manufacturing wherever from aerospace, automotive, and building merchandise, to packaging, coatings, and energy era.

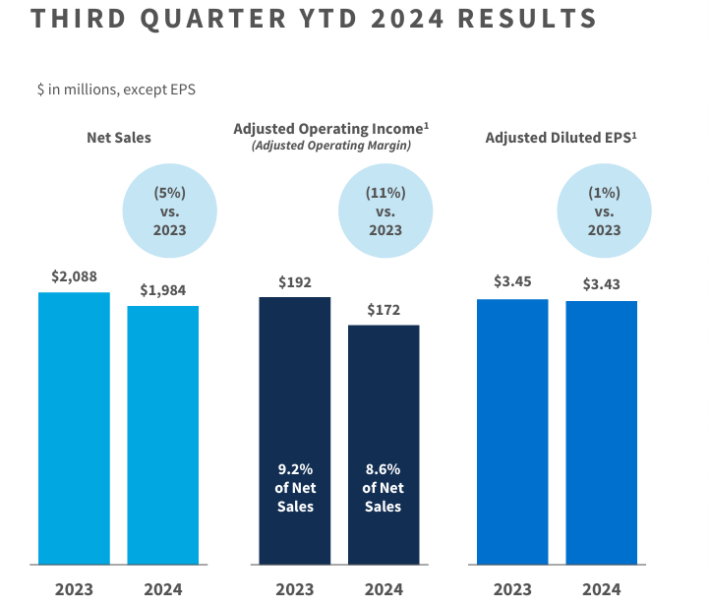

On November 4th, 2024, Huntsman launched its Q3 and outcomes for the interval ending September thirtieth, 2024. For the quarter, revenues grew 2.3% year-over-year to $1.54 billion.

Particularly, Polyurethanes noticed a income improve of 4%. Efficiency Merchandise and Superior Supplies revenues grew by 1% and declined by 3% respectively. Nonetheless, the weak complete improve in revenues wasn’t sufficient to elevate margins.

On a per-share foundation, this interprets to adjusted revenue of $0.10 versus adjusted revenue of $0.15 in Q3 2023. This was regardless of buybacks notably decreasing the per-share end result.

Click on right here to obtain our most up-to-date Certain Evaluation report on HUN (preview of web page 1 of three proven under):

Excessive Dividend Inventory You’ve By no means Heard Of: United Bancorp Inc. (UBCP)

United Bancorp a monetary holding firm primarily based in the US, working primarily by way of its wholly-owned subsidiary, United Financial institution.

The corporate gives a variety of banking providers together with retail and industrial banking, mortgage lending, and funding providers.

A few of its different options embrace checking and financial savings accounts, private and enterprise loans, in addition to wealth administration.

On August twenty second, 2024, United Bancorp raised its dividend by 1.4% to a quarterly charge of $0.1775. On a year-over-year foundation, this was a 4.4% improve.

On November sixth, 2024, United Bancorp posted its Q3 outcomes for the interval ending September thirtieth, 2024. The corporate reported complete curiosity revenue of $9.94 million, which was up 3.0% year-over-year.

This progress was primarily pushed by a 13.9% rise in curiosity revenue on loans, regardless of a 32.9% decline in mortgage charge revenue and a 15.2% lower in curiosity revenue from securities.

Nevertheless, complete curiosity bills elevated by about 23.4%, resulting in a 6.5% decline in internet curiosity revenue, which fell to $6.1 million.

Click on right here to obtain our most up-to-date Certain Evaluation report on UBCP (preview of web page 1 of three proven under):

Excessive Dividend Inventory You’ve By no means Heard Of: Carters Inc. (CRI)

Carter’s, Inc. is the most important branded retailer of attire solely for infants and younger youngsters in North America. It was based in 1865 by William Carter. The corporate owns the Carter’s and OshKosh B’gosh manufacturers, two of essentially the most recognized manufacturers within the youngsters’s attire area.

Carter’s acquired competitor OshKosh B’gosh for $312 million in 2005. Now, these manufacturers are offered in main shops, nationwide chains, and specialty retailers domestically and internationally.

On October twenty sixth, 2024, the corporate reported third-quarter outcomes for Fiscal 12 months (FY)2024. The corporate reported a decline in third-quarter fiscal 2024 outcomes, with internet gross sales down 4.2% to $758 million in comparison with the earlier 12 months’s $792 million.

Supply: Investor Presentation

The corporate’s working margin decreased to 10.2% from 11.8%, attributed to greater investments in pricing and advertising and marketing, regardless of a decrease price of products.

Earnings per diluted share (EPS) dropped to $1.62 from $1.78, reflecting softer demand in key segments.

Click on right here to obtain our most up-to-date Certain Evaluation report on CRI (preview of web page 1 of three proven under):

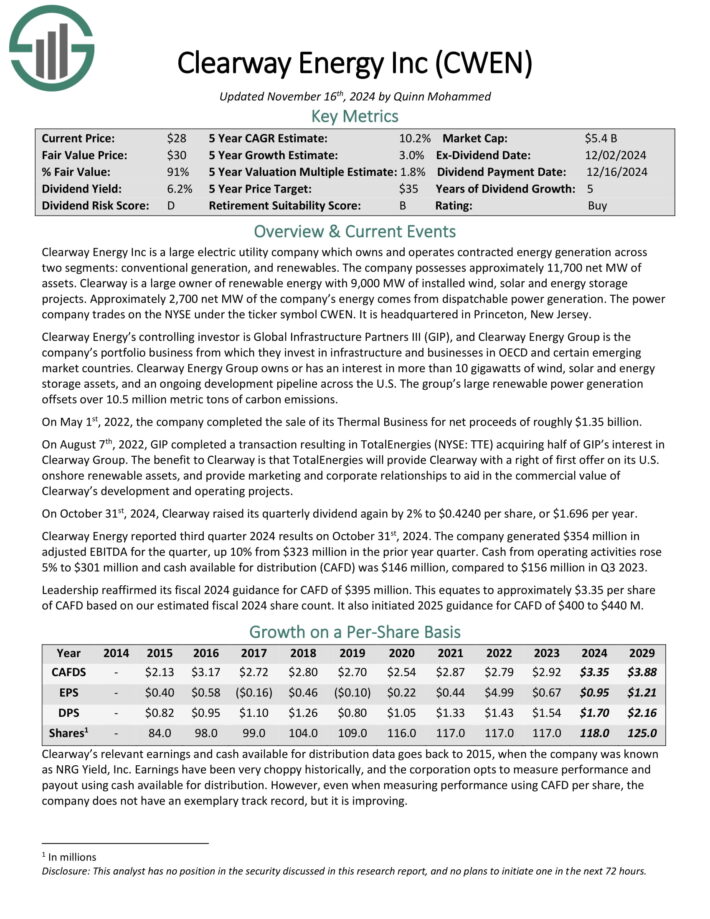

Excessive Dividend Inventory You’ve By no means Heard Of: Clearway Power (CWEN)

Clearway Power Inc is a big electrical utility firm which owns and operates contracted vitality era throughout two segments: standard era, and renewables. The corporate possesses roughly 11,700 internet MW of belongings.

Clearway is a big proprietor of renewable vitality with 9,000 MW of put in wind, photo voltaic and vitality storage tasks. Roughly 2,700 internet MW of the corporate’s vitality comes from dispatchable energy era. The facility firm trades on the NYSE underneath the ticker image CWEN. It’s headquartered in Princeton, New Jersey.

Clearway Power’s controlling investor is International Infrastructure Companions III (GIP), and Clearway Power Group is the corporate’s portfolio enterprise from which they put money into infrastructure and companies in OECD and sure rising market nations.

Clearway Power Group owns or has an curiosity in additional than 10 gigawatts of wind, photo voltaic and vitality storage belongings, and an ongoing growth pipeline throughout the U.S. The group’s giant renewable energy era offsets over 10.5 million metric tons of carbon emissions.

On October thirty first, 2024, Clearway raised its quarterly dividend once more by 2% to $0.4240 per share, or $1.696 per 12 months. Clearway Power reported third quarter 2024 outcomes on October thirty first, 2024. The corporate generated $354 million in adjusted EBITDA for the quarter, up 10% from $323 million within the prior 12 months quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on CWEN (preview of web page 1 of three proven under):

Excessive Dividend Inventory You’ve By no means Heard Of: Fortitude Gold (FTCO)

Fortitude Gold Company was spun-off from Gold Useful resource Company right into a separate public firm in December 2021. Fortitude Gold is a junior gold producer with operations in Nevada, U.S.A, one of many world’s premier mining-friendly jurisdictions.

The corporate targets high-grade gold open pit heap leach operations averaging one gram per tonne of gold or better. Its property portfolio at present consists of 100% possession in six high-grade gold properties.

All six properties are inside an approximate 30-mile radius of each other inside the prolific Walker Lane Mineral Belt. The corporate generated $73.1 million in revenues final 12 months, virtually nearly all of which have been from gold, and is predicated in Colorado Springs, Colorado. It pays dividends on a month-to-month foundation.

On November fifth, 2024, Fortitude Gold launched its Q3 outcomes for the interval ending September 30st, 2024. For the quarter, revenues got here in at $10.2 million, 52% decrease in comparison with final 12 months.

The decline in revenues was primarily attributable to a 62% drop in gold gross sales quantity and a 54% lower in silver gross sales quantity. Nevertheless, these reductions have been partially offset by a 26% improve in gold costs and a 23% rise in silver costs.

Click on right here to obtain our most up-to-date Certain Evaluation report on FTCO (preview of web page 1 of three proven under):

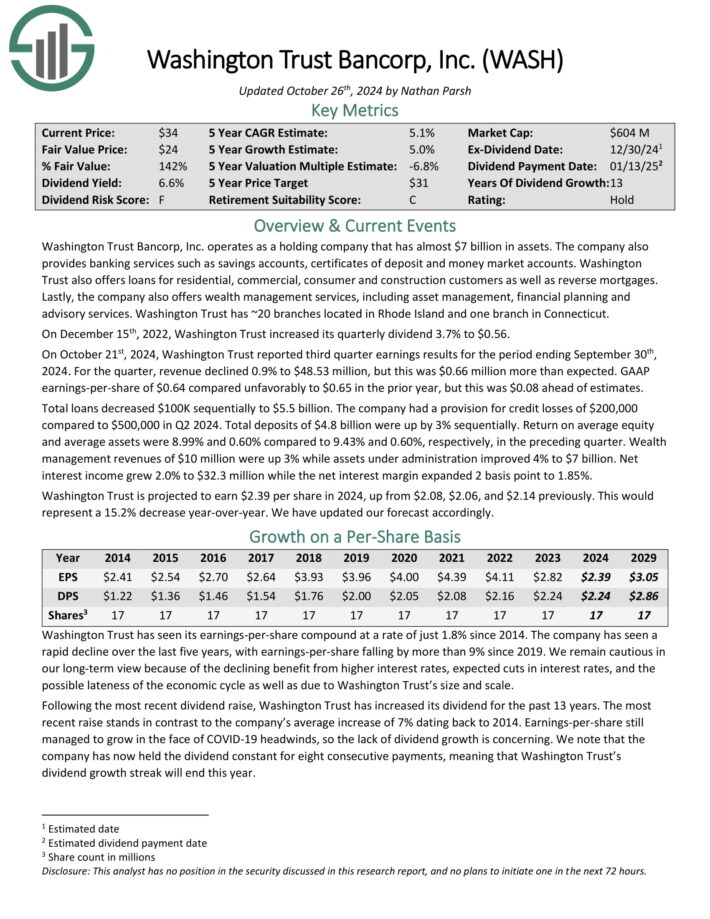

Excessive Dividend Inventory You’ve By no means Heard Of: Washington Bancorp (WASH)

Washington Belief Bancorp, Inc. operates as a holding firm that has virtually $7 billion in belongings. The corporate gives banking providers equivalent to financial savings accounts, certificates of deposit and cash market accounts.

Washington Belief additionally gives loans for residential, industrial, client and building prospects in addition to reverse mortgages.

Lastly, the corporate additionally gives wealth administration providers, together with asset administration, monetary planning and advisory providers. Washington Belief has ~20 branches positioned in Rhode Island and one department in Connecticut.

On October twenty first, 2024, Washington Belief reported third quarter earnings outcomes for the interval ending September thirtieth, 2024. For the quarter, income declined 0.9% to $48.53 million, however this was $0.66 million greater than anticipated. GAAP earnings-per-share of $0.64 in contrast unfavorably to $0.65 within the prior 12 months, however this was $0.08 forward of estimates.

Complete loans decreased $100K sequentially to $5.5 billion. The corporate had a provision for credit score losses of $200,000 in comparison with $500,000 in Q2 2024. Complete deposits of $4.8 billion have been up by 3% sequentially.

Return on common fairness and common belongings have been 8.99% and 0.60% in comparison with 9.43% and 0.60%, respectively, within the previous quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on WASH (preview of web page 1 of three proven under):

Excessive Dividend Inventory You’ve By no means Heard Of: Haverty Furnishings Corporations (HVT)

Haverty Furnishings Corporations was based in 1885 in Atlanta, GA by J.J. Haverty. Since then, the corporate has grown to greater than 120 shops in 16 U.S. states. Haverty is a specialised retailer of residential furnishings and equipment.

The corporate’s merchandise are used all through the house, together with in residing rooms, bedrooms, eating rooms, workplace, and out of doors areas. The corporate generates annual income of greater than $860 million.

Supply: Investor Presentation

On November 1st, 2024, Haverty reported third quarter earnings outcomes for the interval ending September thirtieth, 2024. For the quarter, income decreased 20.2% to $175.9 million, which was $18.8 million lower than anticipated. GAAP earnings per-share of $0.29 in contrast very unfavorably to $1.02 within the prior 12 months and was $0.18 under estimates.

Comparable gross sales for the interval decreased 20.2%. Because of the year-over-year weak spot, gross margins contracted 60 foundation factors to 60.2%. SG&A bills decreased $11.8 million to $100.9 million, however represented 57.4% of complete gross sales in comparison with 51.1% within the prior 12 months as a result of decrease gross sales complete.

Haverty ended the interval with $127.4 million in money and equivalents. The corporate has no excellent debt and credit score availability of $80 million..

Click on right here to obtain our most up-to-date Certain Evaluation report on HVT (preview of web page 1 of three proven under):

Extra Studying

In case you are concerned with discovering high-quality dividend progress shares and/or different high-yield securities and revenue securities, the next Certain Dividend sources might be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].