Revealed on October twenty eighth, 2025 by Felix Martinez

Excessive-yield shares pay out dividends which can be considerably larger than the market common. For instance, the S&P 500’s present yield is barely ~1.2%.

Excessive-yield shares will be significantly helpful in supplementing revenue after retirement. A $120,000 funding in shares with a mean dividend yield of 5% creates a mean of $500 a month in dividends.

Timbercreek Monetary Corp. (TBCRF) is a part of our ‘Excessive Dividend 50’ sequence, which covers the 50 highest-yielding shares within the Positive Evaluation Analysis Database.

We have now created a spreadsheet of shares (and carefully associated REITs, MLPs, and so on.) with dividend yields of 5% or extra.

You’ll be able to obtain your free full record of all securities with 5%+ yields (together with vital monetary metrics comparable to dividend yield and payout ratio) by clicking on the hyperlink under:

Subsequent on our record of high-dividend shares to assessment is Timbercreek Monetary Corp. (TBCRF).

Enterprise Overview

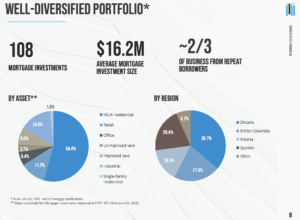

Timbercreek Monetary is a Canadian non-bank lender specializing in short-term, structured financing for industrial actual property. The corporate primarily gives first-mortgage loans for income-producing properties, together with multi-residential, retail, industrial, and workplace belongings. Its loans help acquisitions, redevelopment, or transitional financing and are sometimes repaid via long-term financing or property gross sales. The agency’s portfolio is totally targeted on industrial actual property, with round 92% of capital deployed in Ontario, British Columbia, Quebec, and Alberta.

Timbercreek emphasizes conservative threat administration, sustaining a 63.3% loan-to-value ratio (year-end 2024) and floating-rate loans with fee flooring to guard in opposition to market volatility whereas benefiting from rate of interest actions. The corporate pays month-to-month dividends, interesting to income-focused traders, and has a market capitalization of CAD 460.8 million. Its disciplined lending mannequin and urban-focused portfolio present steady, high-quality publicity to Canada’s main actual property markets.

Supply: Investor Relations

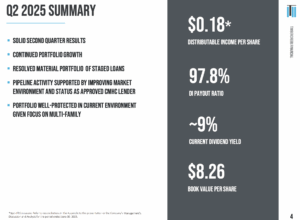

Timbercreek Monetary reported Q2 2025 web revenue of $12.4 million, or $0.15 per share, barely under expectations. Web funding revenue was $25.2 million, and distributable revenue totaled $14.6 million ($0.18 per share). The corporate declared $14.3 million in dividends ($0.17 per share), yielding 9.5% on the present share value.

The online mortgage portfolio grew to $1.114 billion, up 11% year-over-year, with new loans weighted towards the tip of the quarter. Stage 2 and three loans totaling $80 million have been resolved, releasing capital for higher-yield investments. Variable-rate loans with rate of interest flooring made up 87.4% of the portfolio, defending in opposition to rate of interest swings, whereas multi-family residential belongings stay resilient.

The portfolio’s weighted-average LTV was 66%, with first mortgages accounting for 91.6% and cash-flowing properties accounting for 76.3%. Weighted common rates of interest have been 8.6%. Timbercreek’s disciplined underwriting, lively mortgage administration, and concentrate on high-quality city belongings proceed to generate steady revenue and enticing risk-adjusted returns for shareholders.

Supply: Investor Relations

Development Prospects

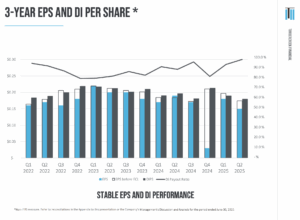

Timbercreek Monetary grows by lending to new clients at enticing charges, primarily in opposition to income-producing properties. Nevertheless, EPS has proven little development over the previous seven years, and U.S. traders face added threat from CAD/USD fluctuations. Even accounting for foreign money results, Timbercreek’s backside line has been principally flat, and EPS is anticipated to stay steady over the subsequent 5 years.

Over the previous decade, EPS ranged from $0.36–$0.43 via 2017, fell to $0.23 in 2020 as a result of low charges and pandemic-related accounting changes, and rebounded to $0.43 by 2023. EPS declined to $0.28 in 2024 from higher-risk mortgage provisions and a few portfolio runoff.

Distributable revenue per share is anticipated to remain round $0.36, and the month-to-month dividend has been steady at roughly $0.042 USD since 2017. Timbercreek stays a low-growth, income-focused funding with predictable dividends.

Supply: Investor Relations

Aggressive Benefits & Recession Efficiency

Timbercreek Monetary’s aggressive benefit lies in its concentrate on short-term, structured lending to industrial actual property traders, permitting sooner execution and extra versatile phrases than conventional Canadian banks. Its disciplined underwriting, conservative loan-to-value ratios, and excessive proportion of first mortgages (over 90% of the portfolio) present draw back safety, whereas variable-rate loans with rate of interest flooring assist the corporate profit from rising charges and mitigate rate of interest threat. Moreover, Timbercreek’s urban-focused, income-producing property portfolio ensures predictable money move and steady distributable revenue for shareholders.

Throughout financial downturns, Timbercreek has demonstrated relative resilience. Its emphasis on cash-flowing properties, primarily multi-family residential belongings, and conservative lending practices helps preserve mortgage efficiency even in softer markets.

Whereas EPS will be risky as a result of accounting changes or foreign money fluctuations, precise defaults have traditionally been restricted, and the corporate has continued to generate regular distributable revenue. This defensive positioning makes Timbercreek a extra steady alternative in contrast with broader industrial actual property lenders throughout recessions.

Dividend Evaluation

Timbercreek Monetary’s annual dividend is $0.50 per share. At its current share value, the inventory has a excessive yield of 9.5%.

Given the corporate’s 2025 earnings outlook, EPS is anticipated to be $0.50 per share. Consequently, the corporate is anticipated to pay out 100% of its EPS to shareholders in dividends.

Ultimate Ideas

Timbercreek Monetary gives publicity to high-yield, short-term industrial actual property lending, benefiting from rate of interest sensitivity and lively portfolio administration. The corporate affords enticing month-to-month dividends, however traders ought to train warning, as the present payout degree might not be totally sustainable.

Its returns are tied to market situations and the efficiency of income-producing properties, making it a higher-risk funding relative to extra diversified or low-volatility choices.

Given its present valuation and restricted potential for dividend development, we count on modest complete returns, forecasting roughly 4.3% annualized via 2030. Contemplating the mix of elevated threat, stagnant earnings, and capped dividend upside, the inventory is rated a promote, as its complete return potential seems restricted relative to different income-focused investments.

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].