Up to date on December seventeenth, 2024 by Bob Ciura

Spreadsheet information up to date day by day

Return on invested capital, or ROIC, is a priceless monetary ratio that buyers can add to their analysis course of.

Understanding ROIC and utilizing it to display screen for top ROIC shares is an efficient approach to give attention to the highest-quality companies.

With this in thoughts, we ran a inventory display screen to give attention to the best ROIC shares within the S&P 500.

You possibly can obtain a free copy of the highest 100 shares with the best ROIC (together with vital monetary metrics like dividend yields and price-to-earnings ratio) by clicking on the hyperlink under:

Utilizing ROIC permits buyers to filter out the highest-quality companies which are successfully producing a return on capital.

This text will clarify ROIC and its usefulness for buyers. It can additionally listing the highest 10 highest ROIC shares proper now.

Desk Of Contents

You should utilize the hyperlinks under to immediately bounce to a person part of the article:

What Is ROIC?

Put merely, return on invested capital (ROIC) is a monetary ratio that reveals an organization’s capacity to allocate capital. The widespread system to calculate ROIC is to divide an organization’s after-tax web working revenue, by the sum of its debt and fairness capital.

As soon as the ROIC is calculated, it’s evaluated towards an organization’s weighted common value of capital, generally known as WACC.

If an organization’s WACC isn’t instantly obtainable, it may be calculated by taking a weighted common of the price of an organization’s debt and fairness.

Price of debt is calculated by averaging the yield to maturity for a corporation’s excellent debt. That is pretty straightforward to seek out, as a publicly-traded firm should report its debt obligations.

Price of fairness is often calculated through the use of the capital asset pricing mannequin, in any other case often known as CAPM.

As soon as the WACC is calculated, it may be in contrast with the ROIC. Traders need to see an organization’s ROIC exceed its WACC.

This means the underlying enterprise is efficiently investing its capital to generate a worthwhile return. On this manner, the corporate is creating financial worth.

Typically, shares producing the best ROIC are doing the perfect job of allocating their buyers’ capital. With this in thoughts, the next part ranks the ten shares with the best ROIC.

The High 10 Highest ROIC Shares

The next 10 shares have the best ROIC. Shares are listed so as from lowest to highest.

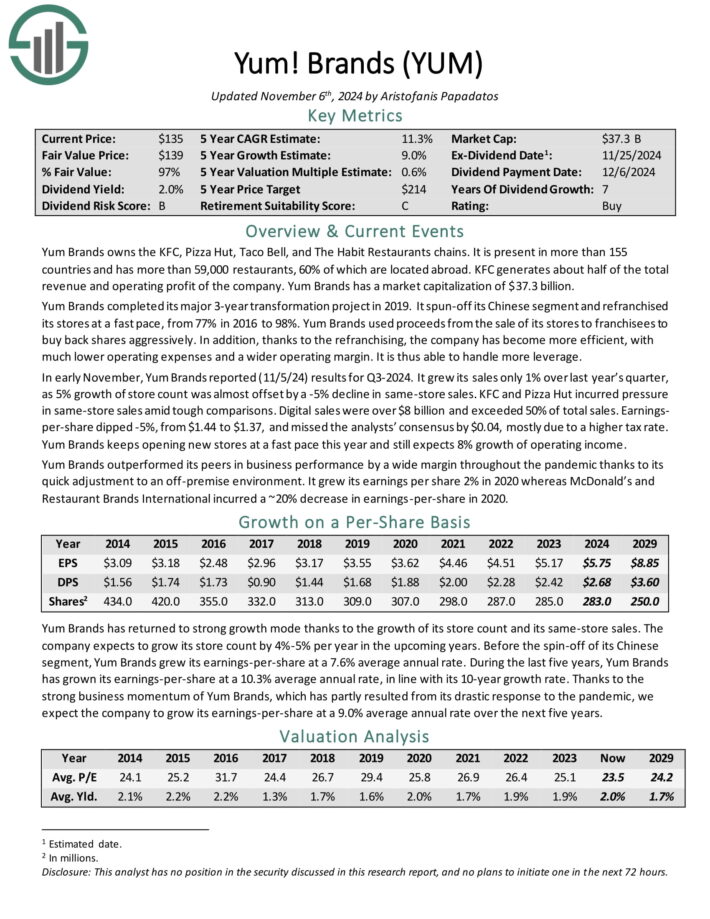

Excessive ROIC Inventory #10: Yum Manufacturers Inc. (YUM)

- 5-year annual anticipated returns: 11.2%

- Return on invested capital: 44.6%

Yum Manufacturers owns the KFC, Pizza Hut, Taco Bell, and The Behavior Eating places chains. It’s current in additional than 155 international locations and has greater than 59,000 eating places, 60% of that are situated overseas. KFC generates about half of the full income and working revenue of the corporate.

In early November, Yum Manufacturers reported (11/5/24) outcomes for Q3-2024. It grew its gross sales only one% over final 12 months’s quarter, as 5% progress of retailer depend was nearly offset by a -5% decline in same-store gross sales. KFC and Pizza Hut incurred strain in same-store gross sales amid robust comparisons.

Digital gross sales had been over $8 billion and exceeded 50% of whole gross sales. Earnings per-share dipped -5%, from $1.44 to $1.37, and missed the analysts’ consensus by $0.04, principally as a result of the next tax charge.

Yum Manufacturers retains opening new shops at a quick tempo this 12 months and nonetheless expects 8% progress of working earnings.

Click on right here to obtain our most up-to-date Positive Evaluation report on YUM (preview of web page 1 of three proven under):

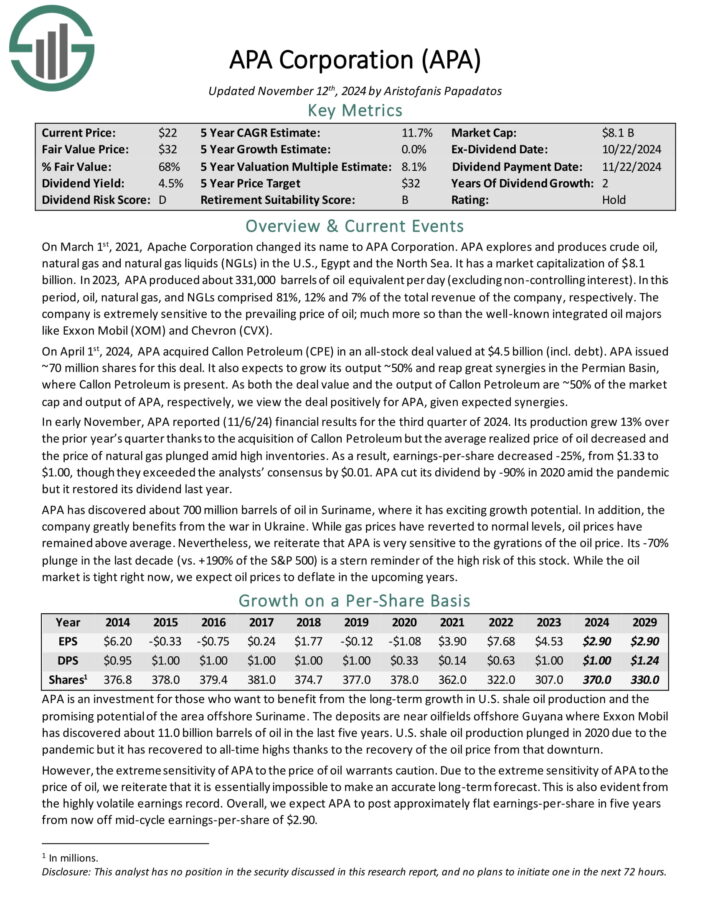

Excessive ROIC Inventory #9: APA Corp. (APA)

- 5-year annual anticipated returns: 11.4%

- Return on invested capital: 21.7%

APA explores for and produces crude oil, pure gasoline and pure gasoline liquids (NGLs) within the U.S., Egypt and the North Sea. In 2023, APA produced about 331,000 barrels of oil equal per day (excluding non-controlling curiosity). On this interval, oil, pure gasoline, and NGLs comprised 81%, 12% and seven% of the full income of the corporate, respectively.

On April 1st, 2024, APA acquired Callon Petroleum (CPE) in an all-stock deal valued at $4.5 billion (incl. debt). APA issued ~70 million shares for this deal. It additionally expects to develop its output ~50% and reap nice synergies within the Permian Basin, the place Callon Petroleum is current.

In early November, APA reported (11/6/24) monetary outcomes for the third quarter of 2024. Its manufacturing grew 13% over the prior 12 months’s quarter due to the acquisition of Callon Petroleum however the common realized value of oil decreased and the value of pure gasoline plunged amid excessive inventories.

Consequently, earnings-per-share decreased -25%, from $1.33 to $1.00, although they exceeded the analysts’ consensus by $0.01.

Click on right here to obtain our most up-to-date Positive Evaluation report on APA (preview of web page 1 of three proven under):

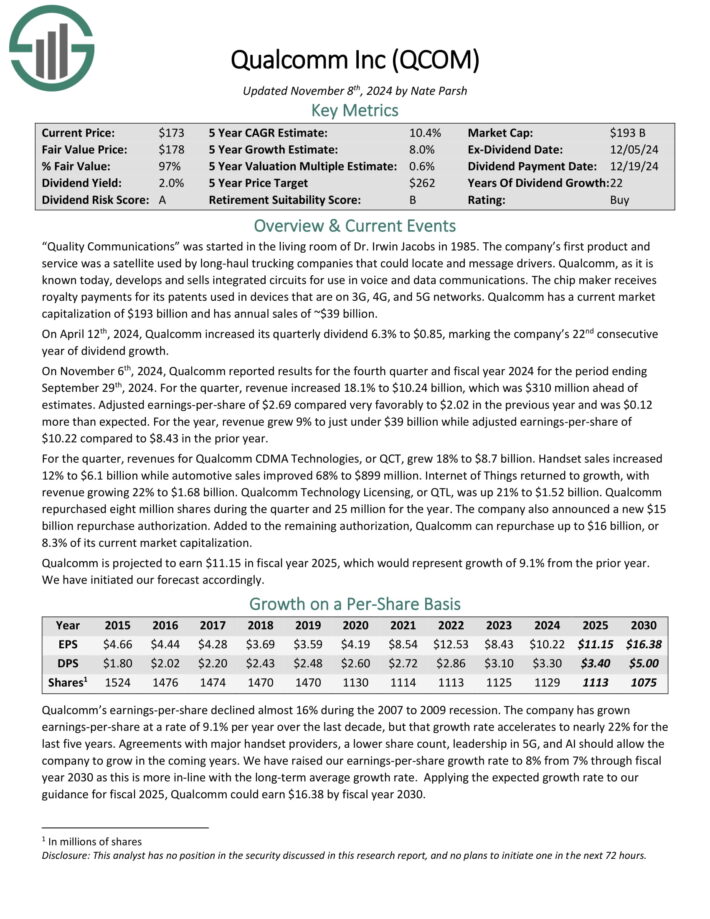

Excessive ROIC Inventory #8: Qualcomm Inc. (QCOM)

- 5-year annual anticipated returns: 12.4%

- Return on invested capital: 25.9%

Qualcomm develops and sells built-in circuits to be used in voice and information communications. The chip maker receives royalty funds for its patents utilized in units which are on 3G, 4G, and 5G networks. Qualcomm has annual gross sales of ~$38 billion.

On November sixth, 2024, Qualcomm reported outcomes for the fourth quarter and financial 12 months 2024 for the interval ending September twenty ninth, 2024. For the quarter, income elevated 18.1% to $10.24 billion, which was $310 million forward of estimates.

Adjusted earnings-per-share of $2.69 in contrast very favorably to $2.02 within the earlier 12 months and was $0.12 greater than anticipated. For the 12 months, income grew 9% to only below $39 billion whereas adjusted earnings-per-share of $10.22 in comparison with $8.43 within the prior 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on QCOM (preview of web page 1 of three proven under):

Excessive ROIC Inventory #7: Utilized Supplies Inc. (AMAT)

- 5-year annual anticipated returns: 12.4%

- Return on invested capital: 30.2%

Utilized Supplies is a semiconductor producer that generates roughly $27 billion in annual income.

Utilized Supplies posted fourth quarter and full-year earnings on November 14th, 2024, and outcomes had been higher than anticipated on each the highest and backside traces.

Adjusted earnings-per-share for the quarter got here to $2.32, which was 13 cents forward of expectations. Income was $7.05 billion, up about 5% year-over-year, and beating estimates by $80 million.

On an adjusted foundation, gross margin got here to 47.5% of income, and working earnings was $2.06 billion, or 29.3% of web income. The corporate generated $2.58 billion in money from operations, and distributed $1.77 billion to shareholders. That included $1.44 billion in share repurchases, and $329 million in dividends.

Click on right here to obtain our most up-to-date Positive Evaluation report on AMAT (preview of web page 1 of three proven under):

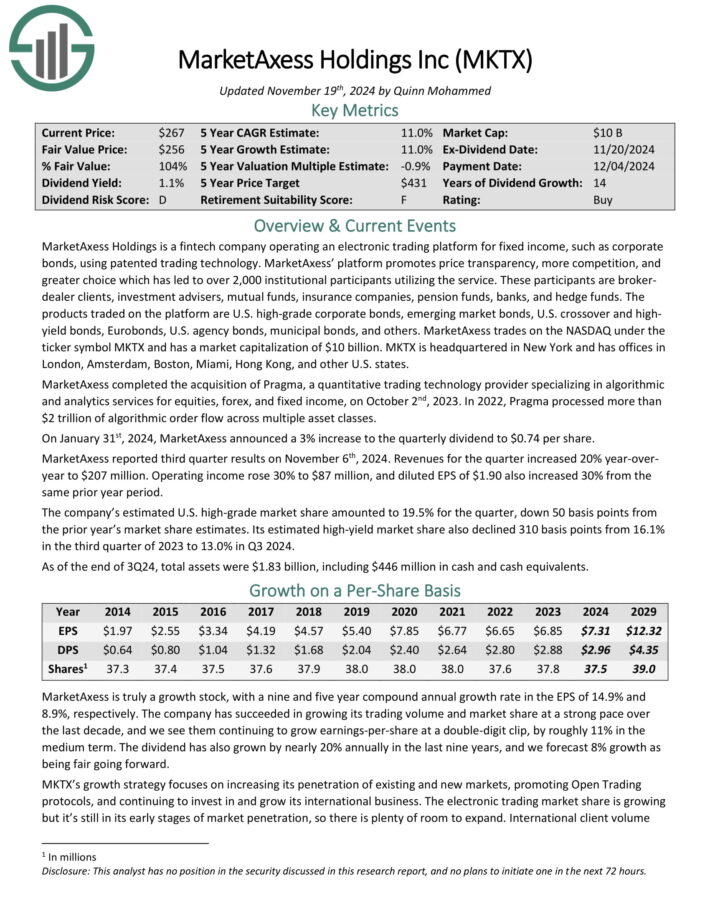

Excessive ROIC Inventory #6: MarketAxess Holdings (MKTX)

- 5-year annual anticipated returns: 14.1%

- Return on invested capital: 21.4%

MarketAxess Holdings is a fintech firm working an digital buying and selling platform for fastened earnings, comparable to company bonds, utilizing patented buying and selling know-how.

The merchandise traded on the platform are U.S. high-grade company bonds, rising market bonds, U.S. crossover and excessive yield bonds, Eurobonds, U.S. company bonds, municipal bonds, and others.

MarketAxess reported third quarter outcomes on November sixth, 2024. Revenues for the quarter elevated 20% year-over-year to $207 million. Working earnings rose 30% to $87 million, and diluted EPS of $1.90 additionally elevated 30% from the identical prior 12 months interval.

The corporate’s estimated U.S. high-grade market share amounted to 19.5% for the quarter, down 50 foundation factors from the prior 12 months’s market share estimates. Its estimated high-yield market share additionally declined 310 foundation factors from 16.1% within the third quarter of 2023 to 13.0% in Q3 2024.

Click on right here to obtain our most up-to-date Positive Evaluation report on MKTX (preview of web page 1 of three proven under):

Excessive ROIC Inventory #5: Eli Lilly & Co. (LLY)

- 5-year annual anticipated returns: 14.3%

- Return on invested capital: 21.5%

Eli Lilly develops, manufactures, and sells prescribed drugs around the globe, and has about 35,000 workers globally. Eli Lilly ought to produce no less than $45 billion of income in 2024.

On October thirtieth, 2024, Eli Lilly reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, income grew 20.5% to $11.4 billion, however this was $680 million lower than anticipated.

Adjusted earnings-per share

of $1.18 in contrast very favorably to adjusted earnings-per-share of $0.10 within the prior 12 months, however this was $0.29 under estimates.

Volumes companywide had been up 15% for the quarter and pricing added 6%, with foreign money performing as a 1% headwind to outcomes. U.S. income grew 42% to $7.84 billion, as quantity was up 27% and better costs added 15%. Worldwide revenues fell 12% to $3.63 billion as volumes fell 10%. Pricing was unchanged.

Income for Mounjaro, which helps sufferers with weight administration and is the corporate’s prime gross product, totaled $3.11 billion, in comparison with $1.41 billion a 12 months in the past.

Click on right here to obtain our most up-to-date Positive Evaluation report on LLY (preview of web page 1 of three proven under):

Excessive ROIC Inventory #4: Nike Inc. (NKE)

- 5-year annual anticipated returns: 14.5%

- Return on invested capital: 23.0%

Nike is the world’s largest athletic footwear, attire and gear maker. The namesake is without doubt one of the most respected manufacturers on the earth. Nike’s choices give attention to six classes: operating, basketball, the Jordan model, soccer (soccer), coaching, and sportswear. Nike additionally owns Converse.

In early October, Nike launched (10/1/24) outcomes for the primary quarter of fiscal 2025 (Nike’s fiscal 12 months ends on Could thirty first). Gross sales and direct gross sales decreased -10% and -13%, respectively, vs. the prior 12 months’s quarter.

Digital gross sales declined -20%. Gross margin expanded from 44.2% to 45.4% thanks to cost hikes and decrease enter prices however earnings-per-share declined -26%, from $0.95 to $0.70, as a result of sharp lower in gross sales.

It nonetheless expects a mid-single digit lower in revenues in fiscal 2025 as a result of difficult macroeconomic circumstances nevertheless it additionally expects to resort to deep reductions with a purpose to cut back stock from excessive ranges.

Click on right here to obtain our most up-to-date Positive Evaluation report on NKE (preview of web page 1 of three proven under):

Excessive ROIC Inventory #3: Meta Platforms Inc. (META)

- 5-year annual anticipated returns: 14.5%

- Return on invested capital: 31.9%

Meta Platforms, beforehand often known as Fb, is multinational know-how conglomerate identified for its social media platforms, together with Fb, Instagram, and WhatsApp. It has additionally invested in rising applied sciences comparable to augmented actuality (AR) and digital actuality (VR) by its Oculus subsidiary.

With practically 4 billion folks logging into no less than one in all Meta’ platforms each month, the corporate attracts practically 20% of all international promoting income, second solely to Alphabet (GOOGL), which instructions a considerable 40% market share. Meta Platforms generates practically $160 billion in annual revenues, and is headquartered in Menlo Park, California.

On October thirtieth, 2024, Meta Platforms reported its Q3 outcomes for the interval ending June thirtieth, 2024. For the quarter, the corporate posted revenues of $40.6 billion, marking a robust progress of 19% in comparison with the earlier 12 months. Income progress was pushed by elevated person exercise, progress in advert impressions, and better advert pricing.

Click on right here to obtain our most up-to-date Positive Evaluation report on META (preview of web page 1 of three proven under):

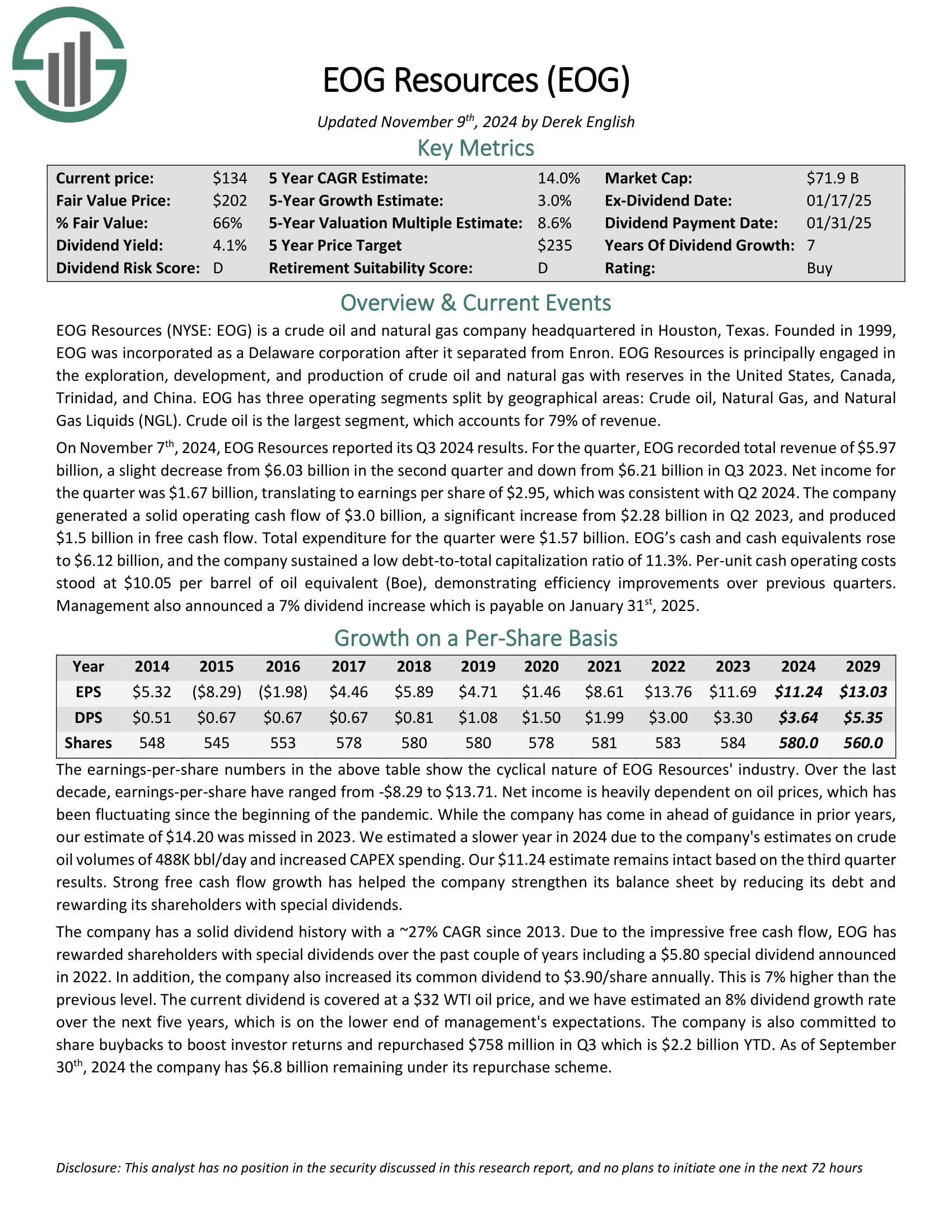

Excessive ROIC Inventory #2: EOG Sources (EOG)

- 5-year annual anticipated returns: 15.7%

- Return on invested capital: 22.0%

EOG Sources is a crude oil and pure gasoline firm headquartered in Houston, Texas. It’s principally engaged within the exploration, improvement, and manufacturing of crude oil and pure gasoline with reserves in america, Canada, Trinidad, and China.

EOG has three working segments cut up by geographical areas: Crude oil, Pure Gasoline, and Pure Gasoline Liquids (NGL). Crude oil is the most important section, which accounts for 79% of income.

On November seventh, 2024, EOG Sources reported its Q3 2024 outcomes. For the quarter, EOG recorded whole income of $5.97 billion, a slight lower from $6.03 billion within the second quarter and down from $6.21 billion in Q3 2023.

Web earnings for the quarter was $1.67 billion, translating to earnings per share of $2.95, which was in step with Q2 2024. The corporate generated a strong working money move of $3.0 billion, a big enhance from $2.28 billion in Q2 2023, and produced $1.5 billion in free money move.

Whole expenditure for the quarter had been $1.57 billion. EOG’s money and money equivalents rose to $6.12 billion, and the corporate sustained a low debt-to-total capitalization ratio of 11.3%.

Click on right here to obtain our most up-to-date Positive Evaluation report on EOG (preview of web page 1 of three proven under):

Excessive ROIC Inventory #1: Alphabet Inc. (GOOG)(GOOGL)

- 5-year annual anticipated returns: 16.4%

- Return on invested capital: 31.0%

Alphabet is a know-how conglomerate that operates a number of companies comparable to Google search, Android, Chrome, YouTube, Nest, Gmail, Maps, and plenty of extra. Alphabet is a pacesetter in lots of the areas of know-how that it operates. On October twenty ninth, 2024, Alphabet reported third quarter outcomes for the interval ending September thirtieth, 2024.

As had been the case for a number of quarters, the corporate delivered higher than anticipated outcomes. Income grew 15.1% to $88.3 billion for the interval and beat analysts’ estimates by $2.05 billion. Adjusted earnings-per-share of $2.12 in contrast very favorably to $1.55 within the prior 12 months and was $0.27 above expectations.

As soon as once more, practically each side of Alphabet’s enterprise carried out properly in the course of the quarter. Income for Google Search, the most important contributor to outcomes, elevated greater than 12% to $49.4 billion. YouTube adverts grew 12.2% to $8.9 billion whereas Google Community declined 1.6% to $7.5 billion. Google subscriptions, platforms, and units had been up nearly 28% to $10.7 billion.

Click on right here to obtain our most up-to-date Positive Evaluation report on GOOGL (preview of web page 1 of three proven under):

Closing Ideas

There are numerous alternative ways for buyers to worth shares. One widespread valuation technique is to calculate an organization’s return on invested capital.

By doing so, buyers can get a greater gauge of corporations that do the perfect job of investing their capital.

ROIC is certainly not the one metric that buyers ought to use to purchase shares. There are numerous different worthwhile valuation strategies that buyers ought to contemplate.

That mentioned, the highest 10 ROIC shares on this listing have confirmed the power to create financial worth for shareholders.

Additional Studying

If you’re curious about discovering high-quality dividend progress shares appropriate for long-term funding, the next Positive Dividend databases shall be helpful:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.