Printed on March eleventh, 2025 by Bob Ciura

Blue-chip shares are established, financially robust, and constantly worthwhile publicly traded firms.

Their energy makes them interesting investments for comparatively protected, dependable dividends and capital appreciation versus much less established shares.

This analysis report has the next sources that can assist you spend money on blue chip shares:

Useful resource #1: The Blue Chip Shares Spreadsheet Record

There are presently greater than 500 securities in our blue chip shares checklist.

We categorize blue chip shares as firms which might be members of 1 or extra of the next 3 lists:

Merely put, blue chip shares have a minimum of 10 consecutive years of dividend will increase.

On the identical time, we regularly suggest revenue buyers think about excessive dividend shares, for his or her elevated dividend yields.

Excessive dividend shares means extra revenue for each greenback invested. All different issues equal, the upper the dividend yield, the higher.

The mix of dividend yield and progress, can lead to excellent long-term returns.

On this analysis report, we analyze 10 blue chip shares with excessive dividend yields of 5.0% and higher.

The checklist is sorted by dividend yield, in ascending order.

Desk of Contents

The desk of contents beneath permits for straightforward navigation.

Excessive Yield Blue Chip #10: Franklin Assets (BEN)

- Dividend Historical past: 45 years of consecutive will increase

- Dividend Yield: 6.2%

Franklin Assets is an funding administration firm. It was based in 1947. Right this moment, Franklin Assets manages the Franklin and Templeton households of mutual funds.

On January thirty first, 2025, Franklin Assets reported web revenue of $163.6 million, or $0.29 per diluted share, for the primary fiscal quarter ending December 31, 2024.

This marked a big enchancment from the earlier quarter’s web lack of $84.7 million, although EPS remained decrease than the $251.3 million web revenue recorded in the identical quarter final 12 months.

Supply: Investor presentation

The previous few years have been troublesome for Franklin Assets. Franklin Assets was sluggish to adapt to the altering atmosphere within the asset administration business.

The explosive progress in exchange-traded funds and indexing investing shocked conventional mutual funds.

ETFs have turn into very fashionable with buyers due largely to their decrease charges than conventional mutual funds. In response, the asset administration business has needed to reduce charges and commissions or danger shedding shopper belongings.

Earnings-per-share are anticipated to say no in 2025 because of this. The corporate nonetheless maintains a manageable payout ratio of 51% anticipated for 2025, but when EPS continues to say no, the dividend payout may very well be in peril down the street.

Click on right here to obtain our most up-to-date Positive Evaluation report on BEN (preview of web page 1 of three proven beneath):

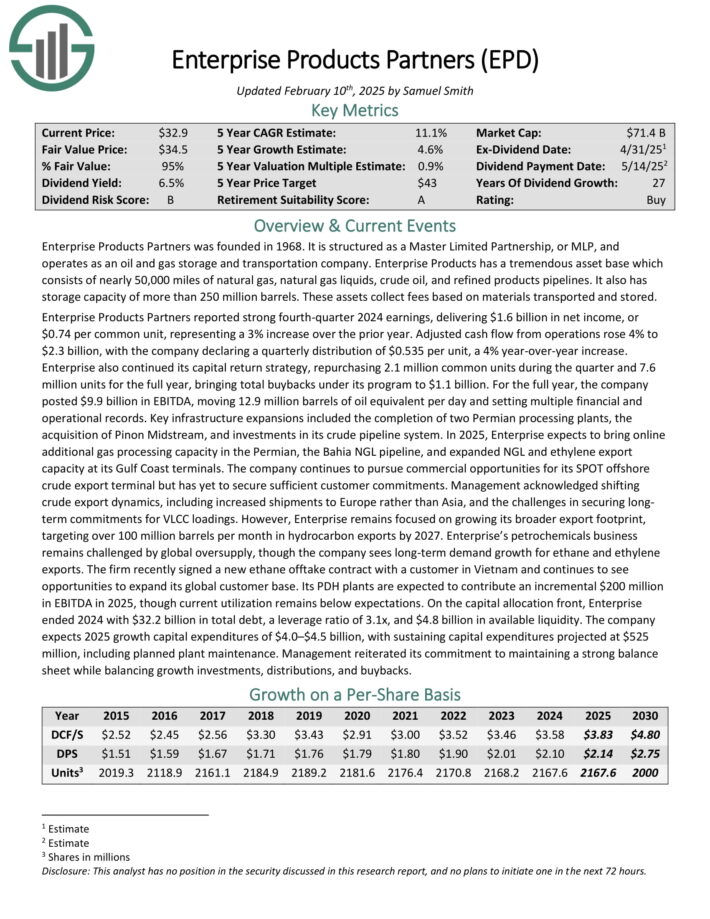

Excessive Yield Blue Chip #9: Enterprise Merchandise Companions LP (EPD)

- Dividend Historical past: 27 years of consecutive will increase

- Dividend Yield: 6.4%

Enterprise Merchandise Companions was based in 1968. It’s structured as a Grasp Restricted Partnership, or MLP, and operates as an oil and gasoline storage and transportation firm.

Enterprise Merchandise has a big asset base which consists of almost 50,000 miles of pure gasoline, pure gasoline liquids, crude oil, and refined merchandise pipelines.

It additionally has storage capability of greater than 250 million barrels. These belongings gather charges based mostly on volumes of supplies transported and saved.

Supply: Investor Presentation

Enterprise Merchandise Companions reported robust fourth-quarter 2024 earnings, delivering $1.6 billion in web revenue, or $0.74 per frequent unit, representing a 3% improve over the prior 12 months.

Adjusted money circulate from operations rose 4% to $2.3 billion, with the corporate declaring a quarterly distribution of $0.535 per unit, a 4% year-over-year improve.

Enterprise additionally continued its capital return technique, repurchasing 2.1 million frequent items throughout the quarter and seven.6 million items for the total 12 months, bringing whole buybacks below its program to $1.1 billion.

For the total 12 months, the corporate posted $9.9 billion in EBITDA, shifting 12.9 million barrels of oil equal per day.

Click on right here to obtain our most up-to-date Positive Evaluation report on EPD (preview of web page 1 of three proven beneath):

Excessive Yield Blue Chip #8: Pfizer Inc. (PFE)

- Dividend Historical past: 16 years of consecutive will increase

- Dividend Yield: 6.5%

Pfizer Inc. is a world pharmaceutical firm specializing in pharmaceuticals and vaccines. Pfizer’s high merchandise are Eliquis, Prevnar household, Paxlovid, Comirnaty, Vyndaqel household, Ibrance, and Xtandi. Pfizer had income of $63.6B in 2024.

Pfizer reported stable This autumn 2024 outcomes on February 4th, 2025. Firm-wide income grew 21% operationally and adjusted diluted earnings per share climbed to $0.63 versus $0.10 on a year-over-year foundation due to stabilizing COVID-19 associated gross sales, rising income from the prevailing portfolio, and decrease bills.

International Biopharmaceuticals gross sales gained 22% to $17,413M from $14,186M led by features in Major Care (+27%), Specialty Care (+12%), and Oncology (+27%). Pfizer Centerone noticed 11% decrease gross sales to $325M, whereas Ignite income was $26M.

Of the highest promoting medicine, gross sales elevated for Eliquis (+14%), Prevnar (-4%), Plaxlovid (flat), Cominraty (-37%), Vyndaqel/ Vyndamax (+61%), Ibrance (-2%), and Xtandi (+24).

Click on right here to obtain our most up-to-date Positive Evaluation report on PFE (preview of web page 1 of three proven beneath):

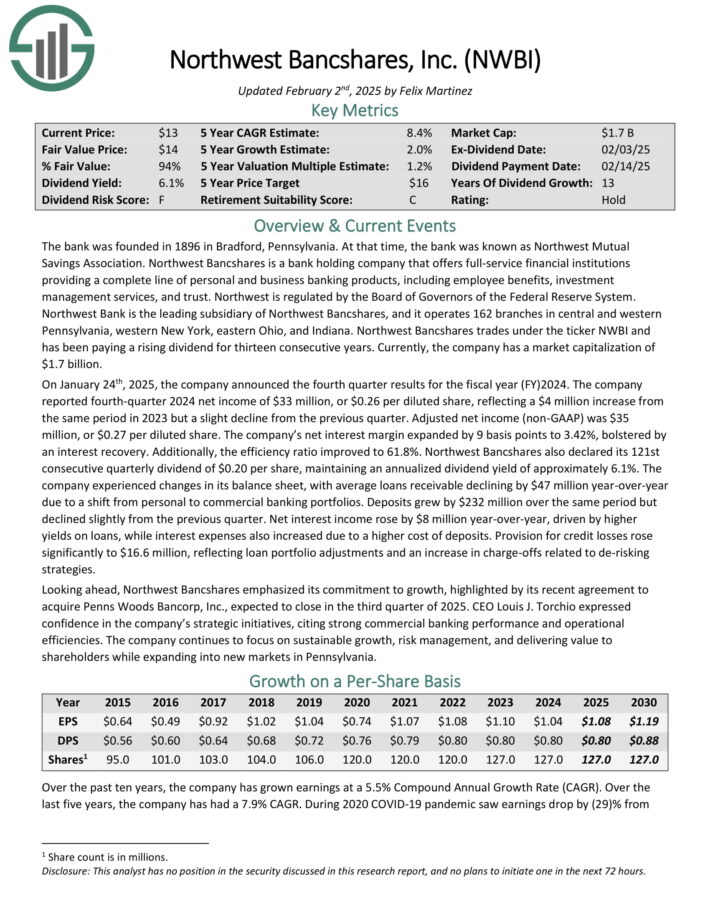

Excessive Yield Blue Chip #7: Northwest Bancshares Inc. (NWBI)

- Dividend Historical past: 13 years of consecutive will increase

- Dividend Yield: 6.7%

Northwest Bancshares is a financial institution holding firm that gives full-service monetary establishments offering a whole line of private and enterprise banking merchandise, together with worker advantages, funding administration companies, and belief.

Northwest Financial institution is the main subsidiary of Northwest Bancshares, and it operates 162 branches in central and western Pennsylvania, western New York, jap Ohio, and Indiana. Northwest Bancshares has been paying a rising dividend for 13 consecutive years.

On January twenty fourth, 2025, the corporate introduced the fourth quarter outcomes for the fiscal 12 months (FY)2024. The corporate reported fourth-quarter 2024 web revenue of $33 million, or $0.26 per diluted share, reflecting a $4 million improve from the identical interval in 2023 however a slight decline from the earlier quarter.

Adjusted web revenue (non-GAAP) was $35 million, or $0.27 per diluted share. The corporate’s web curiosity margin expanded by 9 foundation factors to three.42%, bolstered by an curiosity restoration. Moreover, the effectivity ratio improved to 61.8%.

Click on right here to obtain our most up-to-date Positive Evaluation report on NWBI (preview of web page 1 of three proven beneath):

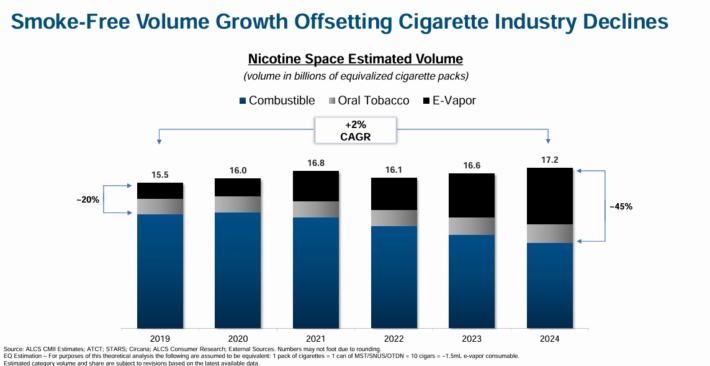

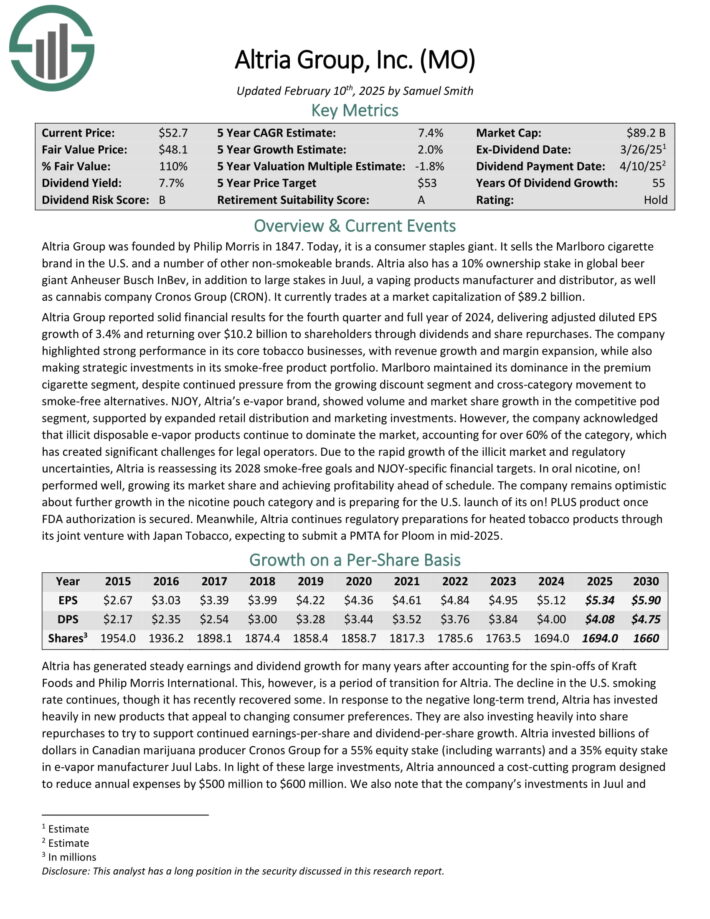

Excessive Yield Blue Chip #6: Altria Group (MO)

- Dividend Historical past: 55 years of consecutive will increase

- Dividend Yield: 6.9%

Altria is a tobacco inventory that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and extra below a wide range of manufacturers, together with Marlboro, Skoal, and Copenhagen, amongst others.

With a present dividend yield of almost 8%, Altria is a perfect retirement funding inventory.

It is a interval of transition for Altria. The decline within the U.S. smoking price continues. In response, Altria has invested closely in new merchandise that attraction to altering client preferences, because the smoke-free class continues to develop.

Supply: Investor Presentation

The corporate additionally has a 35% funding stake in e-cigarette maker JUUL, and a forty five% stake within the Canadian hashish producer Cronos Group (CRON).

Altria Group reported stable monetary outcomes for the fourth quarter and full 12 months of 2024. For the fourth quarter, income of $5.1 billion beat analyst estimates by $50 million, and elevated 1.6% year-over-year. Adjusted EPS of $1.29 beat by a penny.

For the total 12 months, Altria generated adjusted diluted EPS progress of three.4% and returned over $10.2 billion to shareholders by dividends and share repurchases.

For 2025, Altria expects adjusted diluted EPS in a spread of $5.22 to $5.37. This represents an adjusted diluted EPS progress price of two% to five% for 2025.

Click on right here to obtain our most up-to-date Positive Evaluation report on Altria (preview of web page 1 of three proven beneath):

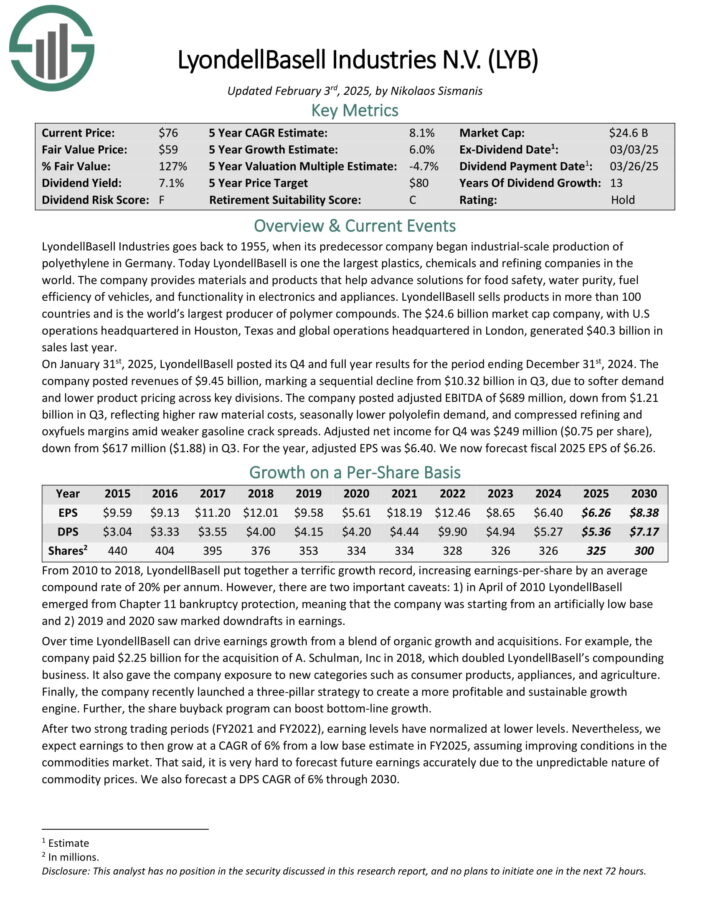

Excessive Yield Blue Chip #5: LyondellBasell Industries (LYB)

- Dividend Historical past: 13 years of consecutive will increase

- Dividend Yield: 7.0%

LyondellBasell is one the most important plastics, chemical compounds and refining firms on this planet. The corporate gives supplies and merchandise that assist advance options for meals security, water purity, gas effectivity of automobiles, and performance in electronics and home equipment.

LyondellBasell sells merchandise in additional than 100 nations and is the world’s largest producer of polymer compounds. The corporate, with U.S operations headquartered in Houston, Texas and world operations headquartered in London, generated $40.3 billion in gross sales final 12 months.

On January thirty first, 2025, LyondellBasell posted its This autumn and full 12 months outcomes for the interval ending December thirty first, 2024. The corporate posted revenues of $9.45 billion, marking a sequential decline from $10.32 billion in Q3, as a consequence of softer demand and decrease product pricing throughout key divisions.

The corporate posted adjusted EBITDA of $689 million, down from $1.21 billion in Q3, reflecting larger uncooked materials prices, seasonally decrease polyolefin demand, and compressed refining and oxyfuels margins amid weaker gasoline crack spreads.

Adjusted web revenue for This autumn was $249 million ($0.75 per share), down from $617 million ($1.88) in Q3. For the 12 months, adjusted EPS was $6.40.

Click on right here to obtain our most up-to-date Positive Evaluation report on LYB (preview of web page 1 of three proven beneath):

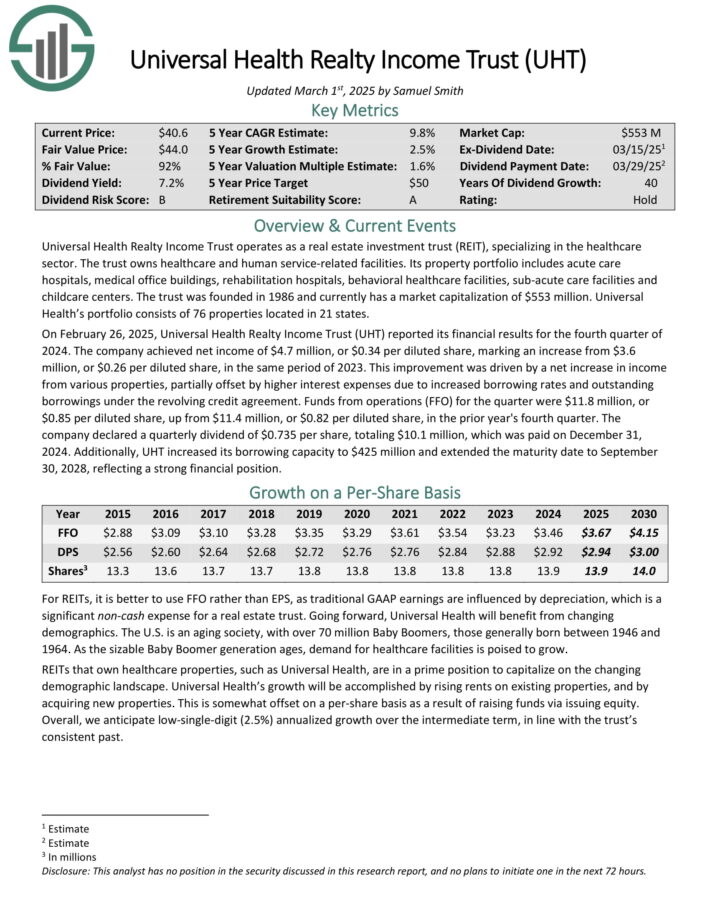

Excessive Yield Blue Chip #4: Common Well being Realty Revenue Belief (UHT)

- Dividend Historical past: 40 years of consecutive will increase

- Dividend Yield: 7.0%

Common Well being Realty Revenue Belief operates as an actual property funding belief (REIT), specializing within the healthcare sector. The belief owns healthcare and human service-related amenities.

Its property portfolio contains acute care hospitals, medical workplace buildings, rehabilitation hospitals, behavioral healthcare amenities, sub-acute care amenities and childcare facilities.

Common Well being’s portfolio consists of 76 properties positioned in 21 states.

On February 26, 2025, Common Well being Realty Revenue Belief (UHT) reported its monetary outcomes for the fourth quarter of 2024. The corporate achieved web revenue of $4.7 million, or $0.34 per diluted share, marking a rise from $3.6 million, or $0.26 per diluted share, in the identical interval of 2023.

This enchancment was pushed by a web improve in revenue from varied properties, partially offset by larger curiosity bills as a consequence of elevated borrowing charges and excellent borrowings below the revolving credit score settlement.

Funds from operations (FFO) for the quarter had been $11.8 million, or $0.85 per diluted share, up from $11.4 million, or $0.82 per diluted share, within the prior 12 months’s fourth quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on UHT (preview of web page 1 of three proven beneath):

Excessive Yield Blue Chip #3: MPLX LP (MPLX)

- Dividend Historical past: 12 years of consecutive will increase

- Dividend Yield: 7.3%

MPLX LP is a Grasp Restricted Partnership that was fashioned by the Marathon Petroleum Company (MPC) in 2012. In 2019, MPLX acquired Andeavor Logistics LP.

The enterprise operates in two segments:

- Logistics and Storage, which pertains to crude oil and refined petroleum merchandise

- Gathering and Processing, which pertains to pure gasoline and pure gasoline liquids (NGLs)

In early February, MPLX reported (2/4/25) monetary outcomes for the fourth quarter of fiscal 2024. Adjusted EBITDA and distributable money circulate (DCF) per share grew 9% and seven%, respectively, primarily because of larger tariff charges and elevated volumes of liquids and gasoline.

MPLX maintained a wholesome consolidated debt to adjusted EBITDA ratio of three.1x and a stable distribution protection ratio of 1.5x.

Click on right here to obtain our most up-to-date Positive Evaluation report on MPLX (preview of web page 1 of three proven beneath):

Excessive Yield Blue Chip #2: Delek Logistics Companions LP (DKL)

- Dividend Historical past: 10 years of consecutive will increase

- Dividend Yield: 10.9%

Delek Logistics Companions, LP is a publicly traded grasp restricted partnership (MLP) headquartered in Brentwood, Tennessee. Established in 2012 by Delek US Holdings, Inc. (NYSE: DK), Delek Logistics owns and operates a community of midstream power infrastructure belongings.

These belongings embody roughly 850 miles of crude oil and refined product transportation pipelines and a 700-mile crude oil gathering system, primarily positioned within the southeastern United States and west Texas.

The corporate’s operations are integral to Delek US’s refining actions, notably supporting refineries in Tyler, Texas, and El Dorado, Arkansas.

Delek Logistics gives companies similar to gathering, transporting, and storing crude oil, in addition to advertising and marketing, distributing, and storing refined merchandise for each Delek US and third-party clients.

On February 25, 2025, Delek Logistics Companions (DKL) reported its monetary outcomes for the fourth quarter of 2024. The corporate achieved an adjusted EBITDA of roughly $107.2 million, a rise from $100.9 million in the identical interval of the earlier 12 months.

Distributable money circulate was $69.5 million, with a protection ratio of roughly 1.2 instances. The Gathering and Processing phase noticed an adjusted EBITDA of $66 million, up from $53.3 million in This autumn 2023, primarily as a consequence of larger throughput from Permian Basin belongings and contributions from the H2O Midstream acquisition.

Click on right here to obtain our most up-to-date Positive Evaluation report on DKL (preview of web page 1 of three proven beneath):

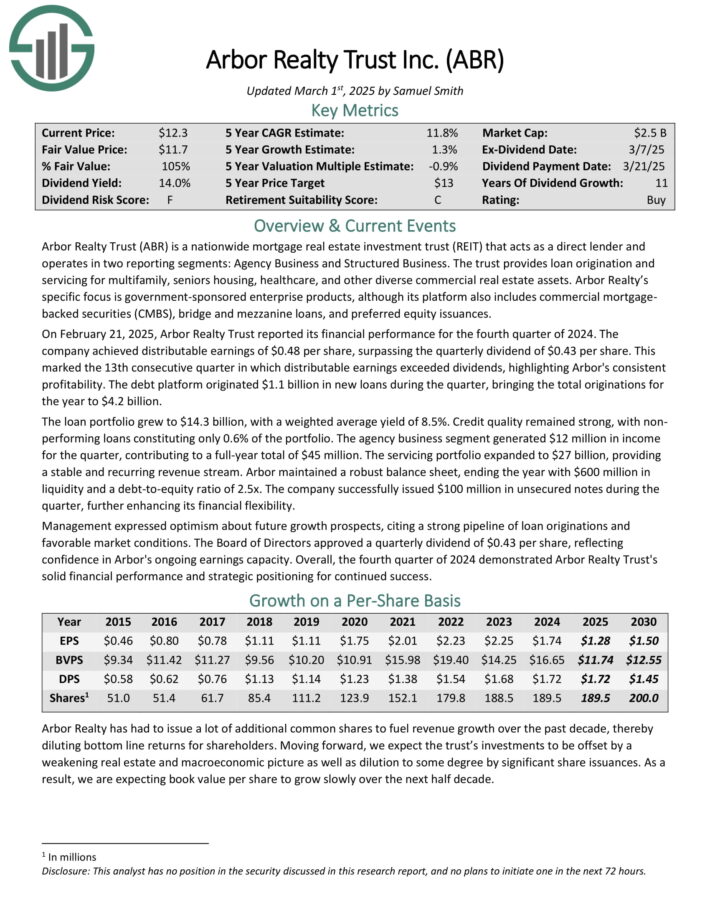

Excessive Yield Blue Chip #1: Arbor Realty Belief (ABR)

- Dividend Historical past: 11 years of consecutive will increase

- Dividend Yield: 14.0%

Arbor Realty Belief is a nationwide mortgage actual property funding belief (REIT) that acts as a direct lender and operates in two reporting segments: Company Enterprise and Structured Enterprise. The belief gives mortgage origination and servicing for multifamily, seniors housing, healthcare, and different various business actual property belongings.

Arbor Realty’s particular focus is government-sponsored enterprise merchandise, though its platform additionally contains business mortgage backed securities (CMBS), bridge and mezzanine loans, and most popular fairness issuances.

On February 21, 2025, Arbor Realty Belief reported its monetary efficiency for the fourth quarter of 2024. The corporate achieved distributable earnings of $0.48 per share, surpassing the quarterly dividend of $0.43 per share.

This marked the thirteenth consecutive quarter by which distributable earnings exceeded dividends, highlighting Arbor’s constant profitability. The debt platform originated $1.1 billion in new loans throughout the quarter, bringing the whole originations for the 12 months to $4.2 billion.

Click on right here to obtain our most up-to-date Positive Evaluation report on ABR (preview of web page 1 of three proven beneath):

Further Studying

If you’re desirous about discovering different high-yield securities, the next Positive Dividend sources could also be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.