Printed on June tenth, 2025 by Bob Ciura

Meals shares are interesting to revenue traders for a lot of causes.

Because the saying goes, everybody has to eat. This implies the main meals producers and distributors see regular demand, even throughout financial downturns.

In flip, meals shares have the distinctive skill to proceed paying–and even elevating–their dividends annually, even by way of recessions.

As well as, many meals shares have excessive dividend yields nicely above the S&P 500 common.

Meals shares are a part of the broader shopper staples sector. The patron staples sector is residence to among the most well-known dividend development shares on the planet.

In truth, shopper staples shares are the biggest particular person sector throughout the Dividend Aristocrats, a choose group of 69 shares within the S&P 500 Index with 25+ consecutive years of dividend will increase.

You may obtain a replica of the Dividend Aristocrats listing by clicking on the hyperlink under:

Disclaimer: Certain Dividend is just not affiliated with S&P International in any means. S&P International owns and maintains The Dividend Aristocrats Index. The knowledge on this article and downloadable spreadsheet is predicated on Certain Dividend’s personal evaluation, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person traders higher perceive this ETF and the index upon which it’s based mostly. Not one of the info on this article or spreadsheet is official knowledge from S&P International. Seek the advice of S&P International for official info.

Throughout the shopper staples sector, meals shares are identified for notably excessive dividend yields, secure payouts even by way of recessions, and constant dividend development.

This text lists the 15 highest-yielding meals shares now, within the Certain Evaluation Analysis Database. The 15 shares are listed by dividend yield, from lowest to highest.

Desk of Contents

Highest-Yielding Meals Inventory #15: Lamb Weston Holdings (LW)

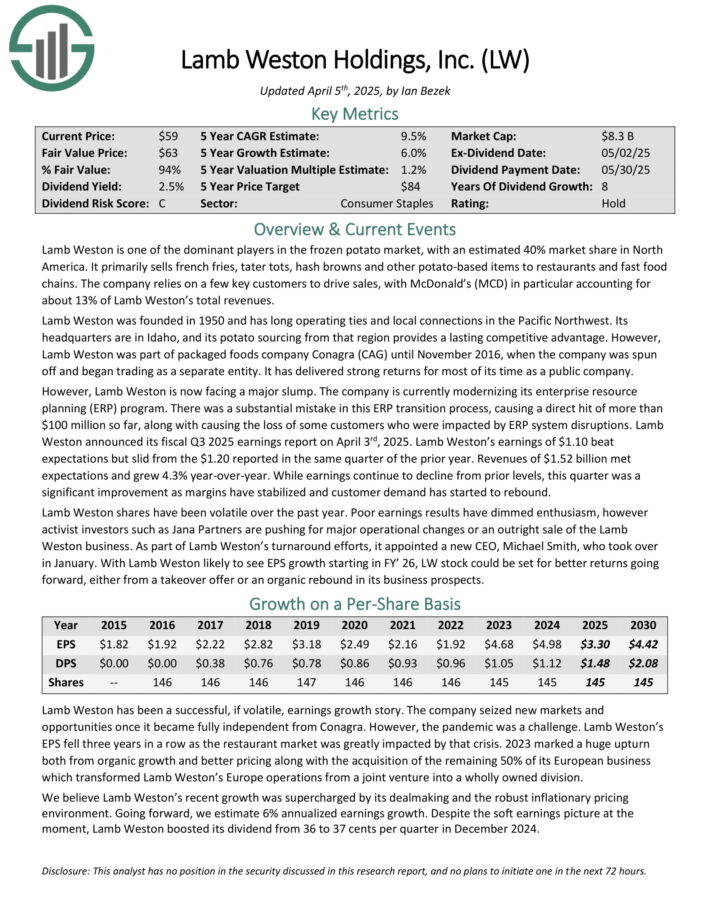

Lamb Weston is among the dominant gamers within the frozen potato market, with an estimated 40% market share in North America.

It primarily sells french fries, tater tots, hash browns and different potato-based objects to eating places and quick meals chains. The corporate depends on a number of key clients to drive gross sales, with McDonald’s (MCD) particularly accounting for about 13% of Lamb Weston’s whole revenues.

Weston introduced its fiscal Q3 2025 earnings report on April third, 2025. Lamb Weston’s earnings of $1.10 beat expectations however slid from the $1.20 reported in the identical quarter of the prior 12 months. Revenues of $1.52 billion met expectations and grew 4.3% year-over-year.

Whereas earnings proceed to say no from prior ranges, this quarter was a major enchancment as margins have stabilized and buyer demand has began to rebound.

Lamb Weston has a good bit of debt, and its BB+ credit standing from S&P International places it barely under funding grade. A steep financial downturn might stress the corporate’s dividend, that stated the corporate’s operations held up alright in the course of the pandemic and the comparatively low payout ratio leaves a major margin of security right now.

Click on right here to obtain our most up-to-date Certain Evaluation report on LW (preview of web page 1 of three proven under):

Highest-Yielding Meals Inventory #14: Sysco Corp. (SYY)

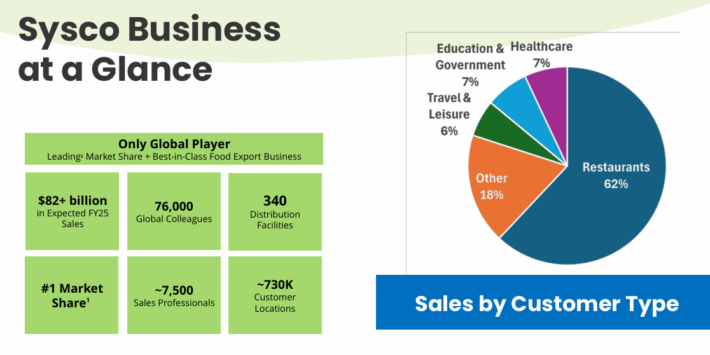

Sysco Company is the biggest wholesale meals distributor in america. The corporate serves 600,000 places with meals supply, together with eating places, hospitals, colleges, inns, and different amenities.

Supply: Investor Presentation

On April twenty ninth, 2025, Sysco reported third-quarter outcomes for Fiscal 12 months (FY)2025. The corporate reported gross sales of $19.6 billion, up 1.1% from Q3 2024, regardless of a 2.0% decline in U.S. Foodservice quantity. Gross revenue fell 0.8% to $3.6 billion, with gross margin dropping 35 foundation factors to 18.3% on account of decrease volumes and product combine.

Working revenue decreased 5.7% to $681 million, and adjusted working revenue fell 3.3% to $773 million, pushed by greater working bills from enterprise investments and provide chain prices. Web earnings dropped 5.6% to $401 million, with adjusted web earnings down 2.9% to $469 million.

Diluted EPS was $0.82, down 3.5%, whereas adjusted EPS remained flat at $0.96. Sysco revised its FY25 steerage, projecting 3% gross sales development and no less than 1% adjusted EPS development.

Click on right here to obtain our most up-to-date Certain Evaluation report on SYY (preview of web page 1 of three proven under):

Highest-Yielding Meals Inventory #13: Kellanova Co. (Okay)

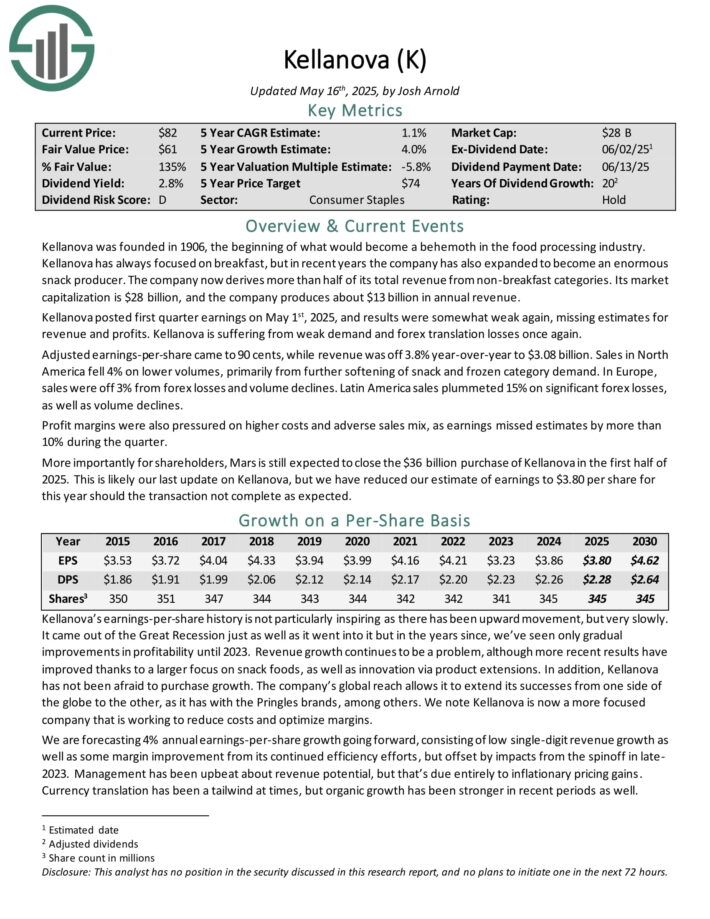

Kellanova was based in 1906, the start of what would change into a behemoth within the meals processing trade.

Kellanova has all the time targeted on breakfast, however in recent times the corporate has additionally expanded to change into an unlimited snack producer. The corporate now derives greater than half of its whole income from non-breakfast classes.

It produces about $13 billion in annual income.

Kellanova posted first quarter earnings on Might 1st, 2025, and outcomes have been considerably weak once more, lacking estimates for income and income. Kellanova is affected by weak demand and foreign exchange translation losses as soon as once more.

Adjusted earnings-per-share got here to 90 cents, whereas income was off 3.8% year-over-year to $3.08 billion. Gross sales in North America fell 4% on decrease volumes, primarily from additional softening of snack and frozen class demand. In Europe, gross sales have been off 3% from foreign exchange losses and quantity declines.

Latin America gross sales plummeted 15% on important foreign exchange losses, in addition to quantity declines. Revenue margins have been additionally pressured on greater prices and adversarial gross sales combine, as earnings missed estimates by greater than 10% in the course of the quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on Okay (preview of web page 1 of three proven under):

Highest-Yielding Meals Inventory #12: Mondelez Worldwide (MDLZ)

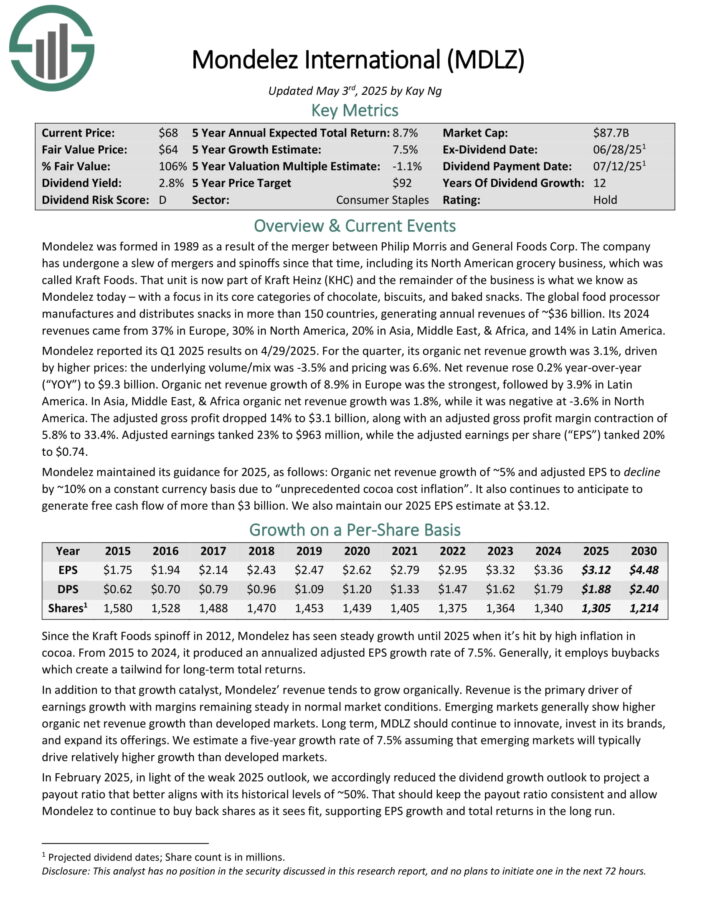

Mondelez was shaped in 1989 on account of the merger between Philip Morris and Common Meals Corp. It focuses on its core classes of chocolate, biscuits, and baked snacks. The worldwide meals processor manufactures and distributes snacks in additional than 150 international locations, producing annual revenues of ~$36 billion.

Its 2024 revenues got here from 37% in Europe, 30% in North America, 20% in Asia, Center East, & Africa, and 14% in Latin America.

Mondelez reported its Q1 2025 outcomes on 4/29/2025. For the quarter, its natural web income development was 3.1%, pushed by greater costs: the underlying quantity/combine was -3.5% and pricing was 6.6%.

Web income rose 0.2% year-over-year to $9.3 billion. Natural web income development of 8.9% in Europe was the strongest, adopted by 3.9% in Latin America. In Asia, Center East, & Africa natural web income development was 1.8%, whereas it was damaging at -3.6% in North America.

The adjusted gross revenue dropped 14% to $3.1 billion, together with an adjusted gross revenue margin contraction of 5.8% to 33.4%.

Mondelez maintained its steerage for 2025, as follows: Natural web income development of ~5% and adjusted EPS to say no by ~10% on a relentless foreign money foundation on account of “unprecedented cocoa price inflation”. It additionally continues to anticipate to generate free money stream of greater than $3 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on MDLZ (preview of web page 1 of three proven under):

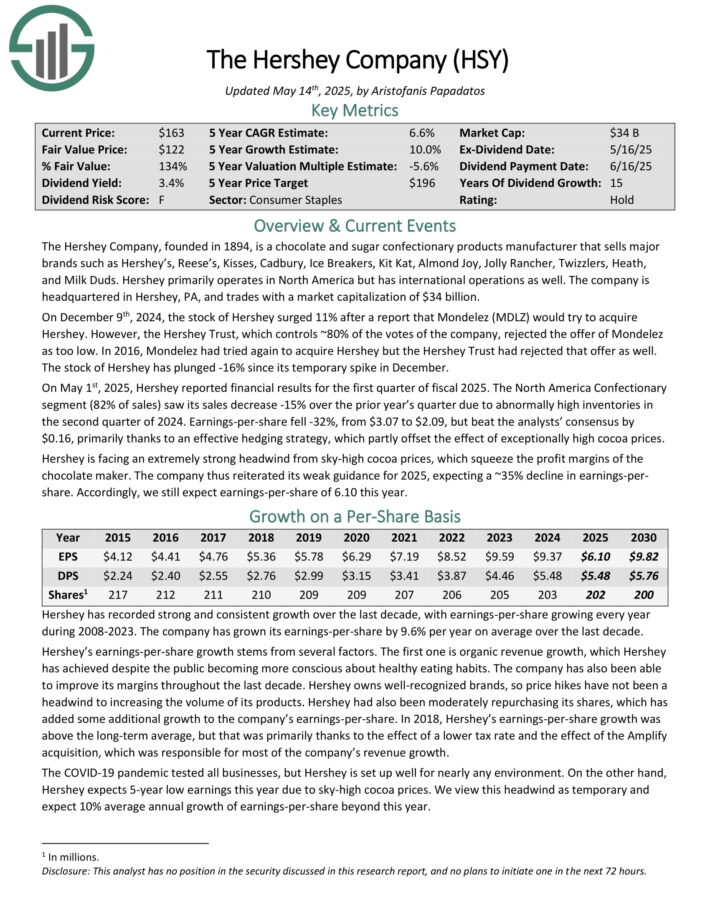

Highest-Yielding Meals Inventory #11: Hershey Firm (HSY)

The Hershey Firm, based in 1894, is a chocolate and sugar confectionary merchandise producer that sells main manufacturers akin to Hershey’s, Reese’s, Kisses, Cadbury, Ice Breakers, Equipment Kat, Almond Pleasure, Jolly Rancher, Twizzlers, Heath, and Milk Duds.

Hershey primarily operates in North America however has worldwide operations as nicely. The corporate is headquartered in Hershey, PA.

On Might 1st, 2025, Hershey reported monetary outcomes for the primary quarter of fiscal 2025. The North America Confectionary phase (82% of gross sales) noticed its gross sales lower -15% over the prior 12 months’s quarter on account of abnormally excessive inventories within the second quarter of 2024.

Earnings-per-share fell -32%, from $3.07 to $2.09, however beat the analysts’ consensus by $0.16, primarily due to an efficient hedging technique, which partly offset the impact of exceptionally excessive cocoa costs.

Hershey is going through a particularly sturdy headwind from sky-high cocoa costs, which squeeze the revenue margins of the chocolate maker. The corporate reiterated its weak steerage for 2025, anticipating a ~35% decline in earnings-per-share.

Click on right here to obtain our most up-to-date Certain Evaluation report on HSY (preview of web page 1 of three proven under):

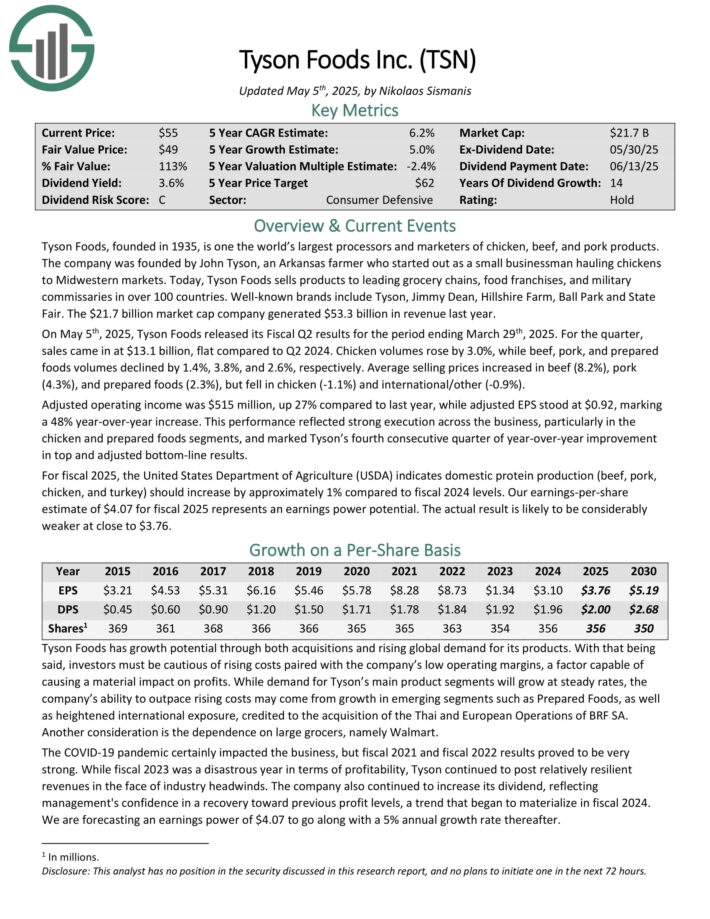

Highest-Yielding Meals Inventory #10: Tyson Meals (TSN)

Tyson Meals, based in 1935, is one the world’s largest processors and entrepreneurs of rooster, beef, and pork merchandise. Tyson Meals sells merchandise to main grocery chains, meals franchises, and navy commissaries in over 100 international locations.

Properly-known manufacturers embody Tyson, Jimmy Dean, Hillshire Farm, Ball Park and State Honest. The generated $53.3 billion in income final 12 months.

On Might fifth, 2025, Tyson Meals launched its Fiscal Q2 outcomes for the interval ending March twenty ninth, 2025. For the quarter, gross sales got here in at $13.1 billion, flat in comparison with Q2 2024. Rooster volumes rose by 3.0%, whereas beef, pork, and ready meals volumes declined by 1.4%, 3.8%, and a pair of.6%, respectively.

Common promoting costs elevated in beef (8.2%), pork (4.3%), and ready meals (2.3%), however fell in rooster (-1.1%) and worldwide/different (-0.9%).

Adjusted working revenue was $515 million, up 27% in comparison with final 12 months, whereas adjusted EPS stood at $0.92, marking a 48% year-over-year enhance.

This efficiency mirrored sturdy execution throughout the enterprise, notably within the rooster and ready meals segments, and marked Tyson’s fourth consecutive quarter of year-over-year enchancment in prime and adjusted bottom-line outcomes.

Click on right here to obtain our most up-to-date Certain Evaluation report on TSN (preview of web page 1 of three proven under):

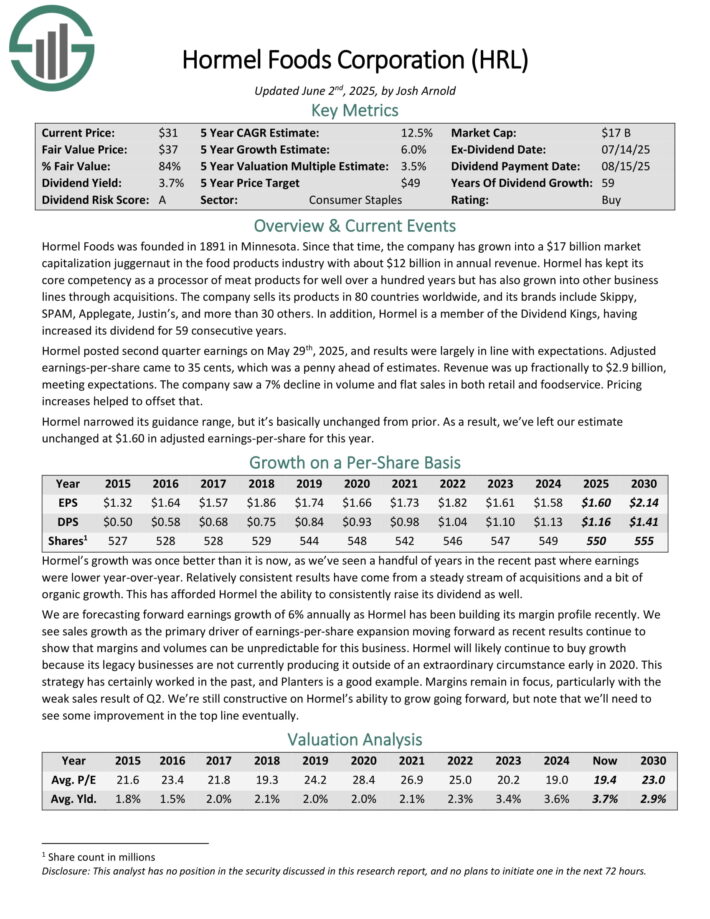

Highest-Yielding Meals Inventory #9: Hormel Meals (HRL)

Hormel Meals was based again in 1891 in Minnesota. Since that point, the corporate has grown right into a juggernaut within the meals merchandise trade with practically $10 billion in annual income.

Hormel has saved with its core competency as a processor of meat merchandise for nicely over 100 years, however has additionally grown into different enterprise traces by way of acquisitions.

Hormel has a big portfolio of category-leading manufacturers. Only a few of its prime manufacturers embody embody Skippy, SPAM, Applegate, Justin’s, and greater than 30 others.

The corporate has elevated its dividend for 59 consecutive years.

Supply: Investor Presentation

Hormel posted second quarter earnings on Might twenty ninth, 2025, and outcomes have been largely in keeping with expectations. Adjusted earnings-per-share got here to 35 cents, which was a penny forward of estimates.

Income was up fractionally to $2.9 billion, assembly expectations. The corporate noticed a 7% decline in quantity and flat gross sales in each retail and foodservice. Pricing will increase helped to offset that.

Click on right here to obtain our most up-to-date Certain Evaluation report on HRL (preview of web page 1 of three proven under):

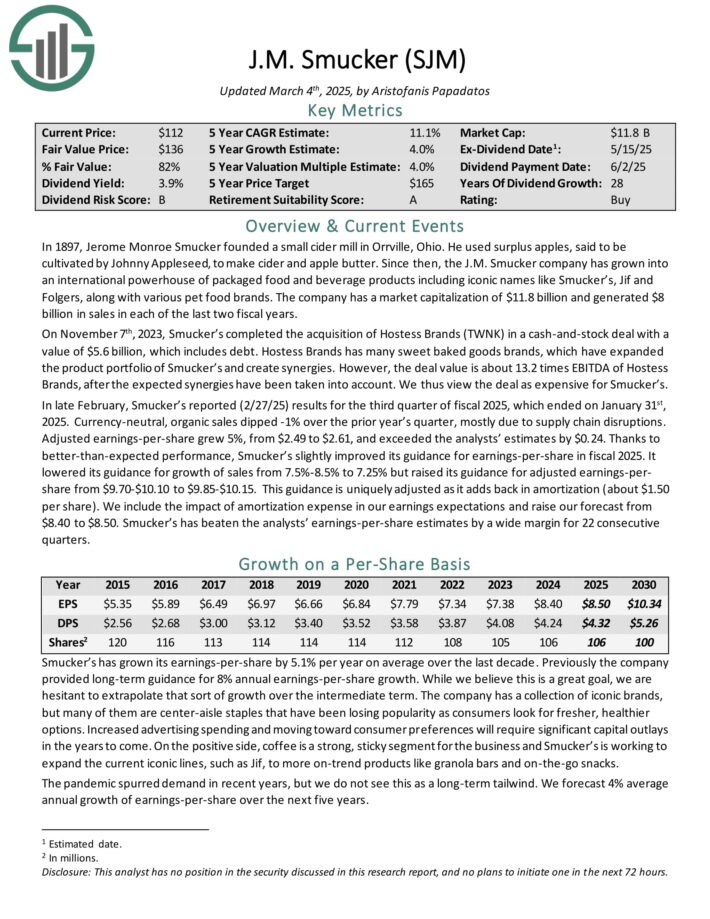

Highest-Yielding Meals Inventory #8: J.M. Smucker Co. (SJM)

The J.M. Smucker firm has grown into a world powerhouse of packaged meals and beverage merchandise together with iconic manufacturers like Smucker’s, Jif and Folgers, together with numerous pet meals manufacturers.

The corporate generated $8 billion in gross sales in every of the final two fiscal years.

Supply: Investor Presentation

In late February, Smucker’s reported (2/27/25) outcomes for the third quarter of fiscal 2025, which ended on January thirty first, 2025. Foreign money-neutral, natural gross sales dipped -1% over the prior 12 months’s quarter, principally on account of provide chain disruptions.

Adjusted earnings-per-share grew 5%, from $2.49 to $2.61, and exceeded the analysts’ estimates by $0.24. Because of better-than-expected efficiency, Smucker’s barely improved its steerage for earnings-per-share in fiscal 2025.

It lowered its steerage for development of gross sales from 7.5%-8.5% to 7.25% however raised its steerage for adjusted earnings-per share from $9.70-$10.10 to $9.85-$10.15.

Click on right here to obtain our most up-to-date Certain Evaluation report on SJM (preview of web page 1 of three proven under):

Highest-Yielding Meals Inventory #7: WK Kellogg Co. (KLG)

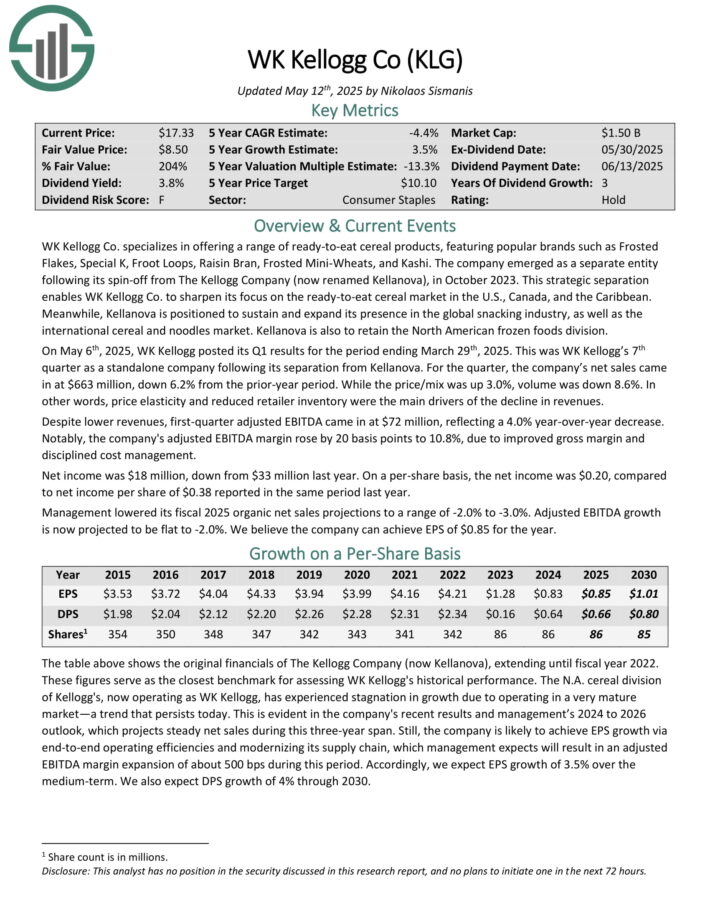

WK Kellogg Co. makes a speciality of providing a spread of ready-to-eat cereal merchandise, that includes standard manufacturers akin to Frosted Flakes, Particular Okay, Froot Loops, Raisin Bran, Frosted Mini-Wheats, and Kashi.

On Might sixth, 2025, WK Kellogg posted its Q1 outcomes for the interval ending March twenty ninth, 2025. This was WK Kellogg’s seventh quarter as a standalone firm following its separation from Kellanova. For the quarter, the corporate’s web gross sales got here in at $663 million, down 6.2% from the prior-year interval.

Whereas the worth/combine was up 3.0%, quantity was down 8.6%. In different phrases, worth elasticity and lowered retailer stock have been the principle drivers of the decline in revenues.

Regardless of decrease revenues, first-quarter adjusted EBITDA got here in at $72 million, reflecting a 4.0% year-over-year lower. Notably, the corporate’s adjusted EBITDA margin rose by 20 foundation factors to 10.8%, on account of improved gross margin and disciplined price administration.

Web revenue was $18 million, down from $33 million final 12 months. On a per-share foundation, the web revenue was $0.20, in comparison with web revenue per share of $0.38 reported in the identical interval final 12 months.

Administration lowered its fiscal 2025 natural web gross sales projections to a spread of -2.0% to -3.0%. Adjusted EBITDA development is now projected to be flat to -2.0%.

Click on right here to obtain our most up-to-date Certain Evaluation report on KLG (preview of web page 1 of three proven under):

Highest-Yielding Meals Inventory #6: PepsiCo Inc. (PEP)

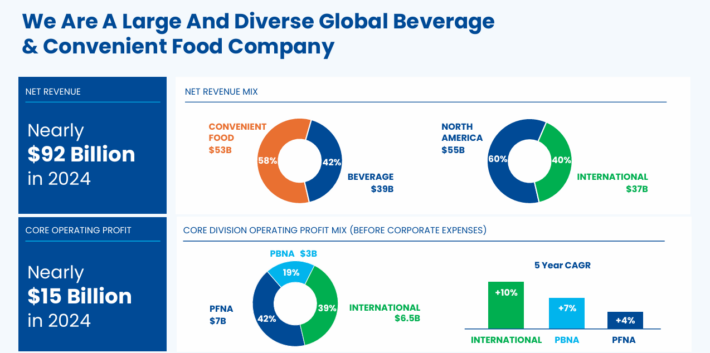

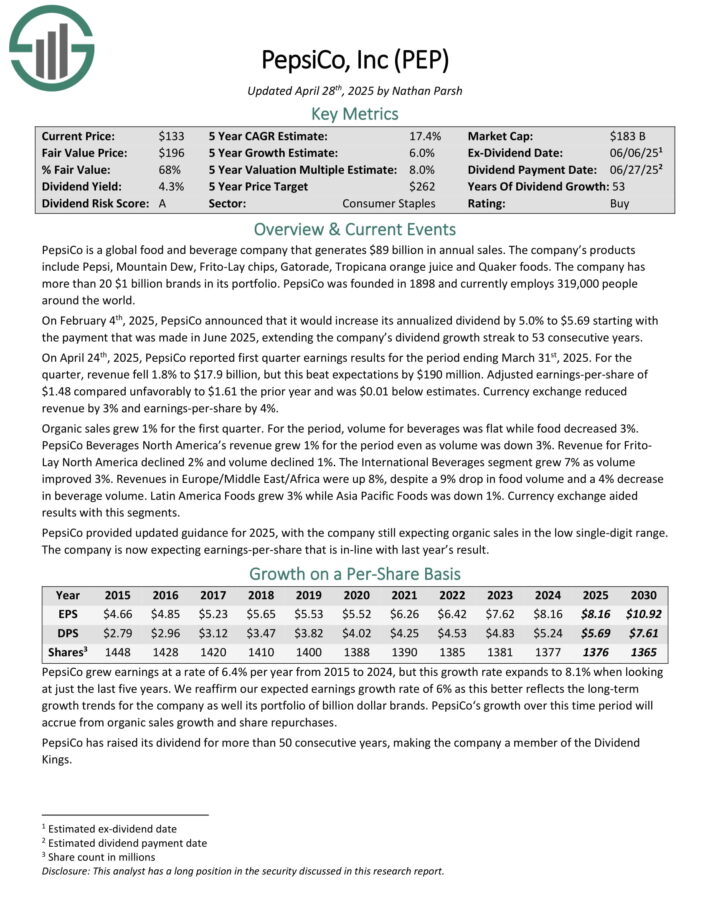

PepsiCo is a worldwide meals and beverage firm. Its merchandise embody Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker meals.

Its enterprise is break up roughly 60-40 by way of meals and beverage income. It is usually balanced geographically between the U.S. and the remainder of the world.

Supply: Investor Presentation

On April twenty fourth, 2025, PepsiCo reported first quarter earnings outcomes for the interval ending March thirty first, 2025. For the quarter, income fell 1.8% to $17.9 billion, however this beat expectations by $190 million.

Adjusted earnings-per-share of $1.48 in contrast unfavorably to $1.61 the prior 12 months and was $0.01 under estimates. Foreign money trade lowered income by 3% and earnings-per-share by 4%.

Natural gross sales grew 1% for the primary quarter. For the interval, quantity for drinks was flat whereas meals decreased 3%. PepsiCo Drinks North America’s income grew 1% for the interval whilst quantity was down 3%.

Income for Frito Lay North America declined 2% and quantity declined 1%.

Click on right here to obtain our most up-to-date Certain Evaluation report on PEP (preview of web page 1 of three proven under):

Highest-Yielding Meals Inventory #5: Common Mills (GIS)

Common Mills is a packaged meals big, with greater than 100 manufacturers and operations in additional than 100 international locations. Common Mills has not reduce its dividend for 125 consecutive years.

In mid-March, Common Mills reported (3/19/25) outcomes for Q3-2025. Web gross sales and natural gross sales fell -5% every over the prior 12 months’s quarter, primarily on account of retailer stock reductions. It was the second-worst decline within the final 5 years.

Gross margin expanded from 33.5% to 33.9%, as price financial savings offset enter inflation. Adjusted earnings-per-share decreased -15%, from $1.18 to $1.00, however exceeded the analysts’ consensus by $0.04.

Common Mills is going through robust comparisons, because the pandemic has subsided. It generates 85% of its gross sales from at-home meals demand. It is usually going through excessive price inflation, which is prone to persist for some time. As well as, it’s at the moment investing in its pet enterprise to reinvigorate development, on the expense of short-term earnings.

Consequently, the corporate lowered its already cautious steerage for fiscal 2025. It expects a 1.5%-2% decline in natural gross sales and a 7%-8% decline in earnings per-share (vs. a 2% decline in earlier steerage).

Click on right here to obtain our most up-to-date Certain Evaluation report on GIS (preview of web page 1 of three proven under):

Highest-Yielding Meals Inventory #4: Campbell Soup (CPB)

Campbell Soup Firm is a multinational meals firm headquartered in Camden, N.J. The corporate manufactures and markets branded comfort meals merchandise, akin to soups, easy meals, drinks, snacks, and packaged recent meals.

The corporate’s portfolio focuses on two particular companies: Campbell Snacks, and Campbell Meals and Drinks. Campbell generated annual gross sales of $9.6 billion in fiscal 2024.

On March 12, 2024, Campbell closed on its acquisition of Sovos Manufacturers (SOVO) for $23 per share in money, which represented a complete enterprise worth of $2.7 billion, and was funded by issuing new debt. Sovos is a frontrunner in excessive development premium Italian sauces, and owns the market-leading Rao’s model.

Campbell Soup reported second quarter FY 2025 outcomes on March fifth, 2025. Web gross sales for the quarter improved by 9% year-over-year to $2.7 billion. This enhance was principally a results of the Sovos Manufacturers acquisition. Adjusted EPS was 8% decrease year-over-year at $0.74 for the quarter, which beat expectations by two cents.

The corporate repurchased $56 million price of shares in H1. There stays $301 million remaining beneath the present $500 million share repurchase program, which is along with the present $205 million remaining on its anti-dilutive share repurchase program.

Management up to date its full-year fiscal 2025 steerage. Administration now estimates that in fiscal 2025, Campbell’s adjusted earnings per share will likely be down 1% to 4%.

Click on right here to obtain our most up-to-date Certain Evaluation report on CPB (preview of web page 1 of three proven under):

Highest-Yielding Meals Inventory #3: Flowers Meals (FLO)

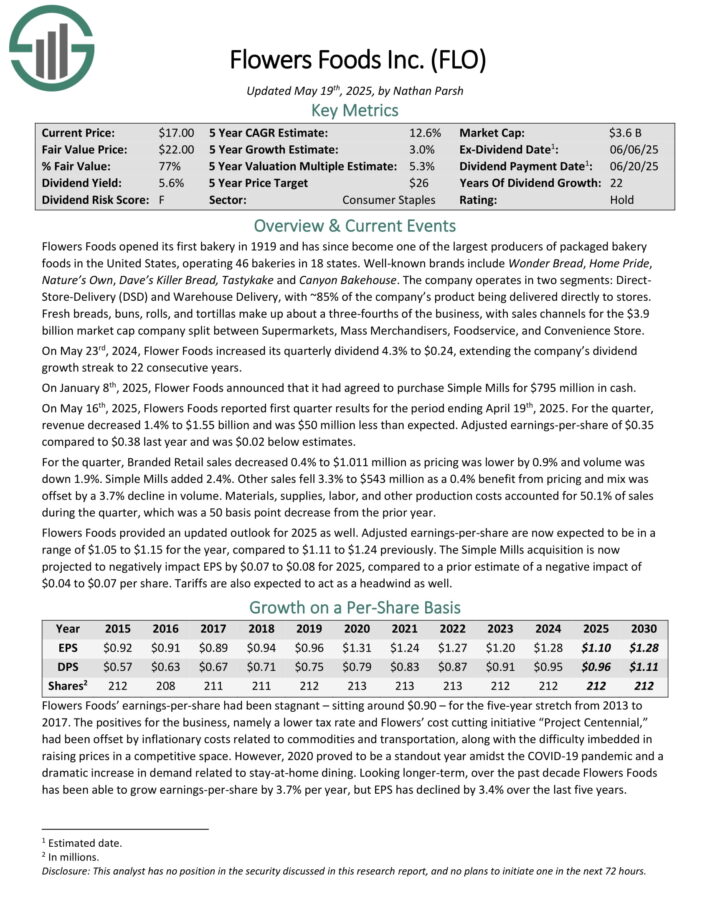

Flowers Meals opened its first bakery in 1919 and has since change into one of many largest producers of packaged bakery meals in america, working 46 bakeries in 18 states.

Properly-known manufacturers embody Surprise Bread, House Satisfaction, Nature’s Personal, Dave’s Killer Bread, Tastykake and Canyon Bakehouse.

The corporate operates in two segments: Direct Retailer-Supply (DSD) and Warehouse Supply, with ~85% of the corporate’s product being delivered on to shops.

Recent breads, buns, rolls, and tortillas make up a couple of three-fourths of the enterprise, with gross sales channels break up between Supermarkets, Mass Merchandisers, Foodservice, and Comfort Retailer.

On Might sixteenth, 2025, Flowers Meals reported first quarter outcomes for the interval ending April nineteenth, 2025. For the quarter, income decreased 1.4% to $1.55 billion and was $50 million lower than anticipated. Adjusted earnings-per-share of $0.35 in comparison with $0.38 final 12 months and was $0.02 under estimates.

For the quarter, Branded Retail gross sales decreased 0.4% to $1.011 million as pricing was decrease by 0.9% and quantity was down 1.9%. Easy Mills added 2.4%. Different gross sales fell 3.3% to $543 million as a 0.4% profit from pricing and blend was offset by a 3.7% decline in quantity.

Click on right here to obtain our most up-to-date Certain Evaluation report on FLO (preview of web page 1 of three proven under):

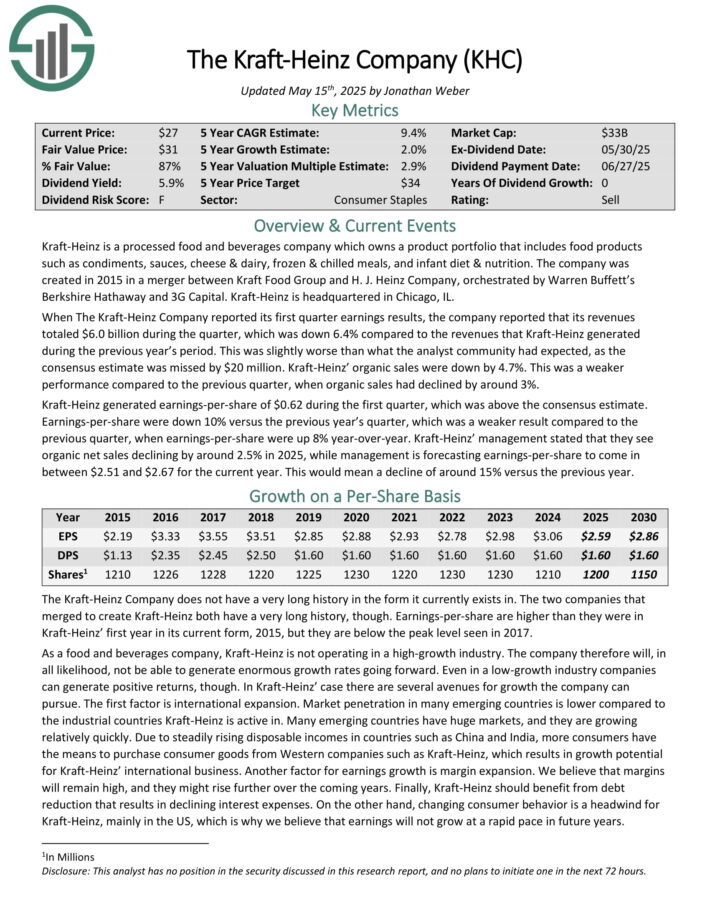

Highest-Yielding Meals Inventory #2: Kraft-Heinz Co. (KHC)

Kraft-Heinz is a processed meals and drinks firm which owns a product portfolio that features meals merchandise akin to condiments, sauces, cheese & dairy, frozen & chilled meals, and toddler weight loss program & vitamin.

When The Kraft-Heinz Firm reported its first quarter earnings outcomes, the corporate reported that its revenues totaled $6.0 billion in the course of the quarter, which was down 6.4% in comparison with the revenues that Kraft-Heinz generated in the course of the earlier 12 months’s interval.

This was barely worse than what the analyst neighborhood had anticipated, because the consensus estimate was missed by $20 million. Kraft-Heinz’ natural gross sales have been down by 4.7%.

Kraft-Heinz generated earnings-per-share of $0.62 in the course of the first quarter, which was above the consensus estimate. Earnings-per-share have been down 10% versus the earlier 12 months’s quarter, which was a weaker outcome in comparison with the earlier quarter, when earnings-per-share have been up 8% year-over-year.

Kraft-Heinz’ administration said that they see natural web gross sales declining by round 2.5% in 2025, whereas administration is forecasting earnings-per-share to come back in between $2.51 and $2.67 for the present 12 months. This could imply a decline of round 15% versus the earlier 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on KHC (preview of web page 1 of three proven under):

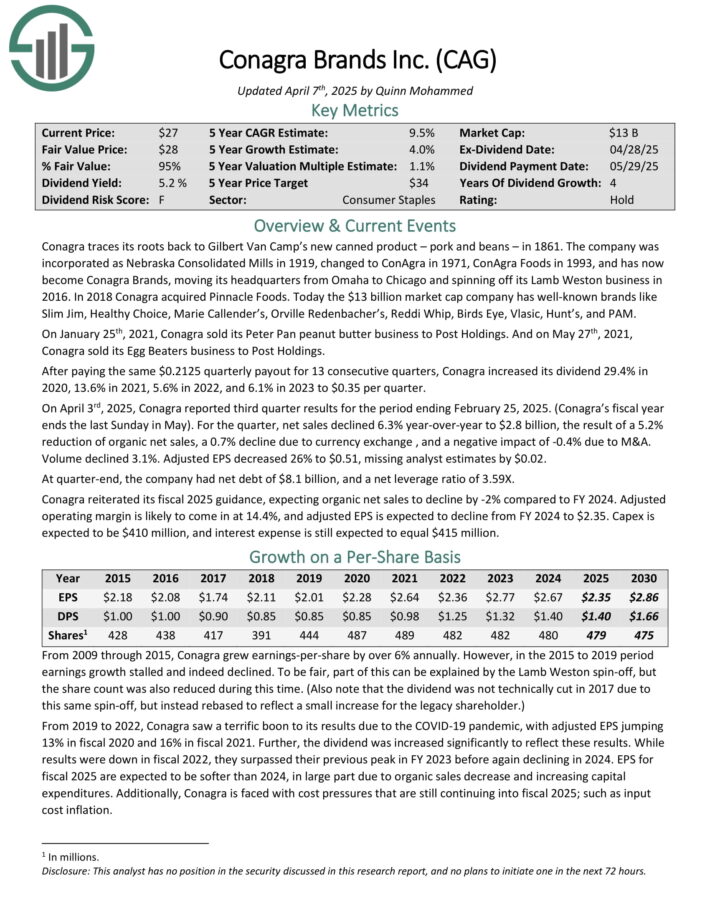

Highest-Yielding Meals Inventory #1: Conagra Manufacturers (CAG)

Conagra has well-known manufacturers like Slim Jim, Wholesome Selection, Marie Callender’s, Orville Redenbacher’s, Reddi Whip, Birds Eye, Vlasic, Hunt’s, and PAM.

On April third, 2025, Conagra reported third quarter outcomes for the interval ending February 25, 2025. For the quarter, web gross sales declined 6.3% year-over-year to $2.8 billion, the results of a 5.2% discount of natural web gross sales, a 0.7% decline on account of foreign money trade , and a damaging affect of -0.4% on account of M&A.

Quantity declined 3.1%. Adjusted EPS decreased 26% to $0.51, lacking analyst estimates by $0.02. At quarter-end, the corporate had web debt of $8.1 billion, and a web leverage ratio of three.59X.

Conagra reiterated its fiscal 2025 steerage, anticipating natural web gross sales to say no by -2% in comparison with FY 2024. Adjusted working margin is prone to are available in at 14.4%, and adjusted EPS is predicted to say no from FY 2024 to $2.35.

Click on right here to obtain our most up-to-date Certain Evaluation report on CAG (preview of web page 1 of three proven under):

Remaining Ideas

Excessive-yield dividend shares have nice attraction to revenue traders. The S&P 500 Index yields simply ~1.2% proper now on common, making excessive yield shares much more enticing by comparability.

The 15 meals shares on this listing have yields no less than double the S&P 500 Index common. And, every of those shares has a demonstrated monitor document of elevating their dividends through the years.

Consequently, revenue traders could discover these 15 meals shares enticing.

Additional Studying

In case you are focused on discovering high-quality dividend development shares and/or different high-yield securities and revenue securities, the next Certain Dividend assets will likely be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].