Printed on September third, 2025 by Bob Ciura

Kevin O’Leary is Chairman of O’Shares Funding Advisors, however you in all probability know him as “Mr. Great”.

He could be seen on CNBC in addition to the tv present Shark Tank. Traders who’ve seen him on TV have probably heard him focus on his funding philosophy.

You’ll be able to obtain the entire record of all of O’Shares Funding Advisors inventory holdings by clicking the hyperlink beneath:

OUSA owns shares which can be market leaders with sturdy earnings, diversified enterprise fashions, they usually pay dividends to shareholders.

This text analyzes the fund’s 10 highest-yielding holdings intimately.

Desk of Contents

The highest 10 highest yielding shares within the O’Shares FTSE U.S. High quality Dividend ETF are listed so as of their present dividend yield, from lowest to highest.

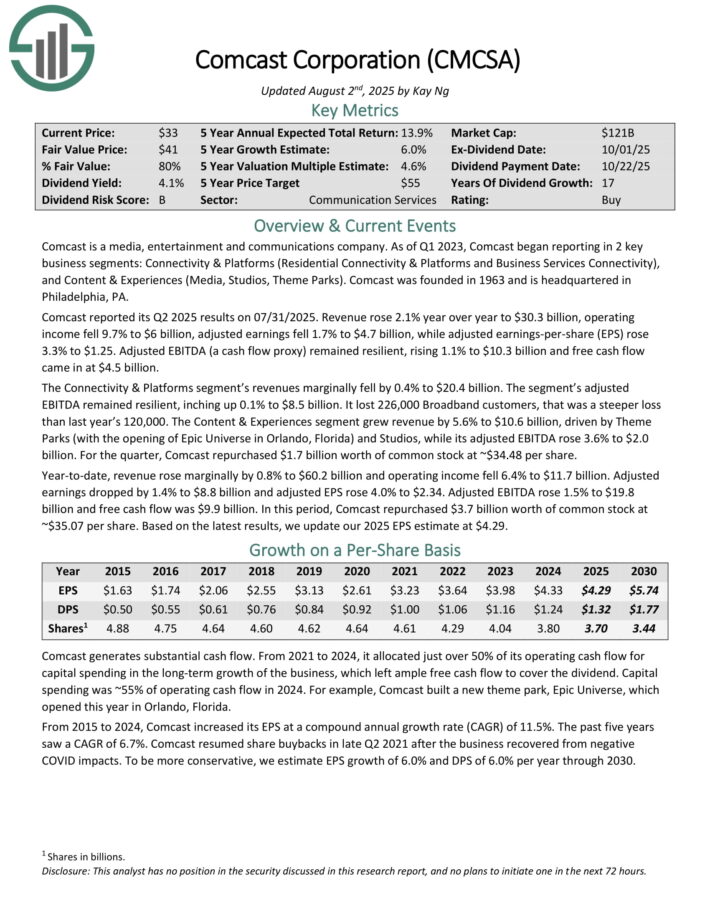

No. 10: Comcast Corp. (CMCSA)

Dividend Yield: 3.9%

Comcast is a media, leisure and communications firm. It experiences in two key enterprise segments: Connectivity & Platforms (Residential Connectivity & Platforms and Enterprise Providers Connectivity), and Content material & Experiences (Media, Studios, Theme Parks).

Comcast reported its Q2 2025 outcomes on 07/31/2025. Income rose 2.1% 12 months over 12 months to $30.3 billion, working earnings fell 9.7% to $6 billion, adjusted earnings fell 1.7% to $4.7 billion, whereas adjusted earnings-per-share rose 3.3% to $1.25. Adjusted EBITDA remained resilient, rising 1.1% to $10.3 billion and free money circulation got here in at $4.5 billion.

The Connectivity & Platforms phase’s revenues marginally fell by 0.4% to $20.4 billion. The phase’s adjusted EBITDA remained resilient, inching up 0.1% to $8.5 billion. It misplaced 226,000 Broadband prospects, that was a steeper loss than final 12 months’s 120,000.

The Content material & Experiences phase grew income by 5.6% to $10.6 billion, pushed by Theme Parks (with the opening of Epic Universe in Orlando, Florida) and Studios, whereas its adjusted EBITDA rose 3.6% to $2.0 billion. For the quarter, Comcast repurchased $1.7 billion price of widespread inventory at ~$34.48 per share.

12 months-to-date, income rose marginally by 0.8% to $60.2 billion and working earnings fell 6.4% to $11.7 billion. Adjusted earnings dropped by 1.4% to $8.8 billion and adjusted EPS rose 4.0% to $2.34. Adjusted EBITDA rose 1.5% to $19.8 billion and free money circulation was $9.9 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on CMCSA (preview of web page 1 of three proven beneath):

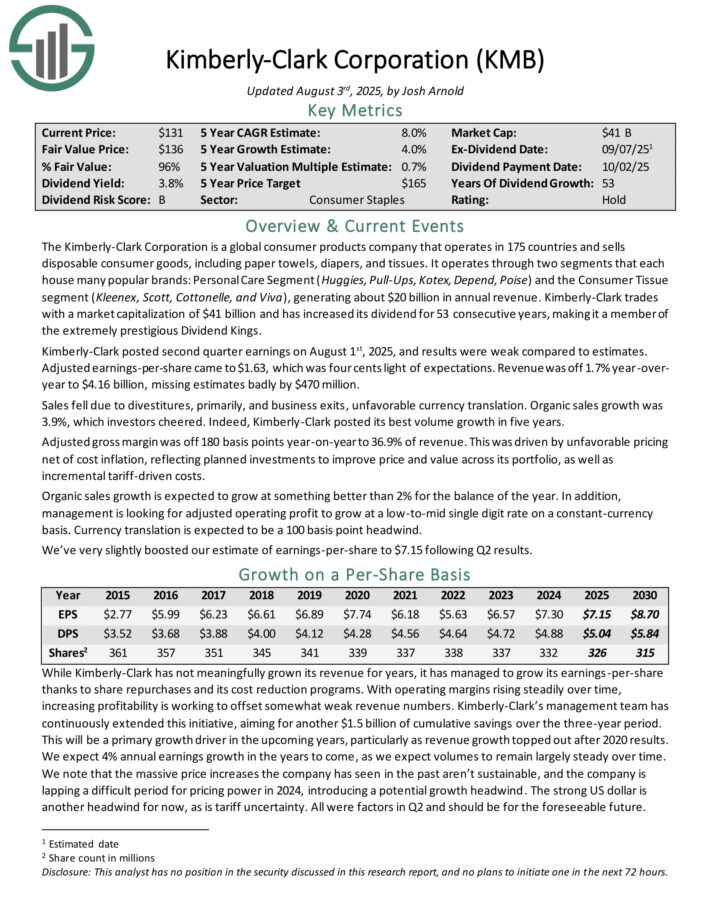

No. 9: Kimberly-Clark Corp. (KMB)

Dividend Yield: 3.9%

Kimberly-Clark is a world shopper merchandise firm that operates in 175 international locations and sells disposable shopper items, together with paper towels, diapers, and tissues.

It operates segments that every home many in style manufacturers: the Private Care Section (Huggies, Pull-Ups, Kotex, Rely, Poise), the Client Tissue phase (Kleenex, Scott, Cottonelle, and Viva), and knowledgeable phase.

Kimberly-Clark posted second quarter earnings on August 1st, 2025, and outcomes have been weak in comparison with estimates. Adjusted earnings-per-share got here to $1.63, which was 4 cents mild of expectations. Income was off 1.7% year-over-year to $4.16 billion, lacking estimates badly by $470 million.

Gross sales fell on account of divestitures, primarily, and enterprise exits, unfavorable forex translation. Natural gross sales development was 3.9%, which traders cheered. Certainly, Kimberly-Clark posted its greatest quantity development in 5 years.

Adjusted gross margin was off 180 foundation factors year-on-year to 36.9% of income. This was pushed by unfavorable pricing internet of price inflation, reflecting deliberate investments to enhance worth and worth throughout its portfolio, in addition to incremental tariff-driven prices.

Click on right here to obtain our most up-to-date Certain Evaluation report on Kimberly-Clark (preview of web page 1 of three proven beneath):

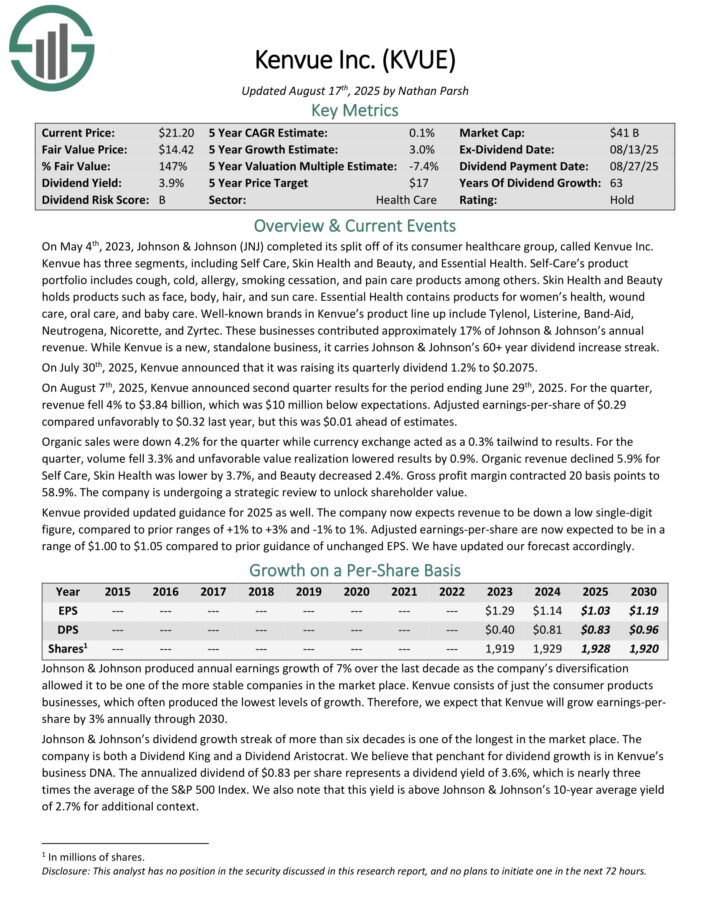

No. 8: Kenvue Inc. (KVUE)

Dividend Yield: 4.0%

Kenvue was spun off from Johnson & Johnson (JNJ) in 2023. It has three segments, together with Self Care, Pores and skin Well being and Magnificence, and Important Well being.

Self-Care’s product portfolio contains cough, chilly, allergy, smoking cessation, and ache care merchandise amongst others. Pores and skin Well being and Magnificence holds merchandise corresponding to face, physique, hair, and solar care. Important Well being accommodates merchandise for ladies’s well being, wound care, oral care, and child care.

Nicely-known manufacturers in Kenvue’s product line up embody Tylenol, Listerine, Band-Support, Neutrogena, Nicorette, and Zyrtec. These companies contributed roughly 17% of Johnson & Johnson’s annual income.

On August seventh, 2025, Kenvue introduced second quarter outcomes for the interval ending June twenty ninth, 2025. For the quarter, income fell 4% to $3.84 billion, which was $10 million beneath expectations. Adjusted earnings-per-share of $0.29 in contrast unfavorably to $0.32 final 12 months, however this was $0.01 forward of estimates.

Natural gross sales have been down 4.2% for the quarter whereas forex change acted as a 0.3% tailwind to outcomes. For the quarter, quantity fell 3.3% and unfavorable worth realization lowered outcomes by 0.9%.

Natural income declined 5.9% for Self Care, Pores and skin Well being was decrease by 3.7%, and Magnificence decreased 2.4%. Gross revenue margin contracted 20 foundation factors to 58.9%. The corporate is present process a strategic assessment to unlock shareholder worth.

Click on right here to obtain our most up-to-date Certain Evaluation report on KVUE (preview of web page 1 of three proven beneath):

No. 7: Paccar Inc. (PCAR)

Dividend Yield: 4.4%

PACCAR designs and manufactures mild, medium and heavy-duty vehicles beneath the Kenworth (U.S., Canada, Mexico & Australia), Peterbilt (U.S. & Canada) and DAF (Netherlands, Belgium, Brazil & UK) nameplates.

As well as, the corporate supplies monetary providers, info expertise, and distributes truck components associated to its enterprise. PACCAR is a $49 billion market cap enterprise that generated $34 billion in gross sales in 2024.

On December tenth, 2024, PACCAR elevated its dividend by 10% to $0.33 per share quarterly. On July twenty second, 2025, PACCAR reported Q2 2025 outcomes. For the quarter, PACCAR generated $7.51 billion in income, down 14% from $8.77 billion earned in Q2 2024.

Elements revenues have been $1.72 billion and monetary providers generated pretax earnings of $123 million. Internet earnings equaled $724 million, or $1.37 per share in comparison with $1.12 billion, or $2.13 per share in Q2 2024.

In Q2 2025, PACCAR delivered 39,300 automobiles worldwide in comparison with 48,400 a 12 months in the past. PACCAR spent $227 million on capital tasks and $113 million on analysis and growth within the quarter.

For 2025, it expects to speculate $750 to $800 million in capital tasks and $450 to $480 million in R&D. It additionally expects to pour $600 to $900 million of investments into its battery JV, Amplify Cell Applied sciences.

Click on right here to obtain our most up-to-date Certain Evaluation report on PCAR (preview of web page 1 of three proven beneath):

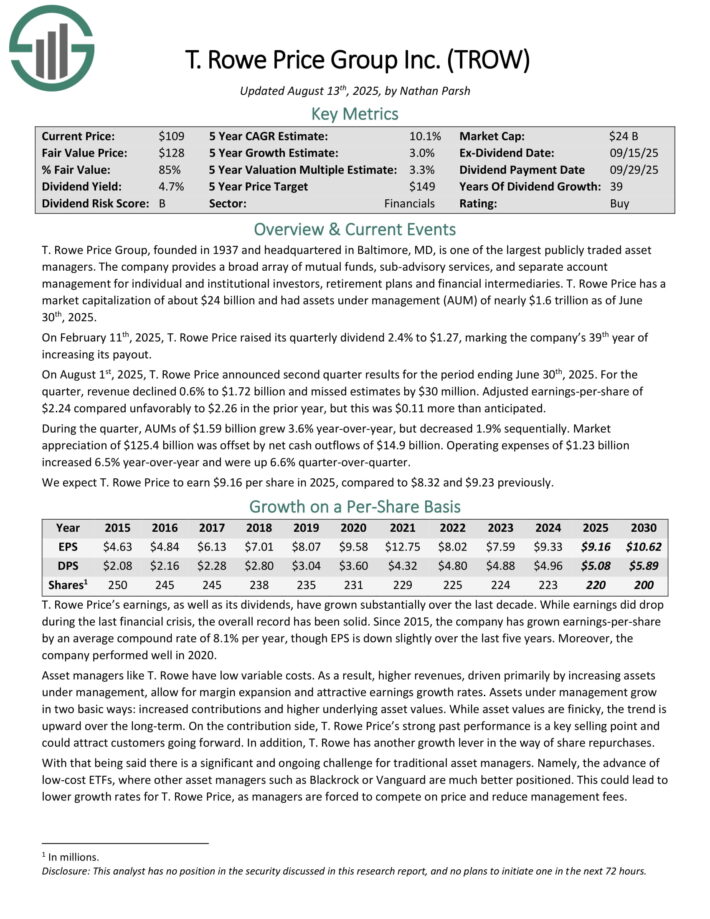

No. 6: T. Rowe Worth Group (TROW)

Dividend Yield: 4.8%

T. Rowe Worth Group is without doubt one of the largest publicly traded asset managers. The corporate supplies a broad array of mutual funds, sub-advisory providers, and separate account administration for particular person and institutional traders, retirement plans and monetary intermediaries.

T. Rowe Worth had property beneath administration (AUM) of almost $1.6 trillion as of June thirtieth, 2025.

On February eleventh, 2025, T. Rowe Worth raised its quarterly dividend 2.4% to $1.27, marking the corporate’s thirty ninth 12 months of accelerating its payout.

On August 1st, 2025, T. Rowe Worth introduced second quarter outcomes for the interval ending June thirtieth, 2025. For the quarter, income declined 0.6% to $1.72 billion and missed estimates by $30 million. Adjusted earnings-per-share of $2.24 in contrast unfavorably to $2.26 within the prior 12 months, however this was $0.11 greater than anticipated.

Throughout the quarter, AUMs of $1.59 billion grew 3.6% year-over-year, however decreased 1.9% sequentially. Market appreciation of $125.4 billion was offset by internet money outflows of $14.9 billion. Working bills of $1.23 billion elevated 6.5% year-over-year and have been up 6.6% quarter-over-quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on TROW (preview of web page 1 of three proven beneath):

No. 5: Goal Company (TGT)

Dividend Yield: 4.9%

Goal was based in 1902 and now operates about 1,850 large field shops, which provide basic merchandise and meals, in addition to serving as distribution factors for the corporate’s e-commerce enterprise.

Goal posted first quarter earnings on Might twenty first, 2025, and outcomes have been weak. Earnings got here to $1.30 per share, which missed estimates by 35 cents. Income was additionally 3% decrease from the prior 12 months at $23.8 billion, lacking estimates by $550 million. Merchandise gross sales have been off 3.1% year-over-year, partially offset by a 13.5% improve in different income.

Digital comparable gross sales have been up 4.7%, with same-day supply development of 35%. Power in Drive Up continues to drive these outcomes. Whole comparable gross sales fell 3.8%, and administration famous Goal held or gained market share in simply 15 of its 35 classes.

The corporate is investing closely in its enterprise so as to navigate by way of the altering panorama within the retail sector. The payout is now 61% of earnings for this 12 months, which is elevated from historic ranges, however the dividend stays well-covered.

Goal’s aggressive benefit comes from its on a regular basis low costs on enticing merchandise in its guest-friendly shops.

Click on right here to obtain our most up-to-date Certain Evaluation report on TGT (preview of web page 1 of three proven beneath):

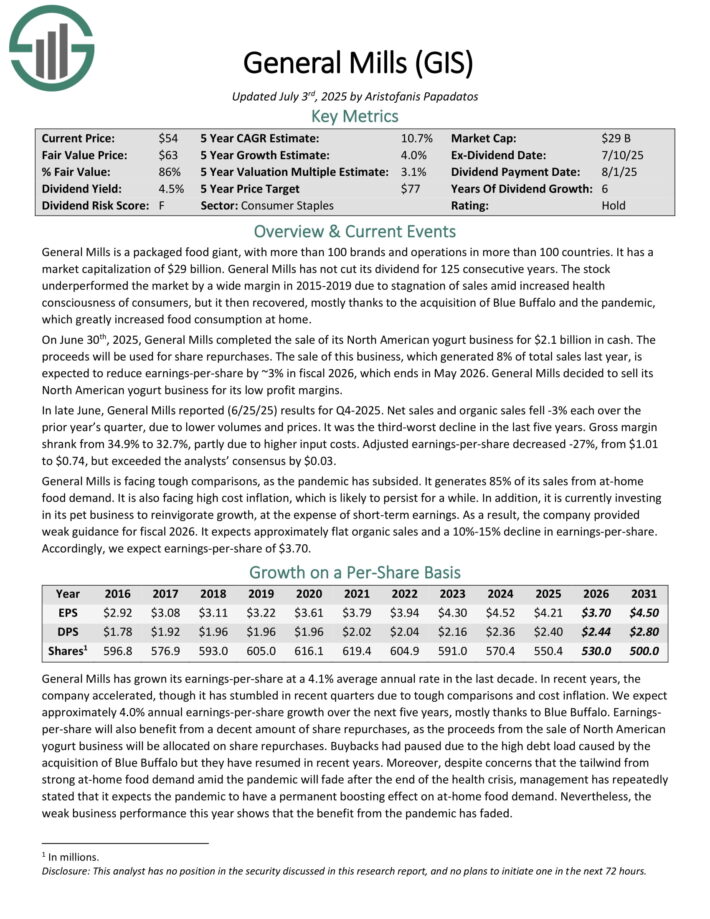

No. 4: Basic Mills (GIS)

Dividend Yield: 5.0%

Basic Mills is a packaged meals big, with greater than 100 manufacturers and operations in additional than 100 international locations. Basic Mills has not minimize its dividend for 125 consecutive years.

On June thirtieth, 2025, Basic Mills accomplished the sale of its North American yogurt enterprise for $2.1 billion in money. The proceeds can be used for share repurchases. The sale of this enterprise, which generated 8% of whole gross sales final 12 months, is anticipated to scale back earnings-per-share by ~3% in fiscal 2026.

In late June, Basic Mills reported (6/25/25) outcomes for This autumn-2025. Internet gross sales and natural gross sales fell -3% every over the prior 12 months’s quarter, on account of decrease volumes and costs. It was the third-worst decline within the final 5 years.

Gross margin shrank from 34.9% to 32.7%, partly on account of increased enter prices. Adjusted earnings-per-share decreased -27%, from $1.01 to $0.74, however exceeded the analysts’ consensus by $0.03.

Click on right here to obtain our most up-to-date Certain Evaluation report on GIS (preview of web page 1 of three proven beneath)

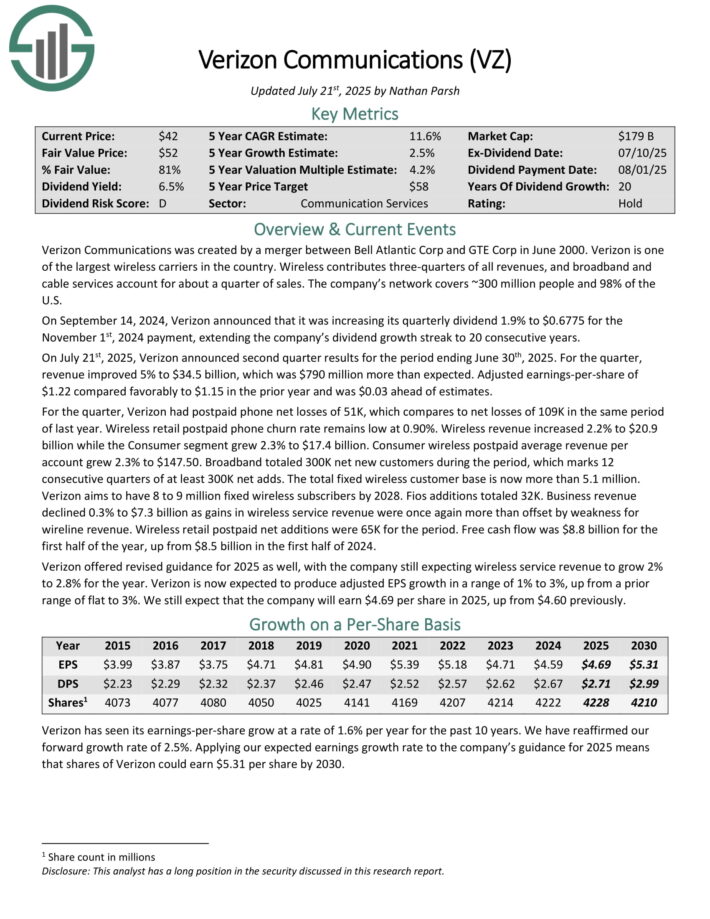

No. 3: Verizon Communications (VZ)

Dividend Yield: 6.2%

Verizon Communications was created by a merger between Bell Atlantic Corp and GTE Corp in June 2000. Verizon is without doubt one of the largest wi-fi carriers within the nation.

Wi-fi contributes three-quarters of all revenues, and broadband and cable providers account for a couple of quarter of gross sales. The corporate’s community covers ~300 million folks and 98% of the U.S.

On July twenty first, 2025, Verizon introduced second-quarter outcomes. For the quarter, income improved 5% to $34.5 billion, which was $790 million greater than anticipated. Adjusted earnings-per-share of

$1.22 in contrast favorably to $1.15 within the prior 12 months and was $0.03 forward of estimates.

For the quarter, Verizon had postpaid cellphone internet losses of 51K, which compares to internet losses of 109K in the identical interval of final 12 months. Wi-fi retail postpaid cellphone churn fee stays low at 0.90%. Wi-fi income elevated 2.2% to $20.9 billion whereas the Client phase grew 2.3% to $17.4 billion.

Client wi-fi postpaid common income per account grew 2.3% to $147.50. Broadband totaled 300K internet new prospects through the interval, which marks 12 consecutive quarters of at the least 300K internet provides.

The entire fastened wi-fi buyer base is now greater than 5.1 million. Verizon goals to have 8 to 9 million fastened wi-fi subscribers by 2028. Fios additions totaled 32K. Enterprise income

declined 0.3% to $7.3 billion as features in wi-fi service income have been as soon as once more greater than offset by weak spot for wireline income.

Wi-fi retail postpaid internet additions have been 65K for the interval. Free money circulation was $8.8 billion for the primary half of the 12 months, up from $8.5 billion within the first half of 2024. .

Click on right here to obtain our most up-to-date Certain Evaluation report on VZ (preview of web page 1 of three proven beneath):

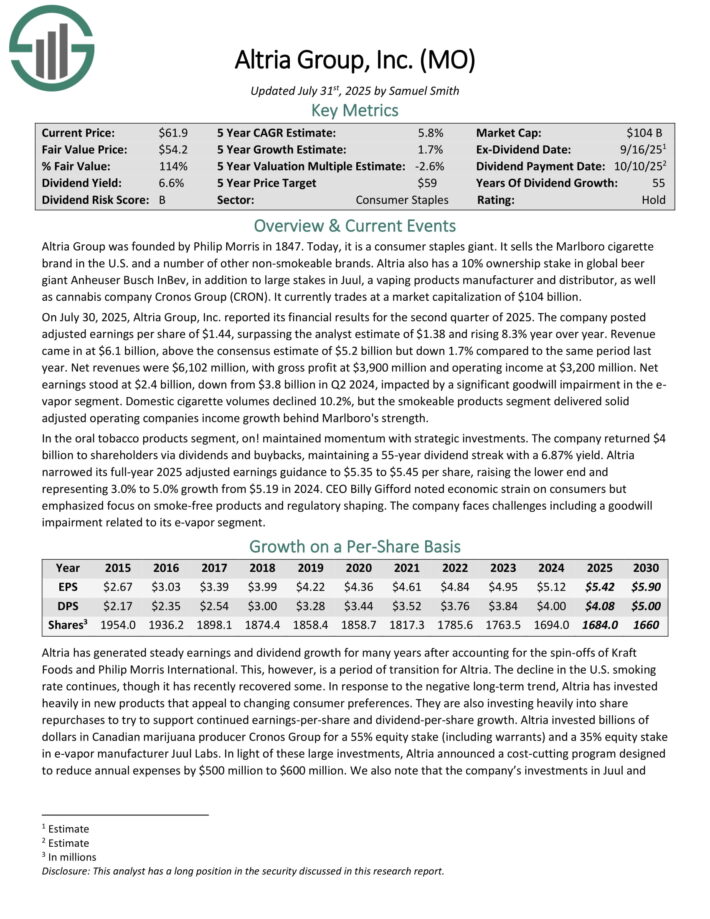

No. 2: Altria Group (MO)

Dividend Yield: 6.3%

Altria is a tobacco inventory that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and extra beneath a wide range of manufacturers, together with Marlboro, Skoal, and Copenhagen, amongst others.

This can be a interval of transition for Altria. The decline within the U.S. smoking fee continues. In response, Altria has invested closely in new merchandise that enchantment to altering shopper preferences, because the smoke-free class continues to develop.

The corporate additionally has a 35% funding stake in e-cigarette maker JUUL, and a forty five% stake within the Canadian hashish producer Cronos Group (CRON).

On July 30, 2025, Altria Group, Inc. reported its monetary outcomes for the second quarter of 2025. The corporate posted adjusted earnings per share of $1.44, surpassing the analyst estimate of $1.38 and rising 8.3% 12 months over 12 months.

Income got here in at $6.1 billion, above the consensus estimate of $5.2 billion however down 1.7% in comparison with the identical interval final 12 months. Internet revenues have been $6,102 million, with gross revenue at $3,900 million and working earnings at $3,200 million.

Internet earnings stood at $2.4 billion, down from $3.8 billion in Q2 2024, impacted by a major goodwill impairment within the e-vapor phase.

Home cigarette volumes declined 10.2%, however the smokeable merchandise phase delivered stable adjusted working firms earnings development behind Marlboro’s energy.

Click on right here to obtain our most up-to-date Certain Evaluation report on Altria (preview of web page 1 of three proven beneath):

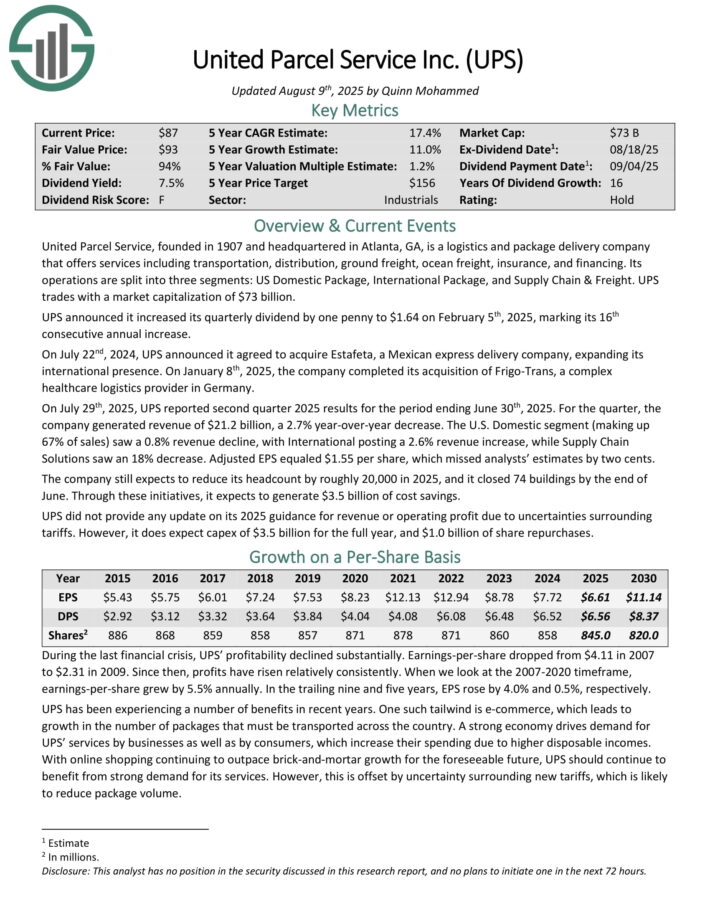

No. 1: United Parcel Service (UPS)

Dividend Yield: 7.7%

United Parcel Service, based in 1907 and headquartered in Atlanta, GA, is a logistics and package deal supply firm that gives providers together with transportation, distribution, floor freight, ocean freight, insurance coverage, and financing. Its operations are cut up into three segments: US Home Package deal, Worldwide Package deal, and Provide Chain & Freight.

On July twenty second, 2024, UPS introduced it agreed to accumulate Estafeta, a Mexican categorical supply firm, increasing its worldwide presence. On January eighth, 2025, the corporate accomplished its acquisition of Frigo-Trans, a fancy healthcare logistics supplier in Germany.

On July twenty ninth, 2025, UPS reported second quarter 2025 outcomes for the interval ending June thirtieth, 2025. For the quarter, the corporate generated income of $21.2 billion, a 2.7% year-over-year lower. The U.S. Home phase (making up 67% of gross sales) noticed a 0.8% income decline, with Worldwide posting a 2.6% income improve, whereas Provide Chain Options noticed an 18% lower. Adjusted EPS equaled $1.55 per share, which missed analysts’ estimates by two cents.

The corporate nonetheless expects to scale back its headcount by roughly 20,000 in 2025, and it closed 74 buildings by the top of June. By way of these initiatives, it expects to generate $3.5 billion of price financial savings.

Click on right here to obtain our most up-to-date Certain Evaluation report on UPS (preview of web page 1 of three proven beneath):

Extra Assets

In case you are all in favour of discovering extra high-quality dividend development shares appropriate for long-term funding, the next Certain Dividend databases can be helpful:

The main home inventory market indices are one other stable useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].