Let’s work by a number of choices concepts for one to place for a giant transfer in oil (one thing we see as an above common chance).

From the outset, we’re relatively bullishly positioned for a giant transfer in oil, as we’ve got been so for the final 5 years or extra, so we most likely don’t should do an excessive amount of further in our portfolios.

Subsequently, the concepts introduced under are a number of that people may contemplate—a thought experiment, if you’ll.

Calls on Exxon

January 2027 choices at the moment are listed. Yup, two years from now could possibly be thought-about a relatively conservative timeframe because it appears to us that if a giant transfer up in oil goes to happen, it can doubtless centre round a “disturbance” within the power from the Center East, which is constructing as we write. However expertise tells us that no matter timeframe you anticipate one thing to happen, as a rule it takes double that point to play out.

An out-of-the-money bull name unfold — shopping for the $150 strike (at $9.0) and promoting the $185 strike (at $2.5) in opposition to it for a complete debit of $6.5 or $650 per contract/unfold.

So, at $185, a 50% transfer in Exxon (NYSE:) would equate to a couple of 430% return. A 25% transfer in Exxon is required to interrupt even, and a 30% transfer for a 100% return.

These returns appear acceptable. If the value of oil takes off, Exxon may simply make a 50% transfer.

The large purpose why the payoff appears to be like affordable is that it doesn’t seem that choices are being priced for any large transfer in Exxon.

Maybe that is additionally a mirrored image of simply how out of favour oil shares are. During the last month or so we’ve got been highlighting how sentiment in the direction of oil futures is the worst since 2011 (and that’s solely as a result of we’ve got been unable to get data going again any additional). It additionally appears that this excessive damaging sentiment is echoed in vitality associated shares.

Generally just some brief paragraphs are all you want:

Goldman Sachs, as one of many largest suppliers of lending and buying and selling providers to buyers by its prime brokerage unit, is ready to observe hedge funds’ funding tendencies.

General, Goldman Sachs stated hedge funds’ buying and selling e-book was underweight vitality shares at ranges approaching a Might 2020 low. It added, hedge funds elevated their brief bets on U.S. vitality shares, apart from oil, fuel, consumable fuels and vitality tools and providers.

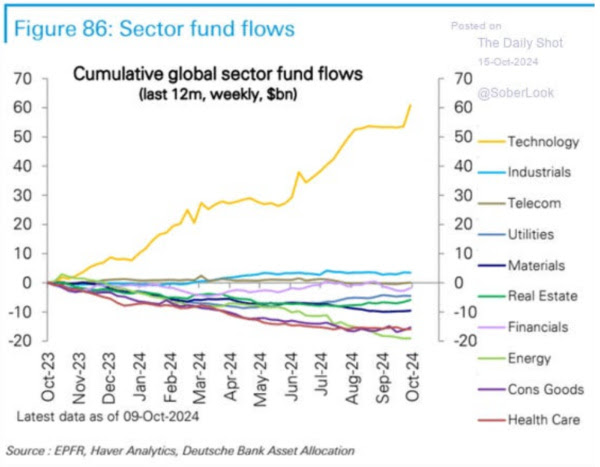

And right here’s a pictorial illustration:

Are you able to hear that big sucking noise? Proper now, it’s all about tech, and nothing else issues (no less than within the eyes of the vast majority of fund managers).

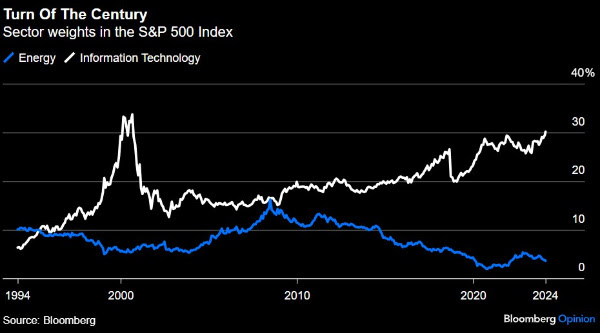

Right here’s one other method of it, from a longer-term time scale.

Appears to us that an ideal short-squeeze storm is brewing. If you happen to don’t know what a brief squeeze is, then we urge people to observe the movie Dumb Cash.

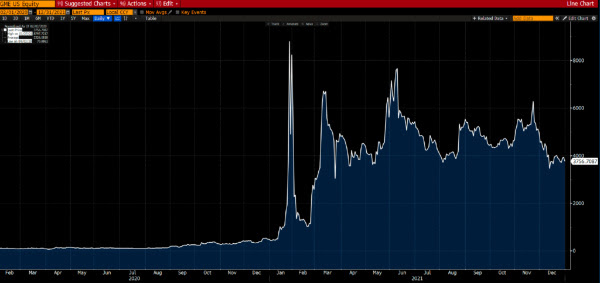

From 2013 to 2020, Gamestop’s inventory value fell by some 90%, and it was one of the closely shorted shares on the planet. Everybody was satisfied that the inventory was going to zero. In early 2020, 100% of the inventory float of Gamestock (the float is what number of shares can be found for the overall investing public to purchase and promote and doesn’t embrace restricted inventory held by insiders) was offered brief, after which by late 2020 this blew out to 150%.

Then one thing weird occurred. In 2020, the inventory began to rise. Come 2021, it was up about 80x from the place it was buying and selling in the beginning of 2020. If somebody had casually put $10,000 into Gamestop in the beginning of 2020 (or roughly at any time through the first half of 2020) after which offered someplace in mid-2021, that $10,000 would have change into $600,000. No isht! $10k into $600k.

On the opposite finish of the Gamestop lengthy commerce was Melvin Capital run by Gabe Plotkin as Wiki explains:

In 2014, with a $200 million funding from Cohen, Plotkin based Melvin Capital Administration, a New York-based hedge fund which he named after his grandfather. It had $3.5 billion below administration by 2017. In 2017, with $300 million in earnings, he was one of many highest-earning hedge fund managers.

This elevated to over $850 million in 2020, putting him within the prime 15 highest-earning hedge fund managers. Nevertheless, his compensation decreased in 2021, as a result of affect of the GameStop brief squeeze on the fund. Regardless of receiving $2 billion from Kenneth C. Griffin and $750 million from Steve Cohen, on Might 18th, 2021, Bloomberg introduced Melvin Capital went defunct shorting GameStop and Gabe Plotkin could be shutting down his agency.

And the wind-down of Melvin Capital, as defined by Bloomberg.

So what’s the ethical of the story right here? Effectively, the massive one is to all the time make sure that asymmetry is in your facet. It might appear that this e-book by no means discovered a spot in Plotkin’s library — it was an amazing narration of the LTCM disaster, in any other case referred to as the Lengthy Time period Capital Administration disaster.

It’s alright to put 1% of your capital into one thing and it drops by 50% or goes to zero. All that occurs is your ego will get bruised and you are feeling like a dope for a bit.

Nevertheless, risking 1% of your capital, solely to see it change into a 20%, 30%, or 50% legal responsibility (choose a determine) is terminal.

If you would like large returns, don’t short-sell (or have any place that creates leverage or a legal responsibility in your portfolio), even whether it is only a small insignificant quantity. All of us underestimate volatility (or as Einstein put it, human stupidity). Fairly, make investments your cash in a set of beaten-up canine like this one (Seatrium):

With asymmetry in your facet, eventually the gods of luck will faucet you on the shoulder.

Bear in mind Dyna-Mac?

It was exactly what we’re in search of!

The Poisonous Waste That Is Coal

Right here we’ve got extra proof of how powerful it’s for coal miners and coal-fired energy stations to function, not to mention increase their enterprise.

The Vales Level energy station isn’t insignificant because it accounts for about 10% of NSW’s electrical energy capability and 4% of Australia’s.

If it failed/shut down, there would virtually actually be blackouts as there isn’t a lot spare electrical energy technology capability (of the bottom load selection) on the nationwide grid. But, the banks are seemingly pleased for this to occur. Discuss self destruction!

Whereas we are able to’t bounce to conclusions primarily based on one information merchandise, this does reinforce our considering that individuals are dreaming in the event that they imagine coal faces an extra of provide.

Right here’s New Hope Coal (OTC:), and we’re fortunately gathering these dividends. That’s a 120% inventory value return since 2019 however near 350% when you had the knowledge to reinvest your dividends.

Here’s a comparability between returns of New Hope Coal, the S&P 500 (), the Nasdaq (), and the ASX 200 (). A boring previous coal miner with returns double the Nasdaq. Name us boring, however we’ll take the cash over glam.

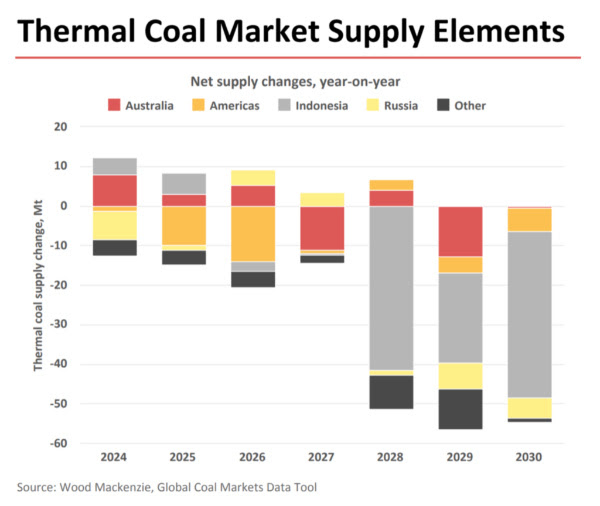

And just a bit extra to assist the assertion we made in the beginning of this blurb on coal — have a look at Indonesia’s large fall in manufacturing.

As we said above, we don’t assume buyers in coal miners have to fret about an oversupply of coal this facet of 2030 on the very least.