got here in as anticipated yesterday, however that didn’t cease long-end charges from rising, with the up six bps and the up two bps. The additionally continued to soften up after the information, displaying that stays sticky after a 0.3% m/m enhance.

The larger query for core CPI is whether or not some pattern change is going down. It’s unclear at this level, however the annualized charge of change for core CPI rose by 3.6%.

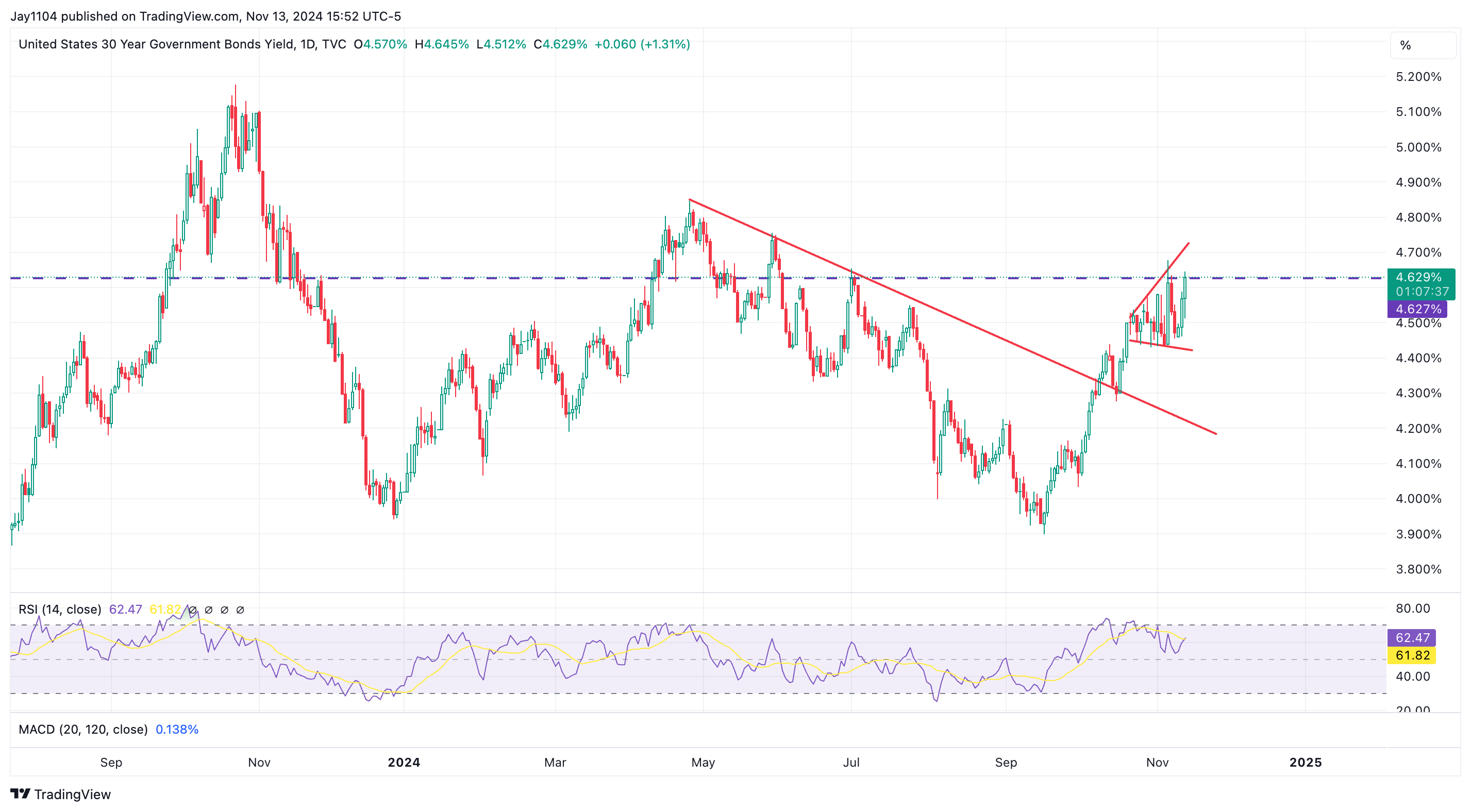

Regardless of the case, the 30-year closed at its highest degree since early July. This appears like an vital potential breakout that, relying on right now’s report, might push the 30-year even larger.

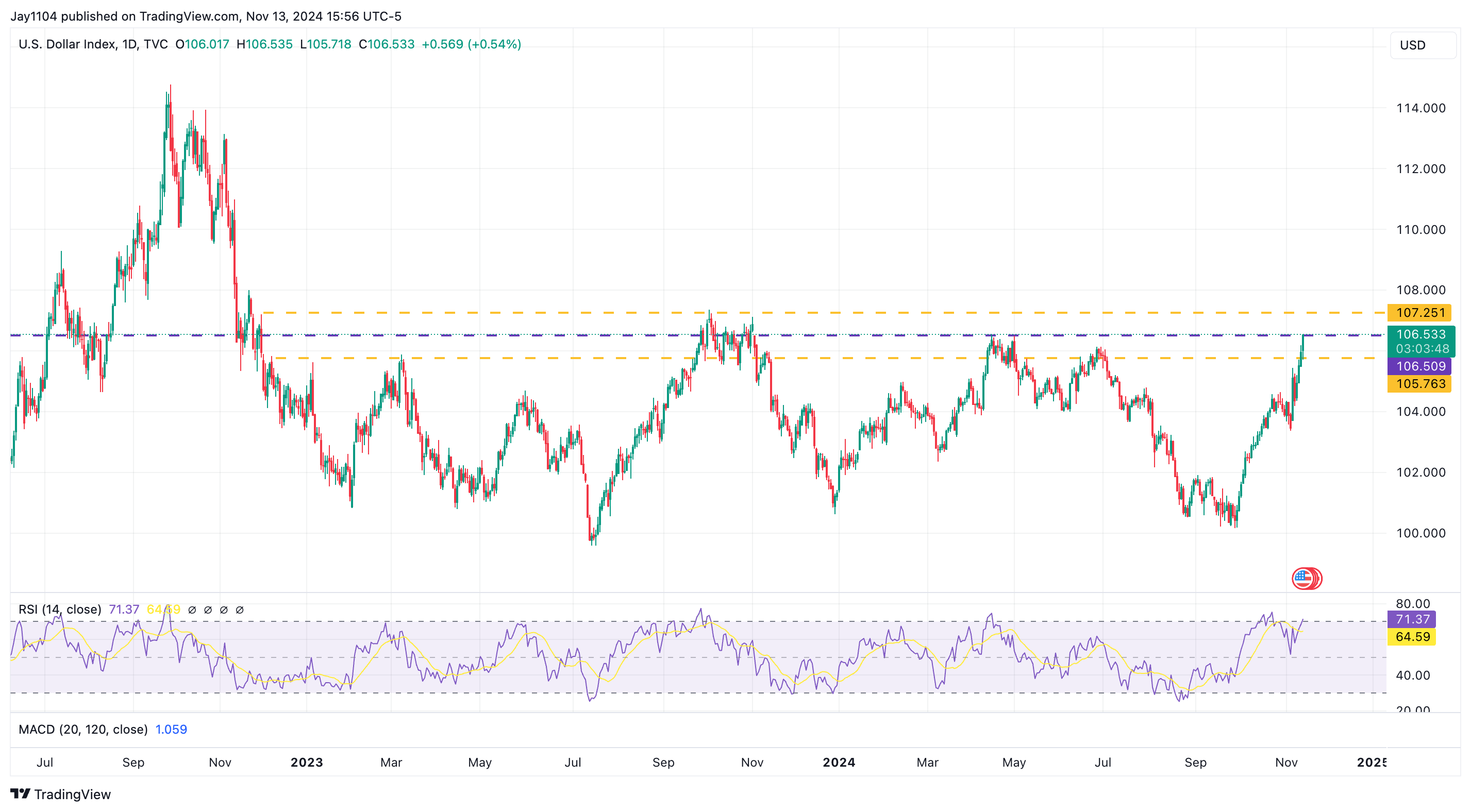

In the meantime, the made its highest shut since November 2023 and is approaching the 107.25 degree, which is of unbelievable significance. A breakout means the highs of 2022 might be in play.

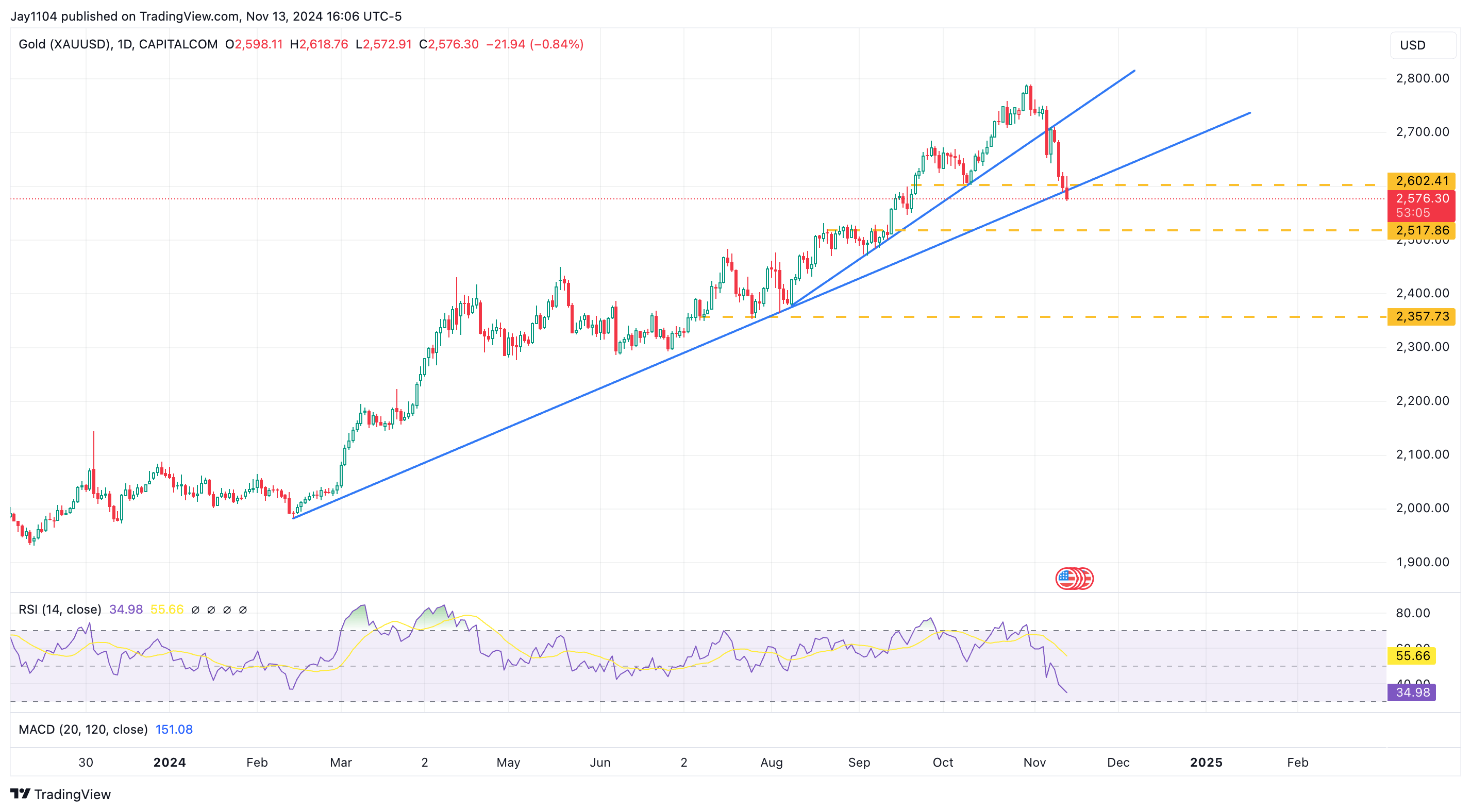

That is wreaking havoc throughout laborious belongings as actual yields rise and commodities like and drop. Gold broke one other assist degree yesterday and an uptrend and will open a path to $2,500.

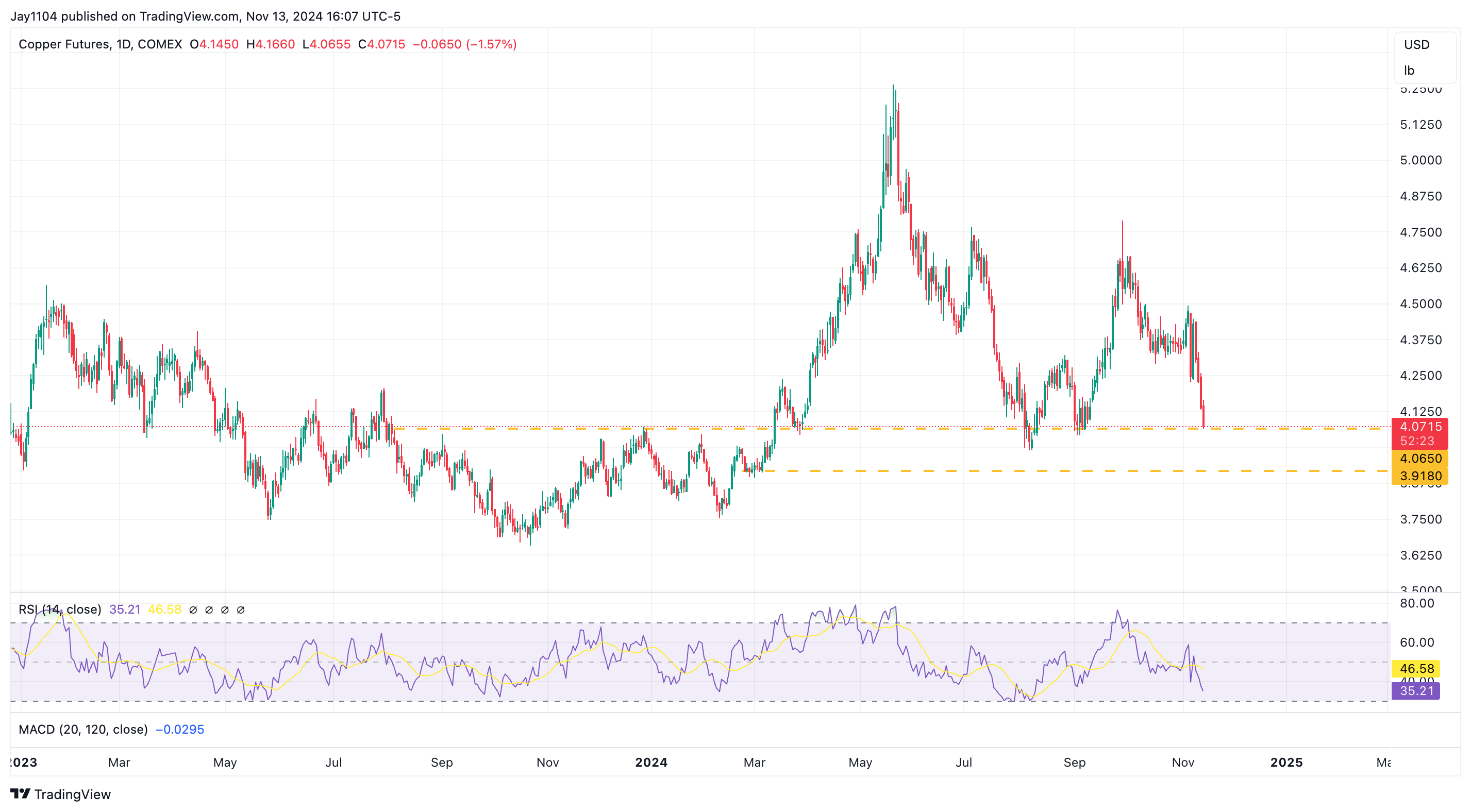

is at assist, too, and a break of $4.05 opens a path to round $3.90.

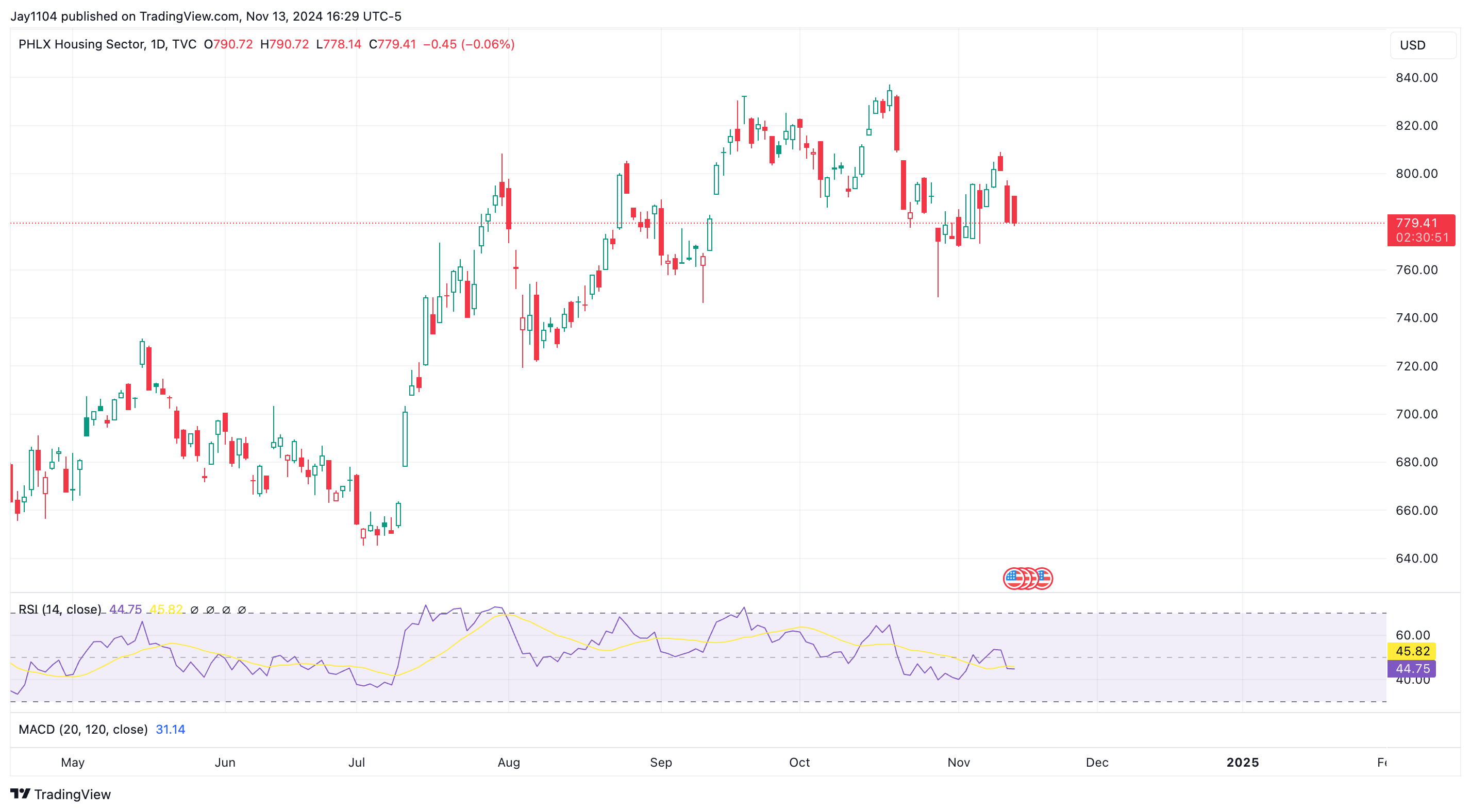

The (HGX) noticed a acquire of almost 1.4% evaporate over the day as charges rose. Rising charges is not going to be pleasant to mortgages or the housing sectors.

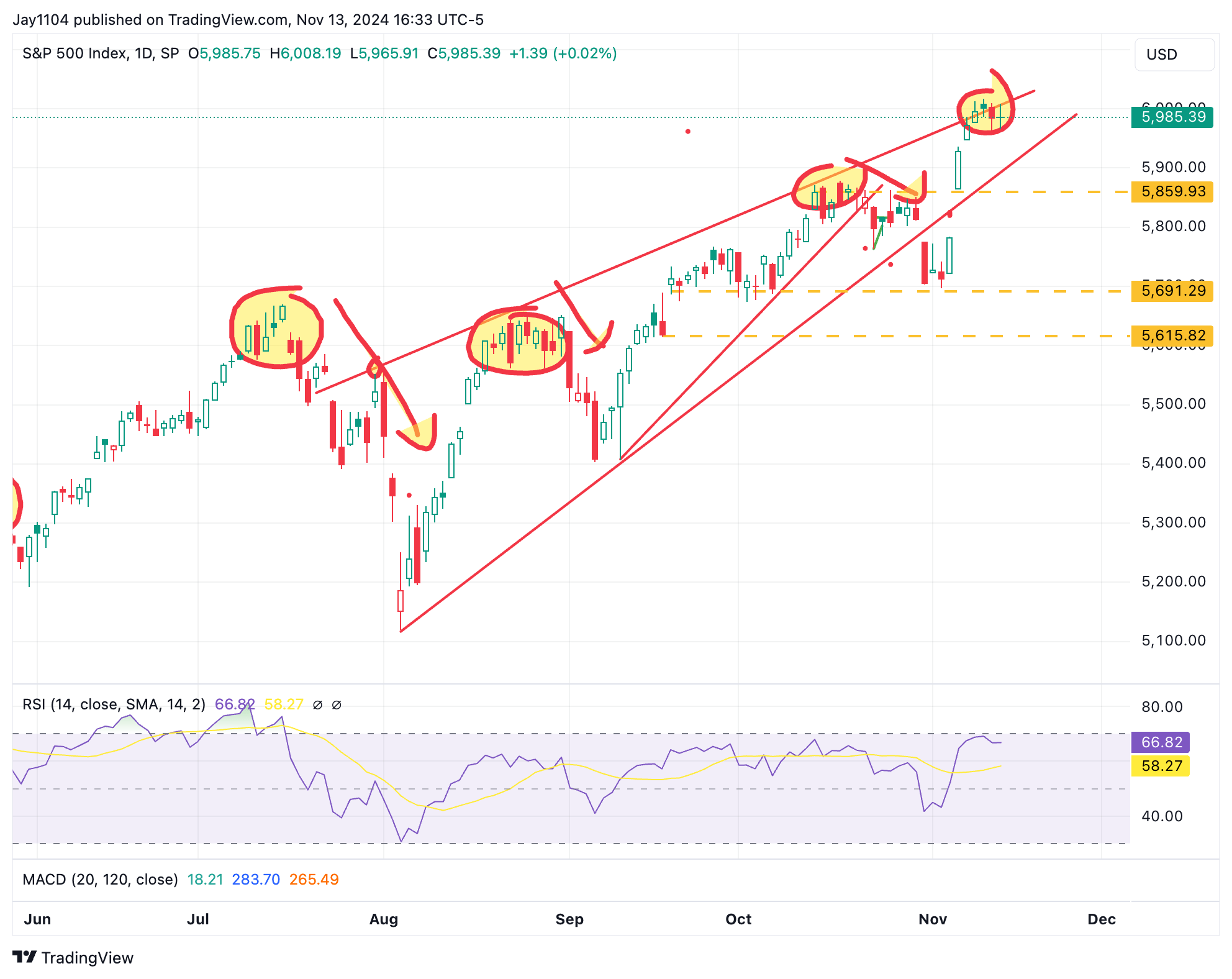

Within the meantime, shares have but to get the memo that charges are rising and will head considerably larger from right here. The was principally flat on the day and has stalled at resistance for now.

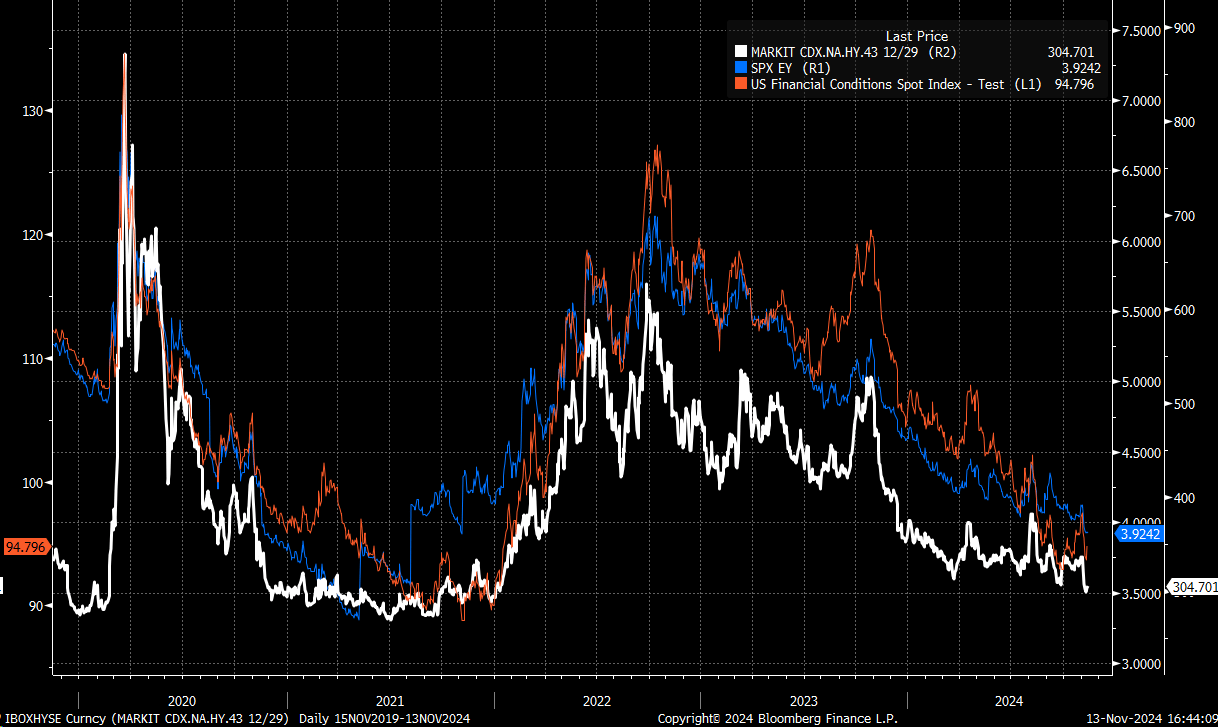

The one query that is still is when credit score spreads snap and begin to widen. Once they do, that would be the level at which shares start to lastly cave.

Unique Submit