Printed on December twentieth, 2024 by Bob Ciura

Spreadsheet knowledge up to date every day

Micro-cap shares are publicly-traded corporations with market capitalizations between $50 million and $300 million. These signify the smallest corporations within the inventory market.

The entire variety of micro-cap shares varies relying upon market circumstances. Proper now there are tons of of micro-cap shares, so there are a lot for traders to select from.

Because the smallest shares, micro-caps might have stronger development potential over the long term than large-cap shares or mega-cap shares.

On the similar time, micro-cap shares carry quite a few distinctive threat components to contemplate.

You may obtain a free spreadsheet of all 1400+ micro cap shares proper now (together with essential monetary metrics equivalent to price-to-earnings ratios and dividend yields) by clicking on the hyperlink under:

The downloadable micro-cap shares checklist above was curated from two main micro-cap inventory ETFs:

- iShares Micro-Cap ETF (IWC)

- First Belief Dow Jones Choose Micro-Cap Index Fund (FDM)

This text features a spreadsheet and desk of all of our micro-cap shares, in addition to detailed evaluation on our Prime 10 micro-cap shares at present.

Maintain studying to see the ten greatest micro-cap shares analyzed intimately.

The ten Greatest Micro Cap Shares Right now

Now that we’ve outlined what a micro-cap inventory is, let’s check out the ten greatest micro-cap shares, as outlined by our Positive Evaluation Analysis Database.

The database ranks whole anticipated annual returns, combining present yield, forecast earnings development and any change in worth from the valuation.

Word: The Positive Evaluation Analysis Database is concentrated on revenue producing securities. In consequence, we don’t monitor or rank securities that don’t pay dividends. Micro-cap shares that don’t pay dividends have been excluded from the Prime 10 rankings under.

We’ve screened the micro-cap shares with the best 5-year anticipated returns and have offered them under, ranked from lowest to highest.

You may immediately leap to any particular person inventory evaluation by utilizing the hyperlinks under:

Micro Cap Inventory #10: Parke Bancorp, Inc. (PKBK)

- 5-year anticipated annual returns: 11.4%

Parke Bancorp is a New Jersey-based regional financial institution. It serves clients within the South New Jersey and Higher New

York metro markets.

The financial institution has about $2 billion in whole belongings. About half its mortgage e book consists of loans on single-family houses, primarily within the Philadelphia and Southern New Jersey space.

The financial institution has grown its deposit base at a 9.5% annualized price over the previous decade whereas rising its gross mortgage e book greater than 10% yearly.

That, mixed with a step by step rising return on fairness “ROE” metric over time, led to speedy development in earnings-per-share. This, in flip, supported an incredible 29% annualized dividend development price since 2014.

The financial institution’s Q3 earnings outcomes, reported October 18th, 2024, confirmed important enchancment. Revenues grew at a 6.8% price year-over-year to $33 million. Earnings per share rose to 62 cents per share from 57 cents per share in the identical interval of final 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on PKBK (preview of web page 1 of three proven under):

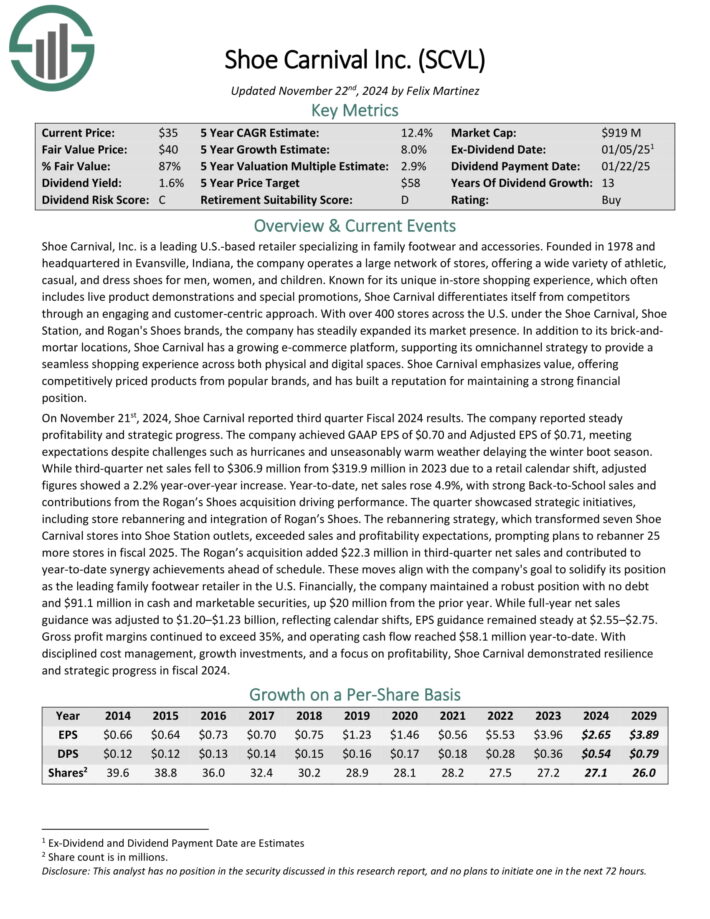

Micro Cap Inventory #9: Shoe Carnival, Inc. (SCVL)

- 5-year anticipated annual returns: 11.4%

Shoe Carnival, Inc. is a number one U.S.-based retailer specializing in household footwear and equipment. The corporate operates a big community of shops, providing all kinds of athletic, informal, and costume sneakers for males, ladies, and kids.

With over 400 shops throughout the U.S. beneath the Shoe Carnival, Shoe Station, and Rogan’s Sneakers manufacturers, the corporate has steadily expanded its market presence.

Along with its brick-and mortar places, Shoe Carnival has a rising e-commerce platform, supporting its omnichannel technique.

On November twenty first, 2024, Shoe Carnival reported third quarter Fiscal 2024 outcomes. The corporate reported GAAP EPS of $0.70 and Adjusted EPS of $0.71, assembly expectations.

Whereas third-quarter internet gross sales fell to $306.9 million from $319.9 million in 2023 as a result of a retail calendar shift, adjusted figures confirmed a 2.2% year-over-year improve.

12 months-to-date, internet gross sales rose 4.9%, with robust Again-to-Faculty gross sales and contributions from the Rogan’s Sneakers acquisition driving efficiency.

Click on right here to obtain our most up-to-date Positive Evaluation report on SCVL (preview of web page 1 of three proven under):

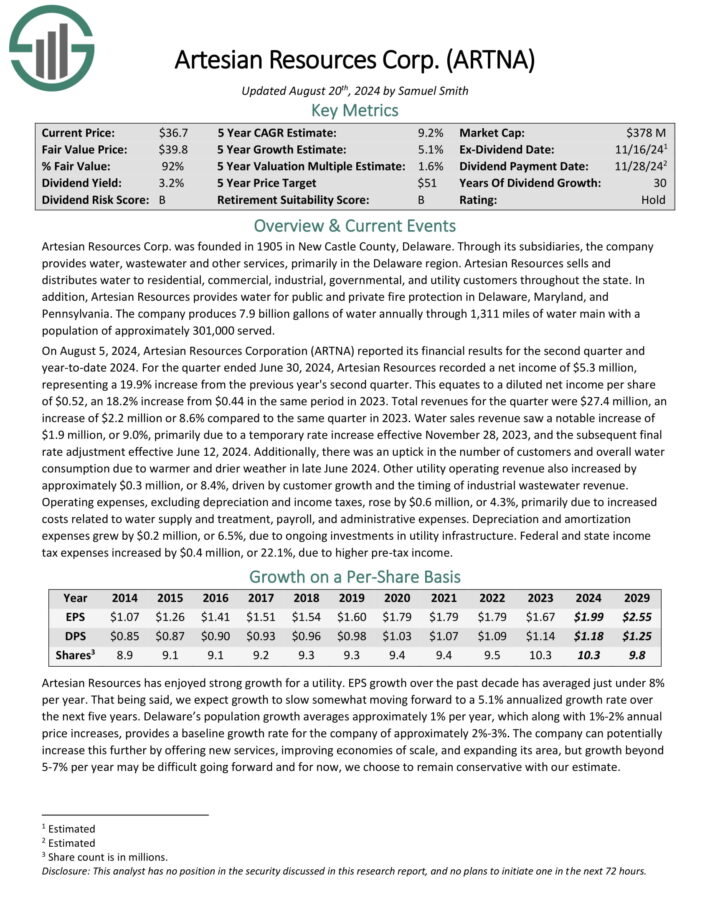

Micro Cap Inventory #8: Artesian Sources (ARTNA)

- 5-year anticipated annual returns: 11.5%

Artesian Sources Corp. was based in 1905 in New Fortress County, Delaware. Via its subsidiaries, the corporate gives water, wastewater and different companies, primarily within the Delaware area.

Artesian Sources sells and distributes water to residential, business, industrial, governmental, and utility clients all through the state.

As well as, Artesian Sources gives water for private and non-private fireplace safety in Delaware, Maryland, and Pennsylvania. The corporate produces 7.9 billion gallons of water yearly via 1,311 miles of water important with a inhabitants of roughly 301,000 served.

On August 5, 2024, Artesian Sources Company (ARTNA) reported its monetary outcomes for the second quarter and year-to-date 2024. For the quarter ended June 30, 2024, Artesian Sources recorded a internet revenue of $5.3 million, representing a 19.9% improve from the earlier 12 months’s second quarter.

This equates to a diluted internet revenue per share of $0.52, an 18.2% improve from $0.44 in the identical interval in 2023. Complete revenues for the quarter have been $27.4 million, a rise of $2.2 million or 8.6% in comparison with the identical quarter in 2023.

Click on right here to obtain our most up-to-date Positive Evaluation report on ARTNA (preview of web page 1 of three proven under):

Micro Cap Inventory #7: Timberland Bancorp (TSBK)

- 5-year anticipated annual returns: 11.8%

Timberland Bancorp is a Hoquiam, Washington-based regional financial institution. It has loved robust development in recent times, each from development in its core market together with the financial institution’s enlargement in enterprise and service provider companies.

It operates 23 financial institution branches at present, all in Washington, serving each rural areas and a few communities within the larger Seattle metropolitan space.

Timberland has a lending e book weighted towards business credit, with greater than half its loans being in both business actual property or building lending.

On October thirty first, 2024, Timberland reported its fiscal fourth quarter 2024 earnings. Earnings per share of 79 cents slipped barely from 81 cents in the identical interval of 2023, however rose sequentially from Q3. Timberland reported an uptick in mortgage volumes, deposits, and internet curiosity margin.

Click on right here to obtain our most up-to-date Positive Evaluation report on TSBK (preview of web page 1 of three proven under):

Micro Cap Inventory #6: Plymouth Industrial REIT (PLYM)

- 5-year anticipated annual returns: 12.4%

Plymouth Industrial REIT is a full-service, vertically built-in actual property funding belief which acquires, owns, and manages single and multi-tenant industrial properties, which embrace distribution facilities, warehouses, gentle industrial and small bay industrial properties.

The vast majority of its property portfolio is situated in Florida, Ohio, Indiana, Tennessee, Illinois, and Georgia. As of June 30, 2024, the belief owned and managed 210 buildings, totaling 33.8 million sq. ft in over 10 markets.

The property portfolio resides nearly totally inside The Golden Triangle states, which is inside a day’s drive to 70% of the U.S. inhabitants, and incorporates extra ports than another area within the nation.

Plymouth Industrial reported third quarter 2024 outcomes on November sixth, 2024. The belief reported core funds from operations (FFO) of $0.44 per frequent share, down two cents in comparison with final 12 months.

Adjusted FFO per share of $0.40 was a 4.8% lower in comparison with Q3 2023. Similar retailer internet working revenue (NOI) on a money foundation rose by 0.6% year-over-year when excluding early termination revenue.

Click on right here to obtain our most up-to-date Positive Evaluation report on PLYM (preview of web page 1 of three proven under):

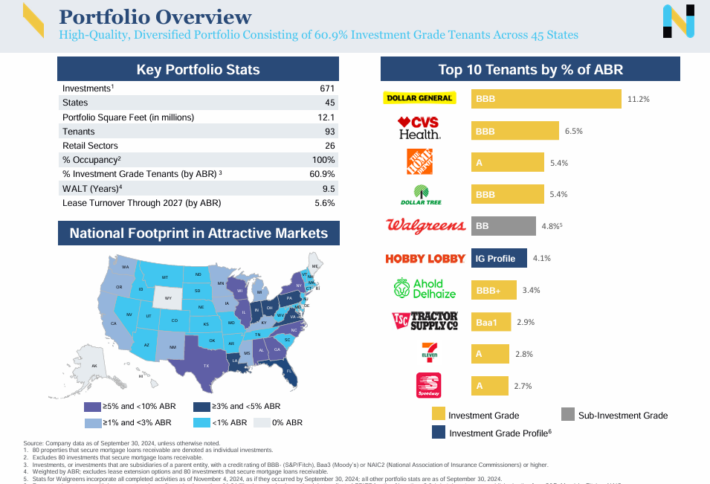

Micro Cap Inventory #5: NETSTREIT Corp. (NTST)

- 5-year anticipated annual returns: 13.2%

Netstreit Corp is a REIT which acquires, owns, and manages a diversified portfolio of single-tenant, retail business actual property.

The property portfolio focuses on leasing to tenants the place brick and mortal is important, equivalent to important companies within the retail sector, and is unfold throughout 45 states and over 25 retail sectors.

Netstreit’s prime 5 tenants by annualized base hire are Greenback Basic, CVS, Residence Depot, Greenback Tree, and Walgreens.

Supply: Investor Presentation

On November 4th, 2024, Netstreit reported third quarter 2024 outcomes for the interval ending September thirtieth, 2024. The belief reported core FFO and AFFO per share of $0.32 for the quarter.

AFFO was 3% larger in comparison with $0.31 earned in Q3 2023. Throughout Q3, Netstreit accomplished $152 million in funding exercise, a brand new quarterly report, at a blended money yield of seven.5% throughout 33 investments. It additionally made eight disposition for $24 million in proceeds.

Click on right here to obtain our most up-to-date Positive Evaluation report on NTST (preview of web page 1 of three proven under):

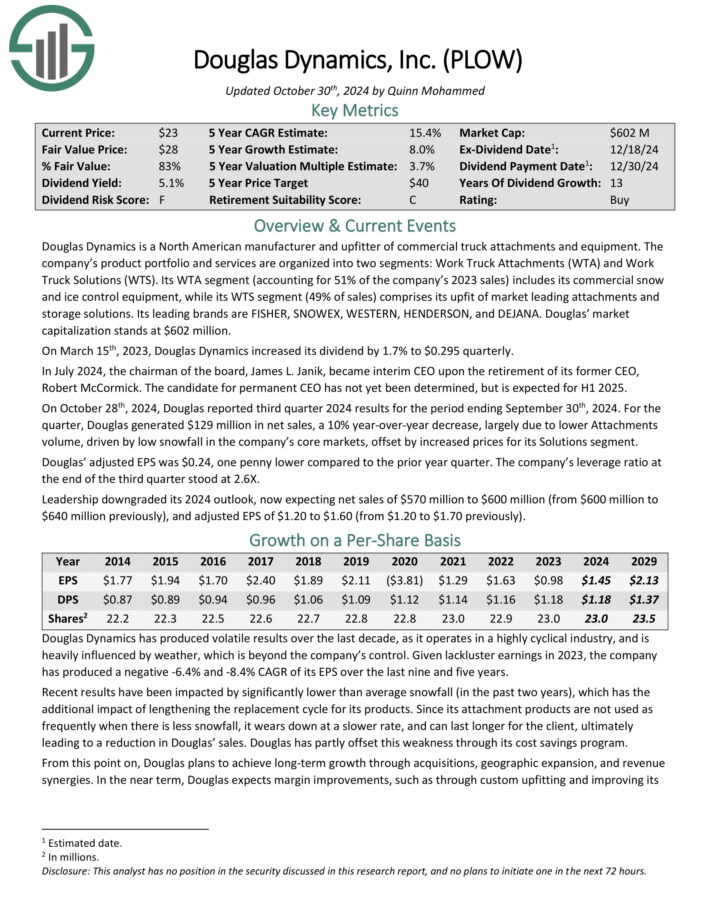

Micro Cap Inventory #4: Douglas Dynamics, Inc. (PLOW)

- 5-year anticipated annual returns: 13.6%

Douglas Dynamics is a North American producer and upfitter of business truck attachments and gear. The corporate’s product portfolio and companies are organized into two segments: Work Truck Attachments (WTA) and Work Truck Options (WTS).

Its WTA phase (accounting for 51% of the corporate’s 2023 gross sales) contains its business snow and ice management gear, whereas its WTS phase (49% of gross sales) includes its upfit of market main attachments and storage options. Its main manufacturers are FISHER, SNOWEX, WESTERN, HENDERSON, and DEJANA.

On October twenty eighth, 2024, Douglas reported third quarter 2024 outcomes. For the quarter, Douglas generated $129 million in internet gross sales, a ten% year-over-year lower.

The gross sales decline was largely as a result of decrease attachments quantity, pushed by low snowfall within the firm’s core markets, offset by elevated costs for its Options phase.

Douglas’ adjusted EPS was $0.24, one penny decrease in comparison with the prior 12 months quarter. The corporate’s leverage ratio on the finish of the third quarter stood at 2.6X.

Click on right here to obtain our most up-to-date Positive Evaluation report on PLOW (preview of web page 1 of three proven under):

Micro Cap Inventory #3: Ares Business Actual Property (ACRE)

- 5-year anticipated annual returns: 13.7%

Ares Business Actual Property Company is a specialty finance firm primarily engaged in originating and investing in business actual property (“CRE”) loans and associated investments. ACRE generated round $198.6 million in curiosity revenue final 12 months.

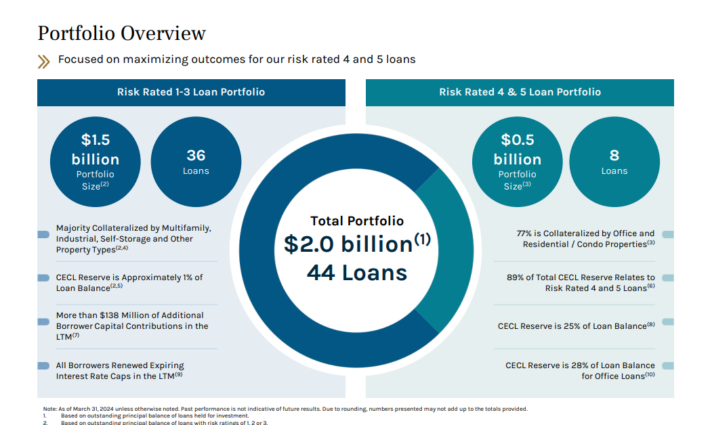

The corporate’s mortgage portfolio (98% of that are senior loans) includes 44 market loans throughout 8 asset sorts, with an impressive principal stability of $2 billion. The vast majority of the loans are tied to multifamily, workplace, and mixed-use properties.

Supply: Investor Presentation

When it comes to geographical diversification, ACRE’s publicity encompasses a wholesome combine between the Southeast, West, and Midwest.

On November seventh, 2024, ACRE reported its Q3 outcomes for the interval ending September thirtieth, 2024. Curiosity revenue got here in at $39.3 million, 26% decrease year-over-year, with business actual property persevering with to wrestle.

Within the meantime, curiosity expense fell by 8% to about $27.4 million. Thus, whole revenues (curiosity revenue – curiosity bills + $4.7 million in income from ACRE’s personal actual property) fell by about 30% to roughly $16.7 million. Complete bills rose by about 41% to $9.3 million, primarily as a result of larger bills from actual property owned beforehand absent.

Click on right here to obtain our most up-to-date Positive Evaluation report on ACRE (preview of web page 1 of three proven under):

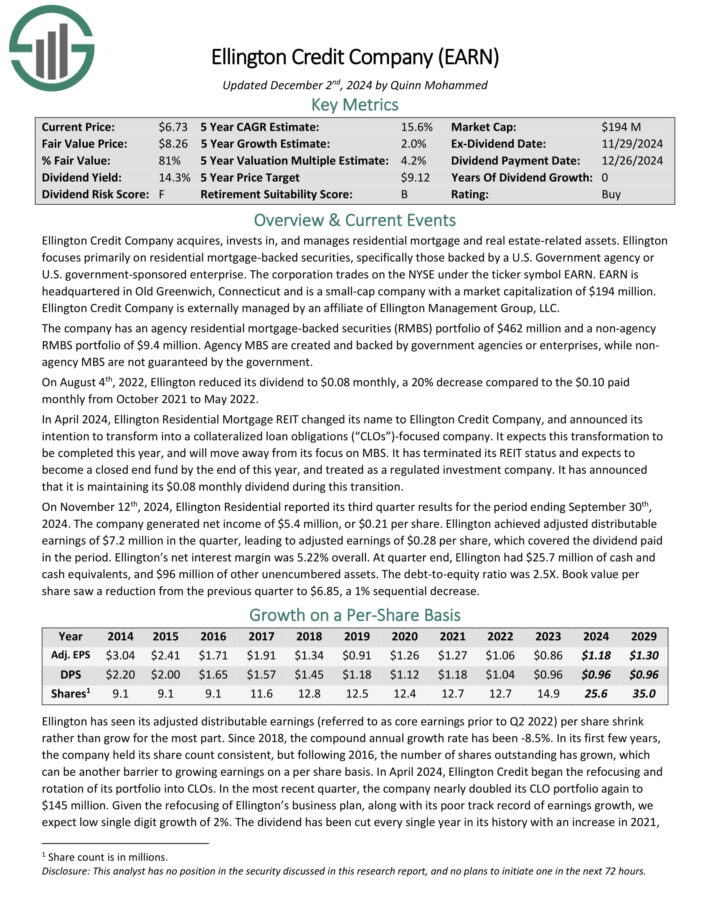

Micro Cap Inventory #2: Ellington Credit score Co. (EARN)

- 5-year anticipated annual returns: 16.2%

Ellington Credit score Co. acquires, invests in, and manages residential mortgage and actual property associated belongings. Ellington focuses totally on residential mortgage-backed securities, particularly these backed by a U.S. Authorities company or U.S. authorities–sponsored enterprise.

Company MBS are created and backed by authorities businesses or enterprises, whereas non-agency MBS are not assured by the federal government.

Supply: Investor Presentation

On November twelfth, 2024, Ellington Residential reported its third quarter outcomes for the interval ending September thirtieth, 2024. The corporate generated internet revenue of $5.4 million, or $0.21 per share.

Ellington achieved adjusted distributable earnings of $7.2 million within the quarter, resulting in adjusted earnings of $0.28 per share, which lined the dividend paid within the interval.

Internet curiosity margin was 5.22% general. At quarter finish, Ellington had $25.7 million of money and money equivalents, and $96 million of different unencumbered belongings.

Click on right here to obtain our most up-to-date Positive Evaluation report on EARN (preview of web page 1 of three proven under):

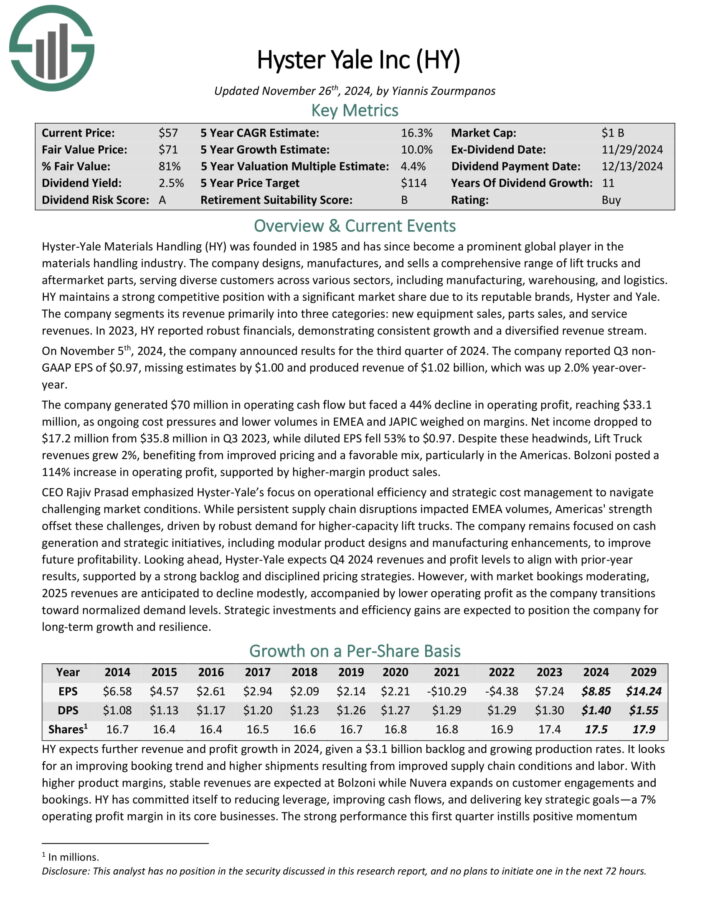

Micro Cap Inventory #1: Hyster Yale Inc. (HY)

- 5-year anticipated annual returns: 18.3%

Hyster-Yale Supplies Dealing with operates within the supplies dealing with business. The corporate designs, manufactures, and sells a complete vary of carry vans and aftermarket components, serving numerous clients throughout varied sectors, together with manufacturing, warehousing, and logistics.

HY maintains a powerful aggressive place with a big market share as a result of its respected manufacturers, Hyster and Yale. The corporate segments its income primarily into three classes: new gear gross sales, components gross sales, and repair revenues. In 2023, HY reported strong financials, demonstrating constant development and a diversified income stream.

On November fifth, 2024, the corporate introduced outcomes for the third quarter of 2024. The corporate reported Q3 non GAAP EPS of $0.97, lacking estimates by $1.00 and produced income of $1.02 billion, which was up 2.0% year-over 12 months.

The corporate generated $70 million in working money stream however confronted a 44% decline in working revenue, reaching $33.1 million, as ongoing price pressures and decrease volumes in EMEA and JAPIC weighed on margins. Internet revenue dropped to $17.2 million from $35.8 million in Q3 2023, whereas diluted EPS fell 53% to $0.97.

Click on right here to obtain our most up-to-date Positive Evaluation report on HY (preview of web page 1 of three proven under):

Remaining Ideas

Micro-cap shares are the smallest corporations at present buying and selling on the inventory market. The potential good thing about investing in micro-cap shares is the potential for larger development, and shareholder returns, over time.

In fact, traders must fastidiously think about the distinctive dangers related to investing in micro-cap shares. The ten micro-cap shares on this checklist all pay dividends to shareholders and have optimistic anticipated returns.

In consequence, these 10 micro-cap shares could possibly be enticing for dividend development traders.

Different Dividend Lists

The next lists include many extra high-quality dividend shares:

- The Dividend Aristocrats Record is comprised of 66 shares within the S&P 500 Index with 25+ years of consecutive dividend will increase.

- The Excessive Yield Dividend Aristocrats Record is comprised of the 20 Dividend Aristocrats with the best present yields.

- The Dividend Achievers Record is comprised of ~400 NASDAQ shares with 10+ years of consecutive dividend will increase.

- The Dividend Kings Record is much more unique than the Dividend Aristocrats. It’s comprised of 53 shares with 50+ years of consecutive dividend will increase.

- The Excessive Yield Dividend Kings Record is comprised of the 20 Dividend Kings with the best present yields.

- The Excessive Dividend Shares Record: shares that attraction to traders within the highest yields of 5% or extra.

- The Month-to-month Dividend Shares Record: shares that pay dividends each month, for 12 dividend funds per 12 months.

- The Dividend Champions Record: shares which have elevated their dividends for 25+ consecutive years.

Word: Not all Dividend Champions are Dividend Aristocrats as a result of Dividend Aristocrats have further necessities like being in The S&P 500.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.