Up to date on November twenty second, 2024 by Bob Ciura

Many who comply with the dividend progress funding technique purpose to stay off the revenue their portfolio gives in retirement.

We consider that those who comply with this technique can have a extra worry-free retirement expertise because the investor’s portfolio can present revenue whatever the state of the financial system.

This is the reason we consider that buyers ought to deal with proudly owning high-quality dividend-paying shares such because the Dividend Aristocrats, that are these firms which have raised their dividends for at the very least 25 consecutive years.

Membership on this group is so unique that simply 66 firms qualify as Dividend Aristocrat.

We’ve got compiled an inventory of all 66 Dividend Aristocrats and related monetary metrics like dividend yield and P/E ratios.

You’ll be able to obtain the complete checklist of Dividend Aristocrats by clicking on the hyperlink beneath:

Disclaimer: Certain Dividend just isn’t affiliated with S&P International in any approach. S&P International owns and maintains The Dividend Aristocrats Index. The knowledge on this article and downloadable spreadsheet is predicated on Certain Dividend’s personal overview, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person buyers higher perceive this ETF and the index upon which it’s based mostly. Not one of the info on this article or spreadsheet is official knowledge from S&P International. Seek the advice of S&P International for official info.

In an ideal world, buyers would obtain the identical or comparable quantity of revenue from their portfolio each month as bills are normally constant.

However this isn’t the case as many firms usually distribute their dividends on the finish of every quarter, which is normally in March, June, September, and December.

This will make for uneven money flows all year long, which presents some points for buyers that require comparable revenue month-to-month.

Nonetheless, buyers can assemble a diversified portfolio with high-quality, dividend-paying shares that may present comparable quantities of revenue each month of the yr.

To that finish, now we have created a mannequin portfolio of 15 shares. Every inventory has at the very least 9 years of dividend progress, with the common place having a dividend progress streak of 25 years.

Shares had been chosen from numerous sectors, giving the investor a diversified portfolio that would supply revenue every month of the yr.

January, April, July, and October Funds

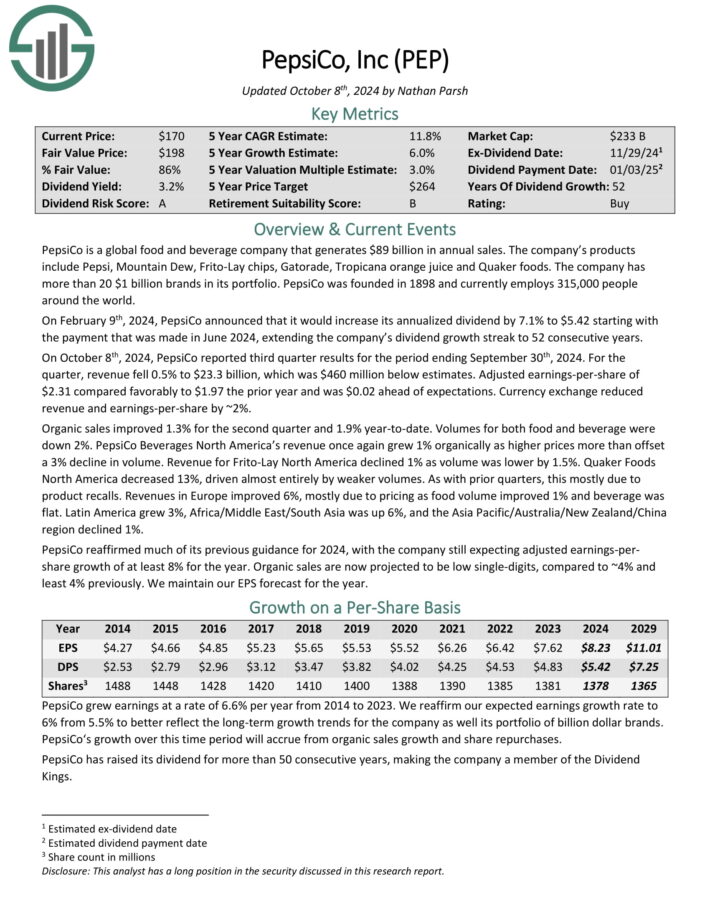

PepsiCo, Inc. (PEP)

PepsiCo is a world meals and beverage firm that generates $89 billion in annual gross sales. The corporate’s merchandise embrace Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker meals.

Its enterprise is break up roughly 60-40 when it comes to meals and beverage income. It is usually balanced geographically between the U.S. and the remainder of the world.

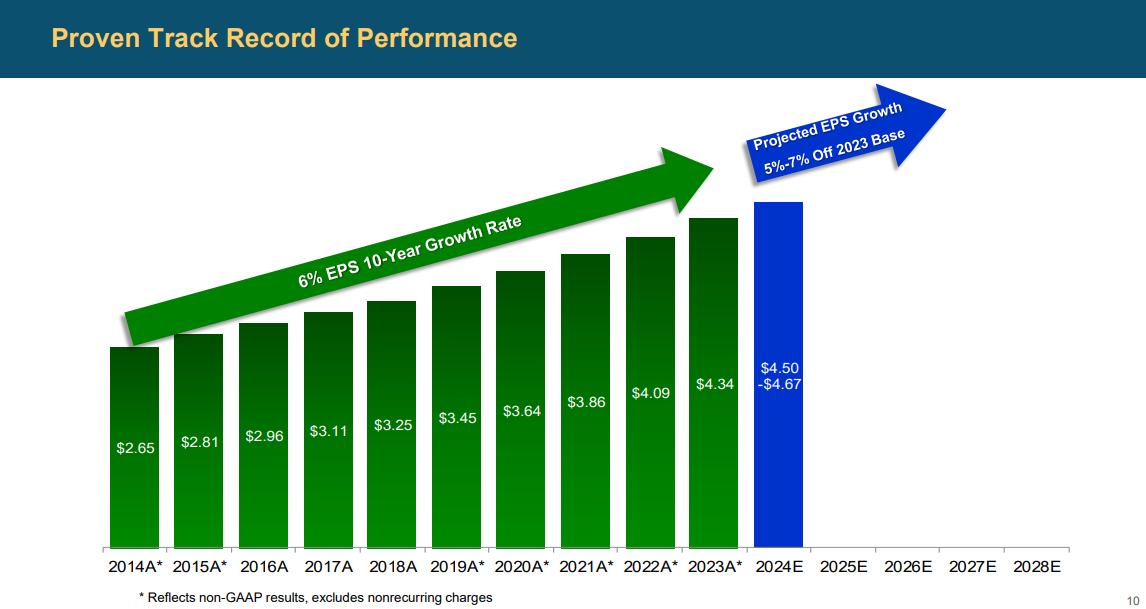

Supply: Investor Presentation

On October eighth, 2024, PepsiCo reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, income fell 0.5% to $23.3 billion, which was $460 million beneath estimates.

Adjusted earnings-per-share of $2.31 in contrast favorably to $1.97 the prior yr and was $0.02 forward of expectations. Foreign money alternate lowered income and earnings-per-share by ~2%.

Natural gross sales improved 1.3% for the second quarter and 1.9% year-to-date. Volumes for each meals and beverage had been down 2%.

PepsiCo Drinks North America’s income as soon as once more grew 1% organically as increased costs greater than offset a 3% decline in quantity.

Click on right here to obtain our most up-to-date Certain Evaluation report on PEP (preview of web page 1 of three proven beneath):

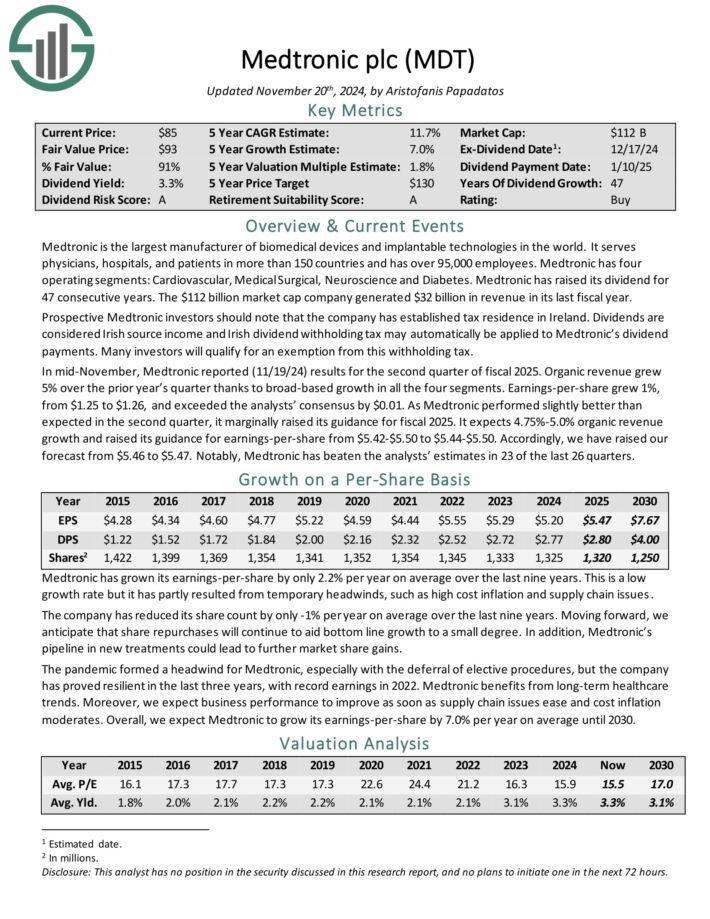

Medtronic plc (MDT)

Medtronic, which has operations in additional than 150 nations, is the world’s largest producer of biomedical units and implantable applied sciences. The corporate consists of segments, together with Cardiovascular, Medical Surgical, Neuroscience, and Diabetes.

Getting old worldwide demographics ought to present a tailwind to the corporate’s enterprise as elevated entry to healthcare services turns into extra obligatory. There are practically 70 million Child Boomers within the U.S. alone that may want rising quantities of medical care as they age.

In mid-November, Medtronic reported (11/19/24) outcomes for the second quarter of fiscal 2025. Natural income grew 5% over the prior yr’s quarter because of broad-based progress in all of the 4 segments. Earnings-per-share grew 1%, from $1.25 to $1.26, and exceeded the analysts’ consensus by $0.01.

As Medtronic carried out barely higher than anticipated within the second quarter, it marginally raised its steerage for fiscal 2025.

Click on right here to obtain our most up-to-date Certain Evaluation report on Medtronic plc (MDT) (preview of web page 1 of three proven beneath):

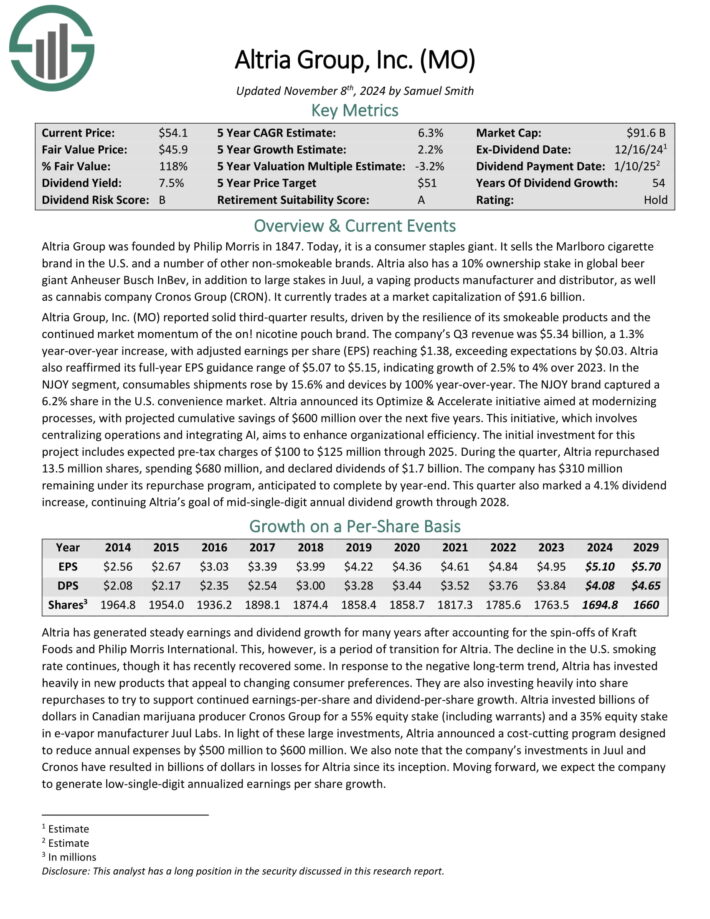

Philip Morris Worldwide (PM)

After being spun off from mum or dad firm Altria Group (MO) in 2008, Philip Morris is among the largest worldwide entrepreneurs of tobacco merchandise. The corporate affords many merchandise, however Marlboro is its most well-known model.

Tobacco utilization is falling within the U.S., however Philip Morris just isn’t uncovered to this market after separating from its mum or dad firm.

On October twenty second, 2024, Philip Morris reported its Q3 outcomes for the interval ending September thirtieth, 2024. For the quarter, the corporate posted web revenues of $9.91 billion, up 8.4% year-over-year. Adjusted EPS was $1.91, up 14.4% in comparison with Q3 2023. In fixed forex, adjusted EPS grew by a fair larger 18.0%.

Complete cargo volumes had been up 2.9% collectively, pushed by progress throughout the board. It was additionally encouraging to see that combustibles skilled an increase in quantity, successfully sustaining their optimistic trajectory after years of declines.

Particularly, cargo volumes in cigarettes, heated tobacco, and oral merchandise rose 2.9%, 8.9%, and 22.2%, respectively. The Swedish Match buyout considerably contributed to the rise in oral merchandise’ cargo volumes.

Click on right here to obtain our most up-to-date Certain Evaluation report on Philip Morris Worldwide (PM) (preview of web page 1 of three proven beneath):

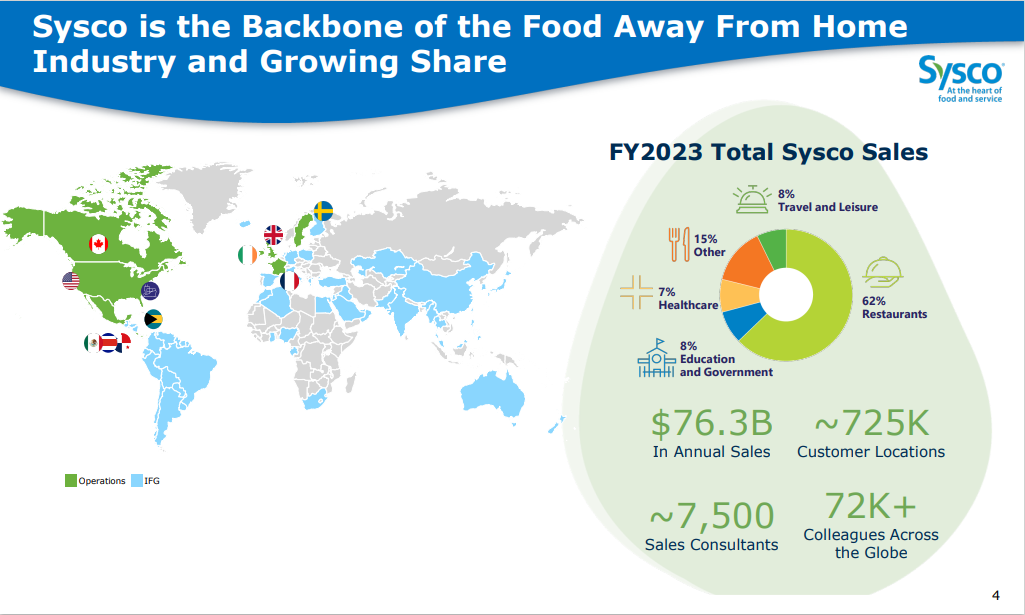

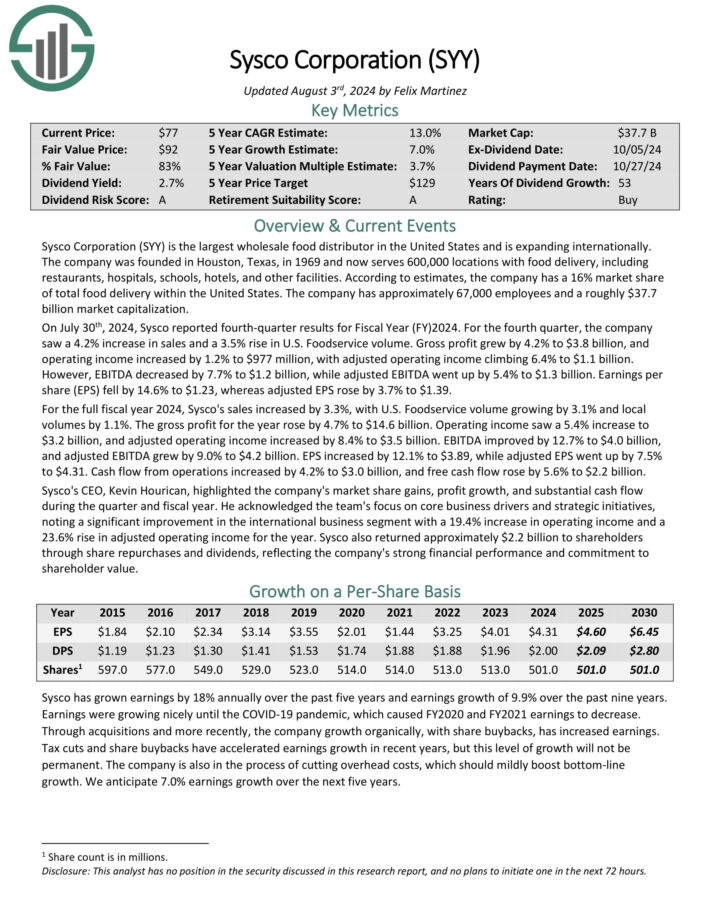

Sysco Company (SYY)

Sysco Company is the most important wholesale meals distributor in the USA. The corporate serves 600,000 areas with meals supply, together with eating places, hospitals, faculties, accommodations, and different amenities.

Supply: Investor Presentation

On July thirtieth, 2024, Sysco reported fourth-quarter outcomes for Fiscal Yr (FY) 2024. For the fourth quarter, the corporate noticed a 4.2% enhance in gross sales and a 3.5% rise in U.S. Foodservice quantity.

Gross revenue grew by 4.2% to $3.8 billion, and working revenue elevated by 1.2% to $977 million, with adjusted working revenue climbing 6.4% to $1.1 billion.

Nonetheless, EBITDA decreased by 7.7% to $1.2 billion, whereas adjusted EBITDA went up by 5.4% to $1.3 billion. Earnings per share (EPS) fell by 14.6% to $1.23, whereas adjusted EPS rose by 3.7% to $1.39.

Click on right here to obtain our most up-to-date Certain Evaluation report on SYY (preview of web page 1 of three proven beneath):

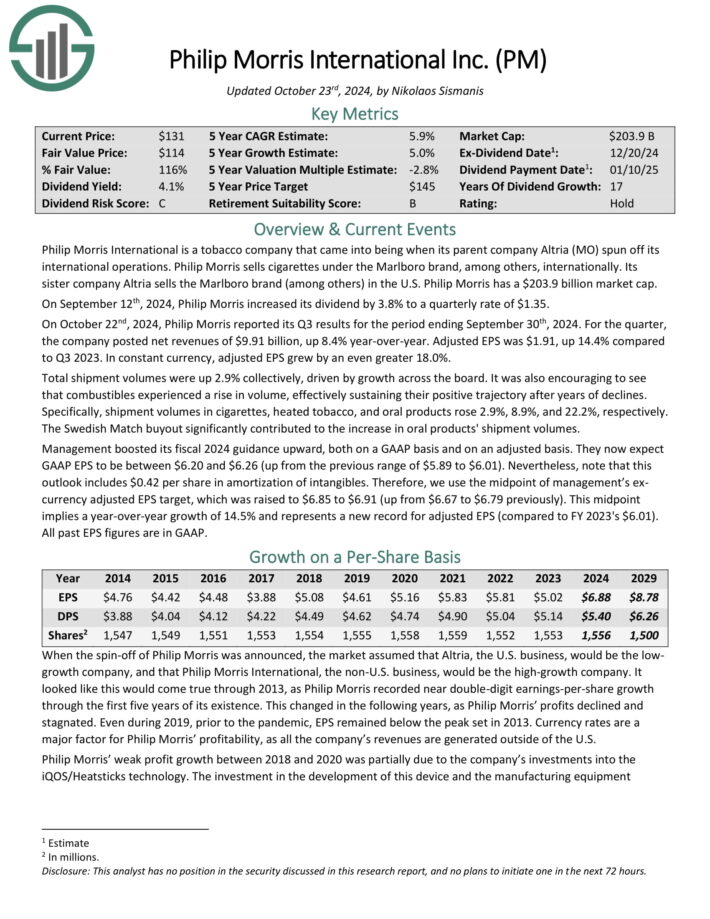

Altria Group (MO)

Altria Group was based by Philip Morris in 1847 and right now has grown right into a client staples big. Whereas it’s primarily recognized for its tobacco merchandise, it’s considerably concerned within the beer enterprise attributable to its 10% stake in international beer big Anheuser-Busch InBev.

Altria reported strong third-quarter outcomes, pushed by the resilience of its smokeable merchandise and the continued market momentum of the on! nicotine pouch model. The corporate’s Q3 income was $5.34 billion, a 1.3% year-over-year enhance, with adjusted earnings per share (EPS) reaching $1.38, exceeding expectations by $0.03.

Altria additionally reaffirmed its full-year EPS steerage vary of $5.07 to $5.15, indicating progress of two.5% to 4% over 2023.

In the course of the quarter, Altria repurchased 13.5 million shares, spending $680 million, and declared dividends of $1.7 billion. The corporate has $310 million remaining beneath its repurchase program, anticipated to finish by year-end.

Click on right here to obtain our most up-to-date Certain Evaluation report on Altria (preview of web page 1 of three proven beneath):

February, Might, August, and November Funds

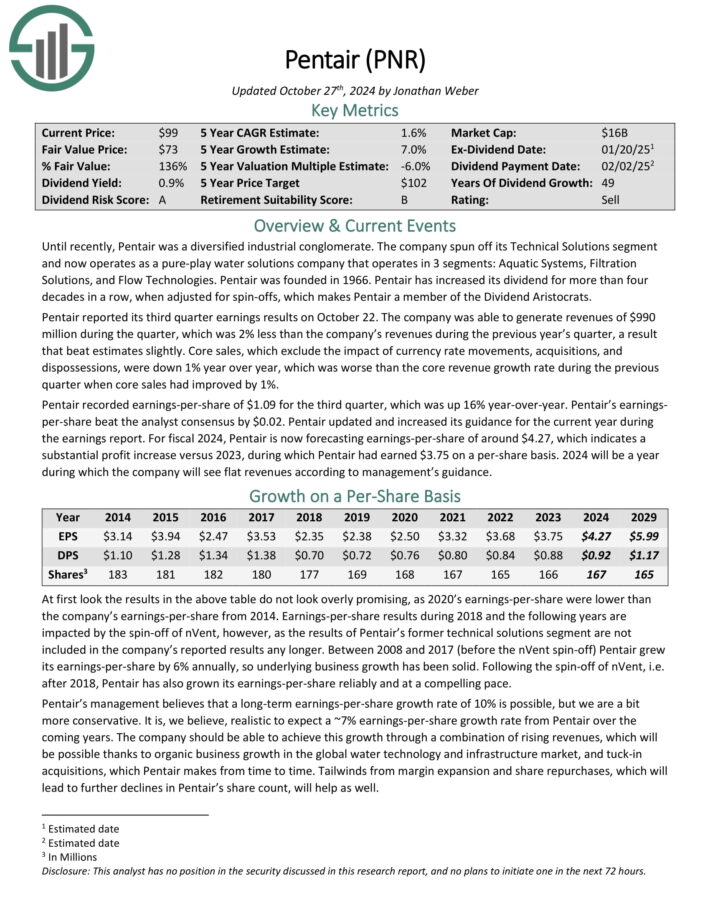

Pentair plc (PNR)

Pentair is a water options firm that operates in 3 segments: Aquatic Methods, Filtration Options, and Circulation Applied sciences. Pentair was based in 1966.

Pentair has elevated its dividend for greater than 4 a long time in a row, when adjusted for spin-offs. Pentair is among the high water shares.

Pentair reported its third quarter earnings outcomes on October 22. The corporate was capable of generate revenues of $990 million throughout the quarter, which was 2% lower than the corporate’s revenues throughout the earlier yr’s quarter, a outcome that beat estimates barely.

Core gross sales, which exclude the influence of forex price actions, acquisitions, and dispossessions, had been down 1% yr over yr, which was worse than the core income progress price throughout the earlier quarter when core gross sales had improved by 1%.

Pentair recorded earnings-per-share of $1.09 for the third quarter, which was up 16% year-over-year. Pentair’s earnings-per-share beat the analyst consensus by $0.02.

Click on right here to obtain our most up-to-date Certain Evaluation report on Pentair (preview of web page 1 of three proven beneath):

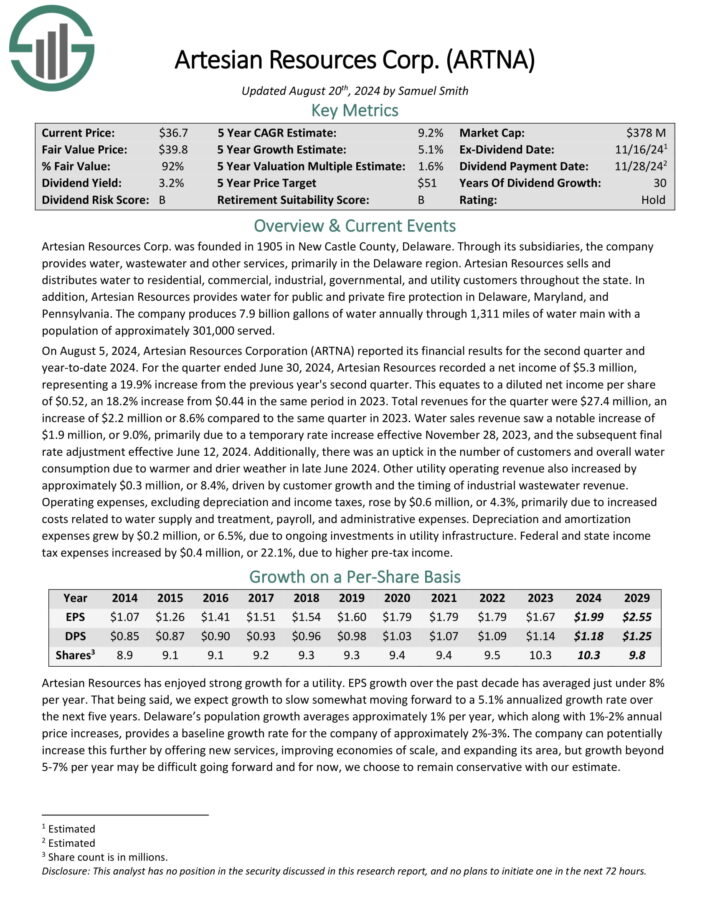

Artesian Assets (ARTNA)

Artesian Assets Corp. was based in 1905 in New Citadel County, Delaware. By means of its subsidiaries, the corporate gives water, wastewater and different providers, primarily within the Delaware area.

Artesian Assets sells and distributes water to residential, business, industrial, governmental, and utility clients all through the state.

As well as, Artesian Assets gives water for private and non-private fireplace safety in Delaware, Maryland, and Pennsylvania. The corporate produces 7.9 billion gallons of water yearly by way of 1,311 miles of water essential with a inhabitants of roughly 301,000 served.

On August 5, 2024, Artesian Assets Company (ARTNA) reported its monetary outcomes for the second quarter and year-to-date 2024. For the quarter ended June 30, 2024, Artesian Assets recorded a web revenue of $5.3 million, representing a 19.9% enhance from the earlier yr’s second quarter.

This equates to a diluted web revenue per share of $0.52, an 18.2% enhance from $0.44 in the identical interval in 2023. Complete revenues for the quarter had been $27.4 million, a rise of $2.2 million or 8.6% in comparison with the identical quarter in 2023.

Click on right here to obtain our most up-to-date Certain Evaluation report on ARTNA (preview of web page 1 of three proven beneath):

Westamerica Bancorp (WABC)

Westamerica Bancorporation is the holding firm for Westamerica Financial institution. Westamerica Bancorporation is a regional neighborhood financial institution with 79 branches in Northern and Central California. The corporate can hint its origins again to 1884. Westamerica Bancorporation affords purchasers entry to financial savings, checking and cash market accounts.

The corporate’s mortgage portfolio consists of each business and residential actual property loans, in addition to building loans. Westamerica Bancorporation is the seventh largest financial institution headquartered in California. It has annual revenues of about $325 million.

On October seventeenth, 2024 Westamerica Bancorporation reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, income decreased 10.8% to $74.4 million, however this was $3.6 million greater than anticipated. GAAP earnings-per-share of $1.31 in contrast unfavorably to $1.33 within the prior yr, however this was $0.07 above estimates.

Complete loans fell 8% to $831.4 million million as business loans had been decrease by 10.1% and client loans fell 22.1%. Business actual property loans, which make up greater than half of the full mortgage portfolio, had been unchanged. As of the tip of the quarter, nonperforming loans decreased 25.8% to $919,000 year-over-year.

As with the second quarter, this era had no provisions for credit score losses, in comparison with $400,000 within the third quarter of 2024. Internet curiosity revenue was $62.5 million, which compares to $64.1 million for the second quarter of 2024 and $72.1 million within the third quarter of 2023.

Click on right here to obtain our most up-to-date Certain Evaluation report on WABC (preview of web page 1 of three proven beneath):

Matthews Worldwide (MATW)

Matthews Worldwide Company gives model options, memorialization merchandise and industrial applied sciences on a world scale.

The corporate’s three enterprise segments are diversified. The SGK Model Options gives model improvement providers, printing tools, inventive design providers, and embossing instruments to the consumer-packaged items and packaging industries.

The Memorialization phase sells memorialization merchandise, caskets, and cremation tools to funeral house industries.

The Industrial applied sciences phase is smaller than the opposite two companies and designs, manufactures and distributes marking, coding and industrial automation applied sciences and options.

Matthews Worldwide reported third quarter outcomes on August 1st, 2024. The corporate reported gross sales of $428 million, a 9.3% decline in comparison with the identical prior yr interval.

The lower was the results of a big 30% gross sales decline in its Industrial Applied sciences phase.

Adjusted earnings had been $0.56 per share, a 24% lower from $0.74 a yr in the past. The corporate’s web debt leverage ratio rose sequentially from 3.6 to three.8.

Click on right here to obtain our most up-to-date Certain Evaluation report on MATW (preview of web page 1 of three proven beneath):

Procter & Gamble Co. (PG)

Procter & Gamble is a client staple big in its personal proper. The corporate has been in enterprise because the 1830s and has constructed a secure of well-known manufacturers, together with Pampers, Charmin, Gillette, Outdated Spice, Oral-B, and Head & Shoulders.

Over the previous few years, the corporate has been on an in depth thinning of its product strains, going from practically 170 manufacturers to only 65 core names.

In mid-October, Procter & Gamble reported (10/18/24) monetary outcomes for the primary quarter of fiscal 2025 (its fiscal yr ends June thirtieth). Its gross sales dipped -1% whereas its natural gross sales grew 2% over final yr’s quarter because of 1% value hikes and 1% quantity progress. Core earnings-per-share grew 5%, from $1.83 to $1.93, beating the analysts’ consensus by $0.03.

The agency gross sales amid sustained value hikes are a testomony to the energy of the manufacturers of Procter & Gamble. Nonetheless, we word a outstanding deceleration in value hikes within the final two quarters.

This means that the corporate can not hold elevating its costs aggressively anymore. Procter & Gamble reaffirmed its steerage for 3%-5% progress of natural gross sales and 5%-7% progress of earnings-per-share in fiscal 2025.

Click on right here to obtain our most up-to-date Certain Evaluation report on Procter & Gamble Co. (PG) (preview of web page 1 of three proven beneath):

March, June, September, and December Funds

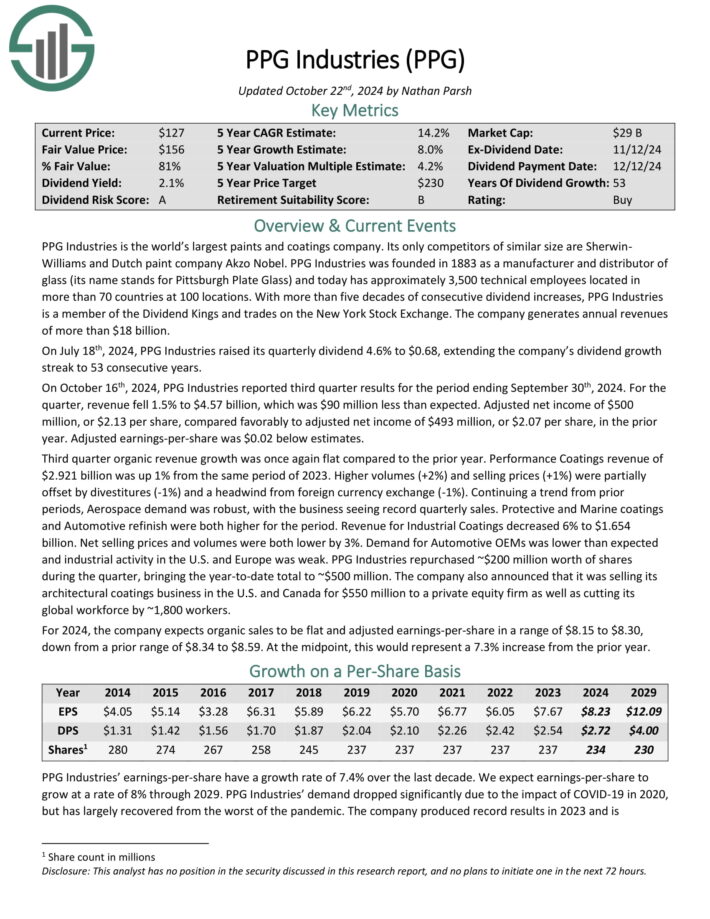

PPG Industries (PPG)

PPG Industries is the world’s largest paints and coatings firm. Its solely opponents of comparable dimension are Sherwin-Williams and Dutch paint firm Akzo Nobel.

On October sixteenth, 2024, PPG Industries reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, income fell 1.5% to $4.57 billion, which was $90 million lower than anticipated.

The corporate generates annual income of about $18.2 billion.

Supply: Investor Presentation

Adjusted web revenue of $500 million, or $2.13 per share, in contrast favorably to adjusted web revenue of $493 million, or $2.07 per share, within the prior yr. Adjusted earnings-per-share was $0.02 beneath estimates.

Third quarter natural income progress was as soon as once more flat in comparison with the prior yr. Efficiency Coatings income of $2.921 billion was up 1% from the identical interval of 2023.

Increased volumes (+2%) and promoting costs (+1%) had been partially offset by divestitures (-1%) and a headwind from international forex alternate (-1%).

Click on right here to obtain our most up-to-date Certain Evaluation report on PPG (preview of web page 1 of three proven beneath):

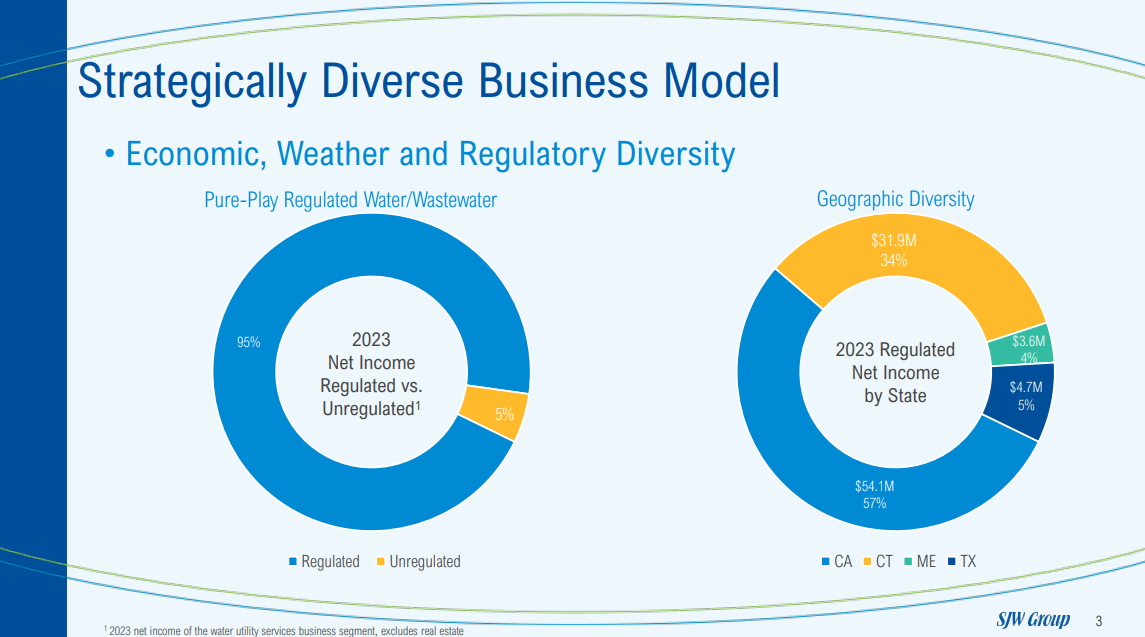

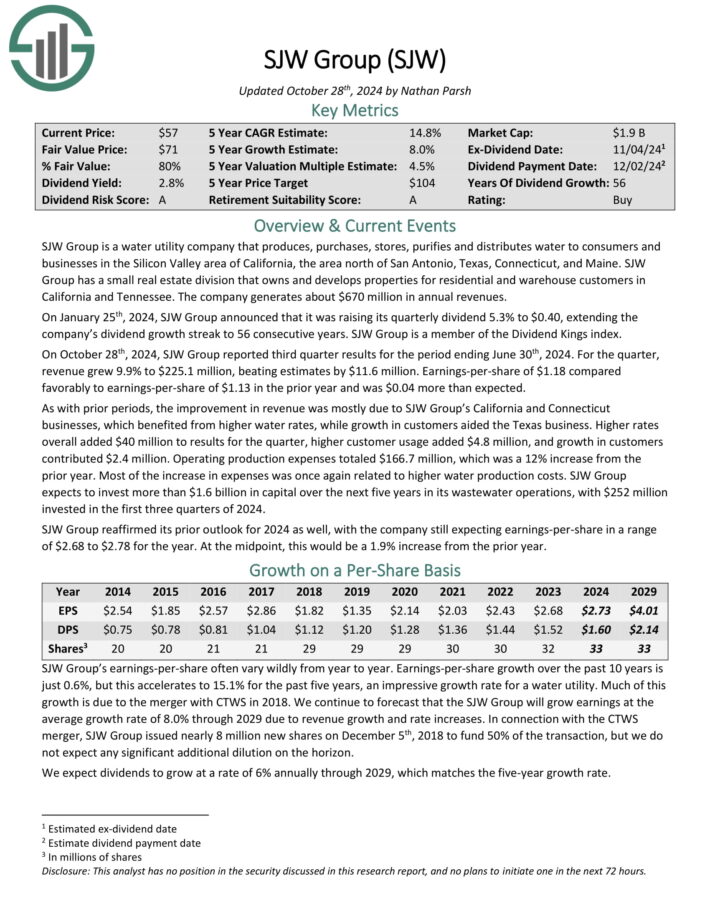

SJW Group (SJW)

SJW Group is a water utility firm that produces, purchases, shops, purifies and distributes water to shoppers and companies within the Silicon Valley space of California, the world north of San Antonio, Texas, Connecticut, and Maine.

SJW Group has a small actual property division that owns and develops properties for residential and warehouse clients in California and Tennessee. The corporate generates about $670 million in annual revenues.

Supply: Investor Presentation

On October twenty eighth, 2024, SJW Group reported third quarter outcomes for the interval ending June thirtieth, 2024. For the quarter, income grew 9.9% to $225.1 million, beating estimates by $11.6 million. Earnings-per-share of $1.18 in contrast favorably to earnings-per-share of $1.13 within the prior yr and was $0.04 greater than anticipated.

As with prior durations, the advance in income was largely attributable to SJW Group’s California and Connecticut companies, which benefited from increased water charges, whereas progress in clients aided the Texas enterprise.

Increased charges total added $40 million to outcomes for the quarter, increased buyer utilization added $4.8 million, and progress in clients contributed $2.4 million. Working manufacturing bills totaled $166.7 million, which was a 12% enhance from the prior yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on SJW (preview of web page 1 of three proven beneath):

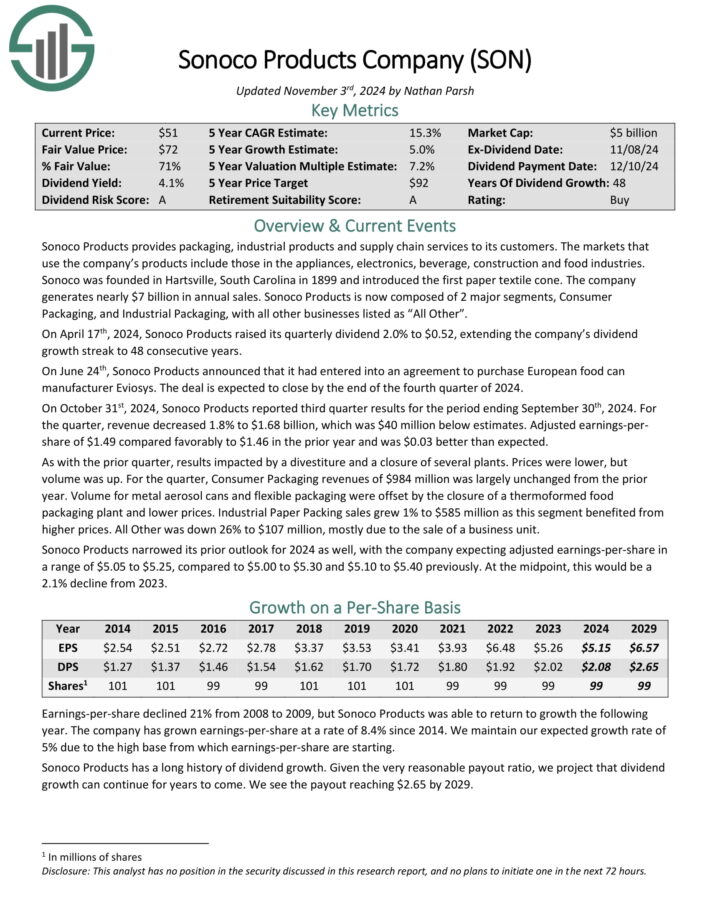

Sonoco Merchandise Firm (SON)

Sonoco Merchandise gives packaging, industrial merchandise and provide chain providers to its clients. The markets that use the corporate’s merchandise embrace these within the home equipment, electronics, beverage, building and meals industries.

The corporate generates practically $7 billion in annual gross sales. Sonoco Merchandise is now composed of two main segments, Client Packaging, and Industrial Packaging, with all different companies listed as “All Different”.

Supply: Investor Presentation

On October thirty first, 2024, Sonoco Merchandise reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, income decreased 1.8% to $1.68 billion, which was $40 million beneath estimates.

Adjusted earnings-per share of $1.49 in contrast favorably to $1.46 within the prior yr and was $0.03 higher than anticipated.

As with the prior quarter, outcomes impacted by a divestiture and a closure of a number of crops. Costs had been decrease, however quantity was up.

For the quarter, Client Packaging revenues of $984 million was largely unchanged from the prior yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on Sonoco (SON) (preview of web page 1 of three proven beneath):

Eversource Power (ES)

Eversource Power is a diversified holding firm with subsidiaries that present regulated electrical, fuel, and water distribution service within the Northeast U.S.

The corporate’s utilities serve greater than 4 million clients after buying NStar’s Massachusetts utilities in 2012, Aquarion in 2017, and Columbia Fuel in 2020.

Eversource has delivered regular progress to shareholders for a few years.

Supply: Investor Presentation

On November 4th, 2024, Eversource Power launched its third-quarter 2024 outcomes for the interval ending September thirtieth, 2024.

For the quarter, the corporate reported a web lack of $(118.1) million, a pointy decline from earnings of $339.7 million in the identical quarter of final yr, which displays the influence of the corporate’s exit from offshore wind investments.

The corporate reported a loss per share of $(0.33), in contrast with earnings-per-share of $0.97 within the prior yr. Earnings from the Electrical Transmission phase elevated to $174.9 million, up from $160.3 million within the prior yr, primarily attributable to the next stage of funding in Eversource’s electrical transmission system.

Click on right here to obtain our most up-to-date Certain Evaluation report on ES (preview of web page 1 of three proven beneath):

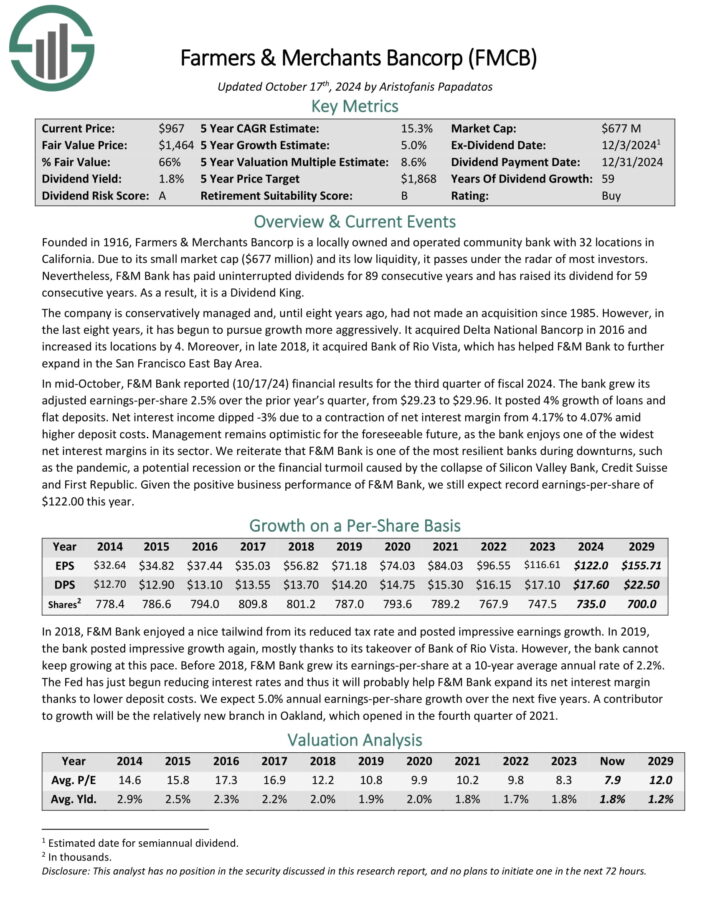

Farmers & Retailers Bancorp (FMCB)

Farmers & Retailers Bancorp is a regionally owned and operated neighborhood financial institution with 32 areas in California. Attributable to its small market cap and its low liquidity, it passes beneath the radar of most buyers.

F&M Financial institution has paid uninterrupted dividends for 88 consecutive years and has raised its dividend for 59 consecutive years.

In mid-October, F&M Financial institution reported (10/17/24) monetary outcomes for the third quarter of fiscal 2024. The financial institution grew its adjusted earnings-per-share 2.5% over the prior yr’s quarter, from $29.23 to $29.96.

It posted 4% progress of loans and flat deposits. Internet curiosity revenue dipped -3% attributable to a contraction of web curiosity margin from 4.17% to 4.07% amid increased deposit prices.

F&M Financial institution is a prudently managed financial institution, which has all the time focused a conservative capital ratio. The financial institution at the moment has a complete capital ratio of 14.95%, which ends up in the very best regulatory classification of “nicely capitalized.”

Furthermore, its credit score high quality stays exceptionally robust, as there are extraordinarily few non-performing loans and leases in its portfolio.

Click on right here to obtain our most up-to-date Certain Evaluation report on FMCB (preview of web page 1 of three proven beneath):

Closing Ideas

Buyers in search of constant month-to-month money flows can assemble a portfolio of high-quality names with lengthy histories of elevating dividends.

The shares created to create this diversified mannequin portfolio yield twice as a lot because the S&P 500 Index. These names even have at the very least 25 years of consecutive dividend will increase.

Buyers can scale this portfolio to fulfill their wants, and future revenue will certainly enhance because of the common dividend will increase that the majority, if not all, of those firms will present.

This will present the investor in retirement with secure money flows that can be utilized to fulfill their wants.

If you’re keen on discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Certain Dividend databases might be helpful:

The main home inventory market indices are one other strong useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them recurrently:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].