Up to date on March thirty first, 2025 by Nathan Parsh

Buyers are sometimes interested in dividend-paying shares due to the revenue they produce. Dividend shares present revenue even whereas the worth of the inventory can fluctuate.

Some firms pay month-to-month dividends, which offer extra constant money stream for traders. Practically 80 shares pay a month-to-month dividend.

You may obtain our full record of month-to-month dividend-paying shares (together with price-to-earnings ratios, dividend yields, and payout ratios) by clicking on the hyperlink beneath:

Ellington Monetary Inc (EFC) is a Actual Property Funding Belief (REIT) that pays a month-to-month dividend. The inventory has a really excessive dividend yield of 11.8%.

Nonetheless, such high-yielding shares will be flashing a warning signal that the underlying enterprise is going through challenges. Shares with extraordinarily excessive yields above 10% would possibly disappoint traders with a dividend minimize afterward. These “yield traps” must be averted.

This text will study Ellington Monetary’s enterprise mannequin, progress prospects, and its dividend security.

Enterprise Overview

Ellington Monetary solely transitioned right into a REIT in the beginning of 2019. Earlier than this, the belief was taxed as a partnership. It’s now categorised as a mortgage REIT.

Ellington Monetary is a hybrid REIT, that means that the belief is a mix of an fairness REIT, which owns properties, and mortgage REITs, which put money into mortgage loans and mortgage-backed securities.

The corporate manages mortgage-backed securities backed by prime jumbo loans, Alt-A loans, manufactured housing loans, and subprime residential mortgage loans.

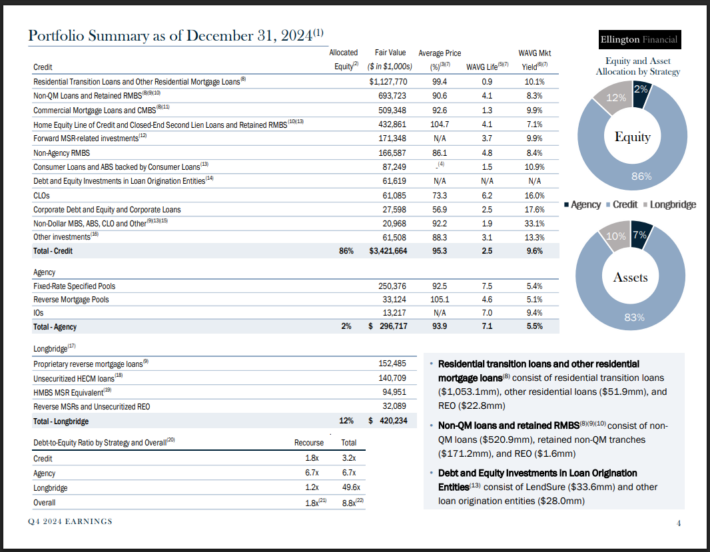

Ellington Monetary has a market capitalization of about $1.2 billion. You may see a snapshot of Ellington’s funding portfolio within the picture beneath:

Supply: Investor Presentation

On February twenty seventh, 2025, Ellington Monetary reported its This fall outcomes for the interval ending December thirty first, 2024. As a result of nature of the corporate’s enterprise mannequin, Ellington doesn’t report income. As a substitute, it data solely revenue.

For the quarter, gross curiosity revenue was $108 million, up 9.4% 12 months over 12 months and 6.2% quarter over quarter. Adjusted (beforehand known as “core”) EPS was $0.45, $0.18 higher than This fall 2023 and 5 cents larger than Q3 2024.

The rise was pushed by sturdy originations and securitization-related positive factors in Longbridge Monetary, which the corporate bought in 2022. Ellington’s e-book worth per share fell from $13.66 to $13.52 for the quarter.

Development Prospects

Ellington’s EPS era has been fairly inconsistent over the previous decade, as charges have primarily been lowering over that point. In consequence, its per-share dividend has additionally principally been falling since 2015.

Nonetheless, the corporate has achieved its greatest to diversify its portfolio and scale back its efficiency variance.

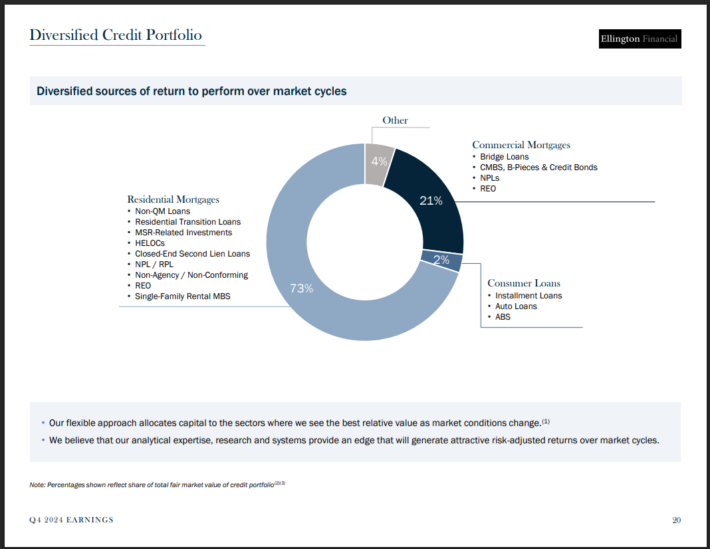

Moreover, its residential mortgage investments are diversified amongst many alternative safety sorts (Non-QM, Reverse mortgages, REOs, and so on.).

Ellington has taken steps to not focus its danger its portfolio, which improves financial return volatility.

Supply: Investor Presentation

Ellington has designed its portfolio in such a approach that actions in charges over time gained’t have a significant influence on its total portfolio.

The Federal Reserve has acknowledged it’s more likely to lower rates of interest sooner or later if inflation reaches its goal, which might profit the corporate.

At Ellington’s present portfolio building, a 50 foundation level decline in rates of interest would end in $2.2 million in fairness positive factors (i.e., 0.14% of fairness), whereas a 50 foundation level enhance in charges would end in losses of $9.7 million (-0.61% of fairness).

We anticipate 1% annual EPS progress over the subsequent 5 years for EFC.

Aggressive Benefit & Recession Efficiency

Ellington doesn’t possess any vital aggressive benefit, however one benefit is that the steadiness sheet stays of top quality.

As an example, EFC’s recourse debt to fairness ratio was 1.8x in This fall, steady on a sequential foundation however down from 2x on the finish of 2023 as a consequence of a decline in borrowings on its smaller however extra extremely levered Company RMBS portfolio and a drop in its recourse borrowings associated to its securitization of proprietary reverse mortgage loans.

Concerning recession efficiency, Ellington Monetary was not a public firm in the course of the Nice Recession, however its share value was decimated on the onset of the COVID-19 pandemic.

EFC’s earnings and dividends have recovered because the pandemic ended, however each measures stay beneath their 2014 ranges.

Dividend Evaluation

Ellington Monetary has a risky dividend historical past with a number of reductions adopted by will increase. The corporate minimize its month-to-month dividend from $0.15 to $0.08 in Q1 2020 as a result of pandemic, however administration has elevated it a number of occasions since then.

In This fall 2023, EFC minimize the month-to-month dividend from $0.15 to $0.13, which the board permitted to construct some fairness worth. The dividend has remained on the similar price since. Presently, EFC has an annual dividend payout of $1.56 per share.

It is a problematic signal for the dividend’s security, and subsequently, the corporate’s DPS shouldn’t be seen as protected in the meanwhile.

With a yield approaching 12%, the inventory is undoubtedly enticing for revenue traders, though a excessive stage of volatility is to be anticipated.

Ellington’s payout ratio has averaged 85% during the last 5 years, although it has typically been above 100% beforehand. Buyers must be conscious that the anticipated payout ratio for 2025 is 111%.

Since its IPO, the corporate has paid cumulative dividends in extra of $34/share, which is almost 3 times its present share value. Subsequently, it has delivered a strong revenue stream to its shareholders through the years.

Remaining Ideas

Excessive-yield dividend shares should all the time be thought of fastidiously, as their elevated yield is commonly a warning signal of basic deterioration.

This appears to be the case with Ellington Monetary, as the corporate has exhibited nice volatility in its dividend funds.

The belief has a diversified mortgage portfolio and has efficiently elevated its profitability over time. Ellington Monetary’s dividend yield additionally seems protected for now, although one other minimize could possibly be attainable if the belief noticed a slowdown in its enterprise.

EFC has a horny yield of 11.8%, however the inventory carries an elevated stage of danger.

Extra Studying

Don’t miss the sources beneath for extra month-to-month dividend inventory investing analysis.

And see the sources beneath for extra compelling funding concepts for dividend progress shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.