Revealed on February 4th, 2025 by Bob Ciura

Spreadsheet information up to date every day

The Dividend Aristocrats are a choose group of 69 S&P 500 shares with 25+ years of consecutive dividend will increase.

The necessities to be a Dividend Aristocrat are:

- Be within the S&P 500

- Have 25+ consecutive years of dividend will increase

- Meet sure minimal measurement & liquidity necessities

There are at the moment 69 Dividend Aristocrats. You may obtain an Excel spreadsheet of all 69 (with metrics that matter akin to dividend yields and price-to-earnings ratios) by clicking the hyperlink beneath:

Disclaimer: Certain Dividend will not be affiliated with S&P International in any manner. S&P International owns and maintains The Dividend Aristocrats Index. The knowledge on this article and downloadable spreadsheet relies on Certain Dividend’s personal evaluate, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person buyers higher perceive this ETF and the index upon which it’s primarily based. Not one of the data on this article or spreadsheet is official information from S&P International. Seek the advice of S&P International for official data.

Annually in late January, Customary & Poor’s updates the listing of Dividend Aristocrats with additions and/or deletions. For 2025, there are three additions to the Dividend Aristocrats listing.

This text will present an in depth evaluation on the three new Dividend Aristocrats for 2025.

Desk of Contents

New Dividend Aristocrat For 2025: FactSet Analysis Techniques (FDS)

- Dividend Historical past: 25 years of consecutive will increase

- Dividend Yield: 0.9%

FactSet Analysis Techniques is a monetary information and analytics agency based in 1978. It offers built-in monetary data and analytical instruments to the funding neighborhood within the Americas, Europe, the Center East, Africa, and Asia-Pacific.

The corporate offers perception and data via analysis, analytics, buying and selling workflow options, content material and know-how options, and wealth administration.

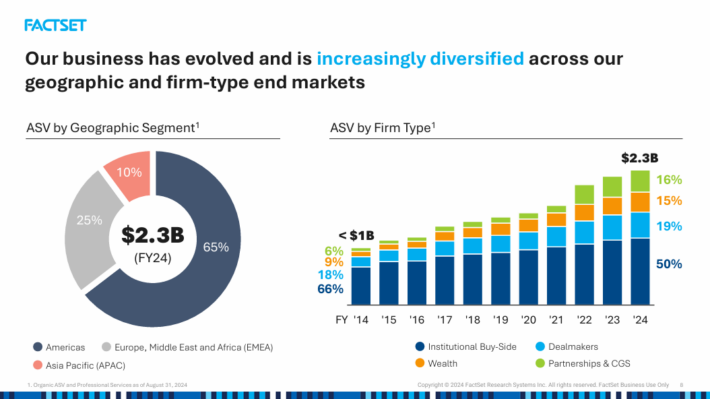

Supply: Investor Presentation

On December nineteenth, 2024, FactSet Analysis Techniques introduced Q1 2025 outcomes, reporting non-GAAP EPS of $4.37 for the interval, beating market consensus by $0.09 whereas income rose 4.9% to $568.7 million.

FactSet Analysis Techniques kicked off fiscal 2025 with strong, but measured development in Q1, reporting GAAP revenues of $568.7 million, a 4.9% year-over-year enhance.

The income enhance was pushed by sturdy efficiency throughout its wealth administration, asset proprietor, and institutional shopper segments.

Natural Annual Subscription Worth (ASV), a key efficiency metric, rose 4.5% to $2.25 billion, reflecting sustained demand for FactSet’s monetary information and analytics options.

FactSet has grown its earnings-per-share by a mean compound development price of 10.3% over the past 10 years. Its investments and improved product choices might result in vital margin growth within the following years.

We now have elevated our EPS estimate for 2025 to $17.10, matching the midpoint of the administration’s steering, however we have now maintained our 8.5% annual earnings development forecast for the subsequent 5 years.

Click on right here to obtain our most up-to-date Certain Evaluation report on FDS (preview of web page 1 of three proven beneath):

New Dividend Aristocrat For 2025: Erie Indemnity (ERIE)

- Dividend Historical past: 34 years of consecutive will increase

- Dividend Yield: 1.3%

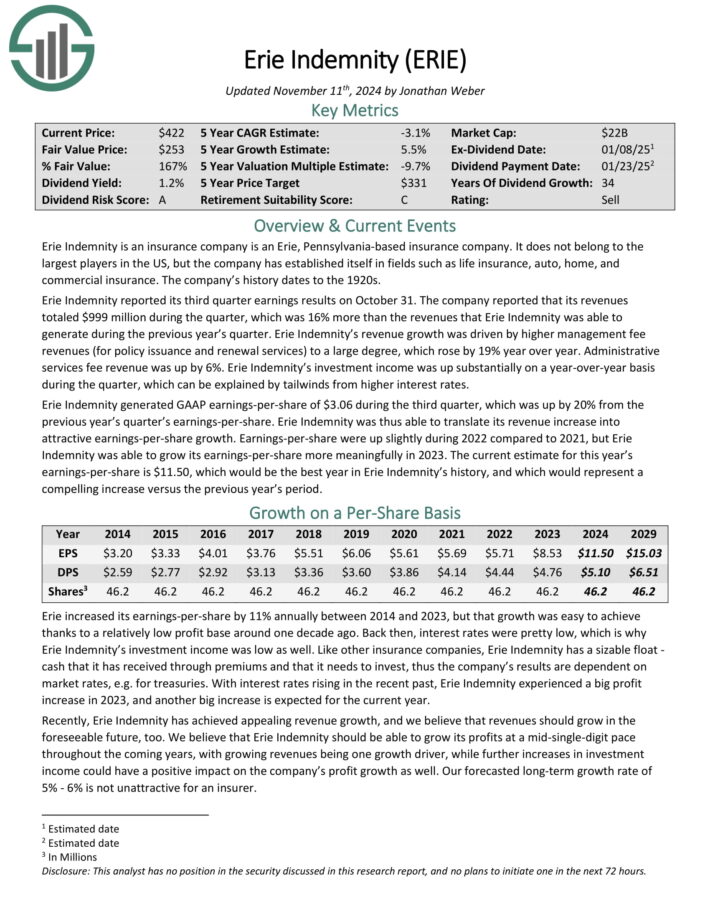

Erie Indemnity is an insurance coverage firm that has established itself in life insurance coverage, auto, residence, and business insurance coverage. The corporate’s historical past dates to the Nineteen Twenties.

Erie Indemnity reported its third quarter earnings outcomes on October 31. Income totaled $999 million in the course of the quarter, up 16% year-over-year.

Income development was pushed by greater administration payment revenues (for coverage issuance and renewal companies), which rose by 19% year-over-year. Administrative companies payment income grew 6%.

Erie Indemnity’s funding revenue was up considerably on a year-over-year foundation in the course of the quarter, which could be defined by tailwinds from greater rates of interest.

Erie Indemnity generated GAAP earnings-per-share of $3.06 in the course of the third quarter, which was up by 20% year-over-year.

Like different insurance coverage firms, Erie Indemnity has a large float–money that it has acquired via premiums that it invests. Subsequently, its monetary outcomes are considerably depending on market charges.

We consider that Erie Indemnity ought to be capable of develop its income at a mid-single-digit price over the subsequent 5 years.

Development will likely be pushed by greater premium income, whereas additional will increase in funding revenue might have a constructive affect on EPS development as properly.

Click on right here to obtain our most up-to-date Certain Evaluation report on ERIE (preview of web page 1 of three proven beneath):

New Dividend Aristocrat For 2025: Eversource Vitality (ES)

- Dividend Historical past: 27 years of consecutive will increase

- Dividend Yield: 5.2%

Eversource Vitality is a diversified holding firm with subsidiaries that present regulated electrical, gasoline, and water distribution service within the Northeast U.S.

The corporate’s utilities serve greater than 4 million clients after buying NStar’s Massachusetts utilities in 2012, Aquarion in 2017, and Columbia Fuel in 2020.

Eversource has delivered regular development to shareholders for a few years.

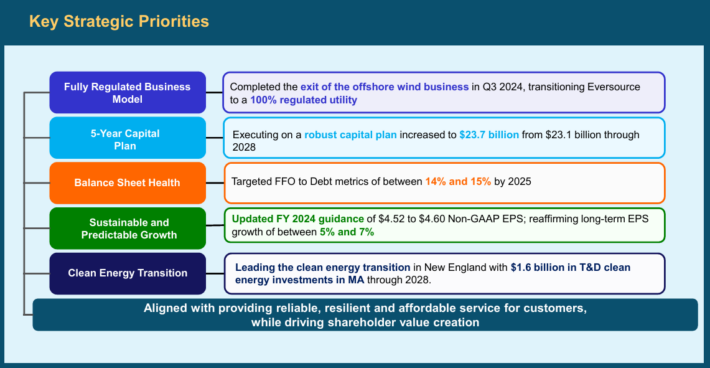

Supply: Investor Presentation

On November 4th, 2024, Eversource Vitality launched its third-quarter 2024 outcomes for the interval ending September thirtieth, 2024.

For the quarter, the corporate reported a web lack of $(118.1) million, a pointy decline from earnings of $339.7 million in the identical quarter of final 12 months, which displays the affect of the corporate’s exit from offshore wind investments.

The corporate reported a loss per share of $(0.33), in contrast with earnings-per-share of $0.97 within the prior 12 months.

Earnings from the Electrical Transmission phase elevated to $174.9 million, up from $160.3 million within the prior 12 months, primarily resulting from a better degree of funding in Eversource’s electrical transmission system.

We anticipate the corporate to develop its earnings-per-share by 6% per 12 months on common over the subsequent 5 years.

The corporate has a superb earnings observe report and can profit from price hikes, transmission investments, and clear vitality initiatives.

Click on right here to obtain our most up-to-date Certain Evaluation report on ES (preview of web page 1 of three proven beneath):

Remaining Ideas

All Dividend Aristocrats are high-quality companies primarily based on their lengthy dividend histories. An organization can not pay rising dividends for 25+ years with out having a robust and sturdy aggressive benefit.

FactSet Analysis Techniques, Erie Indemnity, and Eversource Vitality are the three new additions to the Dividend Aristocrats listing.

Whereas the three new Dividend Aristocrats have totally different enterprise fashions, development catalysts, and dividend yields, all of them have confirmed to be dedicated to rising their dividends.

Moreover, the next Certain Dividend databases comprise essentially the most dependable dividend growers in our funding universe:

For those who’re in search of shares with distinctive dividend traits, take into account the next Certain Dividend databases:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].