- NVIDIA’s Q3 outcomes confirmed a 94% income improve, surpassing expectations.

- Considerations embody a slowdown in income development and potential chip provide points.

- A possible 17% inventory decline is indicated, however long-term development could current shopping for alternatives.

- Prepare for large financial savings on InvestingPro this Black Friday! Entry premium market information and supercharge your analysis at a reduction. Do not miss out – click on right here to avoid wasting 55%!

NVIDIA, the world’s largest firm by market capitalization, has been a dependable indicator of the speedy development of synthetic intelligence.

The behemoth has constantly exceeded expectations for earnings per share and income – because it did within the third quarter of this 12 months. Nonetheless, this time, it did not impress on its ahead steering, as the corporate anticipates a slowdown in income development by a number of proportion factors within the upcoming quarter.

The InvestingPro instrument signifies that the potential correction may very well be extra substantial because of present prolonged valuation metrics.

Let’s check out the primary takeaways from the report back to assess how the corporate’s rock-solid financials take care of yesterday’s report.

Custom Maintained: Forecasts Surpassed

It is turn out to be a convention for NVIDIA to surpass market expectations on key monetary indicators each quarter.

This quarter was no exception. There have been 32 upward revisions and solely 2 downward, resulting in an earnings per share of $0.78 and revenues of $35.1 billion, marking a exceptional 94% improve year-over-year within the latter.

Determine 1: NVIDIA’s quarterly outcomes for Q3, supply: InvestingPro

The remainder of the figures look equally spectacular, led by information middle income, which got here in at $30.8 billion, up 6% from forecasts of $29.14 billion (+17% okay/okay and +112% y/y).

Additionally noteworthy was the gaming section reporting revenues of $3.3 billion in opposition to forecasts of $3.06 billion. Nearly to the purpose, analysts managed to estimate gross margins of 75% as an alternative, however this doesn’t change the general image of total outcomes.

Ahead Steering

The market seems involved by the printed forecasts for This autumn, which point out, amongst different issues, a deceleration in income development from 94% to 69.5%.

There can also be some concern about indications that the availability of Blackwell and Hopper AI chips because of go on sale later this 12 months could have provide constraints because of capability points at key associate TCSM.

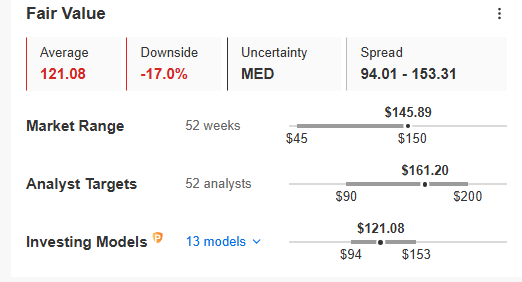

A corrective situation is indicated by InvestingPro’s truthful worth, which indicators the potential for a list decline of as much as 17%.

Determine 2: NVIDIA truthful worth index, supply: InvestingPro

Is Nvidia (NASDAQ:) Nonetheless Price a Purchase? Ranges to Watch

If the corrective situation is certainly realized nonetheless must be a great alternative to connect with the uptrend because of the truth that finally the info doesn’t give grounds for a deeper plunge within the worth.

At the moment, the inventory is transferring inside a worth channel, the breakout of the underside of which opens the best way for an assault on the confluence of the upward development line and the assist degree situated within the worth space of $130 per share.

Determine 3 Technical evaluation of NVIDIA

If this space is damaged out, then it is going to be doable to appreciate truthful worth, which coincides with the demand zone fashioned in early October this 12 months.

Conversely, a breakout above the all-time excessive would sign the beginning of a brand new bull run, with a probable try to assault no less than $160 per share.

You’ll want to subscribe to InvestingPro now for as much as 55% off as a part of our Early Chicken Black Friday sale!

***

Disclaimer: This text is for informational functions solely. It’s not meant as a solicitation, provide, recommendation, or advice to buy any asset. All investments must be evaluated from a number of views, and it is very important keep in mind that any funding determination and the related dangers are the only real accountability of the investor. Moreover, no funding advisory providers are supplied.