Oil costs

are plunging this morning after

OPEC+ agreed

over the weekend to launch extra oil right into a world the place the worldwide economic system and demand are threatened by

Donald Trump’s tariffs.

The group — led by

Saudi Arabia

and Russia — introduced it will enhance output by 411,000 barrels per day from June, after the same enhance final month. Complete hikes now quantity to virtually 1 million bpd, erasing a lot of the two.2 million bpd cuts that had been in place since October 2022.

This isn’t what the worldwide oil alliance usually does. When costs are low their technique has most frequently been to chop output to maintain costs at round US$80 a barrel.

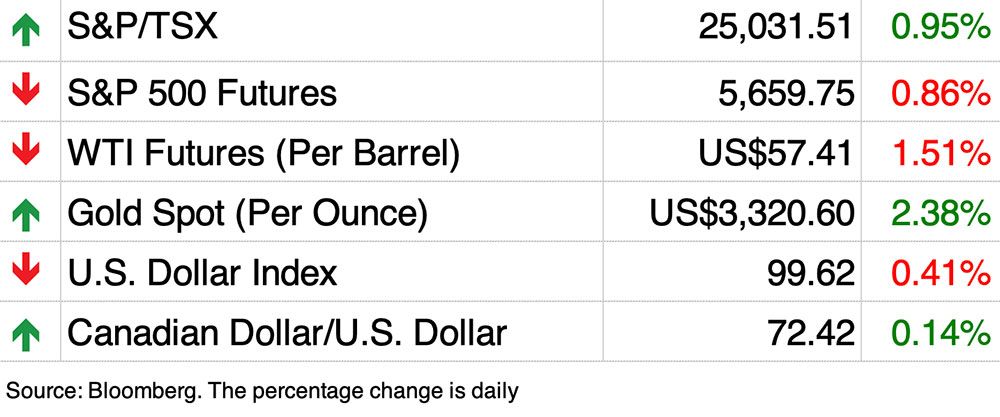

But in the present day the benchmark Brent crude fell as a lot as 4.6 per cent towards US$58 a barrel, whereas

West Texas Intermediate

dropped to US$56.

Oil was already one of many

worst performing commodities

this yr with Trump’s tariff battle threatening to considerably sluggish international progress and power demand. What has analysts puzzled is why OPEC+ would stoke the selloff with this coverage pivot.

The rise from OPEC+ “merely can’t be absorbed,” Ajay Parmar, director of oil analytics at ICIS informed Bloomberg. “Demand progress is weak, notably with the current imposition of tariffs.”

The favorite concept is that Saudi Arabia is punishing OPEC members who haven’t been toeing the road on agreed output cuts. The Saudis have taken on the brunt of manufacturing reductions whereas Kazakhstan and Iraq have been typically accused of not complying with their quotas.

Oil costs dove final week after media studies that Saudi Arabia had briefed allies that it will not prop up the worldwide oil market with its cuts.

“One will get the sense that persistence is working skinny in Riyadh and, as we’ve argued earlier than, it’s absolutely a case of when, not if, Saudi opens the faucets,” stated David Oxley, commodities economist with Capital Economics.

“Because the sharp manufacturing rise in April 2020 attests, the Kingdom has proved itself prepared and capable of transfer a lot additional and quicker to make some extent.”

Others argue the Saudis try to curry favour with Trump who’s scheduled to journey to the Center East later this month. The U.S. president has referred to as on OPEC+ to extend manufacturing to assist deliver down power costs.

Nevertheless, these decrease costs might in flip cripple the U.S.

shale oil {industry}

which wants costs above US$40 to $50 to interrupt even — and that doesn’t match with Trump’s ‘Made in America’ power coverage.

That additionally could be the Saudis’ motivation, pushing U.S. shale operators, which have accounted for many of the world’s oil manufacturing progress over the previous 20 years, out of enterprise.

“The precise motive stays unclear. However the course of oil costs is clearer than the explanations behind OPEC’s transfer,” stated Ipek Ozkardeskaya, senior analyst of Swissquote Financial institution.

“If Saudi is able to dive, oil costs have room to dive additional.”

After Saturday’s OPEC+ choice, Wall Avenue banks, together with Goldman Sachs Group Inc. and Morgan Stanley, lower their oil forecast by as a lot as US$5 a barrel.

“The bears’ $50pb value goal appears to be like simpler to succeed in now than three days in the past,” stated Ozkardeskaya.

Enroll right here to get Posthaste delivered straight to your inbox.

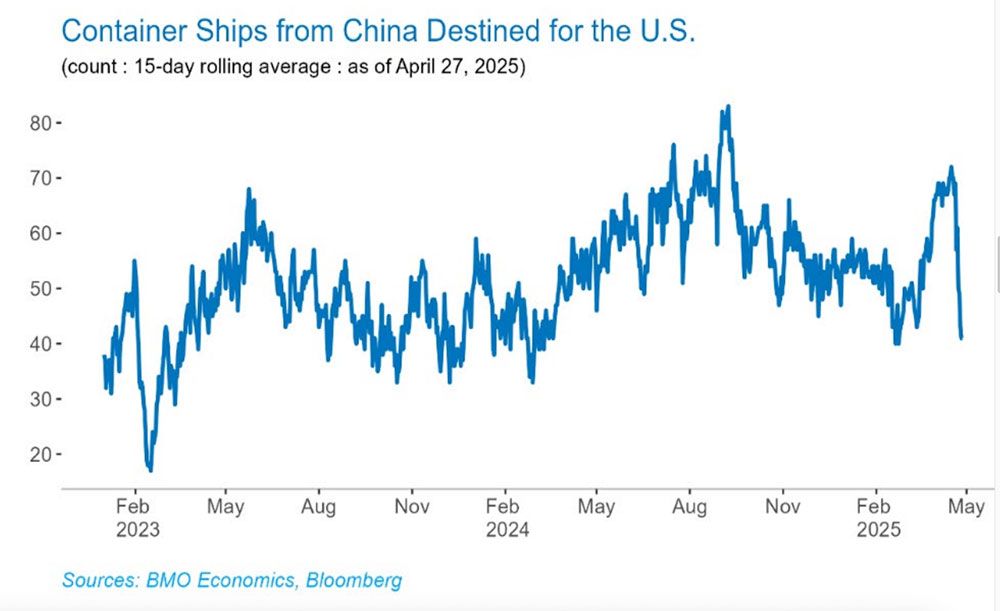

The variety of container ships leaving China for america has dropped dramatically since commerce battle has damaged out. With the exporting big going through a 145 per cent tariffs on items going to the U.S., cargo shipments have plummeted to 41, down 30 per cent from the yr earlier than.

This threatens different components of the U.S. logistical provide chain resembling trucking and rail in addition to retail commerce, stated Erik Johnson, senior economist at BMO Capital Markets.

“We realized again in 2020 that it’s so much simpler to show off components of the worldwide provide chain than to restart them. And the longer commerce between China and the U.S. stays disrupted, the larger the shock that may ultimately circulate by to the broader economic system,” he stated.

U.S. retailers are warning of a provide shock that might final all the way in which to Christmas.

In a gathering final month, Walmart Inc. and Goal Corp informed U.S. President Donald Trump that not solely are consumers prone to see greater costs, however empty cabinets as properly.

- The Toronto Regional Actual Property Board will launch information on April’s dwelling gross sales exercise for the Larger Toronto Space on Monday.

- A $500-million settlement in a pair of class-action lawsuits involving Loblaw Cos. Ltd. and its dad or mum firm George Weston Ltd. will go earlier than a courtroom Monday in Toronto for approval. If the settlement is authorized, it is going to resolve the claims towards Loblaw and Weston referring to an alleged industry-wide scheme to repair the worth of bread.

- Earnings: Parkland Corp., TMX Group Ltd., Ford Motor Co., RioCan Actual Property Funding, Loews Corp., Baytex Vitality Corp., Tyson Meals Inc.

- As Carney prepares to have interaction with Trump, destiny of CUSMA hangs within the steadiness

- Notice to Mr. Carney: There’s a motive few Canadians go for 10-year mortgage phrases

- Ottawa could not need to get out of the pipeline enterprise simply but: Trans Mountain CEO

Louie in Winnipeg, 59, was not too long ago made redundant and need to know the right way to protect his capital till his pension advantages kick in. FP Solutions provides two monetary techniques for him to consider: delaying CPP and OAS to age 70 and revisiting his 60/40 fairness to mounted earnings funding portfolio.

Discover out extra

McLister on mortgages

Need to study extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Put up column

might help navigate the advanced sector, from the most recent traits to financing alternatives you received’t need to miss. Plus verify his

mortgage charge web page

for Canada’s lowest nationwide mortgage charges, up to date every day.

Monetary Put up on YouTube

Go to the Monetary Put up’s

YouTube channel

for interviews with Canada’s main consultants in enterprise, economics, housing, the power sector and extra.

At the moment’s Posthaste was written by Pamela Heaven with extra reporting from Monetary Put up employees, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? E-mail us at

.

Bookmark our web site and assist our journalism: Don’t miss the enterprise information you should know — add financialpost.com to your bookmarks and join our newsletters right here