-

Nasdaq has damaged resistance, Bitcoin gaining too.

-

Bitcoin/threat belongings are scheduled for a seasonal increase.

-

(however) Volatility season just isn’t over but.

-

Election is ready to ship a binary company tax consequence (up vs down).

-

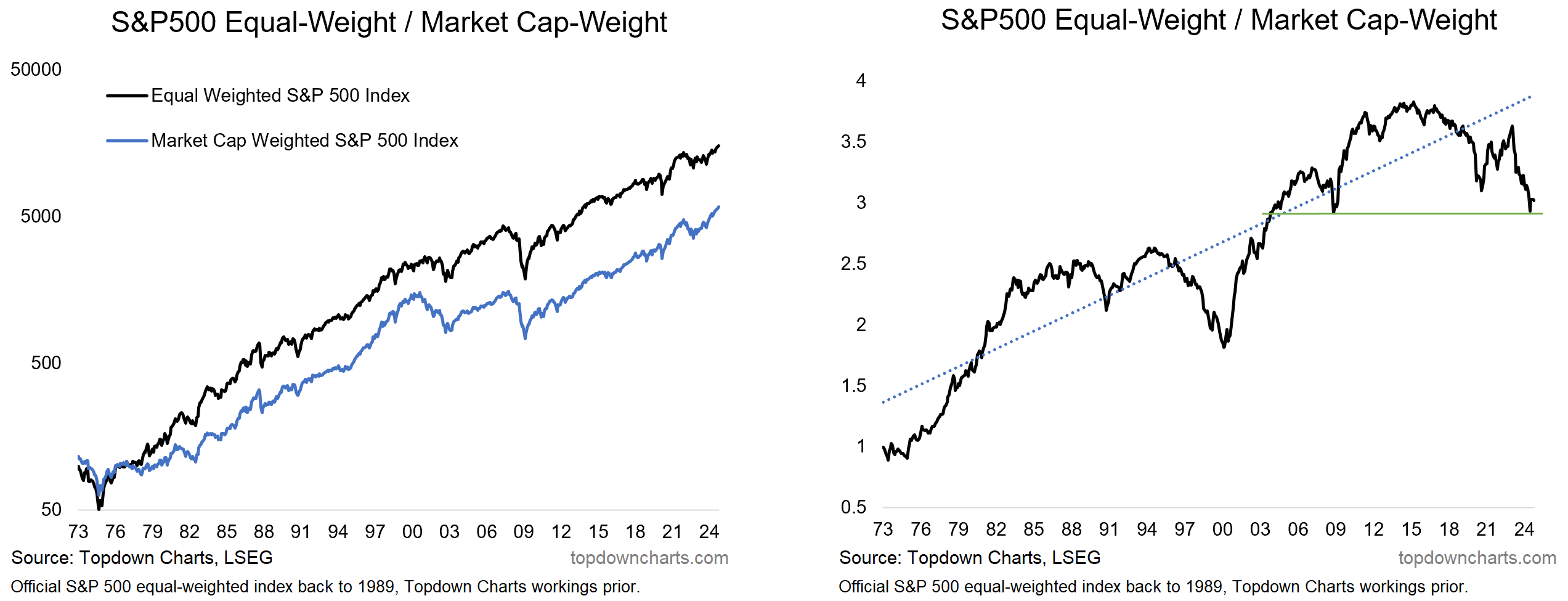

There’s a generational alternative rising in equal vs cap weighting.

Total, there’s actually an air of optimism in markets and a transparent upshift within the speculative temper on show within the charts. And honest sufficient; there has to date been no main unhealthy information, the Fed has pivoted to fee cuts, and seasonality is ready to show constructive. But we are able to’t drop our guard totally as there stays unfinished enterprise on quite a lot of fronts. So hold watching these charts that we focus on beneath.

1. Nasdaq Breaks Out

Nicely, it lastly occurred, the has damaged out of it’s interval of angst and consolidation — just about cementing the notion that it’s nonetheless in an uptrend. The one factor left to do from right here is notch up a brand new excessive (and it most likely will).

Supply: Callum Thomas utilizing MarketCharts.com Charting Instruments

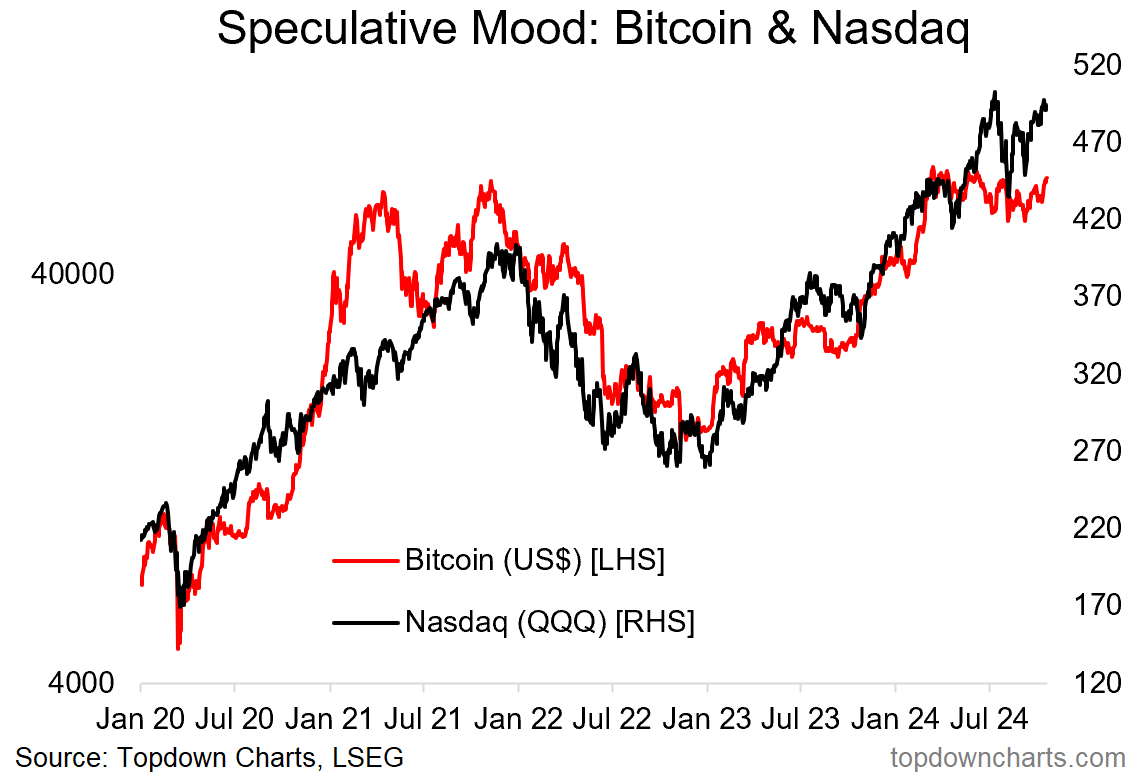

2. Bitcoin, Nasdaq – Temper Up

Wanting over on the Nasdaq’s touring companion, — there does appear additionally to be a broader shift in temper. Whether or not it’s optimism across the attainable election consequence, the shortage of any actual unhealthy information, or just the Fed pivot to fee cuts the temper certain appears to be shifting to the upside after a interval of what we would name a stealth bear market.

Supply: Topdown Charts

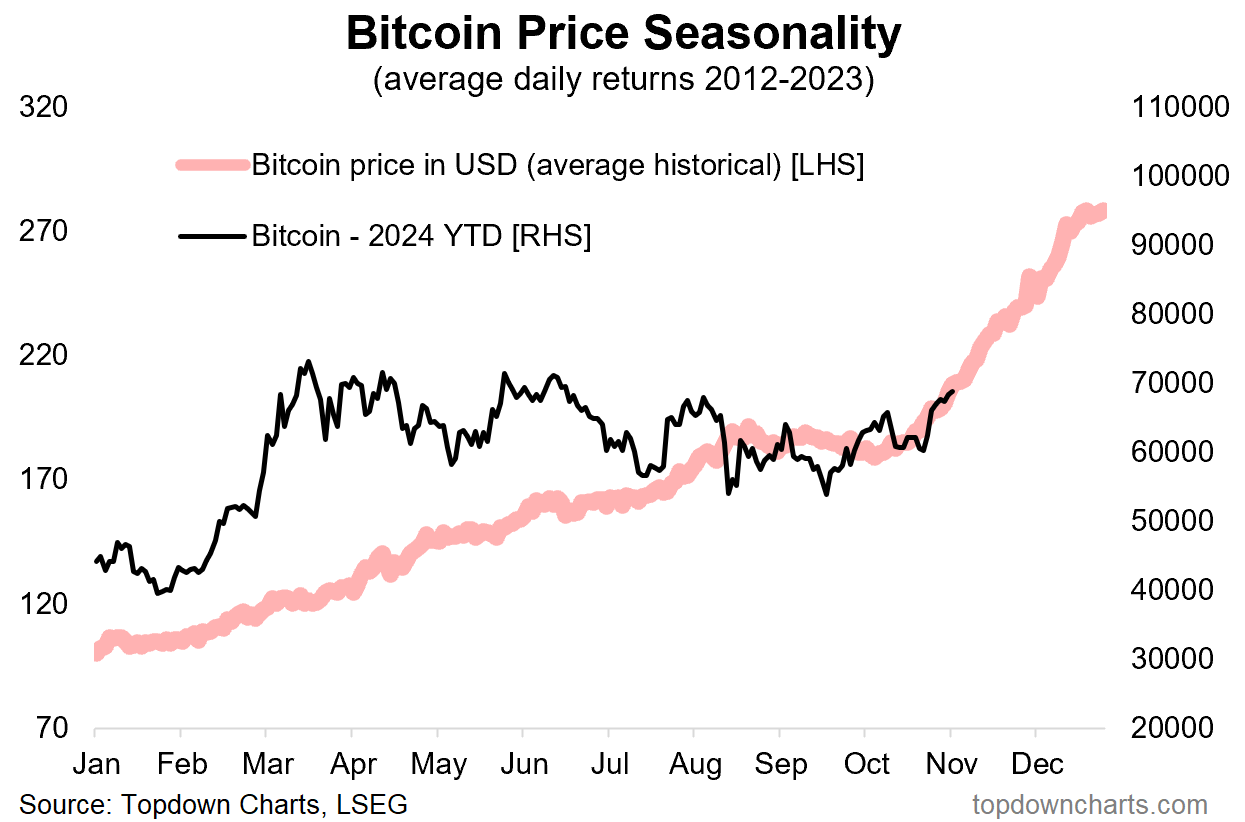

3. 12 months-Finish Rally?

And after-all, there’s a clear seasonal tendency for threat belongings to rally within the ultimate months of the 12 months, and Bitcoin is an excessive instance of that. Whereas we’re nonetheless solely 12 years of knowledge right here, it’s nonetheless one thing, and the seasonality sample (common every day motion by enterprise day of the 12 months) suggests a surge in Bitcoin into year-end; this *if it occurs* would possible replicate and ripple throughout worth motion in shares and threat belongings basically. Very bullish chart.

Supply: Topdown Charts Analysis Providers

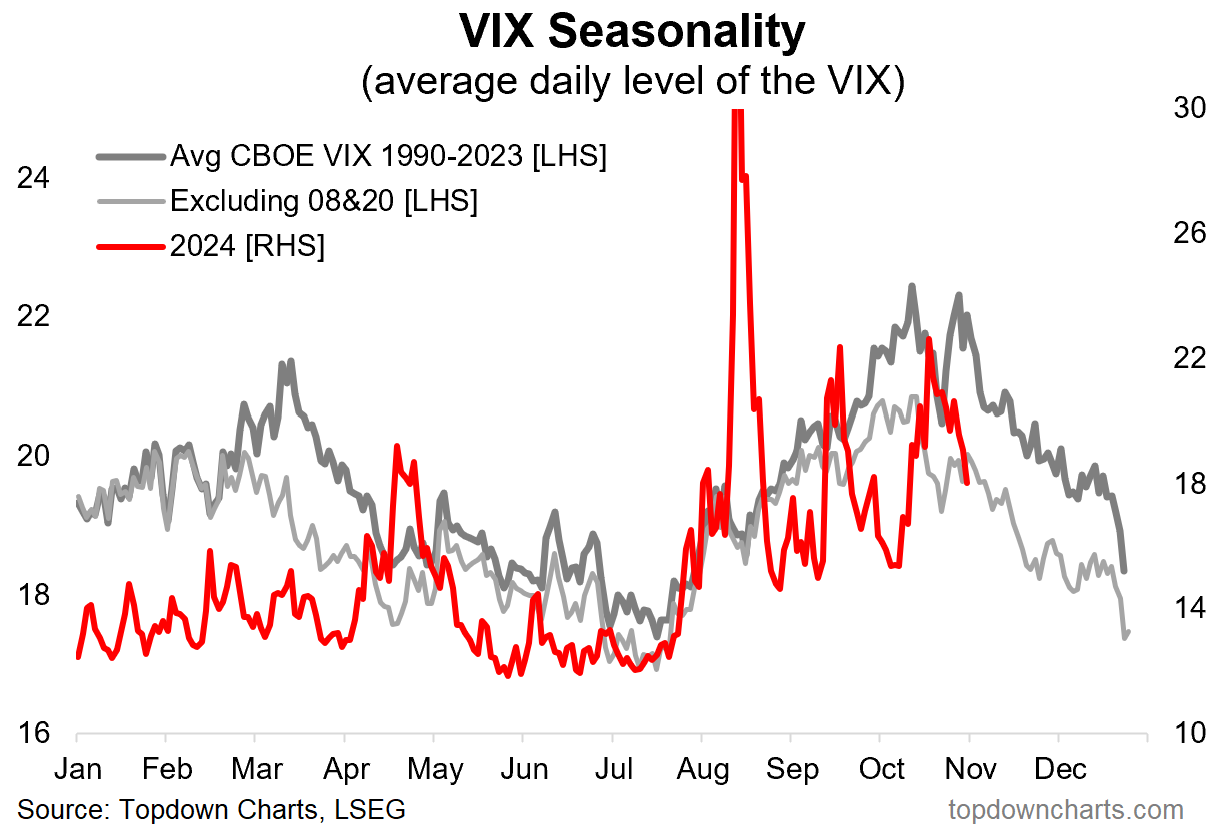

4. However Wait, There’s Extra!

Having stated that, there are nonetheless a bunch of macro-market boogeymen lurking within the shadows (election, geopolitics, stretched sentiment/valuations, recession threat), and we aren’t fairly out of the woods on seasonality simply but. Perhaps another spike earlier than the year-end vol-crush and risk-on journey.

(but in addition, a well timed level to remind folks that seasonality is simply a mean, and there are numerous exceptions to the rule! aka within the phrases of Ron “60% of the time it really works each time”)

Supply: Chart of the Week – Volatility Season

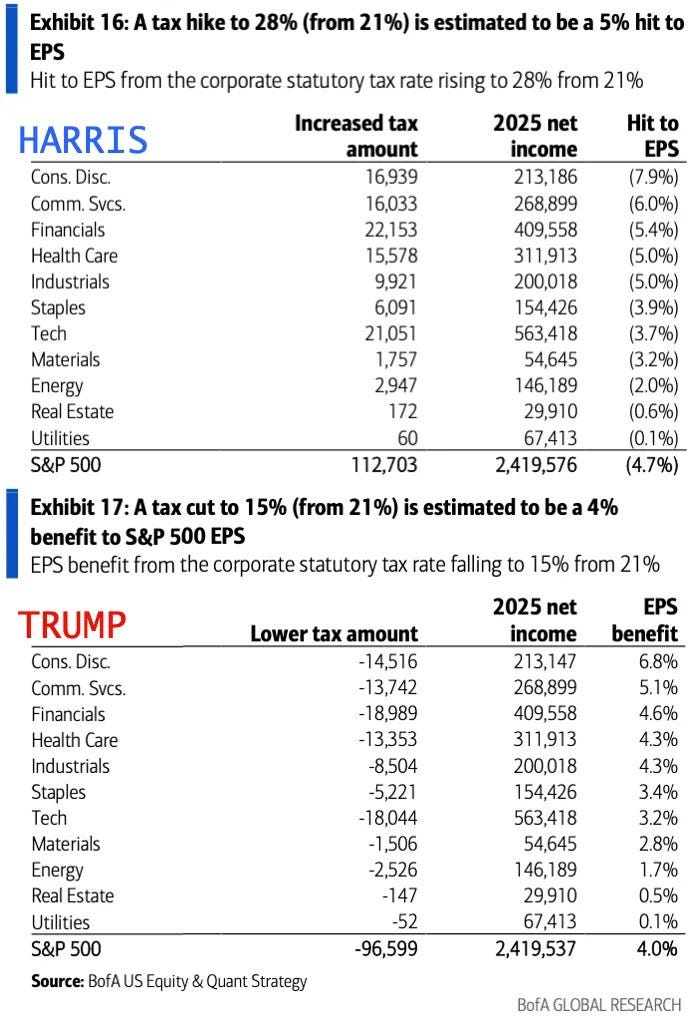

5. Binary Tax Take

As for simply plain volatility, right here’s cause sufficient for uncertainty to linger for shares at the least for the following couple of weeks — so far as we are able to inform, Harris and Trump need reverse issues in the case of the company tax fee. Ignoring all the pieces else, increased company tax charges are unhealthy for shares (and decrease good) — the desk beneath exhibits the potential affect intimately throughout sectors (aka: “it’s the earnings, silly”).

Supply: @dailychartbook Each day Chartbook

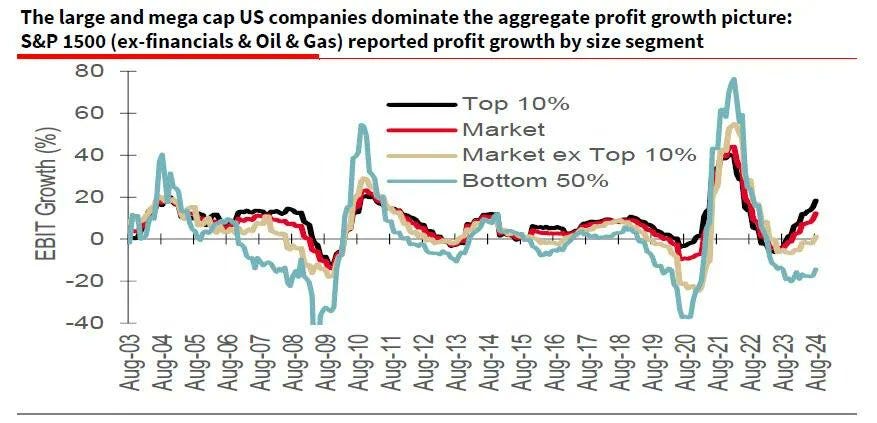

6. Earnings Rorschach

So the unhealthy a part of this chart is the underside 50% seeing earnings contracting however the arguably good half is that the inexperienced (teal?) line is popping up — possibly taking part in catch-up (and catalyzing inventory worth catch-up?).

The opposite level could be if Harris will get in and hikes taxes shortly (not a given) that might most likely take some wind out of the sails of the bigger ones, and put additional downdrafts on the underside 50%’s earnings recession.

Supply: @albertedwards99 by way of @jessefelder

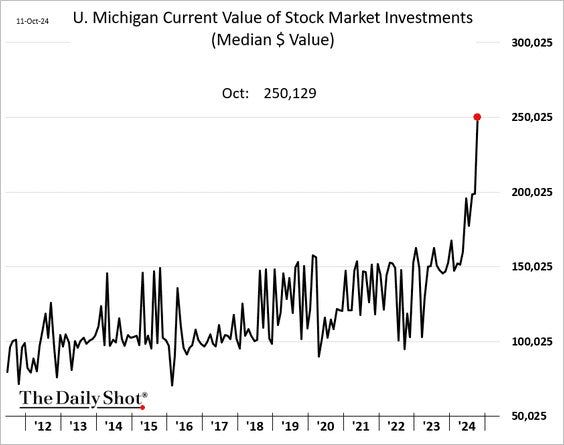

7. Get Wealthy Fast?

One other glass half-full vs half-empty chart, on the upside folks appear to be getting wealthy (or at the least those that have inventory portfolios), which is sweet and good, and in addition possible sees an actual financial system increase by way of wealth results. The draw back could be that it’s simply one other reflection of stretched sentiment and valuations, and an unsustainable late-cycle sign.

Supply: @SoberLook

8. Accounting for Accountants

Sort of fascinating —and much like the pattern in fairness analysts I famous a few weeks in the past— accountants and auditors are on the decline. Perhaps it’s only a tech-disruption factor (and/or outsourcing), possibly there are higher alternatives elsewhere for accountants (+oldies retiring), or possibly really there usually are not sufficient accountants and reviews/audits are vulnerable to high quality loss (pure hypothesis).

Supply: @MikeZaccardi

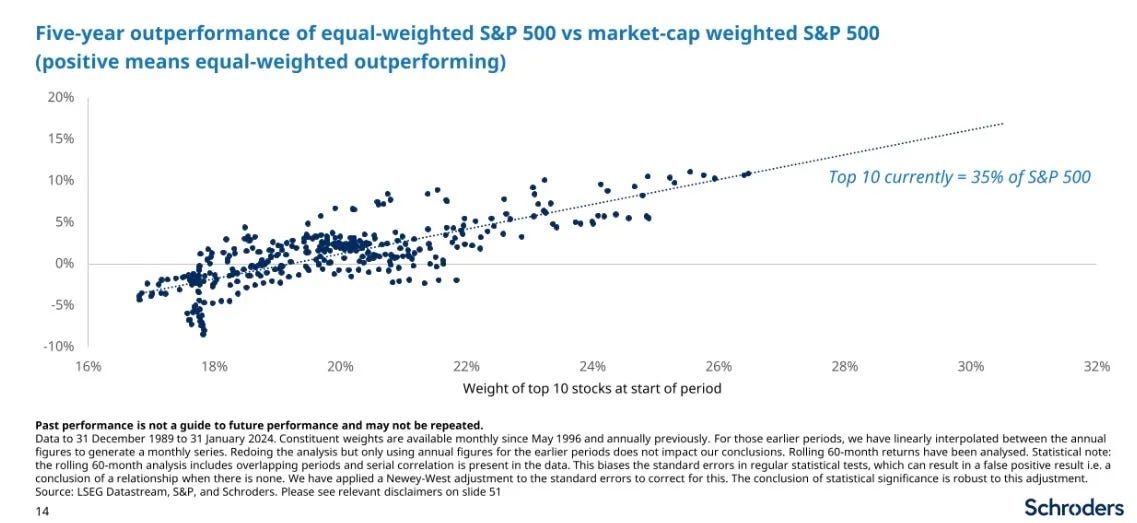

9. Do NOT Focus

In relation to inventory market efficiency the extra concentrated the index turns into, the extra engaging it’s to sail in the wrong way of cap-weighted methods and go for . Most likely a whole lot of that is the results of the dot com bubble and early-1980’s oil growth, but it surely’s not the one evaluation on this difficulty.

Supply: Schroders (LON:) by way of Snippet Finance

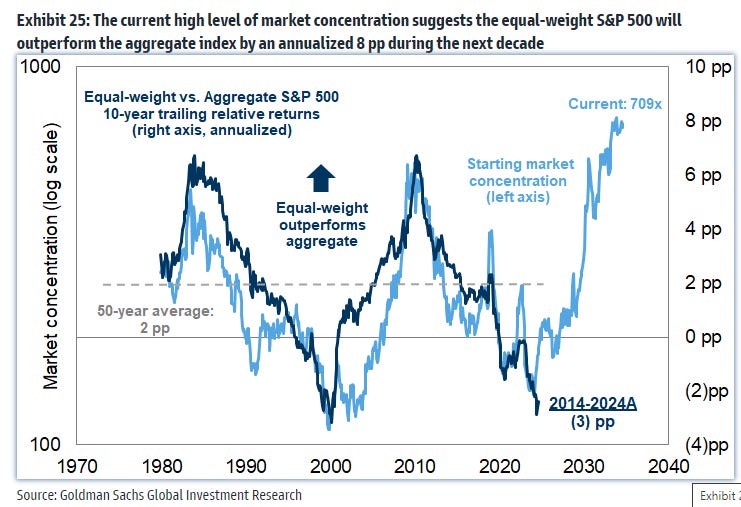

10. No Cap (weight)

One other method of it — time sequence chart exhibiting market focus indicator within the mild blue vs equal-cap weight relative efficiency at the hours of darkness blue. Similar deal, increased focus factors to increased future relative efficiency of equal vs cap weighted

Supply: GS by way of @MikeZaccardi

Equal vs Cap Weight in Perspective: taking it a step additional, over the long-run it’s really extra regular for the equal-weighted index to outperform the cap-weighted index. And as of proper now the equal/cap weight relative efficiency line may be very stretched to the draw back vs pattern and has bounced off the 09 low level.

And it type of is smart that cap-weighted methods over-weighted yesterday’s winners, and underweighted the laggards (typically worth performs, due for a turnaround) new arrivals (tomorrow’s progress shares). So it’s another excuse to rethink simply shopping for the cap-weighted passive index as everybody else does, and positively meals for thought for inventory pickers. Perhaps even some information on total market timing too!

Authentic Put up