Revealed on September ninth, 2025 by Bob Ciura

The S&P 500 is overvalued.

The picture under exhibits the long-term pattern of the Shiller PE ratio for the S&P 500.

Supply: Multpl.com

The Shiller PE ratio “smooths” the PE ratio through the use of 10-year inflation-adjusted common earnings for earnings, as an alternative of trailing-twelve-month earnings. This helps the ratio to be significant even when earnings are very low (like throughout recessions).

There’s no query the S&P 500 is overvalued from a historic perspective…

And it’s not “simply” the Shiller PE. The usual PE ratio is ~30 for the S&P 500 on the time of this writing – one of many highest non-recession (when the ‘E’ within the ratio falls, pushing up the ratio) ranges ever.

However one needn’t make investments broadly within the traditionally overvalued S&P 500…

For instance, the free excessive dividend shares checklist spreadsheet under has our full checklist of particular person securities (shares, REITs, MLPs, and so forth.) with with 5%+ dividend yields.

Shopping for overvalued dividend shares can jeopardize future returns. Even high quality firms can quantity to mediocre or poor investments, if too excessive worth is paid.

Falling valuations can result in low (and even unfavorable) complete returns, even together with dividends.

Due to this fact, traders needs to be cautious in terms of overvalued dividend shares. The next 10 overvalued dividend shares needs to be averted.

The checklist is sorted by the extent of overvaluation.

Desk of Contents

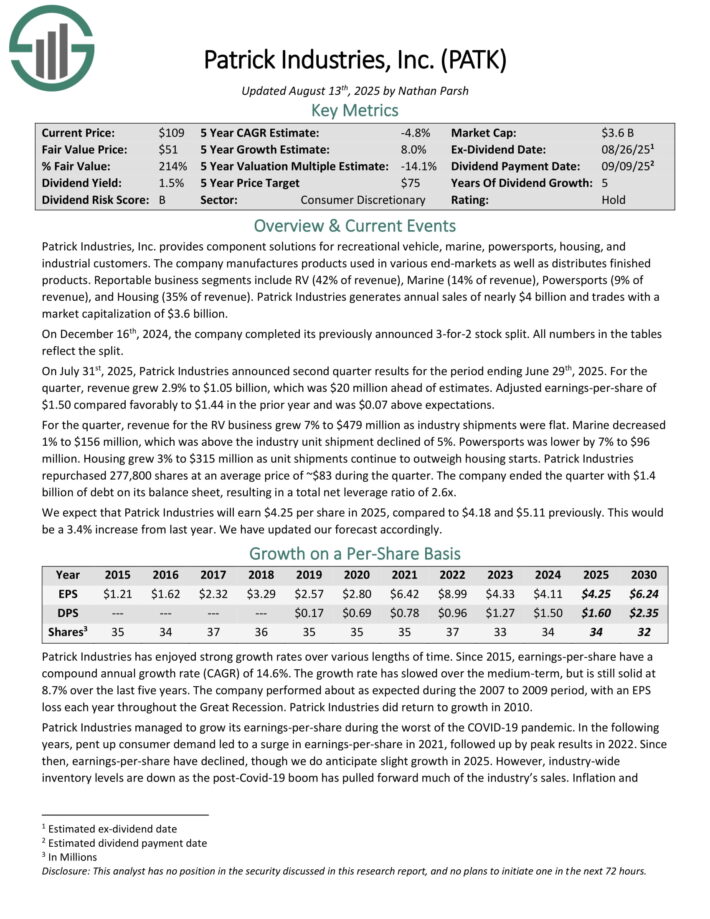

Overvalued Dividend Inventory #10: Patrick Industries (PATK)

- Annual Valuation Return: -14.7%

Patrick Industries supplies element options for leisure car, marine, energy sports activities, housing, and industrial clients.

The corporate manufactures merchandise utilized in numerous end-markets in addition to distributes completed merchandise. Reportable enterprise segments embrace RV (42% of income), Marine (14% of income), Energy sports activities (9% of income), and Housing (35% of income). Patrick Industries generates annual gross sales of almost $4 billion.

On July thirty first, 2025, Patrick Industries introduced second quarter outcomes for the interval ending June twenty ninth, 2025. For the quarter, income grew 2.9% to $1.05 billion, which was $20 million forward of estimates. Adjusted earnings-per-share of $1.50 in contrast favorably to $1.44 within the prior 12 months and was $0.07 above expectations.

For the quarter, income for the RV enterprise grew 7% to $479 million as trade shipments had been flat. Marine decreased 1% to $156 million, which was above the trade unit cargo declined of 5%. Energy sports activities was decrease by 7% to $96 million. Housing grew 3% to $315 million as unit shipments proceed to outweigh housing begins.

Patrick Industries repurchased 277,800 shares at a median worth of ~$83 through the quarter. The corporate ended the quarter with $1.4 billion of debt on its steadiness sheet, leading to a complete web leverage ratio of two.6x.

Click on right here to obtain our most up-to-date Certain Evaluation report on PATK (preview of web page 1 of three proven under):

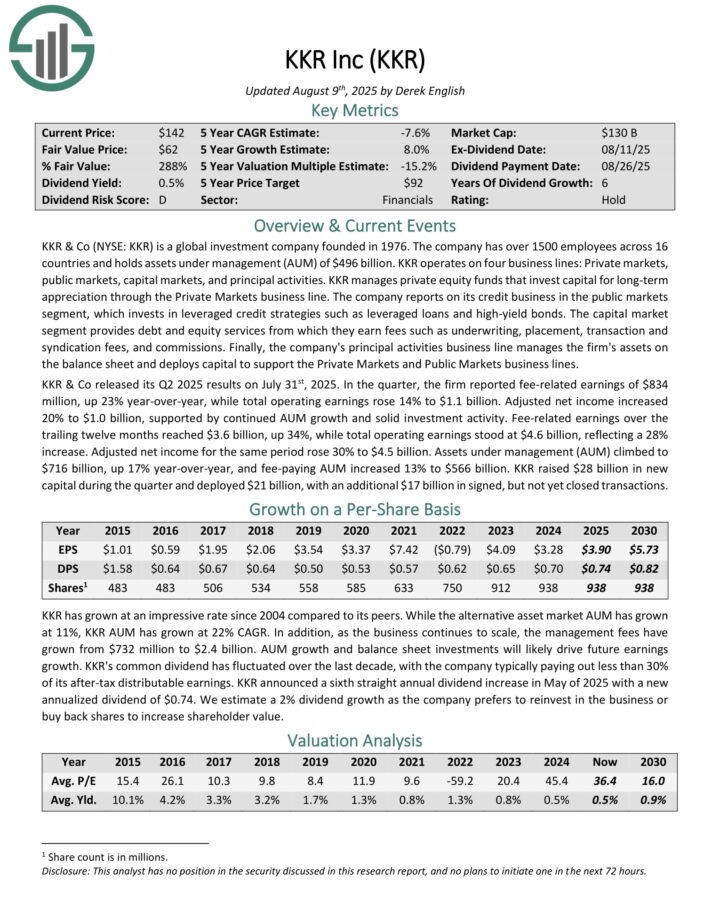

Overvalued Dividend Inventory #9: KKR & Co. (KKR)

- Annual Valuation Return: -15.1%

KKR & Co is a world funding firm with belongings below administration (AUM) of $496 billion. KKR operates on 4 enterprise traces: Non-public markets, public markets, capital markets, and principal actions.

KKR manages personal fairness funds that make investments capital for long-term appreciation by way of the Non-public Markets enterprise line.

KKR & Co launched its Q2 2025 outcomes on July thirty first, 2025. Within the quarter, the agency reported fee-related earnings of $834 million, up 23% year-over-year, whereas complete working earnings rose 14% to $1.1 billion.

Adjusted web revenue elevated 20% to $1.0 billion, supported by continued AUM progress and strong funding exercise.

Charge-related earnings over the trailing twelve months reached $3.6 billion, up 34%, whereas complete working earnings stood at $4.6 billion, reflecting a 28% enhance. Adjusted web revenue for a similar interval rose 30% to $4.5 billion.

Belongings below administration (AUM) climbed to $716 billion, up 17% year-over-year, and fee-paying AUM elevated 13% to $566 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on KKR (preview of web page 1 of three proven under):

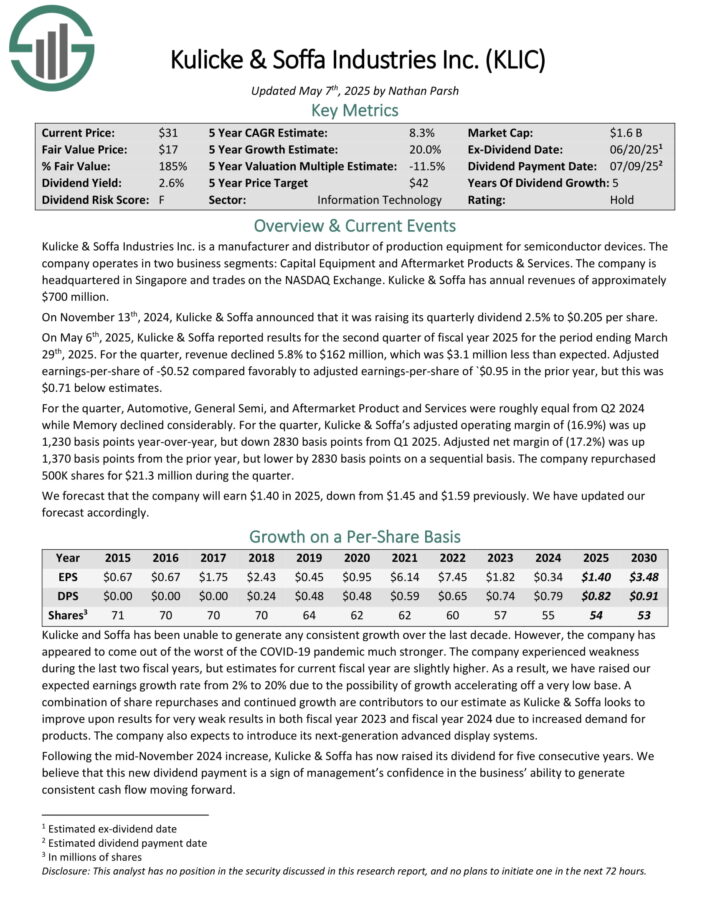

Overvalued Dividend Inventory #8: Kulicke & Soffa Industries (KLIC)

- Annual Valuation Return: -14.0%

Kulicke & Soffa Industries Inc. is a producer and distributor of manufacturing tools for semiconductor gadgets. The corporate operates in two enterprise segments: Capital Gear and Aftermarket Merchandise & Companies.

It’s headquartered in Singapore and trades on the NASDAQ Change. Kulicke & Soffa has annual revenues of roughly $700 million.

On Could sixth, 2025, Kulicke & Soffa reported outcomes for the second quarter of fiscal 12 months 2025. For the quarter, income declined 5.8% to $162 million, which was $3.1 million lower than anticipated.

Adjusted earnings-per-share of -$0.52 in contrast favorably to adjusted earnings-per-share of -$0.95 within the prior 12 months.

For the quarter, Automotive, Basic Semi, and Aftermarket Product and Companies had been roughly equal from Q2 2024 whereas Reminiscence declined significantly.

For the quarter, Kulicke & Soffa’s adjusted working margin of (16.9%) was up 1,230 foundation factors year-over-year, however down 2830 foundation factors from Q1 2025.

Click on right here to obtain our most up-to-date Certain Evaluation report on KLIC (preview of web page 1 of three proven under):

Overvalued Dividend Inventory #7: Blackstone Mortgage Belief (BXMT)

- Annual Valuation Return: -15.3%

On July 30, 2025, Blackstone Mortgage Belief, Inc. reported its monetary outcomes for the second quarter of 2025. The corporate posted web revenue of $7.0 million, or $0.04 per share, a return to profitability from a $0.00 EPS in Q1 2025 and a $61.1 million loss in Q2 2024.

Distributable EPS was $0.19, up from $0.17 in Q1, whereas Distributable EPS previous to charge-offs reached $0.45, in comparison with $0.42 beforehand. Dividends remained at $0.47 per share, yielding 9.7% annualized based mostly on the July 29 share worth of $19.36.

Complete revenues had been $133.9 million, with web revenue from loans and investments at $94.8 million after $264.7 million in curiosity bills. The steadiness sheet confirmed complete belongings of $20.6 billion, together with $19.0 billion in web loans receivable after CECL reserves.

Fairness stood at $3.6 billion, with guide worth per share declining to $21.04 from $21.42 in Q1, reflecting $4.39 per share in reserves. Liquidity was robust at $1.1 billion, with a 3.8x debt-to-equity ratio.

The portfolio grew to $18.4 billion throughout 144 loans, up $1.4 billion over two quarters, with 82% of Q2 originations in multifamily and industrial sectors, and 68% worldwide. Workplace publicity dropped to twenty-eight% from 36% year-over-year.

Impaired loans fell 55% from peak to $1.0 billion, with $0.2 billion resolved above carrying worth. CECL reserves held regular at $755 million (3.8% of principal), and portfolio efficiency was 94%.

Click on right here to obtain our most up-to-date Certain Evaluation report on BXMT (preview of web page 1 of three proven under):

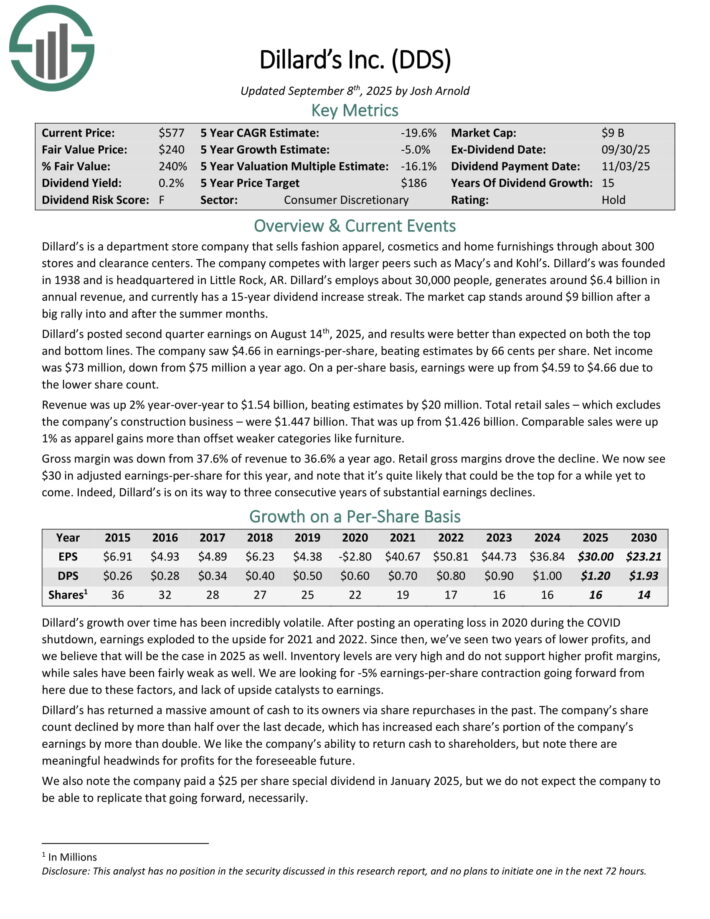

Overvalued Dividend Inventory #6: Dillard’s Inc. (DDS)

- Annual Valuation Return: -16.1%

Dillard’s is a division retailer firm that sells vogue attire, cosmetics and residential furnishings by way of about 300 shops and clearance facilities. The corporate competes with bigger friends comparable to Macy’s and Kohl’s.

Dillard’s employs about 30,000 folks, generates round $6.4 billion in annual income, and presently has a 15-year dividend enhance streak.

Dillard’s posted second quarter earnings on August 14th, 2025, and outcomes had been higher than anticipated on each the highest and backside traces. The corporate noticed $4.66 in earnings-per-share, beating estimates by 66 cents per share.

Internet revenue was $73 million, down from $75 million a 12 months in the past. On a per-share foundation, earnings had been up from $4.59 to $4.66 because of the decrease share rely.

Income was up 2% year-over-year to $1.54 billion, beating estimates by $20 million. Complete retail gross sales – which excludes the corporate’s building enterprise – had been $1.447 billion. That was up from $1.426 billion. Comparable gross sales had been up 1% as attire positive factors greater than offset weaker classes like furnishings.

Gross margin was down from 37.6% of income to 36.6% a 12 months in the past. Retail gross margins drove the decline.

We now see $30 in adjusted earnings-per-share for this 12 months, and word that it’s fairly probably that could possibly be the highest for some time but to come back. Certainly, Dillard’s is on its method to three consecutive years of considerable earnings declines.

Click on right here to obtain our most up-to-date Certain Evaluation report on DDS (preview of web page 1 of three proven under):

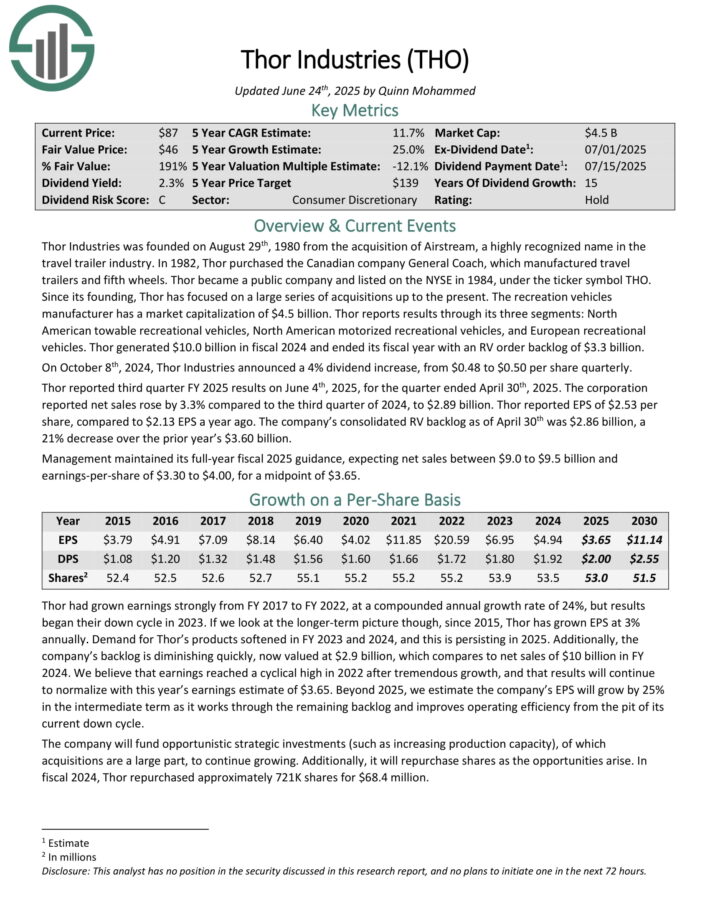

Overvalued Dividend Inventory #5: Thor Industries (THO)

- Annual Valuation Return: -16.4%

Thor Industries was based on August twenty ninth, 1980 from the acquisition of Airstream, a extremely acknowledged title within the journey trailer trade. Thor has targeted on a big collection of acquisitions as much as the current.

Thor experiences outcomes by way of its three segments: North American towable leisure autos, North American motorized leisure autos, and European leisure autos.

Thor generated $10.0 billion in fiscal 2024 and ended its fiscal 12 months with an RV order backlog of $3.3 billion.

Thor reported third quarter FY 2025 outcomes on June 4th, 2025, for the quarter ended April thirtieth, 2025. The company reported web gross sales rose by 3.3% in comparison with the third quarter of 2024, to $2.89 billion.

Thor reported EPS of $2.53 per share, in comparison with $2.13 EPS a 12 months in the past. The corporate’s consolidated RV backlog as of April thirtieth was $2.86 billion, a 21% lower over the prior 12 months’s $3.60 billion.

Administration maintained its full-year fiscal 2025 steerage, anticipating web gross sales between $9.0 to $9.5 billion and earnings-per-share of $3.30 to $4.00.

Click on right here to obtain our most up-to-date Certain Evaluation report on THO (preview of web page 1 of three proven under):

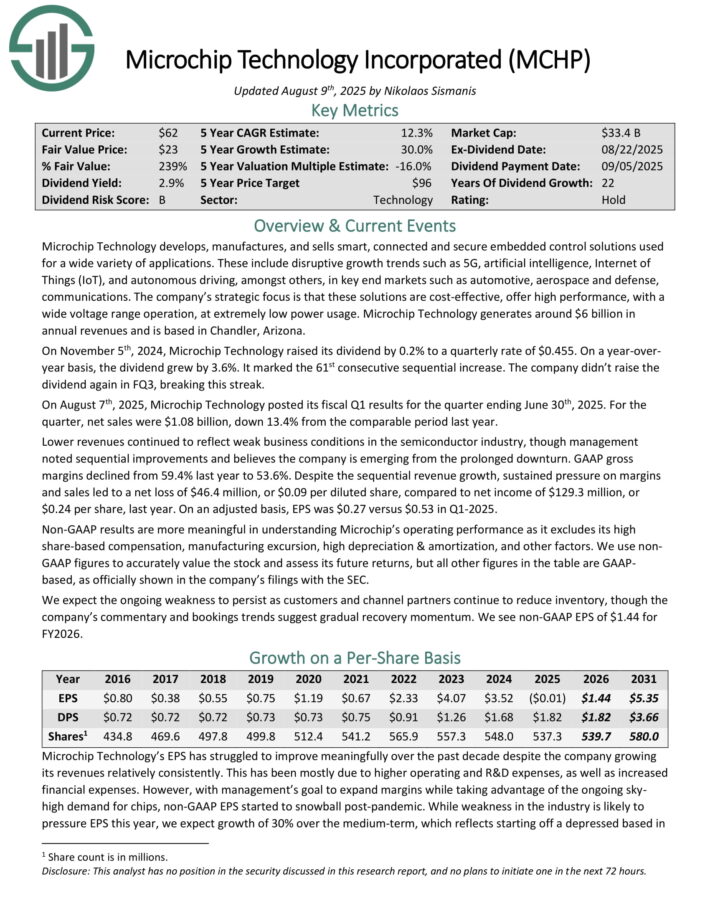

Overvalued Dividend Inventory #4: Microchip Know-how (MCHP)

- Annual Valuation Return: -16.9%

Microchip Know-how develops, manufactures, and sells good, related and safe embedded management options used for all kinds of functions.

These embrace disruptive progress traits comparable to 5G, synthetic intelligence, Web of Issues (IoT), and autonomous driving, amongst others, in key finish markets comparable to automotive, aerospace and protection, communications.

Microchip Know-how generates round $6 billion in annual revenues and relies in Chandler, Arizona.

On August seventh, 2025, Microchip Know-how posted its fiscal Q1 outcomes for the quarter ending June thirtieth, 2025. For the quarter, web gross sales had been $1.08 billion, down 13.4% from the comparable interval final 12 months.

Decrease revenues continued to replicate weak enterprise situations within the semiconductor trade, although administration famous sequential enhancements and believes the corporate is rising from the extended downturn.

GAAP gross margins declined from 59.4% final 12 months to 53.6%. Regardless of the sequential income progress, sustained stress on margins and gross sales led to a web lack of $46.4 million, or $0.09 per diluted share, in comparison with web revenue of $129.3 million, or $0.24 per share, final 12 months.

On an adjusted foundation, EPS was $0.27 versus $0.53 in Q1-2025.

Click on right here to obtain our most up-to-date Certain Evaluation report on MCHP (preview of web page 1 of three proven under):

Overvalued Dividend Inventory #3: Fortitude Gold (FTCO)

- Annual Valuation Return: -17.3%

Fortitude Gold Company was spun-off from Gold Useful resource Company right into a separate public firm in December 2021. Fortitude Gold is a junior gold producer with operations in Nevada, U.S.A, one of many world’s premier mining pleasant jurisdictions.

The corporate targets high-grade gold open pit heap leach operations averaging one gram per tonne of gold or higher. Its property portfolio presently consists of 100% possession in seven high-grade gold properties.

All seven properties are inside an approximate 30-mile radius of each other inside the prolific Walker Lane Mineral Belt. The corporate generated $37.3 million in revenues final 12 months, nearly all of which had been from gold, and relies in Colorado Springs, Colorado.

On April twenty ninth, 2025, Fortitude Gold launched its first-quarter 2025 outcomes for the interval ending March thirty first, 2025. For the quarter, revenues got here in at $6.5 million, marking a 20% decline in comparison with Q1 2024.

The lower in income was largely resulting from a 41% drop in gold gross sales quantity and a 26% lower in silver gross sales quantity. These declines had been partially offset by a 38% enhance in gold costs and a 38% enhance in silver costs.

Transferring to the underside line, Fortitude reported a mine gross revenue of $3.3 million in comparison with $4.2 million the earlier 12 months, reflecting the decrease web gross sales.

The corporate additionally introduced a discount in its month-to-month dividend from $0.04 to $0.01 per share, efficient with the Could 2025 fee.

Click on right here to obtain our most up-to-date Certain Evaluation report on FTCO (preview of web page 1 of three proven under):

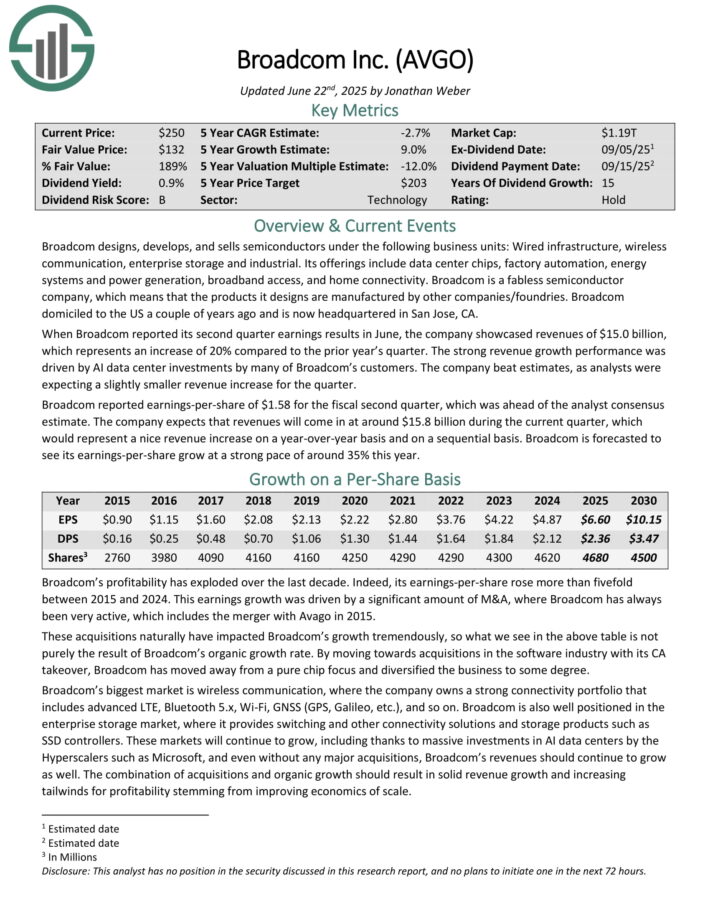

Overvalued Dividend Inventory #2: Broadcom Inc. (AVGO)

- Annual Valuation Return: -17.7%

Broadcom designs, develops, and sells semiconductors below the next enterprise items: Wired infrastructure, wi-fi communication, enterprise storage and industrial. Its choices embrace information heart chips, manufacturing unit automation, vitality methods and energy era, broadband entry, and residential connectivity.

Broadcom is a fabless semiconductor firm, which implies that the merchandise it designs are manufactured by different firms/foundries. Broadcom domiciled to the US a few years in the past and is now headquartered in San Jose, CA.

When Broadcom reported its second quarter earnings ends in June, the corporate showcased revenues of $15.0 billion, which represents a rise of 20% in comparison with the prior 12 months’s quarter.

The robust income progress efficiency was pushed by AI information heart investments by a lot of Broadcom’s clients. The corporate beat estimates, as analysts had been anticipating a barely smaller income enhance for the quarter.

Broadcom reported earnings-per-share of $1.58 for the fiscal second quarter, which was forward of the analyst consensus estimate. The corporate expects that revenues will are available at round $15.8 billion through the present quarter, which might signify a pleasant income enhance on a year-over-year foundation and on a sequential foundation.

Click on right here to obtain our most up-to-date Certain Evaluation report on AVGO (preview of web page 1 of three proven under):

Overvalued Dividend Inventory #1: Hyster Yale (HY)

- Annual Valuation Return: -24.8%

Hyster-Yale Supplies Dealing with was based in 1985 and has since grow to be a outstanding international participant within the supplies dealing with trade.

The corporate designs, manufactures, and sells a complete vary of carry vehicles and aftermarket components, serving numerous clients throughout numerous sectors, together with manufacturing, warehousing, and logistics.

The corporate segments its income primarily into three classes: new tools gross sales, components gross sales, and repair revenues.

On Could sixth, 2025, the corporate introduced outcomes for the primary quarter of 2025. The corporate reported Q1 non-GAAP EPS of $0.49, in-line with analysts’ estimates, and produced income of $910.4 million, which was down 14.1% year-over-year.

Hyster-Yale opened the 12 months with Q1 2025 consolidated revenues of $910 million, down 14% from final 12 months, as softer carry truck demand carried over from late 2024.

Internet revenue dipped to $8.6 million in comparison with $51.5 million a 12 months in the past, as decrease manufacturing volumes and price pressures weighed on margins. Stock ranges improved, down $69 million versus Q1 2024, displaying early progress in aligning manufacturing with present demand traits.

Encouragingly, the carry truck section noticed a notable rebound in bookings, up 13% year-over-year and 48% sequentially, pushed by energy within the Americas and EMEA.

Click on right here to obtain our most up-to-date Certain Evaluation report on HY (preview of web page 1 of three proven under):

Closing Ideas

The inventory market has been on an almost uninterrupted rally for the reason that Nice Recession. After a quick downturn through the coronavirus pandemic, the inventory market has as soon as once more raced to document highs.

Consequently, the S&P 500 is now markedly overvalued in accordance with a number of valuation metrics, such because the Shiller P/E ratio.

Due to this fact, risk-averse revenue traders needs to be cautious of overvalued dividend shares comparable to the ten on this article.

In case you are eager about discovering high-quality dividend progress shares and/or different high-yield securities and revenue securities, the next Certain Dividend sources will likely be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].