Skip to content material

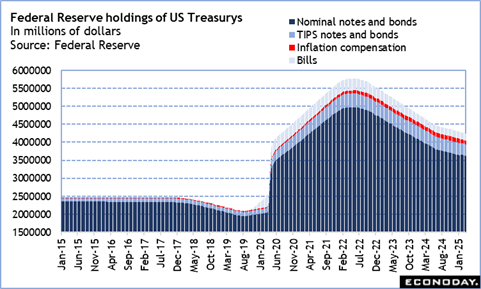

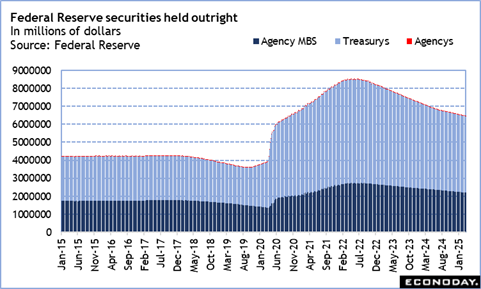

In Could 2022, the FOMC introduced a program to cut back the dimensions of its holdings of US treasuries and company mortgage-backed securities which had ballooned to only over $8.5 trillion in Could 2022 on the finish of its fourth massive scale asset purchases undertaken to help the US financial system from the shocks of the worldwide pandemic and disruptions to the US financial system.

The prior three massive scale asset buy packages (so-called quantitative easing or QE) had beforehand introduced the dimensions of the Fed’s holdings at reserve banks as much as simply above $4.2 trillion in September 2017. Thereafter the FOMC started a program to cut back the dimensions of the steadiness sheet. By October 2019 on the finish of this system, the steadiness sheet was decreased by about $665 billion to round $3.6 billion.

The fourth massive scale asset buy program started in March 2020, first to offer liquidity, then to help the financial system’s restoration by stimulus. This system resulted in January 2022.

This system to start lowering the present holdings was introduced in Could 2022 and commenced in June 2022. This system started with reinvestment caps of $30.0 billion for US treasuries and $17.5 billion for company mortgage-backed securities in June, July, and August. It was elevated as introduced to $60.0 billion in US treasuries and $35.0 billion in company mortgage-backed securities in September.

The caps remained the identical till the FOMC introduced in Could 2024 that starting in June, the cap on US treasuries reinvestments could be decreased to $25.0 billion whereas the cap on mortgage-backed securities would stay at $35.0 billion. It was famous that the cap on mortgage-backed had but to be reached in any given month and that leaving the cap unchanged was in step with steadily returning the Fed’s holdings to an all-US treasuries composition. Two-thirds of the present steadiness sheet composition is US treasuries.

Fed Chair Jerome Powell stated the choice meant that whereas it might take longer to carry down the dimensions of the Fed’s steadiness sheet, it might allow reductions to go additional and with out disruptions to markets.

Powell supplied a lot the identical reasoning after the March 18-19 FOMC when the committee determined to additional gradual the tempo of discount by bringing the cap on reinvestments in US treasuries all the way down to $5.0 billion whereas leaving the cap on reinvestments in mortgage-backed securities at $35.0 billion. The brand new cap will take impact in April.

In his March 19 press convention, Powell emphasised that it is a technical choice and unrelated to financial coverage. He added that the FOMC made no dedication on the final word measurement of the Fed’s holdings of US treasuries and didn’t mission how rapidly the mortgage-backed securities holdings would diminish.

Lots of these securities are backed by mortgages taken out whereas charges had been traditionally low. Debtors with exceptionally low charges are much less more likely to promote their dwelling to up- or down-grade whereas charges are twice what they had been on the time when the mortgage issued relying on the implications for month-to-month housing prices. Few of those mortgages will probably be refinanced until the holders have compelling causes to take out some fairness.

In any case, because the starting of the present program in June 2022, the entire holdings of US treasuries and company mortgage-backed securities are down about $2.0 trillion from the height of $8.5 trillion in Could 2022. Powell stated that the present holdings nonetheless represent “considerable” reserves fairly than the “ample” reserves stage the FOMC want to attain. He did say that the primary hints that reserves are a little bit tighter are showing. The FOMC’s go slower and get additional method implies that will probably be an extended time earlier than that purpose is reached.

Share This Story, Select Your Platform!

Web page load hyperlink