Up to date on November twenty first, 2024 by Bob Ciura

We’re extremely targeted on shares with sturdy dividend development prospects. To that finish, we have now recognized a number of recession-proof shares whose dividend prospects ought to stay stable, even when a bear market happens.

After all, there is no such thing as a such factor as a very recession-proof inventory, as all forms of securities are topic to a point of market threat.

Nonetheless, some shares could also be much less delicate to harsh financial situations. In flip, they might be much less more likely to expertise as a lot of an impression of their monetary efficiency throughout a recession.

Recession-poof shares ought to get pleasure from higher longevity qualities in terms of their dividend payouts.

Some examples are discovered among the many Dividend Aristocrats. The Dividend Aristocrats are a choose group of 66 shares within the S&P 500 Index, with 25+ consecutive years of dividend will increase.

You possibly can obtain an Excel spreadsheet of all 66 Dividend Aristocrats (with metrics that matter corresponding to dividend yields and price-to-earnings ratios) by clicking the hyperlink beneath:

Disclaimer: Positive Dividend isn’t affiliated with S&P World in any method. S&P World owns and maintains The Dividend Aristocrats Index. The knowledge on this article and downloadable spreadsheet is predicated on Positive Dividend’s personal assessment, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person traders higher perceive this ETF and the index upon which it’s primarily based. Not one of the info on this article or spreadsheet is official knowledge from S&P World. Seek the advice of S&P World for official info.

On this article, we’re analyzing 12 dividend shares coated in our Positive Evaluation Analysis Database, whose recession-proof traits ought to allow them to continue to grow their dividends in a bear market and past.

To slender down our whole protection universe, all 12 shares featured right here have been assigned an ‘A’ ranking of their Dividend Danger Rating.

Additionally they have at the very least 15 years of consecutive annual dividend will increase, that means they’ve already confirmed their means to resist recessions.

Lastly, they’ve dividend yields above 1%, making them extra interesting for revenue traders.

The shares are listed in keeping with their 5-year anticipated complete returns, from lowest to highest.

Desk of Contents

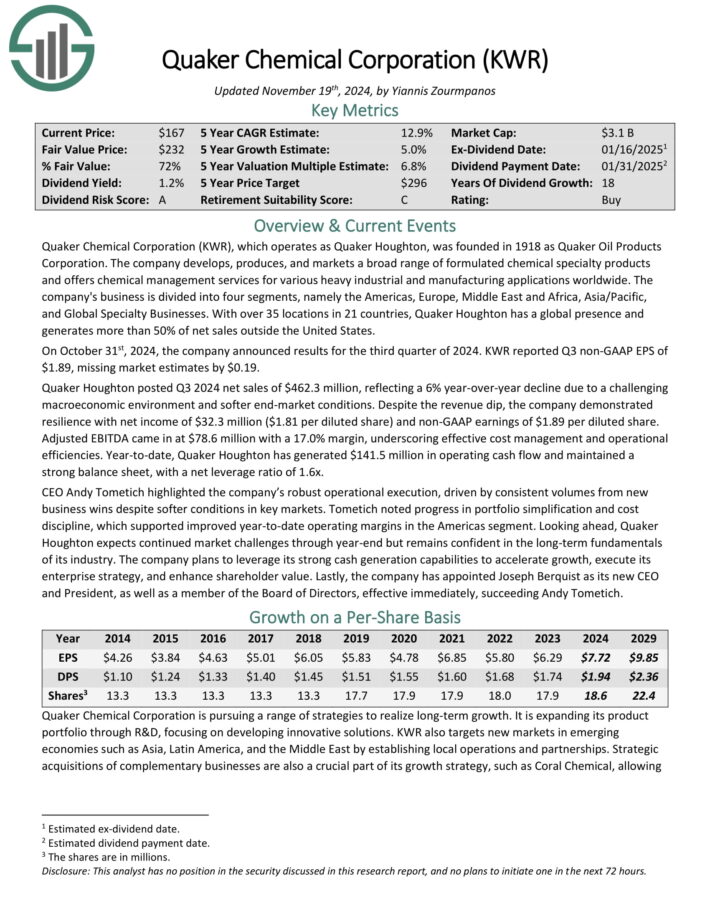

Recession-Proof Inventory #12: Comcast Corp. (CMCSA)

- Dividend Yield: 2.9%

- 5-year Anticipated Annual Returns: 13.1%

Comcast is a media, leisure and communications firm. Its enterprise models embody Cable Communications (Excessive–Velocity Web, Video, Enterprise Providers, Voice, Promoting, Wi-fi), NBCUniversal (Cable Networks, Theme Parks, Broadcast TV, Filmed Leisure), and Sky, a number one leisure firm in Europe.

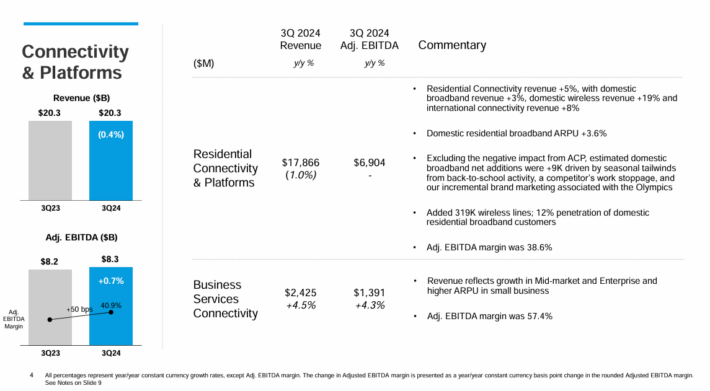

Comcast reported its Q3 2024 outcomes on Oct. thirty first, 2024. For the quarter, the corporate’s income rose 6.5% to $32.1 billion yr over yr. Adjusted EBITDA (a money stream proxy) was down 2.3% to $9.7 billion.

Supply: Investor Presentation

Nonetheless, it was in a position to improve adjusted earnings-per-share (EPS) by 3.3% to $1.12. And Comcast generated free money stream (FCF) of $3.4 billion.

The Connectivity & Platforms section’s revenues have been down 0.4% to $20.3 billion. The section skilled adjusted EBITDA rising marginally by 0.7% to $8.3 billion, helped by margins enlargement of 0.5% to 40.9%.

The Content material & Experiences section noticed income develop 19% to $12.6 billion, whereas its adjusted EBITDA fell 8.7% to $1.8 billion.

Click on right here to obtain our most up-to-date Positive Evaluation report on Comcast (preview of web page 1 of three proven beneath):

Recession-Proof Inventory #11: Tennant Co. (TNC)

- Dividend Yield: 1.4%

- 5-year Anticipated Annual Returns: 13.1%

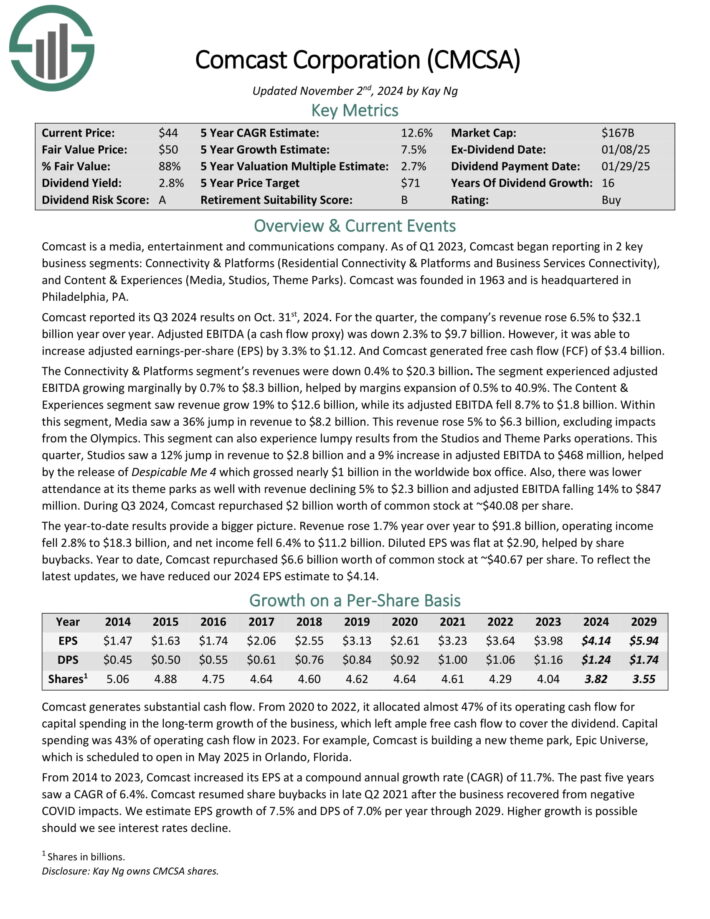

Tennant Firm is a equipment firm that produces cleansing merchandise and that provides cleansing options to its prospects.

Within the US, the corporate holds the market management place in its trade, however the firm additionally sells its merchandise in additional than 100 extra international locations across the globe.

Supply: Investor Presentation

Tennant Firm reported its third quarter earnings outcomes on October thirty first. The corporate introduced that it generated revenues of $316 million through the quarter, which was 4% greater than the highest line quantity from the earlier yr’s quarter.

This was barely higher than the latest pattern, as income had grown much less on a year-over-year foundation through the earlier quarter. Revenues have been decrease in comparison with what the analyst group had forecasted.

Tennant Firm generated adjusted earnings-per-share of $1.39 through the third quarter, which was lower than what the analyst group had forecasted, and which was down 10% in comparison with the earlier yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on TNC (preview of web page 1 of three proven beneath):

Recession-Proof Inventory #10: Qualcomm Inc. (QCOM)

- Dividend Yield: 2.2%

- 5-year Anticipated Annual Returns: 13.1%

Qualcomm develops and sells built-in circuits to be used in voice and knowledge communications. The chip maker receives royalty funds for its patents utilized in gadgets which might be on 3G, 4G, and 5G networks. Qualcomm has annual gross sales of ~$39 billion.

On November sixth, 2024, Qualcomm reported outcomes for the fourth quarter and monetary yr 2024 for the interval ending September twenty ninth, 2024.

For the quarter, income elevated 18.1% to $10.24 billion, which was $310 million forward of estimates. Adjusted earnings-per-share of $2.69 in contrast very favorably to $2.02 within the earlier yr and was $0.12 greater than anticipated.

For the yr, income grew 9% to only beneath $39 billion whereas adjusted earnings-per-share of $10.22 in comparison with $8.43 within the prior yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on QCOM (preview of web page 1 of three proven beneath):

Recession-Proof Inventory #9: Quaker Chemical (KWR)

- Dividend Yield: 1.2%

- 5-year Anticipated Annual Returns: 13.2%

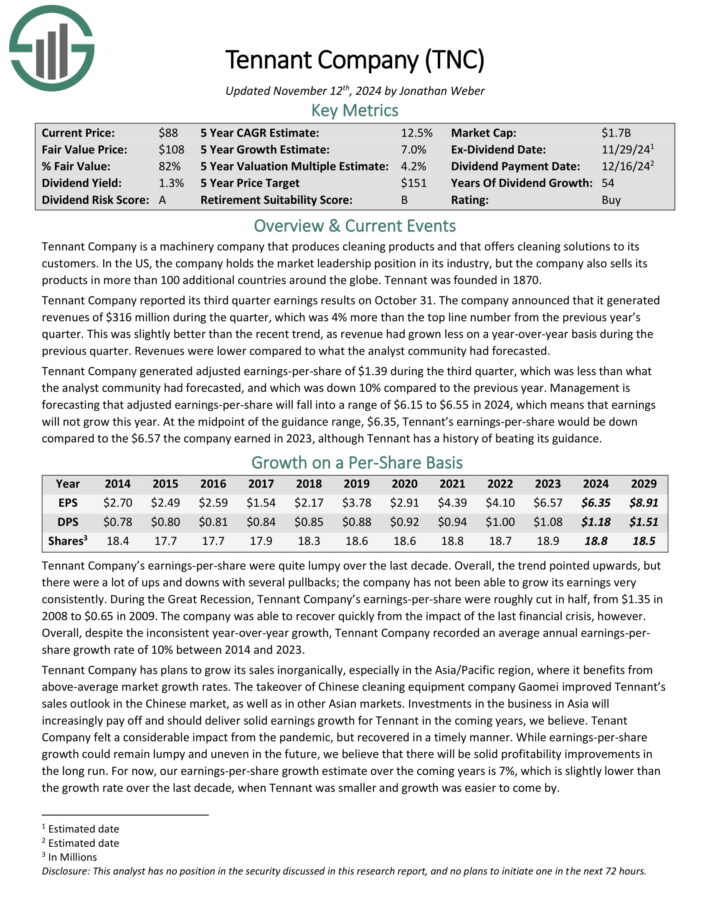

Quaker Chemical Company, which operates as Quaker Houghton, develops, produces, and markets a broad vary of formulated chemical specialty merchandise and presents chemical administration companies for numerous heavy industrial and manufacturing purposes worldwide.

The corporate’s enterprise is split into 4 segments, particularly the Americas, Europe, Center East and Africa, Asia/Pacific, and World Specialty Companies. With over 35 places in 21 international locations, Quaker Houghton has a worldwide presence and generates greater than 50% of internet gross sales exterior the USA.

On October thirty first, 2024, the corporate introduced outcomes for the third quarter of 2024. KWR reported Q3 non-GAAP EPS of $1.89, lacking market estimates by $0.19.

Quaker Houghton posted Q3 2024 internet gross sales of $462.3 million, reflecting a 6% year-over-year decline as a consequence of a difficult macroeconomic surroundings and softer end-market situations.

Regardless of the income dip, the corporate demonstrated resilience with internet revenue of $32.3 million ($1.81 per diluted share) and non-GAAP earnings of $1.89 per diluted share.

Click on right here to obtain our most up-to-date Positive Evaluation report on KWR (preview of web page 1 of three proven beneath):

Recession-Proof Inventory #8: Hillenbrand Inc. (HI)

- Dividend Yield: 2.8%

- 5-year Anticipated Annual Returns: 13.3%

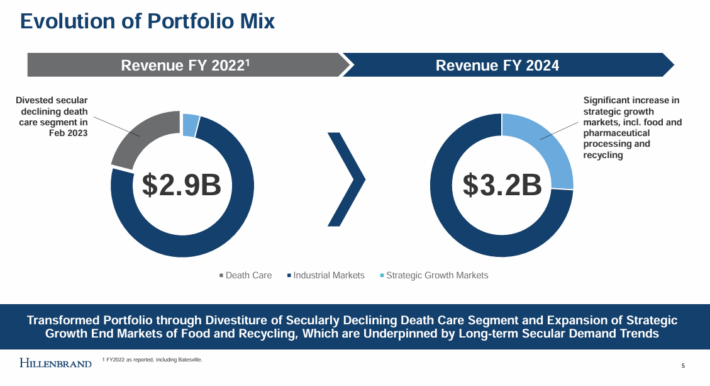

Hillenbrand is an industrial conglomerate that operates by its two segments: Superior Course of Options and Molding Expertise Options.

Superior Course of Options offers a wide range of industrial options for firms’ manufacturing programs. Molding Expertise Options is closely concerned in plastic processing and is uncovered to the oil trade.

Supply: Investor Presentation

On November thirteenth, 2024, Hillenbrand reported fourth quarter and FY 2024 outcomes for the interval ending September thirtieth, 2024. Complete income elevated 10% year-over-year to $838 million. Adjusted earnings-per-share declined 11%

year-over-year, to $1.01.

For FY 2024, Hillenbrand’s income rose 13% to $3.18 billion however adjusted EPS fell 6% to $3.32. Hillenbrand offered FY 2025 steerage which expects $2.95 billion to $3.09 billion in income and $2.80 to $3.15 in adjusted earnings-per-share.

Click on right here to obtain our most up-to-date Positive Evaluation report on HI (preview of web page 1 of three proven beneath):

Recession-Proof Inventory #7: PepsiCo Inc. (PEP)

- Dividend Yield: 3.4%

- 5-year Anticipated Annual Returns: 13.3%

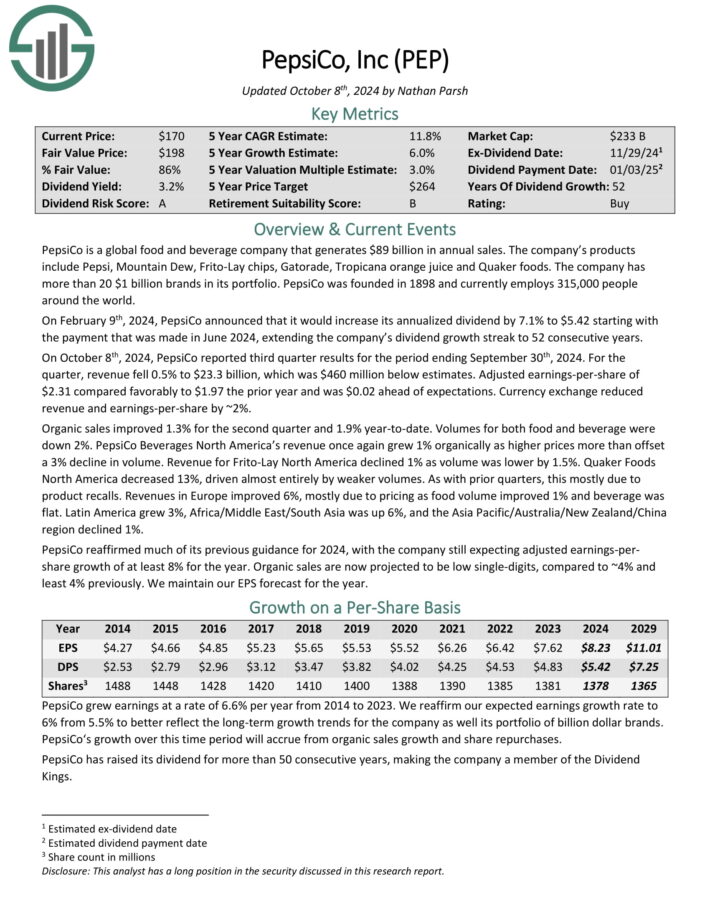

PepsiCo is a worldwide meals and beverage firm that generates $89 billion in annual gross sales. The corporate’s merchandise embody Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker meals.

Its enterprise is break up roughly 60-40 when it comes to meals and beverage income. It’s also balanced geographically between the U.S. and the remainder of the world.

Supply: Investor Presentation

On October eighth, 2024, PepsiCo reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, income fell 0.5% to $23.3 billion, which was $460 million beneath estimates.

Adjusted earnings-per-share of $2.31 in contrast favorably to $1.97 the prior yr and was $0.02 forward of expectations. Forex change diminished income and earnings-per-share by ~2%.

Natural gross sales improved 1.3% for the second quarter and 1.9% year-to-date. Volumes for each meals and beverage have been down 2%.

PepsiCo Drinks North America’s income as soon as once more grew 1% organically as larger costs greater than offset a 3% decline in quantity.

Click on right here to obtain our most up-to-date Positive Evaluation report on PEP (preview of web page 1 of three proven beneath):

Recession-Proof Inventory #6: Farmers & Retailers Bancorp (FMCB)

- Dividend Yield: 1.7%

- 5-year Anticipated Annual Returns: 13.7%

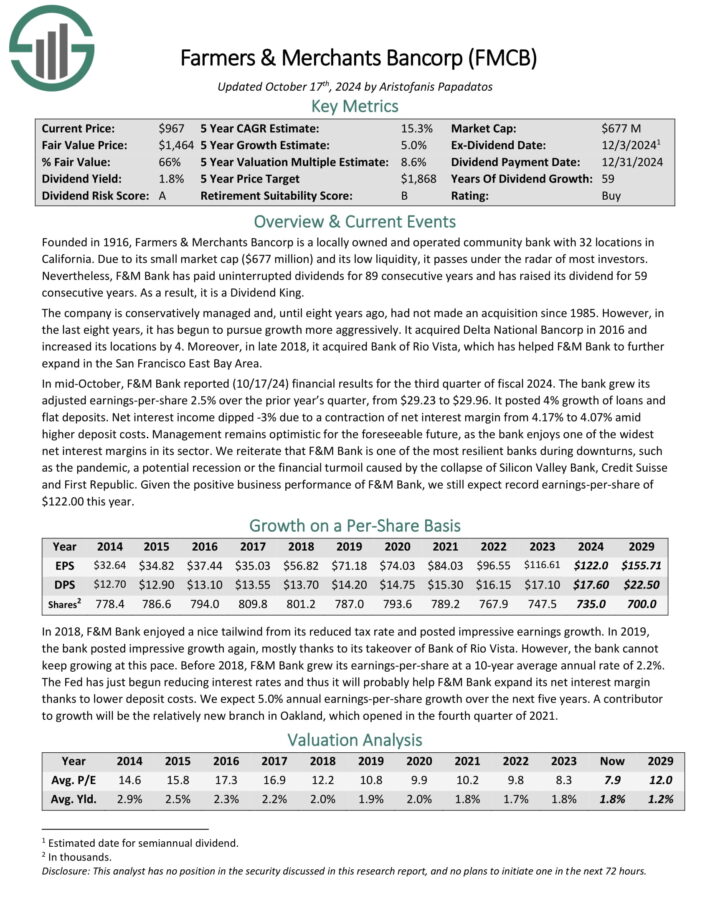

Farmers & Retailers Bancorp is a domestically owned and operated group financial institution with 32 places in California. As a result of its small market cap and its low liquidity, it passes beneath the radar of most traders.

F&M Financial institution has paid uninterrupted dividends for 88 consecutive years and has raised its dividend for 59 consecutive years.

In mid-October, F&M Financial institution reported (10/17/24) monetary outcomes for the third quarter of fiscal 2024. The financial institution grew its adjusted earnings-per-share 2.5% over the prior yr’s quarter, from $29.23 to $29.96.

It posted 4% development of loans and flat deposits. Internet curiosity revenue dipped -3% as a consequence of a contraction of internet curiosity margin from 4.17% to 4.07% amid larger deposit prices.

F&M Financial institution is a prudently managed financial institution, which has all the time focused a conservative capital ratio. The financial institution at the moment has a complete capital ratio of 14.95%, which ends up in the very best regulatory classification of “nicely capitalized.”

Furthermore, its credit score high quality stays exceptionally sturdy, as there are extraordinarily few non-performing loans and leases in its portfolio.

Click on right here to obtain our most up-to-date Positive Evaluation report on FMCB (preview of web page 1 of three proven beneath):

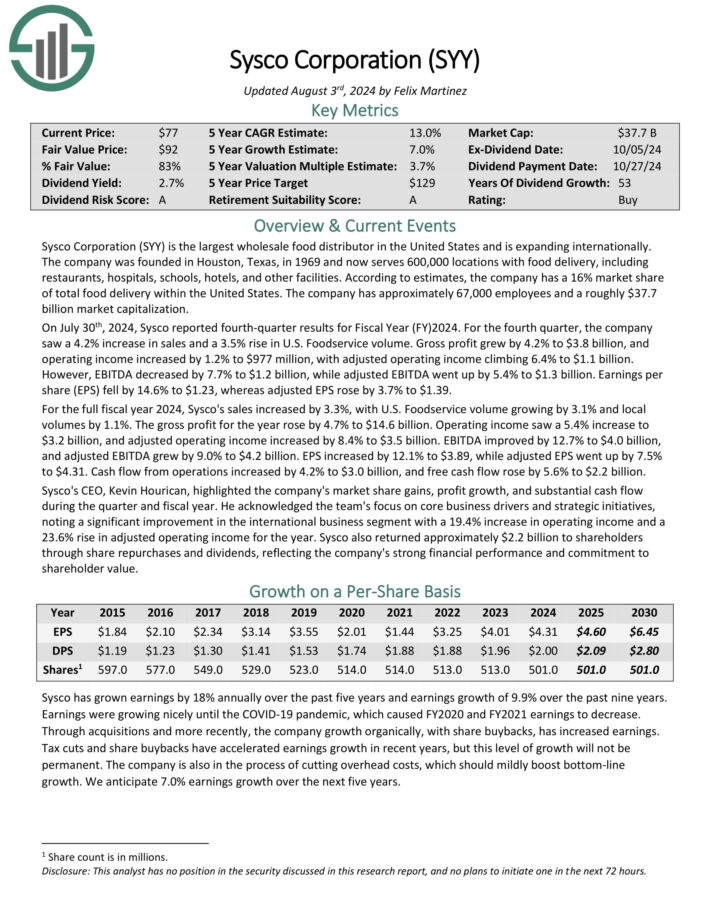

Recession-Proof Inventory #5: Sysco Corp. (SYY)

- Dividend Yield: 2.8%

- 5-year Anticipated Annual Returns: 14.0%

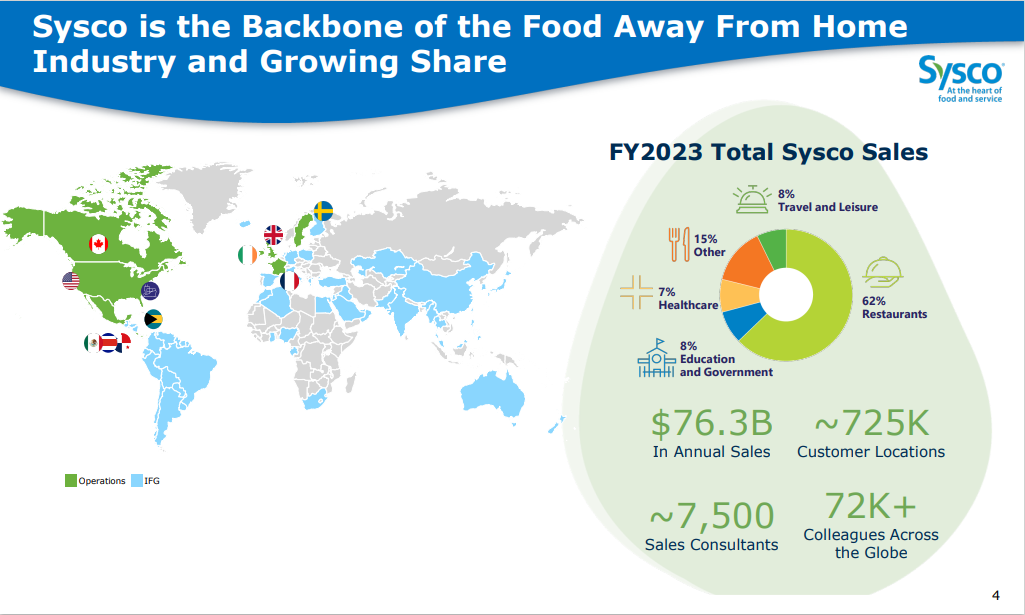

Sysco Company is the most important wholesale meals distributor in the USA. The corporate serves 600,000 places with meals supply, together with eating places, hospitals, faculties, inns, and different amenities.

Supply: Investor Presentation

On July thirtieth, 2024, Sysco reported fourth-quarter outcomes for Fiscal 12 months (FY) 2024. For the fourth quarter, the corporate noticed a 4.2% improve in gross sales and a 3.5% rise in U.S. Foodservice quantity.

Gross revenue grew by 4.2% to $3.8 billion, and working revenue elevated by 1.2% to $977 million, with adjusted working revenue climbing 6.4% to $1.1 billion.

Nonetheless, EBITDA decreased by 7.7% to $1.2 billion, whereas adjusted EBITDA went up by 5.4% to $1.3 billion. Earnings per share (EPS) fell by 14.6% to $1.23, whereas adjusted EPS rose by 3.7% to $1.39.

Click on right here to obtain our most up-to-date Positive Evaluation report on SYY (preview of web page 1 of three proven beneath):

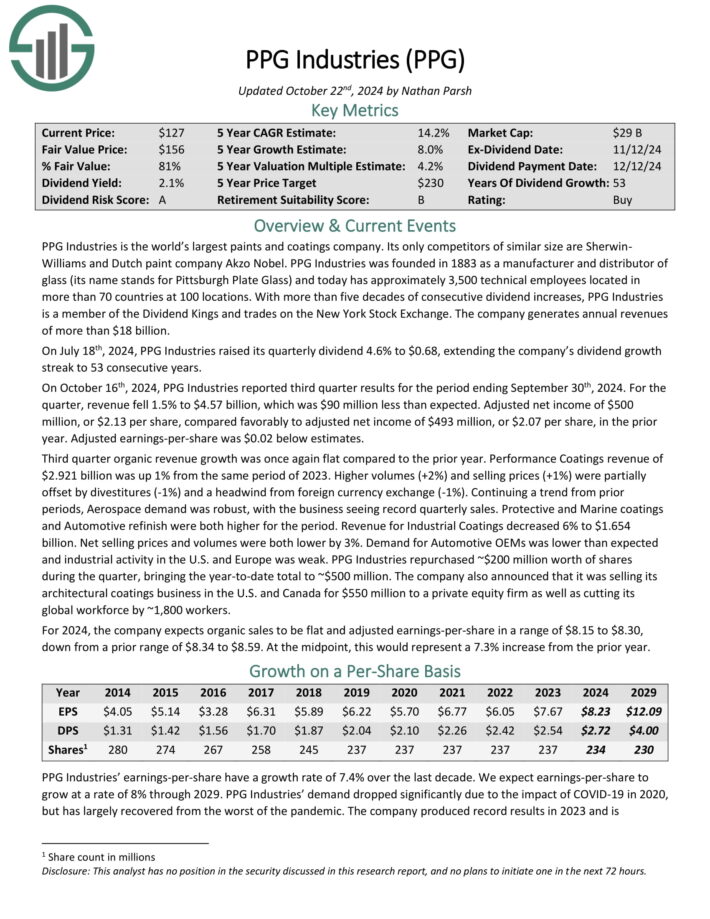

Recession-Proof Inventory #4: PPG Industries (PPG)

- Dividend Yield: 2.2%

- 5-year Anticipated Annual Returns: 15.2%

PPG Industries is the world’s largest paints and coatings firm. Its solely rivals of comparable dimension are Sherwin-Williams and Dutch paint firm Akzo Nobel.

PPG Industries was based in 1883 as a producer and distributor of glass (its identify stands for Pittsburgh Plate Glass) and at the moment has roughly 3,500 technical staff situated in additional than 70 international locations at 100 places.

On October sixteenth, 2024, PPG Industries reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, income fell 1.5% to $4.57 billion, which was $90 million lower than anticipated.

The corporate generates annual income of about $18.2 billion.

Supply: Investor Presentation

Adjusted internet revenue of $500 million, or $2.13 per share, in contrast favorably to adjusted internet revenue of $493 million, or $2.07 per share, within the prior yr. Adjusted earnings-per-share was $0.02 beneath estimates.

Third quarter natural income development was as soon as once more flat in comparison with the prior yr. Efficiency Coatings income of $2.921 billion was up 1% from the identical interval of 2023. Greater volumes (+2%) and promoting costs (+1%) have been partially offset by divestitures (-1%) and a headwind from international foreign money change (-1%).

Click on right here to obtain our most up-to-date Positive Evaluation report on PPG (preview of web page 1 of three proven beneath):

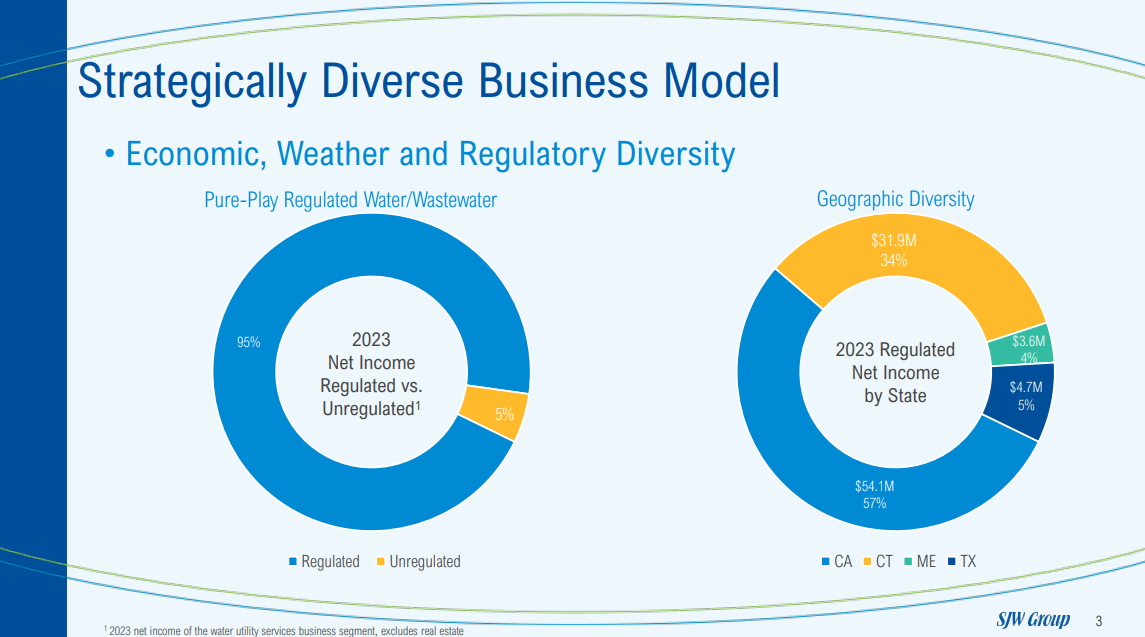

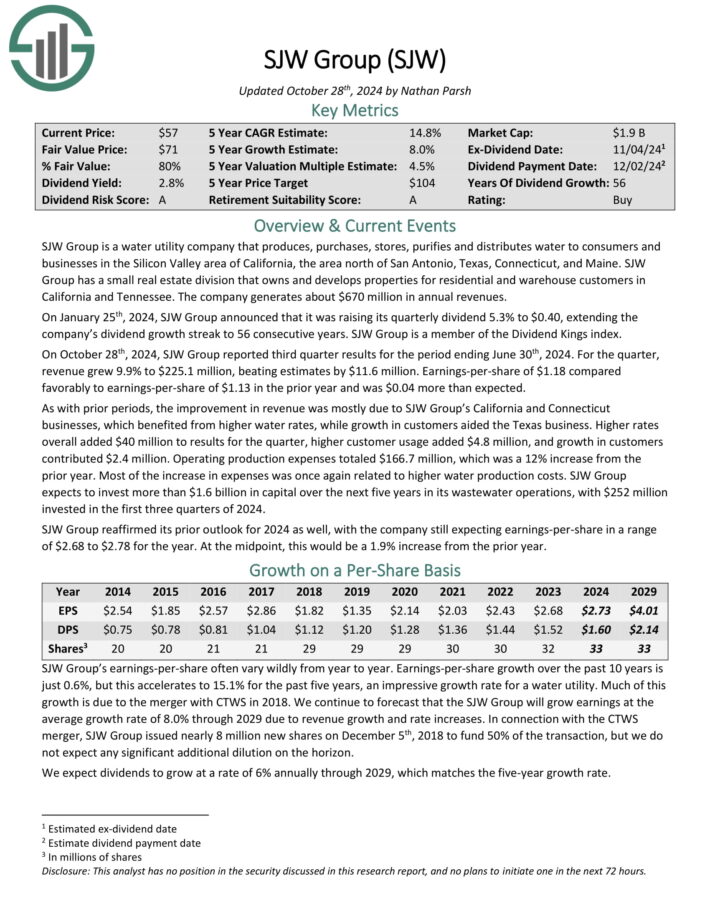

Recession-Proof Inventory #3: SJW Group (SJW)

- Dividend Yield: 2.9%

- 5-year Anticipated Annual Returns: 15.6%

SJW Group is a water utility firm that produces, purchases, shops, purifies and distributes water to shoppers and companies within the Silicon Valley space of California, the realm north of San Antonio, Texas, Connecticut, and Maine.

SJW Group has a small actual property division that owns and develops properties for residential and warehouse prospects in California and Tennessee. The corporate generates about $670 million in annual revenues.

Supply: Investor Presentation

On October twenty eighth, 2024, SJW Group reported third quarter outcomes for the interval ending June thirtieth, 2024. For the quarter, income grew 9.9% to $225.1 million, beating estimates by $11.6 million. Earnings-per-share of $1.18 in contrast favorably to earnings-per-share of $1.13 within the prior yr and was $0.04 greater than anticipated.

As with prior intervals, the advance in income was largely as a consequence of SJW Group’s California and Connecticut companies, which benefited from larger water charges, whereas development in prospects aided the Texas enterprise.

Greater charges total added $40 million to outcomes for the quarter, larger buyer utilization added $4.8 million, and development in prospects contributed $2.4 million. Working manufacturing bills totaled $166.7 million, which was a 12% improve from the prior yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on SJW (preview of web page 1 of three proven beneath):

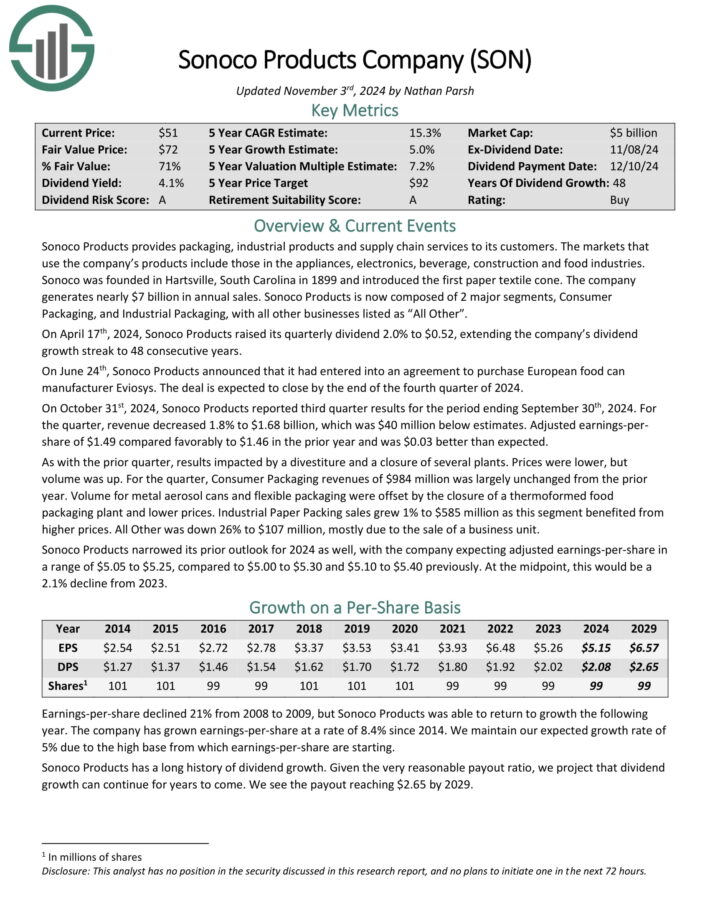

Recession-Proof Inventory #2: Sonoco Merchandise (SON)

- Dividend Yield: 4.2%

- 5-year Anticipated Annual Returns: 15.8%

Sonoco Merchandise offers packaging, industrial merchandise and provide chain companies to its prospects. The markets that use the corporate’s merchandise embody these within the home equipment, electronics, beverage, building and meals industries.

The corporate generates practically $7 billion in annual gross sales. Sonoco Merchandise is now composed of two main segments, Client Packaging, and Industrial Packaging, with all different companies listed as “All Different”.

Supply: Investor Presentation

On October thirty first, 2024, Sonoco Merchandise reported third quarter outcomes for the interval ending September thirtieth, 2024. For the quarter, income decreased 1.8% to $1.68 billion, which was $40 million beneath estimates.

Adjusted earnings-per share of $1.49 in contrast favorably to $1.46 within the prior yr and was $0.03 higher than anticipated.

As with the prior quarter, outcomes impacted by a divestiture and a closure of a number of vegetation. Costs have been decrease, however quantity was up.

For the quarter, Client Packaging revenues of $984 million was largely unchanged from the prior yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on Sonoco (SON) (preview of web page 1 of three proven beneath):

Recession-Proof Inventory #1: Goal Corp. (TGT)

- Dividend Yield: 3.7%

- 5-year Anticipated Annual Returns: 17.7%

Goal was based in 1902 and now operates about 1,850 huge field shops, which supply basic merchandise and meals, in addition to serving as distribution factors for the corporate’s e-commerce enterprise.

Goal posted second quarter earnings on August twenty first, 2024, and outcomes have been fairly sturdy, sending the inventory leaping after the report. Adjusted earnings-per-share got here to $2.57, which was 39 cents forward of estimates. Income was up 2.7% year-over-year to $25.45 billion, which beat by $240 million.

Comparable gross sales have been up 2% year-over-year, making up a lot of the complete gross sales acquire. Consensus was for a acquire of 1.1%. Site visitors was up 3% year-over-year with all six core merchandising classes seeing optimistic development. Digital comparable gross sales have been up 8.7%, as soon as once more driving development.

Goal has grown its dividend for greater than 5 a long time, making it a Dividend King. The corporate is investing closely in its enterprise in an effort to navigate by the altering panorama within the retail sector. The payout is now 47% of earnings for this yr,

Click on right here to obtain our most up-to-date Positive Evaluation report on TGT (preview of web page 1 of three proven beneath):

Ultimate Ideas

Whereas no inventory is in the end recession-proof, there are specific sectors and industries that are typically extra resilient throughout financial downturns.

On the whole, important items and companies, corresponding to healthcare, utilities, and shopper staples, have a greater historical past when it comes to producing stable outcomes and persevering with to develop their dividends throughout robust financial situations.

The shares we have now chosen for this text have already confirmed they’ll stand tall throughout recessionary environments fairly sufficiently, as confirmed by their prolonged dividend development monitor information.

Searching for extra prime quality dividend shares? These different Positive Dividend databases may very well be very helpful:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].