Revealed on February ninth, 2026 by Bob Ciura

Month-to-month dividend shares have prompt attraction for a lot of earnings traders.

Shares that pay their dividends every month provide extra frequent payouts than conventional quarterly or semi-annual dividend payers.

Because of this, we created a full record of over 100 month-to-month dividend shares.

You’ll be able to obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter like dividend yield and payout ratio) by clicking on the hyperlink beneath:

However whereas month-to-month dividend shares are enticing on the floor, not all can maintain their payouts. Earnings traders ought to attempt to keep away from dividend cuts or elimination as a lot as doable.

This text will talk about 10 pink flag month-to-month dividend shares that might be vulnerable to a dividend minimize sooner or later, notably in a recession.

The ten shares on this article all have Dividend Threat Scores of ‘D’ or ‘F’ (our lowest grades) within the Certain Evaluation Analysis Database, with payout ratios above 100%.

A payout ratio above 100% signifies the corporate will not be producing sufficient underlying earnings to maintain the dividend payout. This leaves a excessive chance of a dividend minimize or elimination in some unspecified time in the future sooner or later.

The record is sorted by dividend payout ratio, from lowest to highest.

Desk Of Contents

Shares are listed by their dividend yields, from lowest to highest.

You’ll be able to immediately soar to a person part of the article by using the hyperlinks beneath:

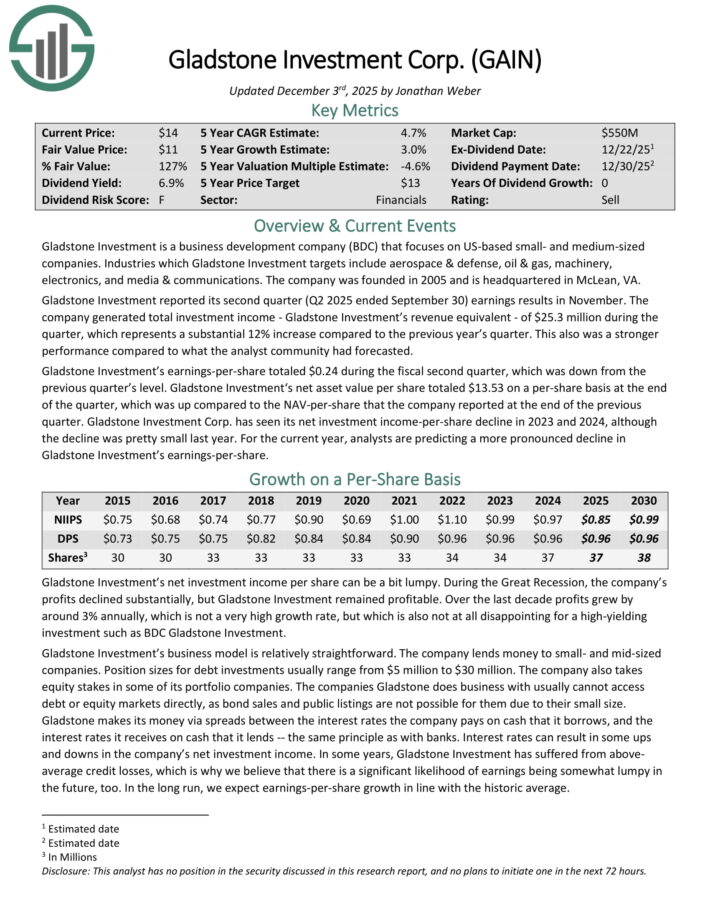

Pink Flag Month-to-month Dividend Inventory #10: Gladstone Funding Company (GAIN)

Gladstone Funding is a enterprise improvement firm (BDC) that focuses on US-based small- and medium-sized corporations.

Industries which Gladstone Funding targets embrace aerospace & protection, oil & gasoline, equipment, electronics, and media & communications. The corporate was based in 2005 and is headquartered in McLean, VA.

Gladstone Funding reported its second quarter (Q2 2025 ended September 30) earnings leads to November. The corporate generated whole funding earnings of $25.3 million through the quarter, which represented a 12% improve year-over-year.

Gladstone Funding’s earnings-per-share totaled $0.24 through the fiscal second quarter, which was down from the earlier quarter’s degree.

Gladstone Funding‘s web asset worth per share totaled $13.53 on a per-share foundation on the finish of the quarter, which was up in comparison with the NAV-per-share that the corporate reported on the finish of the earlier quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on GAIN (preview of web page 1 of three proven beneath):

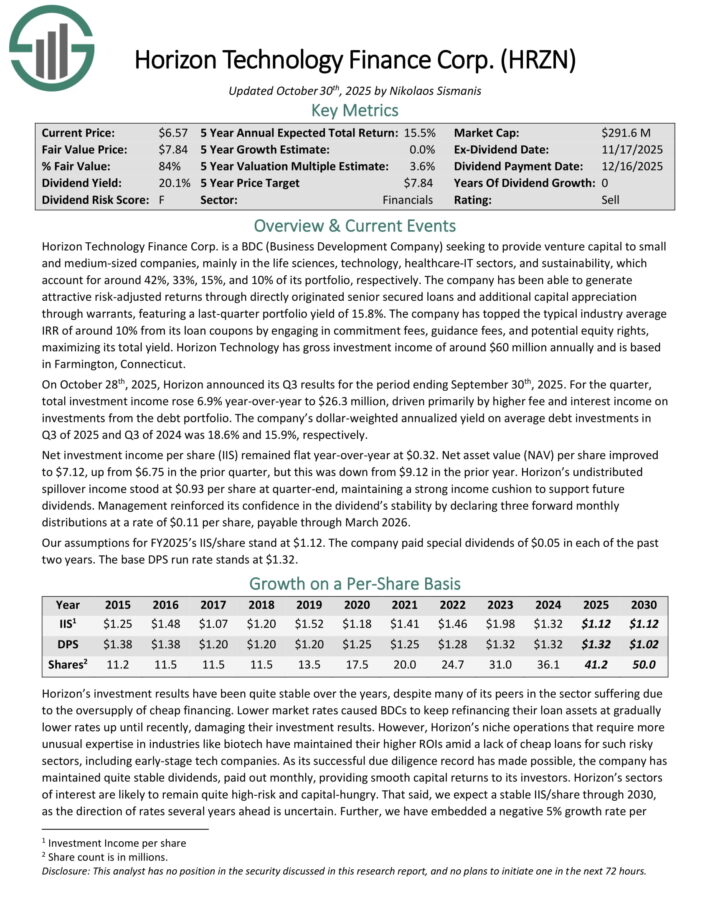

Pink Flag Month-to-month Dividend Inventory #9: Horizon Know-how Finance Corp. (HRZN)

Horizon Know-how Finance Corp. is a BDC that gives enterprise capital to small and medium–sized corporations within the know-how, life sciences, and healthcare–IT sectors.

The corporate has generated enticing danger–adjusted returns by means of immediately originated senior secured loans and extra capital appreciation by means of warrants.

Horizon Know-how Finance Corp. is a BDC that gives enterprise capital to small and medium–sized corporations within the know-how, life sciences, and healthcare–IT sectors.

On October twenty eighth, 2025, Horizon introduced its Q3 outcomes. For the quarter, whole funding earnings rose 6.9% year-over-year to $26.3 million, pushed primarily by greater charge and curiosity earnings on investments from the debt portfolio.

The corporate’s dollar-weighted annualized yield on common debt investments in Q3 of 2025 and Q3 of 2024 was 18.6% and 15.9%, respectively.

Internet funding earnings per share (IIS) remained flat year-over-year at $0.32. Internet asset worth (NAV) per share improved to $7.12, up from $6.75 within the prior quarter, however this was down from $9.12 within the prior yr.

Horizon’s undistributed spillover earnings stood at $0.93 per share at quarter-end, sustaining a robust earnings cushion to help future dividends.

Click on right here to obtain our most up-to-date Certain Evaluation report on HRZN (preview of web page 1 of three proven beneath):

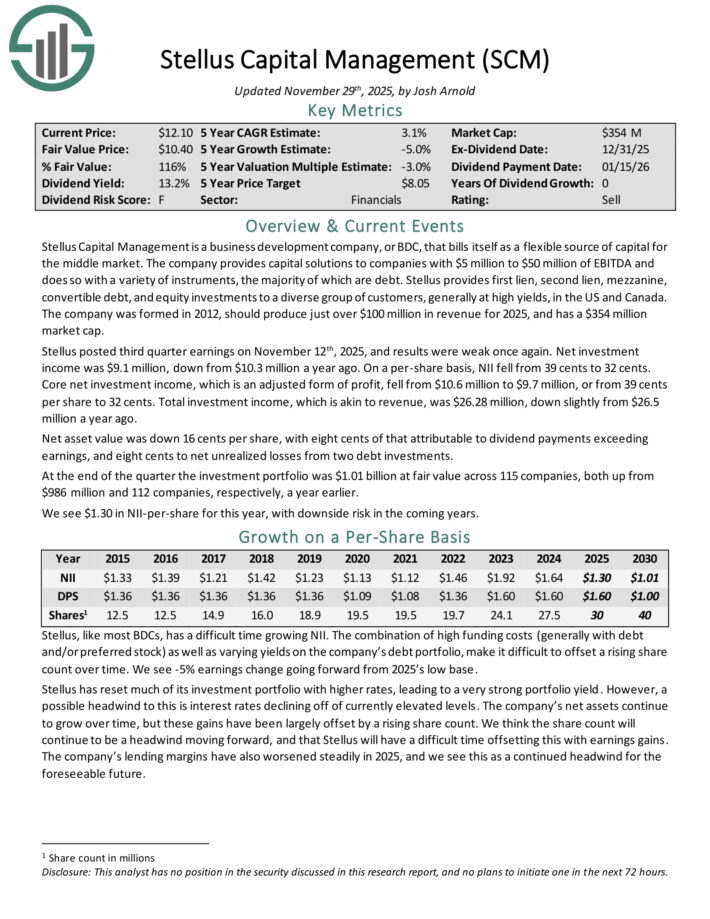

Pink Flag Month-to-month Dividend Inventory #8: Stellus Capital (SCM)

Stellus Capital Administration offers capital options to corporations with $5 million to $50 million of EBITDA and does so with a wide range of devices, nearly all of that are debt.

Stellus offers first lien, second lien, mezzanine, convertible debt, and fairness investments to a various group of shoppers, usually at excessive yields, within the US and Canada.

Stellus posted third quarter earnings on November twelfth, 2025, and outcomes have been weak as soon as once more. Internet funding earnings was $9.1 million, down from $10.3 million a yr in the past. On a per-share foundation, NII fell from 39 cents to 32 cents.

Core web funding earnings, which is an adjusted type of revenue, fell from $10.6 million to $9.7 million, or from 39 cents per share to 32 cents. Complete funding earnings, which is akin to income, was $26.28 million, down barely from $26.5 million a yr in the past.

Internet asset worth was down 16 cents per share, with eight cents of that attributable to dividend funds exceeding earnings, and eight cents to web unrealized losses from two debt investments.

On the finish of the quarter the funding portfolio was $1.01 billion at truthful worth throughout 115 corporations, each up from $986 million and 112 corporations, respectively, a yr earlier.

Click on right here to obtain our most up-to-date Certain Evaluation report on SCM (preview of web page 1 of three proven beneath):

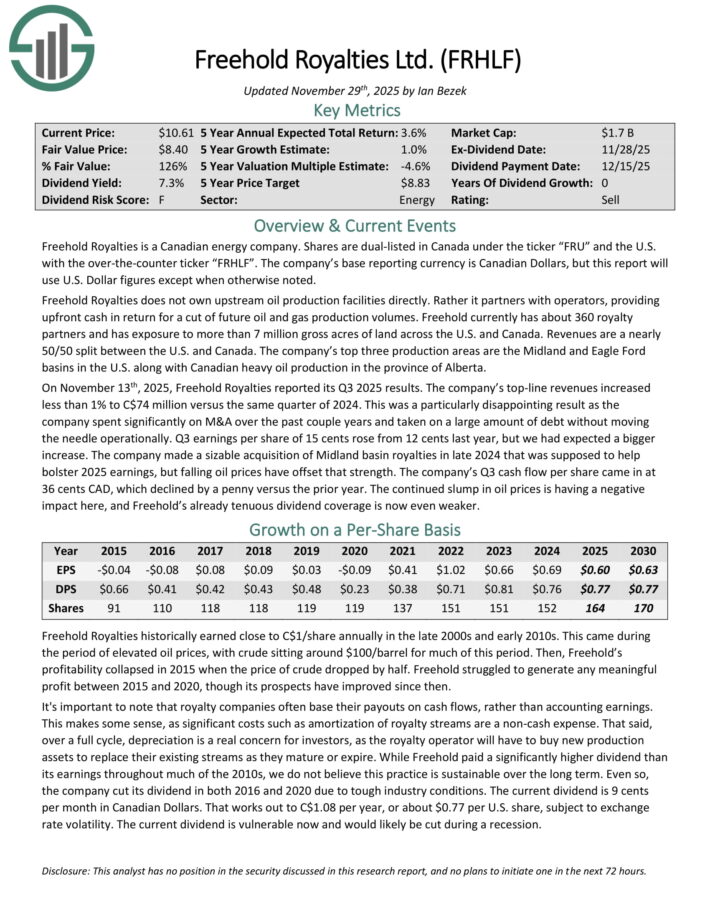

Pink Flag Month-to-month Dividend Inventory #7: Freehold Royalties Ltd. (FRHLF)

Freehold Royalties is a Canadian vitality firm. It doesn’t personal upstream oil manufacturing services immediately. Reasonably it companions with operators, offering upfront money in return for a minimize of future oil and gasoline manufacturing volumes.

Freehold at present has about 360 royalty companions and has publicity to greater than 7 million gross acres of land throughout the U.S. and Canada. Revenues are a virtually 50/50 break up between the U.S. and Canada.

The corporate’s prime three manufacturing areas are the Midland and Eagle Ford basins within the U.S. together with Canadian heavy oil manufacturing within the province of Alberta.

On November thirteenth, 2025, Freehold Royalties reported its Q3 2025 outcomes. The corporate’s top-line revenues elevated lower than 1% to C$74 million versus the identical quarter of 2024.

This was a very disappointing outcome as the corporate spent considerably on M&A over the previous couple years and brought on a considerable amount of debt with out shifting the needle operationally. Earnings per share of 15 cents rose from 12 cents final yr, however we had anticipated an even bigger improve.

The corporate made a large acquisition of Midland basin royalties in late 2024 that was supposed to assist bolster 2025 earnings, however falling oil costs have offset that energy.

Money circulation per share got here in at 36 cents CAD, which declined by a penny versus the prior yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on FRHLF (preview of web page 1 of three proven beneath):

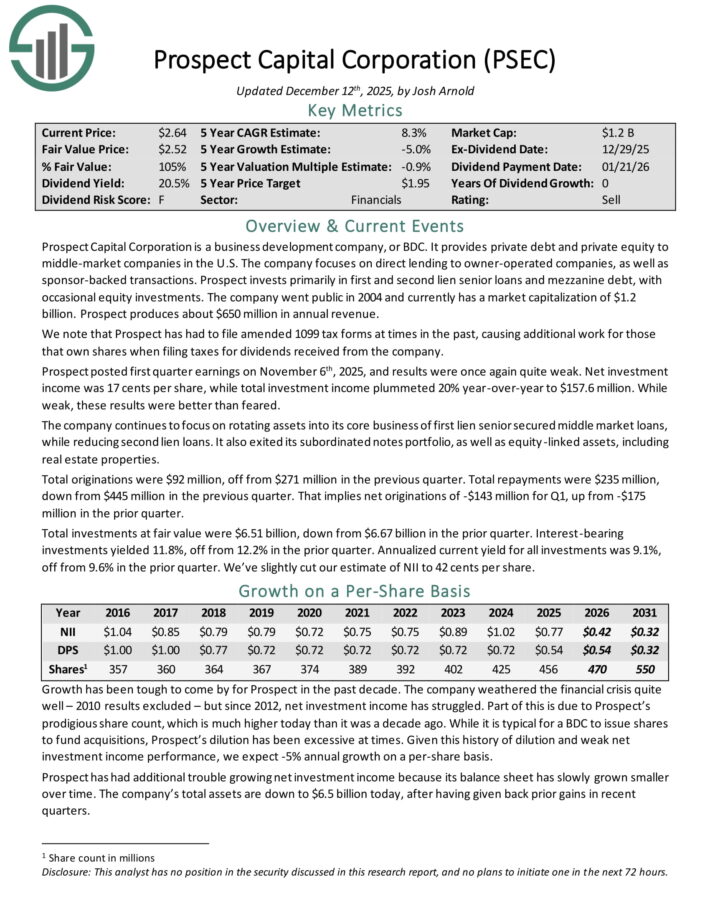

Pink Flag Month-to-month Dividend Inventory #6: Prospect Capital (PSEC)

Prospect Capital Company is a Enterprise Growth Firm, or BDC, that gives personal debt and personal fairness to center–market corporations within the U.S.

The corporate focuses on direct lending to proprietor–operated corporations, in addition to sponsor–backed transactions. Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional fairness investments.

Prospect posted first quarter earnings on November sixth, 2025. Internet funding earnings was 17 cents per share, whereas whole funding earnings plummeted 20% year-over-year to $157.6 million. Whereas weak, these outcomes have been higher than feared.

The corporate continues to give attention to rotating belongings into its core enterprise of first lien senior secured center market loans, whereas lowering second lien loans. It additionally exited its subordinated notes portfolio, in addition to equity-linked belongings, together with actual property properties.

Complete originations have been $92 million, off from $271 million within the earlier quarter. Complete repayments have been $235 million, down from $445 million within the earlier quarter. That means web originations of -$143 million for Q1, up from -$175 million within the prior quarter.

Complete investments at truthful worth have been $6.51 billion, down from $6.67 billion within the prior quarter. Curiosity-bearing investments yielded 11.8%, off from 12.2% within the prior quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on PSEC (preview of web page 1 of three proven beneath):

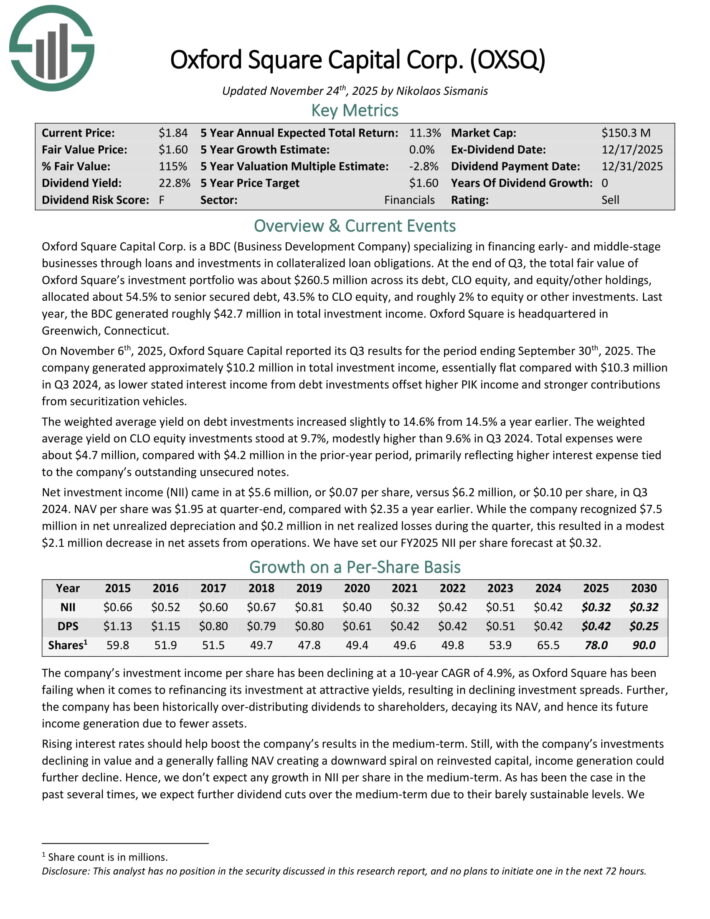

Pink Flag Month-to-month Dividend Inventory #5: Oxford Sq. Capital (OXSQ)

Oxford Sq. Capital Corp. is a BDC (Enterprise Growth Firm) specializing in financing early- and middle-stage companies by means of loans and investments in collateralized mortgage obligations.

On the finish of Q3, the overall truthful worth of Oxford Sq.’s funding portfolio was about $260.5 million throughout its debt, CLO fairness, and fairness/different holdings, allotted about 54.5% to senior secured debt, 43.5% to CLO fairness, and roughly 2% to fairness or different investments. Final yr, the BDC generated roughly $42.7 million in whole funding earnings.

On November sixth, 2025, Oxford Sq. Capital reported its Q3. The corporate generated roughly $10.2 million in whole funding earnings, basically flat in contrast with $10.3 million in Q3 2024, as decrease acknowledged curiosity earnings from debt investments offset greater PIK earnings and stronger contributions from securitization automobiles.

The weighted common yield on debt investments elevated barely to 14.6% from 14.5% a yr earlier. The weighted common yield on CLO fairness investments stood at 9.7%, modestly greater than 9.6% in Q3 2024.

Complete bills have been about $4.7 million, in contrast with $4.2 million within the prior-year interval, primarily reflecting greater curiosity expense tied to the corporate’s excellent unsecured notes.

Internet funding earnings (NII) got here in at $5.6 million, or $0.07 per share, versus $6.2 million, or $0.10 per share, in Q3 2024.

Click on right here to obtain our most up-to-date Certain Evaluation report on OXSQ (preview of web page 1 of three proven beneath):

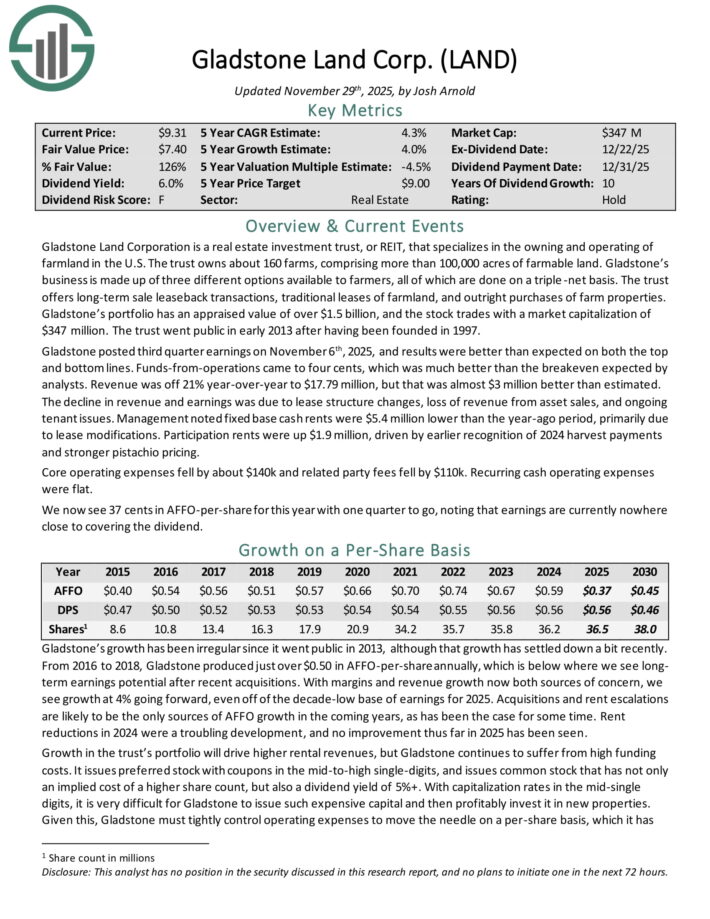

Pink Flag Month-to-month Dividend Inventory #4: Gladstone Land Corp. (LAND)

Gladstone Land Company is a REIT that makes a speciality of the proudly owning and working of farmland within the U.S.

The belief owns about 160 farms, comprising greater than 100,000 acres of farmable land. Gladstone’s enterprise is made up of three completely different choices out there to farmers, all of that are achieved on a triple-net foundation.

The belief gives long-term sale leaseback transactions, conventional leases of farmland, and outright purchases of farm properties. Gladstone’s portfolio has an appraised worth of over $1.5 billion.

Gladstone posted third quarter earnings on November sixth, 2025, and outcomes have been higher than anticipated on each the highest and backside strains.

Funds-from-operations got here to 4 cents, which was significantly better than the breakeven anticipated by analysts. Income was off 21% year-over-year to $17.79 million, however that was virtually $3 million higher than estimated.

The decline in income and earnings was resulting from lease construction modifications, lack of income from asset gross sales, and ongoing tenant points. Administration famous fastened base money rents have been $5.4 million decrease than the year-ago interval, primarily resulting from lease modifications.

Participation rents have been up $1.9 million, pushed by earlier recognition of 2024 harvest funds and stronger pistachio pricing.

Core working bills fell by about $140k and associated occasion charges fell by $110k. Recurring money working bills have been flat.

Click on right here to obtain our most up-to-date Certain Evaluation report on LAND (preview of web page 1 of three proven beneath):

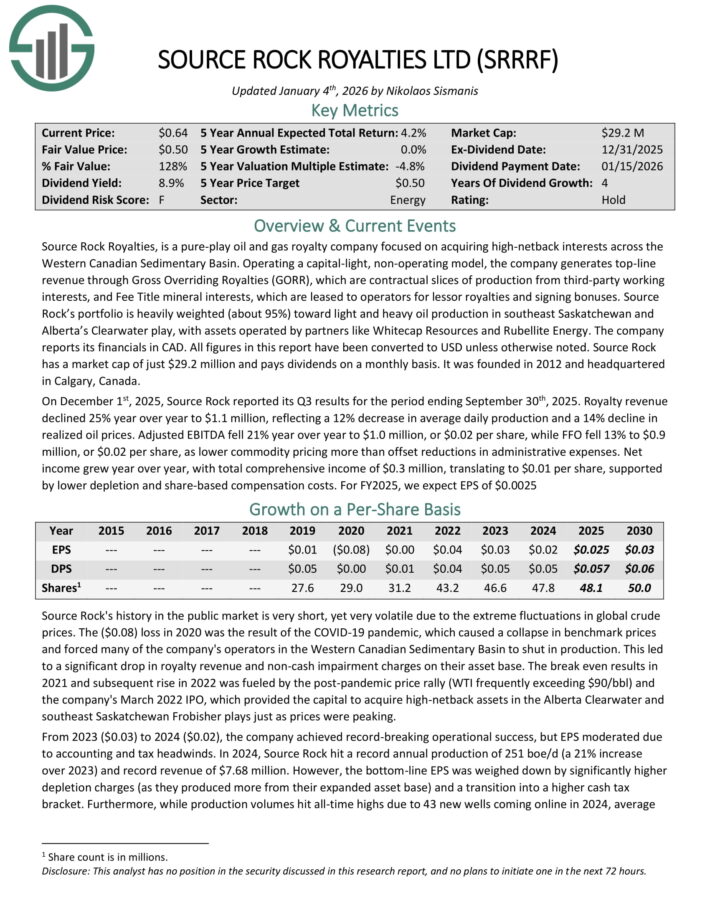

Pink Flag Month-to-month Dividend Inventory #3: Supply Rock Royalties Ltd. (SRRRF)

Supply Rock Royalties, is a pure-play oil and gasoline royalty firm targeted on buying high-netback pursuits throughout the Western Canadian Sedimentary Basin.

Working a capital-light, non-operating mannequin, the corporate generates top-line income by means of Gross Overriding Royalties (GORR), that are contractual slices of manufacturing from third-party working pursuits, and Charge Title mineral pursuits, that are leased to operators for lessor royalties and signing bonuses.

Supply Rock’s portfolio is closely weighted (about 95%) towards gentle and heavy oil manufacturing in southeast Saskatchewan and Alberta’s Clearwater play, with belongings operated by companions like Whitecap Sources and Rubellite Vitality.

Supply Rock was based in 2012 and headquartered in Calgary, Canada.

On December 1st, 2025, Supply Rock reported its Q3 outcomes. Royalty income declined 25% yr over yr to $1.1 million, reflecting a 12% lower in common each day manufacturing and a 14% decline in realized oil costs.

Adjusted EBITDA fell 21% yr over yr to $1.0 million, or $0.02 per share, whereas FFO fell 13% to $0.9 million, or $0.02 per share, as decrease commodity pricing greater than offset reductions in administrative bills.

Internet earnings grew yr over yr, with whole complete earnings of $0.3 million, translating to $0.01 per share, supported by decrease depletion and share-based compensation prices.

Click on right here to obtain our most up-to-date Certain Evaluation report on SRRRF (preview of web page 1 of three proven beneath):

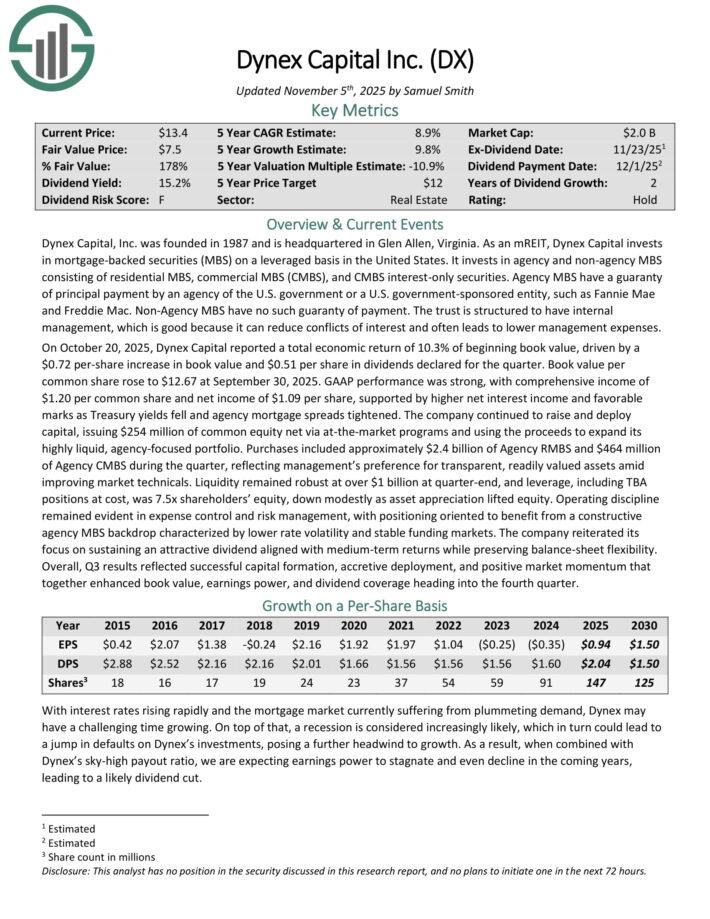

Pink Flag Month-to-month Dividend Inventory #2: Dynex Capital (DX)

Dynex Capital invests in mortgage–backed securities (MBS) on a leveraged foundation in the USA. It invests in company and non–company MBS consisting of residential MBS, business MBS (CMBS), and CMBS curiosity–solely securities.

On October 20, 2025, Dynex Capital reported a complete financial return of 10.3% of starting e book worth, pushed by a $0.72 per-share improve in e book worth and $0.51 per share in dividends declared for the quarter.

Ebook worth per frequent share rose to $12.67 at September 30, 2025. GAAP efficiency was robust, with complete earnings of $1.20 per frequent share and web earnings of $1.09 per share, supported by greater web curiosity earnings and favorable marks as Treasury yields fell and company mortgage spreads tightened.

The corporate continued to lift and deploy capital, issuing $254 million of frequent fairness web by way of at-the-market applications and utilizing the proceeds to develop its extremely liquid, agency-focused portfolio.

Purchases included roughly $2.4 billion of Company RMBS and $464 million of Company CMBS through the quarter, reflecting administration’s desire for clear, readily valued belongings amid enhancing market technicals.

Click on right here to obtain our most up-to-date Certain Evaluation report on DX (preview of web page 1 of three proven beneath):

Pink Flag Month-to-month Dividend Inventory #1: Orchid Island Capital (ORC)

Orchid Island Capital is a mortgage REIT that’s externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), together with pass-through and structured company RMBSs.

These monetary devices generate money circulation primarily based on residential loans similar to mortgages, subprime, and home-equity loans.

On October 23, 2025, Orchid Island Capital, Inc. reported estimated web earnings of $0.53 per frequent share for Q3 2025, with e book worth per share estimated at $7.33 as of September 30, 2025.

The corporate declared a month-to-month dividend of $0.12 per share for October, maintaining in line with its month-to-month payout technique.

The RMBS portfolio and derivatives portfolio advanced as the corporate remained targeted on company residential mortgage-backed securities paired with hedging methods.

Orchid Island highlighted that the funding backdrop stays enticing with enhancing spreads and prepayment danger manageable given the portfolio’s coupon distribution and hedges.

Prepayment exercise remained a focus, with administration noting the necessity for continued vigilance given greater coupon swimming pools and refinancing dynamics.

Click on right here to obtain our most up-to-date Certain Evaluation report on Orchid Island Capital, Inc. (ORC) (preview of web page 1 of three proven beneath):

Closing Ideas

Month-to-month dividend shares might be extra interesting to earnings traders than quarterly or semi-annual dividend shares. It is because month-to-month dividend shares make 12 dividend funds per yr, as a substitute of the same old 4 or 2.

Nevertheless, traders also needs to be involved with the sustainability of an organization’s dividend. Some month-to-month dividend shares have unsustainable dividends, characterised by elevated dividend payout ratios above 100%.

Consequently, these 10 pink flag month-to-month dividend shares might minimize their dividends in some unspecified time in the future sooner or later, notably if a recession hits.

Additional Studying

In case you are eager about discovering high-yield month-to-month dividend shares, the next Certain Dividend assets will probably be helpful:

Month-to-month Dividend Inventory Particular person Safety Analysis

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].