Up to date on November 14th, 2024 by Bob Ciura

Spreadsheet knowledge up to date each day

Actual property funding trusts – or REITs, for brief – could be implausible securities for producing significant portfolio earnings. REITs extensively provide increased dividend yields than the typical inventory.

Whereas the S&P 500 Index on common yields lower than 2% proper now, it’s comparatively simple to seek out REITs with dividend yields of 5% or increased.

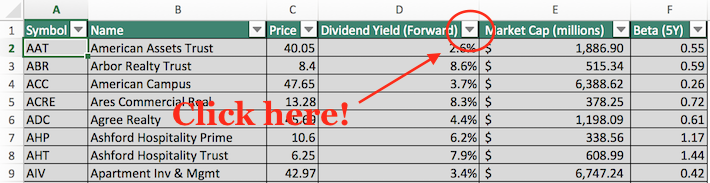

The next downloadable REIT checklist comprises a complete checklist of U.S. Actual Property Funding Trusts, together with metrics that matter together with:

- Inventory value

- Dividend yield

- Market capitalization

- 5-year beta

You’ll be able to obtain your free 200+ REIT checklist (together with vital monetary metrics like dividend yields and payout ratios) by clicking on the hyperlink beneath:

Along with the downloadable Excel sheet of all REITs, this text discusses why earnings buyers ought to pay significantly shut consideration to this asset class.

And, we additionally embody our prime 7 REITs immediately primarily based on anticipated whole returns.

Desk Of Contents

Along with the complete downloadable Excel spreadsheet, this text covers our prime 7 REITs immediately, as ranked utilizing anticipated whole returns from The Positive Evaluation Analysis Database.

The desk of contents beneath permits for straightforward navigation.

How To Use The REIT Record To Discover Dividend Inventory Concepts

REITs give buyers the flexibility to expertise the financial advantages related to actual property possession with out the trouble of being a landlord within the conventional sense.

Due to the month-to-month rental money flows generated by REITs, these securities are well-suited to buyers that goal to generate earnings from their funding portfolios. Accordingly, dividend yield would be the major metric of curiosity for a lot of REIT buyers.

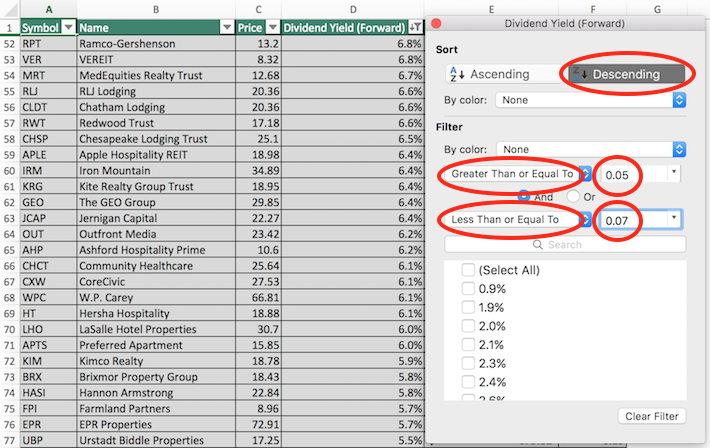

For these unfamiliar with Microsoft Excel, the next pictures present how you can filter for top dividend REITs with dividend yields between 5% and seven% utilizing the ‘filter’ operate of Excel.

Step 1: Obtain the Full REIT Excel Spreadsheet Record on the hyperlink above.

Step 2: Click on on the filter icon on the prime of the ‘Dividend Yield’ column within the Full REIT Excel Spreadsheet Record.

Step 3: Use the filter features ‘Higher Than or Equal To’ and ‘Much less Than or Equal To’ together with the numbers 0.05 advert 0.07 to show REITs with dividend yields between 5% and seven%.

This may assist to eradicate any REITs with exceptionally excessive (and maybe unsustainable) dividend yields.

Additionally, click on on ‘Descending’ on the prime of the filter window to checklist the REITs with the best dividend yields on the prime of the spreadsheet.

Now that you’ve got the instruments to establish high-quality REITs, the subsequent part will present a few of the advantages of proudly owning this asset class in a diversified funding portfolio.

Why Put money into REITs?

REITs are, by design, a implausible asset class for buyers seeking to generate earnings.

Thus, one of many major advantages of investing in these securities is their excessive dividend yields.

The presently excessive dividend yields of REITs shouldn’t be an remoted prevalence. In truth, this asset class has traded at the next dividend yield than the S&P 500 for many years.

Associated: Dividend investing versus actual property investing.

The excessive dividend yields of REITs are because of the regulatory implications of doing enterprise as an actual property funding belief.

In trade for itemizing as a REIT, these trusts should pay out no less than 90% of their web earnings as dividend funds to their unitholders (REITs commerce as models, not shares).

Generally you will notice a payout ratio of lower than 90% for a REIT, and that’s doubtless as a result of they’re utilizing funds from operations, not web earnings, within the denominator for REIT payout ratios (extra on that later).

REIT Monetary Metrics

REITs run distinctive enterprise fashions. Greater than the overwhelming majority of different enterprise varieties, they’re primarily concerned within the possession of long-lived property.

From an accounting perspective, because of this REITs incur important non-cash depreciation and amortization bills.

How does this have an effect on the underside line of REITs?

Depreciation and amortization bills cut back an organization’s web earnings, which implies that typically a REIT’s dividend might be increased than its web earnings, though its dividends are protected primarily based on money movement.

Associated: How To Worth REITs

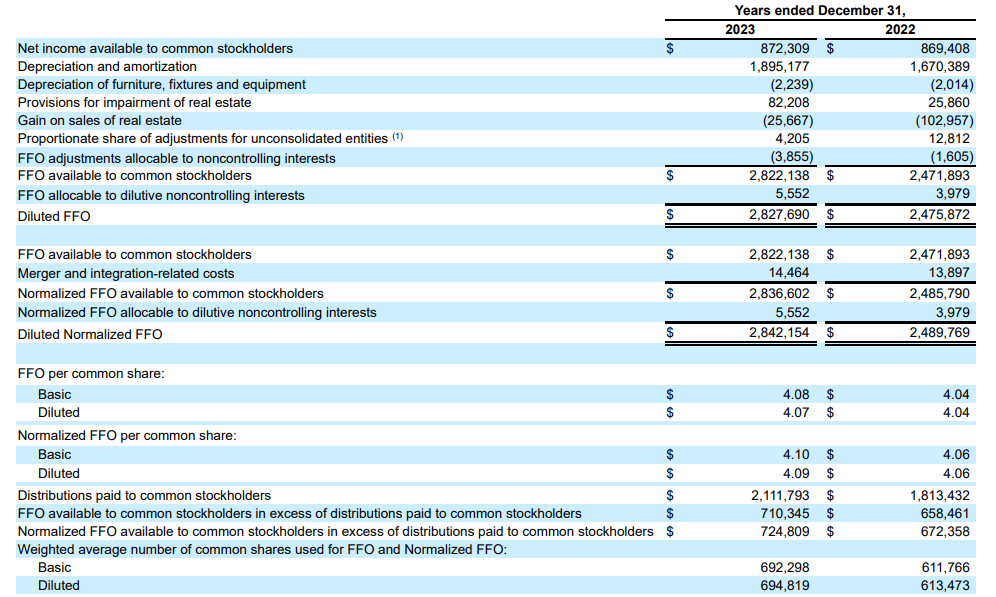

To offer a greater sense of economic efficiency and dividend security, REITs finally developed the monetary metric funds from operations, or FFO.

Identical to earnings, FFO could be reported on a per-unit foundation, giving FFO/unit – the tough equal of earnings-per-share for a REIT.

FFO is set by taking web earnings and including again numerous non-cash costs which might be seen to artificially impair a REIT’s perceived capacity to pay its dividend.

For an instance of how FFO is calculated, think about the next web income-to-FFO reconciliation from Realty Revenue (O), one of many largest and hottest REIT securities.

Supply: Realty Revenue Annual Report

In 2023, web earnings was $872 million whereas FFO accessible to stockholders was above $2.8 billion, a large distinction between the 2 metrics.

This reveals the profound impact that depreciation and amortization can have on the GAAP monetary efficiency of actual property funding trusts.

The High 7 REITs At this time

Under we’ve ranked our prime 7 REITs immediately primarily based on anticipated whole returns.

Anticipated whole returns are in flip made up from dividend yield, anticipated progress on a per unit foundation, and valuation a number of modifications. Anticipated whole return investing takes into consideration earnings (dividend yield), progress, and worth.

Notice: The REITs beneath haven’t been vetted for security. These are excessive anticipated whole return securities, however they might include elevated dangers.

We encourage buyers to completely think about the danger/reward profile of those investments.

For the High 10 REITs every month with 4%+ dividend yields, primarily based on anticipated whole returns and security, see our High 10 REITs service.

High REIT #7: Alexandria Actual Property Equities Inc. (ARE)

- Anticipated Complete Return: 15.5%

- Dividend Yield: 4.8%

Alexandria Actual Property Equities owns and operates life science, know-how and ag-tech campuses throughout North America.

Key areas for this Actual Property Funding Belief (REIT) embody Boston, San Francisco, New York, San Diego, Seattle, Maryland, and the Analysis Triangle (North Carolina). The corporate focuses on prime quality properties in prime areas.

Alexandria’s enterprise mannequin has taken on renewed significance because of the COVID-19 pandemic, as a major variety of the corporate’s life science tenants are engaged on options for comparable future crises.

On June third, 2024, Alexandria elevated its quarterly dividend by 2.4% to $1.30.

On July twenty second, 2024, Alexandria reported second quarter 2024 outcomes for the interval ending June thirtieth, 2024. For the quarter, the corporate generated $767 million in income, a 7.4% improve in comparison with Q2 2023.

Adjusted funds from operations (FFO) totaled $406 million or $2.36 per share in comparison with $382 million or $2.24 per share in Q2 2023.

Alexandria ended the quarter with $5.6 billion in liquidity. And greater than fifty % of the corporate’s tenants are investment-grade or publicly traded massive cap companies.

Click on right here to obtain our most up-to-date Positive Evaluation report on ARE (preview of web page 1 of three proven beneath):

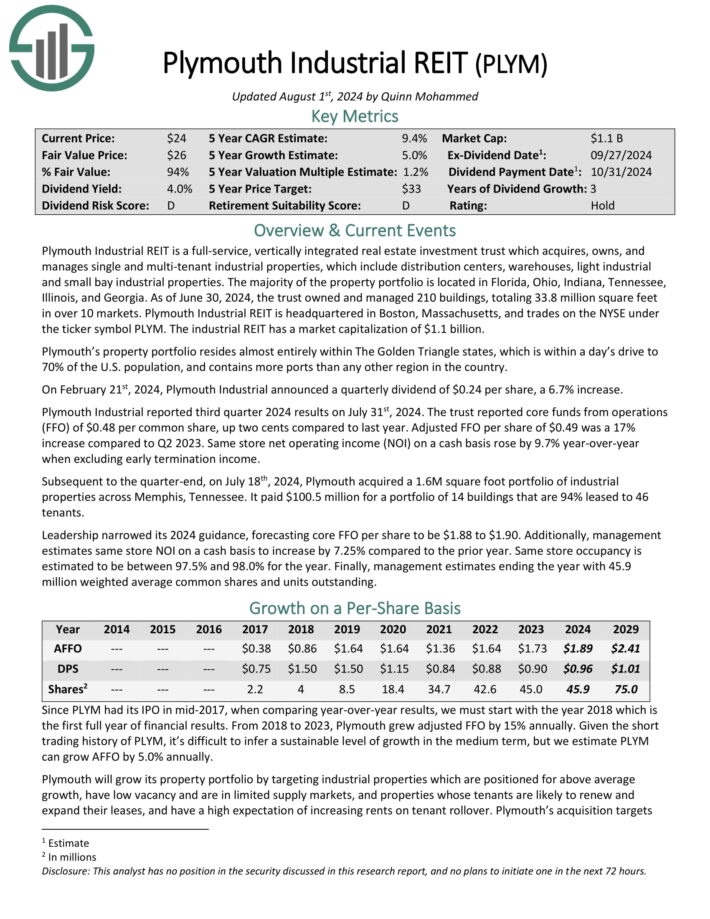

High REIT #6: Plymouth Industrial REIT (PLYM)

- Anticipated Complete Return: 14.3%

- Dividend Yield: 4.9%

Plymouth Industrial REIT is a full-service, vertically built-in actual property funding belief which acquires, owns, and manages single and multi-tenant industrial properties, which embody distribution facilities, warehouses, gentle industrial and small bay industrial properties.

Nearly all of the property portfolio is positioned in Florida, Ohio, Indiana, Tennessee, Illinois, and Georgia. As of June 30, 2024, the belief owned and managed 210 buildings, totaling 33.8 million sq. ft in over 10 markets.

Plymouth’s property portfolio resides virtually totally inside The Golden Triangle states, which is inside a day’s drive to 70% of the U.S. inhabitants, and comprises extra ports than some other area within the nation.

On February twenty first, 2024, Plymouth Industrial introduced a quarterly dividend of $0.24 per share, a 6.7% improve.

Plymouth Industrial reported third quarter 2024 outcomes on July thirty first, 2024. The belief reported core funds from operations (FFO) of $0.48 per widespread share, up two cents in comparison with final 12 months. Adjusted FFO per share of $0.49 was a 17% improve in comparison with Q2 2023. Similar retailer web working earnings (NOI) on a money foundation rose by 9.7% year-over-year when excluding early termination earnings.

Subsequent to the quarter-end, on July 18th, 2024, Plymouth acquired a 1.6M sq. foot portfolio of business properties throughout Memphis, Tennessee. It paid $100.5 million for a portfolio of 14 buildings which might be 94% leased to 46 tenants.

Click on right here to obtain our most up-to-date Positive Evaluation report on PLYM (preview of web page 1 of three proven beneath):

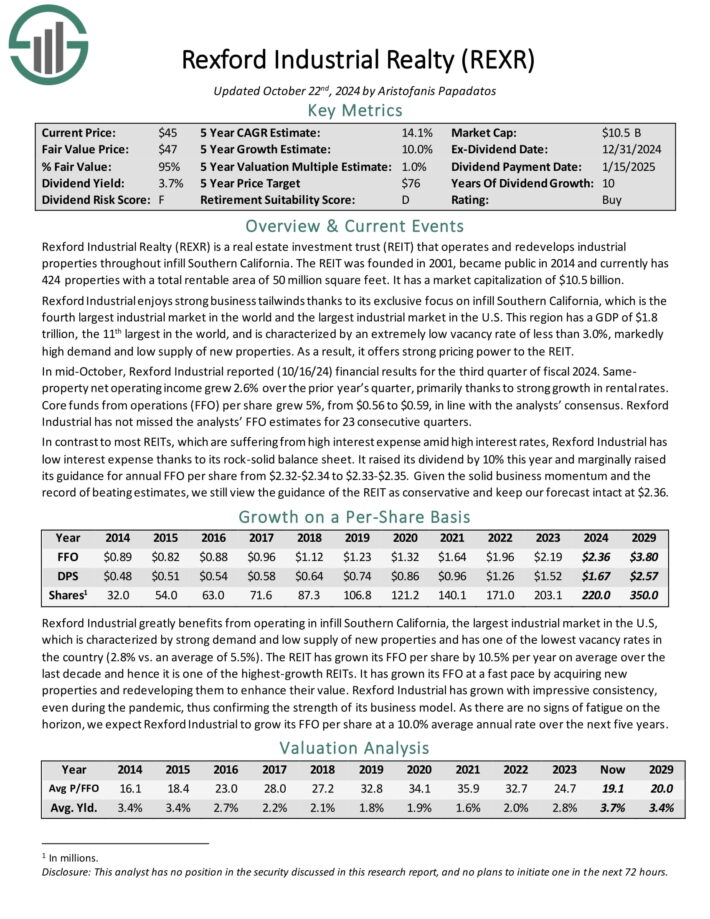

High REIT #5: Rexford Industrial Realty (REXR)

- Anticipated Complete Return: 15.7%

- Dividend Yield: 4.0%

Rexford Industrial Realty owns and redevelops industrial properties all through infill Southern California. The REIT was based in 2001, turned public in 2014 and presently has 424 properties with a complete rentable space of fifty million sq. ft.

Rexford Industrial enjoys sturdy enterprise tailwinds because of its unique concentrate on infill Southern California, which is the fourth largest industrial market on this planet and the biggest industrial market within the U.S.

Supply: Investor Presentation

This area has a GDP of $1.8 trillion, the eleventh largest on this planet, and is characterised by an especially low emptiness fee of lower than 3.0%, markedly excessive demand and low provide of latest properties.

In mid-October, Rexford Industrial reported (10/16/24) monetary outcomes for the third quarter of fiscal 2024. Similar property web working earnings grew 2.6% over the prior 12 months’s quarter, primarily because of sturdy progress in rental charges.

Core funds from operations (FFO) per share grew 5%, from $0.56 to $0.59, in step with the analysts’ consensus. Rexford Industrial has not missed the analysts’ FFO estimates for 23 consecutive quarters.

Click on right here to obtain our most up-to-date Positive Evaluation report on REXR (preview of web page 1 of three proven beneath):

High REIT #4: World Web Lease (GNL)

- Anticipated Complete Return: 16.1%

- Dividend Yield: 11.5%

World Web Lease invests in industrial properties within the U.S. and Europe with an emphasis on sale-leaseback transactions. GNL’s portfolio contains over 1300 properties, spanning almost 67 million sq. ft with a gross asset worth of $9.2 billion.

On August 6, 2024, World Web Lease reported its monetary outcomes for the second quarter of 2024. The corporate recorded a web loss per share of $0.20, lacking expectations by $0.05. Income for the quarter was $203.29 million, which, regardless of representing a major 112.10% year-over-year improve, missed estimates by $2.06 million.

In the course of the quarter, GNL elevated its Adjusted Funds from Operations (AFFO) per share by 2% to $0.33, whereas decreasing its excellent debt by $251 million. This debt discount improved the corporate’s Web Debt to Adjusted EBITDA ratio from 8.4x to eight.1x.

Click on right here to obtain our most up-to-date Positive Evaluation report on World Web Lease (GNL) (preview of web page 1 of three proven beneath):

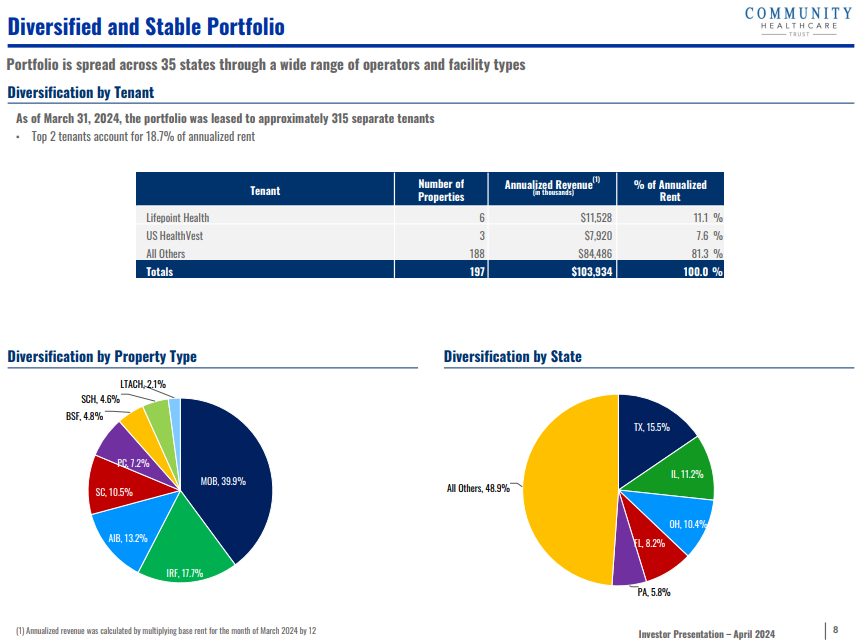

High REIT #2: Neighborhood Healthcare Belief (CHCT)

- Anticipated Complete Return: 17.6%

- Dividend Yield: 9.8%

Neighborhood Healthcare Belief is an REIT which owns income-producing actual property properties linked to the healthcare sector, similar to doctor places of work, specialty facilities, behavioral services, inpatient rehabilitation services, and medical workplace buildings.

The belief has investments in 197 properties in 35 states, totaling 4.4 million sq. ft.

Supply: Investor Presentation

On October twenty ninth, 2024, Neighborhood Healthcare Belief reported third quarter outcomes for the interval ending September thirtieth, 2024.

Funds from operations (FFO) per share dipped 17% to $0.48 from $0.58 within the prior 12 months quarter. Adjusted FFO per share, nonetheless, declined by 13% to $0.55.

In the course of the quarter, Neighborhood Healthcare acquired one doctor clinic for $6.2 million. The property was 100% leased with a lease expiration in 2027.

The belief additionally has eleven properties underneath definitive buy agreements, with a mixed buy value of roughly $178.3 million, anticipated to shut from 2024 by 2027.

Click on right here to obtain our most up-to-date Positive Evaluation report on CHCT (preview of web page 1 of three proven beneath):

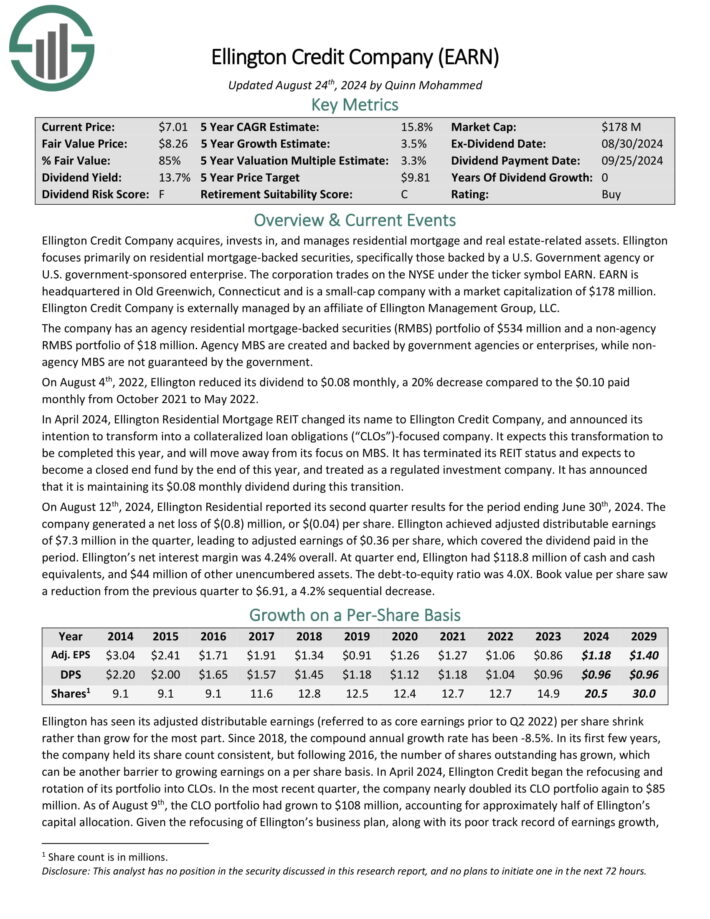

High REIT #1: Ellington Credit score Co. (EARN)

- Anticipated Complete Return: 18.1%

- Dividend Yield: 15.1%

Ellington Credit score Co. acquires, invests in, and manages residential mortgage and actual property associated property. Ellington focuses totally on residential mortgage-backed securities, particularly these backed by a U.S. Authorities company or U.S. authorities–sponsored enterprise.

Company MBS are created and backed by authorities companies or enterprises, whereas non-agency MBS are not assured by the federal government.

On August twelfth, 2024, Ellington Residential reported its second quarter outcomes for the interval ending June thirtieth, 2024. The corporate generated a web lack of $(0.8) million, or $(0.04) per share.

Ellington achieved adjusted distributable earnings of $7.3 million within the quarter, resulting in adjusted earnings of $0.36 per share, which coated the dividend paid within the interval.

Ellington’s web curiosity margin was 4.24% general. At quarter finish, Ellington had $118.8 million of money and money equivalents, and $44 million of different unencumbered property.

Click on right here to obtain our most up-to-date Positive Evaluation report on EARN (preview of web page 1 of three proven beneath):

Remaining Ideas

The REIT Spreadsheet checklist on this article comprises an inventory of publicly-traded Actual Property Funding Trusts.

Nevertheless, this database is actually not the one place to seek out high-quality dividend shares buying and selling at truthful or higher costs.

In truth, among the best strategies to seek out high-quality dividend shares is on the lookout for shares with lengthy histories of steadily rising dividend funds.

Corporations which have elevated their payouts by many market cycles are extremely more likely to proceed doing so for a very long time to come back.

You’ll be able to see extra high-quality dividend shares within the following Positive Dividend databases, every primarily based on lengthy streaks of steadily rising dividend funds:

You may also be seeking to create a extremely custom-made dividend earnings stream to pay for all times’s bills.

The next lists present helpful data on excessive dividend shares and shares that pay month-to-month dividends:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.