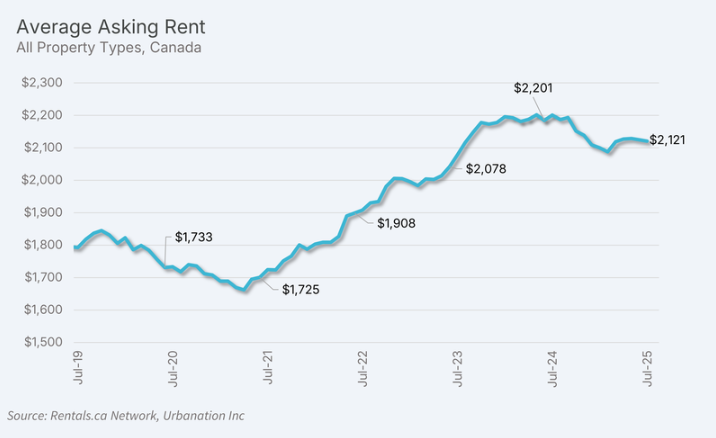

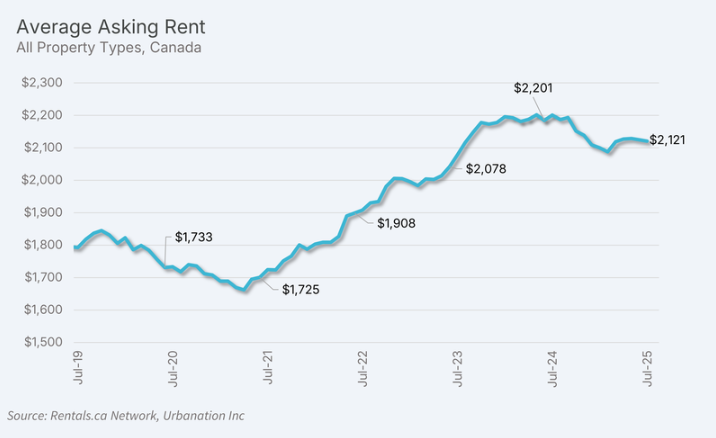

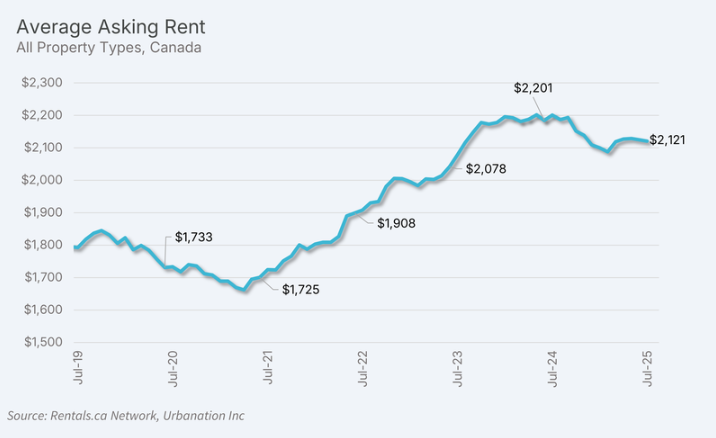

Canadian renters are spending an ever-growing quantity of their paycheques on lease, despite the fact that they might qualify for a mortgage.

Nationally, they’re spending 37.6 per cent of their earnings on lease, in keeping with evaluation from SingleKey Inc., falling slightly below the 40 per cent “disaster” stage.

However Toronto renters have already reached the disaster stage by spending 41.1 per cent of their salaries on housing, or a mean of $2,899 monthly.

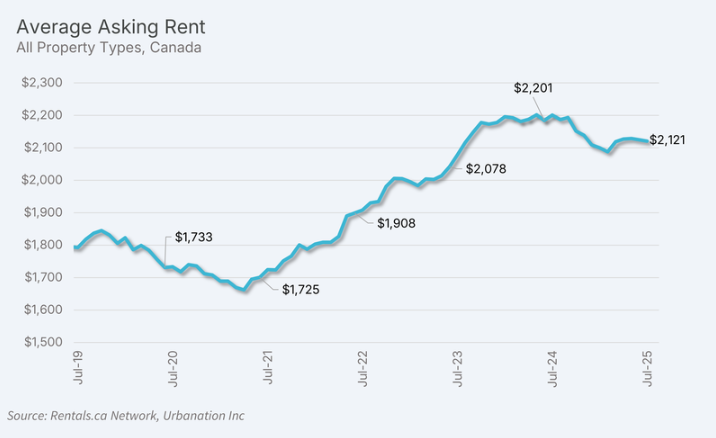

The common lease in Canada is $2,200 monthly, with Vancouver’s $3,095 monthly fee being the costliest metropolis for renters.

It’s no marvel renters have a tough time paying the payments. A latest Equifax Canada report stated non-mortgage holders have been twice as more likely to miss a credit score cost in comparison with these with a mortgage.

“Whereas the general delinquency fee seems to be levelling off, the underlying story is way extra advanced,” Rebecca Oakes, vice-president of superior analytics at Equifax Canada,

stated in a launch

. “We proceed to see a rising divide between mortgage and non-mortgage shoppers, and continued monetary pressure amongst youthful Canadians, who’re going through a slower job market and rising prices.”

General, 1.4 million Canadians missed a credit score cost within the second quarter of 2025, whereas shopper debt climbed to $2.58 trillion, Equifax stated.

This comes regardless of rents for condos and residences falling 3.6 per cent 12 months over 12 months in July, marking the tenth consecutive month the place Canada’s rents have fallen 12 months over 12 months, in keeping with Leases.ca information.

The excellent news for renters is that it doesn’t seem like lease will probably be going up anytime quickly.

“The three.6 per cent year-over-year lease decline in July is larger than the two.7 per cent decline recorded in June and means that lease declines are more likely to proceed compounding,” Leases.ca stated in its report.

Nonetheless, asking costs stay 11.1 per cent larger than three years in the past,

Leases.ca stated

.

Regardless of the challenges of paying their payments, many renters may nonetheless qualify for a mortgage. The common credit score rating amongst renters is 694, SingleKey stated, which is above the 680 threshold wanted for approval at many main banks.

Renters in Toronto and Vancouver have credit score scores of 729 and 730, respectively, that are considerably above the mortgage approval threshold.

Alberta has the bottom provincial credit standing amongst renters at 681, so the typical renter in each province has a credit score rating wanted for mortgage approval.

Enroll right here to get Posthaste delivered straight to your inbox.

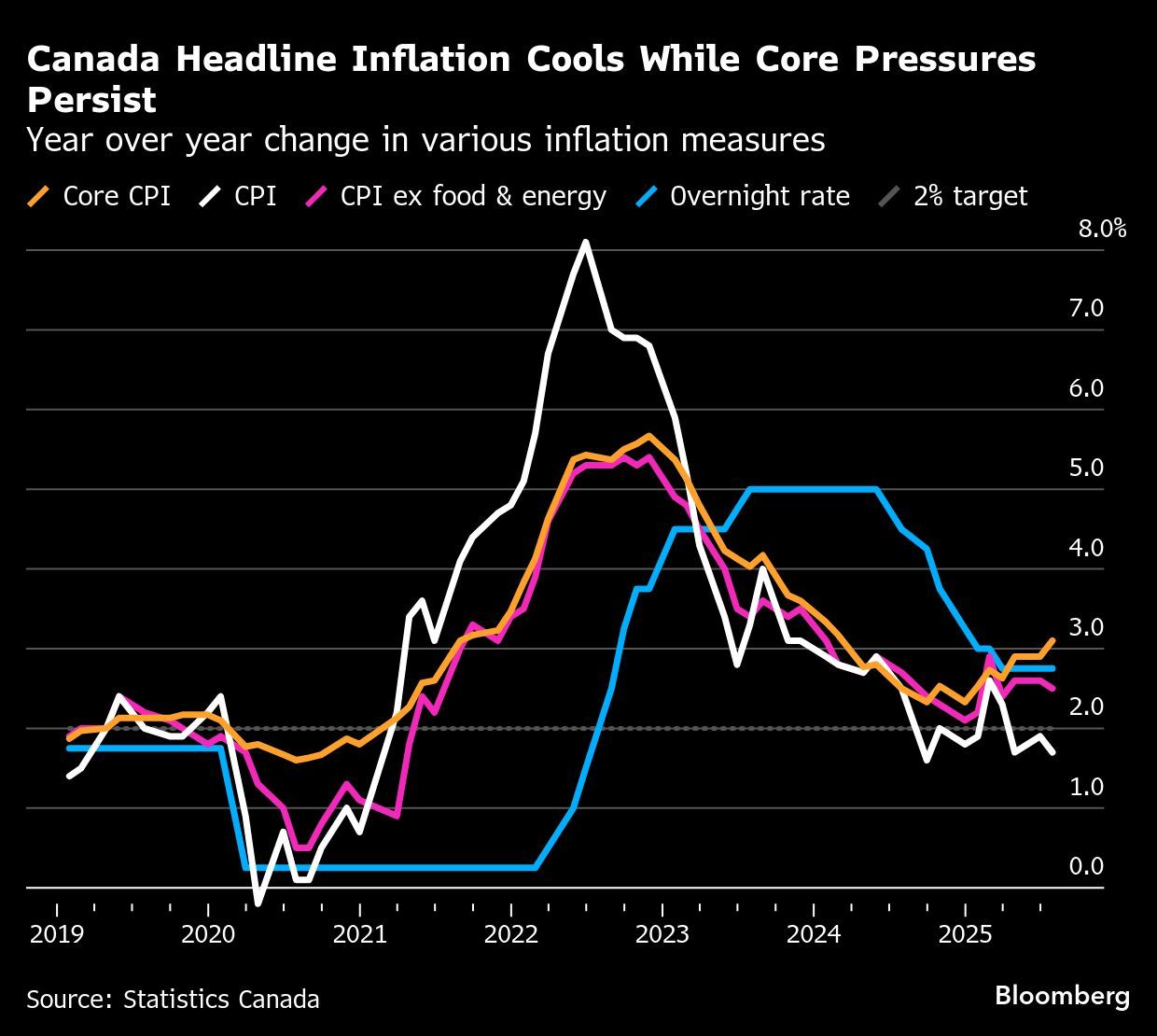

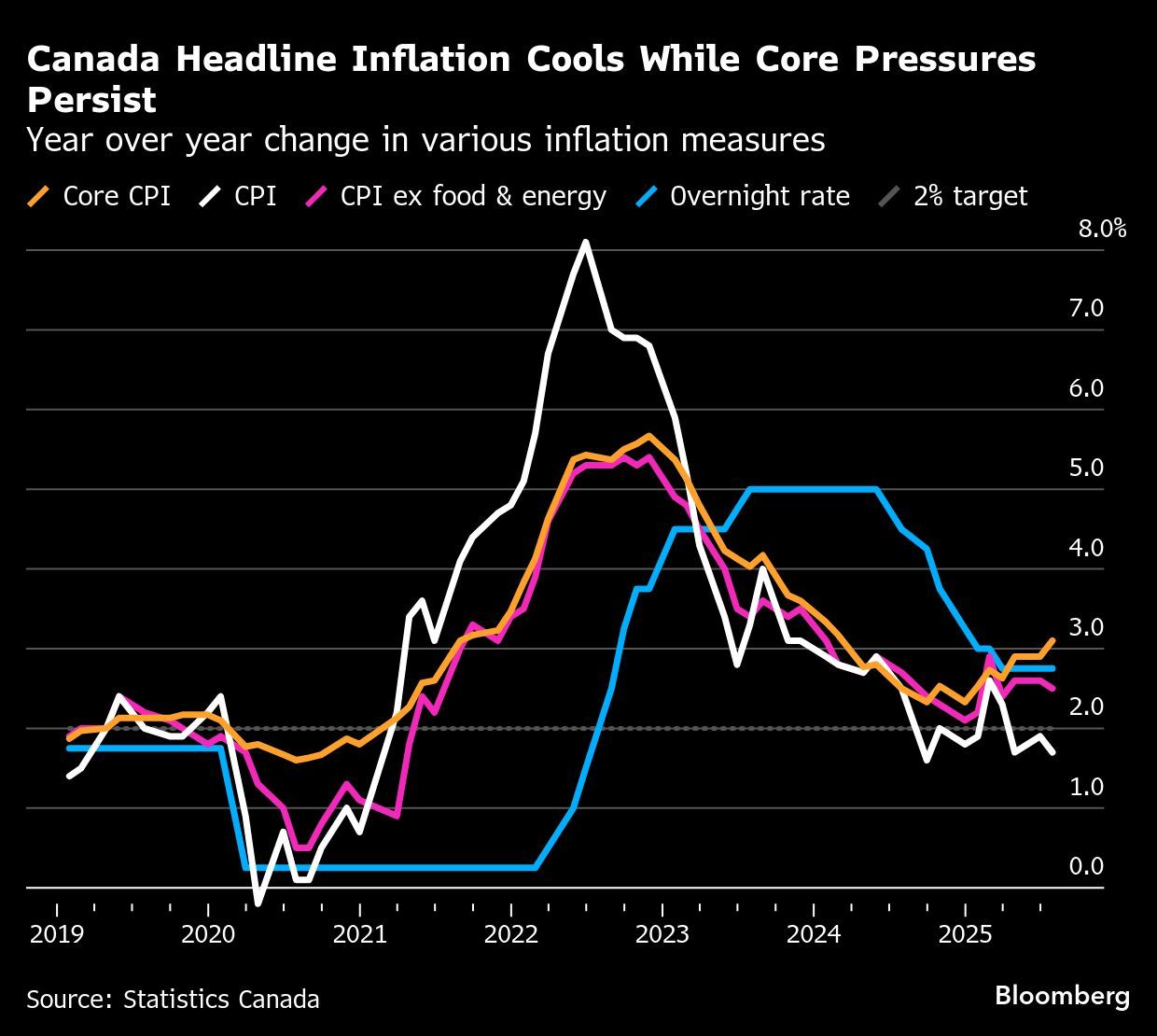

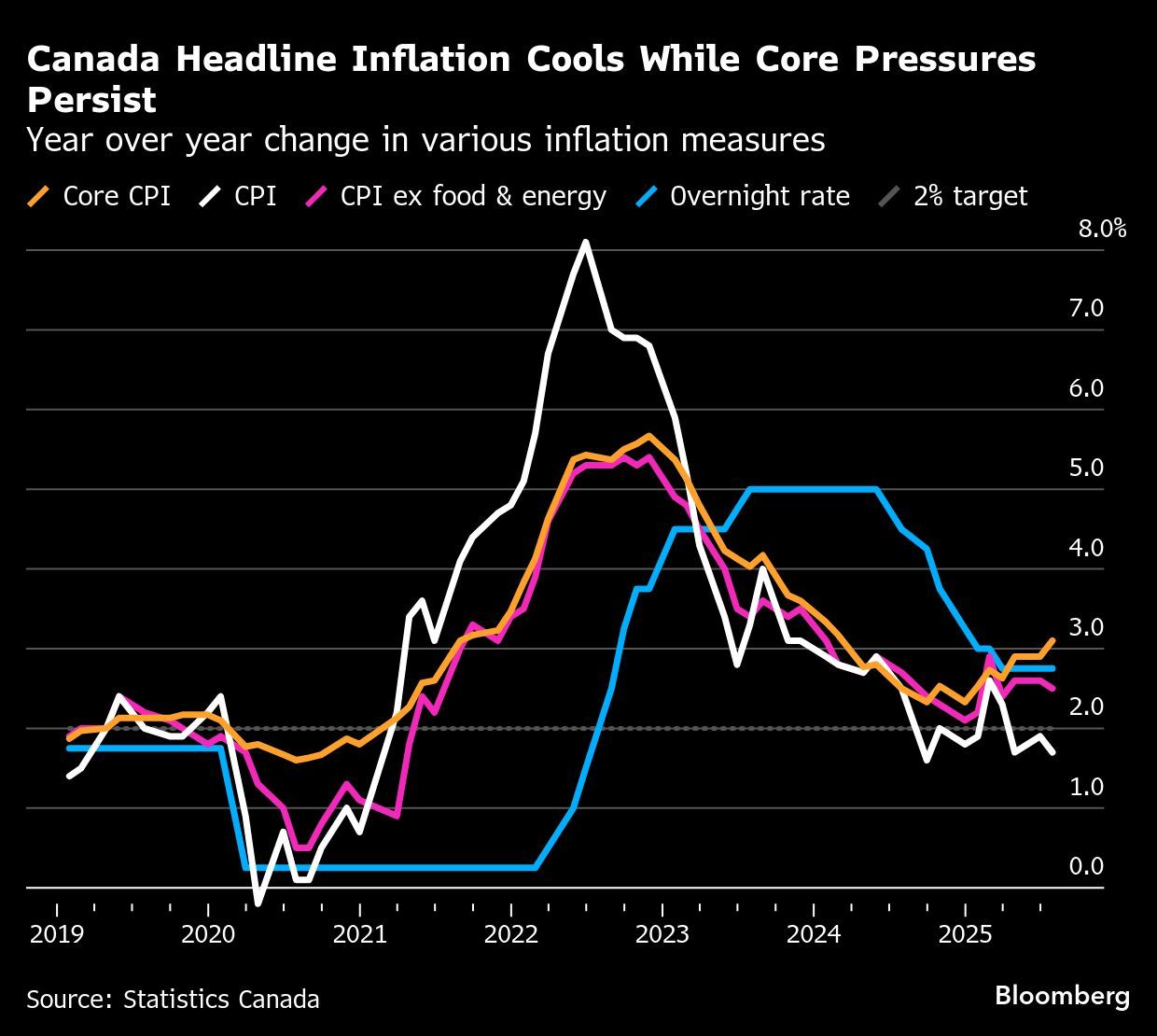

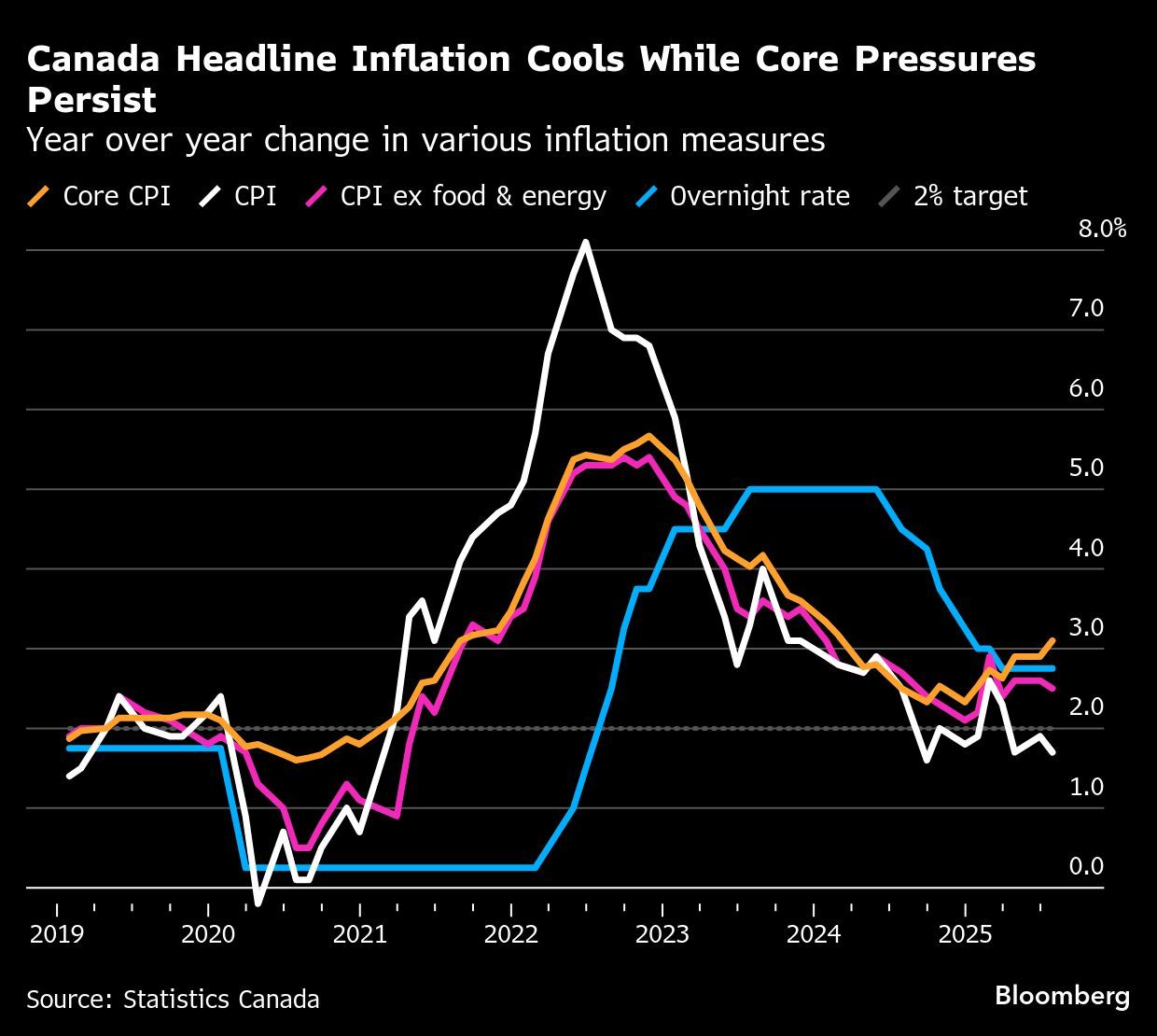

Canada’s inflation fee slowed all the way down to 1.7 pr cent in July from 1.9 per cent a month prior, pushed by a drop in gasoline costs as a result of removing of the federal carbon tax.

General, fuel costs fell 0.7 per cent on a month-to-month foundation.

Regardless of the drop in headline inflation, seven of the primary parts rose within the month. The patron worth index excluding gasoline remained flat at 2.5 per cent.

Core inflation, which the Financial institution of Canada tends to give attention to when making financial selections, remained round three per cent.

Learn extra right here.

- 2 p.m.: United States Federal Reserve to launch its minutes for its July 30 rate of interest maintain

- At this time’s Information: New housing worth index for July

- Earnings: Lowe’s Corporations Inc., Goal Corp.

- Canada’s inflation cools to 1.7% as gasoline costs drop

- Inflation studying gained’t ‘transfer the needle’ for Financial institution of Canada, says economist

- Canada’s commerce diversification push will solely ‘partially offset’ decline in U.S. commerce

- Air Canada to renew service after reaching settlement with union

Canadians on the lookout for a deal on journeys to the U.S. could also be in for a impolite awakening as many airways have already shifted their plans away from the U.S. and extra towards Mexico and the Caribbean. That stated, these prepared to bypass a U.S. boycott can discover lodge offers. U.S. journey faces value headwinds because the loonie lags behind the buck, however locations like Japan, New Zealand and Argentina supply some forex aid as nicely.

Learn extra right here.

McLister on mortgages

Wish to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Put up column

may also help navigate the advanced sector, from the newest traits to financing alternatives you gained’t wish to miss. Plus test his

mortgage fee web page

for Canada’s lowest nationwide mortgage charges, up to date every day.

Monetary Put up on YouTube

Go to the Monetary Put up’s

YouTube channel

for interviews with Canada’s main specialists in enterprise, economics, housing, the vitality sector and extra.

At this time’s Posthaste was written by Ben Cousins with further reporting from Monetary Put up employees, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this article? Electronic mail us at

.

Bookmark our web site and help our journalism: Don’t miss the enterprise information you should know — add financialpost.com to your bookmarks and join our newsletters right here

Canadian renters are spending an ever-growing quantity of their paycheques on lease, despite the fact that they might qualify for a mortgage.

Nationally, they’re spending 37.6 per cent of their earnings on lease, in keeping with evaluation from SingleKey Inc., falling slightly below the 40 per cent “disaster” stage.

However Toronto renters have already reached the disaster stage by spending 41.1 per cent of their salaries on housing, or a mean of $2,899 monthly.

The common lease in Canada is $2,200 monthly, with Vancouver’s $3,095 monthly fee being the costliest metropolis for renters.

It’s no marvel renters have a tough time paying the payments. A latest Equifax Canada report stated non-mortgage holders have been twice as more likely to miss a credit score cost in comparison with these with a mortgage.

“Whereas the general delinquency fee seems to be levelling off, the underlying story is way extra advanced,” Rebecca Oakes, vice-president of superior analytics at Equifax Canada,

stated in a launch

. “We proceed to see a rising divide between mortgage and non-mortgage shoppers, and continued monetary pressure amongst youthful Canadians, who’re going through a slower job market and rising prices.”

General, 1.4 million Canadians missed a credit score cost within the second quarter of 2025, whereas shopper debt climbed to $2.58 trillion, Equifax stated.

This comes regardless of rents for condos and residences falling 3.6 per cent 12 months over 12 months in July, marking the tenth consecutive month the place Canada’s rents have fallen 12 months over 12 months, in keeping with Leases.ca information.

The excellent news for renters is that it doesn’t seem like lease will probably be going up anytime quickly.

“The three.6 per cent year-over-year lease decline in July is larger than the two.7 per cent decline recorded in June and means that lease declines are more likely to proceed compounding,” Leases.ca stated in its report.

Nonetheless, asking costs stay 11.1 per cent larger than three years in the past,

Leases.ca stated

.

Regardless of the challenges of paying their payments, many renters may nonetheless qualify for a mortgage. The common credit score rating amongst renters is 694, SingleKey stated, which is above the 680 threshold wanted for approval at many main banks.

Renters in Toronto and Vancouver have credit score scores of 729 and 730, respectively, that are considerably above the mortgage approval threshold.

Alberta has the bottom provincial credit standing amongst renters at 681, so the typical renter in each province has a credit score rating wanted for mortgage approval.

Enroll right here to get Posthaste delivered straight to your inbox.

Canada’s inflation fee slowed all the way down to 1.7 pr cent in July from 1.9 per cent a month prior, pushed by a drop in gasoline costs as a result of removing of the federal carbon tax.

General, fuel costs fell 0.7 per cent on a month-to-month foundation.

Regardless of the drop in headline inflation, seven of the primary parts rose within the month. The patron worth index excluding gasoline remained flat at 2.5 per cent.

Core inflation, which the Financial institution of Canada tends to give attention to when making financial selections, remained round three per cent.

Learn extra right here.

- 2 p.m.: United States Federal Reserve to launch its minutes for its July 30 rate of interest maintain

- At this time’s Information: New housing worth index for July

- Earnings: Lowe’s Corporations Inc., Goal Corp.

- Canada’s inflation cools to 1.7% as gasoline costs drop

- Inflation studying gained’t ‘transfer the needle’ for Financial institution of Canada, says economist

- Canada’s commerce diversification push will solely ‘partially offset’ decline in U.S. commerce

- Air Canada to renew service after reaching settlement with union

Canadians on the lookout for a deal on journeys to the U.S. could also be in for a impolite awakening as many airways have already shifted their plans away from the U.S. and extra towards Mexico and the Caribbean. That stated, these prepared to bypass a U.S. boycott can discover lodge offers. U.S. journey faces value headwinds because the loonie lags behind the buck, however locations like Japan, New Zealand and Argentina supply some forex aid as nicely.

Learn extra right here.

McLister on mortgages

Wish to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Put up column

may also help navigate the advanced sector, from the newest traits to financing alternatives you gained’t wish to miss. Plus test his

mortgage fee web page

for Canada’s lowest nationwide mortgage charges, up to date every day.

Monetary Put up on YouTube

Go to the Monetary Put up’s

YouTube channel

for interviews with Canada’s main specialists in enterprise, economics, housing, the vitality sector and extra.

At this time’s Posthaste was written by Ben Cousins with further reporting from Monetary Put up employees, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this article? Electronic mail us at

.

Bookmark our web site and help our journalism: Don’t miss the enterprise information you should know — add financialpost.com to your bookmarks and join our newsletters right here

Canadian renters are spending an ever-growing quantity of their paycheques on lease, despite the fact that they might qualify for a mortgage.

Nationally, they’re spending 37.6 per cent of their earnings on lease, in keeping with evaluation from SingleKey Inc., falling slightly below the 40 per cent “disaster” stage.

However Toronto renters have already reached the disaster stage by spending 41.1 per cent of their salaries on housing, or a mean of $2,899 monthly.

The common lease in Canada is $2,200 monthly, with Vancouver’s $3,095 monthly fee being the costliest metropolis for renters.

It’s no marvel renters have a tough time paying the payments. A latest Equifax Canada report stated non-mortgage holders have been twice as more likely to miss a credit score cost in comparison with these with a mortgage.

“Whereas the general delinquency fee seems to be levelling off, the underlying story is way extra advanced,” Rebecca Oakes, vice-president of superior analytics at Equifax Canada,

stated in a launch

. “We proceed to see a rising divide between mortgage and non-mortgage shoppers, and continued monetary pressure amongst youthful Canadians, who’re going through a slower job market and rising prices.”

General, 1.4 million Canadians missed a credit score cost within the second quarter of 2025, whereas shopper debt climbed to $2.58 trillion, Equifax stated.

This comes regardless of rents for condos and residences falling 3.6 per cent 12 months over 12 months in July, marking the tenth consecutive month the place Canada’s rents have fallen 12 months over 12 months, in keeping with Leases.ca information.

The excellent news for renters is that it doesn’t seem like lease will probably be going up anytime quickly.

“The three.6 per cent year-over-year lease decline in July is larger than the two.7 per cent decline recorded in June and means that lease declines are more likely to proceed compounding,” Leases.ca stated in its report.

Nonetheless, asking costs stay 11.1 per cent larger than three years in the past,

Leases.ca stated

.

Regardless of the challenges of paying their payments, many renters may nonetheless qualify for a mortgage. The common credit score rating amongst renters is 694, SingleKey stated, which is above the 680 threshold wanted for approval at many main banks.

Renters in Toronto and Vancouver have credit score scores of 729 and 730, respectively, that are considerably above the mortgage approval threshold.

Alberta has the bottom provincial credit standing amongst renters at 681, so the typical renter in each province has a credit score rating wanted for mortgage approval.

Enroll right here to get Posthaste delivered straight to your inbox.

Canada’s inflation fee slowed all the way down to 1.7 pr cent in July from 1.9 per cent a month prior, pushed by a drop in gasoline costs as a result of removing of the federal carbon tax.

General, fuel costs fell 0.7 per cent on a month-to-month foundation.

Regardless of the drop in headline inflation, seven of the primary parts rose within the month. The patron worth index excluding gasoline remained flat at 2.5 per cent.

Core inflation, which the Financial institution of Canada tends to give attention to when making financial selections, remained round three per cent.

Learn extra right here.

- 2 p.m.: United States Federal Reserve to launch its minutes for its July 30 rate of interest maintain

- At this time’s Information: New housing worth index for July

- Earnings: Lowe’s Corporations Inc., Goal Corp.

- Canada’s inflation cools to 1.7% as gasoline costs drop

- Inflation studying gained’t ‘transfer the needle’ for Financial institution of Canada, says economist

- Canada’s commerce diversification push will solely ‘partially offset’ decline in U.S. commerce

- Air Canada to renew service after reaching settlement with union

Canadians on the lookout for a deal on journeys to the U.S. could also be in for a impolite awakening as many airways have already shifted their plans away from the U.S. and extra towards Mexico and the Caribbean. That stated, these prepared to bypass a U.S. boycott can discover lodge offers. U.S. journey faces value headwinds because the loonie lags behind the buck, however locations like Japan, New Zealand and Argentina supply some forex aid as nicely.

Learn extra right here.

McLister on mortgages

Wish to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Put up column

may also help navigate the advanced sector, from the newest traits to financing alternatives you gained’t wish to miss. Plus test his

mortgage fee web page

for Canada’s lowest nationwide mortgage charges, up to date every day.

Monetary Put up on YouTube

Go to the Monetary Put up’s

YouTube channel

for interviews with Canada’s main specialists in enterprise, economics, housing, the vitality sector and extra.

At this time’s Posthaste was written by Ben Cousins with further reporting from Monetary Put up employees, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this article? Electronic mail us at

.

Bookmark our web site and help our journalism: Don’t miss the enterprise information you should know — add financialpost.com to your bookmarks and join our newsletters right here

Canadian renters are spending an ever-growing quantity of their paycheques on lease, despite the fact that they might qualify for a mortgage.

Nationally, they’re spending 37.6 per cent of their earnings on lease, in keeping with evaluation from SingleKey Inc., falling slightly below the 40 per cent “disaster” stage.

However Toronto renters have already reached the disaster stage by spending 41.1 per cent of their salaries on housing, or a mean of $2,899 monthly.

The common lease in Canada is $2,200 monthly, with Vancouver’s $3,095 monthly fee being the costliest metropolis for renters.

It’s no marvel renters have a tough time paying the payments. A latest Equifax Canada report stated non-mortgage holders have been twice as more likely to miss a credit score cost in comparison with these with a mortgage.

“Whereas the general delinquency fee seems to be levelling off, the underlying story is way extra advanced,” Rebecca Oakes, vice-president of superior analytics at Equifax Canada,

stated in a launch

. “We proceed to see a rising divide between mortgage and non-mortgage shoppers, and continued monetary pressure amongst youthful Canadians, who’re going through a slower job market and rising prices.”

General, 1.4 million Canadians missed a credit score cost within the second quarter of 2025, whereas shopper debt climbed to $2.58 trillion, Equifax stated.

This comes regardless of rents for condos and residences falling 3.6 per cent 12 months over 12 months in July, marking the tenth consecutive month the place Canada’s rents have fallen 12 months over 12 months, in keeping with Leases.ca information.

The excellent news for renters is that it doesn’t seem like lease will probably be going up anytime quickly.

“The three.6 per cent year-over-year lease decline in July is larger than the two.7 per cent decline recorded in June and means that lease declines are more likely to proceed compounding,” Leases.ca stated in its report.

Nonetheless, asking costs stay 11.1 per cent larger than three years in the past,

Leases.ca stated

.

Regardless of the challenges of paying their payments, many renters may nonetheless qualify for a mortgage. The common credit score rating amongst renters is 694, SingleKey stated, which is above the 680 threshold wanted for approval at many main banks.

Renters in Toronto and Vancouver have credit score scores of 729 and 730, respectively, that are considerably above the mortgage approval threshold.

Alberta has the bottom provincial credit standing amongst renters at 681, so the typical renter in each province has a credit score rating wanted for mortgage approval.

Enroll right here to get Posthaste delivered straight to your inbox.

Canada’s inflation fee slowed all the way down to 1.7 pr cent in July from 1.9 per cent a month prior, pushed by a drop in gasoline costs as a result of removing of the federal carbon tax.

General, fuel costs fell 0.7 per cent on a month-to-month foundation.

Regardless of the drop in headline inflation, seven of the primary parts rose within the month. The patron worth index excluding gasoline remained flat at 2.5 per cent.

Core inflation, which the Financial institution of Canada tends to give attention to when making financial selections, remained round three per cent.

Learn extra right here.

- 2 p.m.: United States Federal Reserve to launch its minutes for its July 30 rate of interest maintain

- At this time’s Information: New housing worth index for July

- Earnings: Lowe’s Corporations Inc., Goal Corp.

- Canada’s inflation cools to 1.7% as gasoline costs drop

- Inflation studying gained’t ‘transfer the needle’ for Financial institution of Canada, says economist

- Canada’s commerce diversification push will solely ‘partially offset’ decline in U.S. commerce

- Air Canada to renew service after reaching settlement with union

Canadians on the lookout for a deal on journeys to the U.S. could also be in for a impolite awakening as many airways have already shifted their plans away from the U.S. and extra towards Mexico and the Caribbean. That stated, these prepared to bypass a U.S. boycott can discover lodge offers. U.S. journey faces value headwinds because the loonie lags behind the buck, however locations like Japan, New Zealand and Argentina supply some forex aid as nicely.

Learn extra right here.

McLister on mortgages

Wish to be taught extra about mortgages? Mortgage strategist Robert McLister’s

Monetary Put up column

may also help navigate the advanced sector, from the newest traits to financing alternatives you gained’t wish to miss. Plus test his

mortgage fee web page

for Canada’s lowest nationwide mortgage charges, up to date every day.

Monetary Put up on YouTube

Go to the Monetary Put up’s

YouTube channel

for interviews with Canada’s main specialists in enterprise, economics, housing, the vitality sector and extra.

At this time’s Posthaste was written by Ben Cousins with further reporting from Monetary Put up employees, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this article? Electronic mail us at

.

Bookmark our web site and help our journalism: Don’t miss the enterprise information you should know — add financialpost.com to your bookmarks and join our newsletters right here