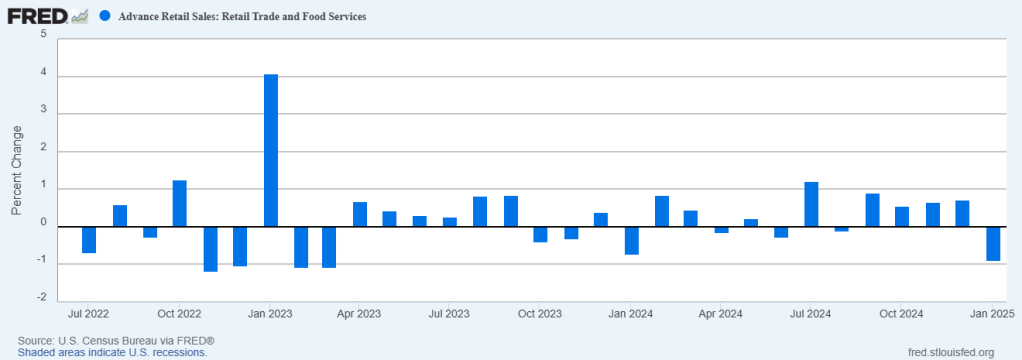

Whole for January got here in at $723.9 billion, a decline of -0.9% for the month. The road was anticipating a decline of solely -0.2%.

This was the largest one-month decline since March 2023. Though December was revised larger, from +0.4% to +0.7% month-to-month acquire.

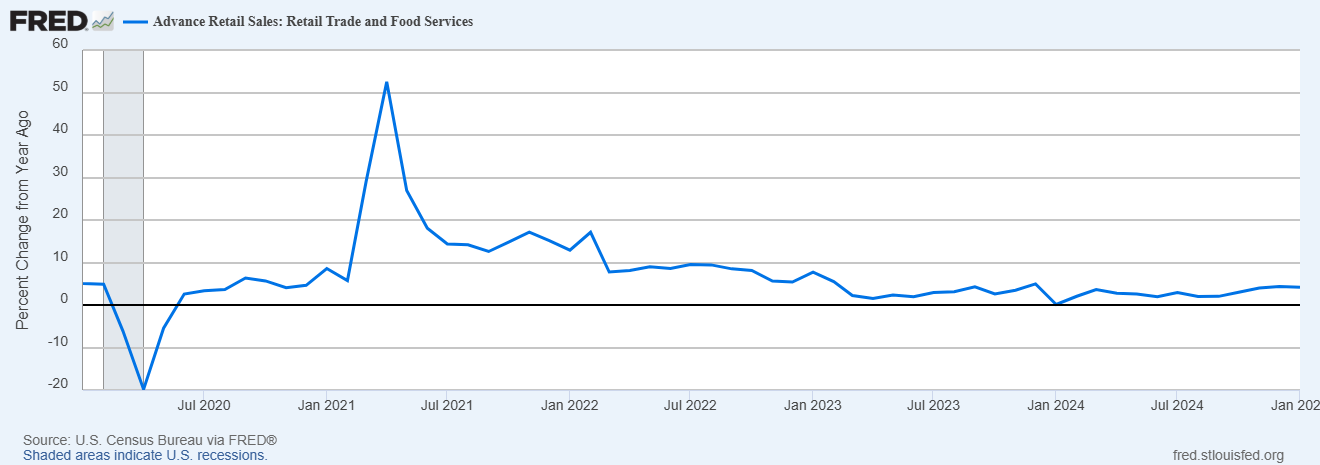

Whole) retail gross sales are up 4.2% over the past 12 months. After the main spike throughout COVID, gross sales have settled inside a 3-4% annualized tempo.

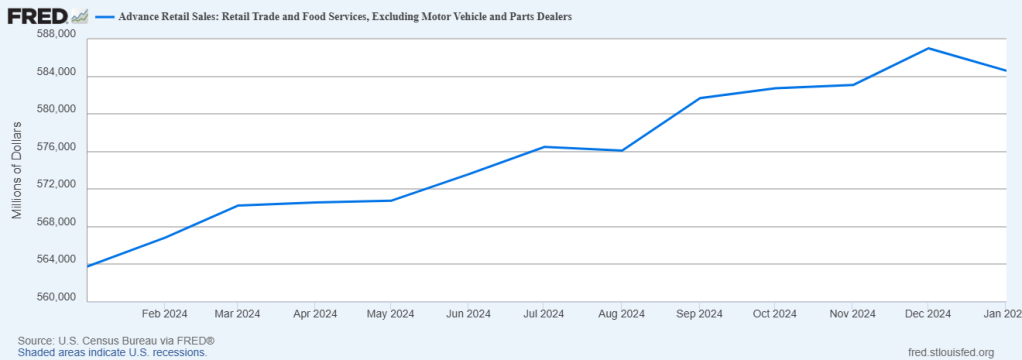

Retail gross sales minus autos (or core retail gross sales) additionally upset; coming in at $584.6 billion. A decline of -0.4% for the month, when the road was anticipating a acquire of 0.3%. Core gross sales are nonetheless up 3.7% over the past 12 months.

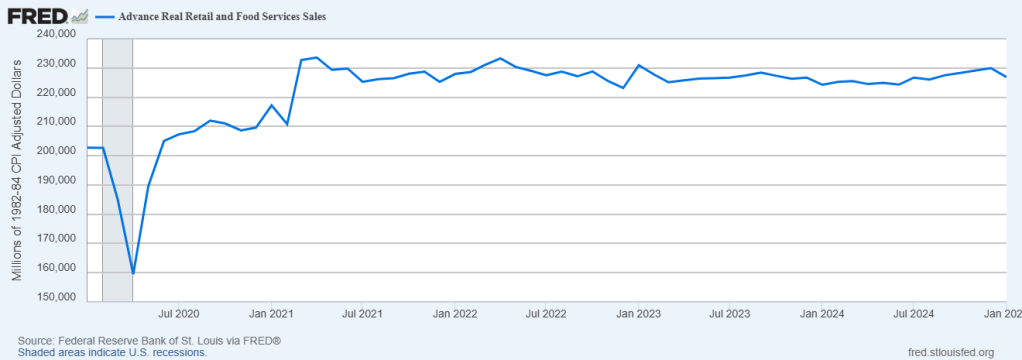

Retail gross sales adjusted for inflation (or actual retail gross sales) haven’t gone wherever for 4 years and nonetheless stay under the January 2021 highs. Actual gross sales declined 1.3% for the month, however are up 1.2% over the past 12 months.

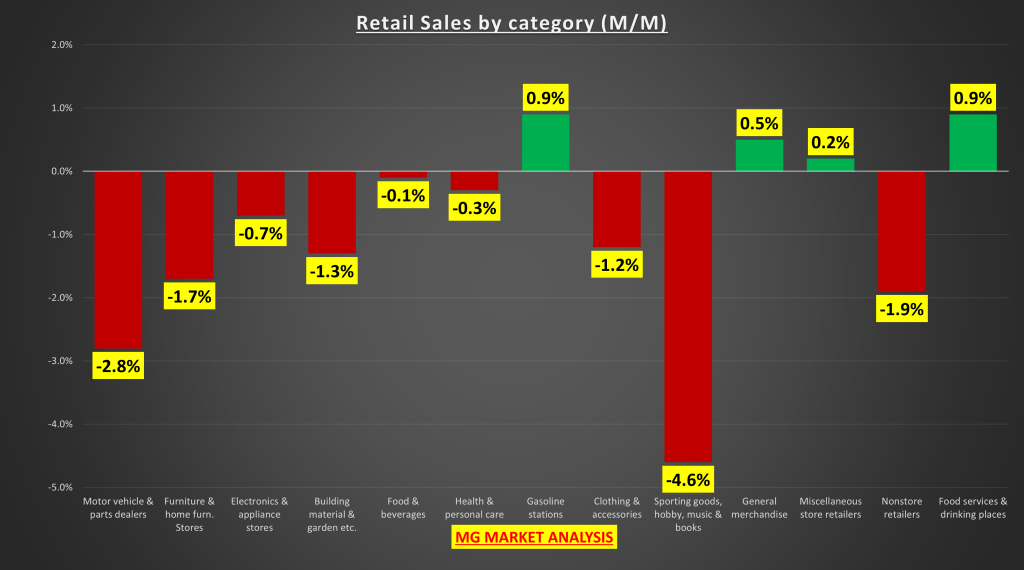

Breaking down the retail gross sales report by class, we are able to see the declines had been broad-based amongst classes. With solely 4 of 13 classes optimistic for the month. Even nonstore retailers (on-line) posted a decline in January.

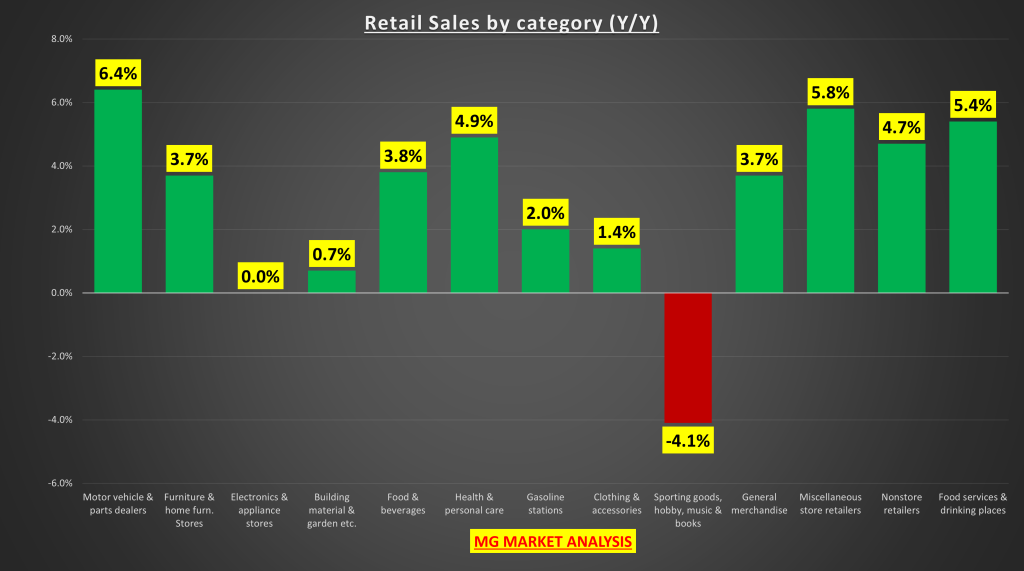

Whereas over the past 12 months, all however 2 classes are nonetheless holding onto good points.

One other disappointing retail gross sales report. After the better-than-expected manufacturing PMI, I used to be to see if it might impact retail gross sales. Clearly, it hasn’t carried over but. In response to COVID, shoppers had been caught of their properties and stocked up on items. This brought about an preliminary surge within the sale of products, however because the economic system and world opened up once more, we see this has normalized over the previous couple of years.

The one motive why complete retail gross sales have moved larger is due to the rise in costs of the products which might be bought (as depicted in the true retail gross sales chart). The extent of demand has not elevated. Whereas as we speak’s report is a disappointment, if we take a look at the larger image (annualized knowledge): as follows:

Whole (EPA:) retail gross sales: +4.2% y/y

Core retail gross sales: +3.7% y/y

Actual retail gross sales: +1.2% y/y

…we are able to see that gross sales are nonetheless rising at a tempo that corresponds to 2-3% financial development.