Up to date on October thirtieth, 2024 by Bob Ciura

The Dividend Aristocrats are the ‘better of the perfect’ dividend progress shares. The Dividend Aristocrats have a protracted historical past of outperforming the market.

Dividend Aristocrats are elite firms that fulfill the next:

- Are within the S&P 500 Index

- Have 25+ consecutive years of dividend will increase

- Meet sure minimal measurement & liquidity necessities

You possibly can obtain an Excel spreadsheet with the complete checklist of all 66 Dividend Aristocrats (with further monetary metrics resembling price-to-earnings ratios and dividend yields) by clicking the hyperlink under:

All Dividend Aristocrats are high-quality companies based mostly on their lengthy dividend histories. An organization can’t pay rising dividends for 25+ years with out having a powerful and sturdy aggressive benefit.

However not all Dividend Aristocrats make equally good investments at present. Some Dividend Aristocrats are higher than others, based mostly on the sustainability of their dividends.

That’s why, on this article, we now have analyzed the ten most secure Dividend Aristocrats from our Positive Evaluation Analysis Database with the most secure dividends based mostly on our Dividend Threat Rating ranking system.

The shares under are all Dividend Aristocrats with Dividend Threat Scores of ‘A’, the highest ranking, and with the bottom payout ratios.

Desk of Contents

Why The Payout Ratio Issues

The dividend payout ratio is solely an organization’s annual per-share dividend, divided by the corporate’s annual earnings-per-share. It’s a measure of the extent of earnings an organization distributes to its shareholders by way of dividends.

The payout ratio is a beneficial investing metric as a result of it differentiates firms with low payout ratios which have numerous room for dividend progress, from firms with excessive payout ratios whose dividends might not be sustainable.

Certainly, analysis has proven that firms with larger dividend progress have outperformed firms with decrease dividend progress or no dividend progress.

In analysis carried out by Ned Davis and Hartford Funds, it was discovered that dividend growers and initiators delivered complete returns of 10.19% per yr from 1973 by 2023, higher than the equal-weighted S&P 500’s efficiency of seven.72% per yr.

Apparently, the dividend growers and initiators analyzed on this research generated outperformance with much less volatility – a rarity and a contradiction to what fashionable educational monetary concept tells us.

A abstract of this analysis might be discovered under.

Supply: Hartford Funds – The Energy Of Dividends

Outperformance of two.47% yearly may not look like a game-changer, however it definitely is due to the marvel that’s compound curiosity.

Utilizing knowledge from the identical piece of analysis, buyers who selected to speculate completely in dividend growers and initiators have been able to turning $100 into $14,118. Throughout the identical time interval, the S&P 500 index turned $100 into $4,439.

Supply: Hartford Funds – The Energy Of Dividends

Shares that didn’t pay dividends couldn’t match the efficiency of all varieties of dividend payers, turning $100 into $843 from 1973-2022. Dividend cutters and eliminators fared even worse, turning $100 into simply $73–that means these shares really misplaced cash.

In consequence, buyers searching for shares with higher dividend progress (and long-term return potential) may contemplate the Dividend Aristocrats with the bottom payout ratios.

Most secure Dividend Aristocrats #10: Dover Company (DOV)

Dover Company is a diversified international industrial producer with annual revenues of almost $9 billion. Dover consists of 5 reporting segments: Engineered Programs, Clear Vitality & Fueling, Pumps & Course of Options, Imaging & Identification, and Local weather & Sustainability Applied sciences.

Barely greater than half of revenues come from the U.S., with the rest coming from worldwide markets.

Supply: Investor Presentation

Dover Company reported its monetary outcomes for Q3 2024, highlighting regular income progress regardless of financial challenges.

Income rose by 1% to $2.0 billion in comparison with the identical interval in 2023, whereas GAAP earnings from persevering with operations elevated by 19% to $313 million, with diluted earnings per share (EPS) from persevering with operations up 22% to $2.26.

Click on right here to obtain our most up-to-date Positive Evaluation report on DOV (preview of web page 1 of three proven under):

Most secure Dividend Aristocrats #9: Sherwin-Williams (SHW)

Sherwin-Williams, based in 1866, is North America’s largest producer of paints and coatings.

The corporate distributes its merchandise by wholesalers in addition to retail shops (together with a sequence of greater than 4,900 company-operated shops and services) to 120 international locations underneath the Sherwin-Williams title.

The corporate additionally manufactures Dutch Boy, Pratt & Lambert, Minwax, Thompson’s Waterseal, Krylon, Valspar (acquired in 2017), and different manufacturers.

On July twenty third, 2024, Sherwin-Williams launched monetary outcomes for the second quarter of fiscal 2024. Gross sales edged up solely 0.5% over the prior yr’s quarter, primarily as a consequence of poor demand in Shopper Manufacturers Group.

Nevertheless, gross margin expanded from 46.0% to 48.8% thanks to cost hikes and adjusted earnings-per-share grew 12.5%, from $3.29 to $3.70.

Sherwin-Williams raised its steering for 2024. It expects gross sales to be up a low-single digit share and raised its steering for earnings-per-share from $10.85-$11.35 to $11.10-$11.40.

Click on right here to obtain our most up-to-date Positive Evaluation report on SHW (preview of web page 1 of three proven under):

Most secure Dividend Aristocrats #8: S&P World (SPGI)

S&P World is a worldwide supplier of monetary providers and enterprise info and income of over $13 billion. Via its varied segments, it gives credit score scores, benchmarks and indices, analytics, and different knowledge to commodity market contributors, capital markets, and automotive markets.

S&P World has paid dividends constantly since 1937 and has elevated its payout for 51 consecutive years.

S&P World posted second quarter earnings on July thirtieth, 2024, and outcomes have been significantly better than anticipated on each the highest and backside traces. Adjusted earnings-per-share got here to $4.04, which was 39 cents higher than estimates.

Earnings have been up from $3.12 per share in final yr’s Q2. Income soared 14.5% year-over-year to $3.55 billion, $140 million higher than anticipated. Administration additionally boosted steering, and we’ve raised our estimate accordingly.

Bills have been $2.11 billion, the identical as Q1, and up fractionally from final yr’s Q2. Given income rose sharply, working revenue soared from $1.44 billion to $1.81 billion.

Income progress was strongest within the Scores enterprise, which noticed income rise from $851 million to $1.14 billion yr over-year. The Market Intelligence enterprise remains to be the biggest phase, however solely simply, as income rose modestly yr over-year.

Click on right here to obtain our most up-to-date Positive Evaluation report on SPGI: (preview of web page 1 of three proven under):

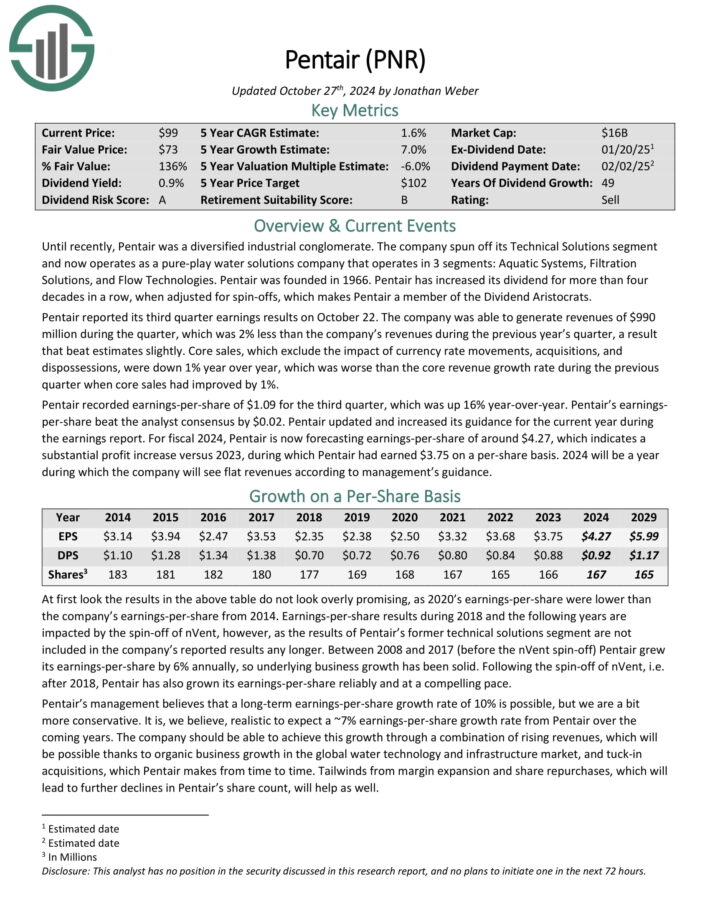

Most secure Dividend Aristocrats #7: Pentair plc (PNR)

Pentair is a pure-play water options firm that operates in 3 segments: Aquatic Programs, Filtration Options, and Circulation Applied sciences. Pentair was based in 1966.

Pentair has elevated its dividend for greater than 4 a long time in a row, when adjusted for spin-offs. Pentair is among the high water shares.

Pentair reported its third quarter earnings outcomes on October 22. The corporate was in a position to generate revenues of $990 million through the quarter, which was 2% lower than the corporate’s revenues through the earlier yr’s quarter, a end result that beat estimates barely.

Core gross sales, which exclude the influence of forex fee actions, acquisitions, and dispossessions, have been down 1% yr over yr, which was worse than the core income progress fee through the earlier quarter when core gross sales had improved by 1%.

Pentair recorded earnings-per-share of $1.09 for the third quarter, which was up 16% year-over-year. Pentair’s earnings-per-share beat the analyst consensus by $0.02.

Click on right here to obtain our most up-to-date Positive Evaluation report on Pentair (preview of web page 1 of three proven under):

Most secure Dividend Aristocrats #6: W.W. Grainger (GWW)

W.W. Grainger, headquartered in Lake Forest, IL, is among the world’s largest business-to-business distributors of upkeep, restore, and operations (“MRO”) provides.

Grainger has greater than 4.5 million energetic prospects, with greater than 30 million merchandise provided globally.

Supply: Investor Presentation

On July thirty first, 2024, W.W. Grainger reported its Q2 outcomes for the interval ending June thirtieth, 2024. Revenues got here in at $4.3 billion, up 3.1% on a reported foundation and up 5.1% on a each day, fixed forex foundation (adjusted) in comparison with final yr.

Outcomes have been pushed by strong efficiency throughout the board. The Excessive-Contact Options phase achieved gross sales progress of three.1% as a consequence of strong quantity progress in all geographies. Within the Countless Assortment phase, gross sales have been up 3.3%.

Progress was once more pushed by B2B prospects throughout the phase in addition to enterprise buyer progress, partially offset by declining gross sales to non-core, consumer-like prospects.

Click on right here to obtain our most up-to-date Positive Evaluation report on GWW (preview of web page 1 of three proven under):

Most secure Dividend Aristocrats #5: Chubb Restricted (CB)

Chubb Ltd is a worldwide supplier of insurance coverage and reinsurance providers headquartered in Zurich, Switzerland. The corporate gives insurance coverage providers together with property & casualty insurance coverage, accident & medical health insurance, life insurance coverage, and reinsurance.

For its fiscal second quarter, Chubb Ltd reported web earned premiums of $12.3 billion, which was 12% year-over-year progress. Internet written premiums have been up 12% year-over-year within the firm’s World P&C enterprise unit, whereas different enterprise items resembling Life noticed strong progress as properly.

CB generated web funding earnings of $1.47 billion through the quarter, or $1.56 billion after changes, which was up by a pleasant 26% in comparison with the earlier yr’s interval.

Click on right here to obtain our most up-to-date Positive Evaluation report on Chubb (preview of web page 1 of three proven under):

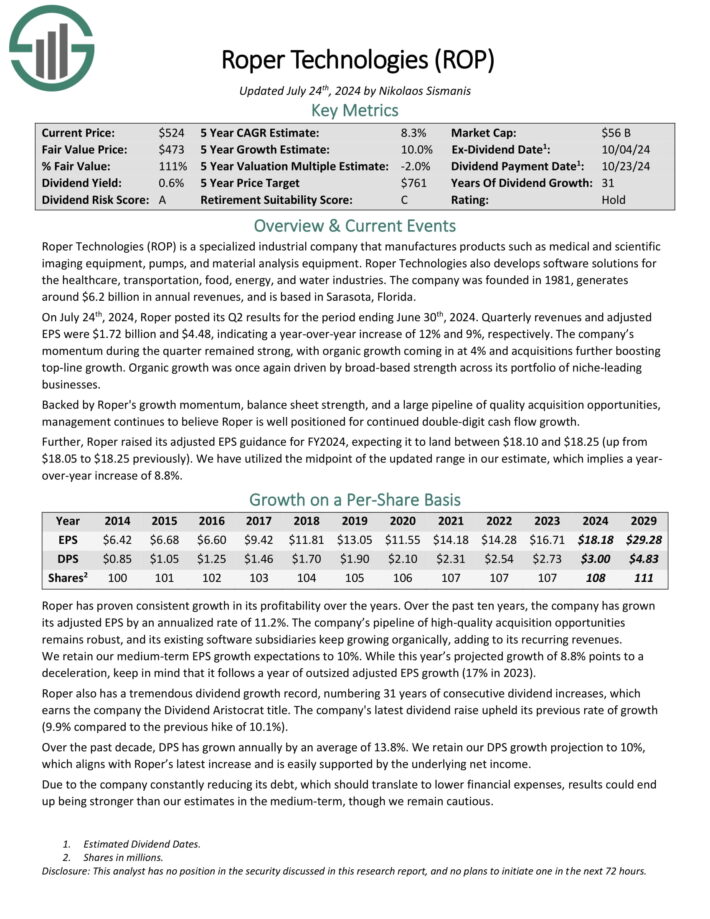

Most secure Dividend Aristocrats #4: Roper Applied sciences (ROP)

Roper Applied sciences is a specialised industrial firm that manufactures merchandise resembling medical and scientific imaging gear, pumps, and materials evaluation gear.

Roper Applied sciences additionally develops software program options for the healthcare, transportation, meals, vitality, and water industries. The corporate was based in 1981, generates round $5.4 billion in annual revenues, and is predicated in Sarasota, Florida.

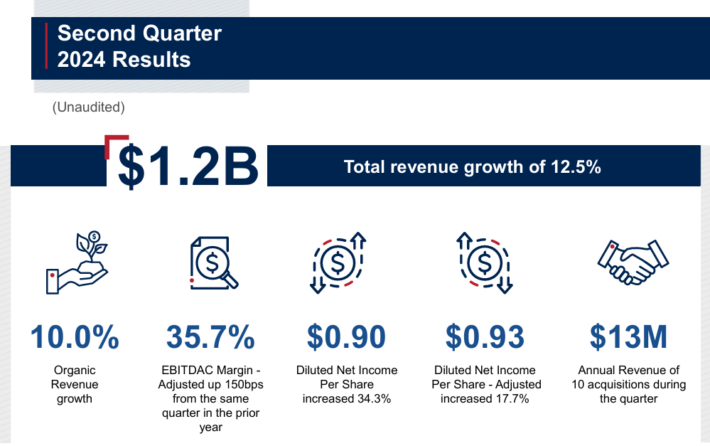

On July twenty fourth, 2024, Roper posted its Q2 outcomes for the interval ending June thirtieth, 2024. Quarterly revenues and adjusted EPS have been $1.72 billion and $4.48, indicating a year-over-year enhance of 12% and 9%, respectively.

The corporate’s momentum through the quarter remained sturdy, with natural progress coming in at 4% and acquisitions additional boosting top-line progress. Natural progress was as soon as once more pushed by broad-based power throughout its portfolio of niche-leading companies.

Backed by Roper’s progress momentum, stability sheet power, and a big pipeline of high quality acquisition alternatives, administration continues to consider Roper is properly positioned for continued double-digit money move progress.

Click on right here to obtain our most up-to-date Positive Evaluation report on ROP (preview of web page 1 of three proven under):

Most secure Dividend Aristocrats #3: Brown & Brown (BRO)

Brown & Brown Inc. is a number one insurance coverage brokerage agency that gives danger administration options to each people and companies, with a concentrate on property & casualty insurance coverage. Brown & Brown has a notably excessive stage of insider possession.

Brown & Brown posted second quarter earnings on July twenty third, 2024, and outcomes have been higher than anticipated on each the highest and backside traces. Adjusted earnings-per-share got here to 93 cents, which was a nickel forward of estimates.

Supply: Investor Presentation

Income was up 12.4% year-over-year to $1.18 billion, which was additionally $40 million forward of expectations.

Brown & Brown’s aggressive benefit comes from its willingness to execute small and frequent acquisitions. This growth-by-acquisition technique provides the corporate a permanent alternative to proceed rising its enterprise for the foreseeable future.

Click on right here to obtain our most up-to-date Positive Evaluation report on BRO (preview of web page 1 of three proven under):

Most secure Dividend Aristocrats #2: Nucor Corp. (NUE)

Nucor is the biggest publicly traded US-based metal company. The metal trade is notoriously cyclical, which makes Nucor’s streak of fifty consecutive years of dividend will increase much more outstanding.

Nucor Company reported its monetary outcomes for the second quarter of 2024, demonstrating sturdy efficiency amidst difficult market situations.

The corporate posted web earnings of $645.2 million, or $2.68 per diluted share, with web gross sales totaling $8.08 billion. Internet earnings earlier than noncontrolling pursuits have been $712.1 million, and EBITDA reached $1.23 billion.

Click on right here to obtain our most up-to-date Positive Evaluation report on NUE (preview of web page 1 of three proven under):

Most secure Dividend Aristocrats #1: West Pharmaceutical Companies (WST)

West Pharmaceutical Companies manufactures packaging and parts concerned within the distribution and utility of prescription drugs. The corporate’s merchandise embody Zenith Crystal, a medical glass different, and SmartDose, an automated remedy supply system.

West Pharmaceutical Companies reported its second quarter earnings outcomes on July 25. The corporate reported that its revenues totaled $702 million, which represents a income decline of seven% in comparison with the prior yr’s quarter.

West Pharmaceutical Companies’ revenues have been decrease than what the analyst neighborhood had anticipated, in contrast to through the earlier quarter, when it beat the consensus estimate. Revenues weren’t positively impacted by forex fee adjustments through the interval, in contrast to through the earlier yr.

West Pharmaceutical Companies generated adjusted earnings-per-share of $1.52 through the second quarter, which represents a decline of 28% in comparison with the prior yr’s quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on WST (preview of web page 1 of three proven under):

Closing Ideas

Traders searching for high quality dividend progress shares ought to begin their search with the Dividend Aristocrats, a choose group of 67 shares within the S&P 500 Index with not less than 25 consecutive years of dividend progress.

Earnings buyers also needs to contemplate dividend security earlier than investing in dividend shares.

Fortuitously, buyers wouldn’t have to sacrifice high quality when investing in dividend progress shares. These 10 Dividend Aristocrats have have high-quality enterprise fashions, sturdy aggressive benefits, and protected dividend payouts that may stand up to recessions.

Further Studying

Don’t miss the assets under for extra Dividend Aristocrats investing analysis.

And see the assets under for extra compelling funding concepts for dividend progress shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].