Up to date on April twenty eighth, 2025 by Bob Ciura

At Positive Dividend, we suggest buyers give attention to one of the best dividend shares that may generate the very best returns over time.

Relating to dividends, buyers must also be targeted on dividend security. There have been many shares with excessive dividend yields that ultimately minimize or get rid of their dividends when enterprise circumstances deteriorate.

Dividend cuts ought to be averted at any time when potential.

We have now created a novel metric known as Dividend Threat Rating, which measures a inventory’s capacity to keep up its dividend throughout recessions, and enhance the dividend over time.

With this in thoughts, we’ve compiled a free listing of the 50 most secure dividend shares based mostly on their payout ratios and Dividend Threat Rating, which you’ll be able to obtain beneath:

The most secure dividend development shares are high-quality companies that may preserve their dividends, even throughout recessions. However investing in poor companies that minimize their dividends is a recipe for under-performance over time.

That’s why, on this article, now we have analyzed the ten most secure dividend shares from our Positive Evaluation Analysis Database with the most secure dividends based mostly on our Dividend Threat Rating ranking system.

The most secure dividend shares beneath all have Dividend Threat Scores of ‘A’ (our prime ranking), and have the bottom payout ratios. The ten most secure dividend shares even have dividend yields of no less than 1%, to make them interesting for earnings buyers.

Desk of Contents

Why The Payout Ratio Issues

The dividend payout ratio is just an organization’s annual per-share dividend, divided by the corporate’s annual earnings-per-share. It’s a measure of the extent of earnings an organization distributes to its shareholders by way of dividends.

The payout ratio is a helpful investing metric as a result of it differentiates the most secure dividend shares which have low payout ratios that room for dividend development, from corporations with excessive payout ratios whose dividends might not be sustainable.

Certainly, analysis has proven that corporations with larger dividend development have outperformed corporations with decrease dividend development or no dividend development.

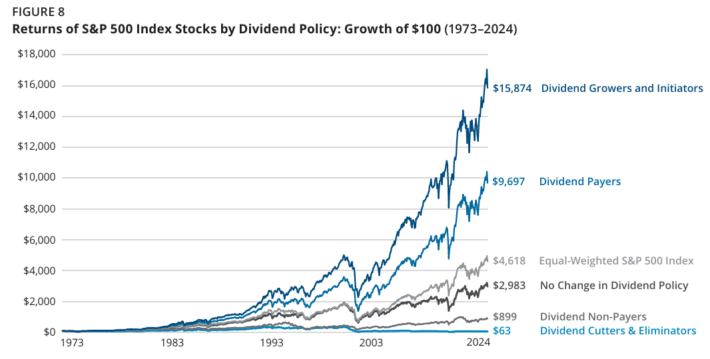

In analysis carried out by Ned Davis and Hartford Funds, it was discovered that dividend growers and initiators delivered complete returns of 10.24% per 12 months from 1973 by 2024, higher than the equal-weighted S&P 500’s efficiency of seven.65% per 12 months.

Curiously, the dividend growers and initiators analyzed on this examine generated outperformance with much less volatility – a rarity and a contradiction to what fashionable tutorial monetary principle tells us.

A abstract of this analysis might be discovered beneath.

Supply: Hartford Funds – The Energy Of Dividends

Outperformance of two.47% yearly won’t appear to be a game-changer, but it surely actually is because of the surprise that’s compound curiosity.

Utilizing knowledge from the identical piece of analysis, buyers who selected to speculate completely in dividend growers and initiators turned $100 into $15,874 from 1973-2024. Throughout the identical time interval, the S&P 500 index turned $100 into $4,618.

Supply: Hartford Funds – The Energy Of Dividends

Shares that didn’t pay dividends couldn’t match the efficiency of all kinds of dividend payers, turning $100 into $899 from 1973-2024. Dividend cutters and eliminators fared even worse, turning $100 into simply $63–which means these shares truly misplaced buyers cash.

Consequently, buyers in search of shares with higher dividend development (and long-term return potential) might take into account these 10 most secure dividend shares with low payout ratios and Dividend Threat Scores of ‘A’.

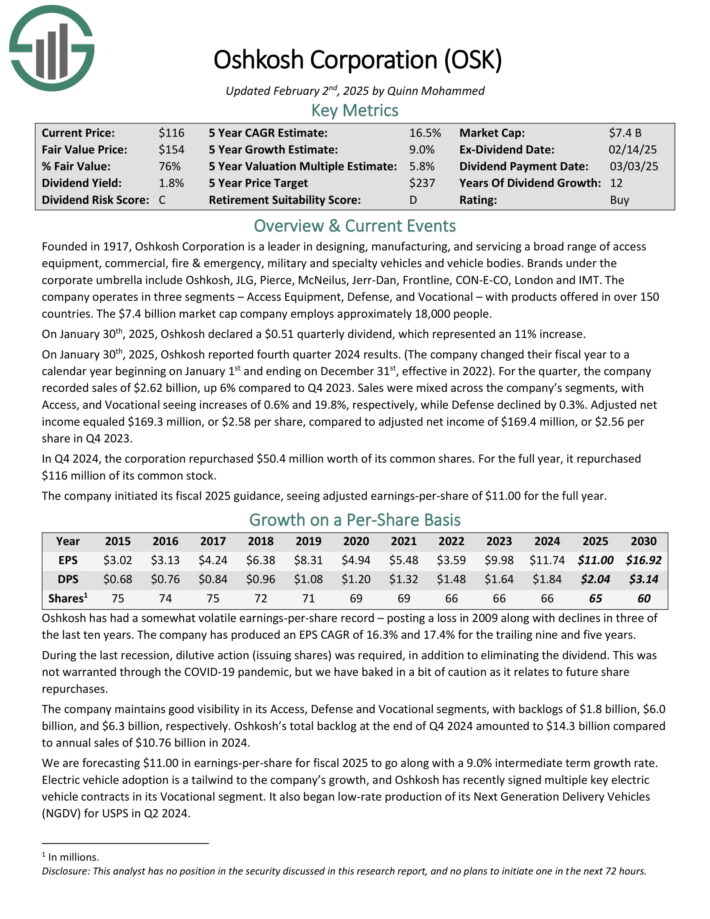

Most secure Dividend Inventory #10: Oshkosh Corp. (OSK)

Oshkosh Company is a frontrunner in designing, manufacturing, and servicing a broad vary of entry tools, industrial, fireplace & emergency, navy and specialty autos and car our bodies.

Manufacturers below the company umbrella embody Oshkosh, JLG, Pierce, McNeilus, Jerr-Dan, Frontline, CON-E-CO, London and IMT.

The corporate operates in three segments – Entry Gear, Protection, and Vocational – with merchandise provided in over 150 nations.

On January thirtieth, 2025, Oshkosh reported fourth quarter 2024 outcomes. For the quarter, the corporate recorded gross sales of $2.62 billion, up 6% in comparison with This autumn 2023. Gross sales had been blended throughout the corporate’s segments, with Entry, and Vocational seeing will increase of 0.6% and 19.8%, respectively, whereas Protection declined by 0.3%.

Adjusted internet earnings equaled $169.3 million, or $2.58 per share, in comparison with adjusted internet earnings of $169.4 million, or $2.56 per share in This autumn 2023.

Click on right here to obtain our most up-to-date Positive Evaluation report on OSK (preview of web page 1 of three proven beneath):

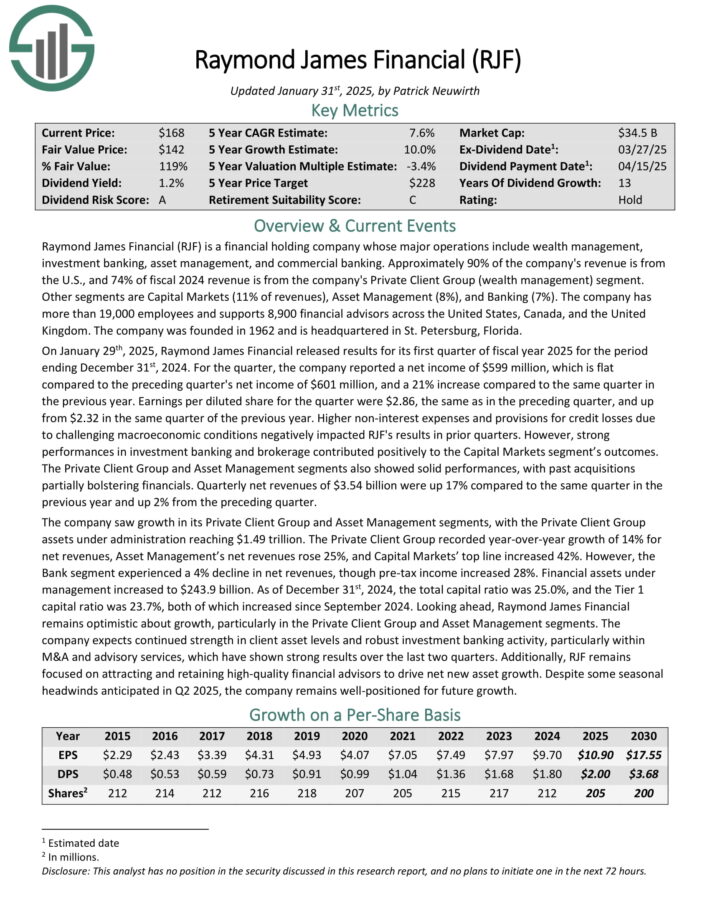

Most secure Dividend Inventory #9: Raymond James Monetary (RJF)

Raymond James Monetary (RJF) is a monetary holding firm whose main operations embody wealth administration, funding banking, asset administration, and industrial banking. Roughly 90% of the corporate’s income is from the U.S., and 74% of fiscal 2024 income is from the corporate’s Personal Shopper Group (wealth administration) section.

Different segments are Capital Markets (11% of revenues), Asset Administration (8%), and Banking (7%). The corporate has greater than 19,000 staff and helps 8,900 monetary advisors throughout the USA, Canada, and the UK.

On January twenty ninth, 2025, Raymond James Monetary launched outcomes for its first quarter of fiscal 12 months 2025 for the interval ending December thirty first, 2024.

For the quarter, the corporate reported a internet earnings of $599 million, which is flat in comparison with the previous quarter’s internet earnings of $601 million, and a 21% enhance in comparison with the identical quarter within the earlier 12 months.

Earnings per diluted share for the quarter had been $2.86, the identical as within the previous quarter, and up from $2.32 in the identical quarter of the earlier 12 months. Robust performances in funding banking and brokerage contributed positively to the Capital Markets section’s outcomes.

Click on right here to obtain our most up-to-date Positive Evaluation report on RJF (preview of web page 1 of three proven beneath):

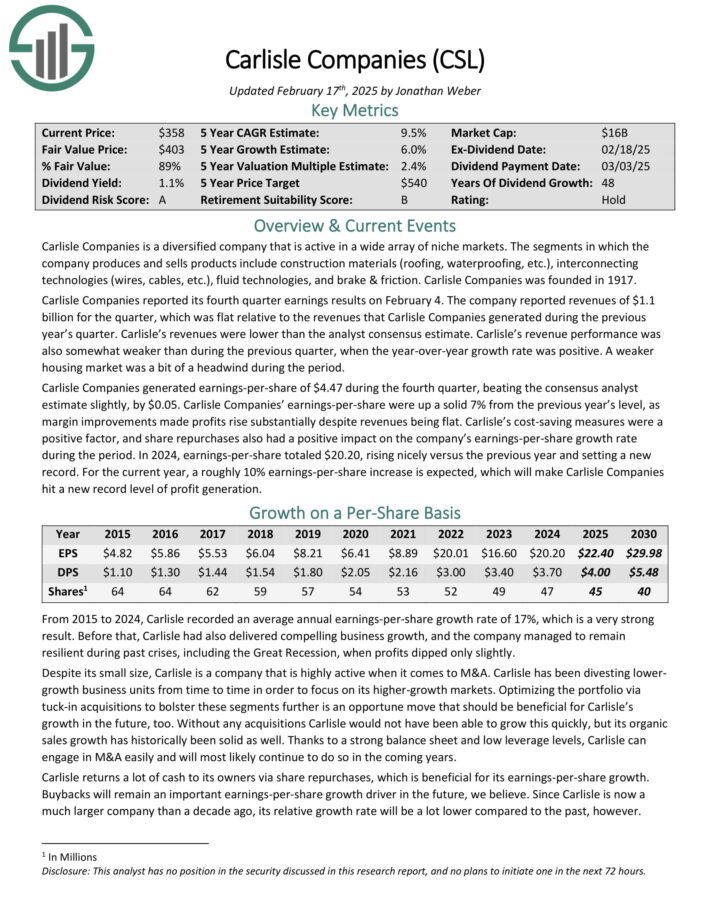

Most secure Dividend Inventory #8: Carlisle Corporations (CSL)

Carlisle Corporations is a diversified firm that’s lively in a wide selection of area of interest markets.

The segments through which the corporate produces and sells merchandise embody building supplies (roofing, waterproofing, and so forth.), interconnecting applied sciences (wires, cables, and so forth.), fluid applied sciences, and brake & friction.

Carlisle Corporations reported its fourth quarter earnings outcomes on February 4. The corporate reported revenues of $1.1 billion for the quarter, which was flat year-over-year. A weaker housing market was a little bit of a headwind throughout the interval.

Carlisle Corporations generated earnings-per-share of $4.47 throughout the fourth quarter, beating the consensus analyst estimate barely, by $0.05. Carlisle Corporations’ earnings-per-share had been up a strong 7% from the earlier 12 months’s degree, as margin enhancements made earnings rise considerably regardless of revenues being flat.

Price-saving measures had been a constructive issue, and share repurchases additionally had a constructive impression on the corporate’s earnings-per-share development.

Click on right here to obtain our most up-to-date Positive Evaluation report on CSL (preview of web page 1 of three proven beneath):

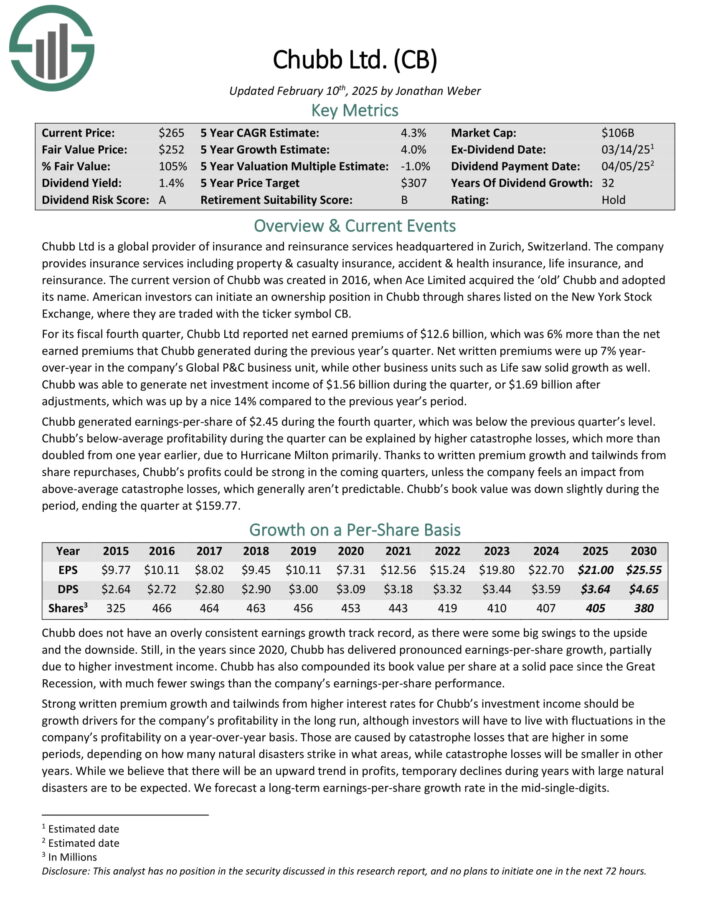

Most secure Dividend Inventory #7: Chubb Ltd. (CB)

Chubb Ltd is a worldwide supplier of insurance coverage and reinsurance providers headquartered in Zurich, Switzerland. The corporate supplies insurance coverage providers together with property & casualty insurance coverage, accident & medical insurance, life insurance coverage, and reinsurance.

For its fiscal fourth quarter, Chubb Ltd reported internet earned premiums of $12.6 billion, which was 6% greater than the online earned premiums that Chubb generated throughout the earlier 12 months’s quarter. Web written premiums had been up 7% year-over-year within the firm’s International P&C enterprise unit, whereas different enterprise models reminiscent of Life noticed strong development as properly.

Chubb generated internet funding earnings of $1.56 billion throughout the quarter, or $1.69 billion after changes, which was up by 14% in comparison with the earlier 12 months’s interval.

Chubb generated earnings-per-share of $2.45 throughout the fourth quarter, which was beneath the earlier quarter’s degree. Chubb’s below-average profitability throughout the quarter might be defined by larger disaster losses, which greater than doubled from one 12 months earlier, because of Hurricane Milton primarily.

Click on right here to obtain our most up-to-date Positive Evaluation report on CB (preview of web page 1 of three proven beneath):

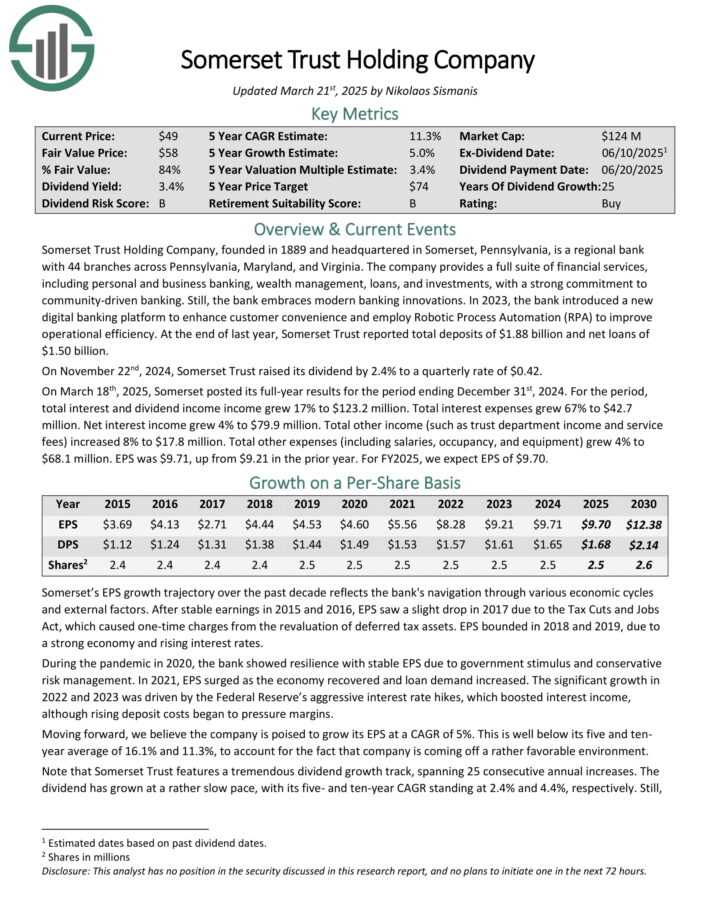

Most secure Dividend Inventory #6: Somerset Belief Holding Firm (SOME)

Somerset Belief Holding Firm is a regional financial institution with 44 branches throughout Pennsylvania, Maryland, and Virginia. The corporate supplies a full suite of economic providers, together with private and enterprise banking, wealth administration, loans, and investments.

On the finish of final 12 months, Somerset Belief reported complete deposits of $1.88 billion and internet loans of $1.50 billion.

On March 18th, 2025, Somerset posted its full-year outcomes for the interval ending December thirty first, 2024. For the interval, complete curiosity and dividend earnings earnings grew 17% to $123.2 million.

Complete curiosity bills grew 67% to $42.7 million. Web curiosity earnings grew 4% to $79.9 million. Complete different earnings (reminiscent of belief division earnings and repair charges) elevated 8% to $17.8 million.

Click on right here to obtain our most up-to-date Positive Evaluation report on SOME (preview of web page 1 of three proven beneath):

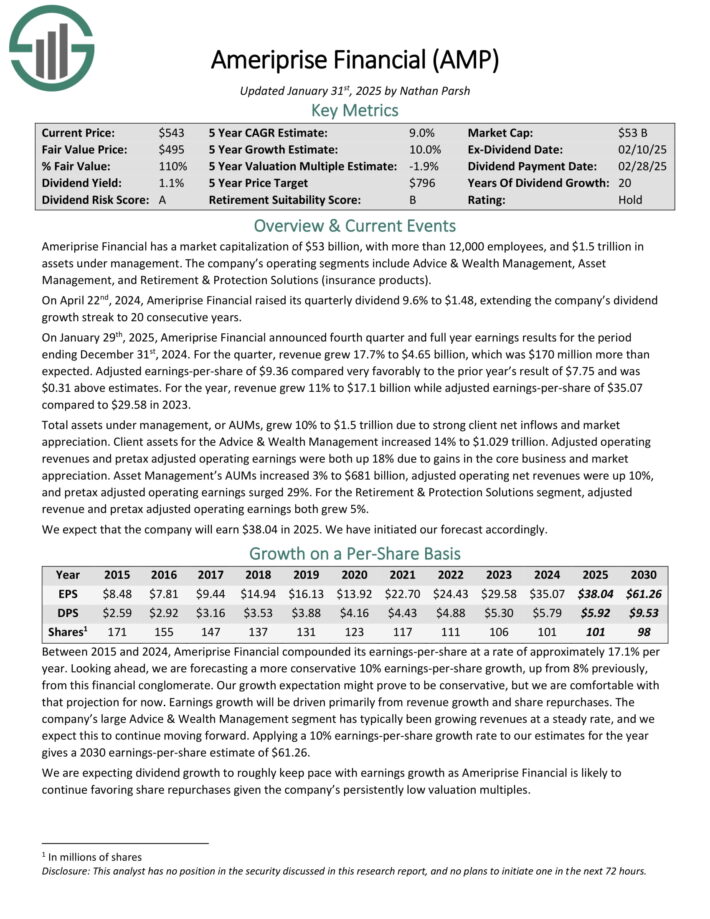

Most secure Dividend Inventory #5: Ameriprise Monetary (AMP)

Ameriprise Monetary is an funding administration firm with greater than $1.5 trillion in belongings below administration. The corporate’s working segments embody Recommendation & Wealth Administration, Asset Administration, and Retirement & Safety Options (insurance coverage merchandise).

On January twenty ninth, 2025, Ameriprise Monetary introduced fourth quarter and full 12 months earnings outcomes for the interval ending December thirty first, 2024. For the quarter, income grew 17.7% to $4.65 billion, which was $170 million greater than anticipated.

Adjusted earnings-per-share of $9.36 in contrast very favorably to the prior 12 months’s results of $7.75 and was $0.31 above estimates. For the 12 months, income grew 11% to $17.1 billion whereas adjusted earnings-per-share of $35.07 in comparison with $29.58 in 2023.

Complete belongings below administration, or AUMs, grew 10% to $1.5 trillion because of sturdy consumer internet inflows and market appreciation. Shopper belongings for the Recommendation & Wealth Administration elevated 14% to $1.029 trillion.

Click on right here to obtain our most up-to-date Positive Evaluation report on AMP (preview of web page 1 of three proven beneath):

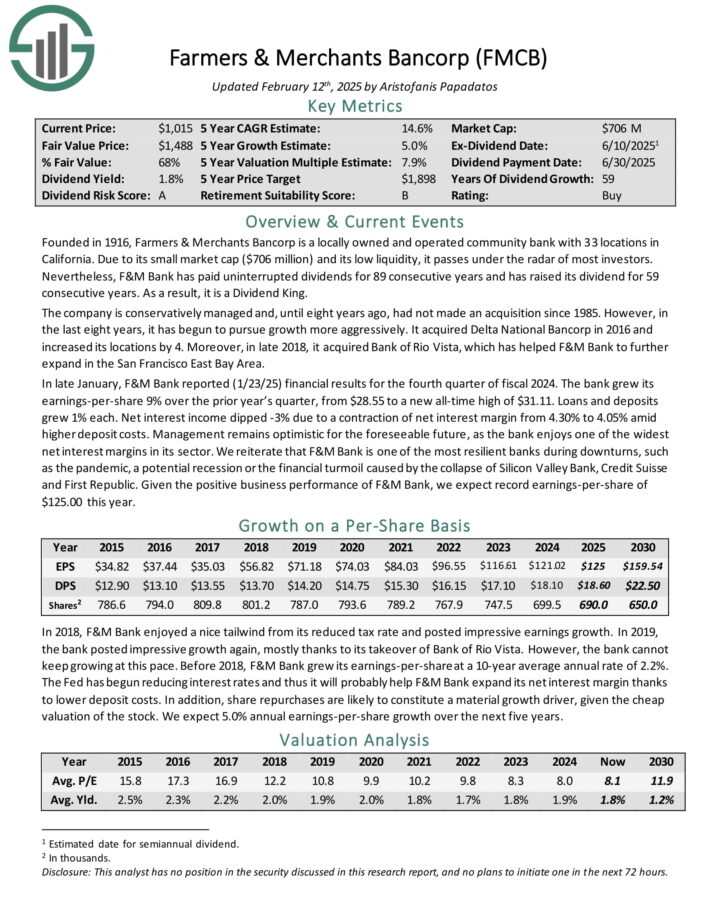

Most secure Dividend Inventory #4: Farmers & Retailers Bancorp (FMCB)

Farmers & Retailers Bancorp is a domestically owned and operated group financial institution with 32 places in California. On account of its small market cap and its low liquidity, it passes below the radar of most buyers.

F&M Financial institution has paid uninterrupted dividends for 88 consecutive years and has raised its dividend for 59 consecutive years.

In late January, F&M Financial institution reported (1/23/25) monetary outcomes for the fourth quarter of fiscal 2024. The financial institution grew its earnings-per-share 9% over the prior 12 months’s quarter, from $28.55 to a brand new all-time excessive of $31.11. Loans and deposits grew 1% every.

Web curiosity earnings dipped -3% because of a contraction of internet curiosity margin from 4.30% to 4.05% amid larger deposit prices. Administration stays optimistic for the foreseeable future, because the financial institution enjoys one of many widest internet curiosity margins in its sector.

We reiterate that F&M Financial institution is likely one of the most resilient banks throughout downturns, such because the pandemic, a possible recession or the monetary turmoil brought on by the collapse of Silicon Valley Financial institution, Credit score Suisse and First Republic.

Click on right here to obtain our most up-to-date Positive Evaluation report on FMCB (preview of web page 1 of three proven beneath):

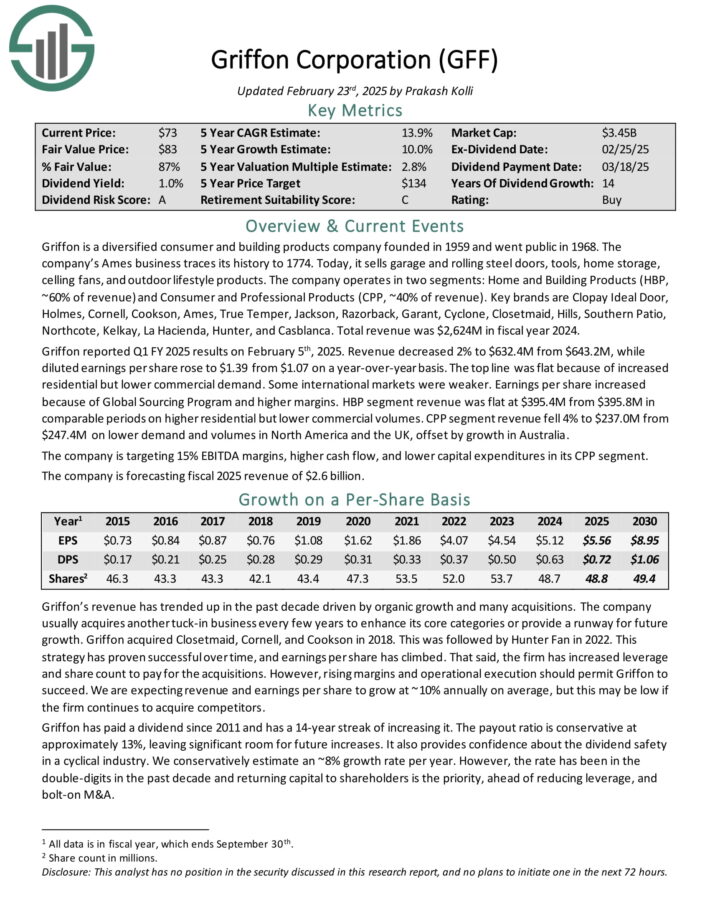

Most secure Dividend Inventory #3: Griffon Corp. (GFF)

Griffon is a diversified shopper and constructing merchandise firm based in 1959. At this time, it sells storage and rolling metal doorways, instruments, dwelling storage, ceiling followers, and outside way of life merchandise.

The corporate operates in two segments: House and Constructing Merchandise (HBP, ~60% of income) and Shopper and Skilled Merchandise (CPP, ~40% of income).

Key manufacturers are Clopay Ultimate Door, Holmes, Cornell, Cookson, Ames, True Mood, Jackson, Razorback, Garant, Cyclone, Closetmaid, Hills, Southern Patio, Northcote, Kelkay, La Hacienda, Hunter, and Casblanca. Complete income was $2,624M in fiscal 12 months 2024.

Griffon reported Q1 FY 2025 outcomes on February fifth, 2025. Income decreased 2% to $632.4M from $643.2M, whereas diluted earnings per share rose to $1.39 from $1.07 on a year-over-year foundation.

The highest line was flat due to elevated residential however decrease industrial demand. Some worldwide markets had been weaker. Earnings per share elevated due to International Sourcing Program and better margins.

Click on right here to obtain our most up-to-date Positive Evaluation report on GFF (preview of web page 1 of three proven beneath):

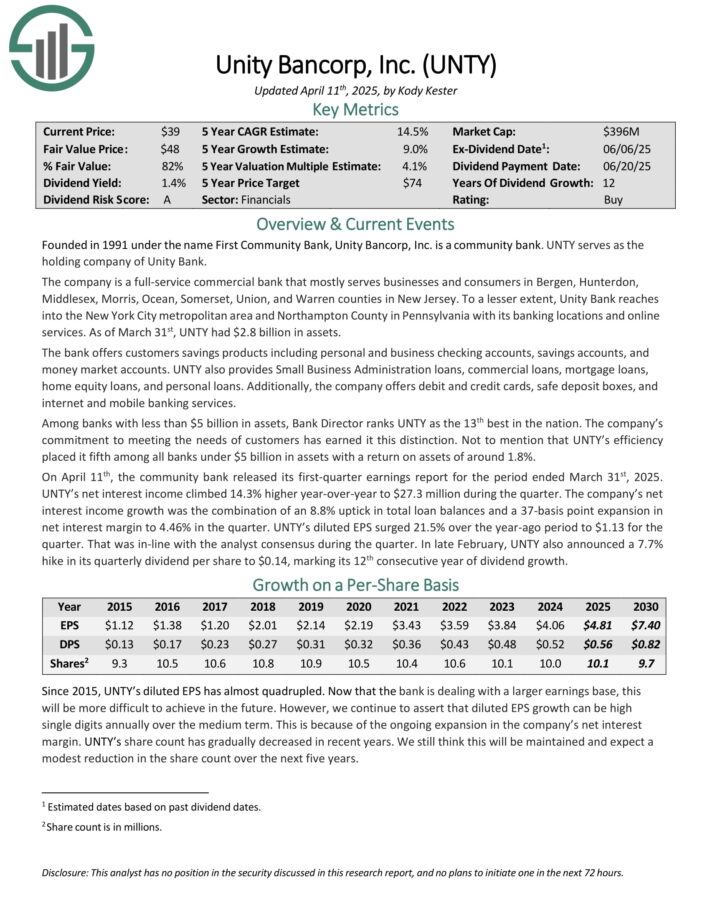

Most secure Dividend Inventory #2: Unity Bancorp (UNTY)

Unity Bancorp, Inc. is a full-service industrial financial institution that largely serves companies and customers in Bergen, Hunterdon, Middlesex, Morris, Ocean, Somerset, Union, and Warren counties in New Jersey.

To a lesser extent, Unity Financial institution reaches into the New York Metropolis metropolitan space and Northampton County in Pennsylvania with its banking places and on-line providers. As of March thirty first, UNTY had $2.8 billion in belongings.

On April eleventh, the group financial institution launched its first-quarter earnings report for the interval ended March thirty first, 2025. UNTY’s internet curiosity earnings climbed 14.3% larger year-over-year to $27.3 million throughout the quarter.

The corporate’s internet curiosity earnings development was the mix of an 8.8% uptick in complete mortgage balances and a 37-basis level growth in internet curiosity margin to 4.46% within the quarter. UNTY’s diluted EPS surged 21.5% over the year-ago interval to $1.13 for the quarter. That was in-line with the analyst consensus throughout the quarter.

In late February, UNTY additionally introduced a 7.7% hike in its quarterly dividend per share to $0.14, marking its twelfth consecutive 12 months of dividend development.

Click on right here to obtain our most up-to-date Positive Evaluation report on UNTY (preview of web page 1 of three proven beneath):

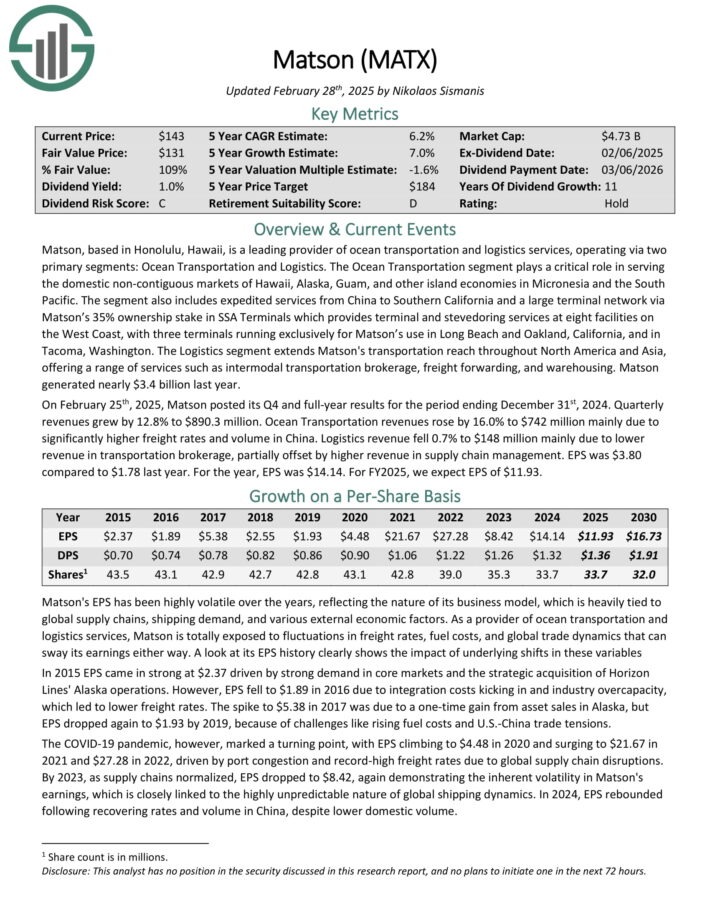

Most secure Dividend Inventory #1: Matson, Inc. (MATX)

Matson, based mostly in Honolulu, Hawaii, is a number one supplier of ocean transportation and logistics providers, working by way of two main segments: Ocean Transportation and Logistics.

The Ocean Transportation section performs a important function in serving the home non-contiguous markets of Hawaii, Alaska, Guam, and different island economies in Micronesia and the South Pacific.

The section additionally consists of expedited providers from China to Southern California and a big terminal community by way of Matson’s 35% possession stake in SSA Terminals.

The Logistics section extends Matson’s transportation attain all through North America and Asia, providing a variety of providers reminiscent of intermodal transportation brokerage, freight forwarding, and warehousing.

On February twenty fifth, 2025, Matson posted its This autumn and full-year outcomes for the interval ending December thirty first, 2024. Quarterly revenues grew by 12.8% to $890.3 million. Ocean Transportation revenues rose by 16.0% to $742 million primarily because of considerably larger freight charges and quantity in China.

Logistics income fell 0.7% to $148 million primarily because of decrease income in transportation brokerage, partially offset by larger income in provide chain administration. EPS was $3.80 in comparison with $1.78 final 12 months. For the 12 months, EPS was $14.14.

Click on right here to obtain our most up-to-date Positive Evaluation report on MATX (preview of web page 1 of three proven beneath):

Extra Studying

Buyers in search of extra of the most secure dividend shares can discover further studying beneath:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].