On January 3, 2009, the worldwide monetary system was nonetheless reeling from the best collapse because the Nice Melancholy.

The earlier 12 months, the S&P 500 had plunged 38%. It was its worst annual drop in 77 years.

Lehman Brothers, a 158-year-old Wall Avenue establishment, had filed for chapter with greater than $600 billion in money owed. It was the biggest failure in U.S. historical past.

In Washington, the Treasury had already licensed $700 billion in emergency bailout funds by the Troubled Asset Reduction Program (TARP). In the meantime, the Federal Reserve had funneled greater than $1.2 trillion in loans to rescue dozens of banks and monetary corporations.

Belief in our monetary system had been shattered.

And in the course of all this chaos, a pseudonymous programmer named Satoshi Nakamoto pressed “enter.”

It was the keystroke that launched bitcoin.

However what he created that day held greater than a brand new sort of foreign money…

It held a secret hidden in its core.

The Secret of the Genesis Block

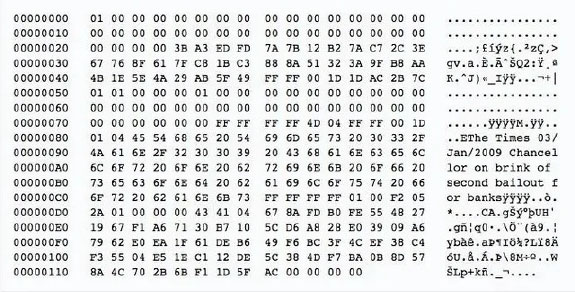

Buried in bitcoin’s very first block — referred to as the Genesis Block — is a line of textual content that has puzzled and fascinated folks ever since.

It’s a newspaper headline from The Instances of London that reads: “Chancellor on brink of second bailout for banks.”

This may appear to be an odd alternative. In spite of everything, Satoshi might have inserted the rest: a cryptic line of code, a mathematical proof and even his personal identify.

As an alternative, he selected to etch a bailout headline into the everlasting basis of bitcoin.

To me, it was a transparent message that the outdated system had reached its breaking level and a brand new one needed to be constructed.

And since bitcoin’s blocks are immutable, that headline is there ceaselessly as a everlasting reminder of what occurs when public belief in cash is shattered.

Each transaction ever made in bitcoin — trillions of {dollars}’ value immediately — in the end factors again to that very first message.

But, sixteen years later, Satoshi’s hidden clue feels much less like a warning and extra like a map…

A map pointing to a world the place cash itself is now not sure by banks, governments or ideologies.

And it’s much more related immediately as a result of we’re residing by a interval of technological convergence in contrast to something in historical past.

Bitcoin was a spark. However what Satoshi couldn’t have recognized is how shortly different applied sciences would rise to bolster the system he began.

Take synthetic intelligence.

AI techniques immediately can already learn authorized contracts, generate code and make buying and selling selections in milliseconds.

However for AI to really function at scale, it wants monetary rails that don’t shut at 5 p.m. or wait two days for settlement.

Blockchain offers these rails.

Take a look at semiconductors. The identical chips powering AI fashions are additionally accelerating blockchain validation, making decentralized techniques quicker and safer.

Nvidia, AMD and Intel aren’t simply serving to to construct knowledge facilities. They’re serving to to construct the spine of a brand new, trendy monetary system.

Add within the rollout of 5G and low-orbit satellites, and billions of units — from smartphones to industrial sensors — can now transact straight, machine to machine. That requires programmable cash.

Once more, blockchain is the one infrastructure that matches.

After which there’s tokenization.

We’ve talked about how belongings from actual property to Treasury payments are already being moved onto the blockchain.

BlackRock CEO Larry Fink, head of the biggest asset administration agency on the planet, has referred to as tokenization “the subsequent technology for markets.”

And the numbers concerned are staggering.

Tether, the corporate behind the U.S.-dollar-backed stablecoin referred to as USDT, is now exploring a deal that might worth it at practically $500 billion.

If that occurs, its co-founder and CFO, Giancarlo Devasini, would immediately turn into one of many wealthiest folks on the planet, with a web value of $224 billion.

That may put him forward of Warren Buffett, and only some steps behind Elon Musk, Jeff Bezos and Mark Zuckerberg.

In different phrases, a person who’s nearly unknown exterior of crypto circles might eclipse Buffett’s wealth by controlling the rails of digital cash within the twenty first century.

That’s why it’s so necessary to know Satoshi’s secret map.

As a result of it factors to unbelievable wealth constructing alternatives, particularly in the course of the convergence of so many unbelievable applied sciences.

Synthetic intelligence, blockchain, superior semiconductors and high-speed networks are all maturing without delay.

Every is highly effective by itself. However collectively, they’re rewriting the foundations of the worldwide financial system.

And now, with this convergence accelerating, that subsequent monetary system is coming into focus.

On this new system, cash strikes on the pace of software program. Settlement occurs in mere seconds as a substitute of days, whereas charges collapse as middlemen are lower out of the image.

And full markets are about to be open to anybody with an web connection.

Which suggests there might be no want for bailouts.

Right here’s My Take

Satoshi Nakamoto didn’t simply create Bitcoin.

He left a map displaying us the place to take a position sooner or later.

That map factors to a world the place cash, AI, microchips and networks converge right into a system that no authorities must bail out.

Observe it, and also you received’t simply survive the subsequent monetary disaster…

You may revenue from the brand new order being constructed.

Regards,

Ian King

Chief Strategist, Banyan Hill Publishing

Editor’s Be aware: We’d love to listen to from you!

If you wish to share your ideas or options in regards to the Each day Disruptor, or if there are any particular subjects you’d like us to cowl, simply ship an e mail to [email protected].

Don’t fear, we received’t reveal your full identify within the occasion we publish a response. So be at liberty to remark away!