The US Securities and Change Fee (SEC) has hit the brakes on 4 intently watched crypto‐exchange-traded product filings, instituting formal proceedings on spot XRP and Dogecoin trade traded funds (ETFs) and lengthening its overview of an Ethereum staking modification.

SEC Delays XRP And Dogecoin ETFs

Orders printed late on Could 20 designate longer durations for the 21Shares Core XRP Belief (Launch No. 34-103080), the Grayscale XRP Belief (34-103090), and the Grayscale Dogecoin Belief (34-103079), whereas a separate discover (34-103086) defers motion on Bitwise’s proposal to allow staking in its already-delayed Ethereum ETF. Every order invitations public remark and makes clear that “establishment of proceedings doesn’t point out that the Fee has reached any conclusions.”

Below Part 19(b)(2)(B) of the Change Act, the Fee now has as much as 240 days from the unique submitting dates—inserting the ultimate deadlines for these merchandise in early October—to approve or disapprove the rule adjustments. Commenters may have 21 days after Federal Register publication to submit briefs, and 35 days to file rebuttals. The company says the prolonged interval is required to evaluate whether or not the proposed constructions are “designed to forestall fraudulent and manipulative acts and practices” and to weigh investor-protection issues.

Bloomberg Intelligence ETF analyst James Seyffart framed the delay as routine slightly than restrictive. “DELAYS on Ether ETF staking for Bitwise and on Grayscale’s XRP ETF submitting. Each anticipated IMO,” he wrote on X, including that the SEC “usually takes the total time to reply to a 19b-4 submitting” and that early approvals, if any, “wouldn’t arrive earlier than late June or early July on the absolute earliest.” When requested whether or not the Litecoin ETF was prone to stay in limbo as nicely, Seyffart replied, “Sure, I believe that’s probably, however I additionally suppose Litecoin is one which has a better probability vs others of getting accredited first.”

Nate Geraci, president of The ETF Retailer, echoed that evaluation. “SEC delays a number of choices at this time on spot xrp & doge ETFs, alongside w/ staking in eth ETFs… Nothing to see right here IMO. Nonetheless suppose all will probably be accredited,” he posted through X, cautioning that readability from the Inside Income Service on the tax remedy of staking rewards inside grantor trusts stays an impressive difficulty. Geraci had already flagged rising institutional demand the day gone by, noting that “CME-traded XRP futures at the moment are stay… Spot XRP ETFs solely a matter of time.”

CME Group’s launch of ordinary and micro XRP futures on Could 19 offers market members their first CFTC-regulated venue for leveraged publicity to the token, increasing a crypto derivatives suite that already consists of Bitcoin, Ether and Solana contracts. Early volumes had been modest—roughly $1.5 million on debut—however analysts say the reference-rate infrastructure these futures require will probably be central to any surveillance-sharing agreements the SEC calls for for spot merchandise.

Finally the calendar is now clear. Barring an unlikely early approval, the remark cycles will run into mid-summer, pushing any definitive Fee vote on XRP, Dogecoin or ETH-staking constructions into the fourth quarter. “If we’re gonna see early approvals from the SEC on any of those property — I wouldn’t count on to see them till late June or early July at absolute earliest. Extra prone to be in early 4Q,” Seyffart writes.

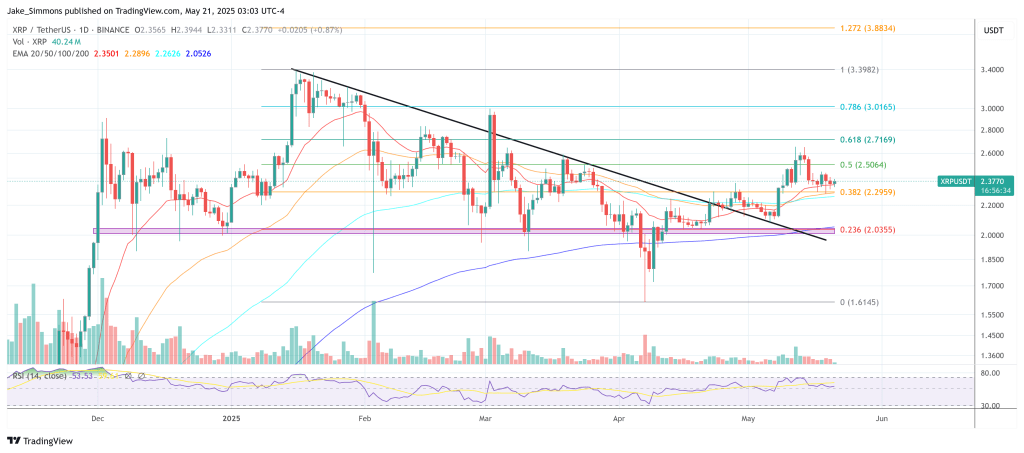

At press time, XRP traded at $2.37.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.