The texts, calls and WhatsApp messages by no means cease.

“Level me within the route of what greenback quantity you want, and we’ll get it priced out and funded as we speak!”

It is Bella, it is Jake, it is Zevi — strangers providing fast money to assist Joshua Esnard’s small enterprise in North Carolina. How does $350,000 sound? Or $768,000 and as much as $900,000? Approval in an hour, they are saying, cash in a day.

“No gimmicks, Joshua.” “No hidden charges, No BS.”

Exceedingly pressing pitches have flooded small-business house owners’ inboxes because the center of final 12 months, when a lot of them scrounged for cash to pay sudden tariff payments.

The identical quantity calls 3 times in a row. When Esnard listens to music on his telephone, the fixed pings make it sound like a skipping CD. He put in a spam-call blocking app. His father began getting the pitches.

“What number of instances do I have to textual content earlier than we make this occur? I am able to ship funding now.”

“Are you ignoring me ???”

Joshua Esnard stands for a portrait in The Minimize Buddy warehouse in Morrisville, N.C., on Jan. 16.

Cornell Watson for NPR

cover caption

toggle caption

Cornell Watson for NPR

For importers like Esnard, President Trump’s world tariffs triggered an existential emergency. Their items from suppliers in China, France or Vietnam have been touchdown in ports of Los Angeles, Houston, New York and New Jersey. However bodily claiming these merchandise abruptly required instantaneous money, tens of 1000’s of unbudgeted {dollars}.

Some turned to a shady, largely unregulated nook of the monetary world. This identical trade had gone after struggling music venues throughout pandemic lockdowns and retailers through the Nice Recession. It presents lifelines that may flip into journey wires — now to a brand new market of determined enterprise house owners.

It began with a nasty haircut

Esnard was 13 when he took a pair of scissors to a thick, see-through plastic folder and carved a stencil that might information first his DIY haircut and, then, his path in life.

Esnard’s mother and father — teachers initially from St. Lucia — had moved the household to upstate New York to show at Cornell College. Good barbers weren’t close to his home. Regardless, his dad was not about to pay for one: A person who’d customary his personal toys as a child and approached residence repairs with MacGyver confidence might actually buzz his son’s hair himself.

“And I am similar to, man, I can not do that,” Esnard says. “I obtained my T.J.Maxx garments, the platinum FUBU. I am able to go discuss to the women. However I obtained this buzz minimize. So I am like, I need a fade and an edge-up.”

He tried winging it himself within the rest room mirror however jacked up his hairline. So Esnard opened his “inventor e book” — as this MacGyver apple positive fell near the tree — and sketched in orange and blue ink a flat instrument with angles and curves. He would maintain it as a template in opposition to his head to information the clippers for sharp strains.

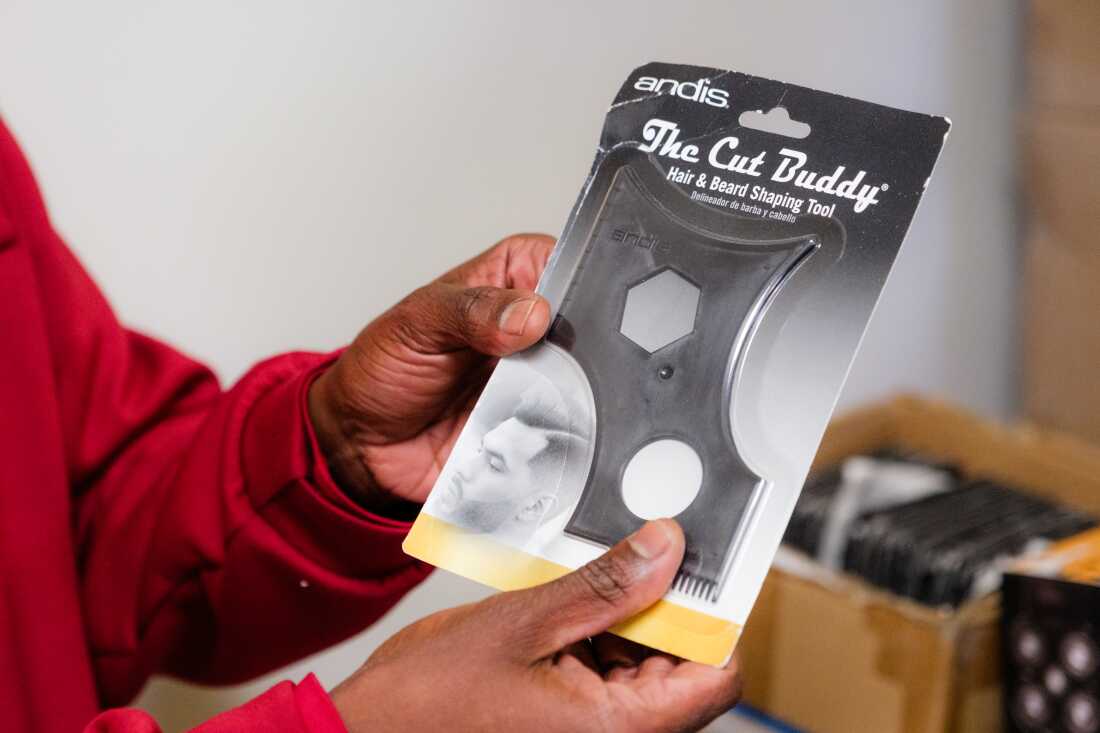

Early on, Esnard had licensed his Minimize Buddy instrument to Andis, one of many high manufacturers for hair-grooming instruments.

Cornell Watson for NPR

cover caption

toggle caption

Cornell Watson for NPR

Many hair trims later — his personal, buddies’ and roommates’ — this “Minimize Buddy” grew to become Esnard’s first patent of seven. Gross sales launched in 2016, with Esnard pondering the facet gig would assist repay his automotive. His buyers have been his mother and father and grandmother, at $1,000 every. Inside weeks, the instrument went viral because of a plug by YouTuber Nick Wavy. Esnard charged $9,000 to his private bank card for a rush of manufacturing unit orders.

Boldly reaching for a literal star, Esnard additionally fired off his pitch to billionaire investor Mark Cuban, who famously reads his personal emails. Cuban did not reply. However the universe works in serendipitous methods. The e-mail that did come was an invitation from Shark Tank, with Cuban on the dais. Esnard left the taping with a handshake cope with his FUBU-founder idol, Daymond John.

Within the present footage, the digicam zooms in on a teardrop streaking Esnard’s cheek as he speaks of eager to do good by his soon-to-be-born first little one. Esnard laughs about it now, saying he has gone from crying on TV about being a dad to crying on a Zoom about high-cost borrowing by means of service provider money advances.

An unregulated “deep, darkish properly”

A service provider money advance, or MCA, is usually in comparison with a payday mortgage for a enterprise, as a result of this cash is fast, handy and expensive. Technically, it isn’t a mortgage however a purchase order of an organization’s future gross sales. The lender offers cash up entrance after which takes a weekly or every day minimize of receipts instantly from the borrower’s checking account till the debt is repaid after which some.

This financing typically fills a spot that banks do not, and it is chaotic. Predatory lenders and mortgage sharks supply service provider money advances. So do Amazon and PayPal, with milder phrases. Rohit Chopra, who investigated the trade as director of the Client Monetary Safety Bureau earlier than Trump fired him and many of the company’s employees, informed NPR he’d discovered ways that “would make a mobster blush.”

Esnard’s workplace partitions are lined with patents, together with one for a model of his instrument to information hair trims.

Cornell Watson for NPR

cover caption

toggle caption

Cornell Watson for NPR

As a result of these money advances aren’t labeled as loans, most lending legal guidelines do not apply. The lenders aren’t required to be licensed. The charges they will cost haven’t any authorized cap. And since this debt is often due inside months, an equal annual rate of interest will be astronomical. John Arensmeyer, who heads the advocacy group Small Enterprise Majority, says the comparable annual value averages 94%, and he has seen phrases as excessive as 350%.

No researcher appears to have a agency grasp on how huge the trade is. Service provider money advances totaled slightly below $9 billion in 2014, federal investigators estimated. 5 years later, they’d ballooned to nearly $20 billion. And that is earlier than the COVID-19 pandemic and tariffs roiled firms’ money flows, creating much more demand for fast credit score. A enterprise that takes out one MCA tends to not cease at one, borrowing extra to repay the unique lender.

“This can be a deep, darkish properly,” says debt reduction lawyer Ken Dramer. “So far as you need to dive into it, it simply retains getting uglier.”

When tariffs value greater than the product

Now a decade previous, The Minimize Buddy turns $6 million in income a 12 months. The corporate sells two dozen grooming objects, together with clippers, brushes and shaving cream. Many are discovered at Walmart, Goal, Amazon and CVS. The “hero product” — the highest moneymaker and, Esnard says, “what’s holding us employed proper now” — is the Bald Buddy, an ergonomic shaver that retails for $38 to $60. It is made in China, as is sort of every thing from this model.

Final 12 months was set to be The Minimize Buddy’s greatest one but.

Esnard was increasing his contracts with big-box shops. And he’d lined up funding to step up manufacturing unit orders. In 2024, when he could not afford to fabricate quick sufficient, Walmart had docked his product from 1,500 shops. In 2025, The Minimize Buddy was again.

Esnard levels merchandise at his workplace to re-create how they may seem on retailer cabinets, together with his high merchandise, the ergonomic bald shaver.

Cornell Watson for NPR

cover caption

toggle caption

Cornell Watson for NPR

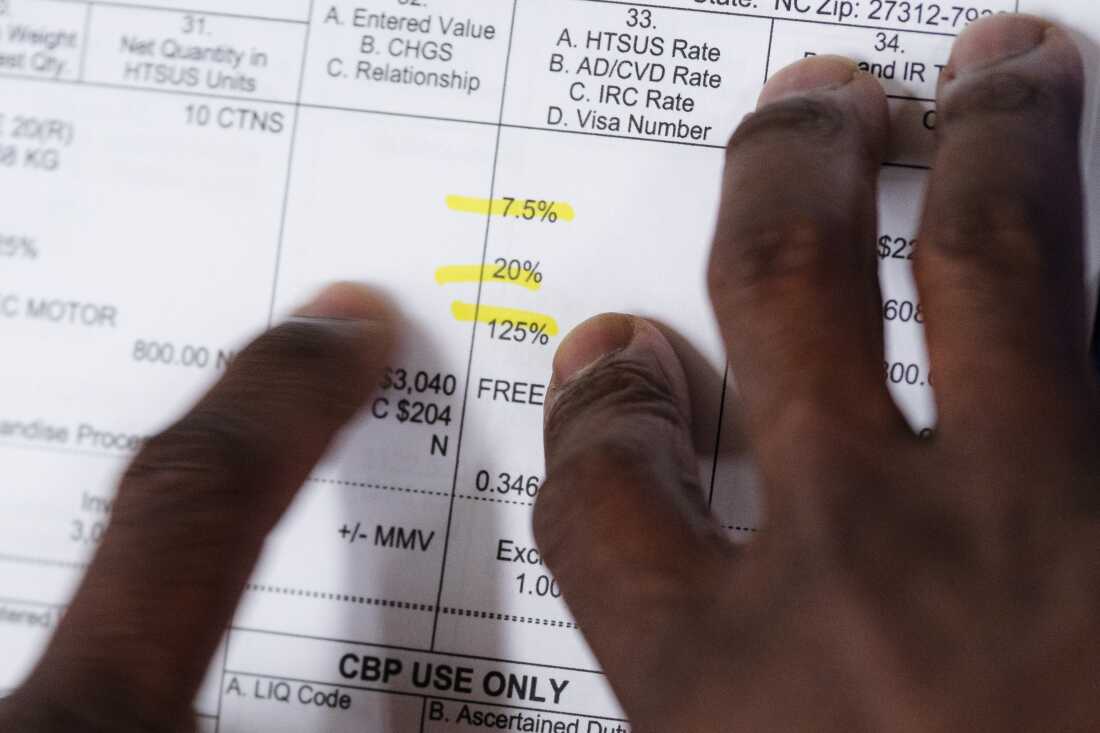

After which got here the tariffs. Trump went after Chinese language imports with distinctive focus, ratcheting levies a number of instances. The import tax briefly peaked at 145% and nonetheless averages 45%. Esnard disassembled the Bald Buddy to depend the components that he might, hypothetically, supply within the U.S. as a substitute of China. He discovered two out of 45 — and the machine’s worth would double.

The Minimize Buddy’s tariff payments grew to become erratic and exorbitant. At some point in Might, Esnard paid an obligation of $4,636 on a cargo of alternative shaver heads price $3,040.

He left some items lingering at customs; storage charges escalated shortly. He considered holding his merchandise overseas, however for the way lengthy? Shops demand stocked cabinets. And web shoppers, unable to get The Minimize Buddy’s alternative heads, may swap manufacturers altogether.

Esnard exhibits tariff fees that totaled 152.5%, costing extra in duties than the worth of the shipped items.

Cornell Watson for NPR

cover caption

toggle caption

Cornell Watson for NPR

“You are caught on this state of affairs while you’re determined, and customs has your product on the dock, and you have to ship it to Walmart, Goal or no matter,” Esnard says. “As a result of for those who do not ship it to those retailers, they drop your product.” Paying the tariff is the a technique ahead. “So the place do you get the cash from?” he says. “You get it from the mob, and that is the MCA.”

A quick repair the place banks keep away

Through the years, to maintain The Minimize Buddy going, Esnard has tapped his residence fairness and private financial savings. As the corporate grew, its greatest loans got here from a nonprofit that helps companies from underinvested communities — which Esnard paid again by early 2025 — and the gold customary of lending, the U.S. Small Enterprise Administration.

A financial institution was by no means actually an possibility.

“As we have seen the biggest banks within the nation gobble up native banks, many small companies can’t get the time of day from these monetary supermarkets,” says Chopra, the previous federal monetary watchdog. The U.S. nonetheless has much more banks than every other nation, however their quantity is now a 3rd of what it was in 1980.

About half of U.S. small companies sooner or later have to borrow cash, says Arensmeyer of Small Enterprise Majority, however almost two-thirds of them get turned down by conventional lenders. The percentages are even decrease for traditionally underbanked communities, together with immigrant entrepreneurs.

Against this, 9 out of 10 companies will get permitted for a service provider money advance, Arensmeyer says.

A number of the MCA lenders are licensed and publicly funded by Wall Road. Others are bankrolled by rich households or networks of personal buyers. They take huge dangers for giant rewards — they usually transfer quick. In contrast to banks, they do not spend weeks scrutinizing troves of monetary data. A fast verify of your receipts, and the funds get on their manner.

“If we attain an settlement I am going to have you ever funded inside hours. Ship me the final 4 months of statements.”

The trade additionally markets relentlessly. Virginia enterprise proprietor Sarah Wells, who manufactures purses and equipment, will get 5 calls and texts a day providing tons of of 1000’s of {dollars} inside a day. Richard Brown, who imports sneaker-care merchandise for his Ohio enterprise, Proof Tradition, has fielded over 100 emailed pitches in a matter of weeks.

“If I have been to outperform the chumps and electronic mail you one of the best funding supply, would you a minimum of entertain it?”

It is Josh, it is Harper, it is Camilla — “circling again from the funding approval unit.” A search of public data exhibits that a few of the messengers are actual individuals from actual corporations. Others are linked to unregistered entities or web sites with inventory pictures for “workforce members.” NPR left voice and textual content messages for lenders who’d pitched Esnard. None responded, aside from one who replied solely, “How did you get my data?”

Nevertheless shady the supply, quick entry to money is engaging in a disaster.

The Minimize Buddy’s tariff payments stacked to roughly $800,000 final 12 months — greater than 5 instances what Esnard would usually finances. He coated that tab with three service provider money advances.

Their sum ran $950,000. With the charges, Esnard’s complete debt topped $1.2 million.

“My dad informed me, once we moved to the US, ‘Do not ever owe anyone,'” Esnard says. He then leans ahead, throws his palms up and flashes a smile. “Properly, I tousled, Dad!”

Trying to find shelter in a “zombie assault”

The irony is that 2025 was, in truth, The Minimize Buddy’s greatest 12 months by income.

However all of the income have been devoured up, both by the tariffs or the debt funds wanted to cowl them.

Week after week, Esnard’s three MCA lenders every took a minimize from the corporate’s gross sales. One week, they withdrew $9,286, $7,381 and $13,500. To remain afloat, Esnard exhausted his private credit score restrict. He fired The Minimize Buddy’s consultants who’d helped run the web site and promoting. He paused donations of clippers and grooming instruments to veterans, which broke his workforce’s hearts. This January, Esnard skipped his personal paycheck.

Esnard receives a name pitching a service provider money advance. Such pitches flood his telephone every day.

Cornell Watson for NPR

cover caption

toggle caption

Cornell Watson for NPR

At one level, he appealed to the Small Enterprise Administration, or SBA, hoping to refinance his debt. However final 12 months, the company stopped accepting such functions, figuring out service provider money advances to be a crimson flag on a enterprise document.

“I have a look at it as like a zombie assault,” Esnard says. “These zombies are the MCAs, calling you and harassing you, attempting to offer you cash in 24 hours with a loopy price. And then you definately’re operating for assist to the SBA, which is the shelter, they usually simply shut the door on you, as a result of they assume you’ll have gotten bit by these zombies.”

Lately, states have waded in. A number of, together with Texas and Virginia, have required MCA lenders to register with the state and provides debtors clearer disclosures of phrases. California gave its monetary watchdog company the ability to punish abuses. New York has prosecuted abusive lenders, and lawmakers there are weighing a legislation to reclassify some money advances as loans.

Some trade gamers have pushed to weed out the unhealthy apples, too. For instance, the Small Enterprise Finance Affiliation, whose Wall Road-funded members supply service provider money advances together with different kinds of financing, needs regulators to require that lenders be licensed.

“There’s unhealthy actors in our house for positive. There’s unhealthy doughnut makers. There’s unhealthy bankers. There’s unhealthy gamers in each trade,” says the group’s CEO, Steve Denis. He acknowledges that some corporations push predatory funding with forceful advertising and marketing. “We’re actually counting on the regulators and policymakers to assist us actually clear up our trade,” he says.

In 2023, the federal Client Monetary Safety Bureau beneath Chopra tried to require MCA lenders to gather and report information about small-business debtors. However in November, after Trump’s shake-up, the company revised these lending guidelines to exclude service provider money advances. Regulators, who did not reply to NPR, wrote that MCAs are “structured in another way,” do not use “conventional lending ideas like ‘rate of interest'” and haven’t been totally regulated by states but.

A manner out

Within the lowest moments, Esnard thinks again to a message that altered his view of his job.

“My enterprise blew up when a disabled veteran despatched an electronic mail saying, ‘I take medicine and my palms shake, and due to your product, I might regular my hand and I might minimize my hair completely,'” Esnard says. “That was the primary time I spotted, wow, this wasn’t about getting cash. This was really serving to individuals.”

He outfitted his hair clippers with a curvy, joystick-style swiveling deal with that is simpler for somebody with restricted dexterity or imaginative and prescient. He made the machine so quiet that it has appealed to folks of youngsters delicate to sound.

At this desk, Esnard creates and tweaks new merchandise for The Minimize Buddy. However current monetary stress has left him little time for that.

Cornell Watson for NPR

cover caption

toggle caption

Cornell Watson for NPR

At present, Esnard’s workplace close to the Raleigh-Durham airport is stuffed with 3D-printed prototypes and patents, his personal and his mentees’. His 8-year-old son — who now has a 4-year-old sister — lately received his strategy to a state science honest. The Dremel carving instrument they’d used for the mission now sits on Esnard’s testing desk subsequent to disassembled clippers for a brand new invention in progress.

“That is my favourite space,” Esnard says, turning two metal clipper blades in his palms. However he isn’t right here sufficient, “as a result of I am extra spending time taking a look at profit-and-loss statements and determining if I can afford the loans.”

He reached out to the rescue squad that has backed him earlier than: his previous lender, the Enterprise Consortium Fund, a nonprofit that invests in underfunded companies. Esnard informed a committee of entrepreneurs and company executives that he had nowhere left to go. His enterprise was rising. He’d paid off their previous loans on time. Would possibly they think about topping out their standard lending limits?

The group agreed to refinance Esnard’s service provider money advances, turning his debt into a standard five-year mortgage with a manageable rate of interest. The fund’s CEO says Esnard had proved himself an entrepreneur with grit and gumption. And Esnard says he seems like he has received the lottery.

However on the day the deal closed final week, Esnard sounded much less jubilant and extra exhausted. He is relieved to be freed from the MCAs, he says. However the debt stays, and the hustle to outlive continues.

NPR’s Greta Pittenger contributed to this report. Graphics by Alyson Damage.