Up to date on December sixteenth, 2024 by Bob Ciura

The objective of most traders is to both:

- Maximize returns given a set degree of threat

- Reduce threat given a very degree of desired returns

Maybe the very best metric for analyzing each threat and return is the Sharpe Ratio. With that in thoughts, we’ve compiled a listing of the 100 shares within the S&P 500 Index with the best Sharpe Ratios.

You’ll be able to obtain your free checklist (together with related monetary metrics like dividend yields and price-to-earnings ratios) by clicking on the hyperlink beneath:

Hold studying this text to be taught extra about utilizing the Sharpe Ratio to investigate publicly-traded shares.

Desk Of Contents

The desk of contents beneath offers for simple navigation of the article:

What Is The Sharpe Ratio?

The Sharpe ratio is the monetary business’s favourite measure of risk-adjusted returns. It tells traders whether or not they’re being appropriately rewarded for the dangers they’re assuming of their investments.

There are three elements to the Sharpe Ratio calculation:

- Funding return

- Danger free price of return

- Funding normal deviation

For many traders, an acceptable Danger-free price of return is the present yield on 10-year U.S. authorities bonds. For this text, we’ve got used a threat free price of 0, as rates of interest have declined considerably.

For our functions right here, the Funding return could be both a historic return or an anticipated annual return. It’s expressed utilizing a decimal; for instance, 0.51 would signify a 51% return.

Word: We use 252 as a substitute of 365 – the variety of days in a yr – for a one-year interval as a result of there are roughly 252 buying and selling days in a mean calendar yr, or we could make use of 757 or a slight variant of that for a selected three-year interval.

We make use of the calculated Funding normal deviation, normally primarily based on every day variations, to take note of periodic fluctuations within the funding attributable to things like dividends and inventory splits.

Willpower of the Sharpe ratio can require a lot of repetitive calculations. This may be carried out simply and conveniently through a Microsoft Excel spreadsheet, as will probably be demonstrated later.

The Sharpe ratio is calculated with the next method:

The danger free price of return could be totally different relying in your use case. For risk-free price of return = 0, the equation for the Sharpe ratio reduces to:

As you may think, quite a few advanced variants of this simplified method have been developed and used for quite a lot of funding functions.

Right here, we’re primarily thinking about a most return with minimal related threat. This may be indicated by values which can be bigger or smaller, or by figures which can be both constructive or detrimental.

Such numbers should be seen with the good thing about appreciable investor judgment; they aren’t meant to be taken completely.

How To Use The Sharpe Ratio Shares Record To Discover Compelling Funding Concepts

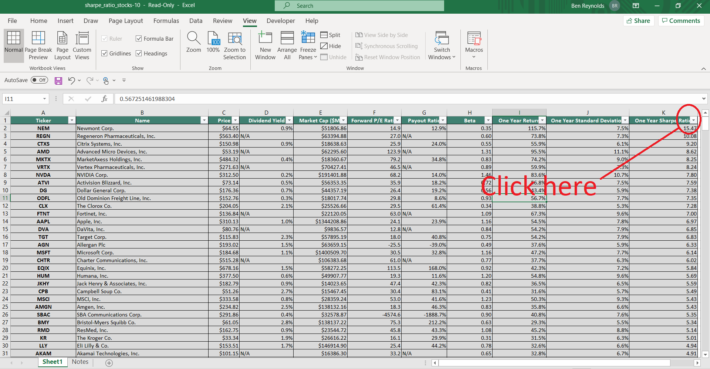

Having an Excel doc with the 100 highest Sharpe Ratios within the S&P 500 could be extraordinarily helpful.

The useful resource turns into much more highly effective when mixed with a rudimentary information of easy methods to use the filter operate of Microsoft Excel to seek out funding concepts.

With that in thoughts, this part will present you step-by-step easy methods to implement a specific investing display utilizing the Sharpe Ratio shares checklist.

Extra particularly, we’ll present you easy methods to display for shares with Sharpe Ratios above 1 and price-to-earnings ratios beneath 15.

Step 1: Obtain the Sharpe Ratio Shares Record by clicking right here.

Step 2: Click on the filter icon on the prime of the Sharpe Ratio column, as proven beneath.

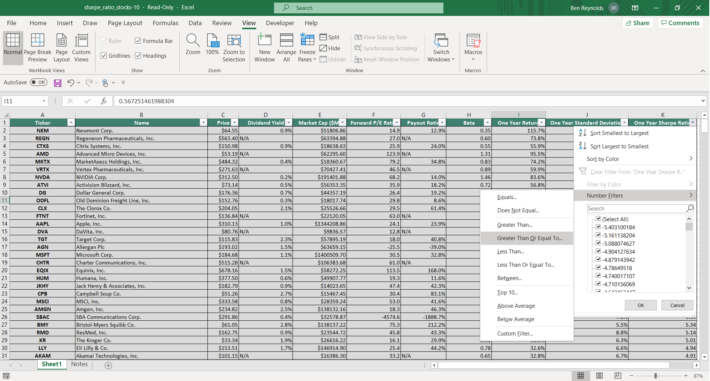

Step 3: Change the filter setting to “Larger Than Or Equal To”, enter “1”, and click on “OK”. This filters for S&P 500 shares with Sharpe Ratios better than or equal to 1.

Step 4: Then, click on the filter icon on the prime of the P/E Ratio column, as proven beneath.

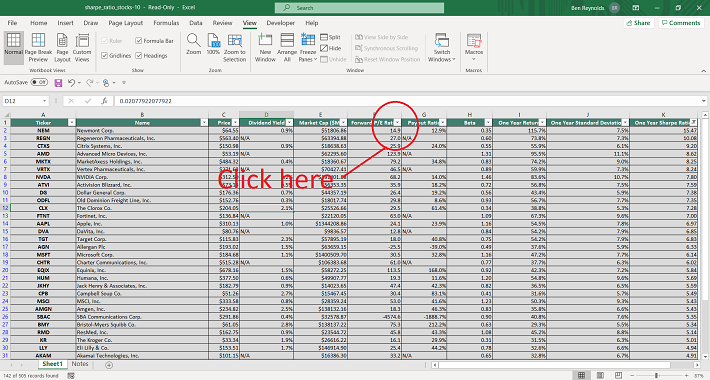

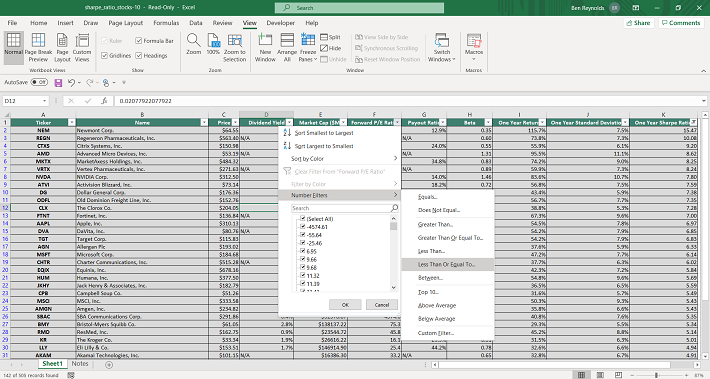

Step 5: Change the filter setting to “Much less Than Or Equal To”, enter “15”, and click on “OK”. This filters for S&P 500 shares with P/E ratios lower than or equal to fifteen.

The remaining shares on this Excel doc are S&P 500 shares with Sharpe Ratios greater than 1 and price-to-earnings ratios lower than 15.

You now have a stable basic understanding of easy methods to use the Sharpe Ratios checklist to seek out funding concepts.

The rest of this text will present extra info on easy methods to analyze shares utilizing the Sharpe Ratio.

How To Manually Calculate Sharpe Ratios Utilizing Yahoo! Finance

At Certain Dividend, we use YCharts for a lot of our knowledge analytics. YCharts requires a paid subscription that lots of our readers do not need.

Accordingly, we need to present you easy methods to manually calculate Sharpe Ratio for publicly-traded shares over a given time interval.

Extra particularly, this tutorial will present you easy methods to calculate a 3-year Sharpe ratio for Apple, Inc (AAPL).

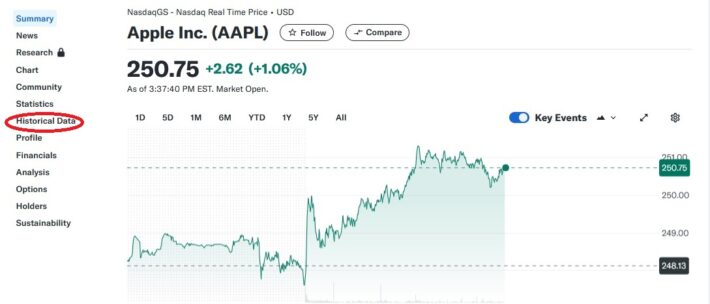

Step 1: Navigate to Yahoo! Finance. Kind the ticker of your required inventory into the search bar on the prime of the Yahoo! Finance bar. In our case, it’s AAPL for Apple Inc. (AAPL).

Step 2: Click on on historic knowledge, as proven beneath.

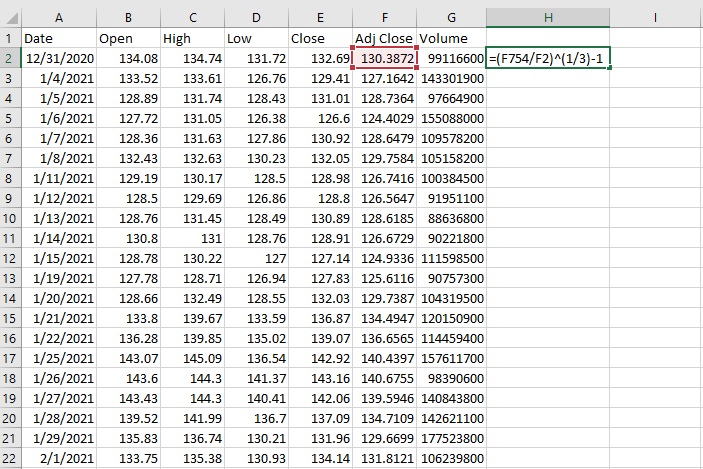

Step 3: Change the dates to get 3 years of information, after which click on “Apply.” After that, click on “Obtain” (which is just under the Apply button).

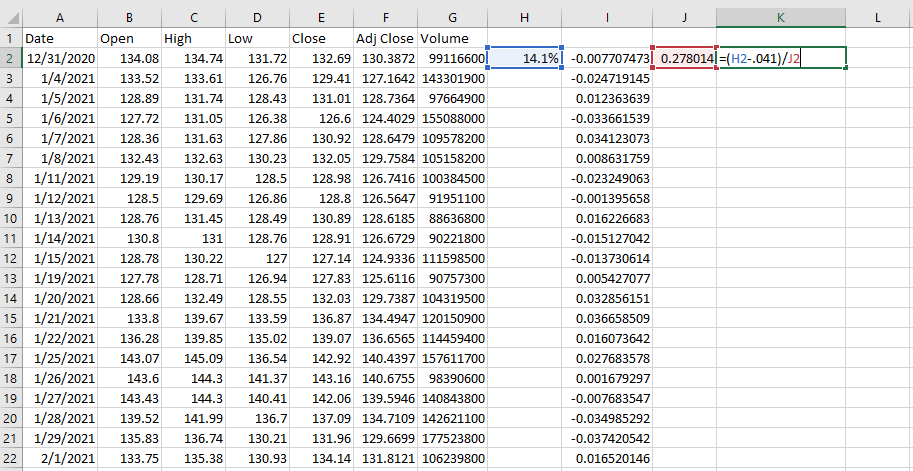

Step 4: The Excel doc that may obtain because of your course of thus far could have six columns: Open, Excessive, Low, Shut, Adjusted Shut (or “Adj Shut” within the prime row of the spreadsheet), and Quantity. It’s Adjusted Shut that we’re thinking about, as this accounts for inventory splits and dividend funds.

Utilizing the adjusted shut column, calculate the inventory’s annualized returns in the course of the time interval below investigation.

Within the instance proven beneath, that is carried out by dividing the present value by the oldest value after which elevating this to the inverse energy of the variety of years in the course of the pattern (3 on this case). The equation is proven beneath.

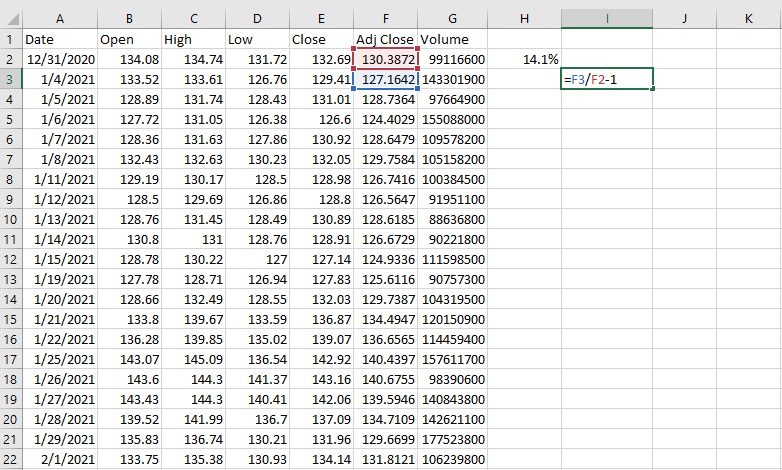

Step 5: Subsequent, a time collection of every day returns must be calculated. That is carried out in column I within the spreadsheet proven beneath. Do that by dividing “new day” adj. shut value by “previous day” adj. shut value, as proven within the instance beneath. Then drag or copy/paste the method right down to all cells.

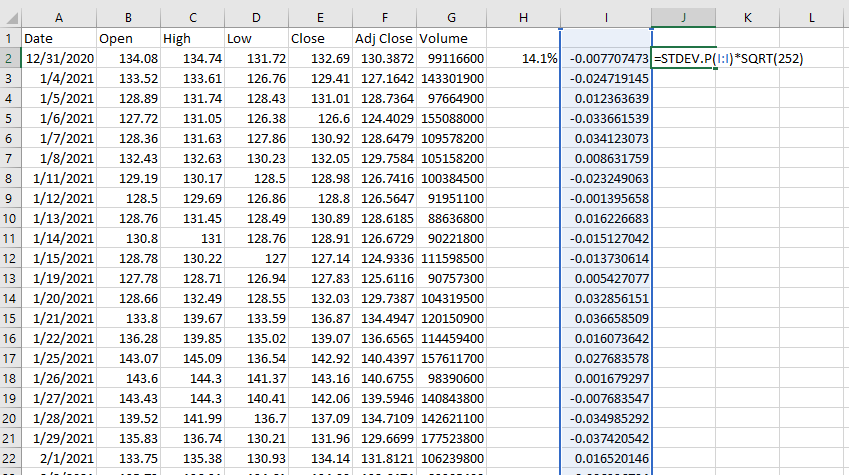

Step 6: Calculate the usual deviation of every day value returns utilizing the STDEV.P() operate, after which convert this quantity to an annualized determine by multiplying by the sq. root of 252. We use 252 as a substitute of 365 (the variety of days in a yr) as a result of there are roughly 252 buying and selling days in a mean calendar yr. The method to calculate the annualized normal deviation determine is proven beneath.

Step 7: Use the annualized return and annualized normal deviation knowledge to calculate a Sharpe ratio. An instance of how to do that is proven beneath, utilizing 4.1% as the chance free price of return (equal to the present 10-year U.S. Treasury yield).

The ensuing quantity is the Sharpe ratio of the funding in query. On this case, Apple had a 3-year Sharpe ratio of 0.35 from when the instance photos had been created.

The High 10 Sharpe Ratio Shares At present

The subsequent part will checklist the highest 10 Sharpe Ratio shares now, in keeping with 5-year annual anticipated returns.

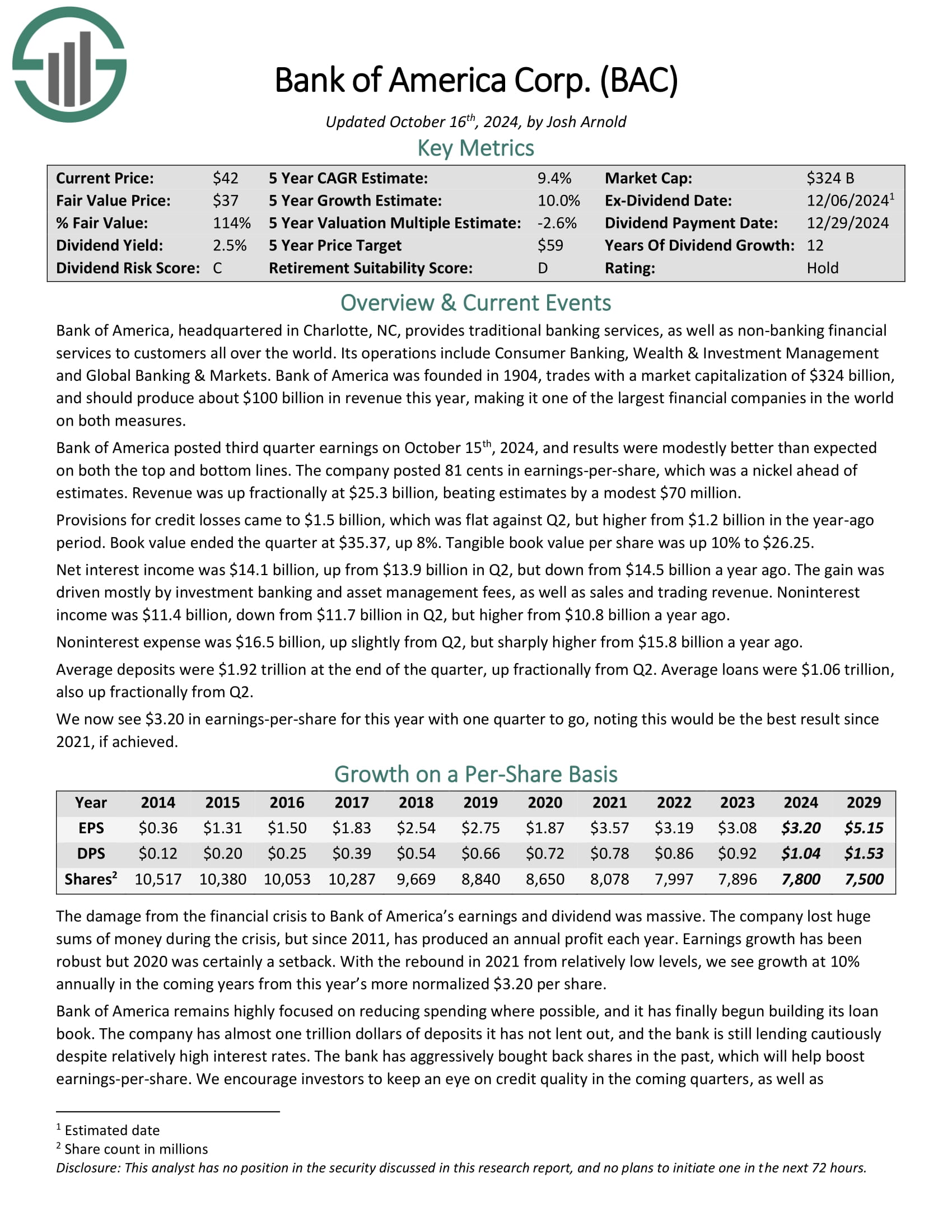

Sharpe Ratio Inventory #10: Financial institution of America Corp. (BAC)

Financial institution of America, headquartered in Charlotte, NC, offers conventional banking providers, in addition to non–banking monetary providers to clients throughout the world. Its operations embody Client Banking, Wealth & Funding Administration and World Banking & Markets.

Financial institution of America posted third quarter earnings on October fifteenth, 2024, and outcomes had been modestly higher than anticipated on each the highest and backside traces. The corporate posted 81 cents in earnings-per-share, which was a nickel forward of estimates. Income was up fractionally at $25.3 billion, beating estimates by a modest $70 million.

Provisions for credit score losses got here to $1.5 billion, which was flat towards Q2, however greater from $1.2 billion within the year-ago interval. E book worth ended the quarter at $35.37, up 8%. Tangible ebook worth per share was up 10% to $26.25.

Click on right here to obtain our most up-to-date Certain Evaluation report on Financial institution of America (preview of web page 1 of three proven beneath):

Sharpe Ratio Inventory #9: Allstate Corp. (ALL)

Allstate Company is an insurance coverage firm that provides property and casualty insurance coverage. The corporate additionally sells life, accident, and medical health insurance merchandise.

Its segments embody Allstate Safety, Service Companies, Allstate Life, Allstate Advantages, Allstate Annuities, and so forth. Allstate’s insurance coverage manufacturers embody Allstate, Embody, and Esurance.

Allstate reported third quarter 2024 outcomes on October thirtieth, 2024. The corporate reported consolidated revenues of $16.6 billion for the quarter, a 14.7% year-over-year improve, largely attributable to greater Property-Legal responsibility earned premium.

Property-Legal responsibility insurance coverage premiums earned totaled $13.7 billion, up 11.6% from $12.3 billion in the identical interval a yr in the past.

Adjusted web earnings per share of $3.91 was a major enchancment from $0.81 a yr in the past. Disaster losses amounted to $1.7 billion within the quarter, 44% greater than the identical quarter final yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on ALL (preview of web page 1 of three proven beneath):

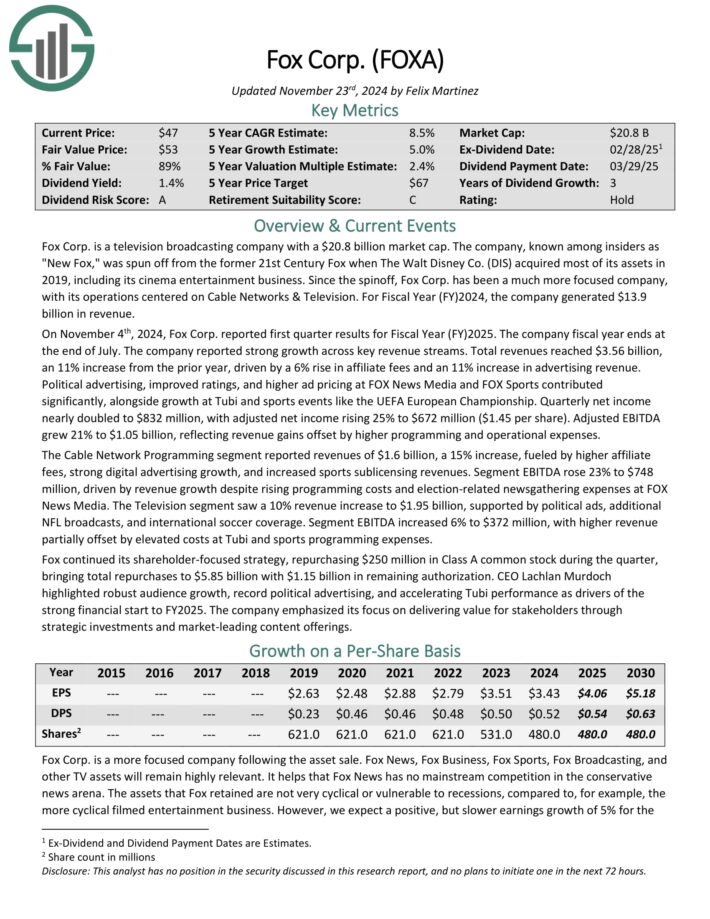

Sharpe Ratio Inventory #8: Fox Corp. (FOXA)

Fox Corp. is a tv broadcasting firm. The corporate was spun off from the previous twenty first Century Fox when The Walt Disney Co. (DIS) acquired most of its property in 2019, together with its cinema leisure enterprise.

On November 4th, 2024, Fox Corp. reported first quarter outcomes for Fiscal Yr (FY) 2025. Complete revenues reached $3.56 billion, an 11% improve from the prior yr, pushed by a 6% rise in affiliate charges and an 11% improve in promoting income.

Political promoting, improved rankings, and better advert pricing at FOX Information Media and FOX Sports activities contributed considerably, alongside progress at Tubi and sports activities occasions just like the UEFA European Championship. Quarterly web earnings almost doubled to $832 million, with adjusted web earnings rising 25% to $672 million ($1.45 per share).

Adjusted EBITDA grew 21% to $1.05 billion, reflecting income good points offset by greater programming and operational bills. The Cable Community Programming section reported revenues of $1.6 billion, a 15% improve, fueled by greater affiliate charges, sturdy digital promoting progress, and elevated sports activities sublicensing revenues.

Click on right here to obtain our most up-to-date Certain Evaluation report on FOXA (preview of web page 1 of three proven beneath):

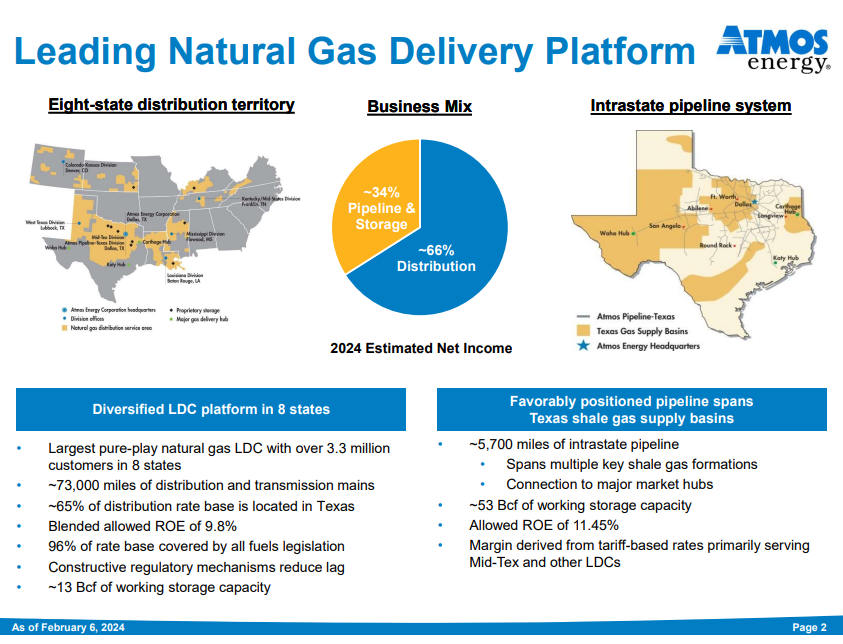

Sharpe Ratio Inventory #7: Atmos Vitality (ATO)

Atmos Vitality can hint its beginnings all the best way again to 1906 when it was fashioned in Texas. Since that point, it has grown each organically and thru mergers.

The corporate distributes and shops pure gasoline in eight states, serves over 3 million clients, and may generate about $5 billion in income this yr.

Supply: Investor Presentation

Atmos has a 41-year historical past of elevating dividends, placing it in uncommon firm amongst dividend shares.

Atmos posted fourth quarter and full-year earnings on November sixth, 2024, and outcomes had been largely consistent with expectations. The corporate noticed simply over a billion {dollars} in web earnings for the yr, and $134 million for the fourth quarter. On a per-share foundation, earnings got here to $6.83 and 86 cents, respectively.

For the quarter, distribution earnings got here to $41 million, which was up from $38 million a yr in the past. Pipeline and storage earnings had been $93 million, up from $81 million in final yr’s This autumn.

For the yr, distribution earnings rose from $580 million to $671 million. Pipeline and storage full-year earnings had been up sharply from $306 million to $372 million, serving to to drive one other yr of report earnings for Atmos.

Click on right here to obtain our most up-to-date Certain Evaluation report on ATO (preview of web page 1 of three proven beneath):

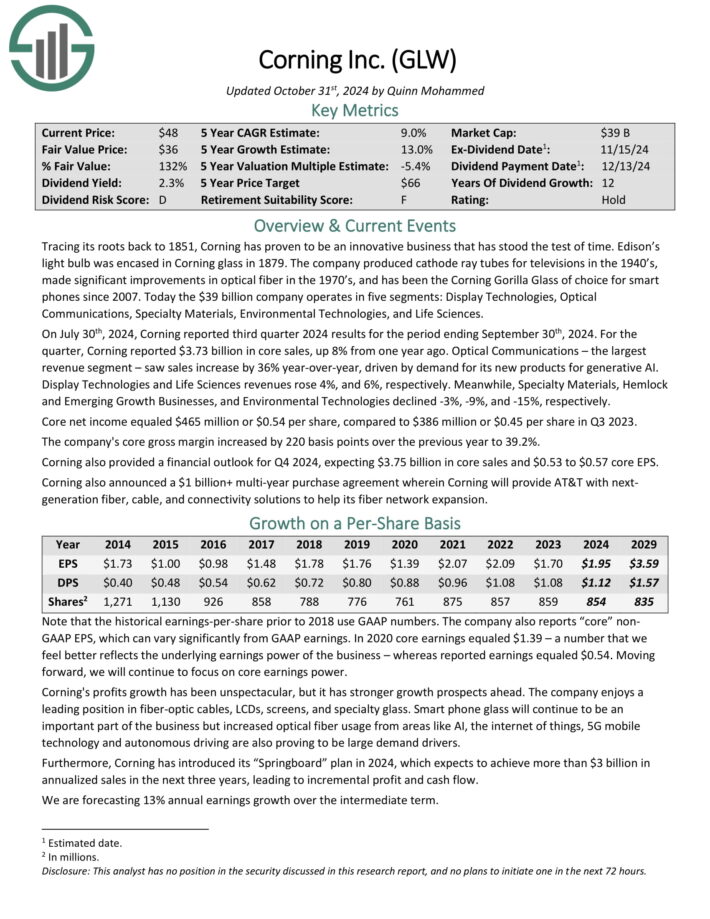

Sharpe Ratio Inventory #6: Corning Inc. (GLW)

Corning operates in 5 segments: Show Applied sciences, Optical Communications, Specialty Supplies, Environmental Applied sciences, and Life Sciences.

On October thirtieth, 2024, Corning reported third quarter 2024 outcomes for the interval ending September thirtieth, 2024. For the quarter, Corning reported $3.73 billion in core gross sales, up 8% from one yr in the past.

Optical Communications – the most important income section – noticed gross sales improve by 36% year-over-year, pushed by demand for its new merchandise for generative AI. Show Applied sciences and Life Sciences revenues rose 4%, and 6%, respectively.

In the meantime, Specialty Supplies, Hemlock and Rising Progress Companies, and Environmental Applied sciences declined -3%, -9%, and -15%, respectively.

Corning enjoys aggressive benefits in its companies attributable to its patented manufacturing course of, value benefits, elevated R&D spending, and main relationships with the very best expertise companies on the planet.

Click on right here to obtain our most up-to-date Certain Evaluation report on GLW (preview of web page 1 of three proven beneath):

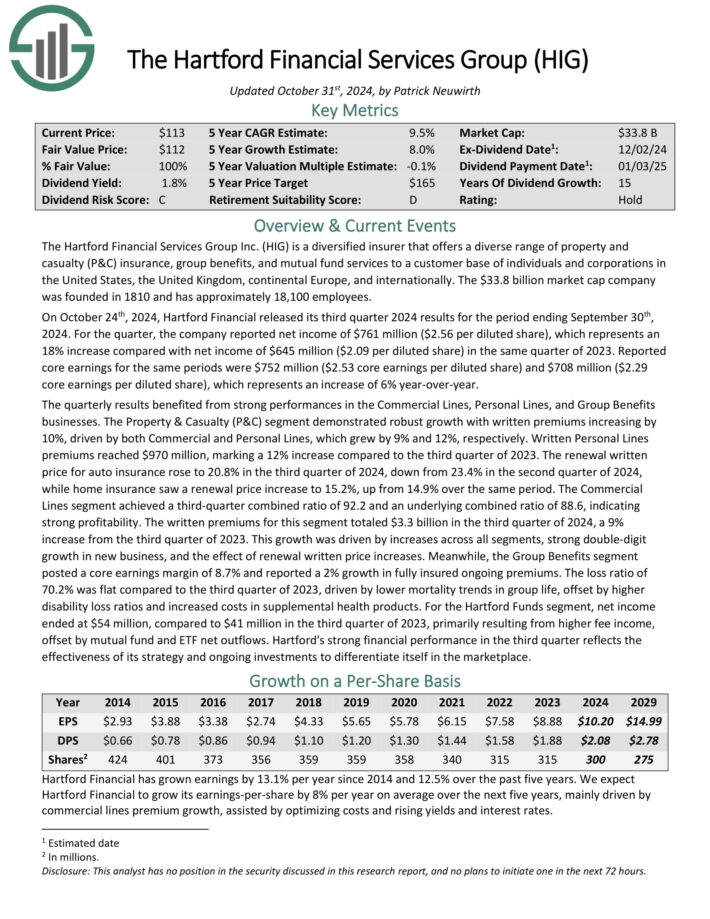

Sharpe Ratio Inventory #5: The Hartford Monetary Providers Group (HIG)

The Hartford Monetary Providers Group is a diversified insurer that provides a various vary of property and casualty (P&C) insurance coverage, group advantages, and mutual fund providers to a buyer base of people and firms in america, the UK, continental Europe, and internationally.

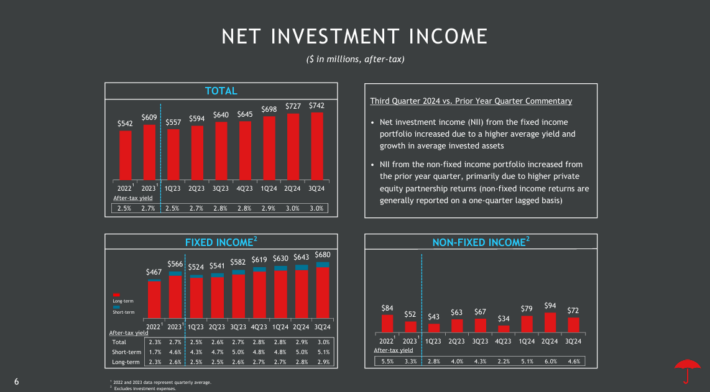

On October twenty fourth, 2024, Hartford Monetary launched its third quarter 2024 outcomes. For the quarter, the corporate reported web earnings of $761 million ($2.56 per diluted share), which represents an 18% improve in contrast with web earnings of $645 million ($2.09 per diluted share) in the identical quarter of 2023.

Reported core earnings for a similar intervals had been $752 million ($2.53 core earnings per diluted share) and $708 million ($2.29 core earnings per diluted share), which represents a rise of 6% year-over-year.

The quarterly outcomes benefited from sturdy performances within the Business Strains, Private Strains, and Group Advantages companies. The Property & Casualty (P&C) section demonstrated sturdy progress with written premiums growing by 10%, pushed by each Business and Private Strains, which grew by 9% and 12%, respectively.

Click on right here to obtain our most up-to-date Certain Evaluation report on HIG (preview of web page 1 of three proven beneath):

Sharpe Ratio Inventory #4: Computerized Information Processing Inc. (ADP)

Computerized Information Processing is likely one of the largest enterprise providers outsourcing firms on the earth. The corporate offers payroll providers, human sources expertise, and different enterprise operations to greater than 700,000 company clients.

ADP posted first quarter earnings on October thirtieth, 2024, and outcomes had been higher than anticipated on each the highest and backside traces. Adjusted earnings-per-share got here to $2.33, which was 12 cents forward of estimates.

Earnings had been up from $2.08 within the year-ago interval. Income was up 6.7% year-over-year to $4.8 billion, beating expectations by $30 million.

Administration famous income and margin efficiency exceeded expectations as the corporate benefited from new enterprise bookings, sturdy income retention and better shopper funds curiosity income.

Employer Providers income was $3.26 billion, up 7% year-over-year whereas section earnings grew 15% to $1.16 billion. That was ok from pretax margin to rise from 33.1% of income to 35.7%.

PEO Providers income was $1.57 billion, up 7% year-over-year, whereas section earnings rose 1% to $226 million. Pretax margin was decrease from 15.2% of income to 14.3%.

Click on right here to obtain our most up-to-date Certain Evaluation report on ADP (preview of web page 1 of three proven beneath):

Sharpe Ratio Inventory #3: Financial institution of New York Mellon Corp. (BK)

Financial institution of New York Mellon has grown to greater than $17 billion in annual income and a market capitalization of $54 billion. The financial institution is current in 35 international locations all over the world and acts as extra of an funding supervisor than a conventional financial institution.

BNY posted third quarter earnings on October eleventh, 2024, and outcomes had been higher than anticipated on each the highest and backside traces. Adjusted earnings-per-share got here to $1.52, which was 10 cents forward of expectations. Income was up 5.2% year-over-year to $4.65 billion, which was $90 million forward of estimates.

Provisions for credit score losses got here to only $23 million. Web curiosity earnings of $1.05 billion was ~$40 million greater than anticipated, and up from $1.03 billion in Q2. Charge income, which is the majority of the financial institution’s whole income, was $3.40 billion, flat to Q2.

Click on right here to obtain our most up-to-date Certain Evaluation report on BK (preview of web page 1 of three proven beneath):

Sharpe Ratio Inventory #2: Citigroup Inc. (C)

Citigroup was based in 1812, when it was referred to as the Metropolis Financial institution of New York. Previously 200+ years, the financial institution has grown into a world juggernaut in bank cards, industrial banking, buying and selling, and quite a lot of different monetary actions.

It has hundreds of branches, produces about $80 billion in annual income.

Citigroup posted third quarter earnings on October fifteenth, 2024, and outcomes had been higher than anticipated on each the highest and backside traces. Earnings-per-share got here to $1.51, which was twenty cents forward of estimates. Income was up fractionally year-over-year to $20.32 billion, however beat estimates by $500 million.

Income was up 3% on an natural foundation, with the distinction being the sale of the Taiwan shopper banking enterprise. The achieve in income was pushed by progress throughout all of its segments.

Click on right here to obtain our most up-to-date Certain Evaluation report on Citigroup (preview of web page 1 of three proven beneath):

Sharpe Ratio Inventory #1: The Vacationers Corporations Inc. (TRV)

Vacationers is an insurance coverage inventory and generates about $42 billion in annual income. The corporate gives all kinds of safety merchandise for auto, dwelling, and enterprise clients.

Vacationers posted third quarter earnings on October seventeenth, 2024, and outcomes had been higher than anticipated. Adjusted earnings-per-share got here to $5.24, which was a staggering $1.65 forward of estimates.

Supply: Investor Presentation

Earnings soared from $2.51 in Q2, and simply $1.95 from a yr in the past.

Income, as measured by earned premiums, rose 10.1% year-over-year to $10.7 billion, and beat expectations by $130 million. Complete income was $11.9 billion, up from $10.6 billion a yr in the past, and $11.3 billion in Q2.

Click on right here to obtain our most up-to-date Certain Evaluation report on Vacationers (preview of web page 1 of three proven beneath):

Remaining Ideas

In search of shares with sturdy historic Sharpe ratios is a helpful strategy to discover funding concepts.

With that stated, this technique isn’t the solely strategy to discover high-quality investments. To conclude this text, we’ll present extra sources that you should use on your funding due diligence.

In case you are searching for high-quality dividend progress shares appropriate for long-term funding, the next databases will probably be helpful:

You might also be searching for interesting shares from a sure inventory market sector to make sure applicable diversification inside your portfolio. If that’s the case, you will see that the next sources helpful:

You might also want to take into account different investments throughout the main market indices. Our downloadable checklist of small-cap U.S. shares could be accessed beneath:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].