JSTORIES ー In 2022, the Japanese authorities carried out the Startup Growth 5-year Plan to extend funding in startups to 10 trillion yen by 2027. In accordance with a report by the Ministry of Economic system, Commerce, and Trade, one of many key elements needed for reaching this objective is the promotion of mergers and acquisitions (M&A) and world enlargement.

Giant companies like GAFAM have been actively buying startups to realize discontinuous progress. M&As are additionally seen as a strategic possibility for secure progress for startups. Actually, within the U.S., 90% of startups select M&As as their exit technique as a substitute of an preliminary public providing (IPO). Nevertheless, in Japan, there are nonetheless comparatively few M&As involving startups. Most startups nonetheless goal for IPOs, and M&As are usually not actively utilized as a progress funding technique.

Why are M&As nonetheless underutilized in Japan regardless of their significance for growing the startup ecosystem alongside worldwide enlargement? How can we unlock the potential for enterprise progress by way of M&As and improve exit choices for startups?

To discover these questions, Toshi Maeda, government editor of JStories, interviewed an M&A specialist in Japan.

Hidetaka Kojima graduated from the College of International Research at Tokyo College of International Research in 2003, accomplished an MBA on the Graduate Faculty of Commerce and Administration at Hitotsubashi College in 2009, and accomplished the Program for Management Growth (PLD) at Harvard Enterprise Faculty in 2019.

After working at Daiwa Securities and GCA (now Houlihan Lokey), he joined Mitsubishi Corp. in 2011 to launch the Life Sciences Division and was concerned in M&A/PMI. In 2020, he joined SHIFT and established the M&A/PMI system, main the corporate’s outstanding M&A outcomes. In 2022, he based SHIFT Development Capital and took on the function of Director/CEO of SHIFT USA in 2025 to supervise worldwide methods. Kojima can be concerned as an adviser and angel investor for Japanese startups and goals to construct Japan’s startup ecosystem.

SHIFT – The M&A Powerhouse

SHIFT is an organization that helps clients in creating “sellable providers,” with its base in software program high quality assurance. As of February 2025, the corporate has about 14,000 staff and 37 group firms. SHIFT aimed for 100 billion yen in gross sales by 2025 by way of its midterm progress technique, “SHIFT1000,” and hit this goal by the tip of fiscal 12 months 2024. SHIFT is now specializing in reaching 300 billion yen in gross sales by way of its subsequent technique, “SHIFT3000,” and is implementing numerous initiatives.

Abroad technique – the important thing to startup progress

JStories Government Editor Toshi Maeda (JTales beneath): I’m happy to welcome my visitor in the present day, Hidetaka Kojima, who has accountability for M&A/PMI (post-merger integration) at SHIFT Group. SHIFT makes a speciality of software program high quality assurance and testing, and its gross sales have been rising strongly for the final decade. Within the second half of this interview, I’d prefer to ask about SHIFT’s abroad technique, the startup ecosystem in Japan, and easy methods to improve the variety of unicorns.

However first, let me ask about your profession and what first made you interested by what’s taking place abroad. Additionally, what particular work abroad have you ever been concerned in?

Hidetaka Kojima (Kojima beneath): Once I was a college pupil, I studied in Washington state in america. From round that point, I believed that I’d prefer to work overseas sometime. So, after I graduated, I stored asking to take part in abroad tasks. My want to actually work abroad got here true once I labored for Mitsubishi Corp. within the U.S., which I discussed earlier than. After I efficiently closed the acquisition of a U.S. firm, I used to be assigned on to the corporate.

What I realized abroad… ‘It’s very important to fastidiously hearken to voices on the bottom.’

JStories: What particular issues did you study when working overseas?

Kojima: I used to be working as an assistant to the CEO. Particularly, I had a variety of duties, together with organizing and facilitating administration and board conferences, planning and executing M&A technique for North America, PMI of acquired firms, and reporting administration points and our monetary scenario to the top workplace in Japan. The factor I realized from that was easy, i.e., that it’s very important to fastidiously hearken to voices on the bottom. That is true for exterior advisers, too, however though the HQ in Japan can learn paperwork to grasp floor points and conditions considerably, they typically don’t perceive how staff on the bottom really feel as they do their work everyday. Naturally, typically it’s tough to ask about folks’s true emotions in a work-only relationship, so we had been all the time working to construct relationships of belief by way of firm occasions equivalent to crew constructing.

JStories: I see. After that, you studied at Harvard Enterprise Faculty, didn’t you?

Kojima: Sure, that’s proper. The issues I realized at Harvard Enterprise Faculty significantly influenced my curiosity in abroad. Every day discussions with about 170 classmates from 37 international locations made me extra conscious of myself as a Japanese particular person. On the similar time, my want to compete on the worldwide stage turned even stronger.

JStories: Am I proper that the stuff you realized at Harvard Enterprise Faculty have helped you a large number in your M&A piece?

Kojima: Sure, that’s proper. At Harvard Enterprise Faculty, folks come collectively from all around the world. There are alumni in all places. My classmates know that I’m concerned in M&A, so that they typically come to me and say, “How about this mission?” Since details about tasks is usually closed to others, with the ability to enter that neighborhood and get data is vital.

Additionally, even now my classmates and I share updates and new enterprise concepts. I get a number of power from how everyone seems to be lively of their respective fields. Often, classmates come to Japan for leisure journeys, and I’m going with them to varied locations.

A enterprise tie-up with a U.S. firm and the institution of an area subsidiary as the primary steps in abroad enlargement

JStories: I see. On that matter, SHIFT not too long ago introduced enterprise tie-ups with two U.S. firms and the institution of SHIFT USA. It appears to be like like the corporate has lastly began to make concrete strikes towards abroad enlargement.

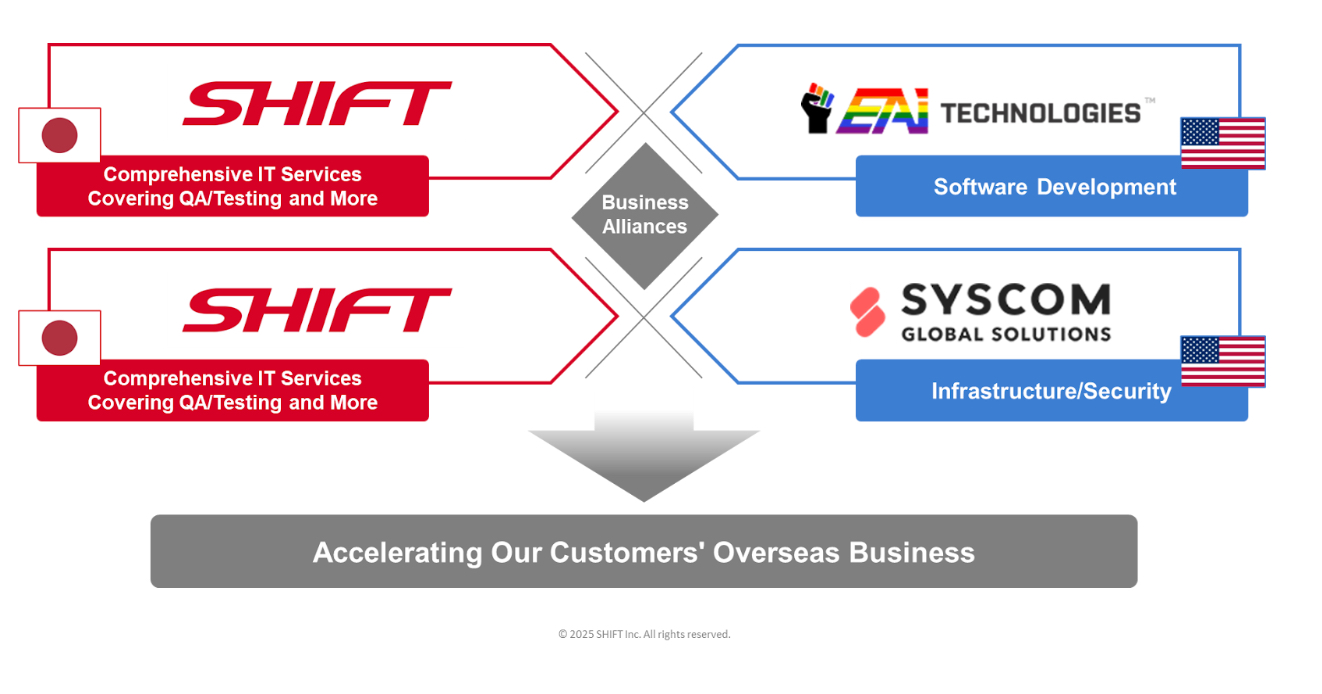

Kojima: These days, increasingly of SHIFT’s current shoppers are asking if we may help with their abroad enlargement. We wished to correctly reply to these wants, so we entered right into a enterprise tie-up with two U.S. firms final December and arrange SHIFT USA in February. The primary was EAI Applied sciences, LLC (Virginia, U.S.), an organization with robust software program growth experience and a big buyer base within the distribution/logistics, telecommunications, and safety markets. The second was Syscom World Options, Inc. (New York state, U.S.). This firm has strengths in infrastructure and safety, and has many consumers, from small to giant, primarily within the monetary, telecommunications, buying and selling, and system integration sectors. By means of enterprise alliances with these two firms with completely different strengths, we have now sought to construct a relationship the place we cannot solely introduce tasks to one another and share assets, but in addition work collectively on rolling out our personal providers.

JStories: Are you specializing in the U.S. as a area for enterprise enlargement?

Kojima: To begin with, we’re engaged on concentrating on the most important market, which is america. We have now accomplished plenty of analysis and talked loads inside the firm about areas, however contemplating SHIFT’s present capability, we determined that it might be too tough to increase in all instructions from the beginning. As soon as our U.S. enterprise has seen some enlargement, we intend to increase into different areas, too.

JStories: I’m wanting ahead to that abroad enlargement. What measures are you contemplating as a part of SHIFT USA’s future technique?

Kojima: There are three pillars to the SHIFT USA technique.

The primary is “supporting our clients’ abroad enlargement”. As I discussed earlier, as our enterprise expands, we’ve not too long ago been receiving extra inquiries and consultations about abroad tasks. Then again, so far we lacked abroad places of work and networks, so couldn’t reply correctly to such inquiries. So, first we pushed ahead with tie-ups with abroad firms and established abroad subsidiaries.

The second pillar is “promotion of abroad M&A.” In Japan, our setup permits us to contemplate round 300 M&A per 12 months, however there may be nonetheless virtually nothing abroad. We have now sourced tasks by tapping our community of abroad members, together with me, and a few offers have accomplished due diligence and reached the ultimate pre-contract alternate stage. Sadly, nevertheless, because of the phrases and situations not being favorable, no offers have been closed as of but. We intend to strengthen our M&A promotion construction by making use of our abroad places of work, tapping native networks extra deeply, and — as we do in Japan — formulating extremely reproducible sourcing methods. I imagine that M&A is an efficient approach to each strengthen abroad enlargement and set up a aggressive benefit in abroad markets.

The third pillar is “discovering new abroad applied sciences.” We’re aiming to be in a scenario the place we are able to take into account collaborations and investments with promising startups, equivalent to distributors of next-generation take a look at instruments and AI, and monitor the newest developments.

JStories: Talking for myself, I’m excited to listen to the way you, Japan’s M&A king, are lastly transferring into the U.S. and different abroad markets!

Kojima: Thanks very a lot.

JStories: By the best way, you’re the writer of “Contract Observe in Cross Border M&A” (Chuokeizai-sha). Was the e-book based mostly in your experiences abroad?

Kojima: Mikiharu Mori, who heads the Tokyo Worldwide Legislation Workplace, approached me to write down a e-book for them concerning the issues I’ve realized from cross-border M&A/PMI offers, each as an adviser and from inside an working firm. That led to me co-authoring the e-book with folks from the regulation workplace. Mori and I had a gathering of the minds over our shared imaginative and prescient of “growing the variety of Japanese firms that may compete on the worldwide stage by way of skillfully utilizing cross-border M&A.” We had been sharing numerous ideas even earlier than the workplace was established.

JStories: What was the important thing factor you wished to convey in your e-book?

Kojima: I wrote this e-book about easy methods to supply M&A abroad and easy methods to effectively improve worth (PMI) from the attitude of an working firm and primarily with a concentrate on my experiences abroad.

For instance, in the case of sourcing tasks exterior Japan, usually firms lack the type of established networks they’ve at residence, so that they depend on tasks dropped at them. However I feel it’s best that firms actively seek for their very own tasks. What sort of construction is greatest for that? As a result of it’s abroad, there are extra issues that firms don’t perceive than in Japan. An important factor is to focus on firms that you may correctly perceive. Additionally, in the case of growing worth, there are various areas the place it’s essential to arrange a governance construction completely different from that of Japanese firms, equivalent to company tradition and organizational construction. So, within the e-book, I wished to elucidate how Japanese firms may deal with that whereas additionally tapping their very own strengths.

The best way to develop a enterprise additional by approaching the abroad market

JStories: SHIFT has additionally grown its enterprise in Japan. To a sure extent, it’s potential to do enterprise relying solely on the home market, and there are various startups that compete solely within the Japanese market. However, whenever you appeared to the long run, did you determine that it was vital for SHIFT to strategy abroad markets?

Kojima: Final fiscal 12 months, SHIFT achieved its midterm progress technique, SHIFT1000, which focused gross sales of 100 billion yen. Now it’s methods to realize gross sales of 300 billion yen and extra. I imagine that “abroad technique” is a subject that may’t be ignored once we take into account future progress. SHIFT addresses a market that also has enough potential for progress in Japan, however I feel that if we turn out to be in a position to strategy abroad markets, too, our perspective will change loads. Following the current announcement of SHIFT USA’s institution, I spoke with each home and overseas buyers. They’ve excessive hopes for SHIFT’s abroad enlargement.

All the identical, we totally acknowledge that Japanese startups are struggling to increase abroad, and that SHIFT nonetheless lacks data and internationally various employees. Till one 12 months in the past, once we arrange a crew known as the “Abroad Enterprise Promotion Workplace”, we didn’t even have an abroad technique. Nevertheless, one of many challenges I’d prefer to take up is for Japanese firms, whose presence on the worldwide stage has turn out to be weaker, to be lively overseas, and notably for startups to increase abroad. I’d undoubtedly prefer to make that occur at SHIFT.

What must occur for there to be extra Japanese unicorns (unlisted startups with a valuation of over $1 billion)?

JStories: Lastly, I’d prefer to cowl a barely broader theme, which is the challenges dealing with Japan’s startup ecosystem. Just lately, the nationwide authorities and native authorities have begun to supply actual help with a purpose to improve the variety of unicorns. What are your ideas on that?

Kojima: I really feel just like the startup atmosphere has improved rather a lot these previous few years. The quantity of startup funding has elevated about 10 occasions over the past decade, and excellent expertise is flowing into startups. The Japanese authorities has created a five-year plan for startup growth with a objective of accelerating the variety of startups 10 occasions over 5 years.

What’s extra, not solely are working firms like ours contemplating startups for M&A, however in recent times, extra startups have been partnering with personal fairness funds, and there was progress on deregulation of shopping for and promoting unlisted shares, together with in startups.

JStories: Then again, there are fewer unicorns in Japan than in different international locations. You could have been an adviser to startups and in addition an angel investor. What do you assume are the problems confronted by those that handle startups?

Kojima: As you say, the variety of unicorns in Japan is way fewer than in different international locations. My work offers me many alternatives to speak with startup managers. Some points that usually come up are “easy methods to create a system for scaling up the enterprise,” “human useful resource growth,” “lack of mentors for senior administration,” “communication with buyers,” and “an excessive amount of concentrate on an IPO as an exit technique.” I feel these points intersect to create a construction characterised by small IPOs, subsequent absence of market capitalization progress, and unicorns not being created. Actually, over half of the businesses listed on the TSE Development Market have a market capitalization beneath their preliminary itemizing. It even begs the query, why are they being listed?

JStories: Once I discuss to abroad buyers, they often inform me that startups should use M&A nicely to turn out to be unicorns. I’ve heard from some that it’s just about a should, or that it’s unattainable to turn out to be a unicorn with out M&A. However what do you assume?

Kojima: M&A is only one software of administration technique, so I don’t assume they will turn out to be a unicorn simply by way of M&A. Nevertheless, if they will use M&A skillfully, there is no such thing as a doubt that their enterprise will scale extra rapidly. A lot of in the present day’s startups acknowledge that, and we get extra consultations yearly. For instance, in March 2022, we invested within the Subsequent Era Expertise Group Inc., headquartered in Shibuya, Tokyo, and led by Consultant Director and President Eiichi Arai, who expressed a want to find out about SHIFT’s strategy to M&A and PMI (Submit-Merger Integration). They went public on the Tokyo Inventory Alternate Development Market in February 2025. To date, they’ve introduced 10 M&A offers, and their inventory value has remained robust even after going public. I feel it is a nice instance of how M&A could be leveraged to efficiently scale a enterprise.

JStories: In that scenario, there’s a necessity for help from folks such as you, people with a lot expertise and experience to supply.

Kojima: Proper now, I’m an adviser to 2 firms: Asuene Inc. (HQ in Minato-ku, Tokyo, Founder & CEO Kohei Nishiwada), a local weather tech firm, and FLUX Inc. (HQ in Shibuya-ku, Tokyo, CEO Genji Nagai), which supplies enterprise operations optimization. The senior administration of each these firms consists of longtime acquaintances of mine or junior colleagues from my former firm. I turned an adviser after they approached me straight. I’ve been giving each firms hands-on recommendation since they launched their M&A groups round one 12 months in the past. In that 12 months, Asuene introduced three M&A and FLUX two. I’m all the time interested by “reproducible methods,” so I do my advisory work with the arrogance that I can obtain the identical outcomes for different startups, not only for SHIFT. Each firms are aiming for terribly robust progress whereas making use of M&A/PMI methods.

JStories: You might be interested by reproducible methods, however I don’t assume that may occur in a single day. So, evidently the function of advisers like you’ll hold turning into extra important.

Kojima: Exterior Japan, entrepreneurs and skilled businesspeople typically act as mentors for startups. They share their very own successes and failures, and even present a community. In that means, startups can quickly create reproducible methods with out making the identical errors. By means of advising startups and numerous different actions, I wish to make my very own small contribution to serving to the startup ecosystem in Japan develop.

JStories: I see. That’s fantastic. At J-Tales, we have now experience in abroad enterprise enlargement and communication with folks overseas, however we’re fully new to M&A. I hoped we’d work with you to help firms by way of seminars and workshops.

Kojima: I do know that J-Tales is run as a media outlet that goals to inform the world about revolutionary and impressive tasks from Japan. We have now talked a number of occasions earlier than concerning the present scenario of startups in Japan, what we expect the problems are, and the course Japan ought to goal for. I actually hope we are able to hold working collectively in numerous methods to help Japan’s formidable startups and assist Japan prosper.

JStories: Thanks on your encouraging phrases! Lastly, what are your aspirations transferring ahead?

Kojima: SHIFT will hold working intently collectively as a crew whereas reviewing its M&A technique and delivering strong outcomes. We’ll steadily step into the abroad market, beginning with SHIFT USA. There’s additionally the difficulty I discussed earlier than, particularly that Japan’s startup sector has extraordinarily few unicorns. I hope that sharing the experiences I’ve collected in Japan and overseas with as many startups as I can would possibly result in as many unicorns as potential and improve the variety of firms competing on the worldwide stage.

JStories: Thanks for taking the time to speak to us in the present day. Since becoming a member of SHIFT, you’ve got always taken on new challenges in numerous roles, equivalent to organising M&A/PMI constructions and abroad groups, establishing SHIFT Development Capital and SHIFT USA, lecturing at universities, and appearing as a startup adviser and angel investor. I actually hope you’ll hold making use of that data to setting up a startup ecosystem in Japan!

Translated by Tony McNicol

High video: JStories (Jeremy Touitou, Giulia Righi)

For inquiries relating to this text, please contact [email protected]