Skip to content material

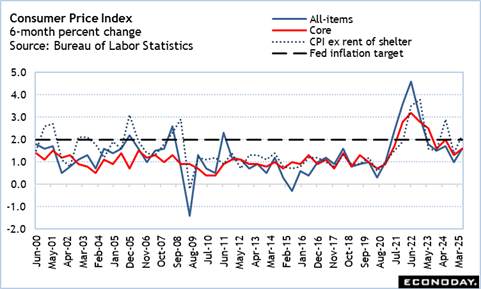

A take a look at the six-month % change within the CPI on the finish of the second half of 2025 corporations up expectations that the FOMC received’t change its thoughts about inflation remaining “considerably elevated” as a motive to maintain the fed funds goal charge vary at 4.25-4.50 %.

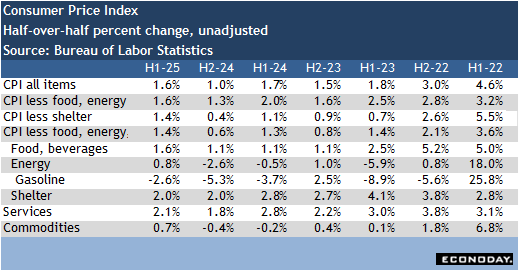

In truth, the tempo of client worth will increase picked up significantly over the previous six months as general costs rose for each providers and commodities. The index for providers is up 2.1 % within the first half of 2025 in comparison with up 1.8 % within the second half of 2024. The index for commodities costs is up 0.7 % within the first half of 2025 after down 0.4 % within the second half of 2024. As soon as extra client costs are broadly shifting away from the Fed’s 2 % inflation goal, and never simply in non-housing providers.

The six-month enhance within the all-items CPI is 1.6 % within the first half of 2025, up from 1.0 % within the second half of 2024 and almost again to the 1.7 % within the first half of 2024. The core CPI is up 1.6 % within the first half of 2025 in comparison with up 1.3 % and up 2.0 % within the second and first half of 2024, respectively.

Power costs are up 0.8 % within the first half of 2025, though gasoline costs are down 2.6 %. Nonetheless, the power worth index is up after two halves of decreases of two.6 % and 0.5 % within the second and first half of 2024, respectively. Moderation in meals costs has ended. The meals worth index was up 1.1 % within the prior three halves, however up 1.6 % within the first half of 2025.

The one brilliant spot could also be that the persistent worth positive factors in shelter prices have began to degree off. The index for shelter is up 2.0 % within the first half of 2024, the identical as within the second half of 2024, and under the up 2.8 % within the first half of 2024.

Share This Story, Select Your Platform!

Web page load hyperlink