, we mentioned how hypothesis and leverage have returned in earnest to the market as traders rush to tackle growing ranges of danger. With markets rising steadily all 12 months, it’s unsurprising to witness traders lulled into an elevated sense of complacency.

Shares, , leveraged investments, and meme shares are all surging increased, which is definitely paying homage to the “insanity” we witnessed following the Covid lockdowns. I posted the next chart on “X” Friday morning for reference.

In fact, hypothesis and sentiment drive markets increased, and traders at present have little concern a few correction. Markets are overbought and indifferent from short-term shifting averages. Moreover, one of many near-term dangers to extra bullish traders is the mix of excessive inventory valuations and the need of portfolio rebalancing, which might impression market stability.

Utilizing 2023 knowledge, it’s estimated that mutual funds in the US maintain roughly $19.6 trillion in belongings, whereas exchange-traded funds (ETFs) handle about $8.1 trillion, suggesting a considerable variety of portfolios containing mixtures of shares and bonds.

Portfolio Rebalancing Danger

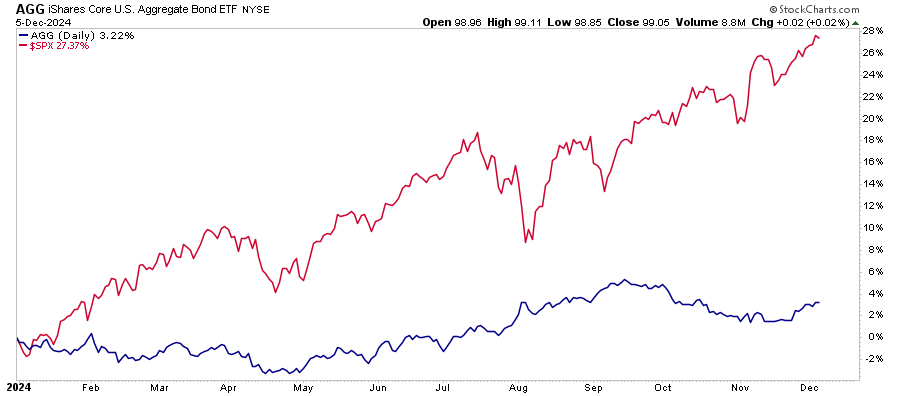

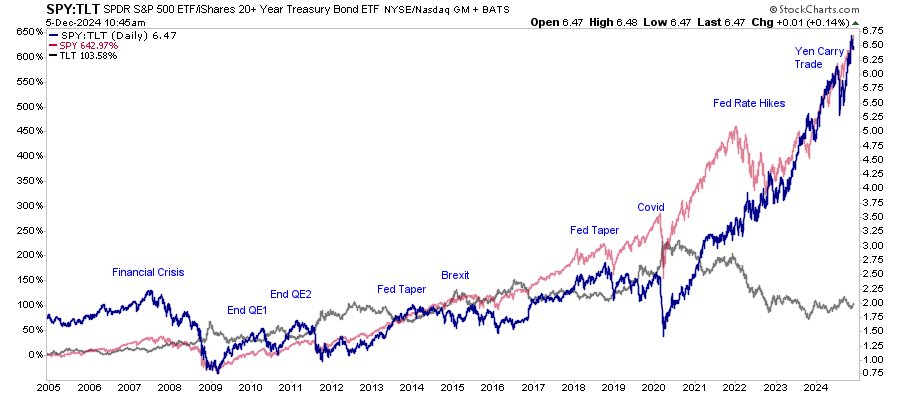

With the year-end approaching, portfolio managers must rebalance their holdings attributable to tax issues, distributions, and annual reporting. For instance, as of this writing, the is at present up about 28% year-to-date, whereas investment-grade bonds (as measured by iShares US Combination Bond ETF (NYSE:) are up 3.2%. That differential in efficiency would trigger a 60/40 inventory/bond allocation to shift to a 65/35 allocation. To rebalance that portfolio again to 60/40, portfolio managers should scale back fairness publicity by 5% and enhance bond publicity by 5%.

Relying on the magnitude of the rebalancing course of, it might exert downward stress on danger belongings, resulting in a short-term market correction or consolidation.

A few of that rebalancing has already been in course of, however we suspect there may be extra to go, notably given the fairly excessive studying of the stock-to-bond ratio.

Traditionally, the inventory/bond ratio remained vary certain between roughly 1:1 to 2.5:1. Right this moment, that ratio has skyrocketed for the reason that flood of liquidity following the pandemic as cash chased danger belongings over security. At a ratio of 6.5:1, we suspect that, sooner or later, a reversion will happen. Within the brief time period, given the outsized efficiency of shares versus bonds in 2024, there may be doubtless an unappreciated danger that portfolio rebalancing by managers might add a layer of promoting stress over the subsequent couple of weeks.

Nevertheless, repeating what we wrote final week, we anticipate any correction to be short-lived.

“If you’re underweight equities, take into account minor pullbacks and consolidations so as to add publicity as wanted to convey portfolios to focus on weights. Pullbacks will doubtless be shallow, however being able to deploy capital will probably be useful. As soon as we go the inauguration, we are able to assess what insurance policies will doubtless be enacted and regulate portfolios accordingly.”

Whereas there isn’t a cause to be bearish, this doesn’t imply you need to abandon danger administration. Such is especially the case as we head into 2025, which might counsel a much less optimistic final result.

Want Assist With Your Investing Technique?

Are you searching for full monetary, insurance coverage, and property planning? Want a risk-managed portfolio administration technique to develop and shield your financial savings? No matter your wants are, we’re right here to assist.

2025 Earnings Forecasts Are Very Bullish

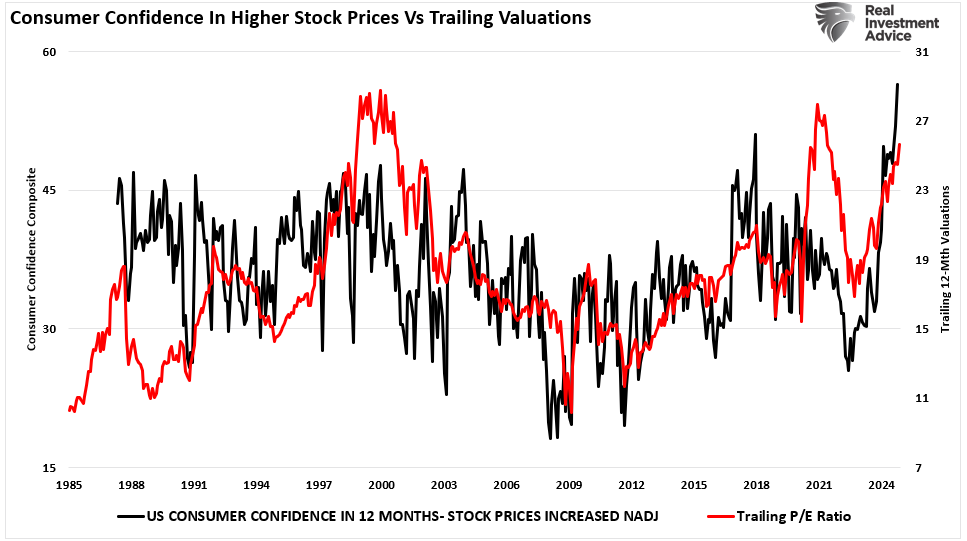

Final week, we mentioned the surge in available in the market. As mentioned in that article, regardless that valuations are elevated, such is as a result of sentiment drives valuations within the brief time period. As we head into 2025, Wall Road could be very optimistic about earnings progress, main traders to pay up for increased valuations.

Such can also be the case with shoppers whose confidence in increased inventory costs over the subsequent 12 months has surged to document ranges.

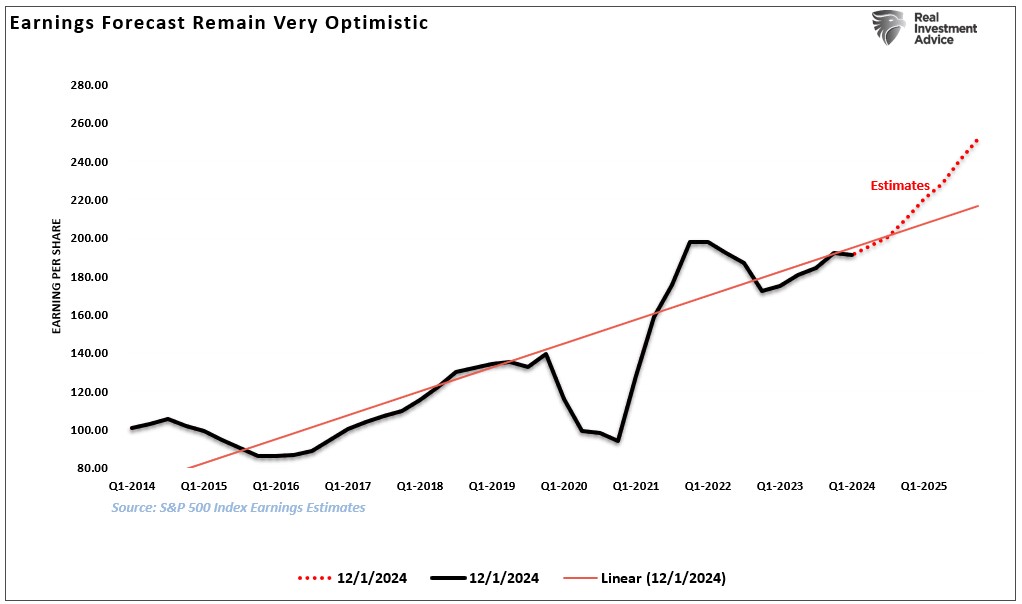

In line with S&P International, earnings are anticipated to develop by 19.87% in 2025 from $209.83 to $251.53 per share. As mentioned, such is nicely above the long-term earnings progress development from 1900 to the current. Nonetheless, such exuberance is unsurprising throughout strongly trending bull markets in an try to justify increased valuations. The issue is that such exuberant forecasts not often come to fruition. For instance, in March 2023, S&P International predicted that 2024 earnings would develop by 13% for the 12 months. In actuality, earnings grew by simply 9% regardless of the market rising almost 28%.

As proven, present estimates are nicely elevated above the operating linear development line from 2014, whereas precise earnings progress stays near it. This means that we’ll doubtless see a decline in estimates for 2025 to roughly $225/share, equating to earnings progress of roughly 7%. In fact, the linear development of earnings progress is a perform of financial progress and an vital consideration for traders betting on elevated returns within the New Yr.

Earnings Can’t Outgrow The Economic system

Crucially, earnings can not outgrow the economic system over the long run as earnings are derived from financial exercise. Provided that measures the full worth of products and providers produced inside a rustic, it’s a dependable gauge of general exercise. A rising GDP signifies elevated financial exercise, usually driving increased company earnings attributable to elevated shopper spending and enterprise funding. Conversely, a contracting GDP suggests an financial slowdown, typically dampening company earnings.

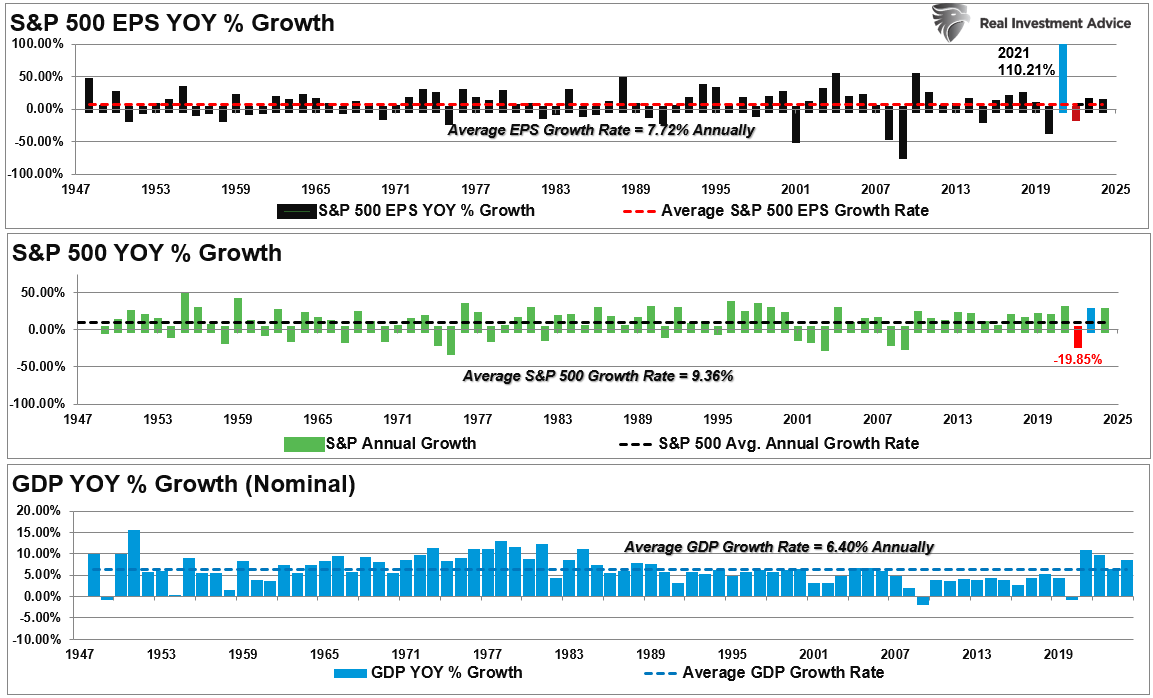

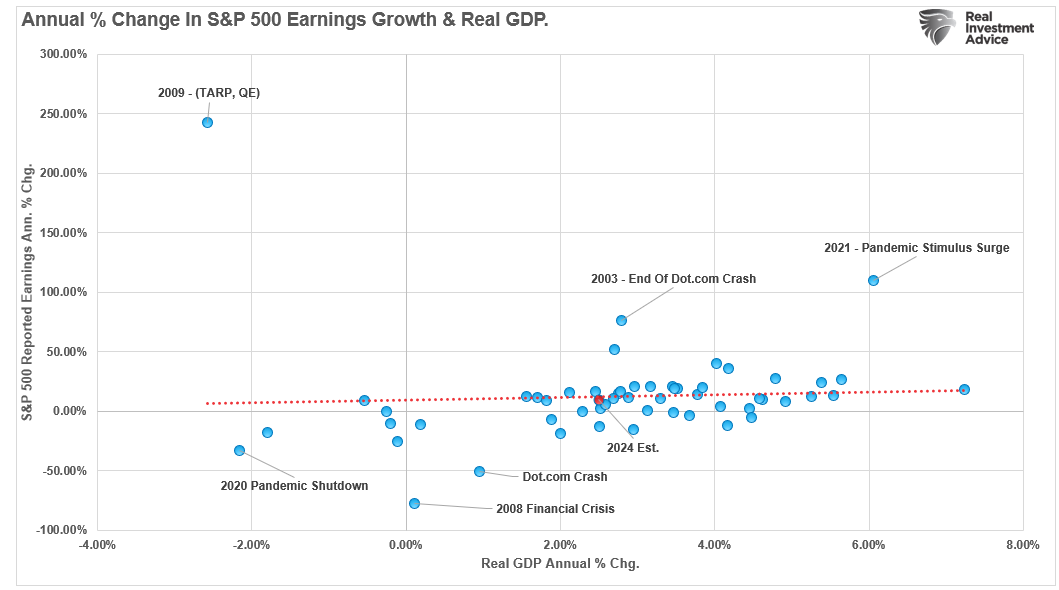

The information helps this idea. Traditionally, GDP progress has intently correlated with company earnings progress. Information from the Federal Reserve exhibits that, since 1948, a 1% enhance in actual GDP progress has translated to roughly a 6% enhance in S&P 500 earnings on common. This relationship underscores why GDP is a cornerstone for assessing earnings developments. We will additionally see this visually.

“Since 1947, earnings per share have grown at 7.7% yearly, whereas the economic system expanded by 6.40% yearly. That shut relationship in progress charges must be logical, notably given the numerous function that shopper spending has within the GDP equation.” –

A greater approach to visualize this knowledge is to have a look at the correlation between the annual change in earnings progress and inflation-adjusted GDP. There are durations when earnings deviate from underlying financial exercise. Nevertheless, these durations are attributable to pre- or post-recession earnings fluctuations. At present, financial and earnings progress are very near the long-term correlation.

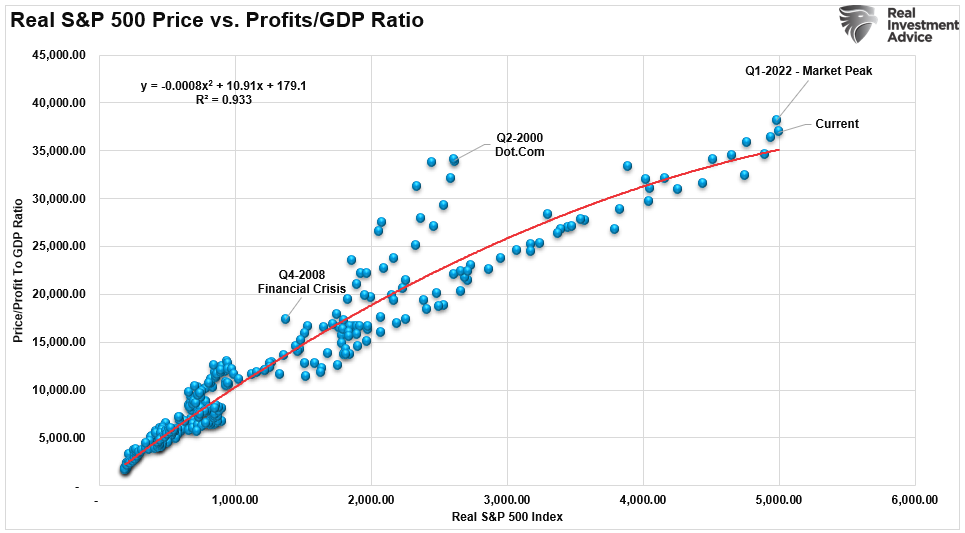

Nevertheless, as we mentioned beforehand, there may be additionally a excessive correlation between the market and the company earnings to GDP ratio. As is the case at present, markets can detach from underlying financial realities attributable to momentum and psychology for transient durations. Nevertheless, these deviations are unsustainable in the long run, and company profitability, as mentioned, is derived from underlying financial exercise.

I’ll write an article quickly protecting the significance of a handful of financial indicators on earnings. Nevertheless, I wish to focus on two in the present day: the ISM Manufacturing Index and the Chicago Fed Nationwide Exercise Index.

ISM Manufacturing Index

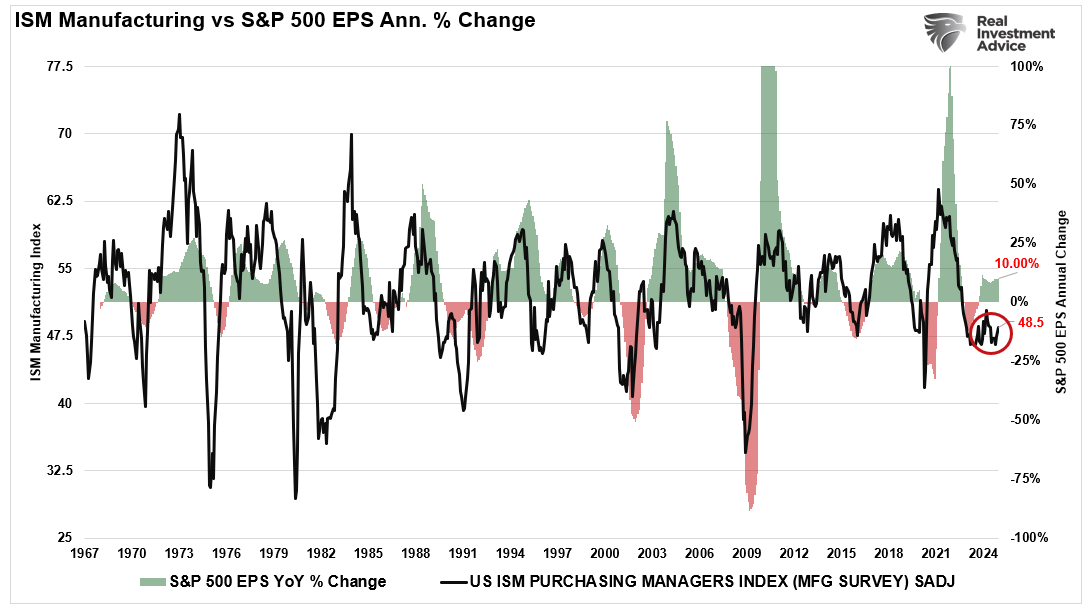

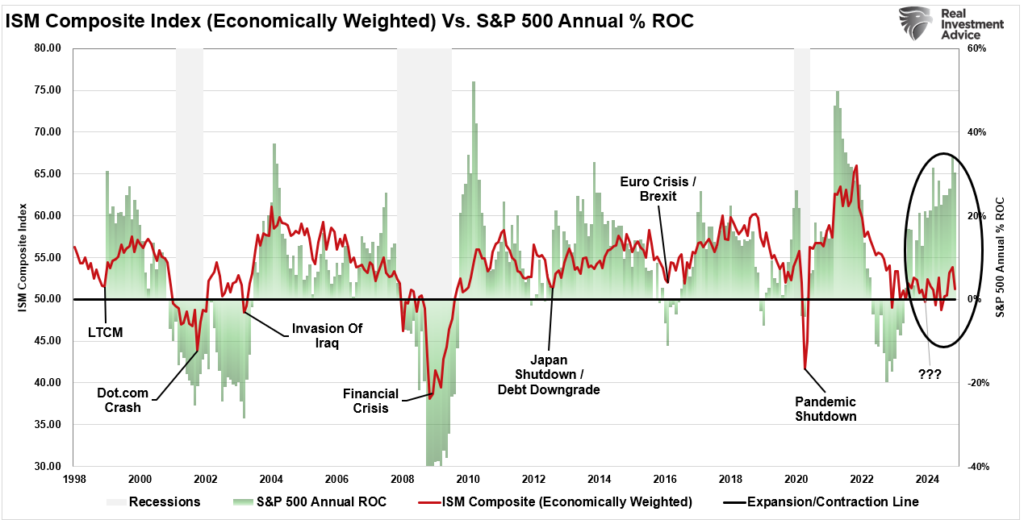

The Index is a extensively adopted main indicator of financial exercise within the manufacturing sector. It surveys buying managers on essential metrics like new orders, manufacturing ranges, and employment.

- A studying above 50 indicators growth, which tends to help earnings progress.

- A studying under 50 suggests contraction, typically foreshadowing financial weak point and declining company earnings.

As of late 2024, the ISM Manufacturing Index has been persistently under 50, marking a producing recession. This knowledge aligns with declining new orders and softer demand, elevating considerations about company earnings resilience in 2025. Nevertheless, whereas manufacturing solely accounts for about 20% of U.S. GDP, it has an outsized affect that extends throughout provide chains, amplifying the impression on broader financial exercise.

Company earnings progress, which correlates with financial indicators just like the ISM Manufacturing index, suggests some warning in regards to the extra optimistic 2025 Wall Road estimates. Nevertheless, even when we embody the providers facet of the index, which includes the majority of financial progress, and weigh it accordingly, we see that the inventory market has far outpaced underlying financial exercise.

Traditionally, such outsized returns haven’t been sustainable as earnings progress fails to fulfill expectations.

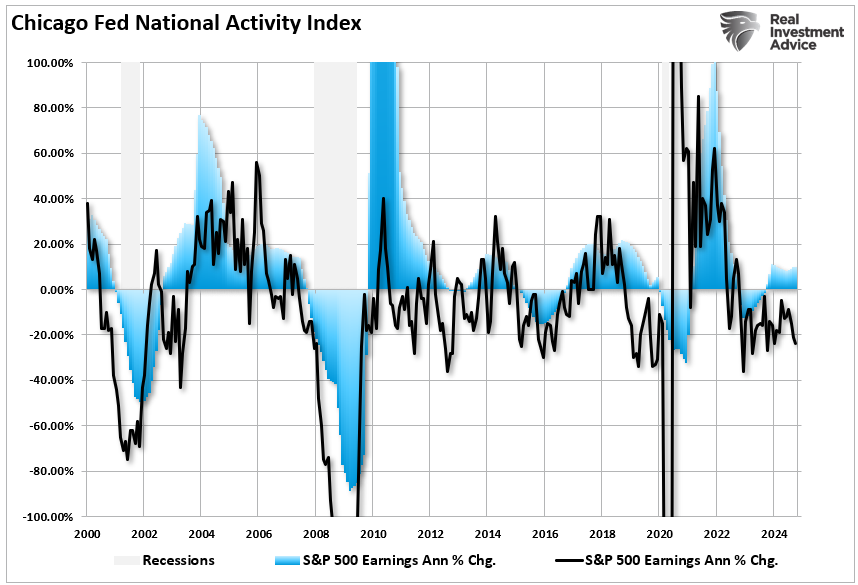

Nevertheless, one of many higher financial indicators to concentrate to is the Chicago Fed Nationwide Exercise Index, which is a broad measure of the economic system however doesn’t obtain a lot consideration.

Chicago Fed Nationwide Exercise Index (CFNAI)

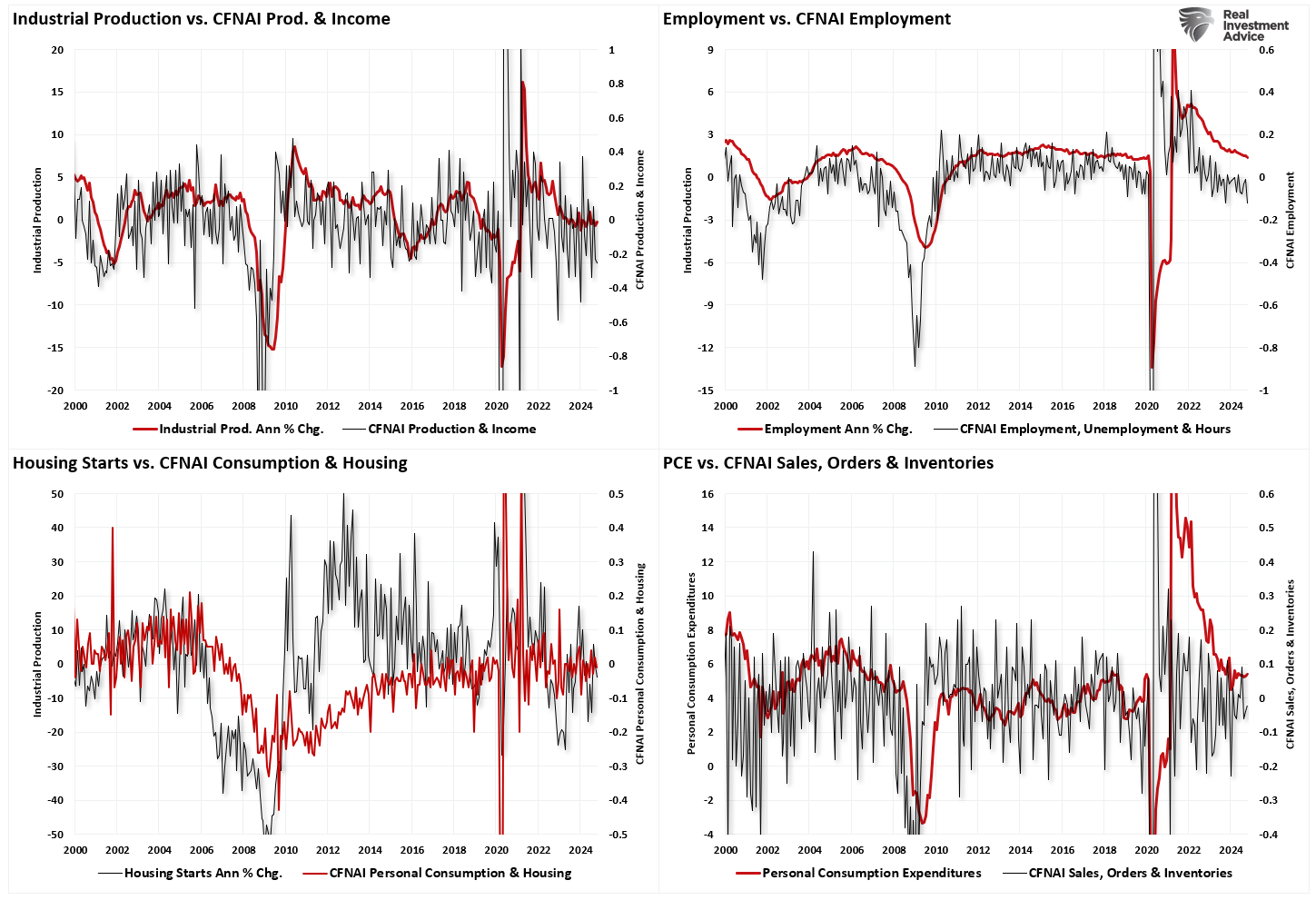

The CFNAI aggregates 85 month-to-month financial indicators from 4 classes:

- Manufacturing and earnings.

- Employment, unemployment, and hours labored.

- Private consumption and housing.

- Gross sales, orders, and inventories.

A CFNAI studying above zero signifies above-trend financial progress, whereas under zero suggests below-trend progress. In October 2024, the CFNAI registered at -0.15, reflecting subdued financial exercise. Extended readings in unfavorable territory typically sign a rising danger of recession. Notably, the employment measure means that the annual fee of change in employment will proceed to say no, will gradual, and will average decrease.

The CFNAI’s broad scope supplies a nuanced view of how numerous financial forces mix to have an effect on company earnings. With manufacturing and employment metrics deteriorating, the outlook for strong earnings in 2025 seems more and more strained. As proven, a excessive however unstable historic correlation exists between the CFNAI and company earnings.

Dangers In 2025

Nonetheless, traders ought to be aware that analysts’ outlook for 2025 is exceptionally optimistic in contrast to what’s more likely to be the precise final result. It’s because, as mentioned in “,” there are quite a few headwinds going through markets subsequent 12 months.

“The issue with present ahead estimates is that a number of components should exist to maintain traditionally excessive earnings progress and document company profitability.”

- Financial progress should stay extra strong than the typical 20-year progress fee.

- Wage and labor progress should reverse (weaken) to maintain traditionally elevated revenue margins.

- Each rates of interest and inflation want to say no to help shopper spending.

- Trump’s deliberate tariffs will enhance prices on some merchandise and might not be absolutely offset by substitute and substitution.

- Reductions in Authorities spending, debt issuance, and the deficit subtract from company profitability (Kalecki Revenue Equation).

- Slower financial progress in China, Europe, and Japan reduces demand for U.S. exports, slowing financial growth.

- The Federal Reserve sustaining increased rates of interest and persevering with to cut back its steadiness sheet will scale back market liquidity.

You get the thought. Whereas analysts are at present very optimistic about financial and earnings progress going into 2025, there are dangers to these forecasts. Such is especially true when inspecting present financial knowledge’s relative power and development. Subdued manufacturing exercise, slowing GDP progress, and cautious shopper conduct all level to an financial atmosphere much less supportive of aggressive earnings progress. As such, traders should rigorously navigate the disconnect between excessive Wall Road expectations and softening financial situations.

If these headwinds persist, company earnings could develop slower or contract barely in comparison with Wall Road’s present projections. For traders, this situation might imply decrease returns from equities, notably in high-growth sectors extra delicate to earnings disappointments.

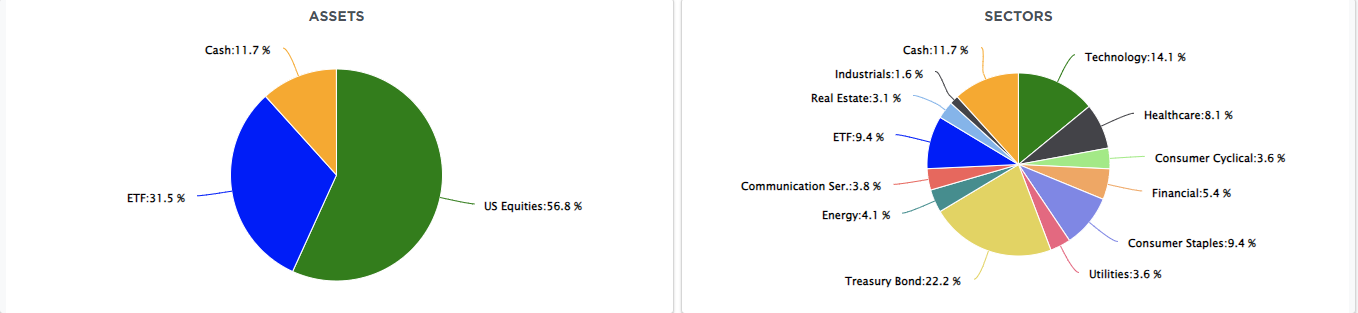

How We Are Buying and selling It

Heading into year-end, there may be little have to be overly cautious. The bullish development stays intact, company buybacks proceed, and funding managers have to be “absolutely dressed” by New Yr’s Eve for annual reporting.

Nevertheless, even with the market in a seasonally sturdy interval of the 12 months, there may be all the time the potential for one thing “going incorrect.” As such, proceed to observe the foundations as wanted to take care of a manageable stage of volatility.

- Tighten up stop-loss ranges to present help ranges for every place.

- Hedge portfolios in opposition to main market declines.

- Take earnings in positions which were huge winners

- Promote laggards and losers

- Increase money and rebalance portfolios to focus on weightings.

Discover, nothing in there says “promote all the pieces and go to money.”

The trick to navigating markets in 2025 is just not attempting to “time” the market to promote precisely on the high. That’s unattainable. Profitable long-term administration is knowing when “sufficient is sufficient” and being prepared to take earnings and shield your positive factors. For a lot of shares at present, that’s the scenario we’re in.

Handle danger accordingly. (Learn our article on “” for a whole record of guidelines)

Have an ideal week.