Bother with bubbles is they’re onerous to identify if you’re in a single

Article content material

The S&P 500 has hit 50, sure 50, information this 12 months.

With the market up 24 per cent, forecasters like Goldman Sachs and others are predicting new heights to return.

So let the nice instances roll or ought to we be apprehensive?

In keeping with Deutsche Financial institution Analysis, the S&P 500’s CAPE ratio — the cyclically adjusted price-to-earnings ratio usually used to point if a market is undervalued or overvalued — has solely been increased twice within the final century.

Commercial 2

Article content material

This received macro strategist Henry Allen fascinated about three different instances when market valuations had been traditionally excessive.

In all probability essentially the most well-known bubble in our reminiscence is the dotcom increase. Within the late Nineties, the S&P 500 greater than tripled over 5 years, however then plunged right into a prolonged correction that noticed it publish three annual declines in a row, one thing that hadn’t occurred for the reason that Second World Conflict, stated Allen.

How does that evaluate to at this time? Like that relentless rally, the S&P 500 is now on observe to publish back-to-back annual features above 20 per cent for the primary time since 1997 to 1998, he stated.

Then, like now, a slender group of tech shares was driving features, and the Federal Reserve was slicing rates of interest.

Then there was the worldwide monetary disaster — few noticed it coming and when it did most failed to know how unhealthy it will be, stated Allen.

In 2007 earlier than the disaster hit, markets had been in fairly good condition with the S&P 500 exceeding its earlier report in March 2000. Volatility was low and credit score spreads had been tight, similar to at this time.

The disaster in 2008 got here after an extended interval of calm and the identical may be stated of at this time, a decade and a half after the monetary disaster.

Article content material

Commercial 3

Article content material

“Because the economist Hyman Minsky argued, a prolonged interval of stability can itself be a destabilizing pressure. That’s as a result of it could possibly induce risk-taking and complacency that itself lays the foundations for the following interval of economic instability,” wrote Allen.

2000 despatched the world reeling into COVID shock, however when markets bounced again in 2021, it was large time, fuelled by financial and monetary stimulus that exceeded the help dispatched in the course of the world monetary disaster.

Valuations grew to become more and more stretched, stated Allen, and by November of that 12 months there have been indicators the rally was turning. What adopted was a large selloff in 2022 by which the S&P 500 fell 25 per cent from its peak.

The underside line: “In all three circumstances, there was little scope for additional features since valuations had been already so stretched to start out with, and so they had been every adopted by a major correction,” he stated.

One placing factor about all three episodes looking back is the “bubble mindset” and a powerful perception that good instances will proceed, stated Allen. In 2000, the Congressional Price range Workplace was predicting that the US would pay down its whole nationwide debt and within the mid-2000s earlier than the monetary disaster, there was discuss of the “Nice Moderation,” a time of macroeconomic stability. When the worldwide financial system started to recuperate from the shock of COVID-19, there was skepticism that inflation would get as unhealthy because it did.

Commercial 4

Article content material

“So turning factors can occur rapidly,” he wrote.

Enroll right here to get Posthaste delivered straight to your inbox.

Should you thought inflation was unhealthy, spare a thought for Albertans.

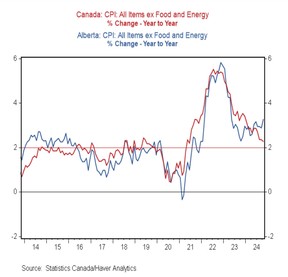

Canada’s inflation price ticked again as much as 2 per cent in October, however in wild rose nation it hit 3 per cent, stated Douglas Porter, chief economist at BMO Capital Markets in a word.

Seven of the opposite provinces are cool as compared, coming in underneath 2 per cent. Ontario was bang on the nationwide common and British Columbia a bit hotter at 2.4 per cent.

Alberta’s sturdy housing market is perhaps one rationalization, however the inflation goes past shelter prices, stated Porter — “it’s virtually throughout the board.”

Core inflation, which strips out the extra risky elements, has additionally been trending increased on this province. At 3.3 per cent it’s also a full proportion level above the nationwide common.

The underside line is that Alberta’s financial system is working hotter, stated Porter, scoring effectively above common on GDP, employment and inhabitants progress.

“One may argue that the excessive inflation is a value of success,” he stated.

Commercial 5

Article content material

- Immediately’s Knowledge: Canada industrial product value and uncooked materials value index, United States exiting house gross sales

- Earnings: Deere & Co., Intuit Inc.

Really helpful from Editorial

At ages 57 and 52, Leo and Siobahn want to semi-retire after they every flip 60, however they are going to be carrying a major mortgage effectively into retirement – one thing to be averted in any respect prices, in keeping with most of the monetary planning guides Leo has learn. Is that this actually such a foul factor — particularly since their $2.6 million endlessly B.C. house has a separate, two-bedroom income-generating suite? Household Finance runs the numbers.

Hard-earned truths

In an ongoing collection about what the following era must know to construct wealth, we provide Arduous Earned Reality #7: The professionals can’t decide shares and neither are you able to. So, what ought to an investor do? Learn on.

Commercial 6

Article content material

McLister on mortgages

Need to be taught extra about mortgages? Mortgage strategist Robert McLister’s Monetary Submit column may help navigate the complicated sector, from the newest developments to financing alternatives you gained’t wish to miss. Plus test his mortgage price web page for Canada’s lowest nationwide mortgage charges, up to date every day.

Monetary Submit on YouTube

Go to the Monetary Submit’s YouTube channel for interviews with Canada’s main specialists in enterprise, economics, housing, the vitality sector and extra.

Immediately’s Posthaste was written by Pamela Heaven, with further reporting from Monetary Submit workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this article? E-mail us at posthaste@postmedia.com.

Bookmark our web site and assist our journalism: Don’t miss the enterprise information you must know — add financialpost.com to your bookmarks and join our newsletters right here

Article content material