The market’s efficiency over the previous month displays a blended image of resilience and weak point. Whereas the stays in a bullish construction and has held above key assist ranges, a better look reveals important divergence beneath the floor. Market breadth has deteriorated, with the typical inventory performing a lot worse than the index itself. This disparity highlights a difficult atmosphere, the place energy in a couple of large-cap shares masks broader market struggles—a theme that will likely be explored all through this article.

Over the previous month, the market has skilled a pullback, with the S&P 500 declining roughly 3.8% from its latest highs. Within the chart’s prime panel, we see that the index stays above a important assist stage that has been examined 3 times over the previous six weeks. This assist stage has thus far held.

In distinction, the , proven within the decrease panel, paints a much less bullish image. The common inventory inside the index has carried out worse, declining roughly 7.2% from its highs. Whereas the equal-weighted index had the same assist stage to the S&P 500, it has decisively damaged beneath that stage, highlighting the present weak point in market breadth.

If the S&P 500 have been to fall decisively beneath its assist stage, it will sign near-term market weak point and characterize a significant shift in market dynamics. Such a transfer would disrupt the market’s bullish construction, which has been characterised by a constant sample of upper highs and better lows over the previous 12 months. The market has proven energy by repeatedly holding assist throughout prior pullbacks, however a break beneath this stage would point out a change in that sample.

You will need to be aware that this potential breakdown wouldn’t essentially sign an impending crash or a transition right into a bear market. Nonetheless, it will recommend elevated warning, because the market’s means to maintain its uptrend would come into query. In such a state of affairs, adopting a extra defensive stance till situations enhance could be prudent. This underscores the significance of carefully monitoring market conduct at this key juncture.

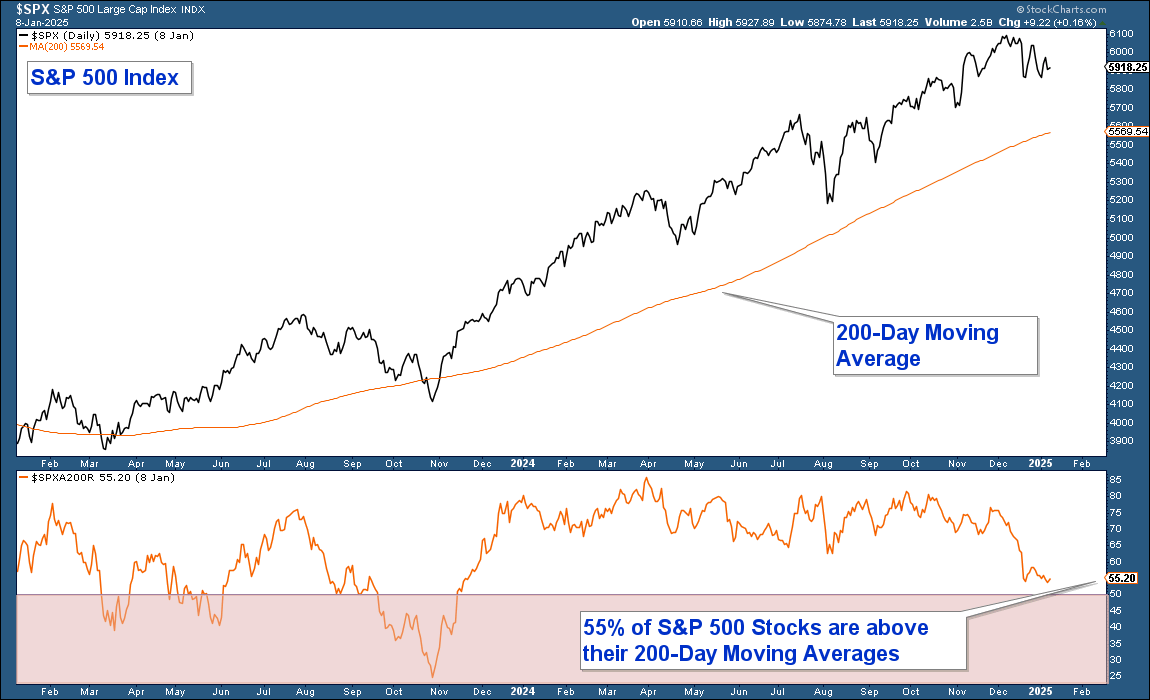

Market Breadth: S&P 500 vs. Shares Above Their 200-Day Transferring Averages

The second chart emphasizes the disconnect between the S&P 500’s efficiency and the underlying participation of its constituent shares, offering additional proof of poor market breadth.

Within the prime panel, the S&P 500 is proven sitting effectively above its 200-day transferring common, demonstrating relative energy on the index stage. Regardless of a pullback from its highs, the S&P 500 stays in a bullish posture, staying comfortably above this widely-watched transferring common, which frequently serves as a long-term pattern indicator.

Nonetheless, the decrease panel reveals a starkly completely different story for the broader index parts. Presently, solely 55% of shares inside the S&P 500 are buying and selling above their respective 200-day transferring averages. This implies almost half of the shares within the index are in a longer-term downtrend, regardless of the S&P 500 itself sustaining a bullish construction.

This divergence highlights a important theme: whereas the S&P 500’s efficiency is buoyed by the energy of a smaller subset of large-cap shares, the broader market has struggled. Poor market breadth of this sort generally is a warning signal, as sustained market advances sometimes require broader participation throughout a bigger variety of shares.

Technical Overview: Help Ranges and Momentum Indicators

The third chart gives an in depth technical view of the S&P 500’s present place relative to its key transferring averages and MACD momentum indicator.

Within the higher panel, the S&P 500 is displayed alongside its 200-day, 100-day, and 50-day transferring averages, with a thick inexperienced line marking the important assist stage the place the index has bounced a number of occasions over the previous six weeks. Notably, this chart additionally highlights two prior cases (pink strains) the place related assist ranges held, reinforcing the significance of this zone as a pivotal level for the market.

The decrease panel shows the MACD (Transferring Common Convergence Divergence) momentum indicator, which is trending decrease and sits beneath zero. This alerts that draw back momentum has been constructing, elevating issues concerning the potential for additional weak point.

The implications of this chart hinge available on the market’s subsequent transfer:

- If assist holds and the S&P 500 strikes larger, this might be a bullish growth, significantly if accompanied by improved market breadth. It could sign a resumption of the longer-term uptrend and reinforce the energy the index has displayed all through the previous 12 months.

- If the index falls decisively beneath assist, it will mark a departure from the bullish sample of holding above key assist ranges seen over the previous 12 months. Such a transfer would recommend near-term market weak point and point out that warning is warranted. Whereas this wouldn’t essentially sign a crash or the onset of a bear market, it will replicate a change out there’s dynamic, encouraging a extra defensive stance till situations enhance.

This chart underscores the significance of the present assist stage as a key inflection level. The market’s response right here will doubtless set the tone for its near-term course.

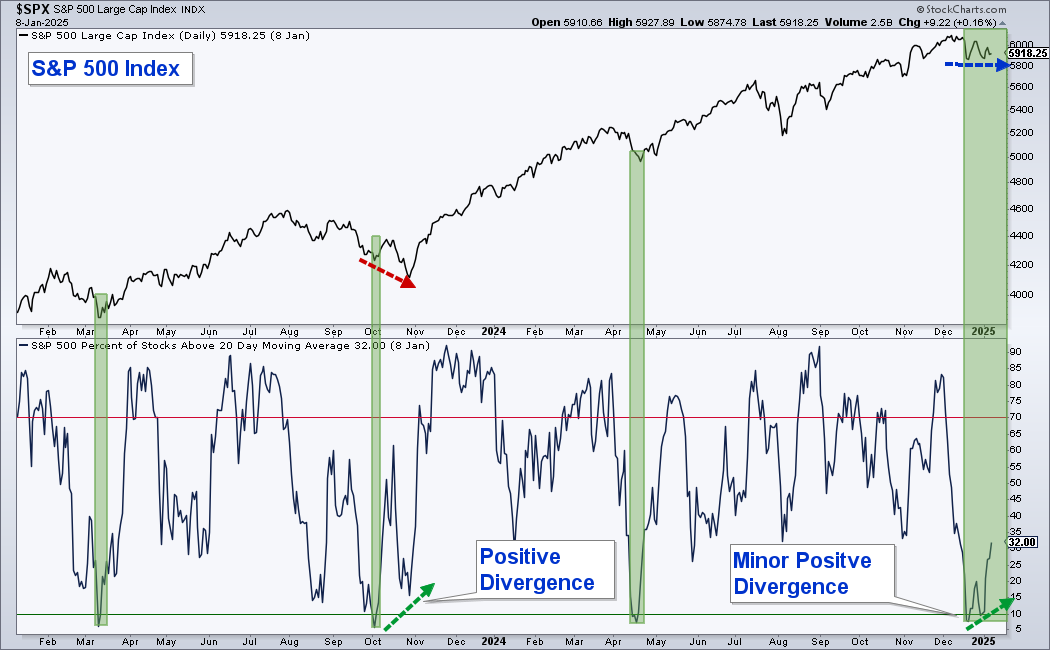

Analyzing Market Oscillation: Overbought/Oversold Indicator

The ultimate chart gives perception into the connection between the S&P 500 and its short-term market breadth, as measured by the proportion of shares inside the index buying and selling above their 20-day transferring averages.

Within the higher panel, the S&P 500 is proven transferring sideways over the previous few weeks at assist. Within the decrease panel, the oscillator depicts the proportion of shares above their 20-day transferring averages, which has traditionally been a dependable overbought/oversold indicator.

This indicator has successfully predicted three prior market pullback bottoms over the previous two years, though with some variation in timing. For instance, through the October 2024 pullback, the road dropped beneath 10%, signaling oversold situations. Whereas the index fell to a decrease low afterward, the oscillator shaped the next low – a optimistic divergence that finally preceded a powerful market restoration.

Presently, the same sample is rising. Whereas the S&P 500 has held assist and moved sideways, the oscillator has shaped the next low and is now advancing, reaching the 32% stage. This optimistic divergence between the index and the oscillator is an encouraging signal that implies assist might maintain once more if historic patterns repeat.

Nonetheless, it’s important to notice that this is only one indicator amongst many, and the market’s near-term course will rely upon a wide range of elements. One such issue is the upcoming employment report, scheduled for launch tomorrow morning earlier than the market opens. This extremely anticipated report has the potential to considerably affect market actions within the close to time period.

Present Account Replace

Given present market situations, our accounts preserve a considerably lowered fairness allocation. Presently, fairness publicity stands at roughly 60% of what could be thought of a completely allotted place. This method displays a cautious stance, with our whole fairness allocation roughly 40% beneath a completely invested stage.

If the market bounces off assist and situations enhance, I plan to extend our fairness publicity to reap the benefits of strengthening tendencies. Conversely, if the market decisively breaks beneath assist and situations deteriorate, I’ll doubtless undertake a extra defensive posture within the quick time period to guard towards potential draw back threat.

This dynamic method ensures that portfolio allocations stay aligned with evolving market situations, balancing alternatives for progress with prudent threat administration.