Printed on March twentieth, 2025 by Bob Ciura

Many buyers have a want to ‘beat the market’.

This appears like a great objective. In any case, the market is ‘simply common’, so it could make sense to a minimum of beat common.

However as an alternative of specializing in an arbitrary benchmark or compounding goal (‘I need to compound at 20% yearly’ for instance), I consider it makes extra sense to concentrate on the rationale you’re investing.

Broadly, that’s to earn cash. However extra particularly, the purpose of dividend development investing is to construct a rising passive earnings stream.

And the underlying objective there’s to have a rising passive earnings stream that exceeds your bills – so you’ve true, lasting monetary freedom.

The securities you choose on your dividend development portfolio with a view to obtain lasting monetary freedom by means of rising passive earnings definitely matter.

That’s the place dividend development shares are available–extra particularly, blue chip shares which have elevated their dividends for a minimum of 10 consecutive years.

You possibly can obtain our free blue chip shares listing with essential monetary metrics corresponding to dividend yields and price-to-earnings ratios, by clicking on the hyperlink beneath:

There are at the moment greater than 500 securities in our blue chip shares listing.

Blue-chip shares are established, financially robust, and persistently worthwhile publicly traded corporations.

Their energy makes them interesting investments for comparatively secure, dependable dividends and capital appreciation versus much less established shares.

As an alternative of chasing returns, buyers can begin constructing long-term passive earnings by means of dividend development shares.

The next 10 blue chip shares have elevated their dividends for a minimum of 10 years, and have Dividend Danger Scores of ‘C’ or higher within the Certain Evaluation Analysis Database, plus the very best dividend development.

The ten blue chip shares are sorted by dividend development price.

Desk of Contents

The desk of contents beneath permits for simple navigation.

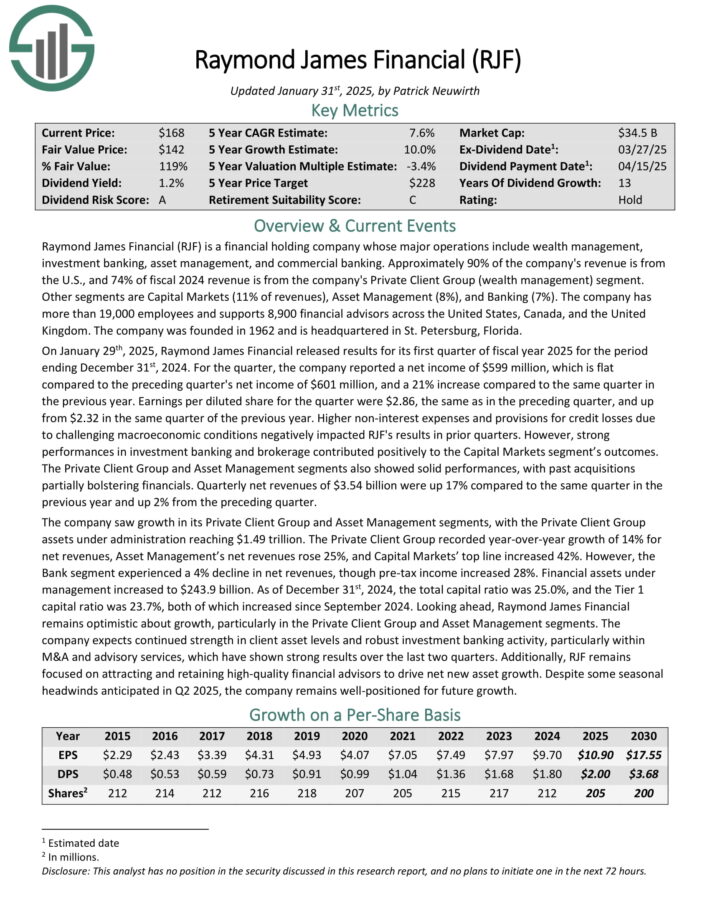

Blue Chip #10: Raymond James Monetary (RJF)

- Dividend Historical past: 13 years of consecutive will increase

- Dividend Progress: 13.0%

Raymond James Monetary (RJF) is a monetary holding firm whose main operations embrace wealth administration, funding banking, asset administration, and industrial banking. Roughly 90% of the corporate’s income is from the U.S., and 74% of fiscal 2024 income is from the corporate’s Personal Shopper Group (wealth administration) phase.

Different segments are Capital Markets (11% of revenues), Asset Administration (8%), and Banking (7%). The corporate has greater than 19,000 workers and helps 8,900 monetary advisors throughout the US, Canada, and the UK.

On January twenty ninth, 2025, Raymond James Monetary launched outcomes for its first quarter of fiscal 12 months 2025 for the interval ending December thirty first, 2024.

For the quarter, the corporate reported a internet earnings of $599 million, which is flat in comparison with the previous quarter’s internet earnings of $601 million, and a 21% improve in comparison with the identical quarter within the earlier 12 months.

Earnings per diluted share for the quarter have been $2.86, the identical as within the previous quarter, and up from $2.32 in the identical quarter of the earlier 12 months. Robust performances in funding banking and brokerage contributed positively to the Capital Markets phase’s outcomes.

Click on right here to obtain our most up-to-date Certain Evaluation report on RJF (preview of web page 1 of three proven beneath):

Blue Chip #9: Intuit Inc. (INTU)

- Dividend Historical past: 13 years of consecutive will increase

- Dividend Progress: 13%

Intuit is a cloud-based accounting and tax preparation software program big, headquartered in Mountain View, California. Its merchandise present monetary administration, compliance, and companies for shoppers, small companies, self-employed employees, and accounting professionals worldwide.

Its hottest platforms embrace QuickBooks, TurboTax, Mint, and TSheets. Cumulatively they serve greater than 100 million prospects. The corporate recorded $16.3 billion in revenues final 12 months and is headquartered in Mountain View, California.

On February twenty fifth, 2025, Intuit printed its fiscal Q2 outcomes for the interval ending January thirty first, 2025. This was one other stable quarter, with “World Enterprise Options Group” revenues up 19% year-over-year.

Particularly, QuickBooks On-line Accounting revenues grew 22% year-over-year, pushed by buyer development, increased efficient costs, and mix-shift.

Adjusted EPS for the quarter grew by 26% to $3.32 in comparison with FQ2 2024.

Administration reiterated its income and nonGAAP EPS steerage for FY2025. Revenues are anticipated to be in a variety of $18.160 billion to $18.347 billion, implying a development price between 12% and 13% from final 12 months.

Adjusted EPS is predicted to be between $19.16 and $19.36. This means a year-over-year development of 18% to 19%.

Click on right here to obtain our most up-to-date Certain Evaluation report on INTU (preview of web page 1 of three proven beneath):

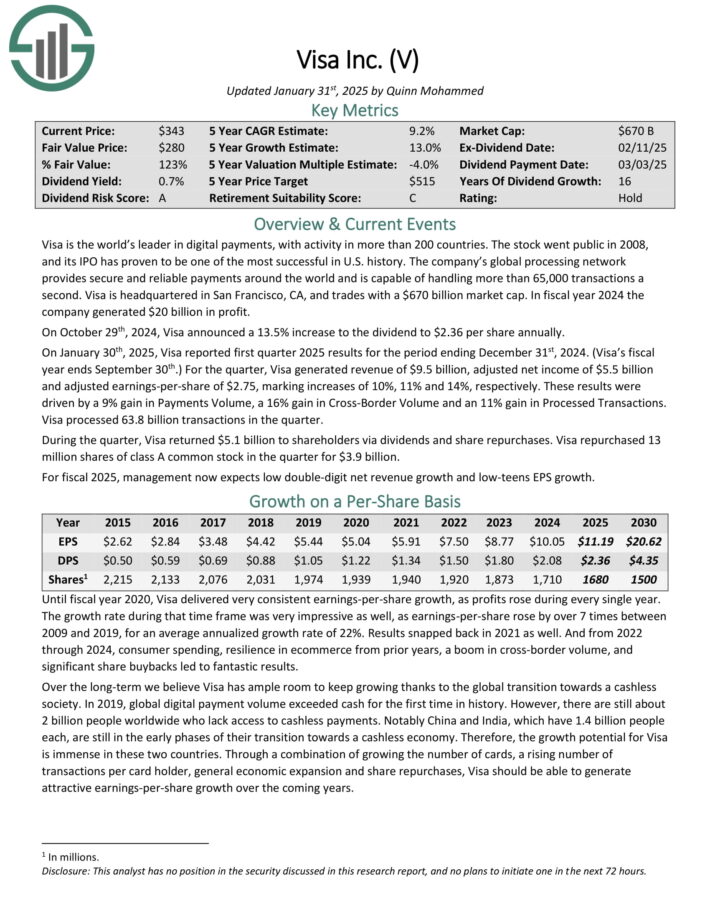

Blue Chip #8: Visa Inc. (V)

- Dividend Historical past: 16 years of consecutive will increase

- Dividend Progress: 13%

Visa is the world’s chief in digital funds, with exercise in additional than 200 nations. The corporate’s international processing community gives safe and reliable funds world wide and is able to dealing with greater than 65,000 transactions a second.

On January thirtieth, 2025, Visa reported first quarter 2025 outcomes for the interval ending December thirty first, 2024. (Visa’s fiscal 12 months ends September thirtieth.)

For the quarter, Visa generated income of $9.5 billion, adjusted internet earnings of $5.5 billion and adjusted earnings-per-share of $2.75, marking will increase of 10%, 11% and 14%, respectively.

These outcomes have been pushed by a 9% achieve in Funds Quantity, a 16% achieve in Cross-Border Quantity and an 11% achieve in Processed Transactions. Visa processed 63.8 billion transactions within the quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on Visa (preview of web page 1 of three proven beneath):

Blue Chip #7: Apple Inc. (AAPL)

- Dividend Historical past: 12 years of consecutive will increase

- Dividend Progress: 13.9%

Apple is a know-how firm that designs, manufactures, and sells merchandise corresponding to iPhones, iPads, Mac, Apple Watch and Apple TV. Apple additionally has a companies enterprise that sells music, apps, and subscriptions.

On January thirtieth, 2025, Apple reported monetary outcomes for the primary quarter of fiscal 12 months 2025 (Apple’s fiscal 12 months ends the final Saturday in September).

Whole gross sales grew 4% over the prior 12 months’s quarter, to a brand new report of $124.3 billion, because of sustained development in iPhone, iPad and Wearables throughout all areas.

Earnings-per-share grew 10%, from $2.18 to $2.40, and exceeded the analysts’ consensus by $0.05. Notably, Apple has missed the analysts’ estimates solely as soon as within the final 25 quarters.

Going ahead, Apple’s earnings development might be pushed by a number of elements. Considered one of these is the continuing cycle of iPhone releases, which creates lumpy outcomes. In the long term, Apple ought to be capable of develop its iPhone gross sales, albeit in an irregular trend.

Click on right here to obtain our most up-to-date Certain Evaluation report on AAPL (preview of web page 1 of three proven beneath):

Blue Chip #6: UnitedHealth Group (UNH)

- Dividend Historical past: 15 years of consecutive will increase

- Dividend Progress: 14%

UnitedHealth dates again to 1974 when Constitution Med was based by a gaggle of well being care professionals on the lookout for methods to develop healthcare choices for shoppers.

The corporate has two main reporting segments: UnitedHealth and Optum. The previous gives international healthcare advantages to people, employers, and Medicare/Medicaid beneficiaries. The Optum phase is a companies enterprise that seeks to decrease healthcare prices and optimize outcomes for its prospects.

UnitedHealth posted fourth quarter and full-year earnings on January sixteenth, 2025, and outcomes confirmed a uncommon miss on the highest line. Even though shares have been effectively off their highs previous to the report, the inventory declined anyway as the corporate disenchanted buyers for the primary time shortly.

Adjusted earnings-per-share got here to $6.81, which was seven cents forward of estimates. Nevertheless, income was up solely 6.8% to $100.8 billion, lacking by virtually a billion {dollars}.

UnitedHealthcare noticed income of $74.1 billion through the quarter, lacking consensus by $1.3 billion. OptumRx posted $35.8 billion of income, up 15% year-over-year and beating estimates. OptumHealth noticed 5% development year-over-year to $25.7 billion, additionally beating estimates.

The corporate’s medical care ratio was 85.5% in 2024, a deterioration of about 230 foundation factors year-over-year. This was attributable to elevated Medicare funding reductions and member combine, primarily. The corporate issued steerage for this 12 months of $29.50 to $30.00 in adjusted earnings-per-share.

Click on right here to obtain our most up-to-date Certain Evaluation report on UNH (preview of web page 1 of three proven beneath):

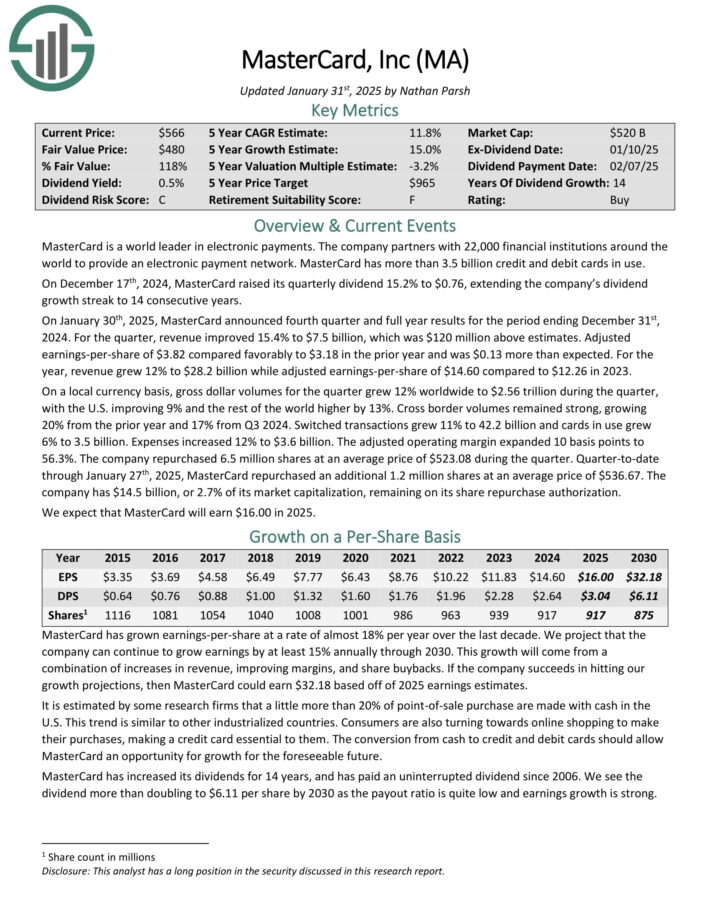

Blue Chip #5: Mastercard Inc. (MA)

- Dividend Historical past: 14 years of consecutive will increase

- Dividend Progress: 15%

MasterCard is a world chief in digital funds. The corporate companions with 25,000 monetary establishments world wide to supply an digital fee community. MasterCard has greater than 3.1 billion credit score and debit playing cards in use.

On January thirtieth, 2025, MasterCard introduced fourth quarter and full 12 months outcomes for the interval ending December thirty first, 2024.

For the quarter, income improved 15.4% to $7.5 billion, which was $120 million above estimates. Adjusted earnings-per-share of $3.82 in contrast favorably to $3.18 within the prior 12 months and was $0.13 greater than anticipated.

For the 12 months, income grew 12% to $28.2 billion whereas adjusted earnings-per-share of $14.60 in comparison with $12.26 in 2023.

On a neighborhood forex foundation, gross greenback volumes for the quarter grew 12% worldwide to $2.56 trillion through the quarter, with the U.S. bettering 9% and the remainder of the world increased by 13%.

Cross border volumes remained robust, rising 20% from the prior 12 months and 17% from Q3 2024.

Click on right here to obtain our most up-to-date Certain Evaluation report on Mastercard (preview of web page 1 of three proven beneath):

Blue Chip #4: Zoetis Inc. (ZTS)

- Dividend Historical past: 11 years of consecutive will increase

- Dividend Progress: 15%

Zoetis is a drug firm that focuses on animal well being, together with discovering, creating, manufacturing, and commercialising medicines, vaccines, and diagnostic merchandise.

Biodevices, genetic assessments, and precision livestock farming complement the corporate’s choices. The Vaccine phase is the biggest income producing phase, with 22% of the full income, whereas the US generates 54% of the income.

On February thirteenth, 2025, Zoetis Inc. reported robust monetary outcomes for the fourth quarter of 2024, with income reaching $2.3 billion, a 5% improve from the earlier 12 months and up 6% on an operational foundation. The corporate skilled development in each its U.S. and Worldwide segments, pushed primarily by robust demand for companion animal merchandise.

Within the U.S. phase, income was $1.3 billion, reflecting a 4% improve in comparison with This autumn 2023. Gross sales of companion animal merchandise grew by 7%, fueled by continued robust demand for Simparica Trio, dermatology merchandise corresponding to Apoquel and Cytopoint, and monoclonal antibody therapies for osteoarthritis ache.

Progress was partially offset by the affect of the preliminary stocking of Librela and Apoquel Chewable merchandise throughout their prior-year launches. Livestock product gross sales declined by 8%, primarily because of the divestiture of the medicated feed additive portfolio and sure water-soluble merchandise.

Click on right here to obtain our most up-to-date Certain Evaluation report on ZTS (preview of web page 1 of three proven beneath):

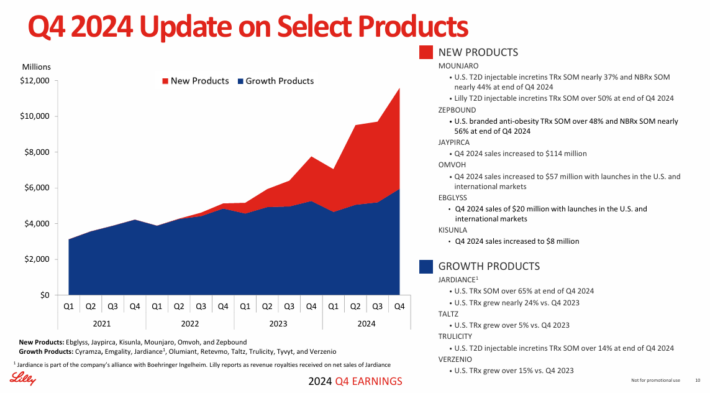

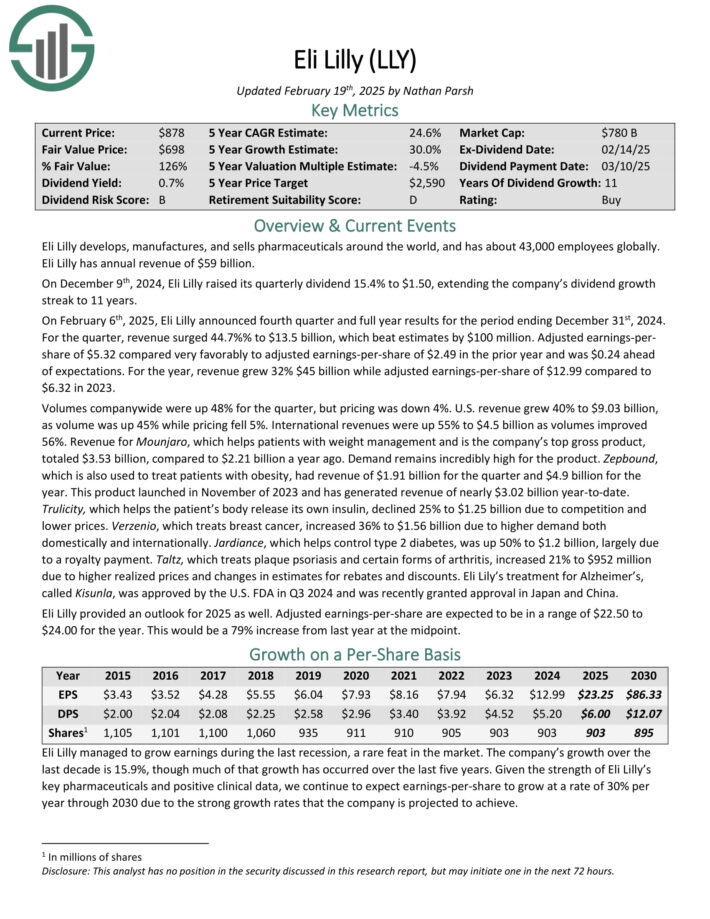

Blue Chip #3: Eli Lilly & Co. (LLY)

- Dividend Historical past: 11 years of consecutive will increase

- Dividend Progress: 15%

Eli Lilly develops, manufactures, and sells prescribed drugs world wide, and has about 43,000 workers globally. Eli Lilly has annual income of $59 billion.

On December ninth, 2024, Eli Lilly raised its quarterly dividend 15.4% to $1.50, extending the corporate’s dividend development streak to 11 years.

On February sixth, 2025, Eli Lilly introduced fourth quarter and full 12 months outcomes for the interval ending December thirty first, 2024. For the quarter, income surged 44.7%% to $13.5 billion, which beat estimates by $100 million.

Supply: Investor Presentation

Adjusted earnings-per-share of $5.32 in contrast very favorably to adjusted earnings-per-share of $2.49 within the prior 12 months and was $0.24 forward of expectations.

For the 12 months, income grew 32% $45 billion whereas adjusted earnings-per-share of $12.99 in comparison with $6.32 in 2023. Volumes company-wide have been up 48% for the quarter, however pricing was down 4%.

U.S. income grew 40% to $9.03 billion, as quantity was up 45% whereas pricing fell 5%. Worldwide revenues have been up 55% to $4.5 billion as volumes improved 56%.

Income for Mounjaro, which helps sufferers with weight administration and is the corporate’s prime gross product, totaled $3.53 billion, in comparison with $2.21 billion a 12 months in the past.

Demand stays extremely excessive for the product. Zepbound, which can also be used to deal with sufferers with weight problems, had income of $1.91 billion for the quarter and $4.9 billion for the 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on LLY (preview of web page 1 of three proven beneath):

Blue Chip #2: Consolation Methods USA (FIX)

- Dividend Historical past: 13 years of consecutive will increase

- Dividend Progress: 15%

Consolation Methods USA gives mechanical and electrical contracting companies throughout the U.S. The corporate focuses on HVAC, plumbing, piping, controls, and electrical system installations and companies, working 47 models with 178 areas in 136 cities.

Serving primarily industrial, industrial, and institutional markets, Consolation Methods USA works in sectors like manufacturing, healthcare, schooling, and authorities.

The corporate generated $7.0 billion in revenues final 12 months, with 56.7% of it coming from new facility installations and 43.3% coming from companies for current buildings. On February twentieth, 2025, Consolation Methods raised its dividend by 14.3% to a quarterly price of $0.40.

On the identical day, the corporate posted its This autumn and full-year outcomes for the interval ending December thirty first, 2024. Income for the interval was $1.87 billion, up 37.5% in comparison with final 12 months.

The rise included robust same-store exercise development and contributions from acquisitions. The identical-store income development was largely pushed by continued energy in market circumstances, significantly in knowledge facilities and chip crops.

The mechanical phase recorded income development of over 40% year-over-year, fueled by sturdy natural development in development and companies. {The electrical} phase additionally maintained stable efficiency, reflecting sustained demand. EPS elevated by about 60% to $4.09.

For the total 12 months, the corporate reported EPS of $14.64, exceeding prior estimates. The corporate’s backlog remained robust, reaching $5.99 billion on the finish of December.

Click on right here to obtain our most up-to-date Certain Evaluation report on FIX (preview of web page 1 of three proven beneath):

Excessive Yield Blue Chip #1: Badger Meter Inc. (BMI)

- Dividend Historical past: 32 years of consecutive will increase

- Dividend Progress: 15%

Badger Meter was based in 1905 in Milwaukee, WI. It manufactures and markets meters and valves which can be used to measure and management the stream of liquids, corresponding to water, oil and varied chemical substances.

Its merchandise are additionally used to manage the stream of air and different gases. Badger Meter generates ~$827 million in annual revenues.

On January thirty first, 2025, Badger Meter introduced fourth quarter and full 12 months earnings outcomes for the interval ending December thirty first, 2025. For the quarter, income improved 12.5% to $205.2 million, which topped estimates by $2.45 million.

Earnings-per-share of $1.04 in contrast favorably to earnings-per-share of $0.84 within the prior 12 months and was $0.04 greater than anticipated. For the 12 months, income grew 18% to a brand new report $826.6 million. Earnings-per-share totaled $4.23, which was a brand new report and was up from $3.14 in 2023.

The utility water enterprise as soon as once more grew 14% for the quarter. As with prior intervals, this development was led by a rise in demand for ORION Mobile endpoint, E-Sequence Ultrasonic meters, and BEACON Software program as a Service.

Click on right here to obtain our most up-to-date Certain Evaluation report on BMI (preview of web page 1 of three proven beneath):

Further Studying

In case you are taken with discovering different high-yield securities, the next Certain Dividend assets could also be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.