Up to date on October twenty first, 2024 by Bob Ciura

Spreadsheet knowledge up to date each day

The expertise trade is without doubt one of the most enjoyable areas of the inventory market, identified for its speedy progress and propensity to create speedy and life-changing wealth for early buyers.

Till just lately, the expertise sector was not identified for being a supply of high-quality dividend funding concepts. That is now not the case.

In the present day, among the most interesting dividend shares come from the tech sector.

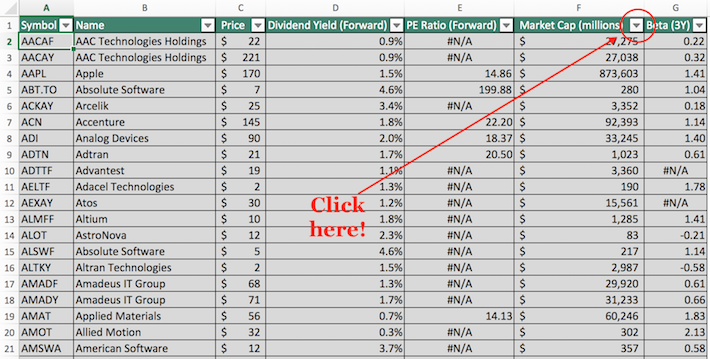

With that in thoughts, we’ve compiled an inventory of 130+ expertise shares full with essential investing metrics, which you’ll entry beneath:

The holdings of the expertise shares record have been derived from the next main exchange-traded funds:

- Know-how Choose Sector SPDR ETF (XLK)

- Invesco S&P SmallCap Info Know-how ETF (PSCT)

Preserve studying this text to study extra about the advantages of investing in dividend-paying expertise shares.

Along with offering a full spreadsheet of tech shares and methods to use the spreadsheet, we give our prime 10-ranked tech shares at the moment when it comes to 5-year anticipated annual returns.

Desk Of Contents

The next desk of contents permits you to immediately bounce to any part:

How To Use The Know-how Shares Record To Discover Dividend Funding Concepts

Having an Excel doc containing the names, tickers, and monetary metrics for all dividend-paying expertise shares could be extraordinarily highly effective.

The doc turns into considerably extra highly effective if the person has a working data of Microsoft Excel.

With that in thoughts, this part will present you methods to implement two actionable investing screens to the expertise shares record. The primary display that we’ll implement is for shares with dividend yields above 3%.

Display 1: Excessive Dividend Yield Know-how Shares

Step 1: Obtain the expertise shares record on the hyperlink above.

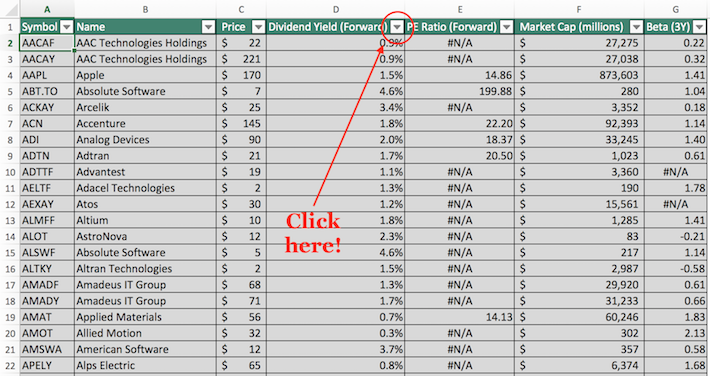

Step 2: Click on on the filter icon on the prime of the dividend yield column, as proven beneath.

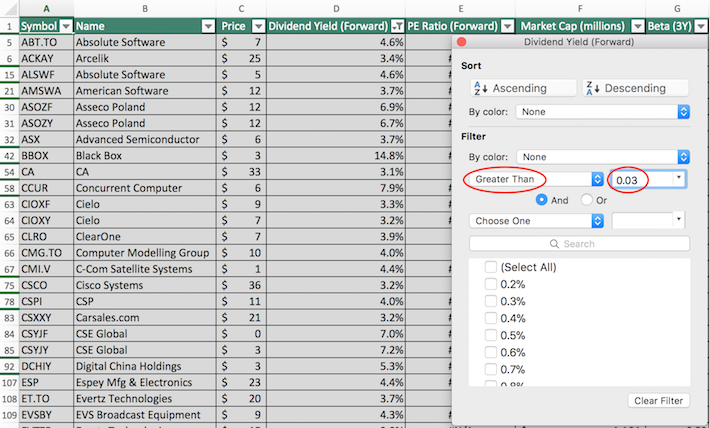

Step 3: Change the filter setting to “Better Than” and enter 0.03 into the sector beside it, as proven beneath.

The remaining shares on this spreadsheet are dividend-paying expertise shares with dividend yields above 3%, which give a basket of securities that ought to attraction to retirees and different income-oriented buyers.

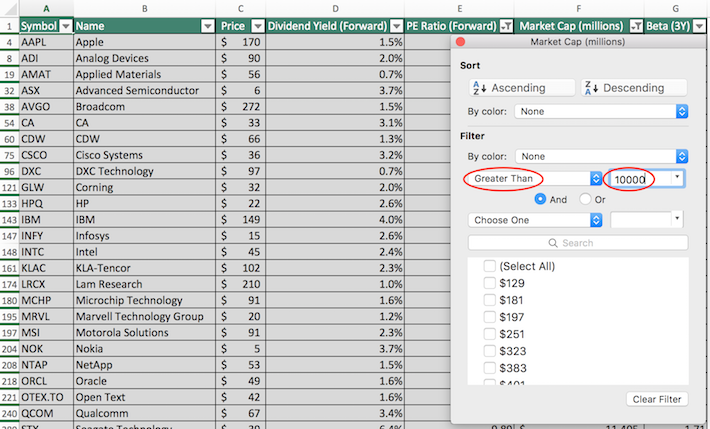

The subsequent part will present you methods to concurrently display for shares with price-to-earnings ratios beneath 20 and market capitalizations above $10 billion.

Display 2: Low Value-to-Earnings Ratios, Massive Market Capitalizations

Step 1: Obtain the expertise shares record on the hyperlink above.

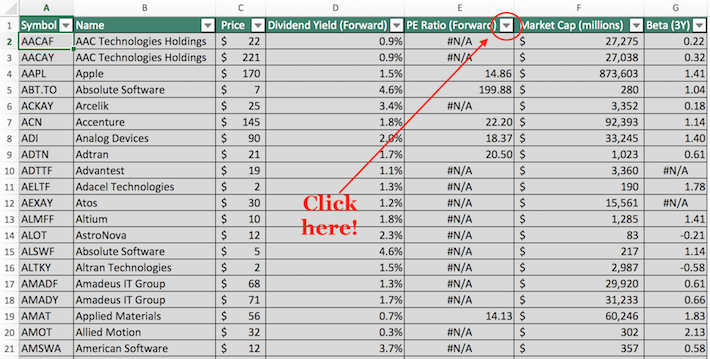

Step 2: Click on on the filter icon on the prime of the price-to-earnings ratio column, as proven beneath.

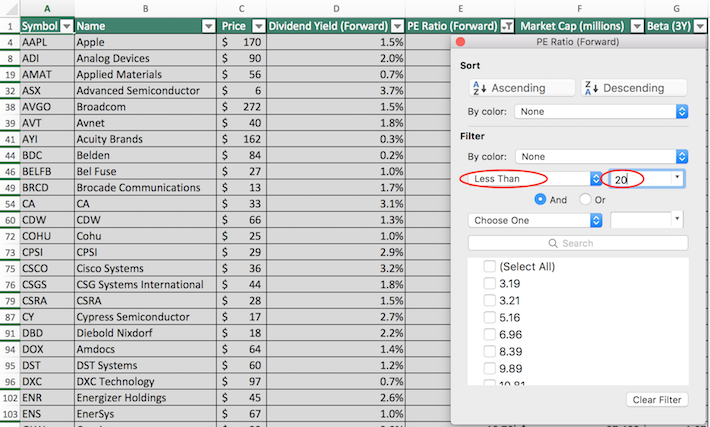

Step 3: Change the filter setting to “Much less Than” and enter 20 into the sector beside it, as proven beneath.

Step 4: Exit out of the filter window (by clicking the exit button, not by clicking the Clear Filter button). Then, click on on the filter icon on the prime of the market capitalization button, as proven beneath.

Step 5: Change the filter setting to “Better Than” and enter 10000 into the sector beside it, as proven beneath. Observe that since market capitalization is measured in thousands and thousands of {dollars} on this spreadsheet, inputting “$10,000 million” is equal to screening for shares with market capitalizations above $10 billion.

The remaining shares within the Excel spreadsheet are dividend-paying expertise shares with price-to-earnings ratios beneath 20 and market capitalizations above $10 billion. The scale and cheap valuation of those companies make this a helpful display for value-conscious, risk-averse buyers.

You now have an understanding of methods to use the expertise shares record to search out investments with sure monetary traits. The rest of this text will focus on the relative deserves of investing within the expertise sector.

Why Make investments In The Know-how Sector?

The expertise trade is thought for having among the best-performing shares over quick intervals of time. Certainly, it’s exhausting to overstate how a lot wealth was created for the early buyers in corporations like Microsoft (MSFT) or Apple (AAPL).

As well as, the expertise sector is very diversified. It contains every little thing from social media corporations to semiconductor shares. The expertise sector itself will not be a monolith; there are various kinds of companies inside the sector.

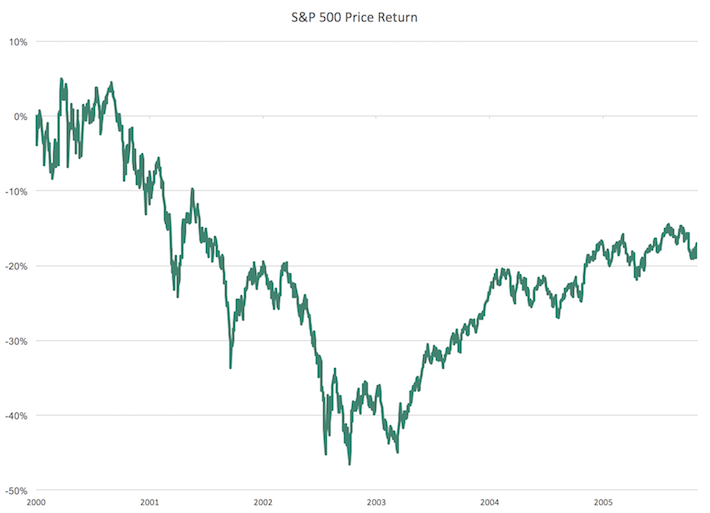

Sadly, the expertise trade can be identified for inflicting some of the dramatic inventory market bubbles on file. The 2000-2001 dot-com bubble destroyed billions of {dollars} of market worth as a result of expertise shares have been buying and selling at such irrationally excessive valuations.

Supply: YCharts

This notable bear market would possibly lead some buyers to keep away from the expertise sector totally.

Happily, at the moment’s expertise sector is tremendously totally different from its predecessor within the early 2000s. Whereas expertise shares have been beforehand valued primarily based on web page views or different self-importance metrics, this faculty of thought has modified considerably.

In the present day’s expertise shares are valued primarily based on the identical yardsticks as different companies: earnings, free money stream, and, to a lesser extent, property.

Furthermore, cautious safety evaluation permits buyers to search out undervalued expertise shares and income, simply as with all different trade.

Traders may also keep away from tech shares due to a perceived lack of ability to grasp how they generate profits.

Whereas some buyers ignore expertise shares due to their harder-to-understand enterprise fashions, it’s essential to notice that not all expertise shares have enterprise operations which might be shrouded in complexity.

For example, Apple has a quite simple enterprise mannequin. The corporate manufactures and sells iPhones, Mac computer systems, and wearable gadgets. It additionally makes cash from providers via its {hardware} gadgets such because the App Retailer and iTunes.

Furthermore, one might argue that Apple’s biggest power will not be its expertise, however its model – much like many non-technology corporations just like the Coca-Cola Firm (KO), Procter & Gamble (PG), and Colgate-Palmolive (CL).

Importantly, there are alternatives much like Apple all through the sector – not all expertise shares have aggressive benefits which might be primarily based on microchip capability or cloud computing velocity.

The final cause why expertise shares can play an essential function in your funding portfolio is that they’ve the potential to be very robust dividend shares.

Traditionally, the expertise sector was devoid of any interesting dividend investments as a result of expertise corporations reinvested all cash to drive speedy natural progress.

That is now not the case, at the least not normally. Many expertise corporations now pay steadily rising dividends 12 months in and 12 months out.

The income of those massive, steady expertise corporations are solely rising. And, many expertise corporations have pretty low payout ratios.

These components lead us to imagine that the expertise sector will proceed to supply robust dividend progress funding alternatives for the foreseeable future.

The Prime 10 Tech Shares In the present day

With all that stated, the next 10 shares symbolize our highest-ranked tech shares within the Positive Evaluation Analysis Database, when it comes to 5-year anticipated annual returns.

Rankings are listed so as of anticipated complete annual returns, so as from lowest to highest.

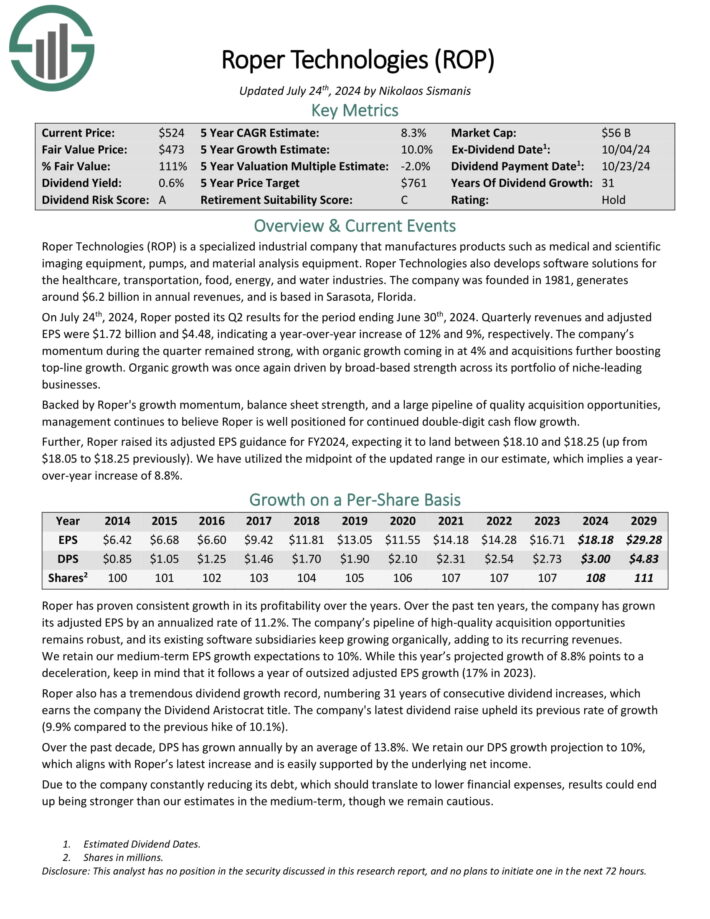

Tech Dividend Inventory #10: Roper Applied sciences (ROP)

- 5-12 months Annual Anticipated Returns: 7.0%

Roper Applied sciences is a specialised industrial firm that manufactures merchandise similar to medical and scientific imaging gear, pumps, and materials evaluation gear. Roper Applied sciences additionally develops software program options for the healthcare, transportation, meals, vitality, and water industries.

The corporate was based in 1981, generates round $6.2 billion in annual revenues, and is predicated in Sarasota, Florida.

On July twenty fourth, 2024, Roper posted its Q2 outcomes for the interval ending June thirtieth, 2024. Quarterly revenues and adjusted EPS have been $1.72 billion and $4.48, indicating a year-over-year improve of 12% and 9%, respectively.

The corporate’s momentum in the course of the quarter remained robust, with natural progress coming in at 4% and acquisitions additional boosting top-line progress. Natural progress was as soon as once more pushed by broad-based power throughout its portfolio of niche-leading companies.

Backed by Roper’s progress momentum, stability sheet power, and a big pipeline of high quality acquisition alternatives, administration continues to imagine Roper is properly positioned for continued double-digit money stream progress.

Click on right here to obtain our most up-to-date Positive Evaluation report on ROP (preview of web page 1 of three proven beneath):

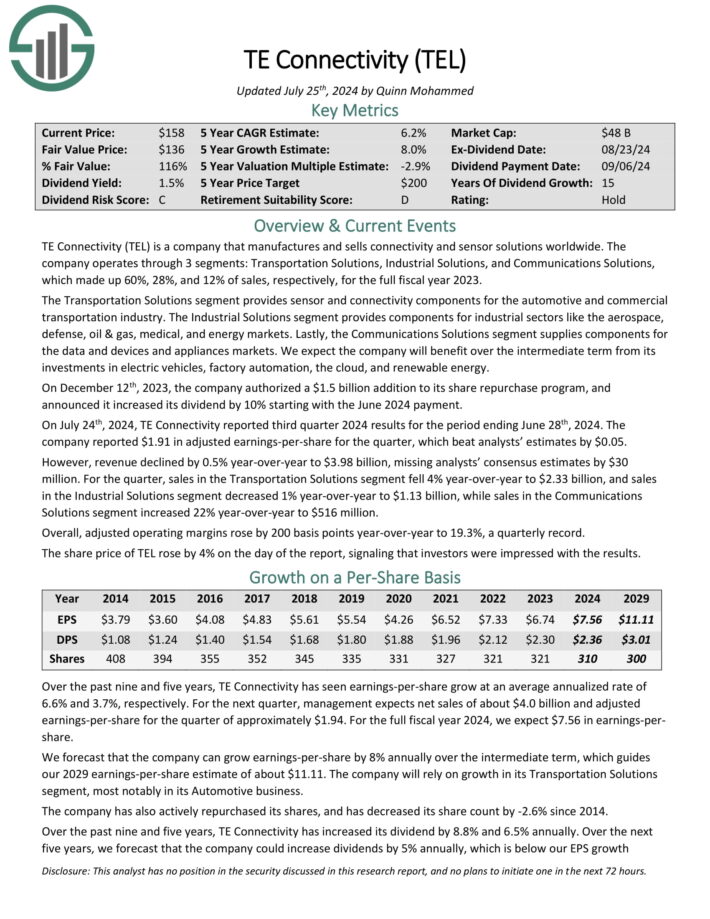

Tech Dividend Inventory #9: TE Connectivity (TEL)

- 5-12 months Annual Anticipated Returns: 7.5%

TE Connectivity is an organization that manufactures and sells connectivity and sensor options worldwide. The corporate operates via 3 segments: Transportation Options, Industrial Options, and Communications Options, which made up 60%, 28%, and 12% of gross sales, respectively, for the complete fiscal 12 months 2023.

The Transportation Options section offers sensor and connectivity parts for the automotive and business transportation trade.

The Industrial Options section offers parts for industrial sectors just like the aerospace, protection, oil & gasoline, medical, and vitality markets.

Lastly, the Communications Options section provides parts for the info and gadgets and home equipment markets.

On July twenty fourth, 2024, TE Connectivity reported third quarter 2024 outcomes for the interval ending June twenty eighth, 2024. The corporate reported $1.91 in adjusted earnings-per-share for the quarter, which beat analysts’ estimates by $0.05.

Nonetheless, income declined by 0.5% year-over-year to $3.98 billion, lacking analysts’ consensus estimates by $30 million.

Click on right here to obtain our most up-to-date Positive Evaluation report on TEL (preview of web page 1 of three proven beneath):

Tech Inventory #8: Analog Gadgets (ADI)

- 5-12 months Annual Anticipated Returns: 7.6%

Analog Gadgets (ADI) makes built-in circuits which might be bought to OEMs (authentic gear producers) to be integrated into gear and methods for communications, laptop, instrumentation, industrial, army/aerospace, and shopper electronics functions.

ADI has elevated dividend funds to shareholders for 20 consecutive years.

On August twenty first, 2024, Analog Gadgets reported third quarter 2024 outcomes for the interval ending August third, 2024. For the quarter, the corporate reported income of $2.31 billion, down 25% in comparison with the prior 12 months’s quarter, which beat analysts’ estimates by $40 million.

The corporate noticed adjusted earnings-per-share of $1.58, which additionally beat analysts’ estimates by 7 cents however represented a 37% decline in EPS in comparison with the year-ago quarter. Through the quarter, Analog Gadgets repurchased $118 million of its shares, and paid $456 million in dividends.

Click on right here to obtain our most up-to-date Positive Evaluation report on ADI (preview of web page 1 of three proven beneath):

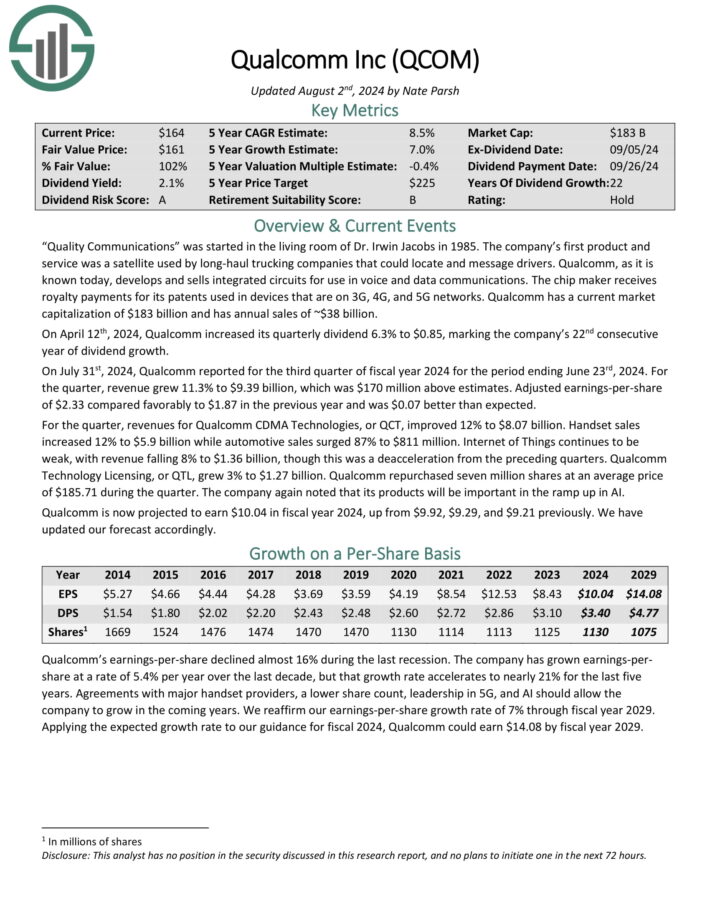

Tech Dividend Inventory #7: Qualcomm Inc. (QCOM)

- 5-12 months Annual Anticipated Returns: 7.6%

Qualcomm develops and sells built-in circuits to be used in voice and knowledge communications. The chip maker receives royalty funds for its patents utilized in gadgets which might be on 3G, 4G, and 5G networks. Qualcomm has annual gross sales of ~$38 billion.

On July thirty first, 2024, Qualcomm reported for the third quarter of fiscal 12 months 2024 for the interval ending June twenty third, 2024. For the quarter, income grew 11.3% to $9.39 billion, which was $170 million above estimates. Adjusted earnings-per-share of $2.33 in contrast favorably to $1.87 within the earlier 12 months and was $0.07 higher than anticipated.

For the quarter, revenues for Qualcomm CDMA Applied sciences, or QCT, improved 12% to $8.07 billion. Handset gross sales elevated 12% to $5.9 billion whereas automotive gross sales surged 87% to $811 million. Web of Issues continues to be weak, with income falling 8% to $1.36 billion, although this was a deacceleration from the previous quarters.

Qualcomm Know-how Licensing, or QTL, grew 3% to $1.27 billion. Qualcomm repurchased seven million shares at a median value of $185.71 in the course of the quarter. The corporate once more famous that its merchandise shall be essential within the ramp up in AI.

Click on right here to obtain our most up-to-date Positive Evaluation report on QCOM (preview of web page 1 of three proven beneath):

Tech Dividend Inventory #6: Cognizant Know-how Options (CTSH)

- 5-12 months Annual Anticipated Returns: 7.7%

Cognizant Know-how Options offers info expertise, consulting and enterprise course of outsourcing providers in North America, Europe, and different areas. The corporate operates in 4 segments: monetary providers, healthcare, merchandise & sources and communications, media & expertise.

In late July, Cognizant reported (7/31/24) monetary outcomes for the second quarter of fiscal 2024. The currency-neutral income dipped -0.5% over the prior 12 months’s quarter however adjusted earnings-per-share grew 6%, from $1.10 to $1.17, and exceeded the analysts’ consensus by $0.05 because of decrease working bills and share repurchases. Bookings grew 4% over the prior 12 months’s quarter, to $26.2 billion (~1.4 instances annual gross sales).

As enterprise momentum has considerably improved, administration raised its steerage for 2024. It nonetheless expects primarily flat revenues and a modest growth of working margin but it surely raised its steerage for adjusted earnings-per-share from $4.50-$4.68 to $4.62-$4.70. Accordingly, we’ve got raised our forecast from $4.60 to $4.66.

Click on right here to obtain our most up-to-date Positive Evaluation report on CTSH (preview of web page 1 of three proven beneath):

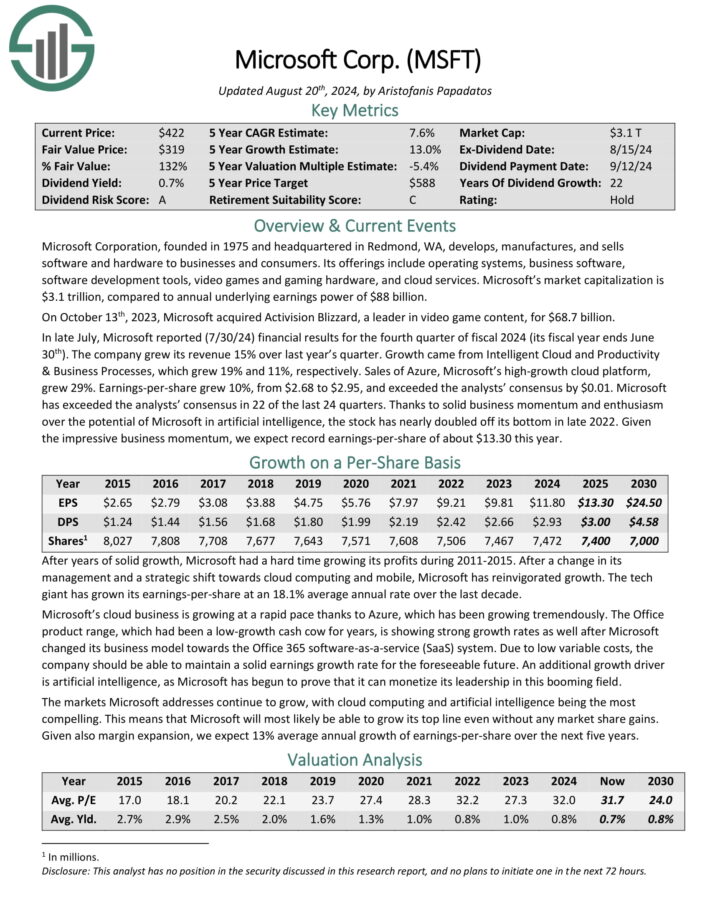

Tech Dividend Inventory #5: Microsoft Company (MSFT)

- 5-12 months Annual Anticipated Returns: 7.8%

Microsoft Company manufactures and sells software program and {hardware} to companies and shoppers. Its choices embrace working methods, enterprise software program, software program growth instruments, video video games and gaming {hardware}, and cloud providers.

On October thirteenth, 2023, Microsoft acquired Activision Blizzard, a frontrunner in online game content material, for $68.7 billion. In late July, Microsoft reported (7/30/24) monetary outcomes for the fourth quarter of fiscal 2024 (its fiscal 12 months ends June thirtieth).

The corporate grew its income 15% over final 12 months’s quarter. Progress got here from Clever Cloud and Productiveness & Enterprise Processes, which grew 19% and 11%, respectively. Gross sales of Azure, Microsoft’s high-growth cloud platform, grew 29%.

Earnings-per-share grew 10%, from $2.68 to $2.95, and exceeded the analysts’ consensus by $0.01. Microsoft has exceeded the analysts’ consensus in 22 of the final 24 quarters.

Click on right here to obtain our most up-to-date Positive Evaluation report on MSFT (preview of web page 1 of three proven beneath):

Tech Dividend Inventory #4: NXP Semiconductors (NXPI)

- 5-12 months Annual Anticipated Returns: 9.5%

NXP Semiconductors is a semiconductor designer and producer. It’s headquartered in Eindhoven, Netherlands, and operates in over 30 international locations with a workforce of roughly 31,000 workers.

NXP is a number one supplier of revolutionary options for automotive, industrial, IoT, cell, and communication infrastructure markets and holds over 9,500 patent households.

NXP Semiconductors N.V. reported monetary outcomes for Q2 2024 on the July twenty second, 2024. NXP reported quarterly income of $3.13 billion, which regardless of being a 5% year-over-year decline, aligned with their steerage and expectations throughout all focus end-markets.

Regardless of the decrease income, the corporate achieved a GAAP gross margin of 57.3%, a GAAP working margin of 28.7%, and a GAAP diluted internet revenue per share of $2.54.

Click on right here to obtain our most up-to-date Positive Evaluation report on NXPI (preview of web page 1 of three proven beneath):

Tech Dividend Inventory #3: Juniper Networks (JNPR)

- 5-12 months Annual Anticipated Returns: 9.6%

Juniper Networks goals to resolve the world’s most troublesome issues in networking expertise via its merchandise, options and providers which join the globe.

Juniper designs, develops, and sells switching, routing, safety, software program services for the networking trade.

JNPR sells its options in additional than 150 international locations. In 2023, the corporate earned $5.6 billion in income.

Juniper Networks reported second quarter 2024 outcomes on July twenty fifth, 2024. Web revenues for the quarter have been $1.19 billion, down 17% year-over-year.

GAAP internet revenue for the quarter was $0.10 per share, a 43% improve over $0.07 in the identical prior 12 months interval. Non-GAAP internet revenue was $0.31 per share, a 47% lower over $0.58 in second quarter 2023.

The corporate repurchased $14.6 million of widespread inventory for retirement year-to-date. Complete money, money equivalents and investments have been $1.43 billion at quarter-end.

Click on right here to obtain our most up-to-date Positive Evaluation report on JNPR (preview of web page 1 of three proven beneath):

Tech Inventory #2: Utilized Supplies (AMAT)

- 5-12 months Annual Anticipated Returns: 9.7%

Utilized Supplies is a semiconductor producer that generates roughly $27 billion in annual income.

Utilized Supplies posted third quarter earnings on August fifteenth, 2024, and outcomes have been higher than anticipated on each the highest and backside strains. Adjusted earnings-per-share got here to $2.12, which was a dime forward of estimates. Income was additionally forward by $110 million, rising 5.4% year-over-year to $6.78 billion.

Semiconductor Programs income was $4.92 billion, a year-over-year improve of $248 million. The corporate famous it believes it’s well-positioned within the AI race, which ought to proceed to gasoline demand for its services.

Money from operation was $2.39 billion in the course of the quarter, and $1.19 billion was distributed to shareholders. That included $861 million in share repurchases and the stability in dividends.

Click on right here to obtain our most up-to-date Positive Evaluation report on AMAT (preview of web page 1 of three proven beneath):

Tech Dividend Inventory #1: Intuit Inc. (INTU)

- 5-12 months Annual Anticipated Returns: 10.8%

Intuit is a cloud-based accounting and tax preparation software program large. Its merchandise present monetary administration, compliance, and providers for shoppers, small companies, self-employed employees, and accounting professionals worldwide.

Its hottest platforms embrace QuickBooks, TurboTax, Mint, and TSheets. Cumulatively they serve greater than 100 million prospects. The corporate recorded $16.3 billion in revenues final 12 months.

On August twenty second, 2024, Intuit raised its dividend by 16% to a quarterly price of $1.04. On the identical day, Intuit reported its This autumn and full-year outcomes for the interval ending July thirty first, 2024. Intuit printed one other strong quarter, rising its “Small enterprise and Self-employed” income by 20% and its on-line ecosystem income by 18%.

QuickBooks On-line accounting revenues grew 17% year-over-year as properly. Complete revenues for the quarter reached $3.18 billion, up 17% year-over-year.

Adjusted EPS for the quarter grew by 21% to $1.99 in comparison with FQ4 2023. For the 12 months, adjusted EPS got here in at $16.94, up 18% in comparison with the earlier 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on INTU (preview of web page 1 of three proven beneath):

Last Ideas

The expertise sector has turn out to be an intriguing place to search for high-quality dividend funding alternatives.

With that stated, it’s not the solely place to search for funding concepts.

When you’re prepared to enterprise outdoors of the expertise sector, the next databases include among the most high-quality dividend shares round:

When you’re on the lookout for different sector-specific dividend shares, the next Positive Dividend databases shall be helpful:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].